Bouygues Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Bouygues Stock Quote

- Double Formation

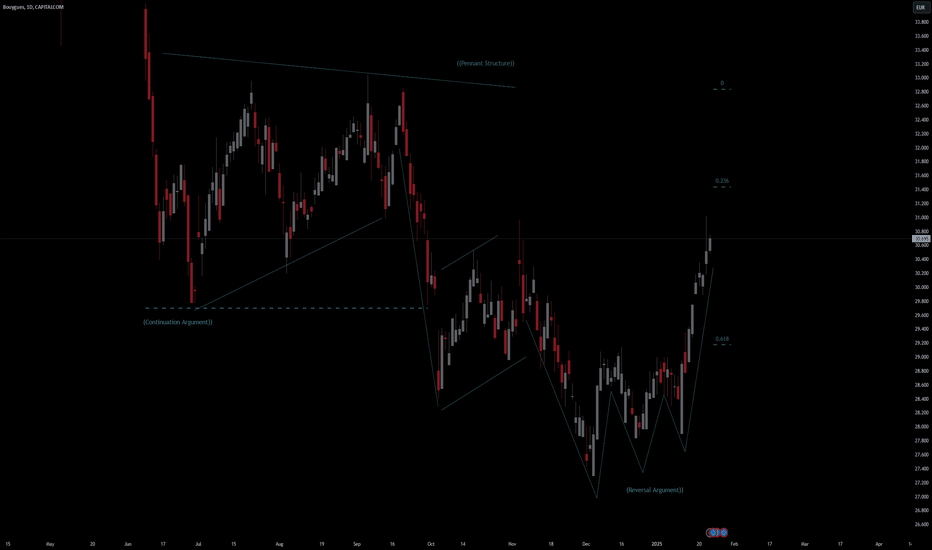

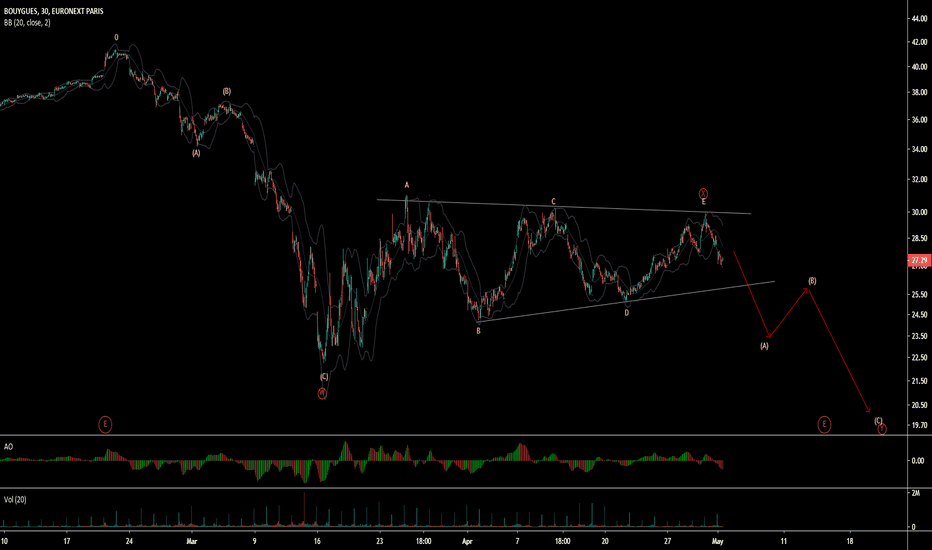

* ((Pennant Structure)) | Short Set Up | Subdivision 1

* (Continuation Argument)) At 29.500 EUR

- Triple Formation

* (Reversal Argument)) At 2

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.7812 EUR

1.06 B EUR

56.75 B EUR

185.90 M

About BOUYGUES

Sector

Industry

CEO

Olivier Roussat

Website

Headquarters

Paris

Founded

1900

ISIN

FR0000120503

FIGI

BBG00NL2MJC2

Bouygues SA provides constructions for building, civil works, energy and services, property, roads and coals. The firm operates through the following segments: Bouygues Construction (Construction & Services), Bouygues Immobilier (Property), Colas (Transport Infrastructure), TF1 (Media) and Bouygues Telecom (Telecoms). The company was founded by Francis Bouygues in 1952 and is headquartered in Paris, France.

Related stocks

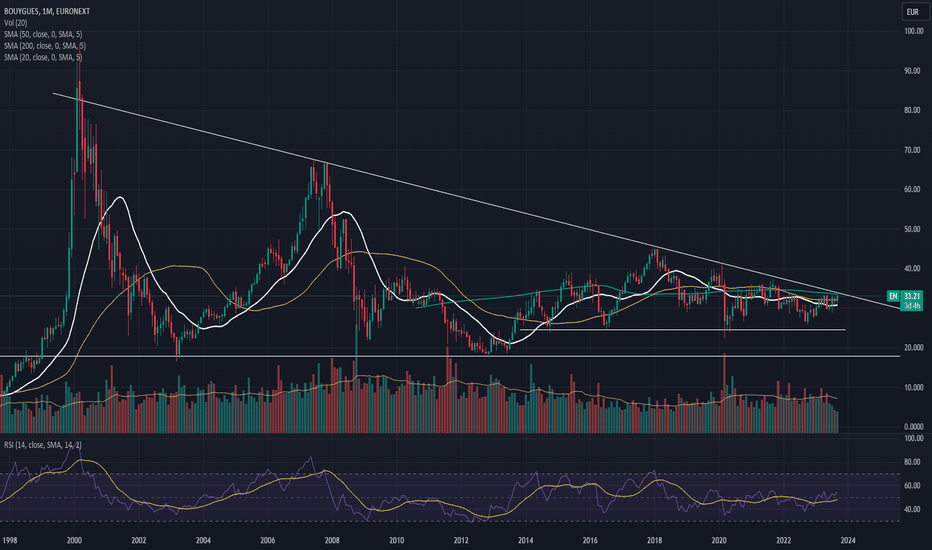

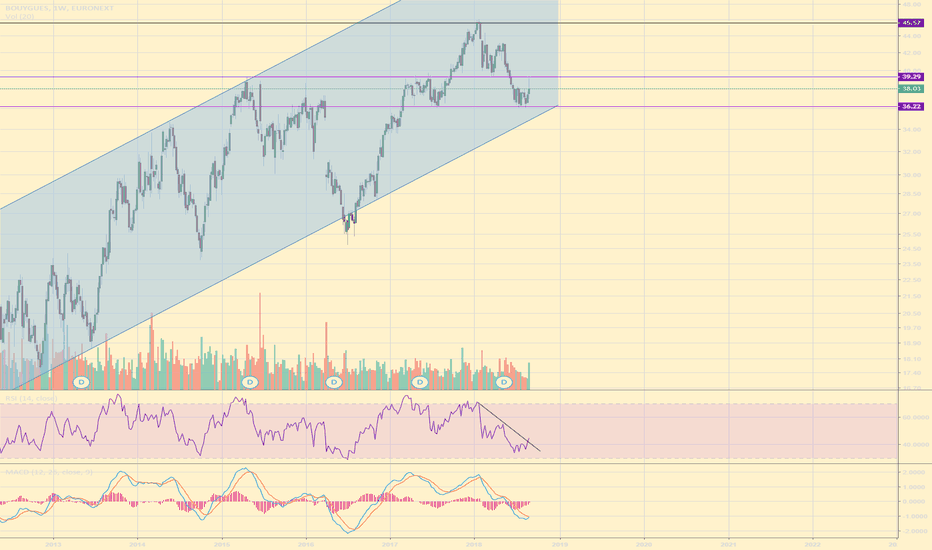

Bouygues Telecom PUT opportunityEN reached 23 years resistance line, with 2 ascending triangles.

Monthly 200 SMA as resistance

Monthly 20 SMA acting as Support.

Due to overall negative market conditions, uncertainty, higher yields, I don't think this is the best time for EN to break this resistance and make a move higher.

PUT opti

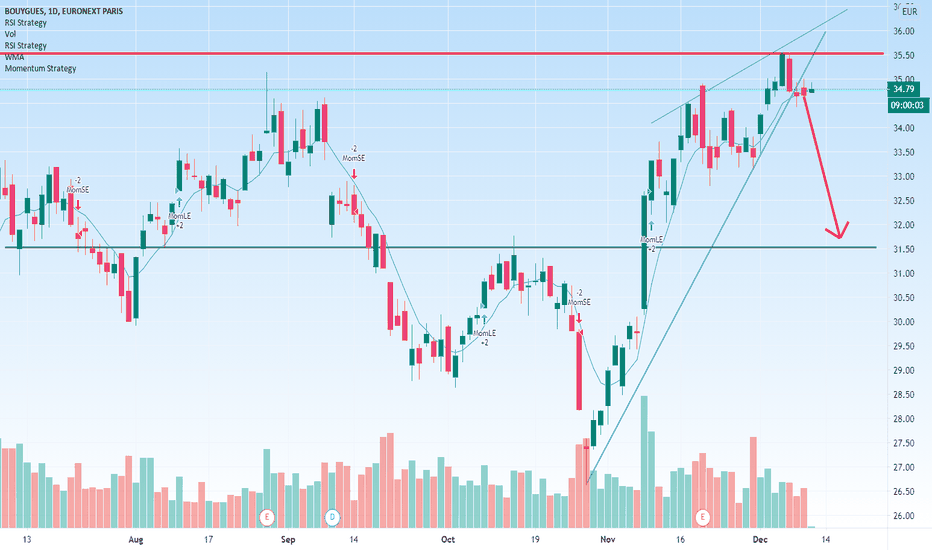

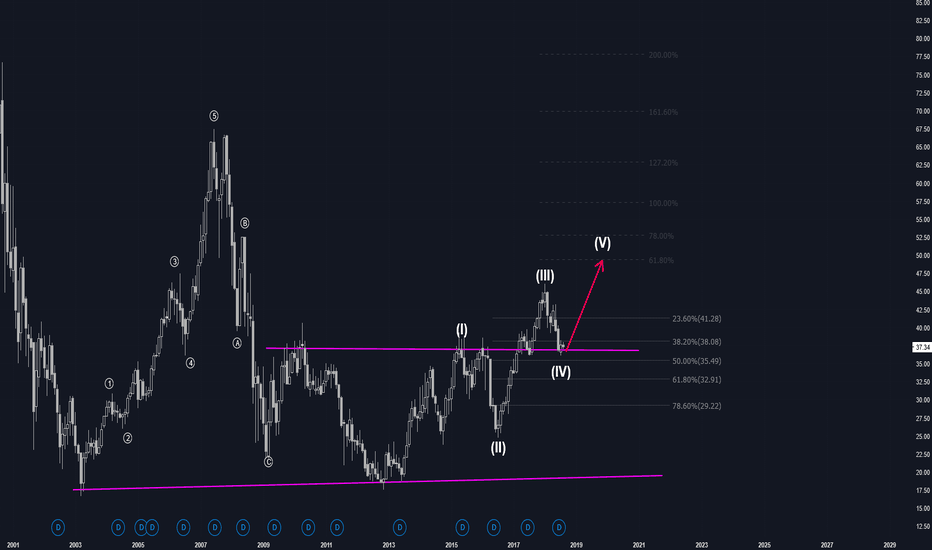

French company Bouygues S.A (EN.pa) at daily chart. Technical outlook:

EN.pa bearish scenario:

We have technical figure Pennant in French company Bouygues S.A (EN.pa) at daily chart. Bouygues S.A specialises in construction (Colas Group and Bouygues Construction), real estate development (Bouygues Immobilier), media (TF1 Group), and telecommunication

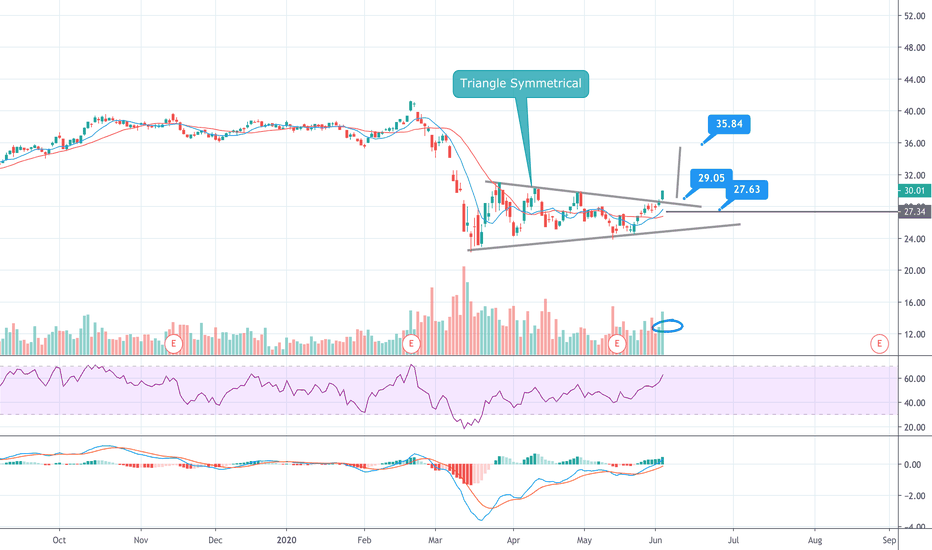

Bouygues SA (EN - France) - WXY wave patternBouygues SA (EN - France) is in WXY complex correction in 60 min time frame as shown in chart and it is now moving in y of Y wave down. X major wave was triangle, but Y wave was again subdivided in wxy wave. Invalidation level on 60 min chart must be followed to remain in count. In weekly time frame

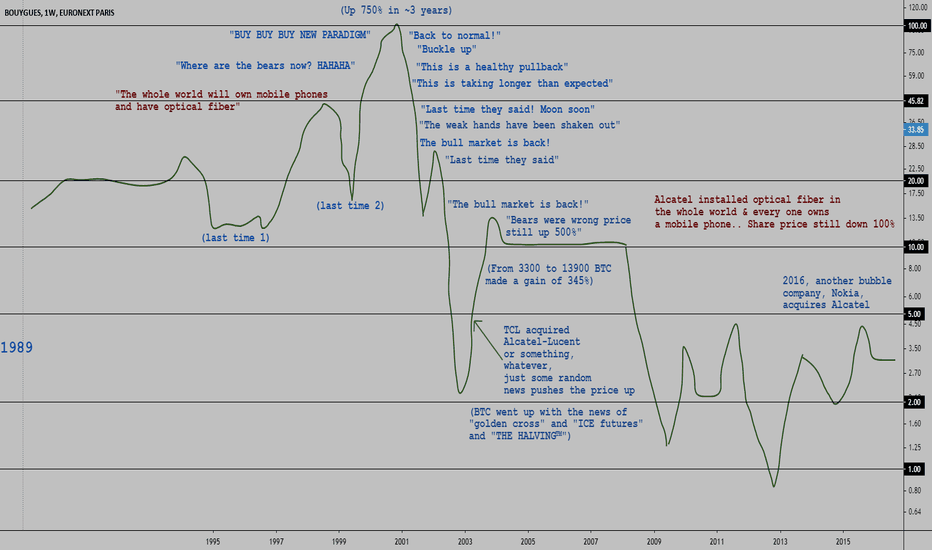

Another speculative bubble: Alcatel-Lucent [Banking] [Crypto]First... a little introduction about mainstream speculation, then I will talk about 50 year market cycles, and then about banking & currencies.

Coronavirus: The "best" models by "the brightest minds" predicted - taking into account lockdown & social distancing - "tens of millions of deaths".

MrRe

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FR0010379255

Bouygues 5,5% 06/10/2026Yield to maturity

4.42%

Maturity date

Oct 6, 2026

A3LAWV

BOUYGUES 2022-30.06.42Yield to maturity

4.01%

Maturity date

Jun 30, 2042

A3K5XQ

BOUYGUES 2022-30.06.37Yield to maturity

3.67%

Maturity date

Jun 30, 2037

A3LAWU

BOUYGUES 2022-07.06.32Yield to maturity

3.21%

Maturity date

Jun 7, 2032

FR1400IBM

BOUYGUES 23/31Yield to maturity

3.13%

Maturity date

Jul 17, 2031

A3KYEM

BOUYGUES 2021-11.02.30Yield to maturity

2.92%

Maturity date

Feb 11, 2030

A3K5XP

BOUYGUES 2022-29.06.29Yield to maturity

2.74%

Maturity date

Jun 29, 2029

FR1350765

BOUYGUES 20/28Yield to maturity

2.56%

Maturity date

Jul 24, 2028

FR1322249

BOUYGUES 16/27Yield to maturity

2.38%

Maturity date

Jun 7, 2027

See all ENP bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on AQUISEU exchange Bouygues SA stocks are traded under the ticker ENP.

We've gathered analysts' opinions on Bouygues SA future price: according to them, ENP price has a max estimate of 53.00 EUR and a min estimate of 36.00 EUR. Watch ENP chart and read a more detailed Bouygues SA stock forecast: see what analysts think of Bouygues SA and suggest that you do with its stocks.

Yes, you can track Bouygues SA financials in yearly and quarterly reports right on TradingView.

Bouygues SA is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

ENP earnings for the last quarter are −0.39 EUR per share, whereas the estimation was −0.65 EUR resulting in a 40.00% surprise. The estimated earnings for the next quarter are 0.78 EUR per share. See more details about Bouygues SA earnings.

Bouygues SA revenue for the last quarter amounts to 12.59 B EUR, despite the estimated figure of 12.54 B EUR. In the next quarter, revenue is expected to reach 14.58 B EUR.

ENP net income for the last quarter is −156.00 M EUR, while the quarter before that showed 371.00 M EUR of net income which accounts for −142.05% change. Track more Bouygues SA financial stats to get the full picture.

Yes, ENP dividends are paid annually. The last dividend per share was 2.00 EUR. As of today, Dividend Yield (TTM)% is 5.21%. Tracking Bouygues SA dividends might help you take more informed decisions.

Bouygues SA dividend yield was 7.01% in 2024, and payout ratio reached 71.34%. The year before the numbers were 5.57% and 68.65% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 29, 2025, the company has 200.2 K employees. See our rating of the largest employees — is Bouygues SA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Bouygues SA EBITDA is 5.50 B EUR, and current EBITDA margin is 9.02%. See more stats in Bouygues SA financial statements.

Like other stocks, ENP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bouygues SA stock right from TradingView charts — choose your broker and connect to your account.