ADAUSD trade ideas

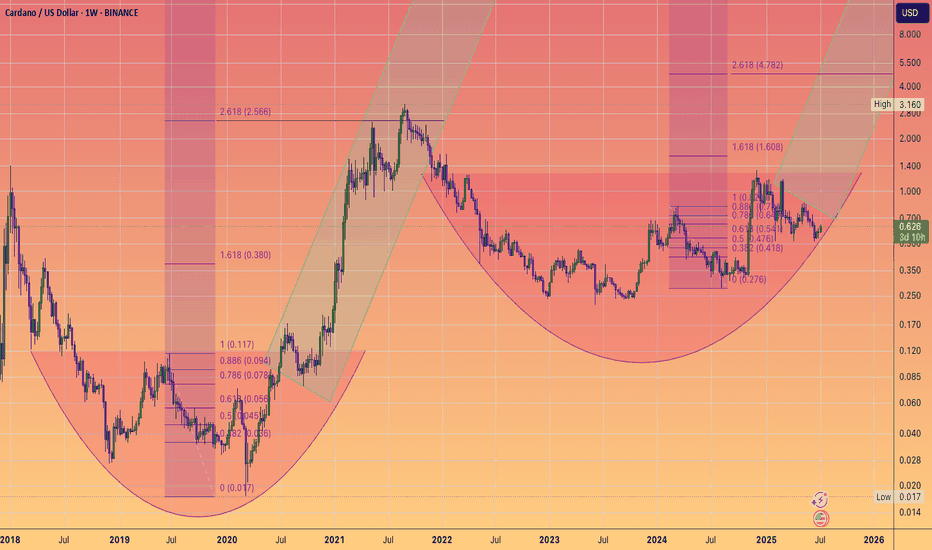

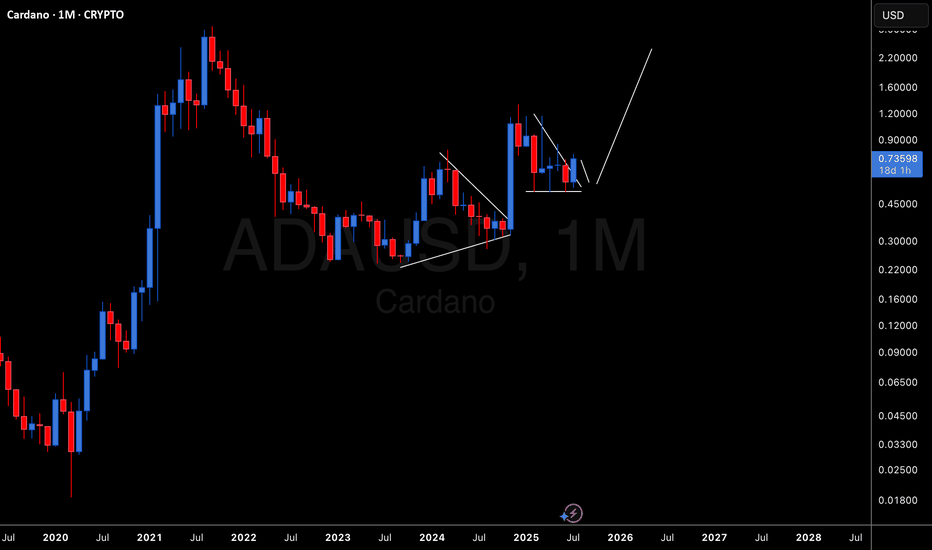

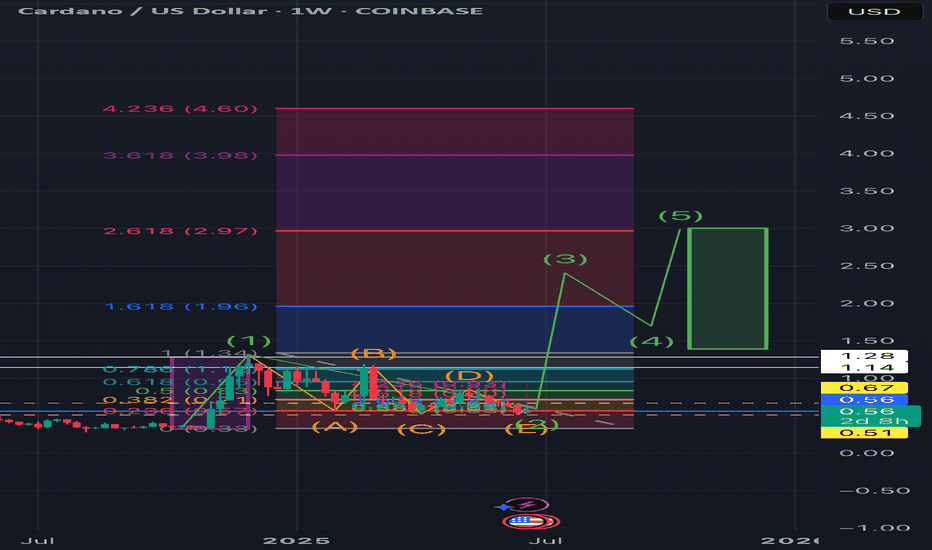

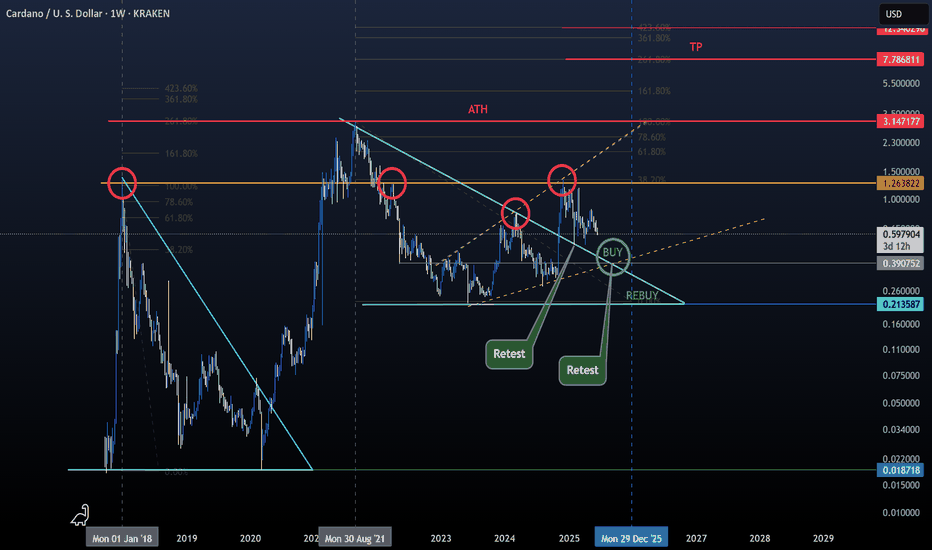

ADA is ready to take offEverything is on the chart.

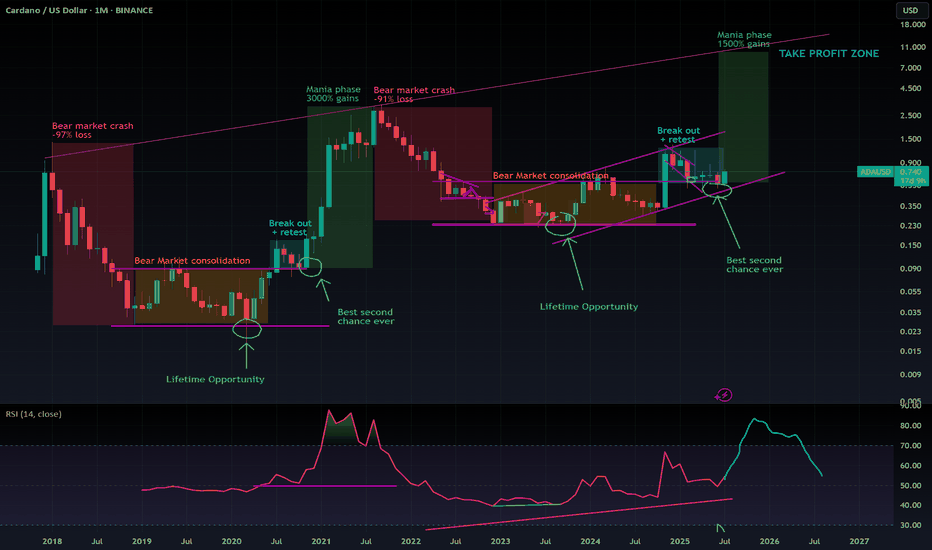

This simple pattern analysis show us clearly that we are about to enter maniac phase.

Diminishing return theory still in play.

This phase was a 30x last cycle, I'm not expecting more than x15 from the last local bottom of March to May.

Final destination is around 7 to 10$.

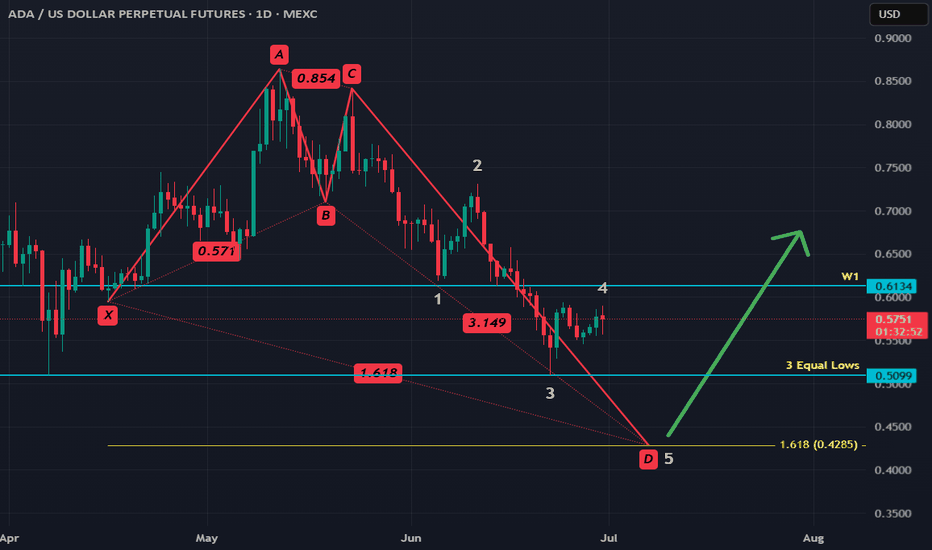

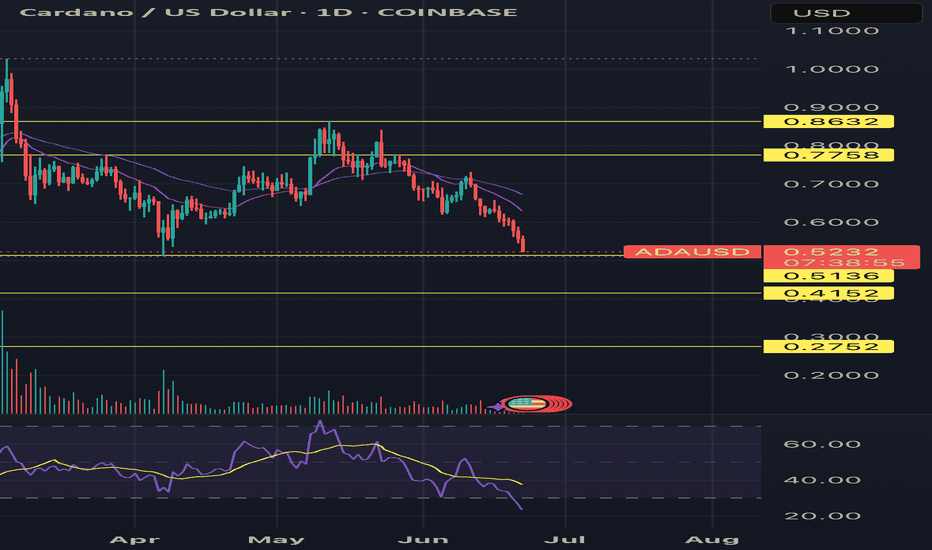

#ADAUSDT Trade Setup! 7-2025📌 Coin: ADAUSDT (Cardano)

💰 Buy Levels:

✅ First Entry: $0.765

✅ Second Entry: $0.650

🧠 Fundamental Analysis (FA)

*️⃣ Sector: Layer 1 blockchain / Proof of Stake

*️⃣ Use Case: Cardano is a smart contract platform focused on security, scalability, and academic research. It powers DeFi, identity, NFTs, and governance protocols.

*️⃣ Tech: Uses a unique eUTXO model (extended UTXO) for deterministic and parallel execution, and the Ouroboros proof-of-stake consensus mechanism.

*️⃣ Development Model: Built on a peer-reviewed, research-first approach, led by Charles Hoskinson and IOHK. Cardano rolls out major upgrades in carefully planned phases (e.g. Byron, Shelley, Goguen, Basho, Voltaire).

*️⃣ Adoption: Hosts growing DeFi/NFT activity, identity pilots in Africa, and a developer base focused on formal verification and high-assurance code.

*️⃣ Ecosystem: Now includes native tokens, smart contracts via Plutus, dApps like Minswap, Indigo, Liqwid, and scaling via Hydra (L2 channels in progress).

*️⃣ Narrative Fit: Positioned as the “safe, decentralized, and academically sound” Ethereum alternative, with a large, loyal community and real-world partnership focus.

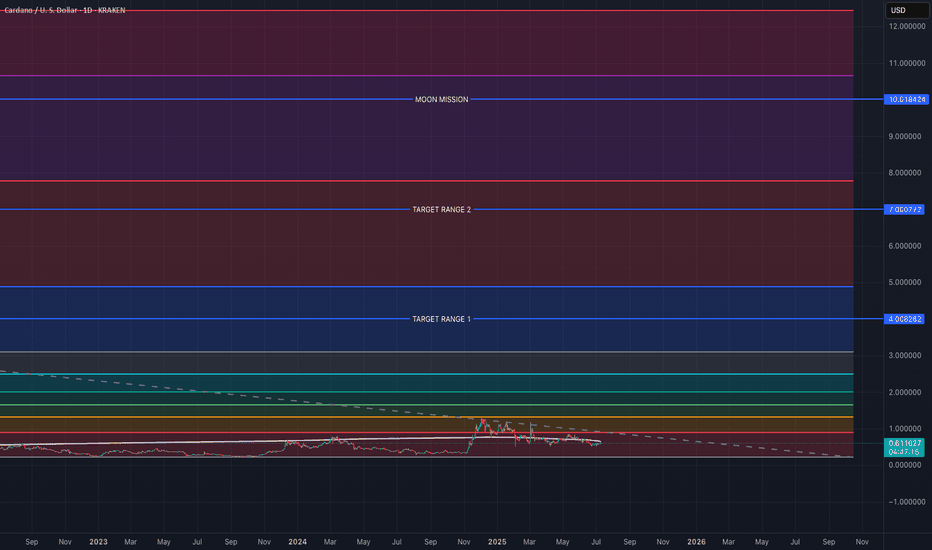

🎯 Bull Market Target (Realistic)

Target Range: $1.80 – $2.20

*️⃣ Matches 2021 recovery zone, achievable with healthy altcoin rotation and new project launches on Cardano.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $3.00 – $4.50+

*️⃣ Would require Cardano to become a leading DeFi/NFT L1 again, global adoption of on-chain identity, full Voltaire governance rollout, and L2 scaling success.

✅ Final Take

🧠 Cardano remains one of the most decentralized, peer-reviewed chains in crypto. While it's slower in execution compared to others, it builds strong foundations. With Voltaire (on-chain governance) and Hydra (scaling) rolling out, ADA is well positioned for a long-term cycle.

we ask Allah reconcile and repay

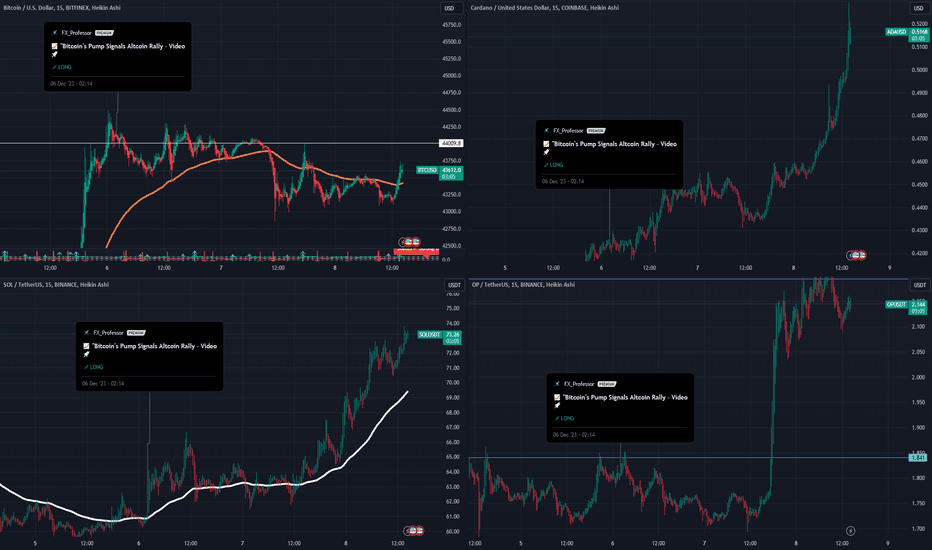

🐋 Deep Dive Part II: Whale Behavior & Market Mastery! 🌊📚Hey Crypto Enthusiasts! 🚀

In a recent analysis, I not only nailed Bitcoin's (BTC) movement but also illuminated the subsequent altcoin surge, driven by insightful whale behavior observations. Let's merge these insights with a focus on ADA (Cardano), OP (Optimism), SOL (Solana), and BTC. 📊

Cardano's (ADA) Meteoric Rise 🌟

ADA's journey began with a break above a pivotal support-resistance level. My entry point at 0.256 turned into a remarkable rally, hitting 52 cents. This movement was a classic case of altcoin buoyancy following Bitcoin's pause.

Optimism (OP) and the Altcoin Breakouts 🌈

In the shadow of Bitcoin's stagnation, altcoins like OP exhibited significant breakouts, showcasing the shifting focus of market whales from Bitcoin to promising altcoins.

Bitcoin (BTC) and Whale Dynamics 📉

Bitcoin's behavior provided a crystal ball into the whale activities. As BTC approached a major resistance level, it signaled a strategic move by whales to divert funds towards altcoins, catalyzing their surge.

Solana (SOL) and Market Trends ☀️

Solana's chart also mirrored this trend, highlighting the broader market dynamics influenced by these significant players.

🔍 Insight on Whale Behavior:

My analysis delved deep into the whale behavior, highlighting how Bitcoin's rally and subsequent pause was a precursor to altcoin dominance. This strategic pause in Bitcoin's ascent was a clear signal for the whales to redistribute their focus and capital, sparking a remarkable rise in altcoins like ADA, OP, and SOL. 🔄

The Bigger Picture - Understanding Market Shifts: What this trend teaches us is the importance of reading between the lines. Whale movements often precede major market shifts, and by understanding these patterns, we position ourselves to make informed decisions. 🧠

Future Outlook: As we continue to monitor these market dynamics, it's crucial to stay vigilant. The crypto market is known for its volatility, and while the current trend favors altcoins, it's essential to be prepared for any shifts that may arise. Always keep an eye on key resistance and support levels, market sentiment, and global economic factors that could influence the next big move. 🌐

Together, let's stay ahead of the curve in this fascinating and ever-evolving world of cryptocurrency. Your insights and engagement are what make this journey exciting and rewarding!

One Love,

The FXPROFESSOR 💙

part 1:

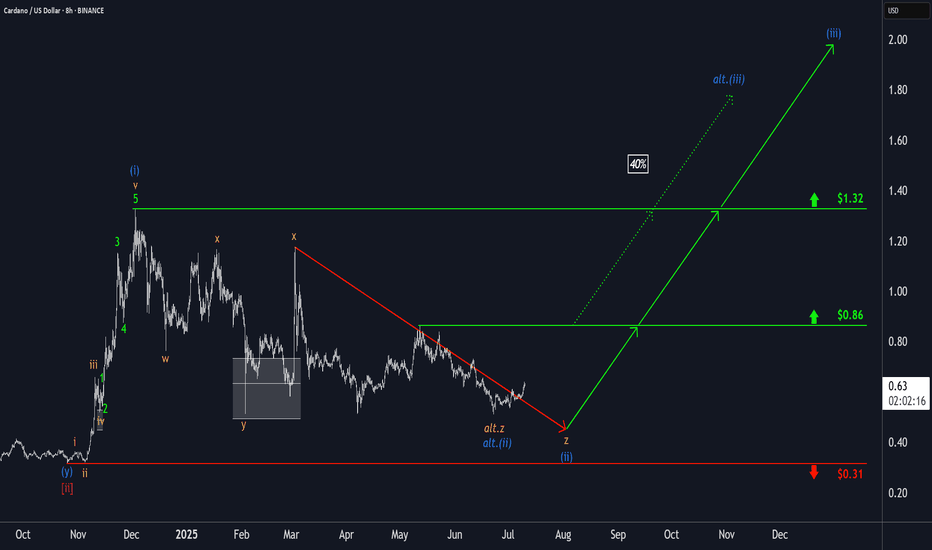

Cardano: Eyeing Alternative Rally ScenarioCardano’s ADA token has realized further gains. As a result, we’ve increased the probability of our alternative scenario—in which the low of the wave (ii) correction is already in place—to 40%. For ADA to take this “shortcut,” the next step would be to break above resistance at $0.86, followed by a move past the $1.32 level. For now, however, we’re maintaining our primary outlook and are preparing for a new low in blue wave (ii). In this scenario, the price should hold above support at $0.31.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

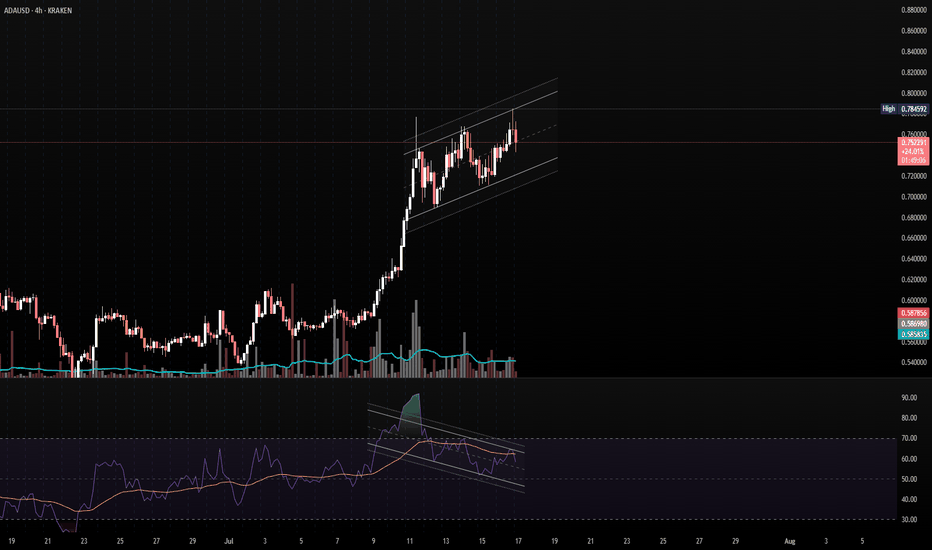

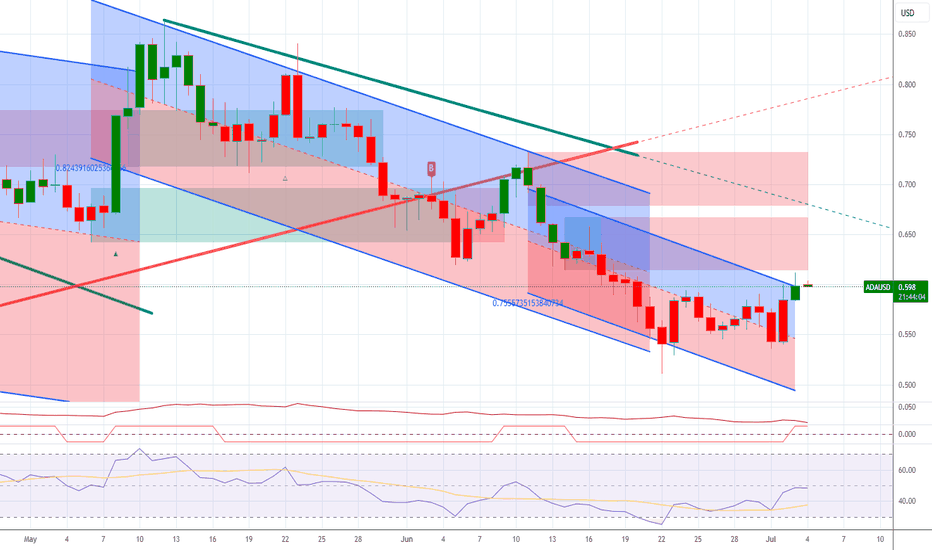

ADAUSD - Possible Correction from Channel ResistanceStructure: Ascending Channel

Indicators: RSI Overbought, Bearish Divergence Forming

📌 Confirmation:

Look for:

A strong bearish candle or

RSI breaking below 60

Volume divergence

Bias: Short-term bearish correction, bullish structure intact as long as price holds the channel.

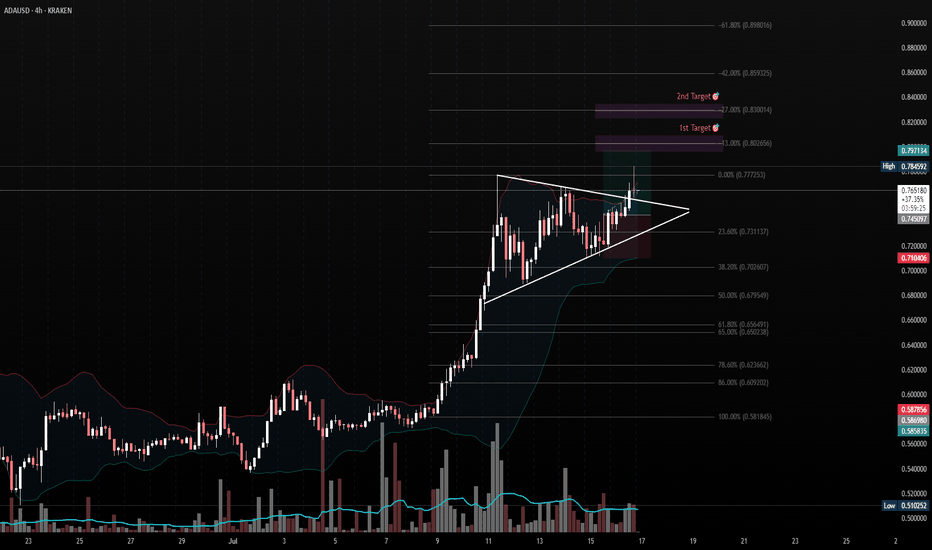

ADA Breakout from Ascending TrianglePair: ADA/USD

Timeframe: 4H

Pattern: Ascending Triangle

Breakout Level: ~$0.777

Entry: On breakout candle close above resistance

Targets:

🎯 1st Target: $0.83

🎯 2nd Target: $0.86

Confluence:

Bullish structure with higher lows pressing into horizontal resistance

Breakout occurred with volume confirmation

Fib extension aligns with target zones

Bollinger Band expansion supports momentum continuation

Bias: Bullish (continuation pattern)

⚠️ If price falls back below $0.745, watch for possible invalidation or retest of the triangle breakout.

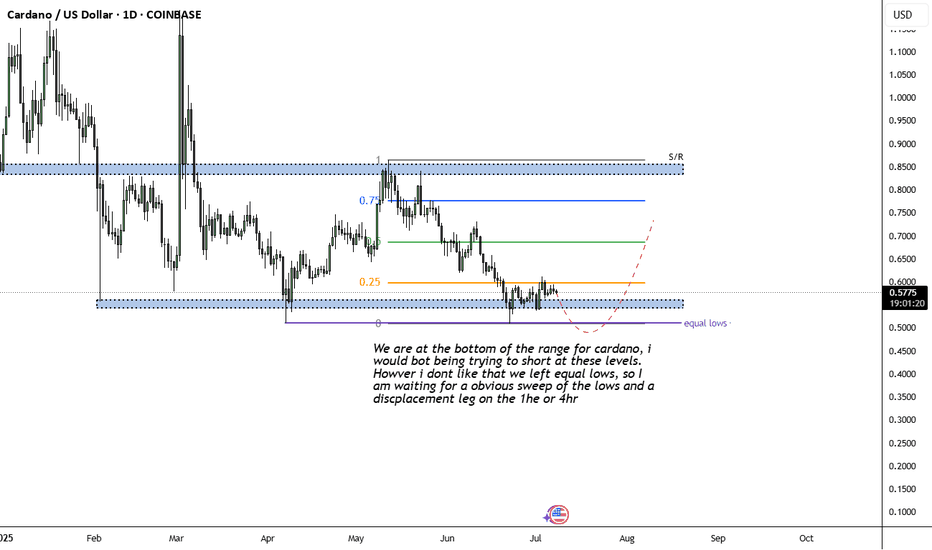

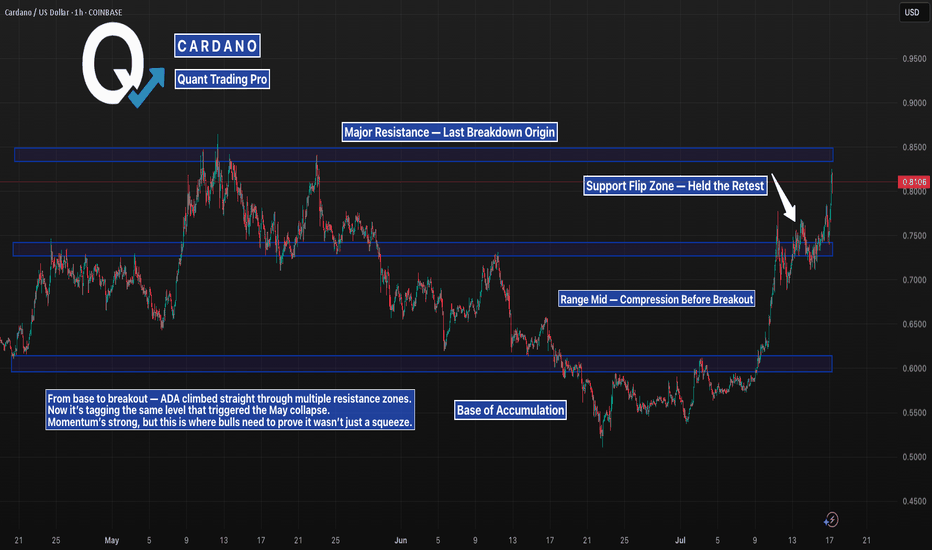

ADA Just Reclaimed Structure and Hit the First WallADA just ran from sub-$0.60 to above $0.80, reclaiming every key level along the way.

Now it’s testing the same resistance that sparked a sharp dump in May.

This zone is no joke — it’s where trends get confirmed… or crushed.

Watch the reaction here closely.

#ADA #Cardano #ADAUSD #CryptoCharting #BreakoutLevels #BacktestEverything #TradingView #QuantTradingPro #CryptoMomentum

ADAUSD – Pressure Builds Beneath ResistanceADA exploded off $0.545 into $0.61 before reversing sharply. After the pullback, price stabilized above $0.575 and began compressing in a coil. Structure is bullish if $0.582 holds — a clean breakout through $0.59 could open a path back to $0.605+. Below $0.575 invalidates.

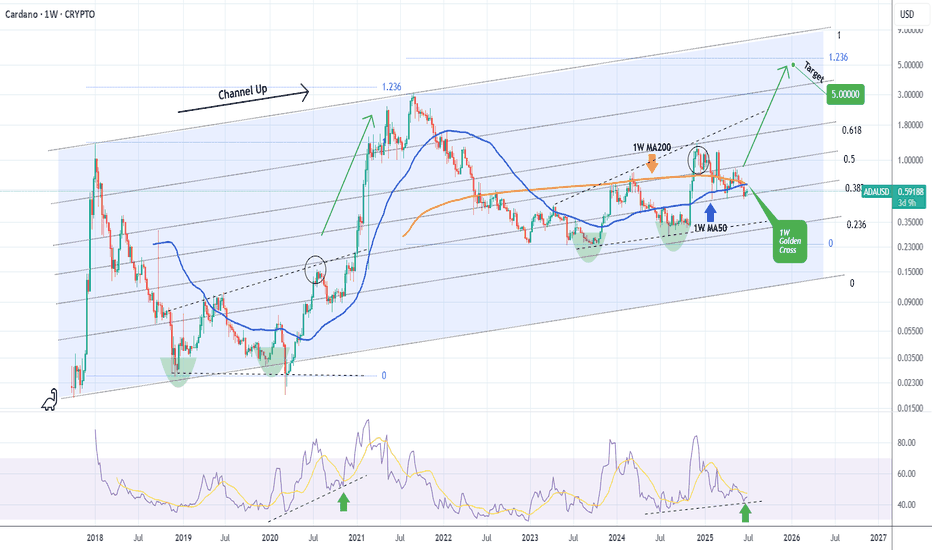

ADAUSD Is this 1W Golden Cross what the market needs??Cardano (ADAUSD) just formed a 1W Golden Cross this week, the first in its history, amidst a continuous bearish sequence since the December 02 2024 High. With its 1W RSI just below neutrality, this simply highlights the undervalued condition of this token relative not only to the rest of the high cap market, but also to its previous Bull Cycle.

As you can see, based both on 1W RSI and price action terms, we may be in a consolidation phase similar to September - November 2020, at the end of a Megaphone pattern. That pattern was the Accumulation vessel of the Cycle that led to the massive 2021 parabolic rally and the eventual Cycle Top / Higher High of the historic Channel Up.

According to that, we should be expecting a 1.236 Fibonacci extension test, targeting $5.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

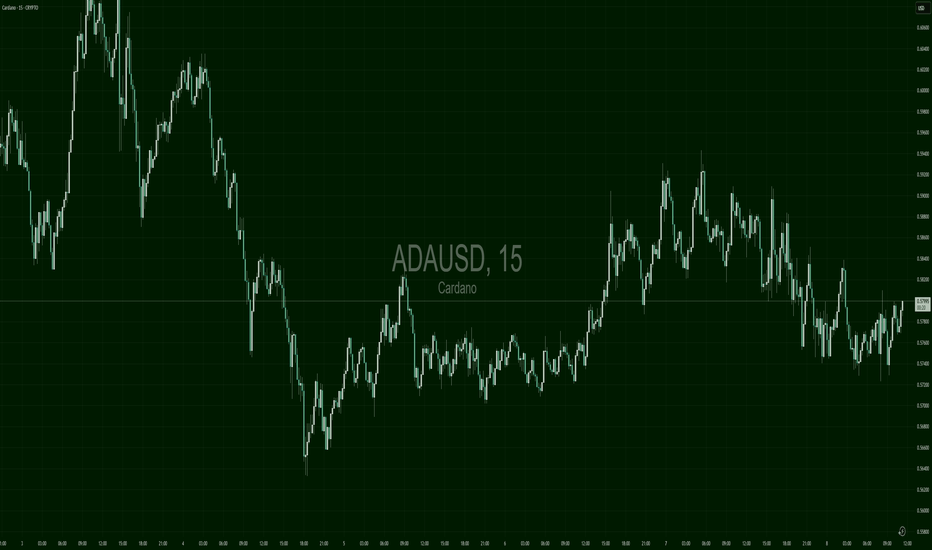

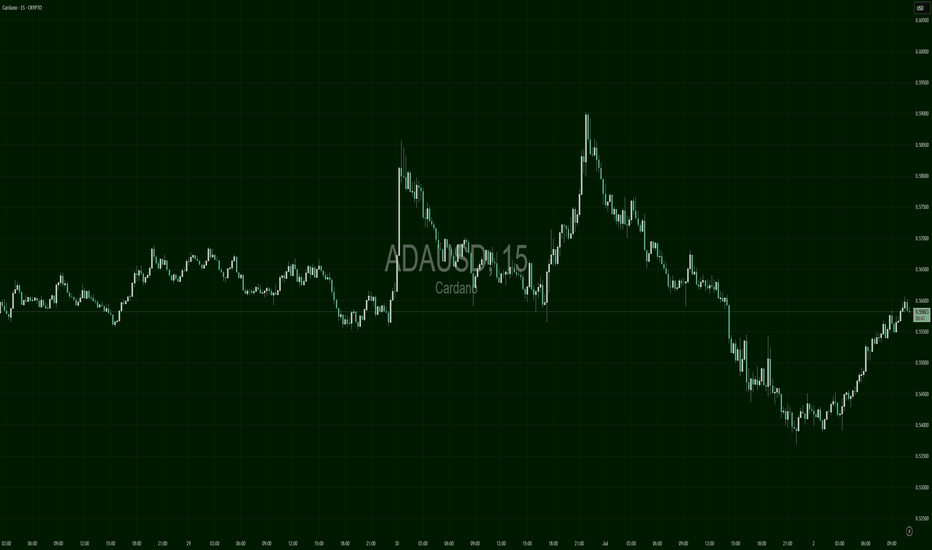

ADAUSD – From Panic to PushADA double-topped near $0.5850 and dropped sharply to $0.5350. The current leg shows a clean recovery structure forming higher lows on the 15-min. If bulls hold $0.5550 on pullbacks, next resistance lies near $0.5750. A breakout from this squeeze setup could trigger a fast move back to highs.

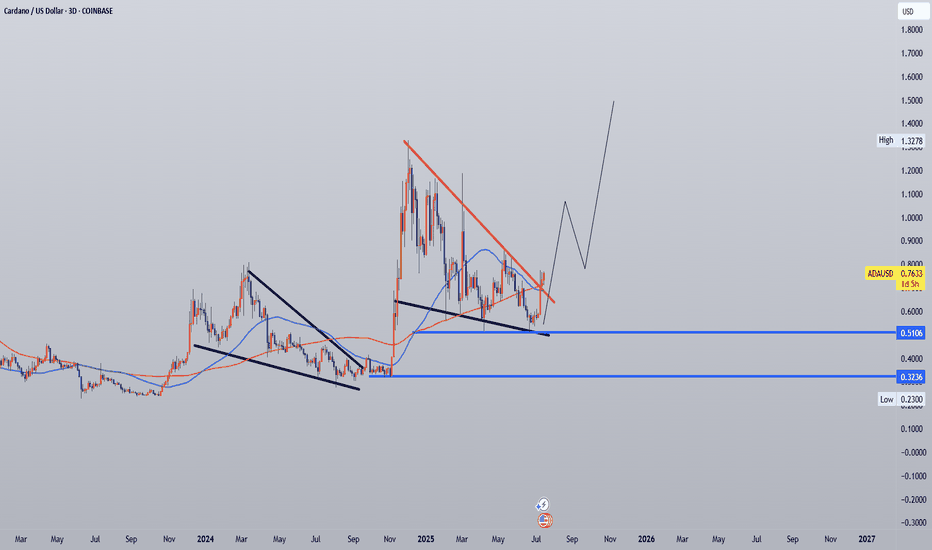

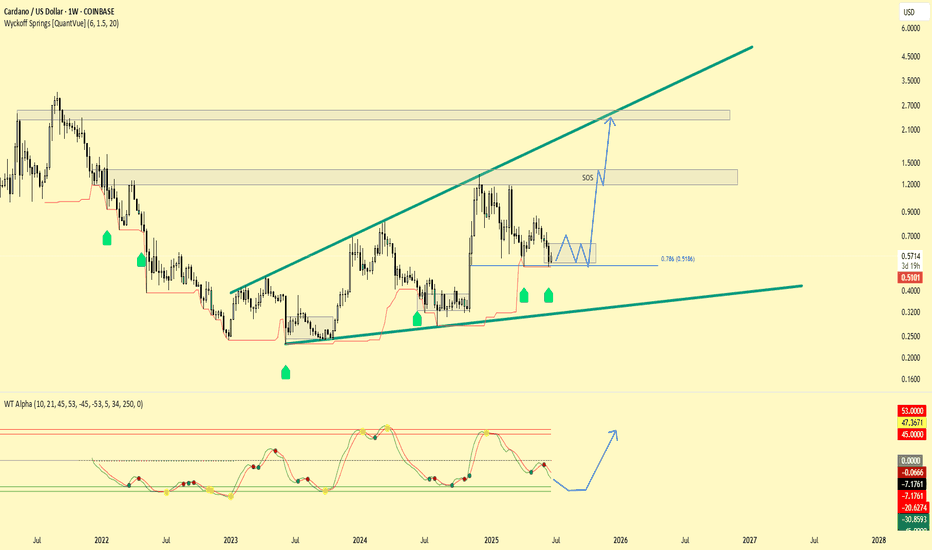

Will History Repeat for Cardano? Looking back we can see the timing of previous runups. 6 month consolidation (grey boxes) followed by a 1-2 month rip of 4-5x. 0.51 support seems to be holding up well so far.. double Wyckoff snipe at the 0.786 retracement level. If history repeats, ADA trades rangebound until Oct/2025 before its next major move up as long as the uptrend remains intact. What do you think?

$ADA Short IdeaCRYPTOCAP:BTC.D just broke and retested its 0.786 retracement and is now headed for 71% over the next 3-4 months. I would expect ADA to first fall to 0.51 (0.786 fib). More likely it will bounce off the bottom of this accumulation cylinder at 0.38 range before making another significant move up, meanwhile BTC.D will quadruple top at 71%. Remember that large institutions know what retail holds and there will be no alt season until most retailer traders have given up and sold their alts.

Cardano UpdateA lot of you have been DMing me asking for altcoin analysis. i hear you, but here's the truth:

- Right now, most altcoins are simply too weak to offer a reliable forecast. I prefer to post when timing makes sense, not just for engagement, but to avoid misleading anyone.

- BTC Dominance is still heavily suppressing the altcoin market, and I’d rather wait than risk rekting my followers with premature calls.

So why do I post about Cardano? :

- Simple, Cardano is one of the most established altcoins. It makes sense to track its evolution alongside Bitcoin and Ethereum. When you're analyzing the broader market cycle, starting with BTC, ETH, and ADA gives meaningful context. Newer cryptocurrencies from 2020+ don’t have the same historical data, which makes reliable analysis much harder.

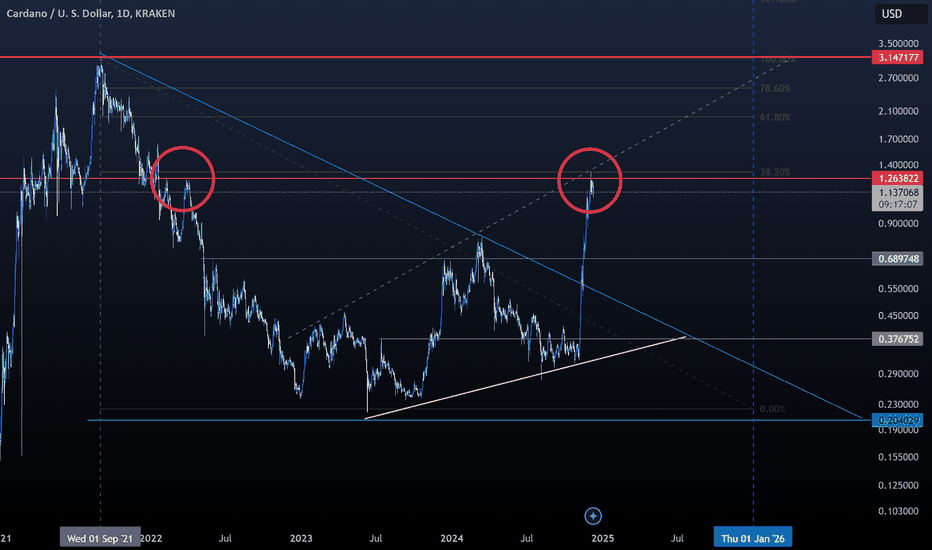

Back to Trading (Everything is marked on the chart for easier reading) :

- Cardano got rejected around $1.25, which aligns with its 2018 ATH, a key historical resistance.

- Check the bullish megaphone pattern and how it connects with the trendline and that $1.25 level (marked with yellow dotted lines).

- Also observe the minor bounces and retests above the bearish triangle trendline (light blue).

What we can do now?

- Nothing. If BTC dips, altcoins will likely follow and get rekt.

Best strategy for now:

- Consider setting a buy order around $0.41 (don’t go all in).

- Keep some dry powder in case of further downside, potentially to rebuy around $0.21 if pressure continues.

Be wise, be patient, ride the wave, don’t fight it.

Happy Tr4Ding !