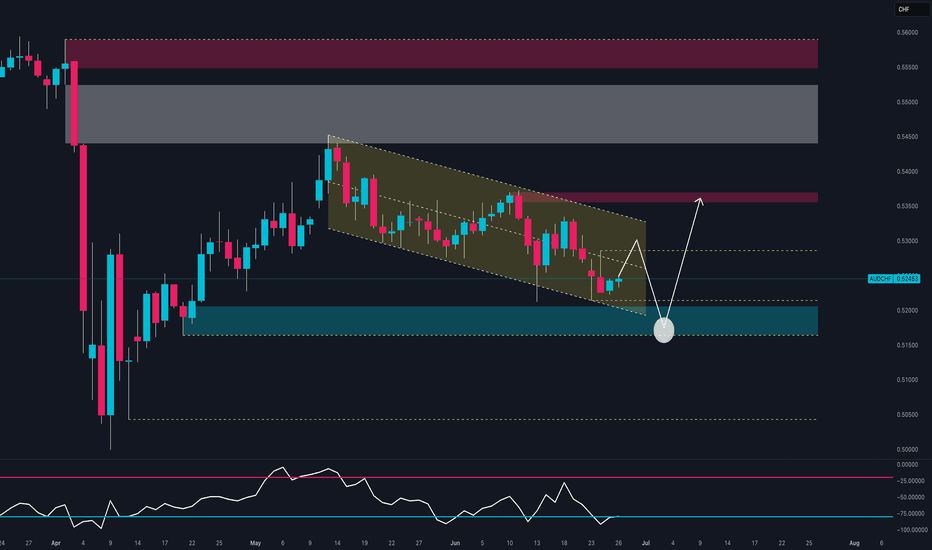

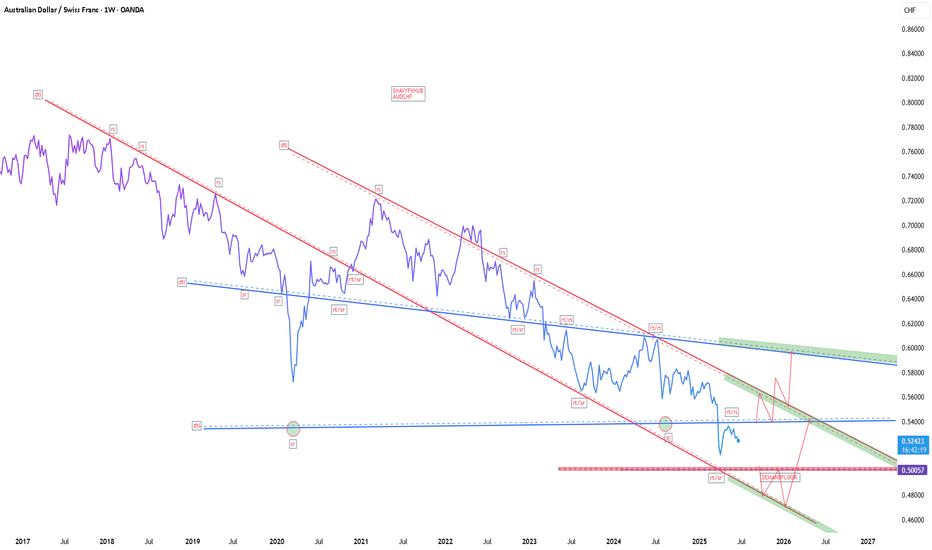

AUDCHF at Make-or-Break Zone: Smart Money Reversal or Breakdown?1. Price Action

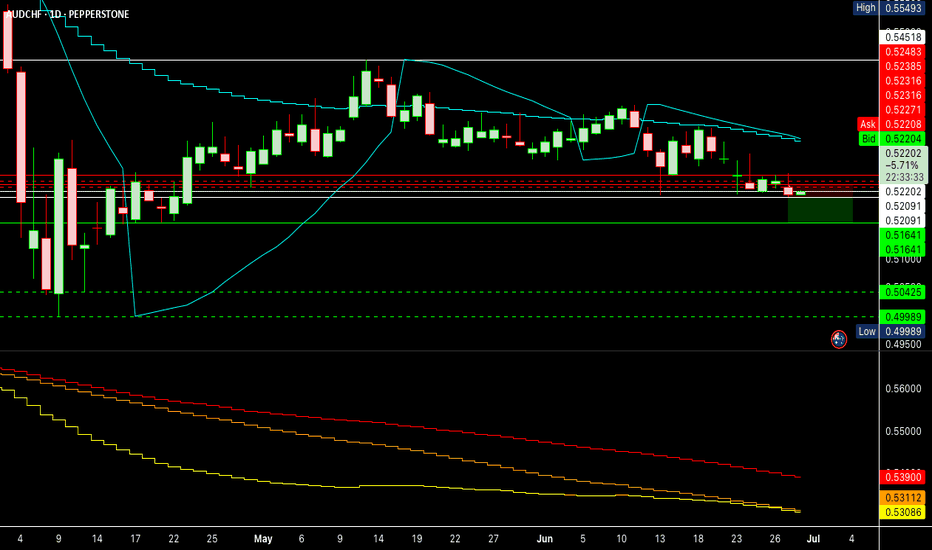

Price is currently trading within a descending channel, with 0.5244 hovering near a key demand zone (0.5150–0.5200), where a first bullish reaction has already occurred.

The structure suggests a potential fake breakdown, with room for a rebound toward static resistances at 0.5330, an

About Australian Dollar / Swiss Franc

The Australian Dollar vs. the Swiss Franc pair is usually used as a carry trade. Swiss Franc is considered as a safe currency during unstable economic times and the Australian Dollar is a more responsive one to global economic conditions. AUD CHF pair is often used as a measuring stick for the global economic performance.

Related currencies

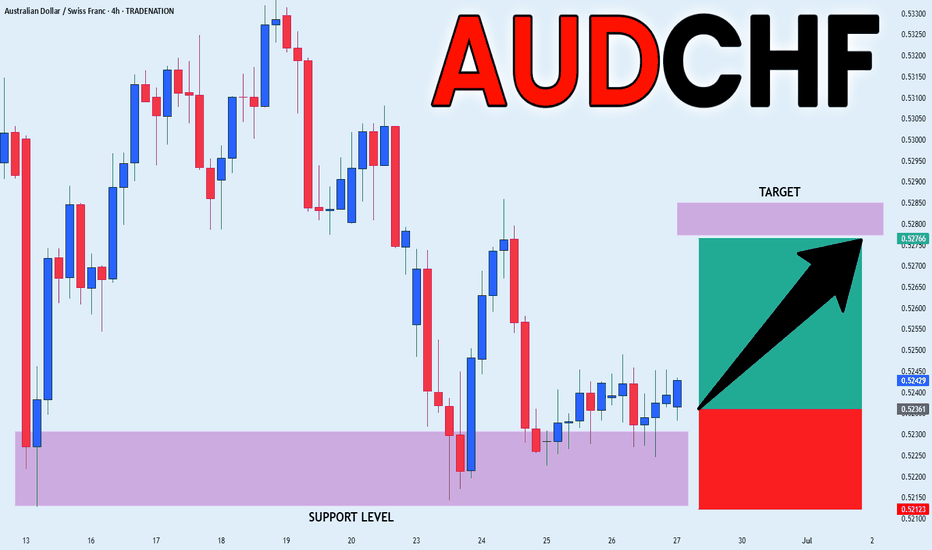

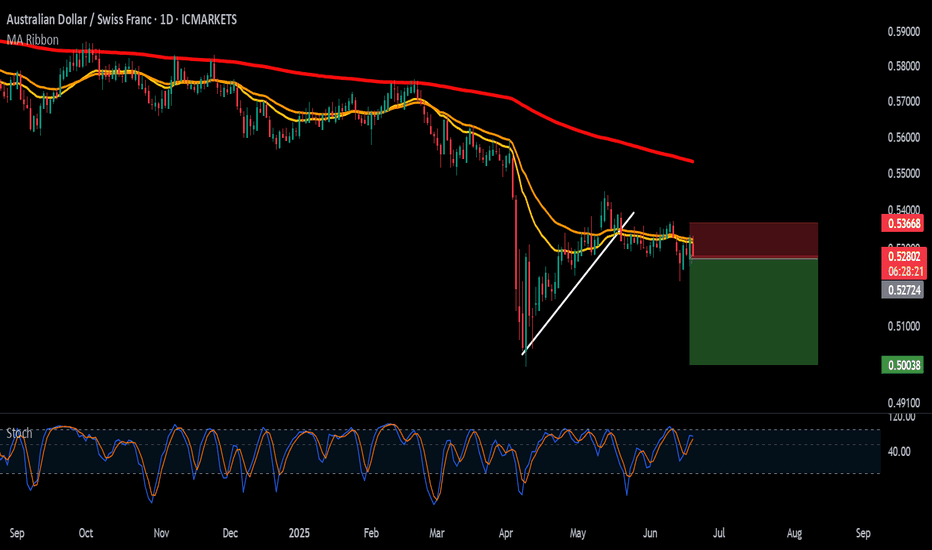

AUD CHF long ideaWith the markets Middle East and tariff concerns put to one side for time being, a risk on trade currently seems viable. The positive mood is backed up by FED board members turning dovish.

This could be classed as either a 'risk on' or '4hr support and resistance' trade simply a 'risk on' trade.

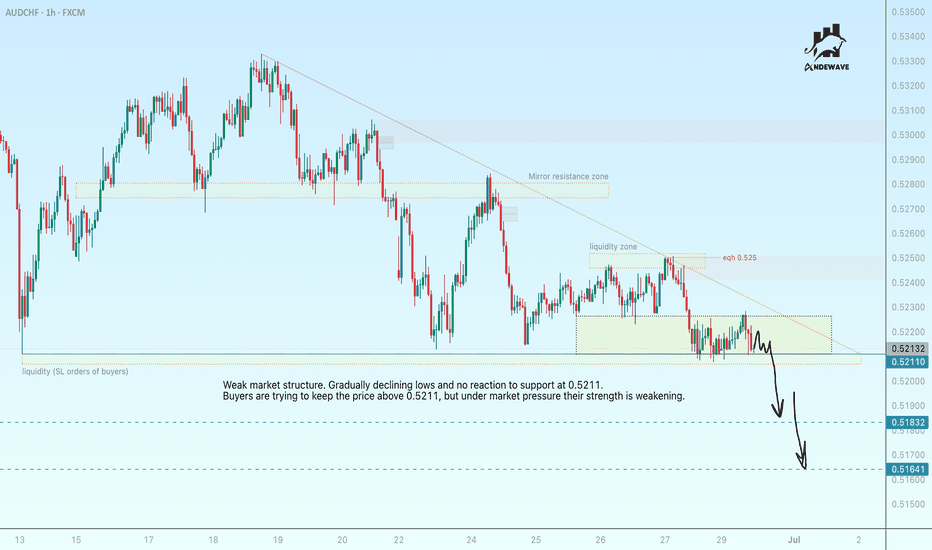

AUDCHF AUDCHF is preparing to break through support and fallWeak market structure. Gradually declining lows and no reaction to support at 0.5211. Buyers are trying to keep the price above 0.5211, but under market pressure their strength is weakening.

Relative to 0.5211, we see the formation of consolidation, which is of a “pre-breakdown” nature.

Accordingl

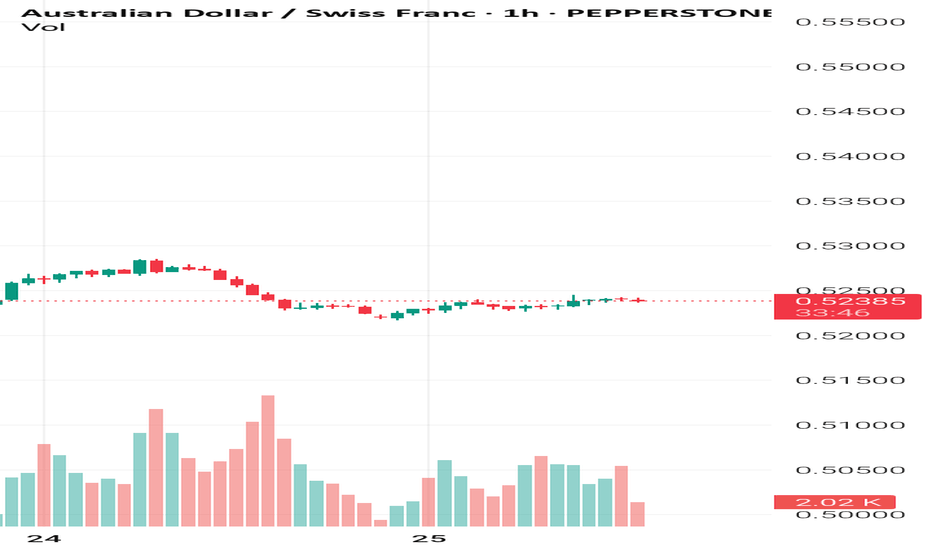

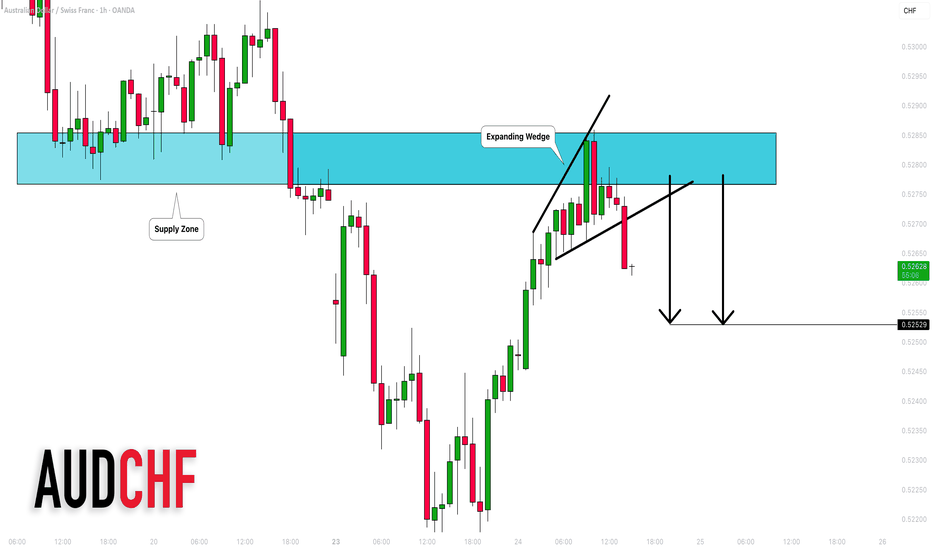

AUD_CHF LONG SIGNAL|

✅AUD_CHF was trading in a

Strong downtrend but then

Has reached a strong horizontal

Demand area around 0.5215

And failed to break the level

Which means that the bearish

Impulse might be absorbed

And we will finally see a

Bullish move up so we can

Enter a long trade with the

TP of 0.5276 and

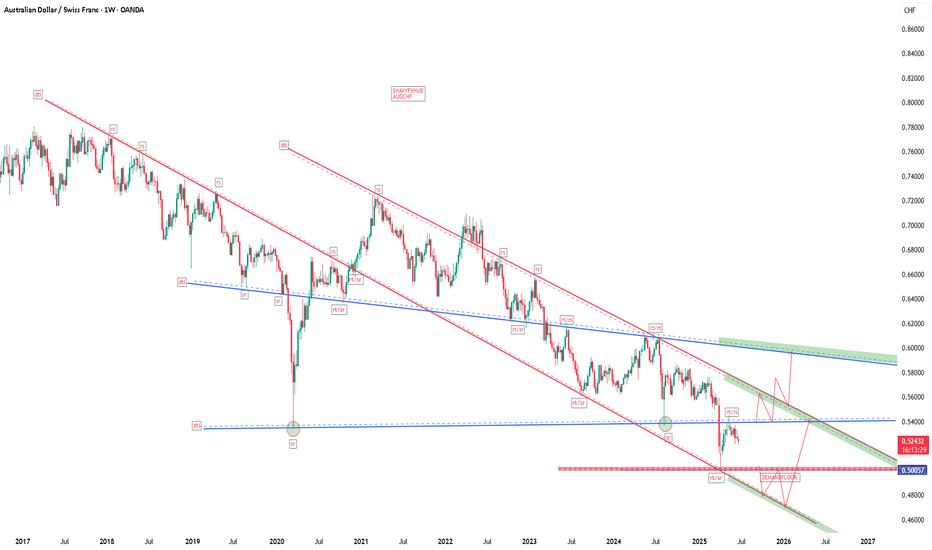

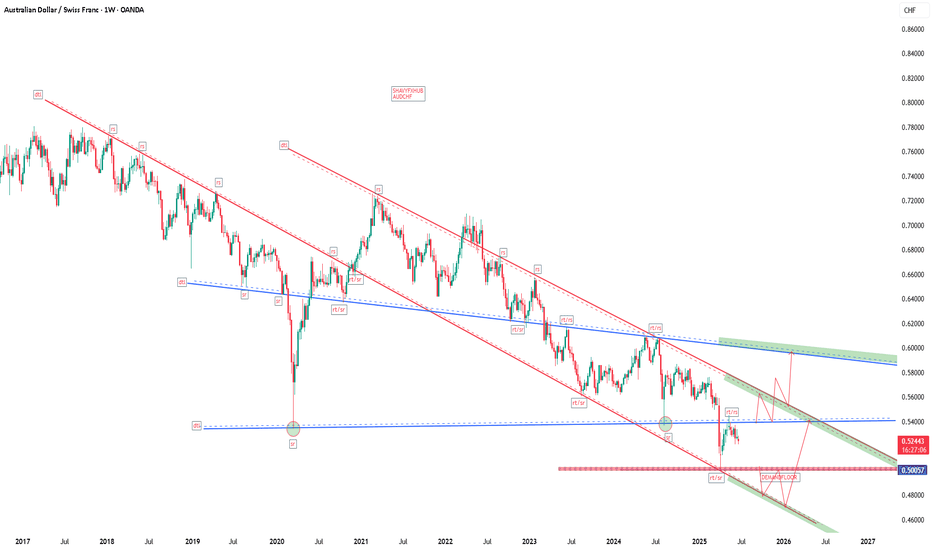

AUDCHF — What’s Going On with the CHF?In this pair, there’s currently a good opportunity to open a short position.

Looking at the weekly and daily timeframes, the price reached the 0.54518 area and started to reverse.

On top of that, it seems to be forming a triangle on these timeframes, which could suggest the price may continue to d

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault i

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault i

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault i

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of AUDCHF is 0.52176 CHF — it has decreased by −0.06% in the past 24 hours. See more of AUDCHF rate dynamics on the detailed chart.

The value of the AUDCHF pair is quoted as 1 AUD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 AUD.

The term volatility describes the risk related to the changes in an asset's value. AUDCHF has the volatility rating of 0.61%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The AUDCHF showed a −0.37% fall over the past week, the month change is a −1.63% fall, and over the last year it has decreased by −12.68%. Track live rate changes on the AUDCHF chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

AUDCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with AUDCHF technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the AUDCHF shows the strong sell signal, and 1 month rating is sell. See more of AUDCHF technicals for a more comprehensive analysis.