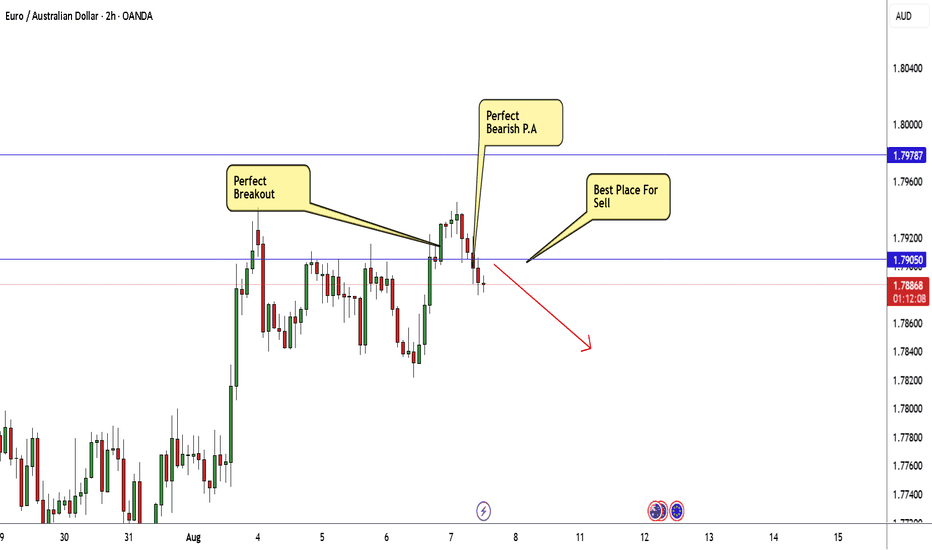

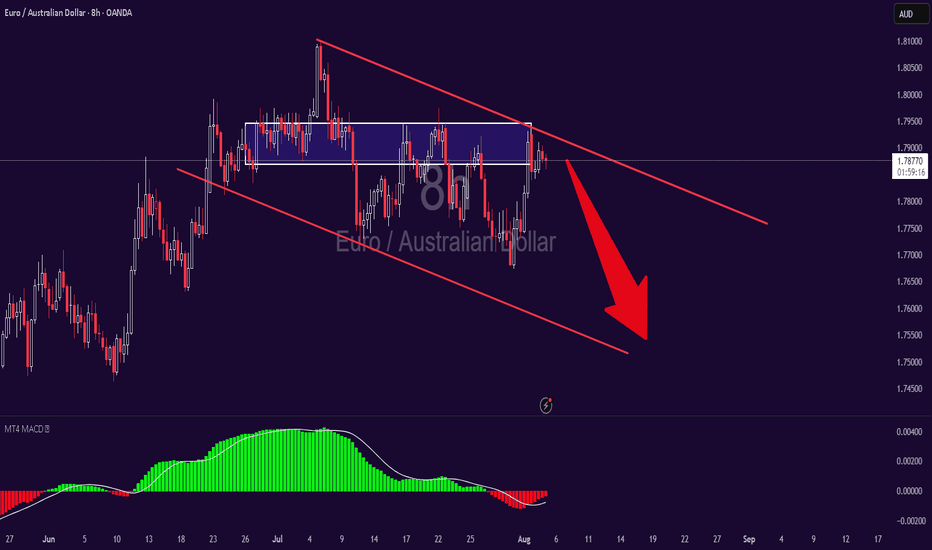

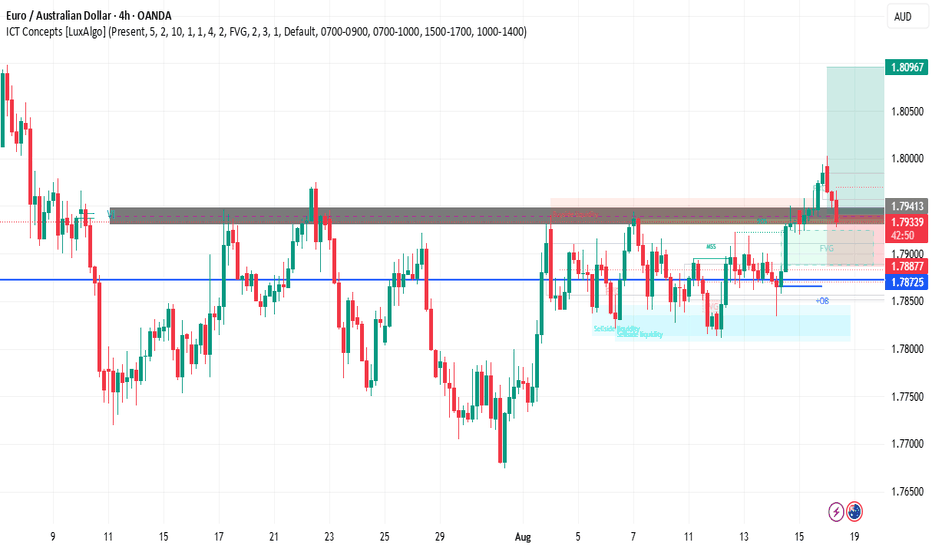

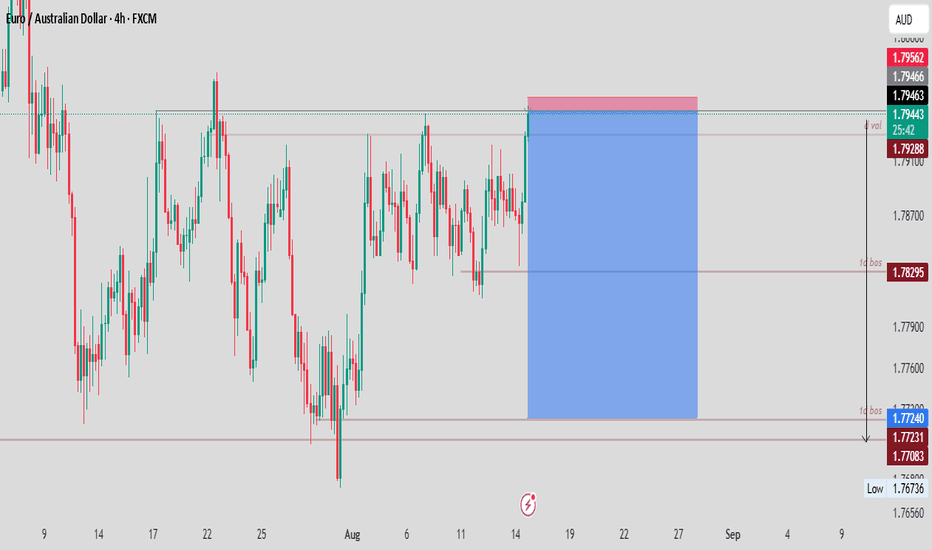

EUR/AUD Confirmed Downside Direction,Short Setup To Get 150 PipsHere is My 2H T.F Chart and if we have a look we will see that we have a very good breakout after this sideways movement , the price finally closed below my res and we have a good confirmation with 4H Bearish candle closure below my res so i`m waiting the price to go back to retest this broken res and then we can enter a sell trade . and if the price closed above my res with daily candle then this idea will not be valid anymore .

AUDEUR trade ideas

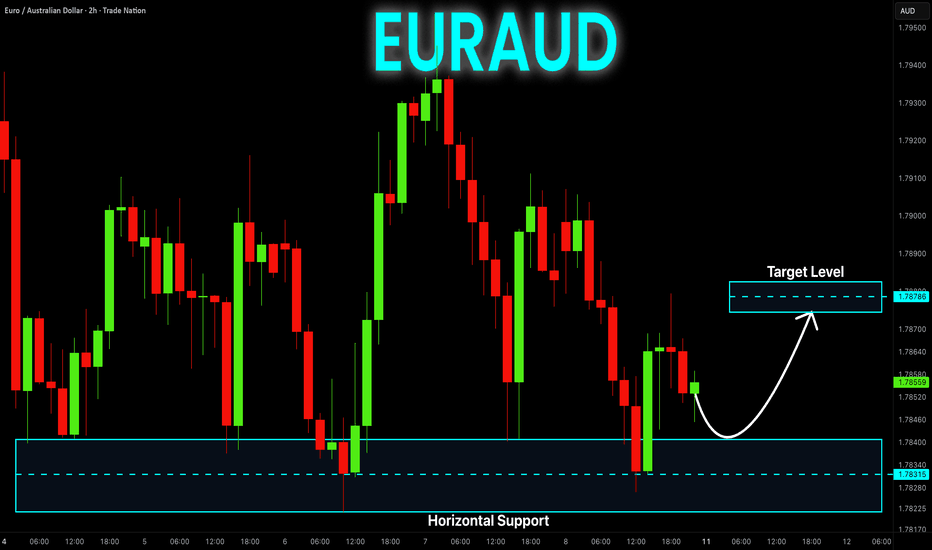

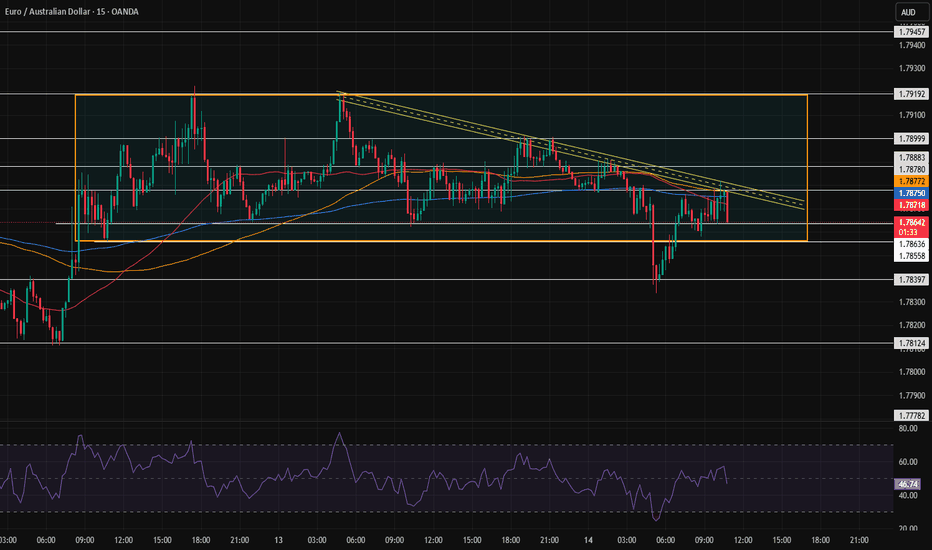

EUR-AUD Rebound Ahead! Buy!

Hello,Traders!

EUR-AUD is already making

A rebound from the horizontal

Support level of 1.7822

So we are locally bullish

Biased and we will be

Expecting a further

Local move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

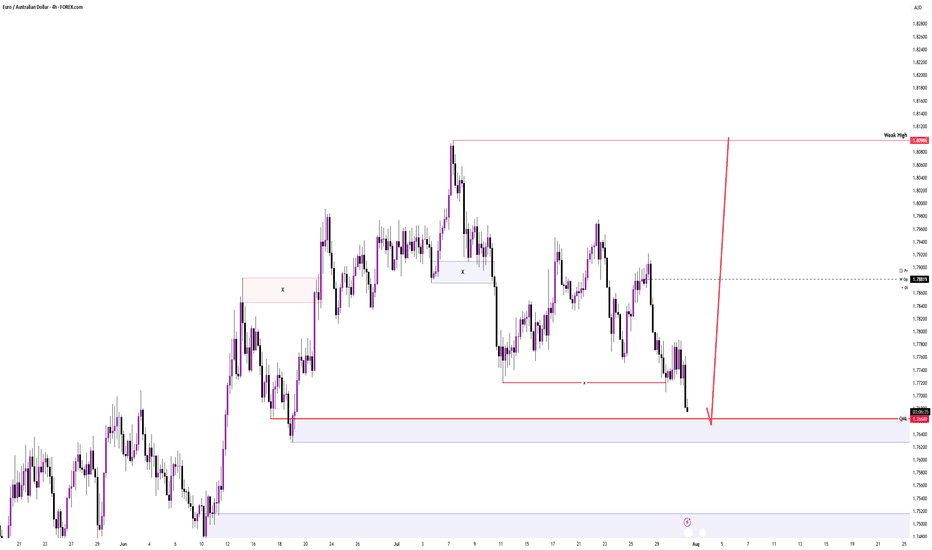

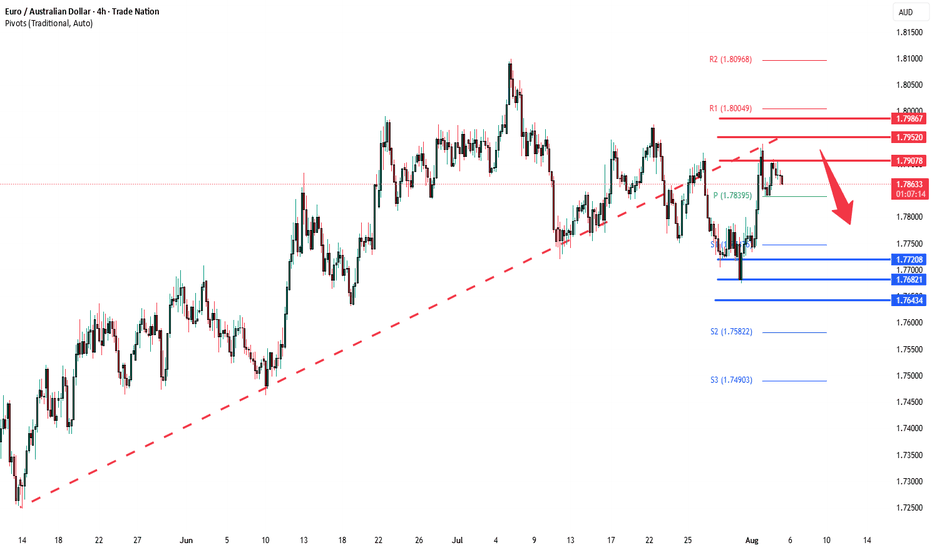

EURAUD Resistance retest The EURAUD pair is currently trading with a bearish bias, aligned with the broader range-bound sideway consolidation. Recent price action shows a retest of the resistance, (previous rising support)

Key resistance is located at 1.7907, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 1.7907 could confirm the resumption of the downtrend, targeting the next support levels at 1.7720, followed by 1.7680 and 1.7643 over a longer timeframe.

Conversely, a decisive breakout and daily close above 1.7907 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 1.7950, then 1.7986.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 1.7907. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

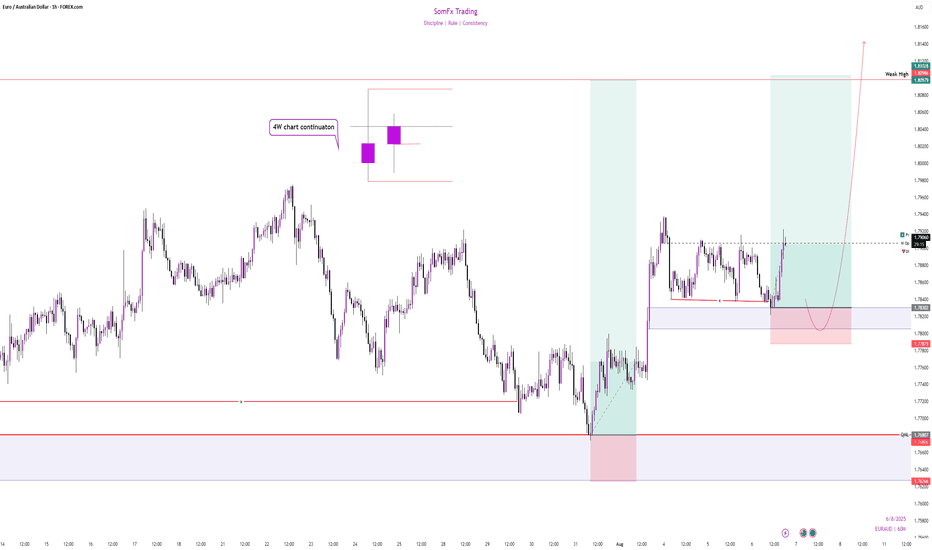

EURAUD – Looking to Fade the Rally at Resistance (Counter-Trend EURAUD – Looking to Fade the Rally at Resistance (Counter-Trend Short Idea)

Sometimes markets climb too far, too fast — and that’s when opportunity knocks. EURAUD has been riding a strong uptrend, but it’s now stalling at a key resistance zone. Both the Euro and the Aussie are fundamentally soft, and this looks like a moment to bet against momentum.

🔻 I’m bearish on EURAUD as a counter-trend short from resistance.

Here’s what’s behind my view:

EUR strength is built on shaky optimism around a potential US-EU trade deal.

Eurozone growth is nearly flat (+0.1% in Q2), and household consumption is falling.

ECB is in pause mode after 8 rate cuts, with inflation expected below target until 2026.

AUD weakness is priced in as markets expect an August rate cut from the RBA.

Both currencies are fundamentally soft — but EUR feels overstretched after a 17% rally.

Zooming out, Euro sentiment is cautiously bullish, but it’s a fragile optimism. Positioning is crowded long (123K net longs), and any disappointment on the trade front could trigger a reversal. Meanwhile, the RBA’s expected dovish move is already in the price — and the AUD has already pulled back 1.4% vs USD.

This setup is risky — I’m going against the broader trend — but I like the odds here. EURAUD is overbought, fading momentum, and sitting right at resistance. If price confirms rejection, I’ll be looking to take a short with tight risk.

⚠️ It’s a counter-trend trade — not for the faint-hearted.

Would you fade this rally? Or are you still riding the Euro wave?

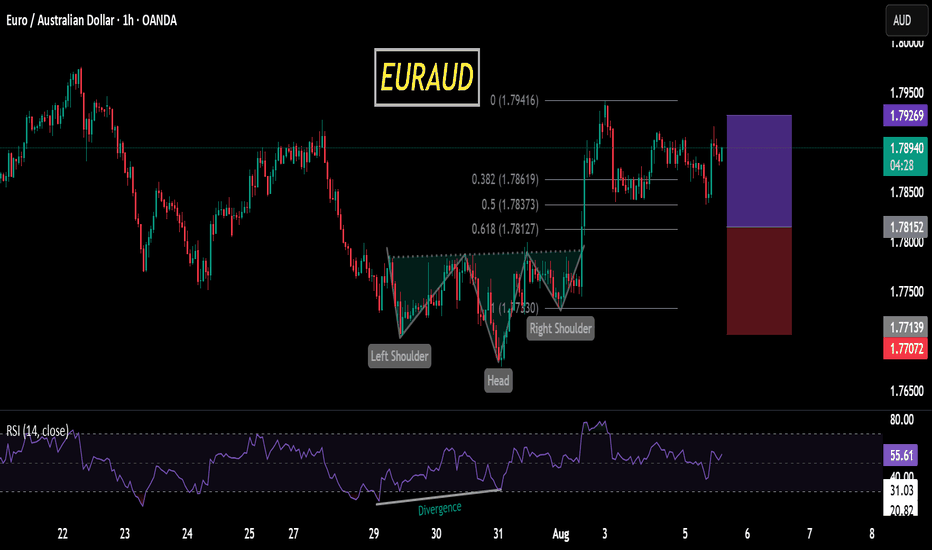

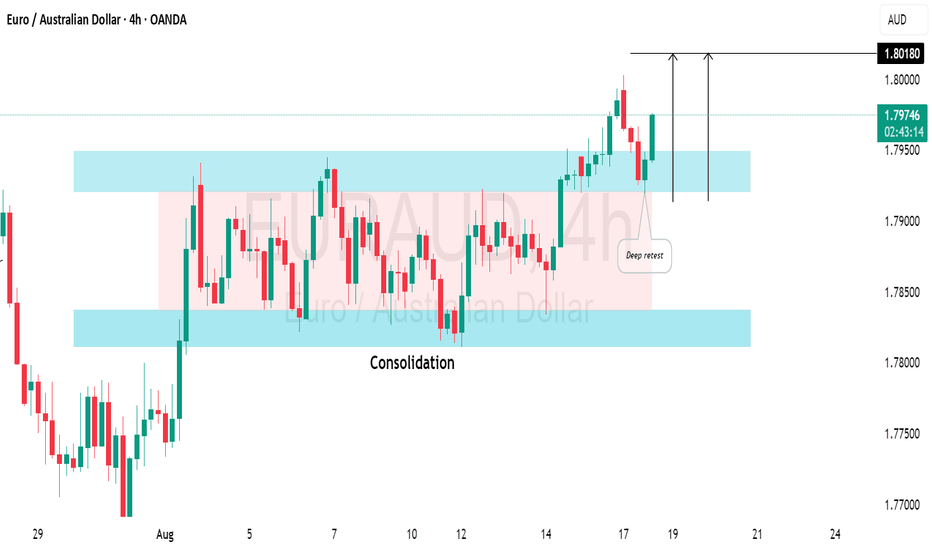

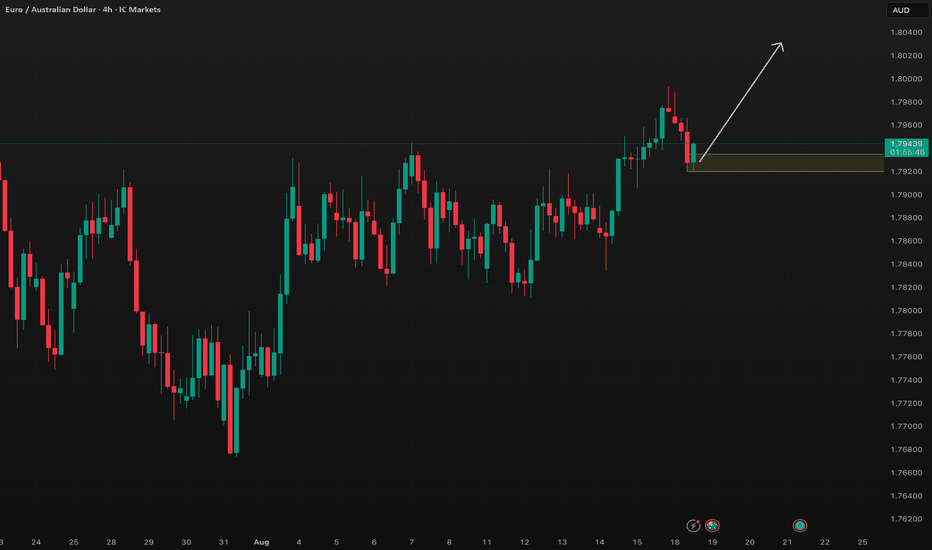

EURAUD: Important Bullish Breakout📈EURAUD has broke and closed above a significant intraday resistance level after a period of consolidation

Upon retesting the breached resistance, a positive bullish response is observed. This suggests a potential for further upward movement in the market.

The anticipated target is 1.8018.

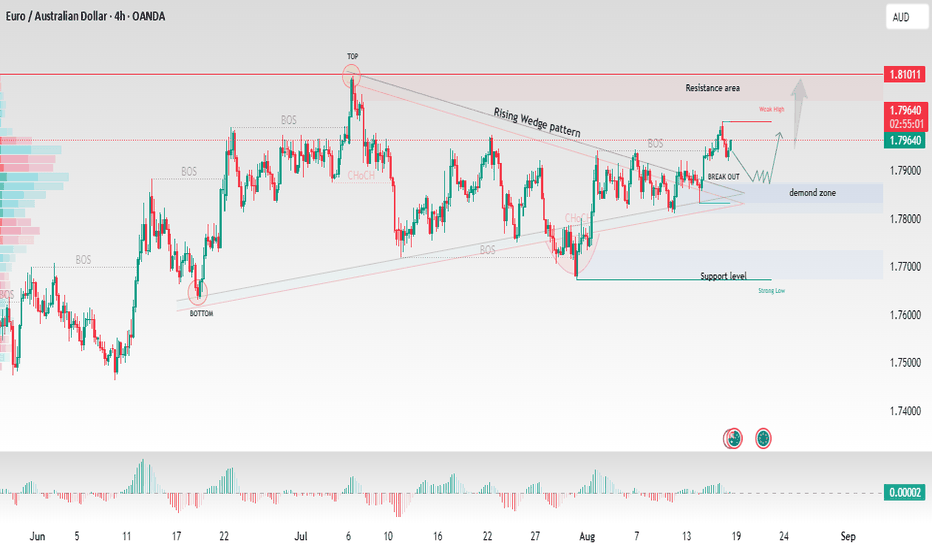

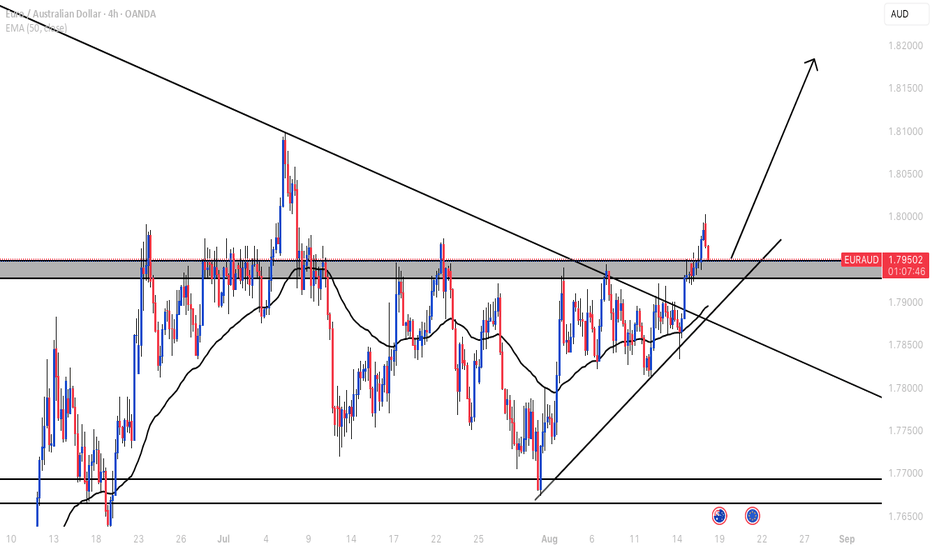

EUR/AUDBreakoutAbove Wedge DemandZone Support&Resistance infocusOn the 4H chart, EUR/AUD has recently broken out from a rising wedge pattern after retesting the demand zone around 1.7800–1.7850. Price action shows a strong bullish attempt while holding above key support levels.

Key points from the structure:

Rising wedge pattern followed by a breakout confirmation.

Strong demand zone support near 1.7800, aligning with previous BOS levels.

Current resistance lies around 1.8000–1.8100, which remains the next target for bulls.

If demand holds, a bullish continuation toward 1.8100 resistance area is possible.

On the other hand, a break back below 1.7800 may weaken momentum and expose the 1.7700 support zone.

This setup highlights both bullish breakout opportunities and risk of pullback, making the upcoming sessions crucial for directional confirmation.

This post is for educational purposes only, not financial advice. Always use proper risk management and follow your trading plan.

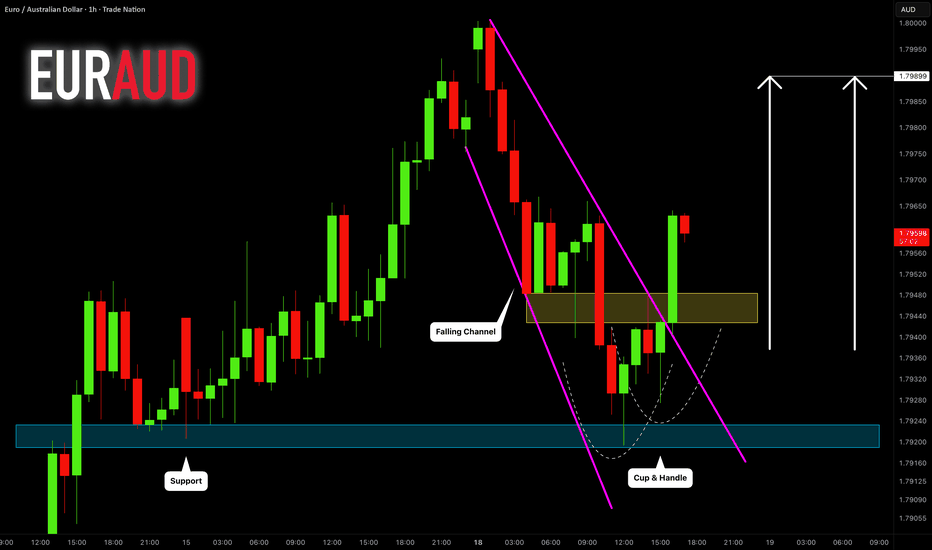

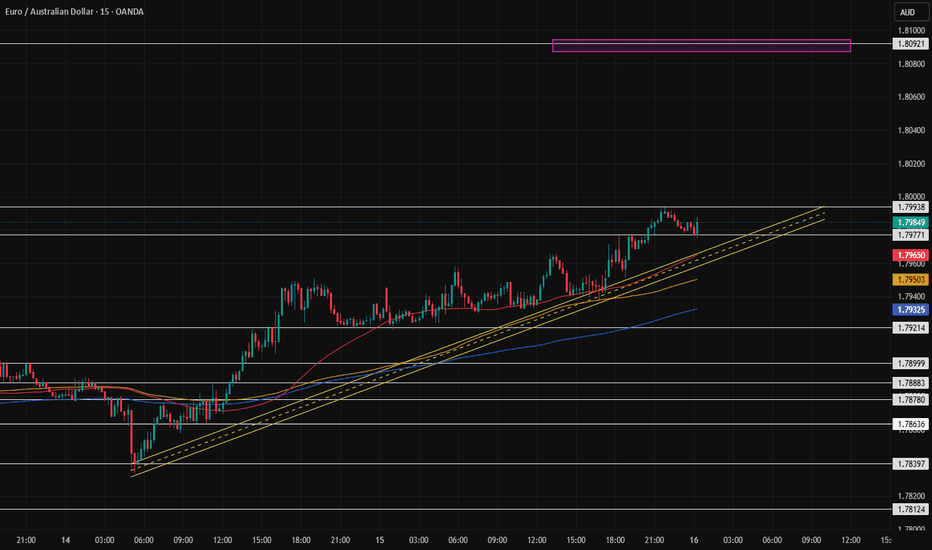

EURAUD: Trend Following Trading 🇪🇺 🇦🇺

EURAUD completed a correctional movement after a strong bullish wave.

The price nicely respected a key intraday horizontal support

and formed a cup and handle pattern on that.

Its neckline breakout with an imbalance candle provides

a strong bullish confirmation.

I expect a rise to 1.799

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

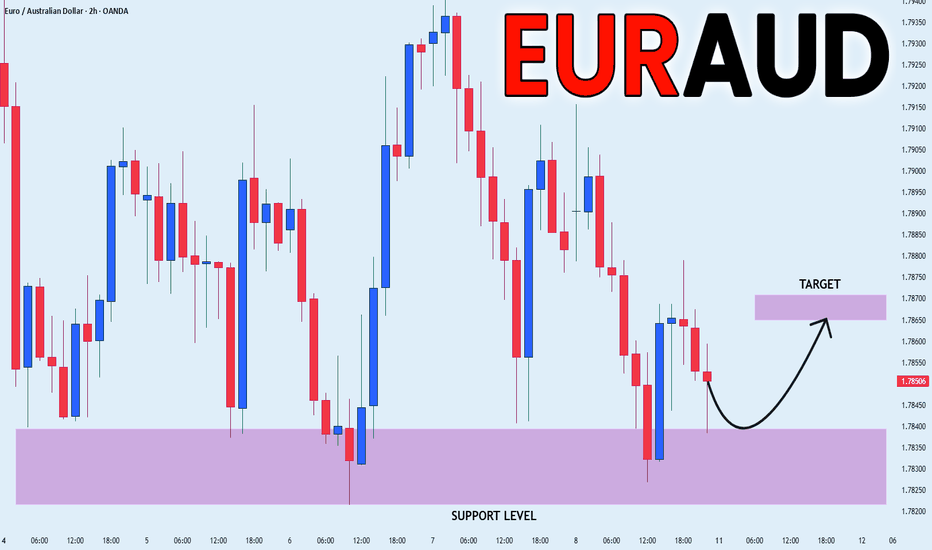

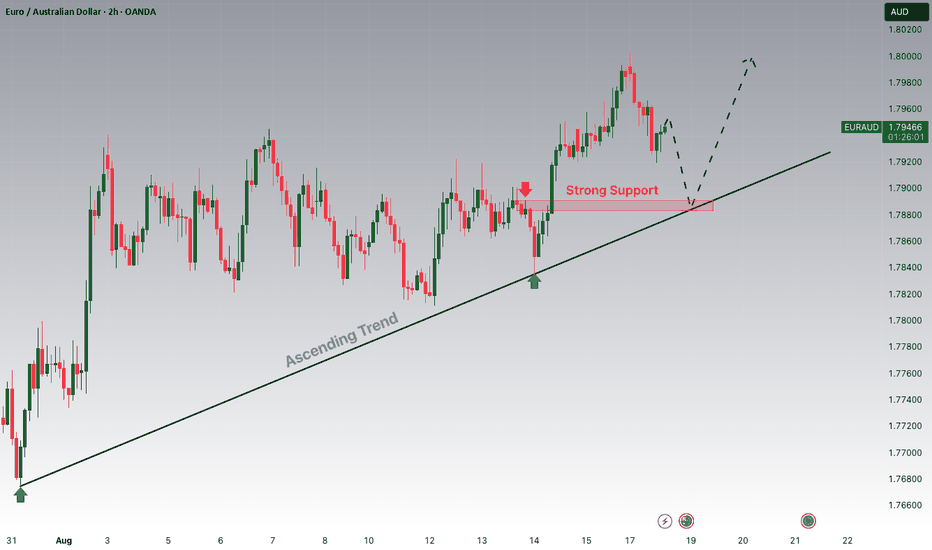

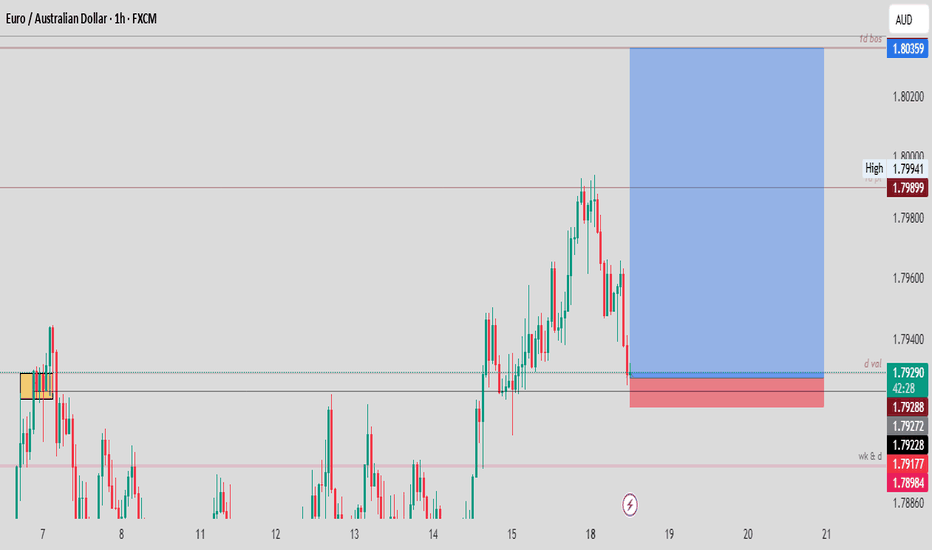

EURAUD is Nearing a Strong Support!!Hey Traders, in today's trading session we are monitoring EURAUD for a buying opportunity around 1.78900 zone, EURAUD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.78900 support and resistance area.

Trade safe, Joe.

EURAUD BUY TRADE PLAN# EURAUD – Ultra V4 Elite Pro Trade Plan

**Date:** \

**Plan ID:** EURAUD-V4-\

---

## PLAN OVERVIEW

* **Category:** Intra-Day

* **Trade Type:** Liquidity Sweep → Reversal

* **Direction:** Buy

* **Confidence:** 74%

* **Min R\:R:** 1:3

* **Status:** ✅ VALID

---

## LEVELS CARD (Quick Action)

**Primary Setup (Higher Probability)**

* **Entry:** 1.7920–1.7935 (H1 demand / sweep zone)

* **Stop Loss:** 1.7885 (below OB & liquidity shelf)

* **TP1:** 1.7985

* **TP2:** 1.8030

* **TP3:** 1.8085 (stretch)

* **Order:** Market after confirmation

* **Session:** London → NY overlap preferred

(No alternate setup: nothing ≥70% valid on the sell side.)

---

## EXECUTION CHECKLIST

1. ✅ News gate cleared (no red events immediately).

2. ✅ Price has tapped zone this session.

3. ✅ **Last H1 candle audit:** clear pinbar rejection from demand (confirmation).

4. Execute market order on London/NY overlap.

5. Partial at TP1 → move SL → BE.

6. Trail to TP2/TP3.

7. Flat if invalidation (H1 close < 1.7885).

---

## FUNDAMENTALS & NEWS

* **CB Bias:** ECB neutral-hawkish; RBA steady.

* **Key Data (7d):** EU PMI soft, AU employment steady.

* **Cross-Asset:** DXY flat, EUR resilient, AUD capped by weak commodities.

* **Positioning:** Specs modestly long EUR; AUD flows neutral.

* **Macro Lean:** EUR has relative resilience vs AUD → EURAUD skewed higher.

---

## MARKET MAP

* **D1/H4 Structure:** Uptrend intact (higher lows, BOS north).

* **Liquidity Pools:** 1.7880 (sell stops), 1.8080 (buy-side liquidity).

* **OB/FVG:** Demand OB 1.7920–1.7935 (fresh sweep).

* **Play Type:** Sweep → Reversal (aligned with HTF trend).

---

## RISK & MONEY MANAGEMENT

* Risk per idea: 1% (staggered partials).

* Basket cap: 2%.

* Min R\:R = 1:3 (valid).

* ATR/Spread filters OK.

---

## CONFIDENCE (ONE SENTENCE)

74% — HTF bullish structure + liquidity sweep + **confirmed H1 pinbar rejection** at demand zone.

---

## FINAL EXECUTION STRATEGY / PERSONAL NOTE

* **Zone Status:** 🔄 *Tapped but Valid* — first touch has printed a pinbar, R\:R intact, trade is live.

* **Action:** Execute buy at 1.7920–1.7935 with SL 1.7885; manage partials.

* **Flat if:** H1 closes below 1.7885 (invalidation).

* **Closing Line:** Trade confirmed; execution is now active, manage as per rules.

---

## POST-TRADE JOURNAL

Outcome + lesson: \ .

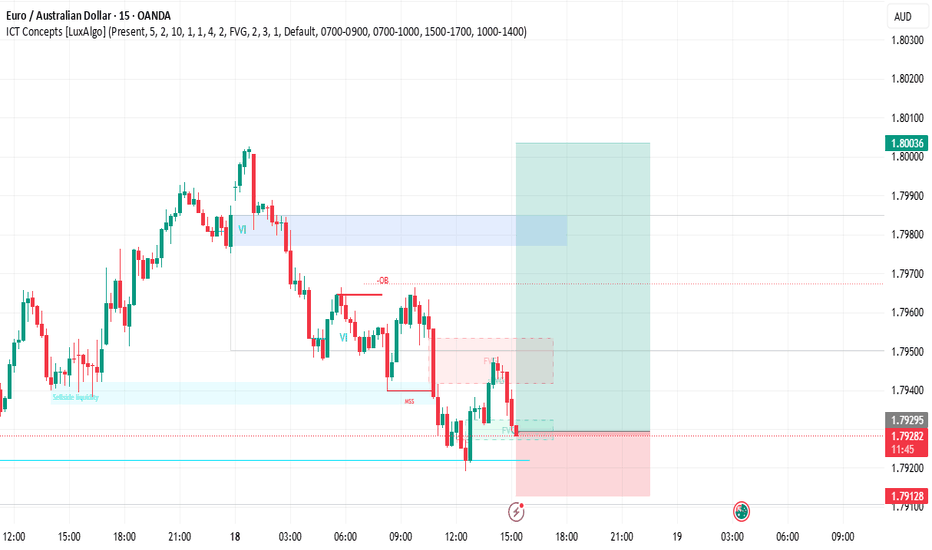

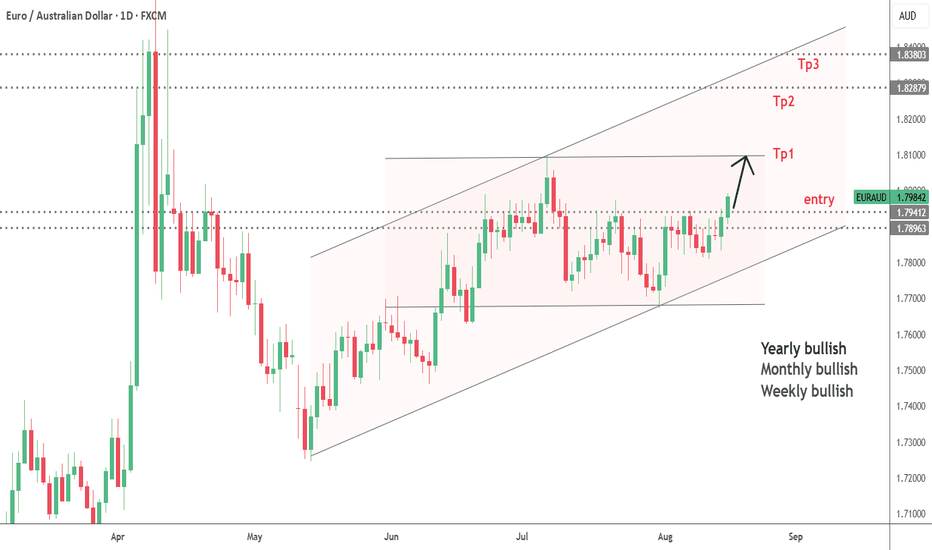

EURAUD, Before the coming short, Part 1Main Parameters

1. Monthly timeframe - Bullish

2. Weekly timeframe - Bullish

3. Daily timeframe - Bullish

4. Intraday timeframes - Bullish

Other Parameters

5. COT Data - EUR (Net Long with main parameters) AUD (Net Short with main Parameters).

Intraday Reason for entry: 1D Validation Level, 1hr Hidden Invalidation and 15min Invalidation confluence.

Based on all these parameters, we are taking a Long position risking not more than 12 Pips, targeting a 1:10+ at significant daily level where we are targeting to take our profits.

CAUTION: This is not a financial advice, always trade with caution considering appropriate risk management.

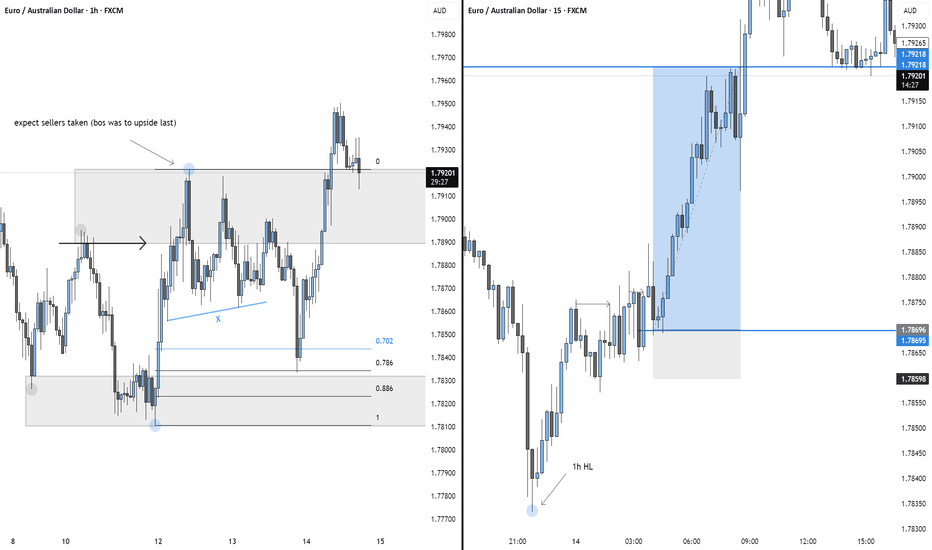

Euraud moneySame play as eurcad. 1h last low gets taken. Drives high making new highs. Price comes back to clear out everyone in the range balance buy orders. Came into discount 702. Look for entry on 15 minute (5 minute was used here) for better risk to reward to head to take out trapped money. Money moved to created sellers since we created sellers last (new high). Clean cut. Must follow the money where is taken and created and where we want to head to next. It will take some stress off your back. Simple order, same process, over and over creates champions.

EURAUD, Behind the disguise.In the higher timeframes, the pair is bullish, very, and that's where the problem is, that there aren't recent structures to break to signify a trend shift.

In the weekly timeframe, the pair is still bullish, facing the same monthly situation of lacking recent structures.

In the daily timeframe though, the outlook is different, although there aren't any near trend ending structures, but there are retracement broken structures which we can use to define the trends, with which we are currently in the daily validation level.

In the lower timeframes we are bearish while confluence with the daily level we get a low risk high probability entry.

We are risking as low as 10 Pips, while targeting a potential RRR of 1:20+.

DISCLAIMER: Trade with caution.