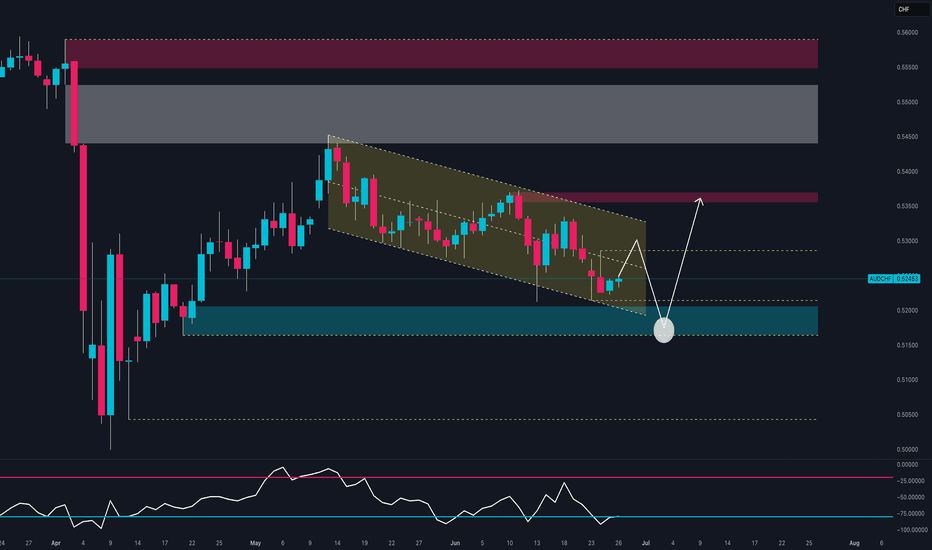

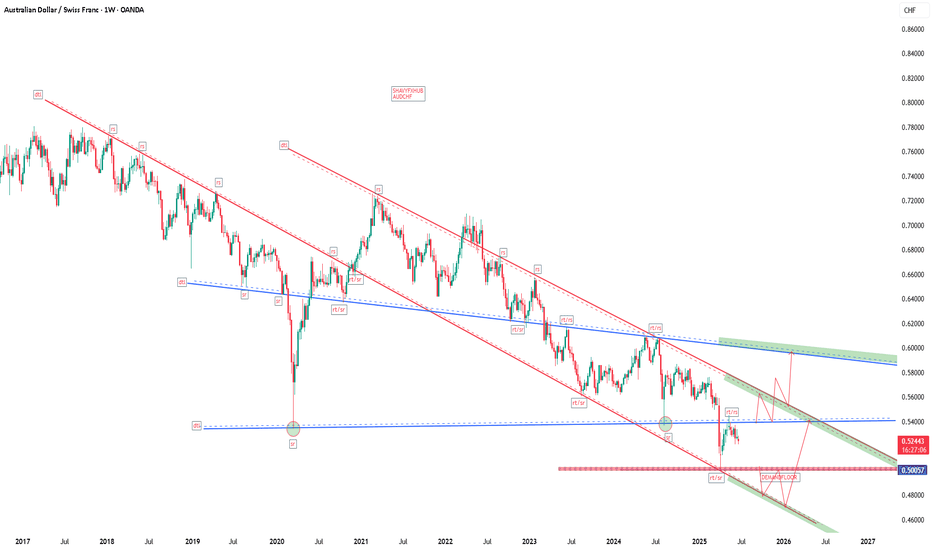

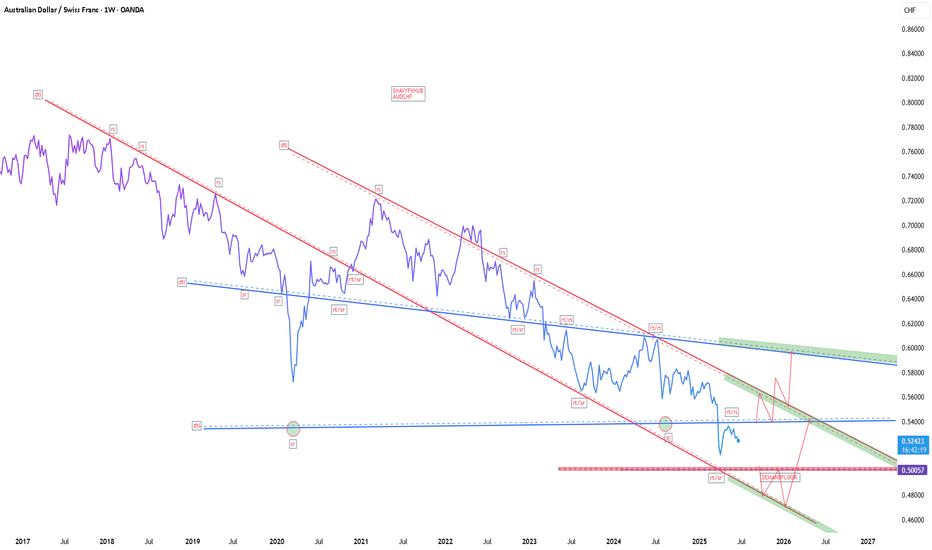

AUDCHF at Make-or-Break Zone: Smart Money Reversal or Breakdown?1. Price Action

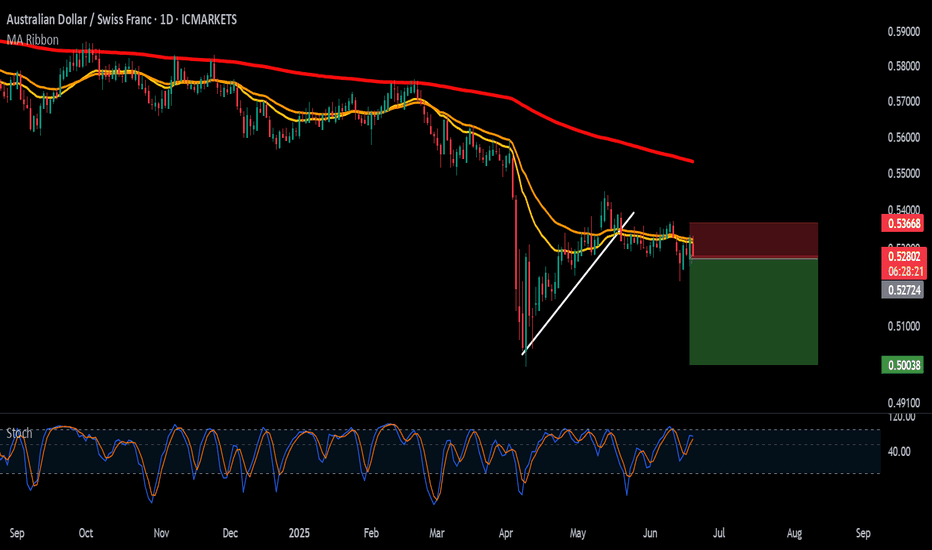

Price is currently trading within a descending channel, with 0.5244 hovering near a key demand zone (0.5150–0.5200), where a first bullish reaction has already occurred.

The structure suggests a potential fake breakdown, with room for a rebound toward static resistances at 0.5330, an

About Australian Dollar / Swiss Franc

The Australian Dollar vs. the Swiss Franc pair is usually used as a carry trade. Swiss Franc is considered as a safe currency during unstable economic times and the Australian Dollar is a more responsive one to global economic conditions. AUD CHF pair is often used as a measuring stick for the global economic performance.

Related currencies

AUD CHF long ideaWith the markets Middle East and tariff concerns put to one side for time being, a risk on trade currently seems viable. The positive mood is backed up by FED board members turning dovish.

This could be classed as either a 'risk on' or '4hr support and resistance' trade simply a 'risk on' trade.

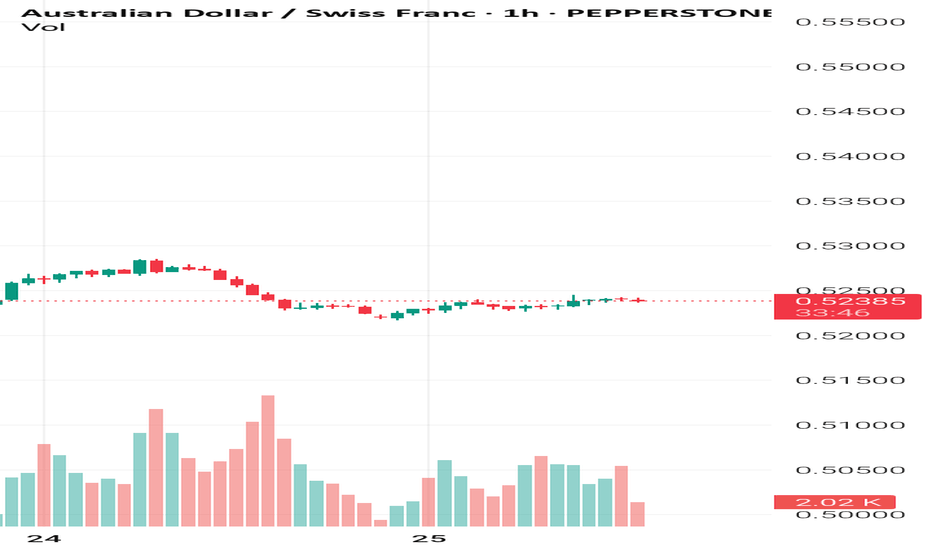

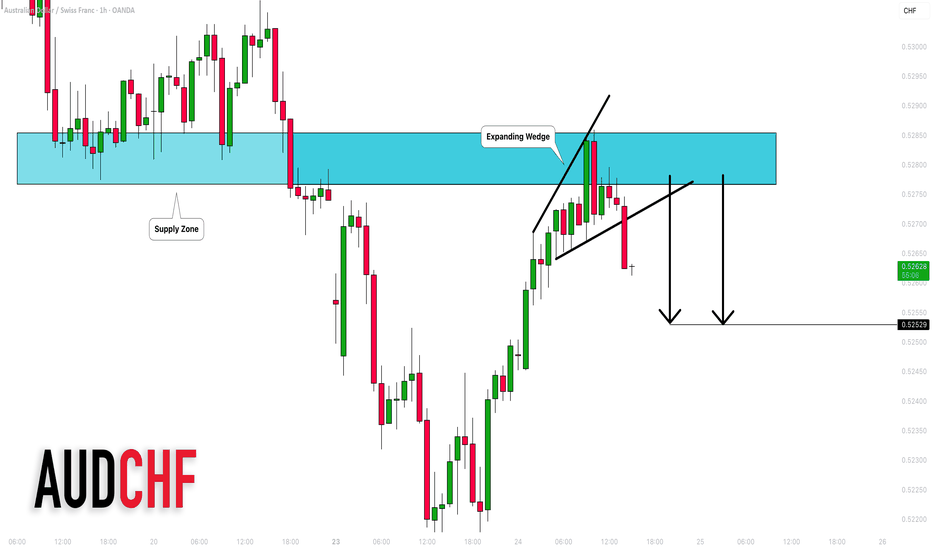

AUD_CHF LONG SIGNAL|

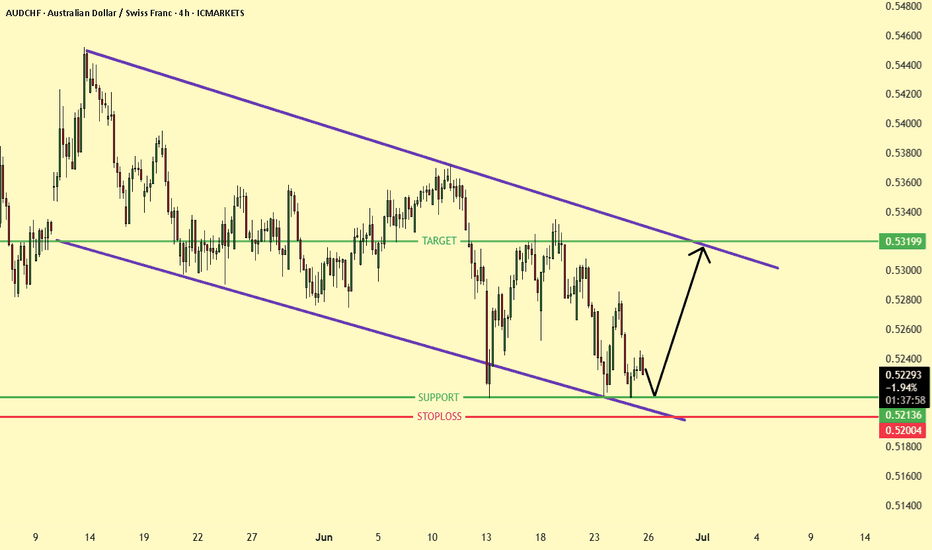

✅AUD_CHF was trading in a

Strong downtrend but then

Has reached a strong horizontal

Demand area around 0.5215

And failed to break the level

Which means that the bearish

Impulse might be absorbed

And we will finally see a

Bullish move up so we can

Enter a long trade with the

TP of 0.5276 and

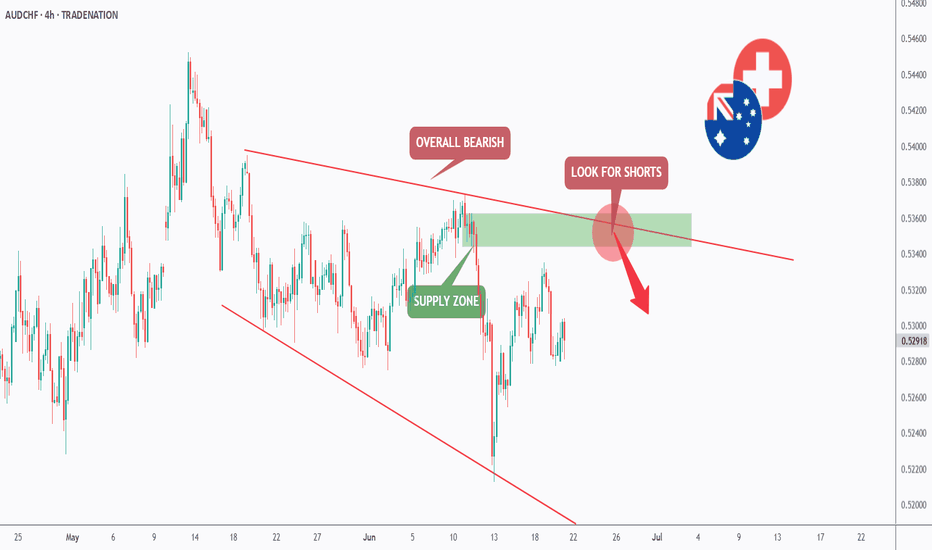

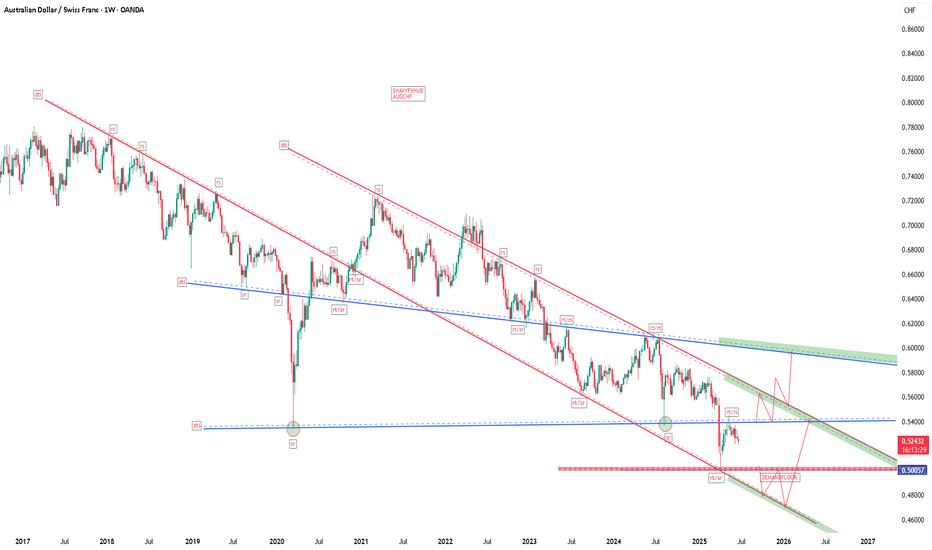

AUDCHF - Wait For it!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDCHF has been overall bearish trading within the flat falling broadening wedge pattern marked in red.

Moreover, the green zone is a supply.

🏹 Thus, the highlighted red circle is a strong area to look for

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault i

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault i

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault i

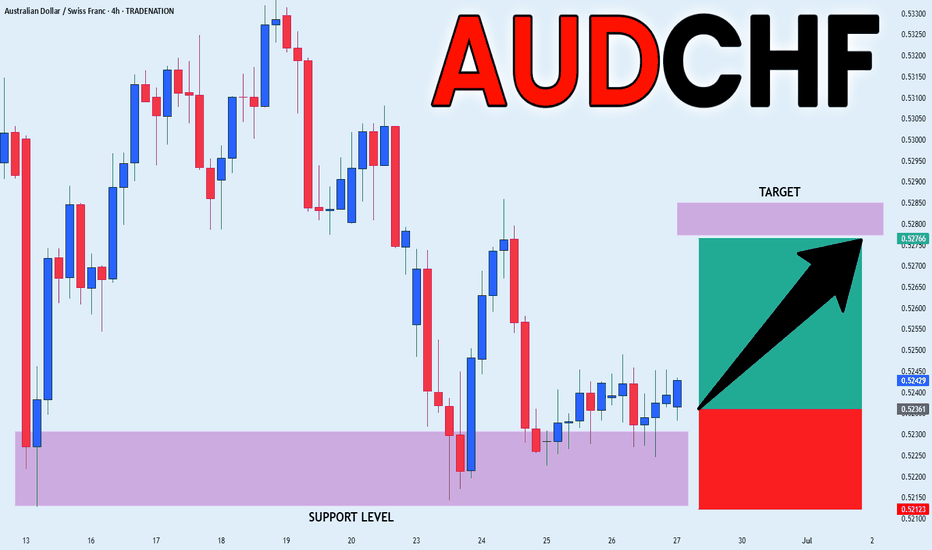

AUD/CHF Falling Channel Reversal SetupThe AUD/CHF 4H chart shows a well-defined descending channel with current price action rebounding from the lower boundary near the 0.52136 support. A bullish reversal is expected toward the upper trendline near the 0.53199 target. The setup suggests a potential buy opportunity with a stop loss at 0.

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the AUDCHF pair is quoted as 1 AUD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 AUD.

AUDCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.