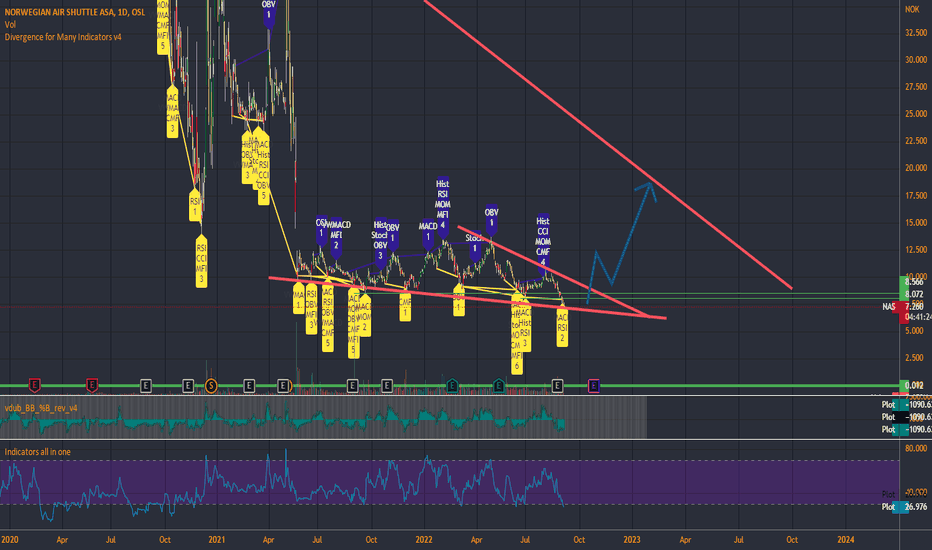

Norwegian Air Shuttle (NAS): Navigating Through VolatilityI've been tracking Norwegian Air Shuttle (NAS) closely, and while it’s been a rocky ride for investors, there's always a sense of unpredictability with this stock. If you look at the big picture, Norwegian has been navigating through tough waters, but the company still holds potential for massive mo

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.930 NOK

1.36 B NOK

35.32 B NOK

842.89 M

About NORWEGIAN AIR SHUTTLE ASA

Sector

Industry

CEO

Geir Magne Karlsen

Website

Headquarters

Fornebu

Founded

1993

ISIN

NO0010196140

FIGI

BBG005HVC4G2

Norwegian Air Shuttle ASA is an airline company, which engages in the provision of aviation, other transport, and travel-related activities. It offers routes to destinations in Europe, North Africa, and the Middle East. It operates through the Domestic Norway and Other geographical segments. The company was founded on January 22, 1993 and is headquartered in Fornebu, Norway.

Related stocks

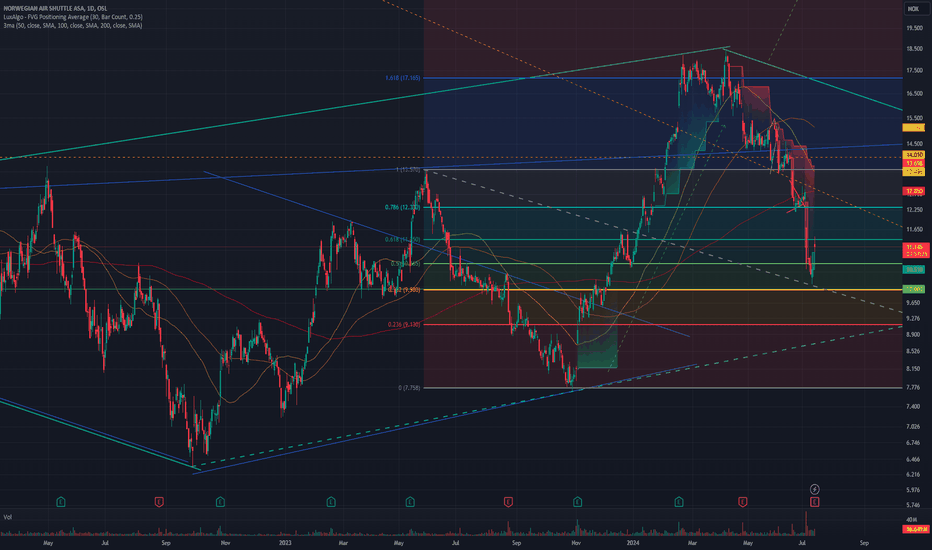

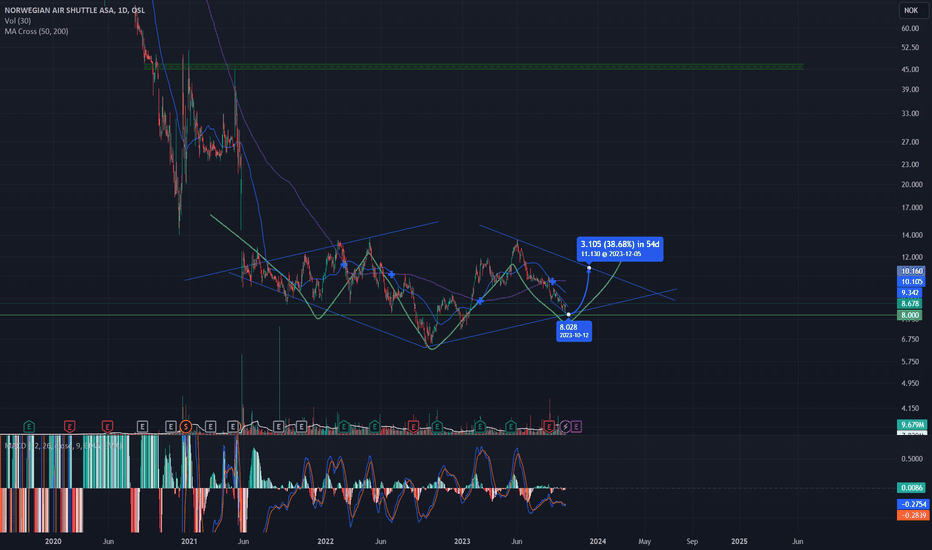

NAS ASA Q2 2024 Financial Report: Strong Performance and outlookSupport at 10NOK and 50% Fibonacci bounce, might be a bullish year!

Norwegian Air Shuttle ASA (NAS) has released its second-quarter financial report for 2024, showcasing impressive growth and strong operational performance. As a result, the stock has surged by 6% today. Here’s a detailed look at t

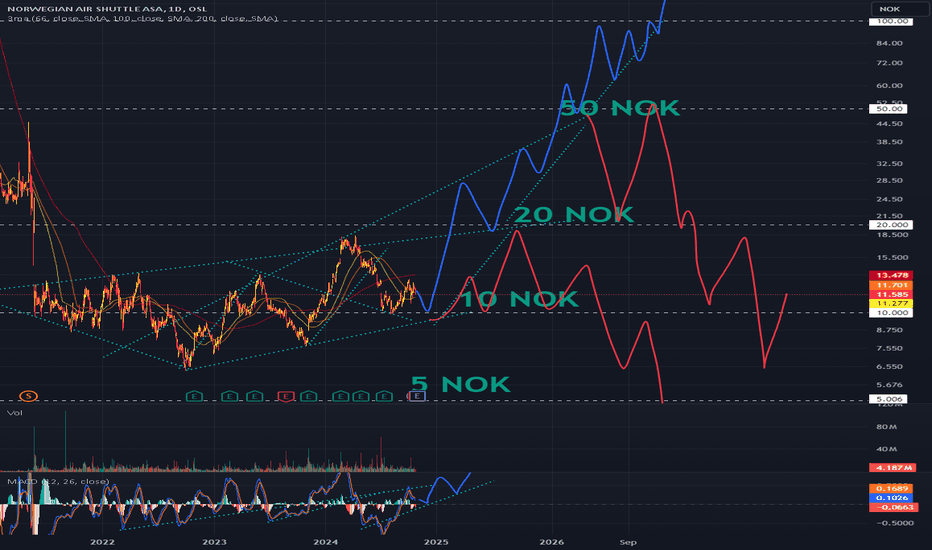

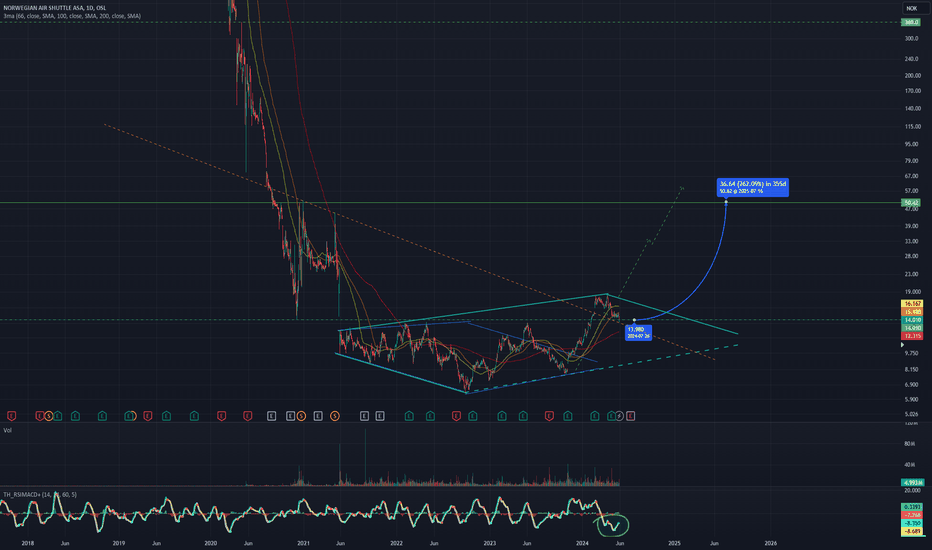

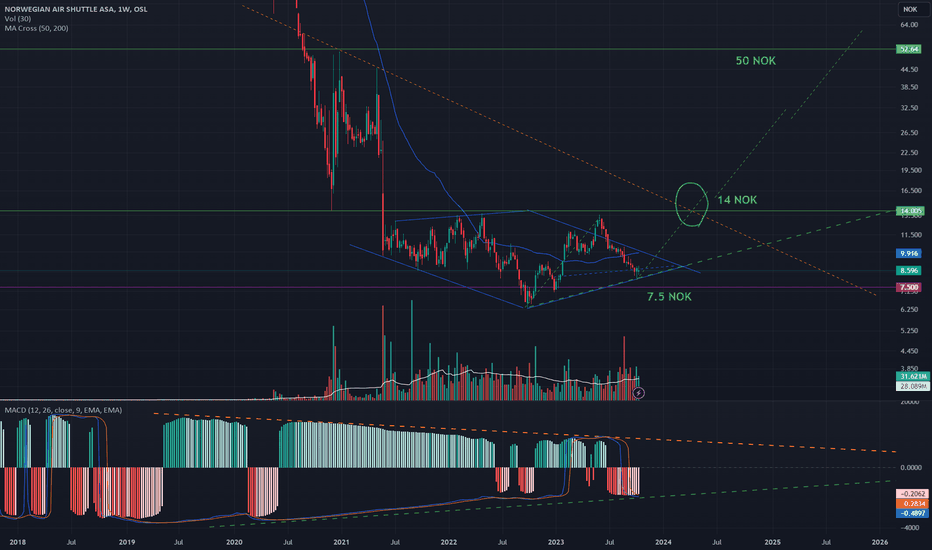

NAS 250% to 50NOK - Path to 360NOKAs some of you know I have been bullish on Norwegian Air Shuttle quite for a while. I really like the stock. They bought 50 airplanes past year and are doing more passengers every year. It's weird t me the stock is trading low. - This is not financial advice, it's my thoughts on NAS!.

Congrats to

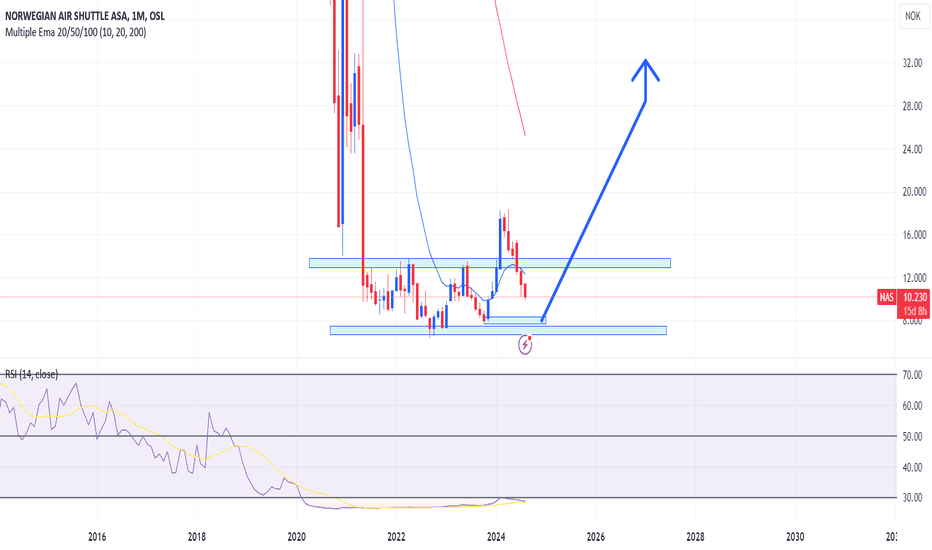

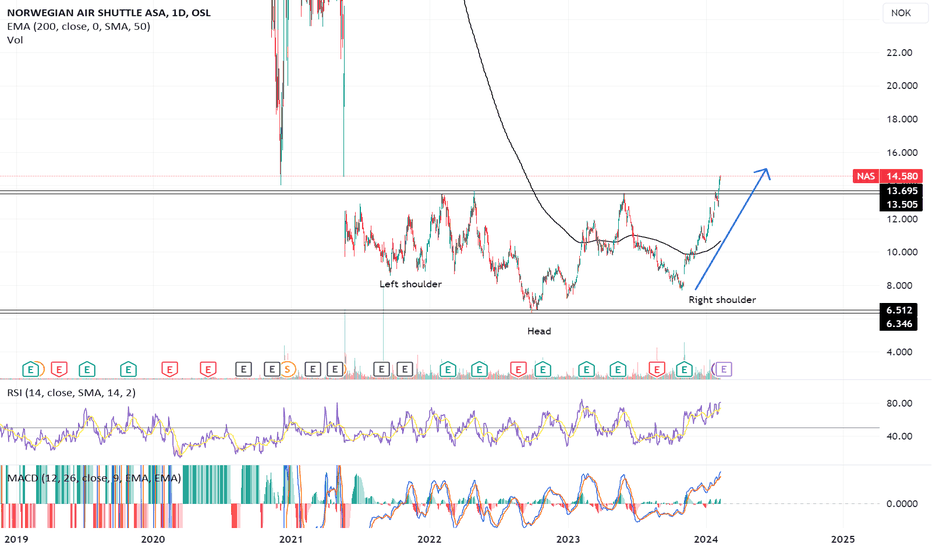

NAS 100% to 15NOK - Path to 50NOKWelcome to a concise chart analysis of NAS (Norwegian Air Shuttle). I'll provide a straightforward overview. NAS is showing intriguing potential.

The NAS chart features a diamond bottom pattern. The crucial point is the robust support at 7.5 - 8 NOK, indicating a stable floor.

The Exponential MACD

NAS reverse head and shoulders formationNorwegian Air Shuttle (NAS) has formed a reverse head and shoulders formation, signaling a shift in dynamics between buyers and sellers in favor of buyers. Since June 2021, the outlook for NAS has been uncertain, but there has now been a significant breakthrough above a resistance level.

The range

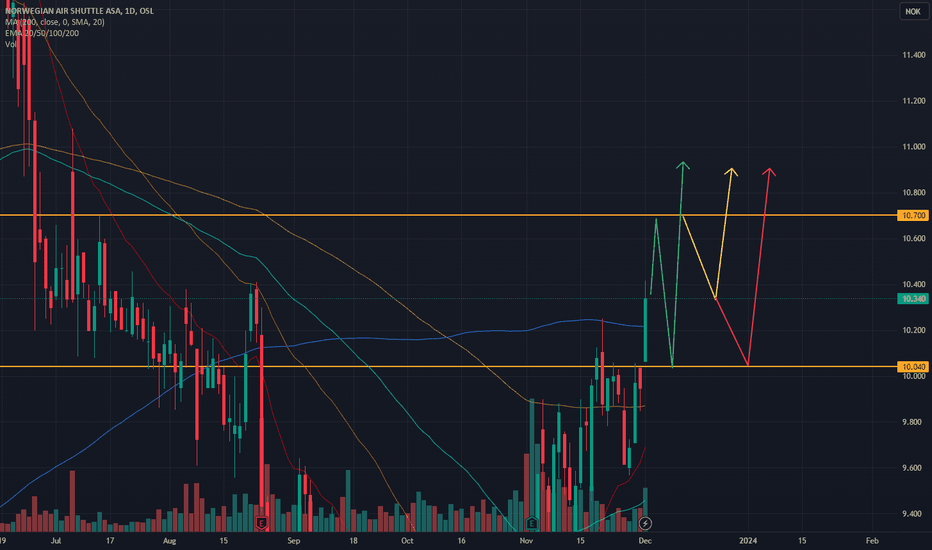

Diamond Pattern in Norwegian Air (NOK) Around 8 NOK supportHello TradingView Community,

I have news regarding a potential trading opportunity that has caught my attention, and I believe it's worth discussing and analyzing together.

Recently, I've observed what appears to be a developing Diamond pattern in Norwegian Air (NAS).

Notable Level 8 kroner (NOK

Norway NasaOnly for ballers. If you looking long term, this shares are the ones you retire for good.

Incredible potential, infinite upside, is to buy now or get the f..k out from trading.

Make your math, your chart, your analysis or whatever you want, this is it.

This is the stock you been waiting all your

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where NASO is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on AQUISUK exchange Norwegian Air Shuttle AS stocks are traded under the ticker NASO.

We've gathered analysts' opinions on Norwegian Air Shuttle AS future price: according to them, NASO price has a max estimate of 19.00 NOK and a min estimate of 12.50 NOK. Watch NASO chart and read a more detailed Norwegian Air Shuttle AS stock forecast: see what analysts think of Norwegian Air Shuttle AS and suggest that you do with its stocks.

NASO reached its all-time high on May 4, 2018 with the price of 315.300 NOK, and its all-time low was 0.300 NOK and was reached on Dec 2, 2020. View more price dynamics on NASO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track Norwegian Air Shuttle AS financials in yearly and quarterly reports right on TradingView.

Norwegian Air Shuttle AS is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

NASO earnings for the last quarter are 0.78 NOK per share, whereas the estimation was 0.75 NOK resulting in a 3.16% surprise. The estimated earnings for the next quarter are 2.16 NOK per share. See more details about Norwegian Air Shuttle AS earnings.

Norwegian Air Shuttle AS revenue for the last quarter amounts to 10.29 B NOK, despite the estimated figure of 10.18 B NOK. In the next quarter, revenue is expected to reach 12.30 B NOK.

NASO net income for the last quarter is 906.30 M NOK, while the quarter before that showed −756.50 M NOK of net income which accounts for 219.80% change. Track more Norwegian Air Shuttle AS financial stats to get the full picture.

Norwegian Air Shuttle AS dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 21, 2025, the company has 7.27 K employees. See our rating of the largest employees — is Norwegian Air Shuttle AS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Norwegian Air Shuttle AS EBITDA is 7.21 B NOK, and current EBITDA margin is 20.38%. See more stats in Norwegian Air Shuttle AS financial statements.

Like other stocks, NASO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Norwegian Air Shuttle AS stock right from TradingView charts — choose your broker and connect to your account.