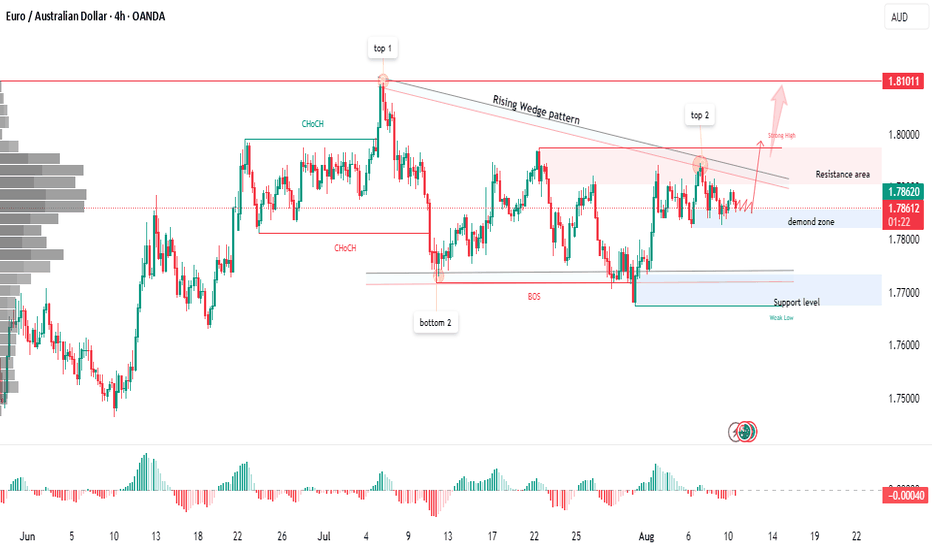

: EUR/AUD | Rising Wedge Pattern Near Key ResistanceEUR/AUD has been consolidating after forming a clear Rising Wedge structure between the first peak (Top 1) and the second peak (Top 2). Price action has recently tested the resistance area around 1.7860–1.7900, while holding above a demand zone near 1.7820.

From a market structure perspective:

CHoCH (Change of Character) signals earlier in the chart indicate a shift in momentum.

BOS (Break of Structure) confirmed a bearish move before price found support around the 1.7700 level.

The demand zone has been respected multiple times, showing active buyers.

At this stage, two key scenarios are in play:

Bullish Breakout: If price closes strongly above the wedge resistance and 1.7900, we could see a continuation toward the strong high at 1.8101.

Bearish Rejection: Failure to break the resistance may cause a pullback toward the support zone near 1.7700, which is also aligned with a previous weak low.

Trading Approach:

Wait for a confirmed breakout with volume before entering a long trade toward the 1.8100 zone.

Watch for bearish rejections with confirmation candles if considering short positions back to the support level.

Risk management is essential—avoid entering before confirmation to reduce false breakout risks.

Key Levels to Watch:

Resistance: 1.7900 – 1.8101

Demand Zone: 1.7820 – 1.7850

Support Level: 1.7700 – 1.7720

The upcoming sessions could bring volatility, so patience and confirmation will be the key to trading this setup effectively.

AUDEUR trade ideas

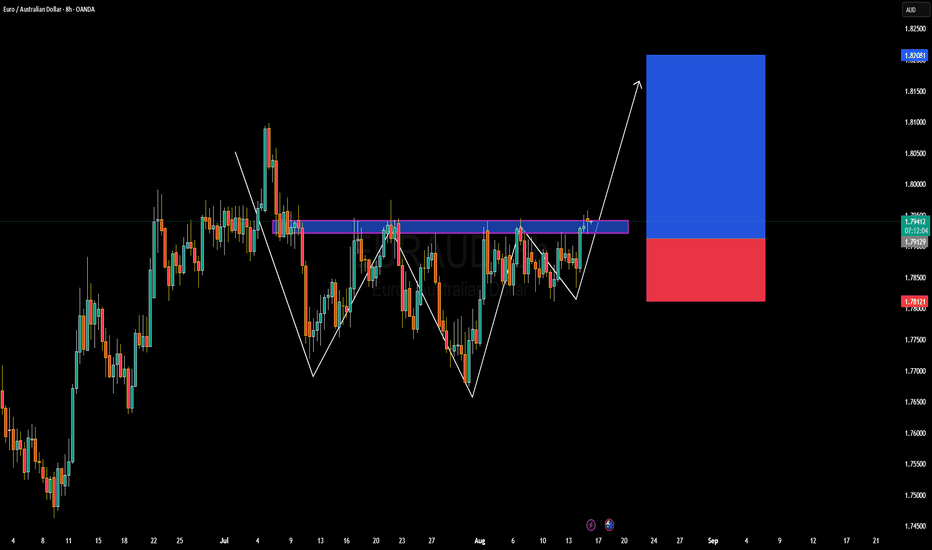

EURAUD Forming Bullish ContinuationEUR/AUD is edging above a persistent resistance zone around 1.7950–1.7970 on the 8-hour chart. The pair has formed a classic two-leg corrective structure, and the recent higher low suggests bullish continuation. A clean break and hold above this resistance could pave the way for a retest of the 1.8200 zone, offering a favorable risk-to-reward setup for trend-following traders.

On the fundamentals front, the backdrop is mixed yet slightly favoring the euro. Both the ECB and RBA remain on easing paths, but the ECB has been more active with its cuts, while market-implied positioning already prices in an RBA cut in August. This divergence, paired with soft growth in Australia and cautious optimism around Eurozone stability, supports a sustained euro bid. Omega forecasts also show projected upside for EUR/AUD into September

However, caution is warranted. ActionForex highlights that intraday bias remains neutral; a sustained break above 1.7972 is needed to validate the bullish scenario, with a move toward the 1.8196 projection thereafter. Additionally, broader sentiment suggests EUR may be overstretched, and the AUD could rebound rapidly once RBA easing is priced in

Technically, this setup offers a clean structure—especially if the breakout is confirmed with volume and a solid candle close above 1.7970. A stop beneath the breakout zone around 1.7910 would provide tight risk control. Long-term targets could range from 1.8100 to 1.8200, depending on momentum sustainability.

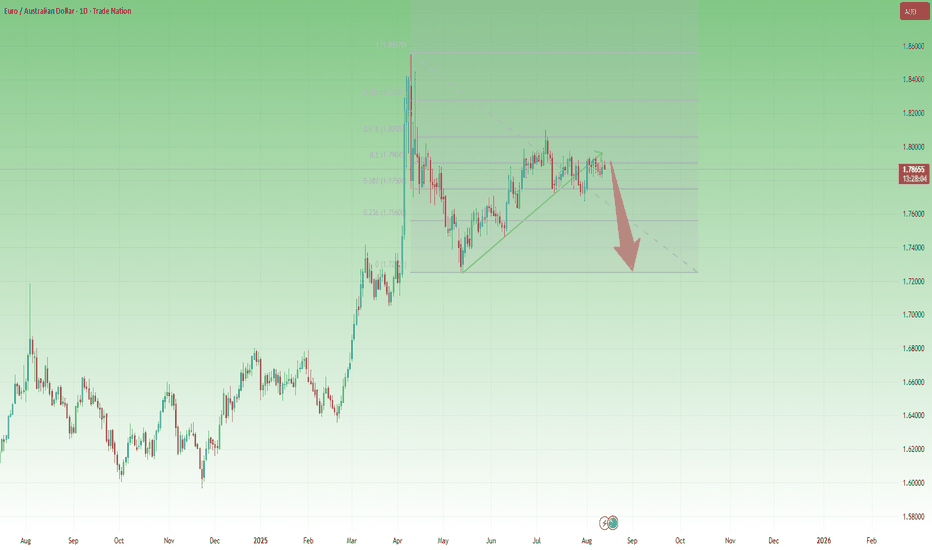

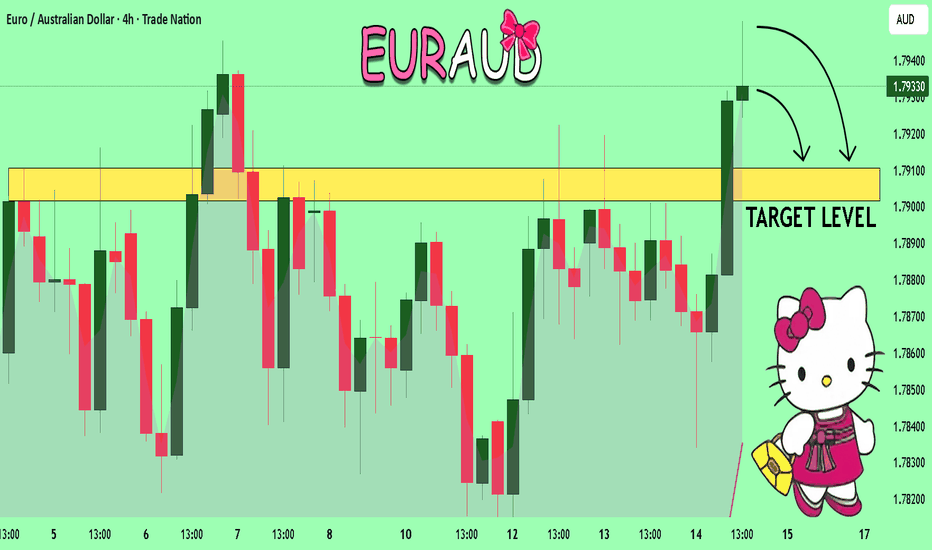

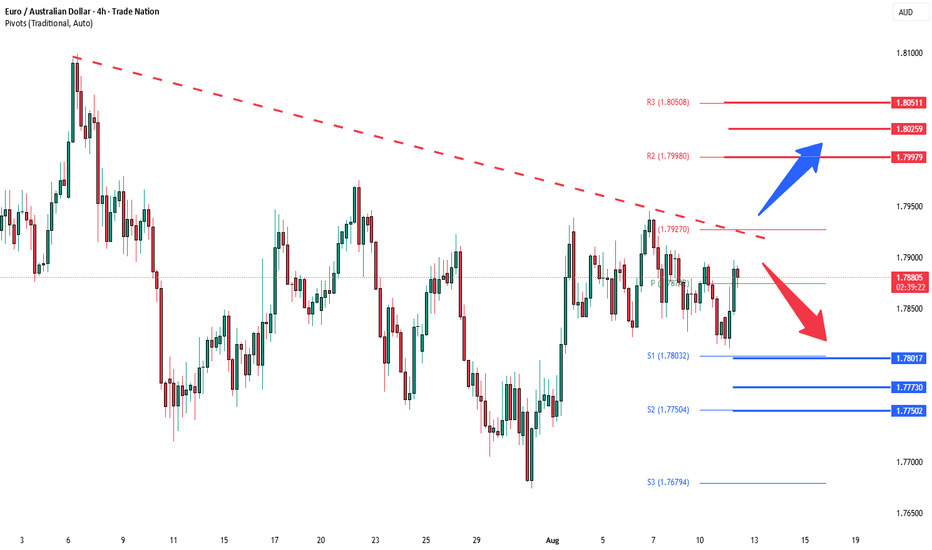

EUR/AUD – Second Chance for Bears?About a month ago, I drew attention to a potential long-term short setup on EUR/AUD, highlighting that the pair had formed a measured move pattern after the sharp drop from 1.85.

Since then, price broke below the rising trendline, but at that moment the drop lacked follow-through, and EUR/AUD bounced back. This bounce may now be a retest of the broken ascending trendline.

If this is the case, bears could get a second chance to enter at higher levels, with the overall bearish structure still intact.

Trading Plan: Selling around 1.79 could offer a solid medium-to-long-term opportunity, with a risk–reward ratio of approximately 1:2.5.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

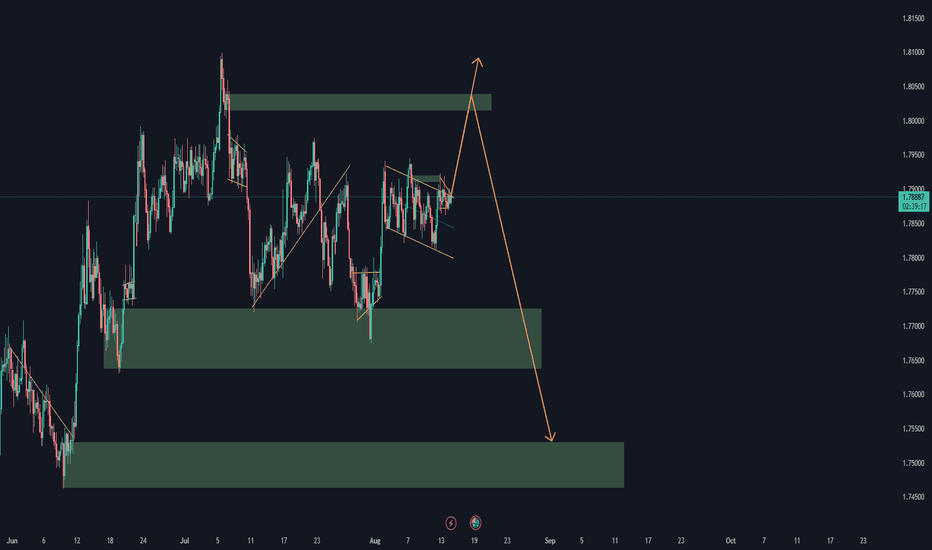

EURAUD, We are still in.In the higher timeframes, the pair is bullish, very, and that's where the problem is, that there aren't recent structures to break to signify a trend shift.

In the weekly timeframe, the pair is still bullish, facing the same monthly situation of lacking recent structures.

In the daily timeframe though, the outlook is different, although there aren't any near trend ending structures, but there are retracement broken structures which we can use to define the trends, with which we are currently in the daily validation level.

In the lower timeframes we are bearish while confluence with the daily level we get a low risk high probability entry.

We are risking as low as 14 Pips, while targeting a potential RRR of 1:20+.

DISCLAIMER: Trade with caution.

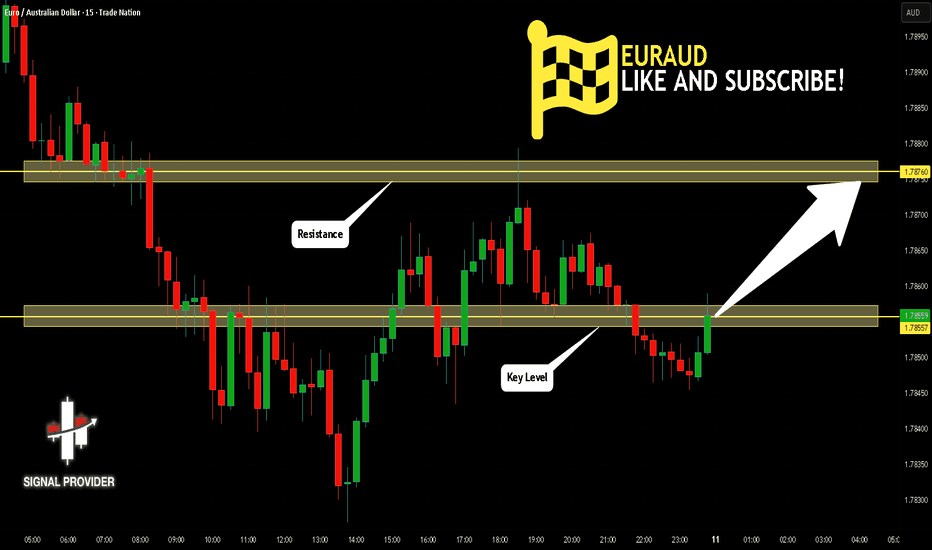

EURAUD Is Bullish! Buy!

Please, check our technical outlook for EURAUD.

Time Frame: 15m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.785.

The above observations make me that the market will inevitably achieve 1.787 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

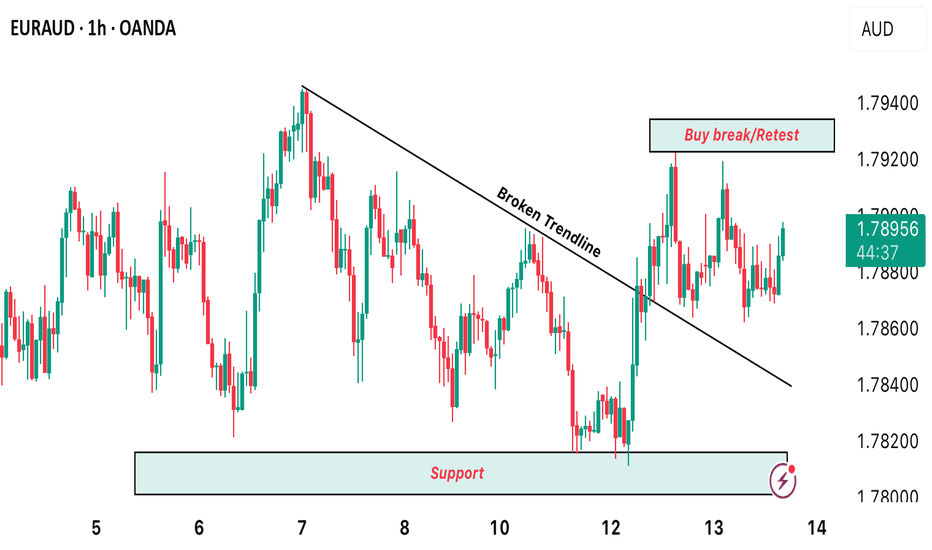

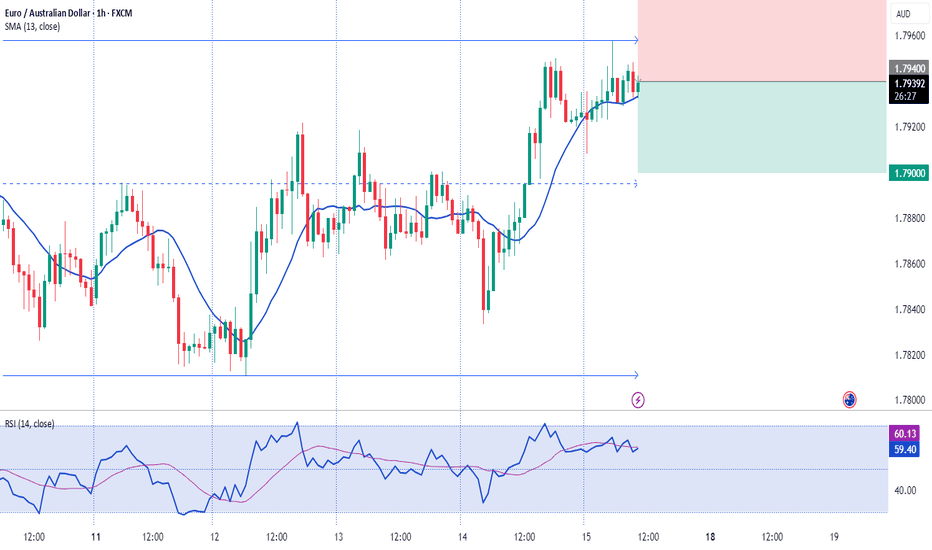

EURUAD LOOKING PROMISING FOR A BUY!!!! WATCHOUT Here’s H1 timeframe on EURUAD and we’re looking forward to buying upon the break/retest of 1.79228 Technical analysis suggest the possible buy opportunity as we see a break of the previous local trendline and a retest to it which signals bullish strength . Therefore, we plan to go long on this pair.

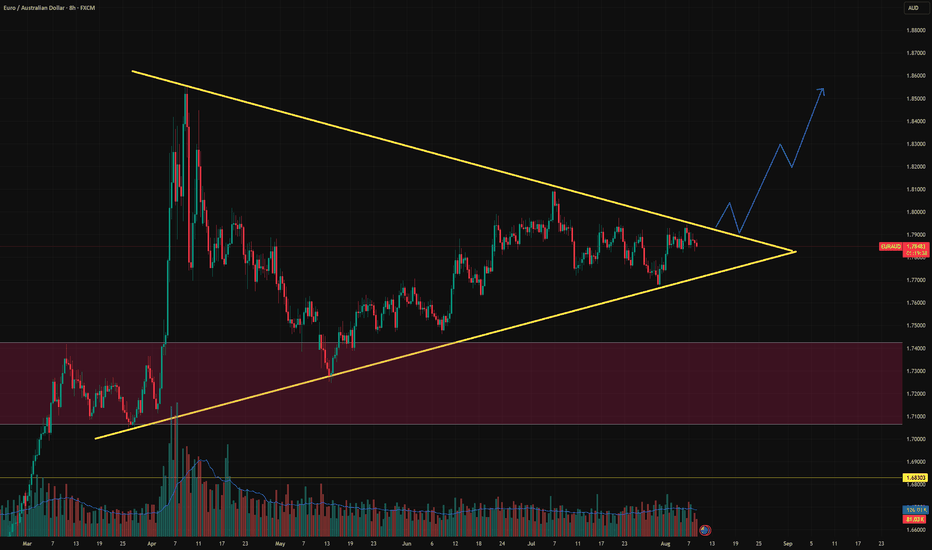

EUR/AUD Analysis – Symmetrical Triangle FormationKey Observations:

Pattern Type: Symmetrical triangle with converging trendlines.

Higher lows show demand stepping in.

Lower highs signal sellers defending resistance.

Volume Profile: Volume is tapering off, aligning with triangle logic → explosive move likely upon breakout.

Liquidity Pool Below: Large liquidity zone marked around 1.68300–1.74000, previously acted as accumulation base and demand zone.

Price Behavior: Currently nearing apex; compression suggests volatility expansion imminent.

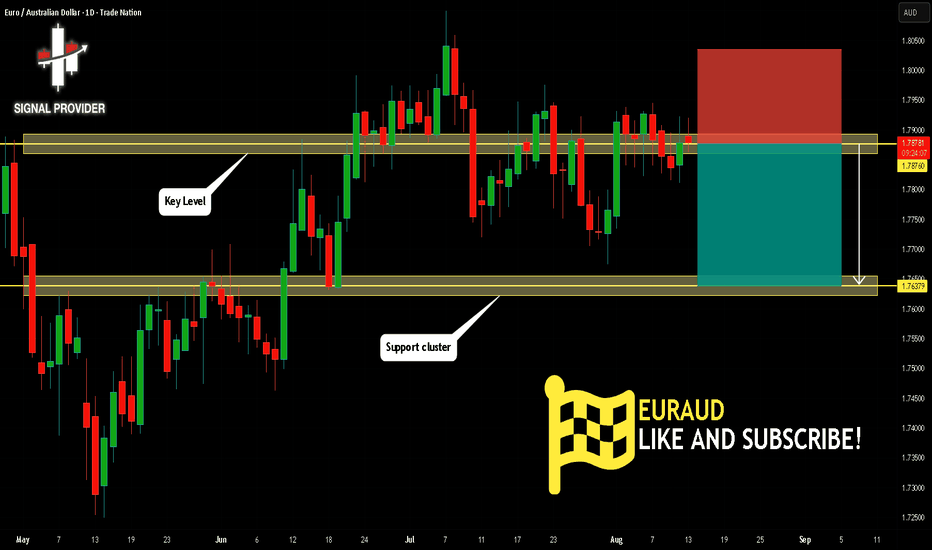

EURAUD Will Fall! Short!

Here is our detailed technical review for EURAUD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.787.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.763 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

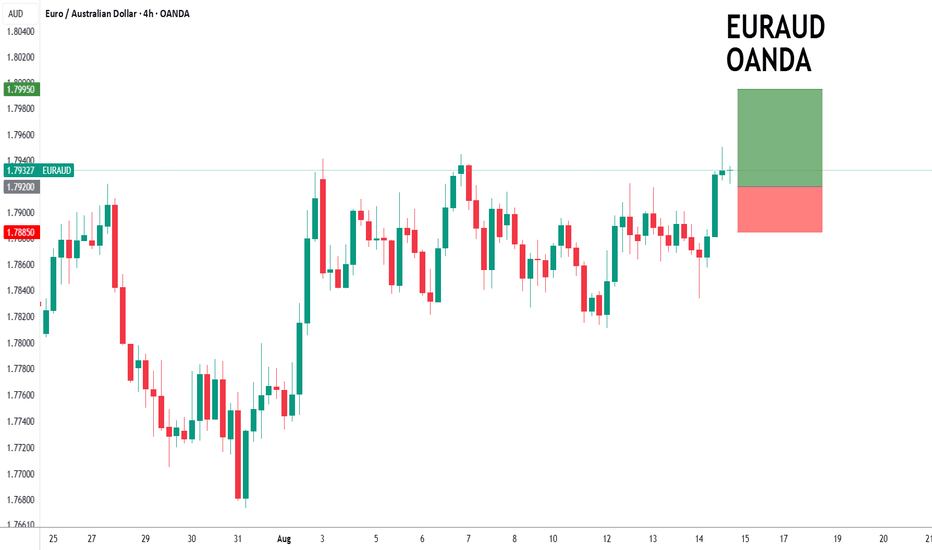

EURAUD to find buyers at market price?EURAUD - 24h expiry

Indecisive price action has resulted in sideways congestion on the intraday chart.

RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending.

Risk/Reward would be poor to call a buy from current levels.

A move through 1.7950 will confirm the bullish momentum.

The measured move target is 1.8000.

We look to Buy at 1.7920 (stop at 1.7885)

Our profit targets will be 1.7995 and 1.8000

Resistance: 1.7950 / 1.7975 / 1.8000

Support: 1.7920 / 1.7900 / 1.7885

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

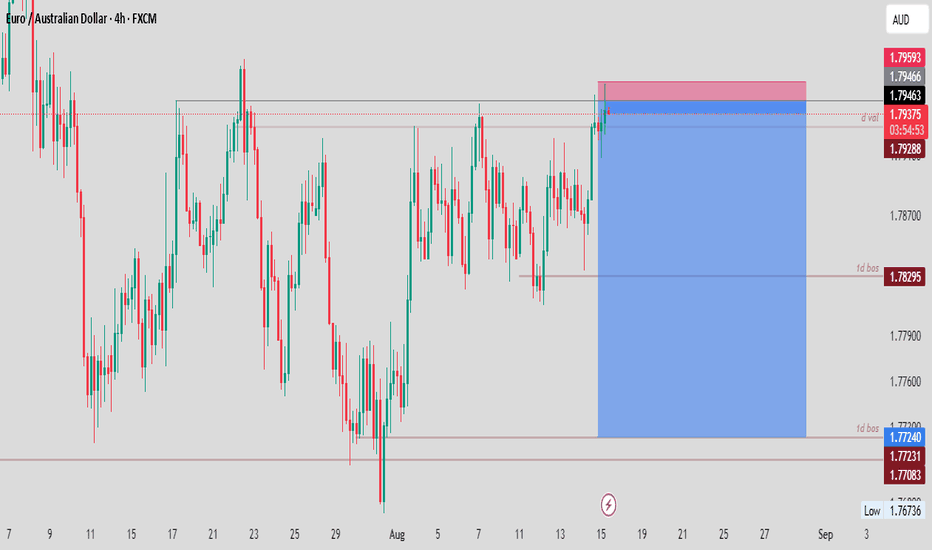

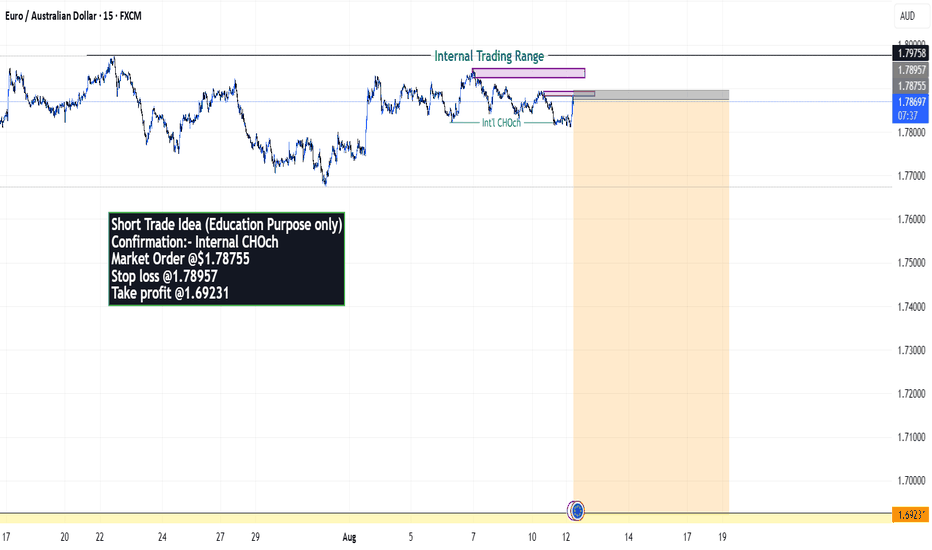

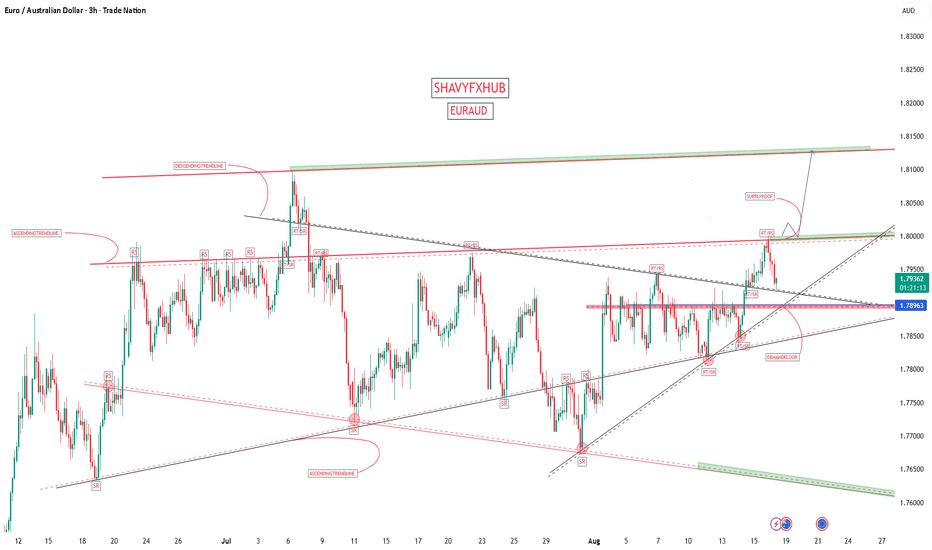

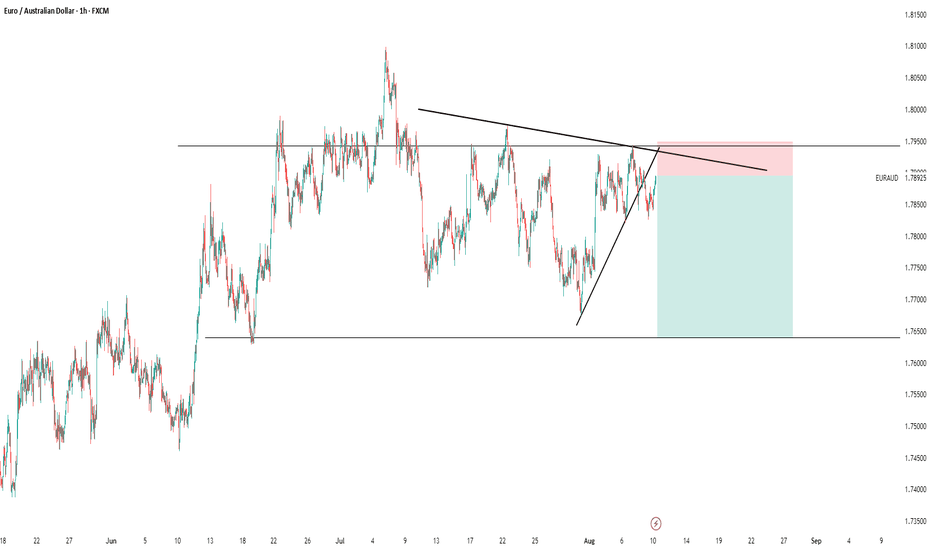

EURAUD ON THE WAY TO FILL FVG ? - {12/08/2025}Educational Analysis says that EURAUD (FX Pair) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

FX Pairs & Crypto Curreny Trade Analysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

Short trade idea analysis (Education Purpose)

Confirmation - InternalCHOch

Market Order @$1.78755

Stop loss @1.78957

Take profit @1.69231

Please check the comment section to see how this turned out.

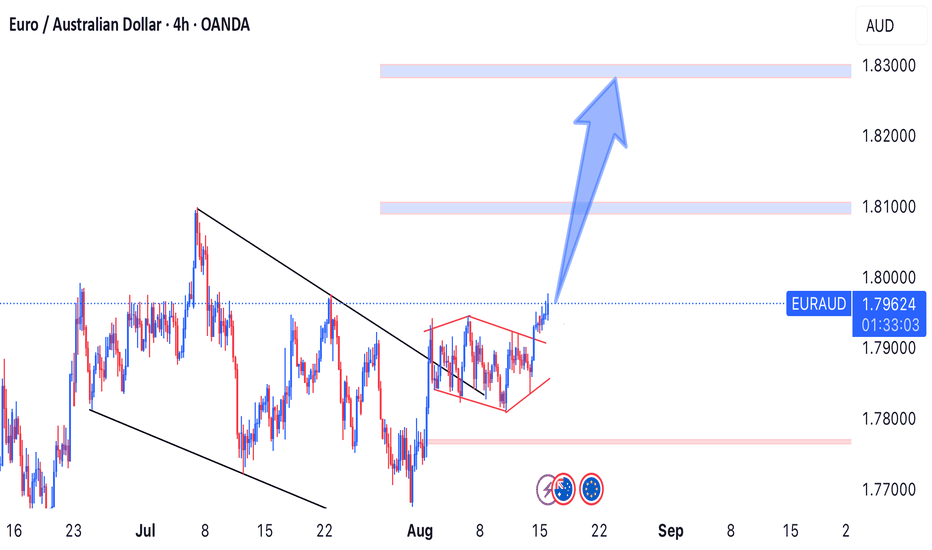

EUR/AUD Technical Analysis – Diamond Breakout Signals Bullish

---

🇪🇺🇦🇺

In recent sessions, EUR/AUD has been trading within a broader sideways structure, with a temporary uptrend forming inside that range. This corrective move evolved into a falling wedge, a classic bullish pattern. But what truly stands out is the emergence of a diamond formation, a rare but powerful reversal signal.

🔹 The diamond pattern has now been broken to the upside, and price has successfully retested the breakout zone, confirming bullish intent A.

📈 Upside Targets:

• 1.81058

• 1.83000

🛑 Stop-loss: Below 1.77700, to protect against false breakouts or unexpected reversals.

This setup suggests strong bullish momentum ahead, especially with the diamond breakout acting as a technical catalyst. Traders should watch for volume confirmation and continuation signals in the coming sessions.

---

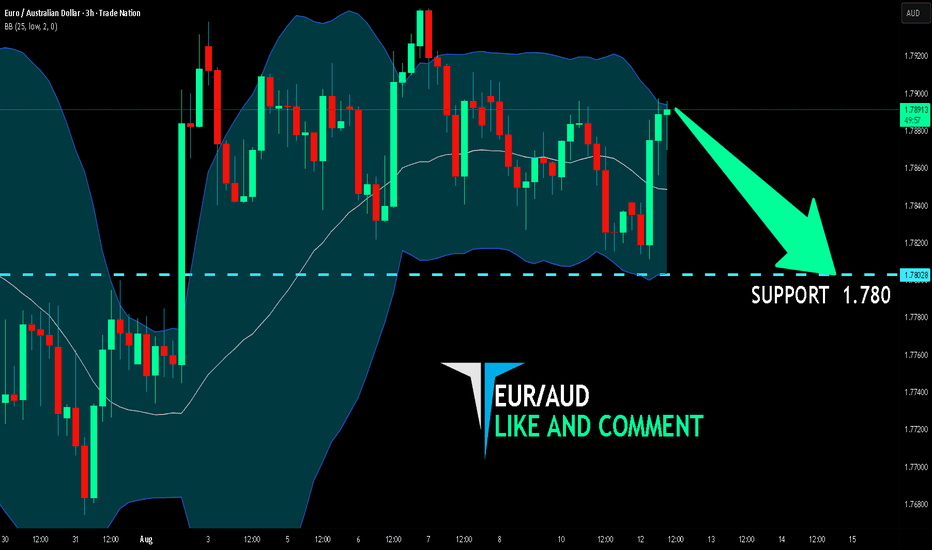

EUR/AUD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

It makes sense for us to go short on EUR/AUD right now from the resistance line above with the target of 1.780 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

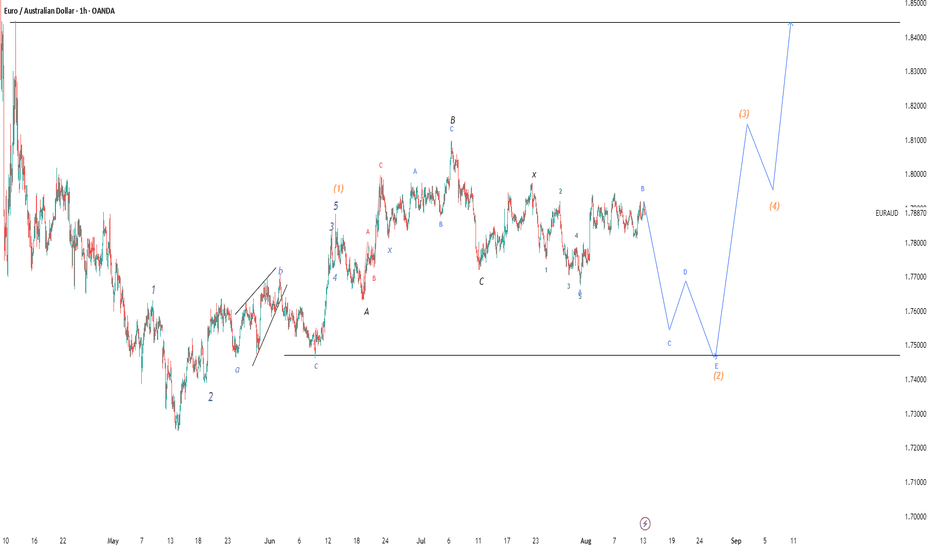

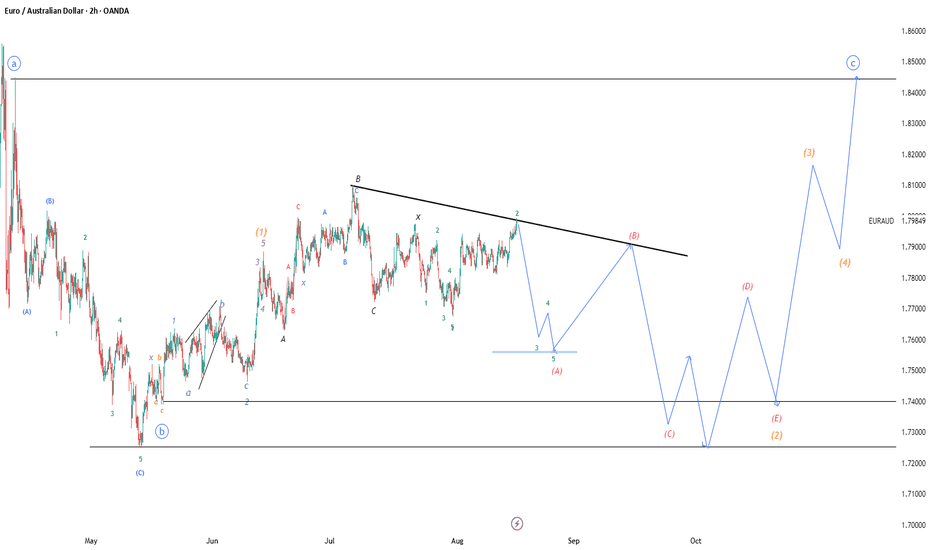

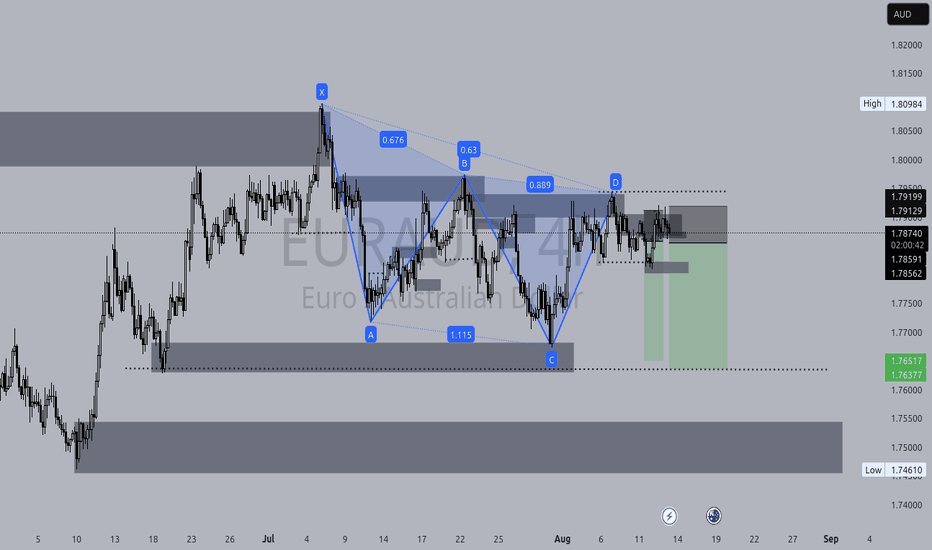

EURAUD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

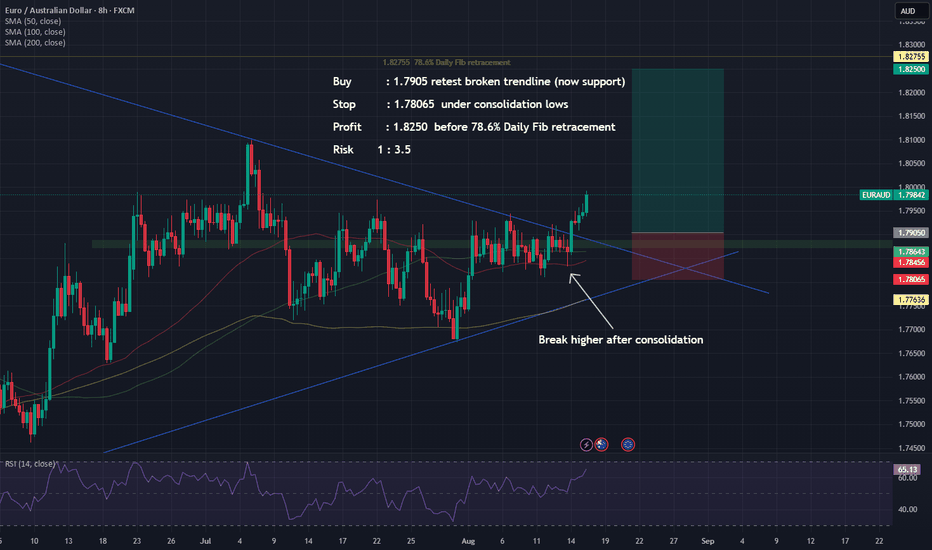

Buy EUR/AUD after retest of broken trendline and consolidation.EUR/AUD has been consolidating for the last couple of weeks and has now broken higher.

EUR crosses look strong and the commodities currencies appear weak so I expect more gains to retrace much of the April high this year.

Buy : 1.7905 retest broken trendline (now support)

Stop : 1.78065 under consolidation lows

Profit : 1.8250 before 78.6% Daily Fib retracement of April 2025 high

Risk 1 : 3.5

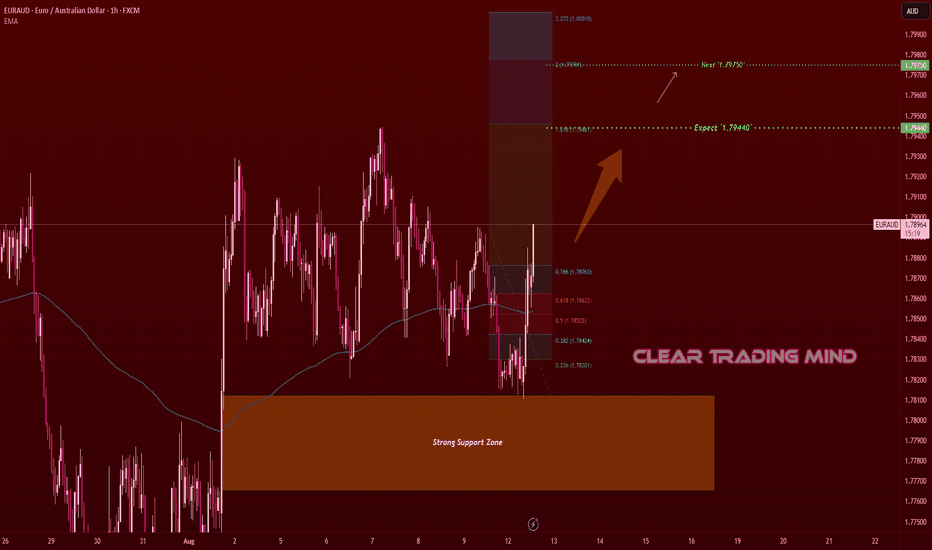

EURAUD – Bullish Momentum Targets 1.7944 & 1.7975 On the 1H chart, EURAUD has bounced strongly from a well-respected Support Zone, reclaiming ground above the 200 EMA, which now acts as a dynamic support. This strong reaction is in line with my bullish bias for the pair.

Fib extension levels are pointing toward upside targets, with the first key level at 1.7944 (1.618 Fib). If momentum holds, my next target is 1.7975 (Fib 2.0). A daily close above these zones could open the path for further gains toward the 1.8000+ psychological level.

📈 Bias – Bullish

📍 Key Support – Strong Support Zone & 200 EMA

🎯 Target Levels – 1.7944 → 1.7975 → 1.8000+

EURAUD Set To Fall! SELL!

My dear subscribers,

This is my opinion on the EURAUD next move:

The instrument tests an important psychological level 1.7938

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.7910

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURAUD EURAUD CURRENT PRICEACTION IS 1.79338

EURAUD 1.79207 DEMAND FLOOR AND 1.79207 DEFENDED WE ARE LOOKING AT 1.81278

Interest Rates

Eurozone (ECB):

Main refinancing rate: 2.15%

Deposit facility rate: 2.00%

Policy remains on hold after eight cuts over the past year, with the ECB noting inflation is at target and adopting a wait-and-see approach due to trade uncertainty.

Australia (RBA):

Official cash rate: 3.60%

The Reserve Bank of Australia cut rates by 0.25% on August 12, 2025, as inflation continues to fall and the labor market gradually loosens, signaling more cuts may follow.

Bond Yields

Eurozone:

5-year central government bond yield: 2.49% (as of August 14, 2025)

10-year government bond yield: 2.79% (as of August 14, 2025)

Yields have slightly increased due to global tariff pressures and investor demand for higher compensation on longer maturities.

Australia:

10-year government bond yield: 4.262% (August 18, 2025)

30-year bond yield: 5.02% (August 18, 2025)

The 10-year yield is up 0.05 percentage points from the previous session.

Summary Table

Region Policy Rate 10Y Bond Yield 5Y Bond Yield Last Policy Action

Eurozone 2.15% 2.793% 2.49% Hold (July 2025)

Australia 3.60% 4.262% — Cut (-0.25%) Aug 12, 2025

These updated figures reflect the monetary stance and market yields currently influencing EURAUD and investment flows.

#EURAUD

euraud analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD Pivotal trading zone at 1.7927The EURAUD remains in a neutral trend, with recent price action showing signs of a corrective consolidation within the broader uptrend.

Support Zone: 1.7800 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.7800 would confirm ongoing upside momentum, with potential targets at:

1.7927 – initial resistance

1.8000 – psychological and structural level

1.8050 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.7800 would weaken the bullish outlook and suggest deeper downside risk toward:

1.7773 – minor support

1.7750 – stronger support and potential demand zone

Outlook:

Neutral bias remains intact while the EURAUD trades around pivotal 1.7927 level. A sustained break below or above this level could shift momentum.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade