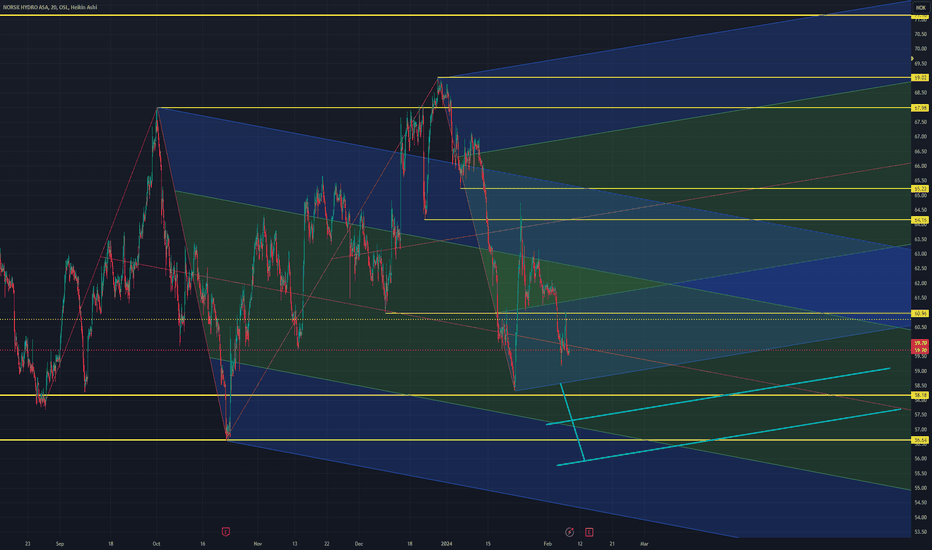

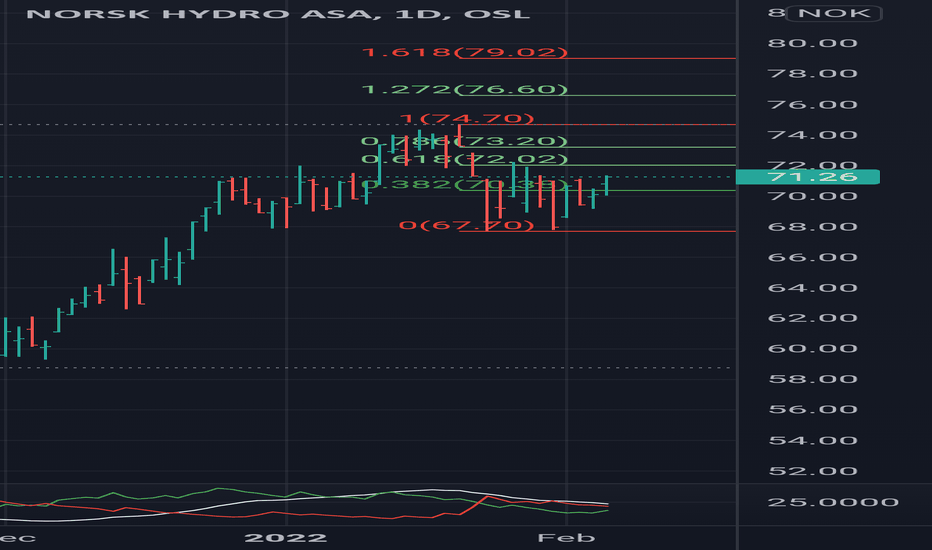

NHY 20 min chart median lines & levels for entry and exitNHY - NORSK HYDRO - 20 min

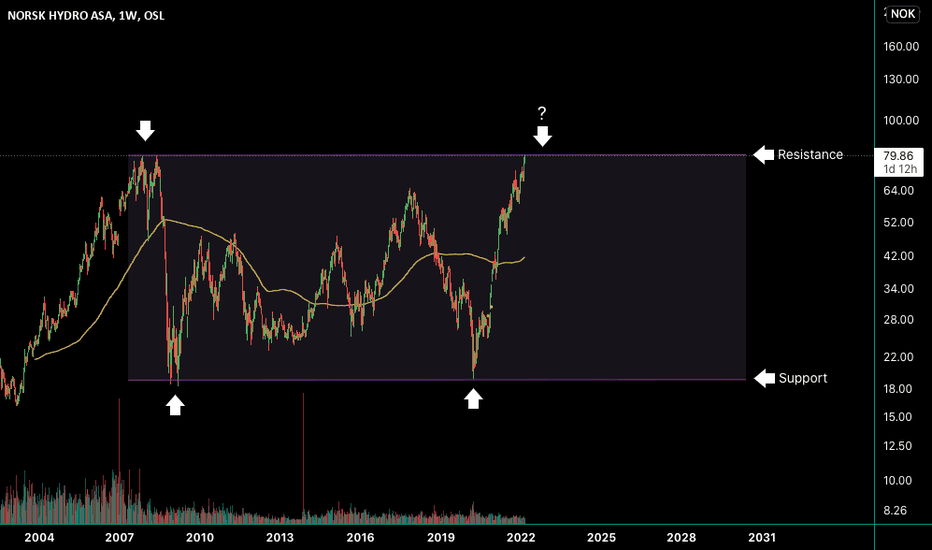

Some median levels for the down side and some upper levels for longer term. POssible entry levels for short and mid term. Currently NHY is in a down trend but a reversal may be soon ahead as it reaches levels under 60, may we see levels under 57 before reversal

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.88 NOK

5.79 B NOK

203.06 B NOK

1.25 B

About NORSK HYDRO ASA

Sector

Industry

CEO

Eivind Kallevik

Website

Headquarters

Oslo

Founded

1905

ISIN

NO0005052605

FIGI

BBG00NL2W620

Norsk Hydro ASA engages in producing and supplying alumina and primary aluminum. It operates through the following segments: Hydro Bauxite and Alumina, Hydro Aluminium Metal, Hydro Extrusions, Hydro Energy, Hydro Metal Markets, and Other. The Hydro Bauxite and Alumina segment includes bauxite mining activities, production of alumina, and related commercial activities, primarily the sale of alumina. The Hydro Aluminium Metal segment focuses on primary aluminium production and casting activities. The Hydro Extrusions segment delivers products within extrusion profiles, building systems and precision tubing, and is operating several recycling facilities, both integrated with its extrusion plants and separate plants. The Hydro Energy refers to operating and commercial responsibility for Hydro's power stations in Norway, a trading and wholesale business in Brazil, and energy sourcing for Hydro’s world-wide operations. The Hydro Metal Markets is involved in all sales activities relating to products from primary metal plants and operational responsibility for stand-alone recyclers as well as physical and financial metal trading activities. The company was founded on December 2, 1905 and is headquartered in Oslo, Norway.

Related stocks

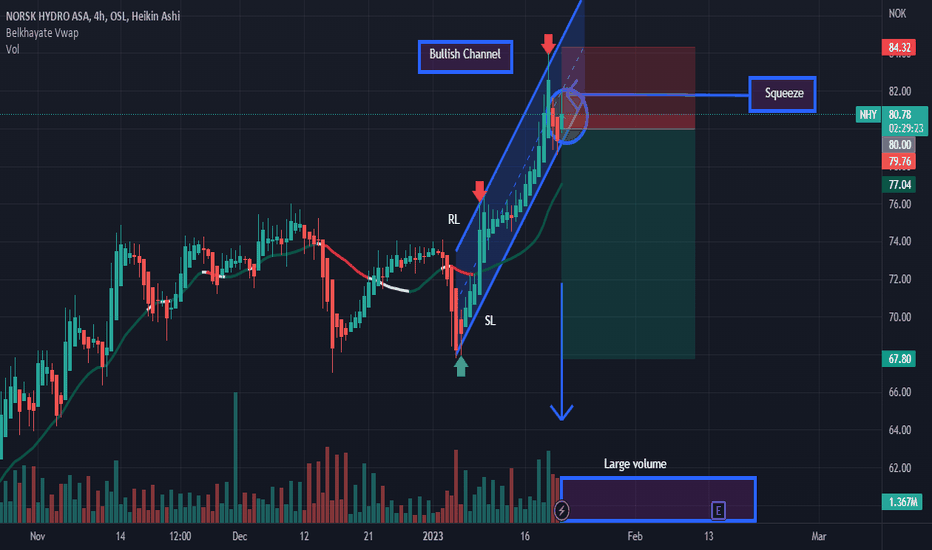

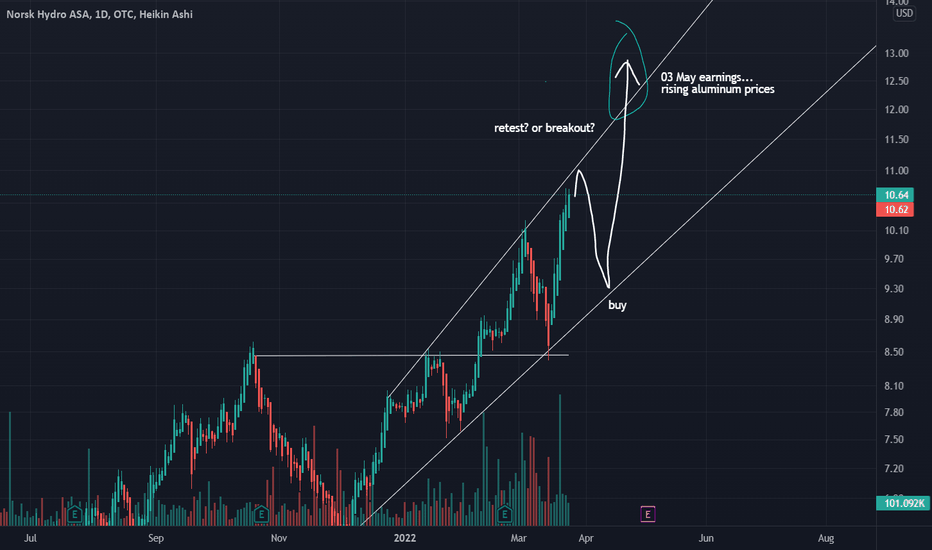

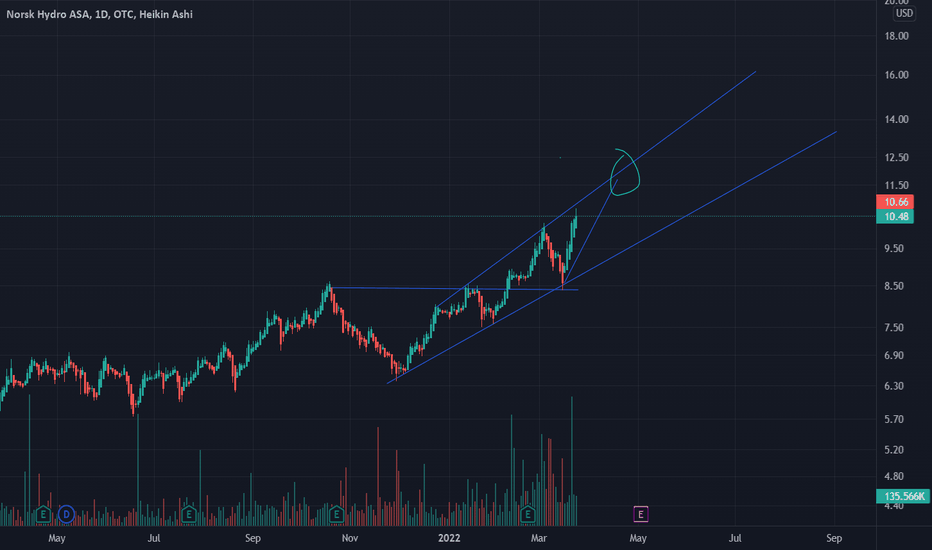

NHYDY Breaking Out?NHYDY has been in this upward channel for a while, could continue to bounce around inside of it (making for some very good trades when it hits support) or could also be posed for a breakout. Volume picking up, previous resistence was broken and retested. Plus the macro: aluminim price has been going

NHYDY Breaking Out?NHYDY has been in this upward channel for a while, could continue to bounce around inside of it (making for some very good trades when it hits support) or could also be posed for a breakout. Volume picking up, previous resistence was broken and retested, plus aluminim price has been going up this we

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS309205782

NORSK HYDRO 25/33 MTNYield to maturity

3.73%

Maturity date

Jun 17, 2033

XS296969311

NORSK HYDRO 25/32 MTNYield to maturity

3.45%

Maturity date

Jan 23, 2032

XS197492252

NORSK HYDRO 19/29Yield to maturity

2.78%

Maturity date

Apr 11, 2029

See all NHYO bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on AQUISEU exchange Norsk Hydro ASA stocks are traded under the ticker NHYO.

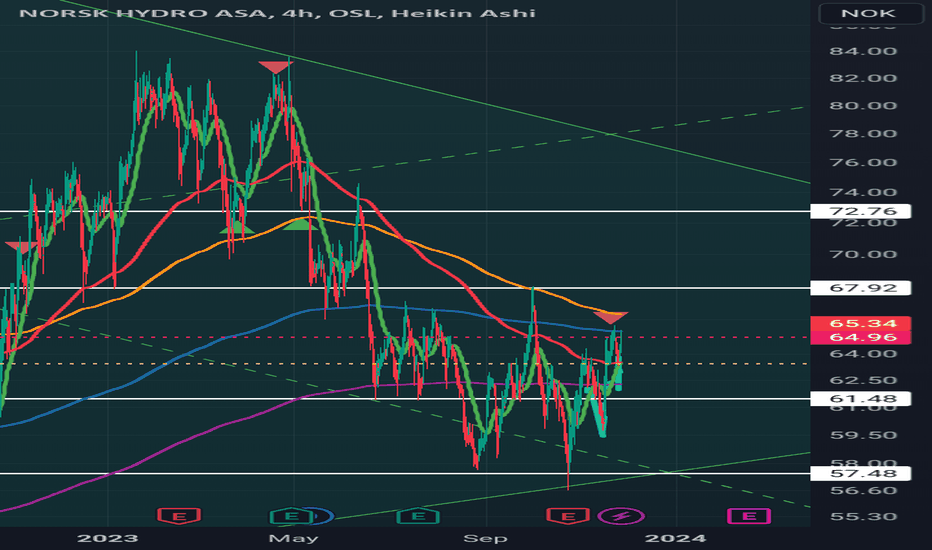

We've gathered analysts' opinions on Norsk Hydro ASA future price: according to them, NHYO price has a max estimate of 80.00 NOK and a min estimate of 43.00 NOK. Watch NHYO chart and read a more detailed Norsk Hydro ASA stock forecast: see what analysts think of Norsk Hydro ASA and suggest that you do with its stocks.

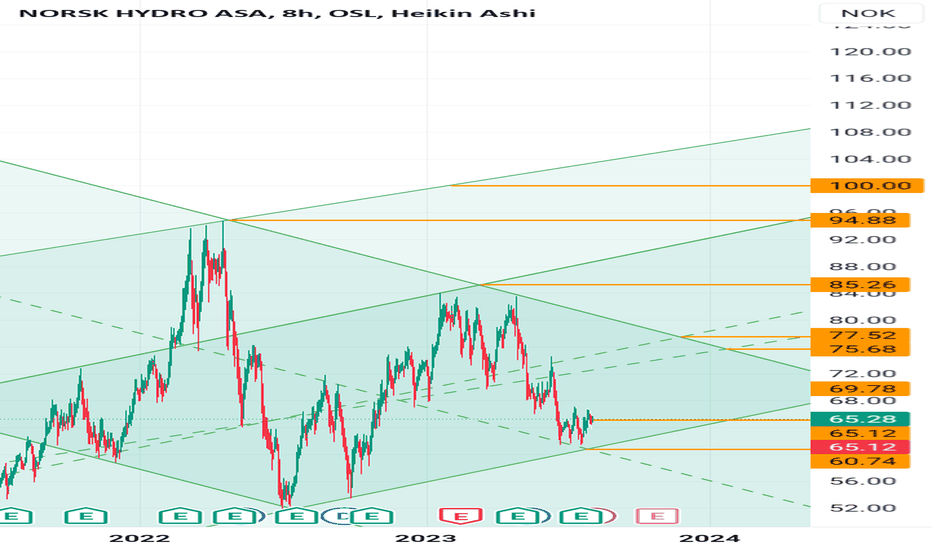

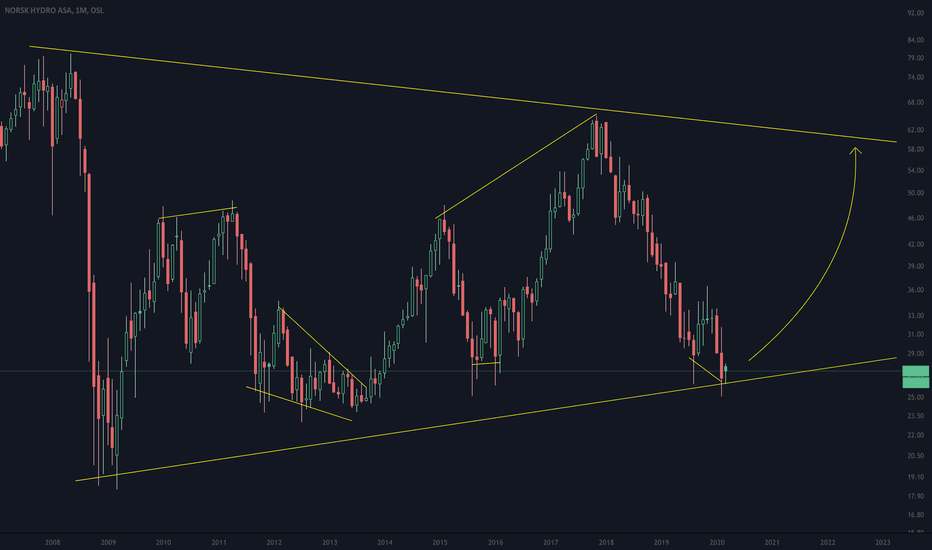

NHYO reached its all-time high on Apr 19, 2022 with the price of 94.78 NOK, and its all-time low was 19.16 NOK and was reached on Mar 16, 2020. View more price dynamics on NHYO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track Norsk Hydro ASA financials in yearly and quarterly reports right on TradingView.

Norsk Hydro ASA is going to release the next earnings report on Jul 22, 2025. Keep track of upcoming events with our Earnings Calendar.

NHYO earnings for the last quarter are 1.63 NOK per share, whereas the estimation was 2.17 NOK resulting in a −25.05% surprise. The estimated earnings for the next quarter are 1.47 NOK per share. See more details about Norsk Hydro ASA earnings.

Norsk Hydro ASA revenue for the last quarter amounts to 57.09 B NOK, despite the estimated figure of 58.21 B NOK. In the next quarter, revenue is expected to reach 51.36 B NOK.

NHYO net income for the last quarter is 4.83 B NOK, while the quarter before that showed 1.91 B NOK of net income which accounts for 152.82% change. Track more Norsk Hydro ASA financial stats to get the full picture.

Yes, NHYO dividends are paid annually. The last dividend per share was 2.25 NOK. As of today, Dividend Yield (TTM)% is 3.83%. Tracking Norsk Hydro ASA dividends might help you take more informed decisions.

Norsk Hydro ASA dividend yield was 3.60% in 2024, and payout ratio reached 77.63%. The year before the numbers were 3.65% and 141.58% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 6, 2025, the company has 32.03 K employees. See our rating of the largest employees — is Norsk Hydro ASA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Norsk Hydro ASA EBITDA is 31.79 B NOK, and current EBITDA margin is 10.15%. See more stats in Norsk Hydro ASA financial statements.

Like other stocks, NHYO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Norsk Hydro ASA stock right from TradingView charts — choose your broker and connect to your account.