AUDEUR trade ideas

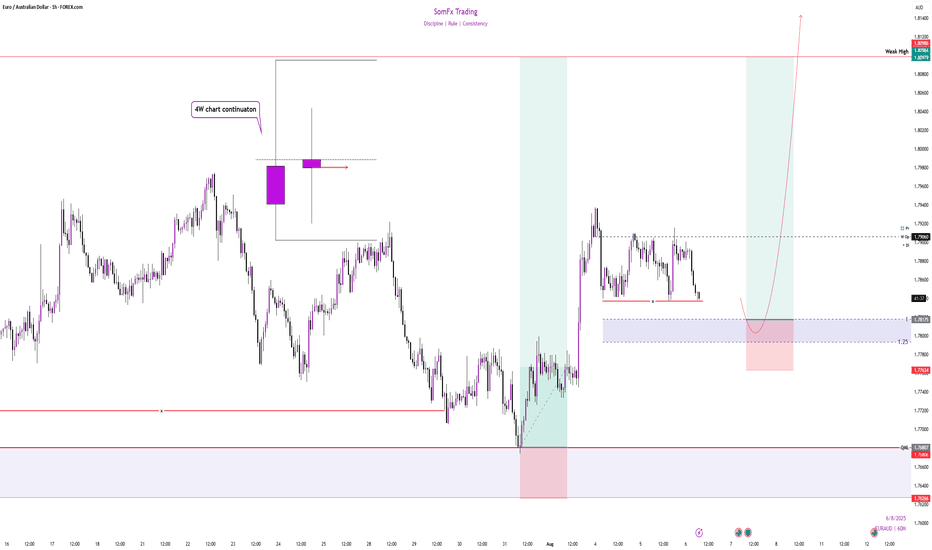

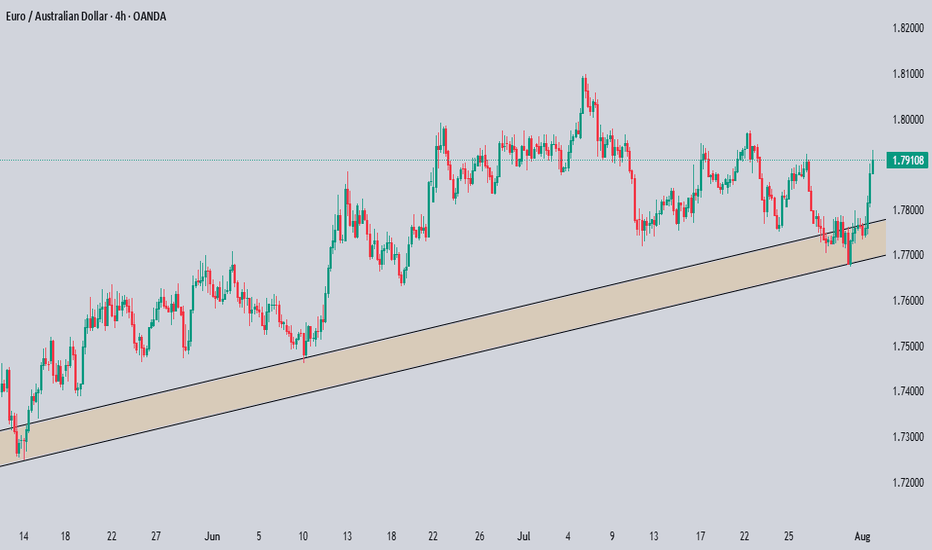

EURAUD Bullish Continuation Methodas you can see form my posts i have shared that lst Bullish Setip few days ago now what we are waiting is a contiuation to bullish side, when we look at 4W chart we can see that th prvious 4W candle was a bullish one and we are looking the next 4W candle to bullish and potetioally to raid the high of previous 4H high, so in 1-4H chart we are lookin bullish continuation and clearly what we are seeing now is Bullsuh continuation correction setup Lets just wait.

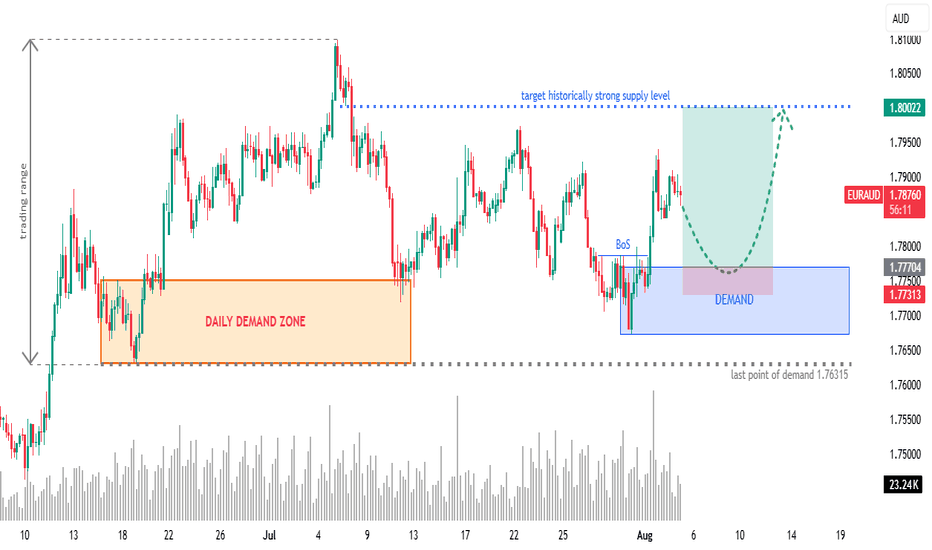

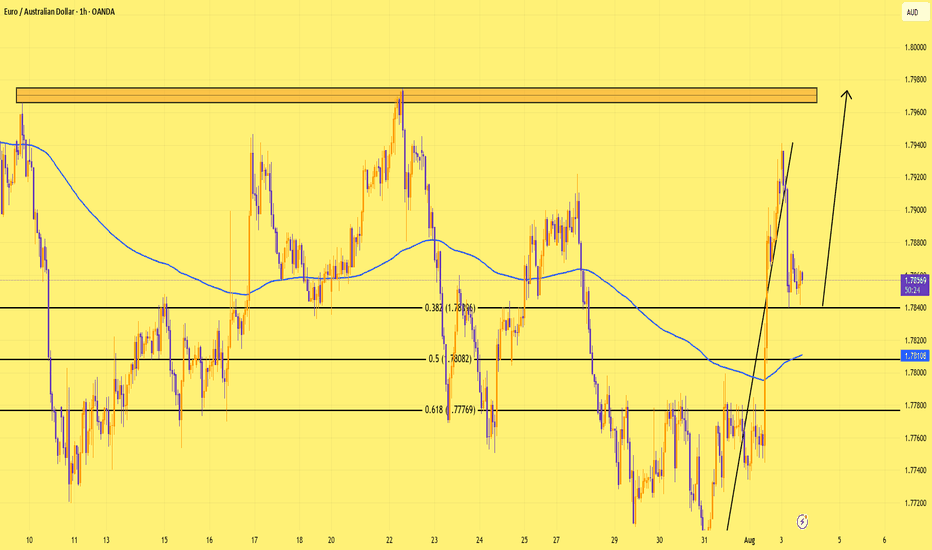

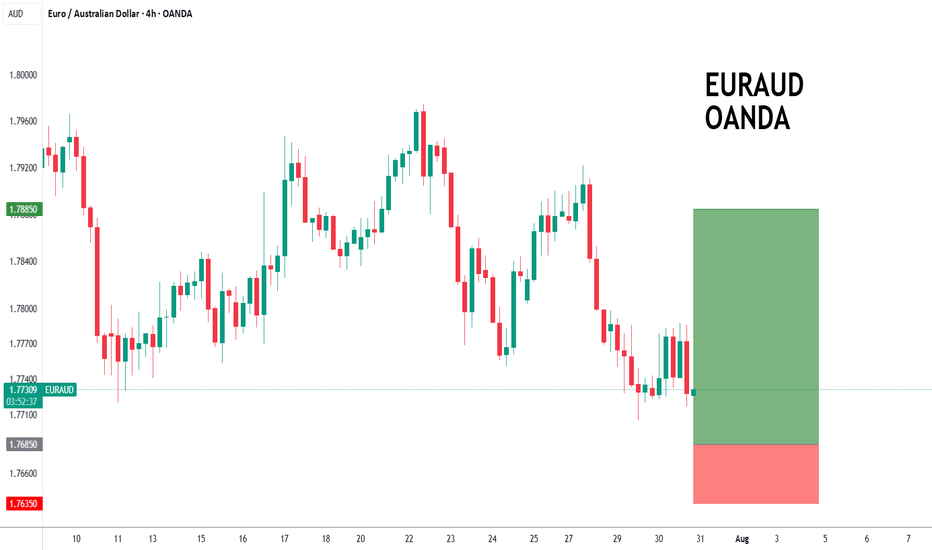

EURAUD 4H: Long Setup from Fresh Demand ZoneOverview:

OANDA:EURAUD retracing into a newly formed 4H demand zone after a bullish Break of Structure (BoS). Eyes on continuation towards a historically significant supply zone at 1.8000.

🧩 Setup Details

• Asset & Timeframe: EURAUD, 4H

• Bias: Bullish

• Entry Zone: 1.77300 – 1.77700 (DEMAND area)

• Targets:

🎯 T1 = 1.7900 (minor reaction level)

🎯 T2 = 1.8000 (historical supply level)

• Stop-Loss: Below 1.77300 (last valid demand)

• Risk-Reward: Approx. 1:6+

🧠 Why Now? (Trade Rationale)

• ✅ Fresh 4H Demand Zone: Price is retracing into a clear demand zone after rejecting lower prices.

• ✅ Break of Structure (BoS): Bullish BoS confirms shift in order flow.

• ✅ Volume Confirmation: Increasing demand near current price levels.

• ✅ Clear Liquidity Sweep: Price likely swept short-term lows before BoS.

• ✅ Target Supply Zone: 1.8000 is a well-respected historical supply/resistance level — clean magnet for price.

⏱ Multi-Timeframe Context

• Daily Chart: Price is reacting off a larger DAILY DEMAND ZONE. Trend bias is bullish.

• 4H Chart: Structure break + demand formation suggest continuation.

• 1H/Entry Level: Monitor price action in the blue zone for lower-timeframe confirmation (e.g. bullish engulfing, flip zones, LQ sweep, etc.) and potentially greater risk-reward.

📉 Risk Management & Duration

• Stop below 1.76315 keeps you protected from deeper invalidation.

• Trade Duration: Short to mid-term (1–4 days).

• Position Size: Scale based on volatility; ideal for swing trade conditions.

📌 Trade Plan Summary

📍 Watch for bullish PA on re-entry into demand (1.77300–1.77700)

📍 Set SL below 1.76315

📍 TP1 at 1.79000 — partials advised

📍 TP2 at 1.80000 — strong historical level

📍 Adjust SL to BE on momentum breakout

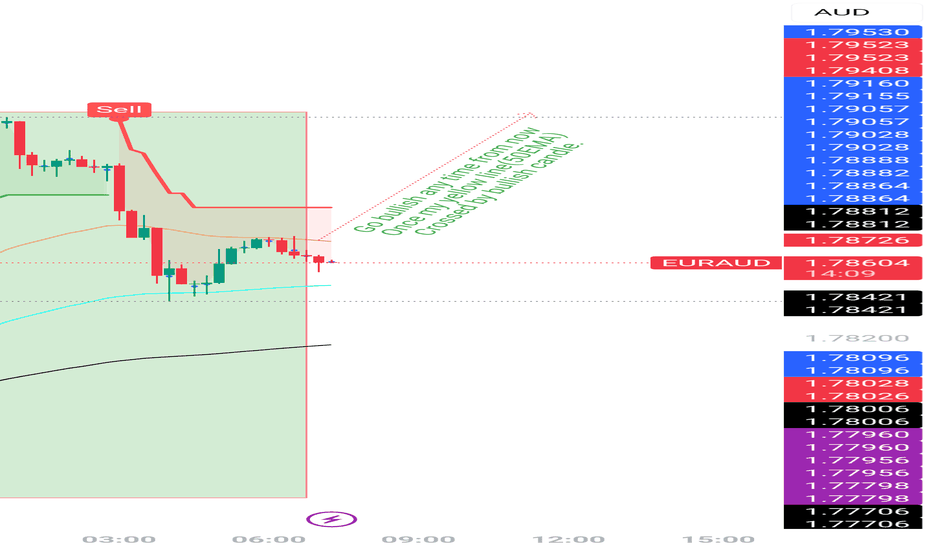

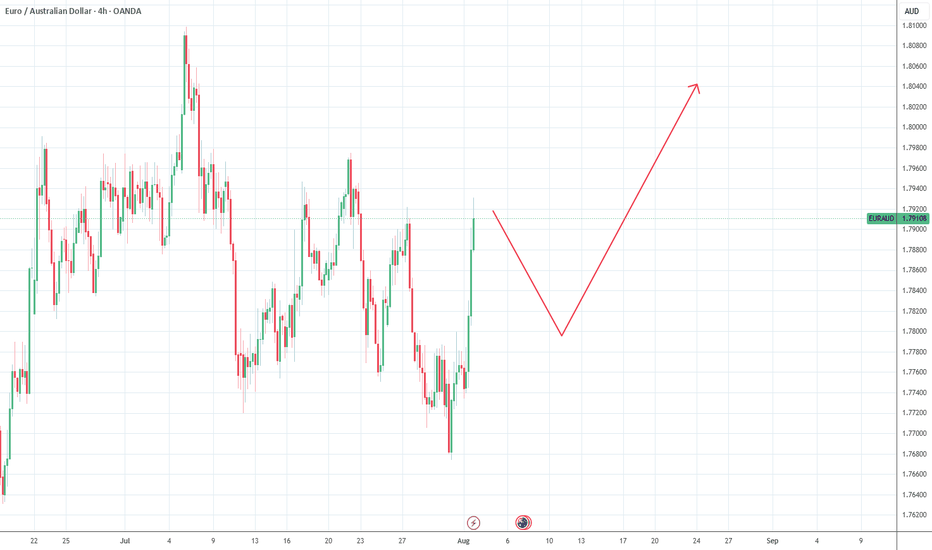

One Sweet Bullish Candle Above 50EMA… and I’m All Yours, 1.7940I’ve got a lovely 1H bullish range from 1.7733 to 1.7940 — pure potential.

Market gave me a 100-pip pullback/retracement from 1.7940 to 1.7840 — just a little mood swing. 😒

Now I’m patiently stalking...

If a bullish candle closes above my 50EMA,

I’m not thinking twice — I’m riding the bull! 🐂💥

SL? Depends on the candle’s vibe:

If it’s a strong Marubozu, I’ll trust it like a loyal partner — SL goes just below it.

TP? Straight to 1.7940 — no detours, no drama. 🎯

Wish me luck… and a Marubozu with commitment issues! 😂📉📈

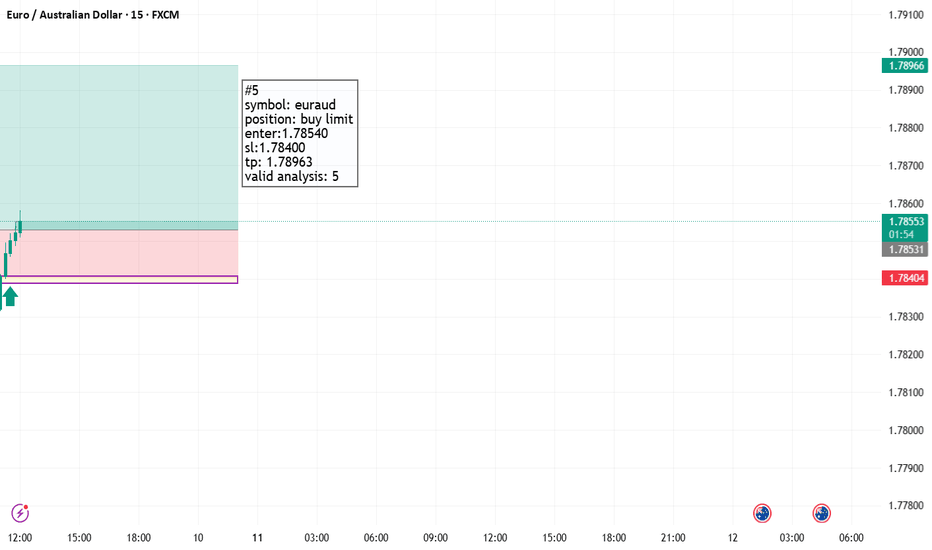

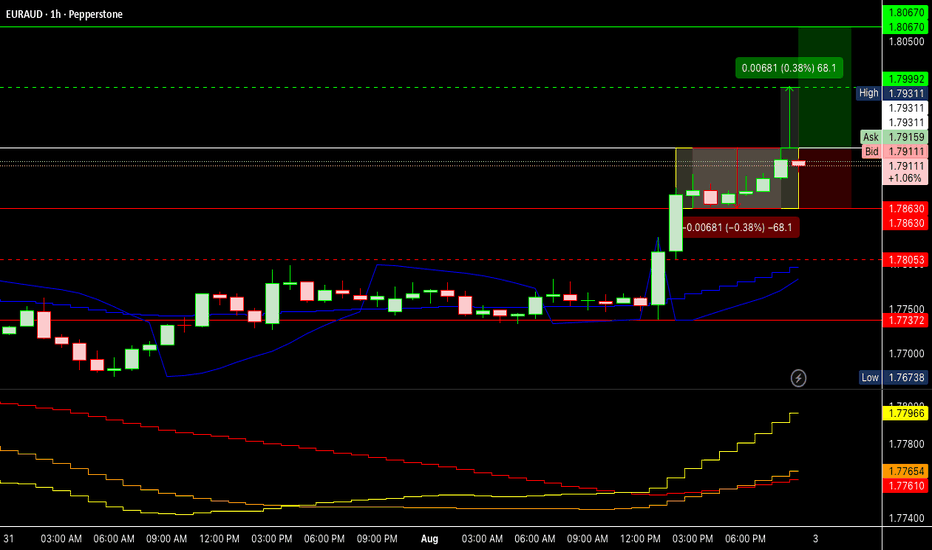

Lower Timeframe Analysis on EUR/AUDWhen analyzing the pair on lower timeframes, there appears to be a potential opportunity for a long position.

Looking at the broader picture on the daily timeframe, the pair may continue its upward movement following the formation of a strong bullish candle on Friday (August 1st, 2025).

Additionally, it's worth noting that the pair recently reached a low around 1.72476 and may now be aiming to establish a new high near 1.85566.

Given that this analysis is based on the daily timeframe, and following the breakout of the resistance at 1.79311 — which corresponds to the upper boundary of a rectangle marking the current range — a long position is considered valid.

Note: Be mindful of the potential for a GAP at the market open.

It is essential to remember that while technical analysis can provide valuable signals, it is crucial to also monitor economic data, news releases, and other fundamental factors that may affect this pair. This analysis focuses solely on the technical aspect.

The long position tool shown on the chart is meant for illustrative purposes only and should not be considered a definitive entry signal.

Disclaimer: This analysis reflects only my personal view of the market and does not, under any circumstances, constitute investment advice.

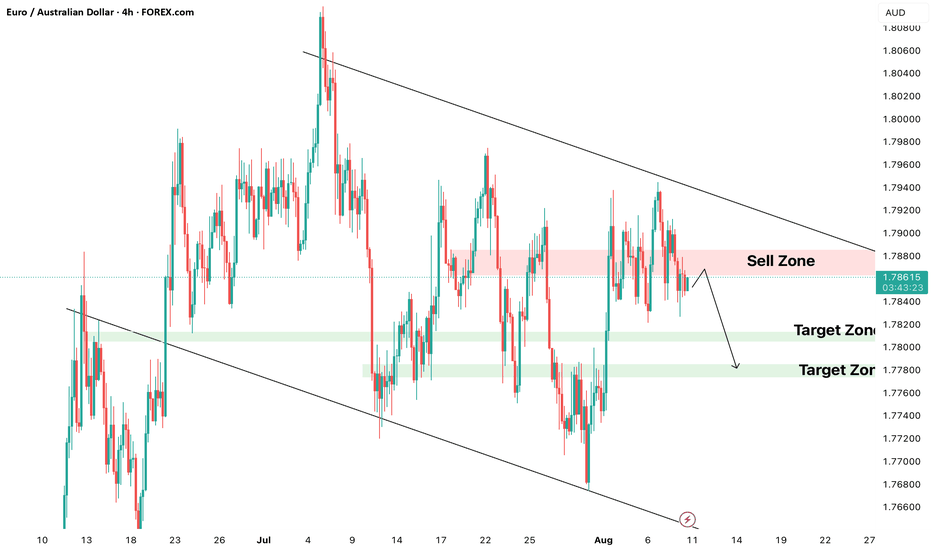

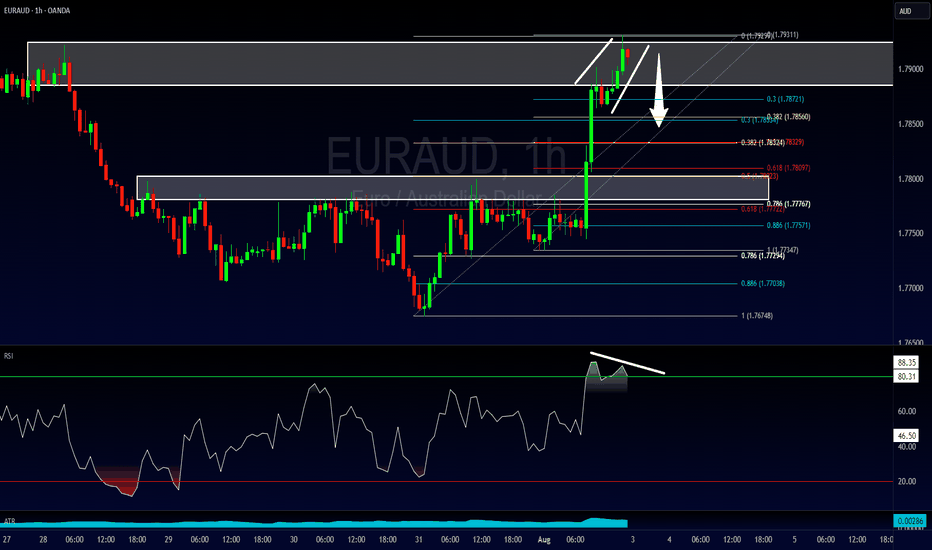

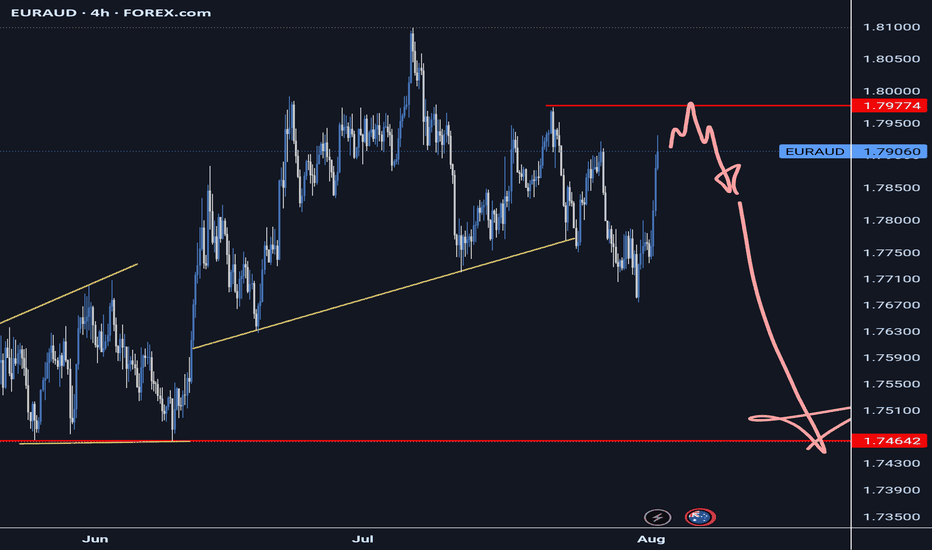

Loss of Momentum Pattern Into StructureSimilar to the OANDA:GBPJPY that I shared, the OANDA:EURAUD has put in a pretty aggressive and direct move into a previous level of structure. However, what makes this opportunity different than "the beast" is that as price approach our level of resistance we started to put in a rising channel which is a loss of momentum pattern along with other clues such as divergence on the RSI.

If you have any questions, comments or want to share your views, please do so below. Also be sure to hit that like button & give me a follow, that way you don't miss my future trading ideas.

Akil

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup more favorable at this stage.

AUD Weakness :

The Reserve Bank of Australia (RBA) has held rates steady at 3.85%, but recent inflation data has dropped to 2.7%, the lowest in over 3 years.

Most economists now expect the RBA to cut rates in its next meeting in August, possibly by 25 basis points.

Slowing economic growth and dovish forward guidance from the central bank are weighing heavily on AUD sentiment.

EUR Outlook :

The European Central Bank (ECB) is also facing weak economic data, but is taking a more cautious approach toward cutting rates.

Despite softer PMIs and sluggish growth in countries like Germany and France, the ECB has not confirmed a near-term rate cut, keeping EUR relatively stable.

This divergence between the RBA’s dovish stance and the ECB’s pause is supportive of EUR strength against AUD.

Summary :

With the RBA likely to ease policy soon and the ECB holding ground for now, the interest rate differential favors EURAUD upside. Fundamentals point toward further weakness in AUD, making the EURAUD Long a strategically sound trade idea for the coming days.

-------------------------------------------

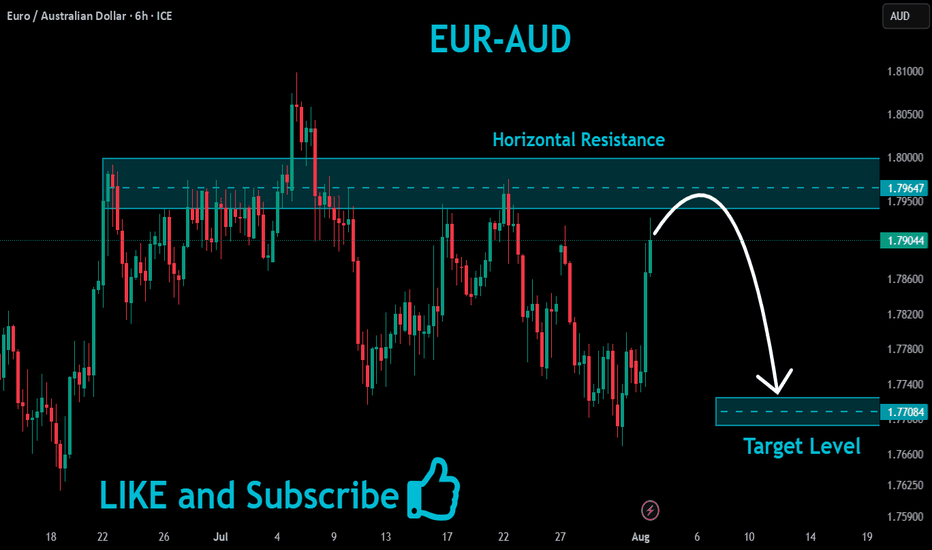

Now let's analyze the conditions of the EURAUD chart on the 4-hour time frame .

EURAUD is currently trading near the Support zone(1.772 AUD-1.763 AUD) , Potential Reversal Zone(PRZ) , and near the lower line of the descending channel .

According to Elliott Wave theory , EURAUD appears to have completed a Zigzag Correction(ABC/5-3-5) .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect EURAUD to rise to at least 1.784 AUD .

Second Target: 1.792 AUD

Note: Stop Loss(SL): 1.762 AUD

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Australian Dollar Analyze (EURAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

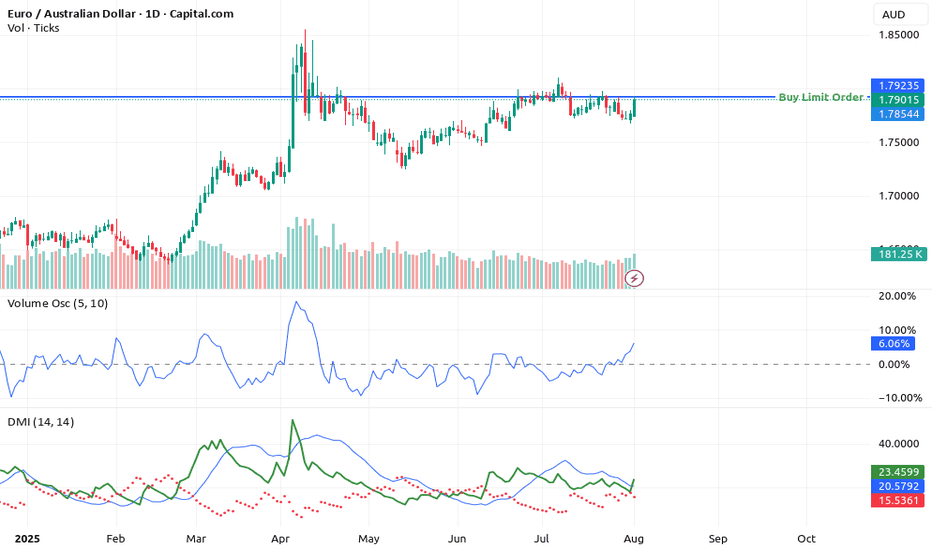

The 7 Secrets Of Trading MasteryIn this video we are going to talk about:

Buy Limit Orders

Sell Limit Orders

Reversal Patterns

Double Tops

Double Bottoms

Using The Rocket Booster Strategy

The Power Of Risk Management

Watch this video on CAPITALCOM:EURAUD in order for you to learn more

take care and trade safe.

Rocket Boost This Content To Learn More

Disclaimer;Trading is risky please a simulation ion trading account

before you trade with real money

also learn risk management and profit taking strategies.

EURAUD BULLISH MOVE CONTINUESOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

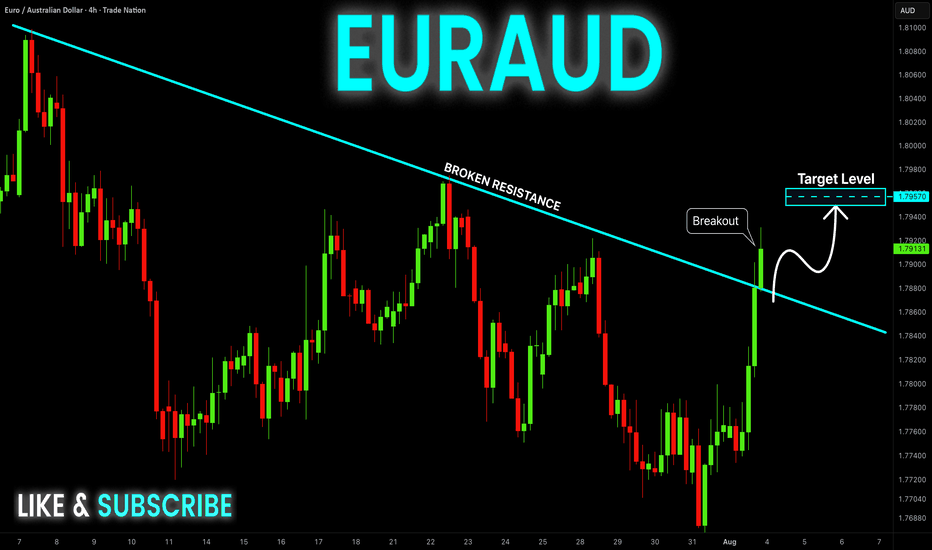

EUR-AUD Bullish Breakout! Buy!

Hello,Traders!

EUR-AUD made a bullish

Breakout of the falling resistance

And the breakout is confirmed

So we are bullish biased

And we will be expecting

A further bullish move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

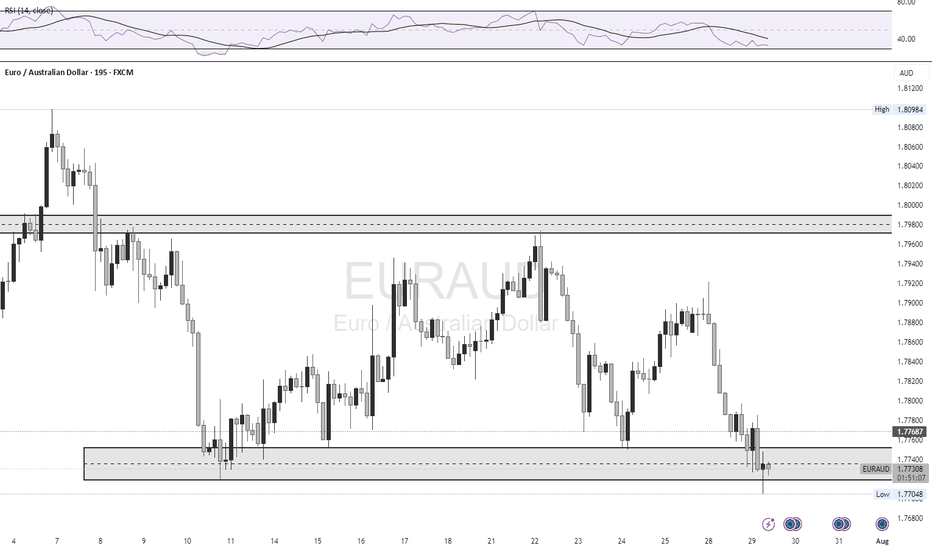

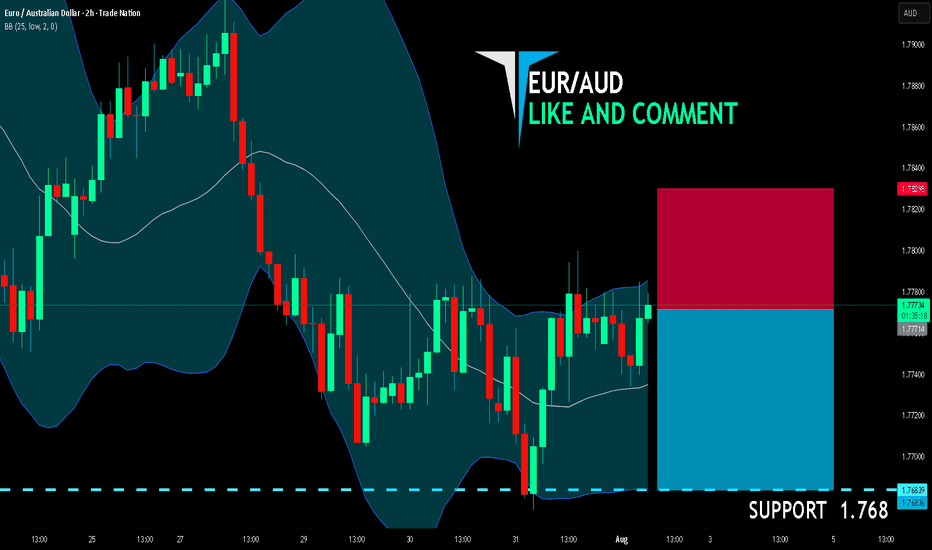

EUR/AUD BEARS ARE GAINING STRENGTH|SHORT

EUR/AUD SIGNAL

Trade Direction: short

Entry Level: 1.777

Target Level: 1.768

Stop Loss: 1.782

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

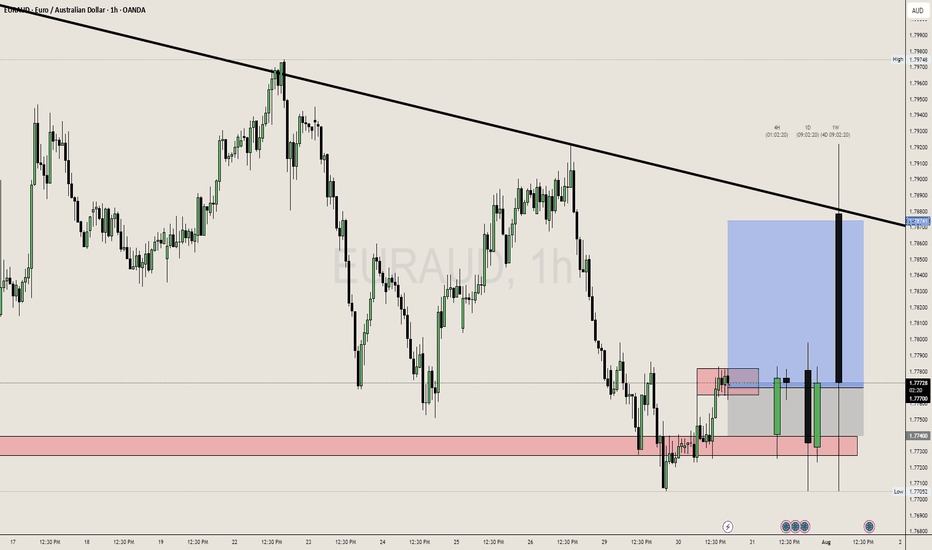

EURAUD waiting for breakoutWe can see a breakout in upside in EURUAD after this consolidation as EA already tested it's support and swept the sell side liquidity. Targeting 1.78500 Zone Again for Testing and also forming a triangle pattern in 4H.

We can take a buy till that trend line test with tight SL.

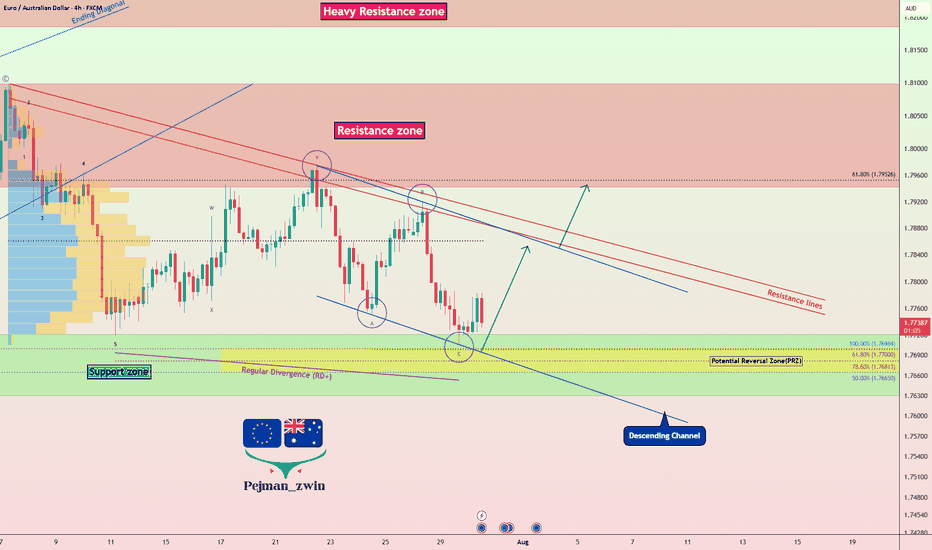

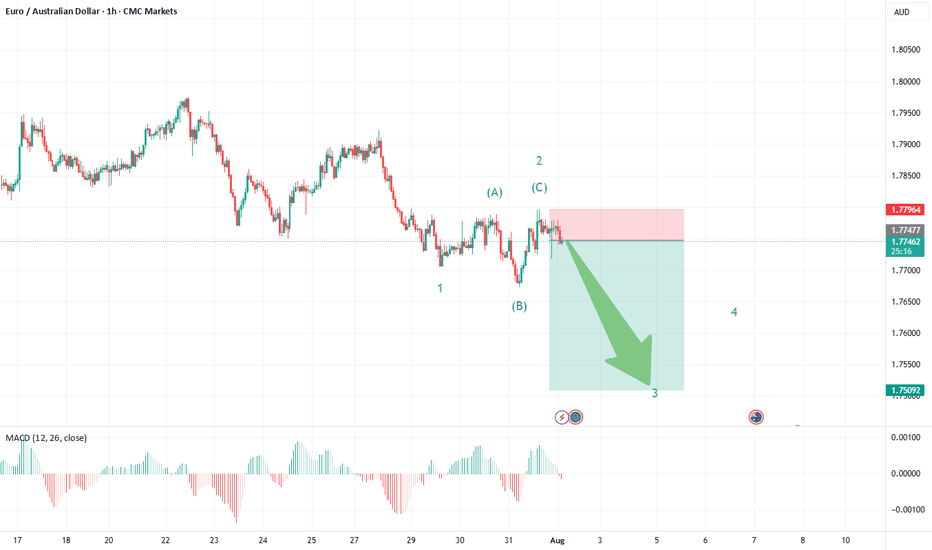

EUR/AUD: Short Setup Forming—Is the Downside Just Beginning?EUR/AUD is flashing the early signs of a new short trading opportunity, with the latest chart pointing toward a fresh move lower as the corrective phase may be wrapping up.

What the Current Structure Shows (Primary Scenario)

Corrective Pattern Complete: The strong advance off the May 14th, 2025 lows at 1.7247 unfolded as a classic double zigzag (WXY), culminating at recent highs. Price action has since reversed and formed an initial impulse down—clear evidence that the correction may be over.

Wave 1 Down, Expanded Flat for Wave 2: The chart now displays a completed wave 1 on the downside, followed by an expanded flat for wave 2—where price retraced upward but failed to break the previous peak, a sign of fading bullish momentum.

The recent structure shows a sharp, impulsive move down (wave 1), fitting Elliott Wave expectations for a new trend immediately after a complex correction.

The expanded flat for wave 2—where the B wave exceeded the start of A and C pushed higher—typically heralds a strong, extended wave 3. This supports a bearish outlook from current levels.

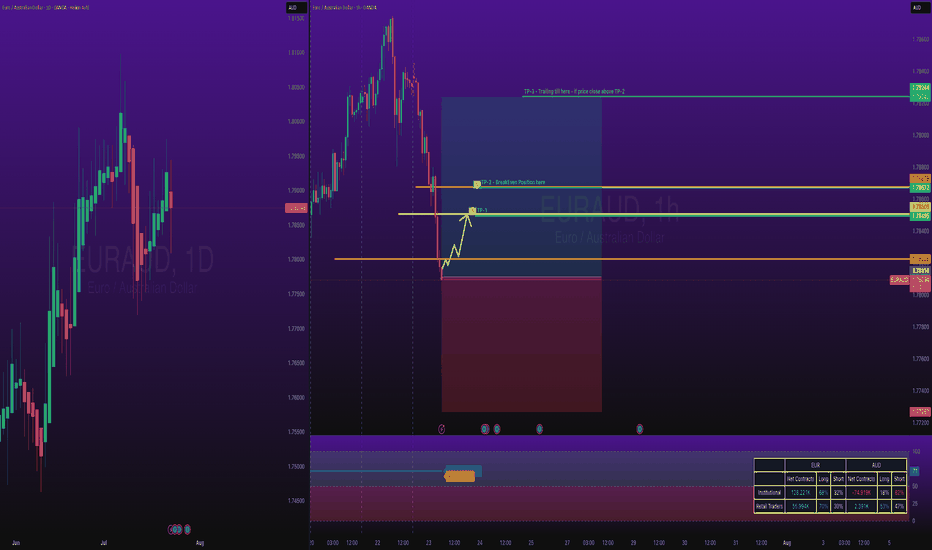

EURAUD Long TradeOANDA:EURAUD Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

TP-1 is high probability.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

EURAUD to see a temporary move lower?EURAUD - 24h expiry

The primary trend remains bullish.

The selloff is close to an exhaustion count on the daily chart.

Preferred trade is to buy on dips.

Risk/Reward would be poor to call a buy from current levels.

Bespoke support is located at 1.7685.

We look to Buy at 1.7685 (stop at 1.7635)

Our profit targets will be 1.7885 and 1.7910

Resistance: 1.7850 / 1.7910 / 1.7950

Support: 1.7700 / 1.7680 / 1.7630

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

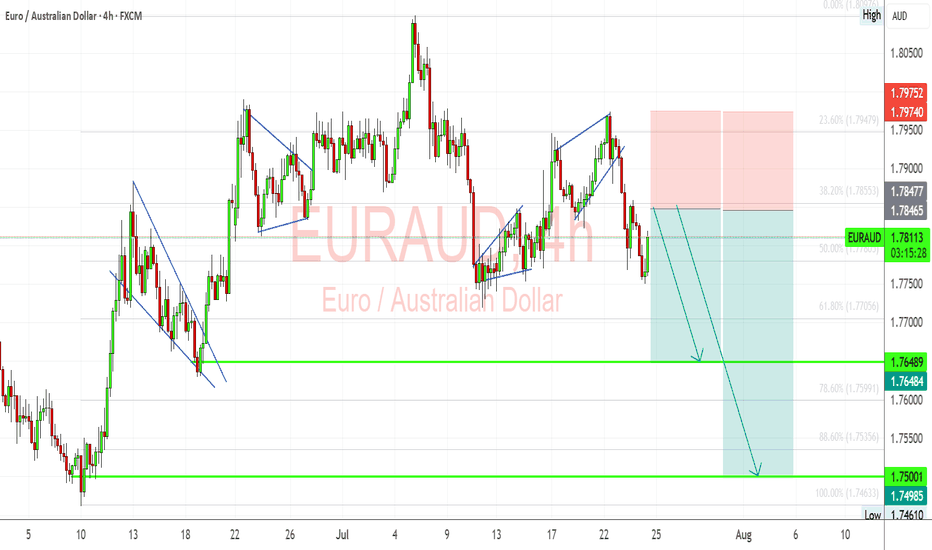

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Australian inflation and supportive commodity dynamics continue to boost AUD sentiment. Technically, the pair has broken down from a rising wedge, confirming bearish momentum and setting the stage for further declines toward key support near 1.7648 and potentially 1.7500.

🟢 Current Bias: Bearish

🔑 Key Fundamentals:

ECB: Markets expect the ECB to hold rates steady this week. While this ends a 7-year streak of cuts, the bank has turned cautiously neutral, with no clear signal of future tightening. Core inflation remains subdued, and growth momentum across Germany and the euro area is weak.

RBA & Australia: The RBA faces persistent inflation risks after the June CPI surprised to the upside, putting rate hikes back on the table. The Aussie dollar is drawing strength from this, especially with rising commodity prices and China's potential fiscal stimulus aiding demand-side confidence.

Macro Divergence: Australia’s macro picture is improving vs. the eurozone. AUD has tailwinds; EUR is under pressure from stagnant growth and tepid inflation outlook.

⚠️ Risks to Bias:

ECB Surprise: A sudden hawkish tone from the ECB (e.g., lifting forecasts or emphasizing wage-driven inflation risk) could spark short-term EUR upside.

RBA Softness: A dovish RBA pivot or weak Aussie data could weaken AUD strength and slow EURAUD downside.

Geopolitical Risk: Broader global volatility (e.g., US-China, oil disruptions) could cause flows into euro as a semi-safe haven.

📅 Key News/Events to Watch:

ECB Rate Decision & Press Conference – July 25

Eurozone Flash GDP + CPI – Next week

China industrial data (AUD-sensitive)

RBA August Meeting Statement (early Aug)

📉 Technical Breakdown (4H Chart):

Price broke bearish from a wedge consolidation.

Minor bullish pullbacks are being sold into, confirming a distribution phase.

Targets:

1st Target: 1.76480 (support & fib confluence)

2nd Target: 1.7500–1.7460 zone (major swing low)

Resistance: 1.7855–1.7975 zone is key invalidation area.

Structure favors lower highs & continuation patterns until support zones break.

🧭 Leader/Lagger Behavior:

AUD is leading the move. Strong CPI and China demand backdrop are fueling bullish AUD momentum.

EUR is lagging, tracking broader USD risk tone and internal Eurozone data weakness.

EURAUD is currently reactive to external forces rather than setting direction for other pairs.

✅ Summary: Bias and Watchpoints

Bias: Bearish

Fundamentals: Weak Eurozone growth vs. hotter Aussie inflation and hawkish RBA tone.

Risk: ECB hawkish tilt or a dovish shift from the RBA.

Event to Watch: ECB press conference and Aussie CPI commentary from policymakers.

Leader/Lagger: Lagger — following AUD strength rather than leading.