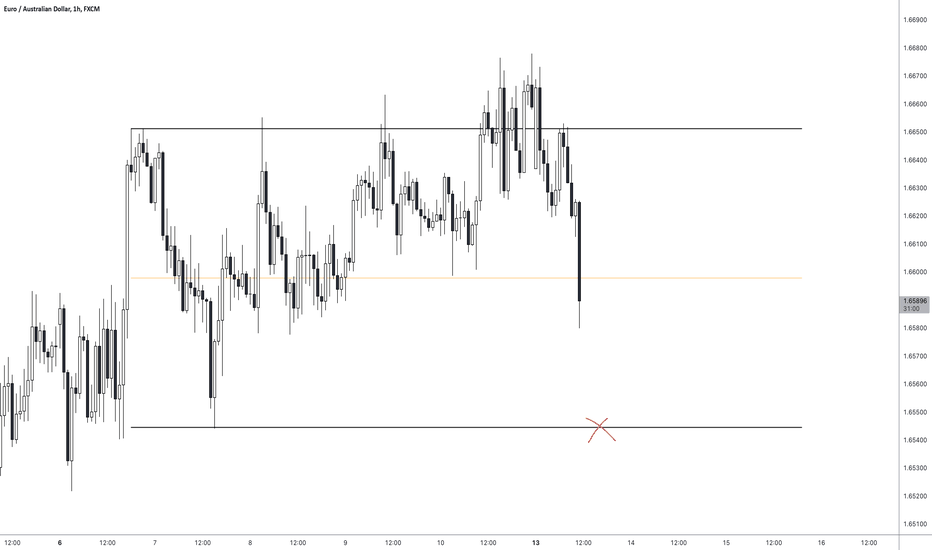

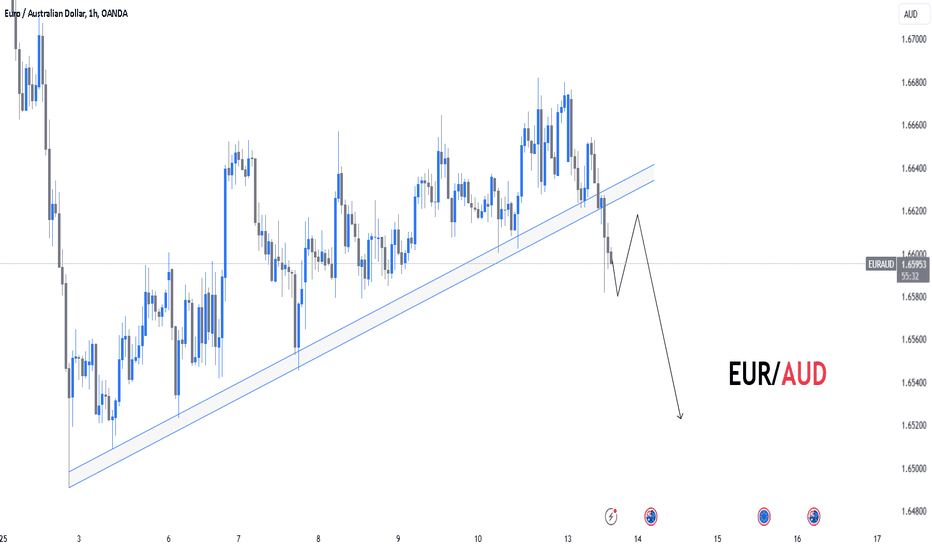

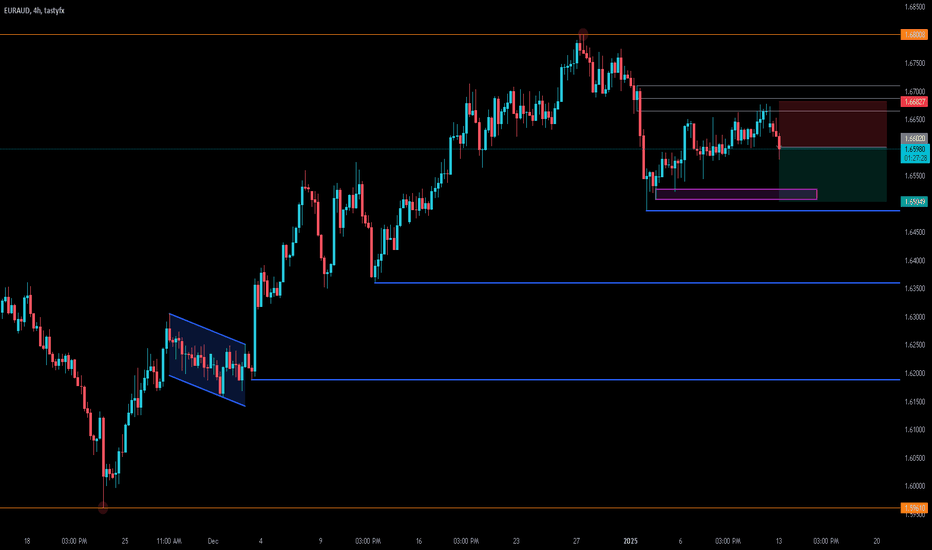

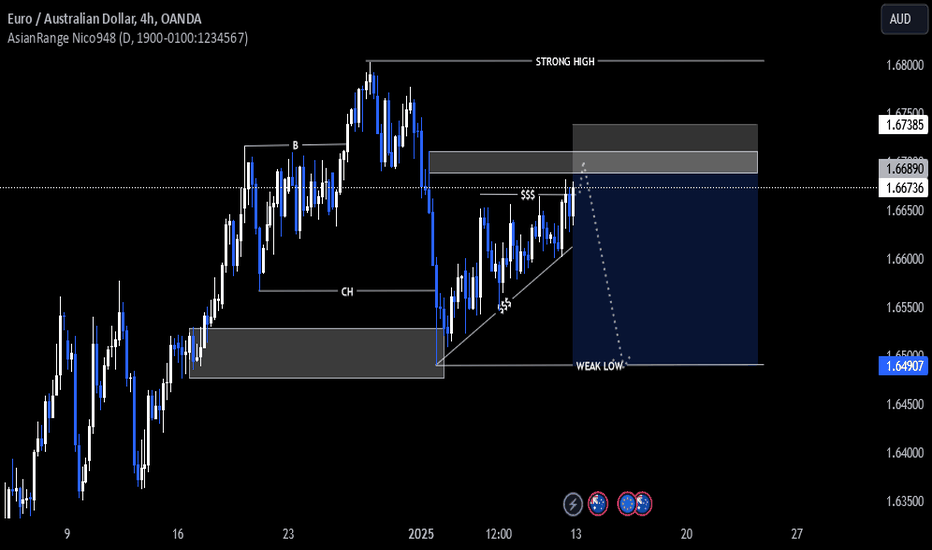

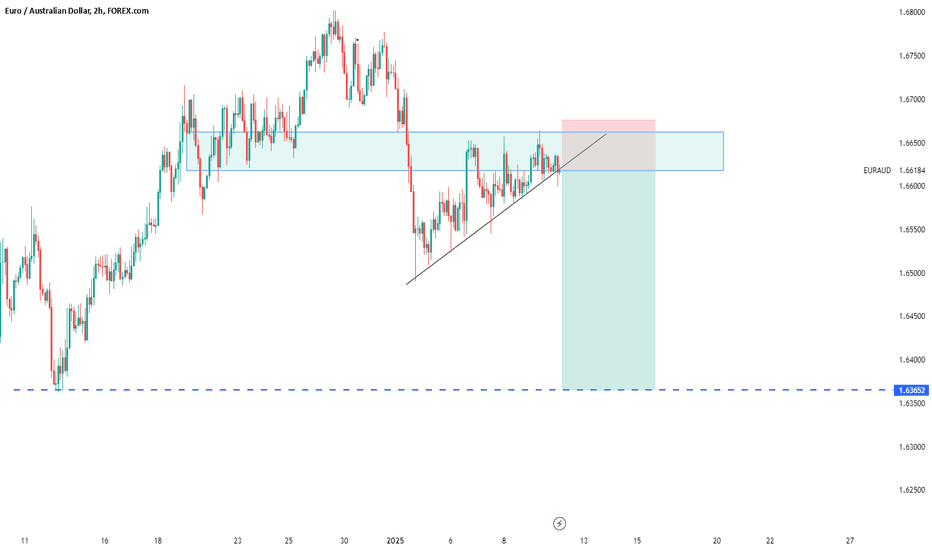

EURAUD - Short SetupMy main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.

In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level lower, this indicates on probable distribution Wyckoff range.

But to take more statistically probable trades we should wait for some type of lower timeframe confirmation, and in this case we can notice sign of weakness (reaching the middle of the range), so potentially there is a higher probability to see price lower.

Your success is determined solely by your ability to consistently follow the same principles.

AUDEUR trade ideas

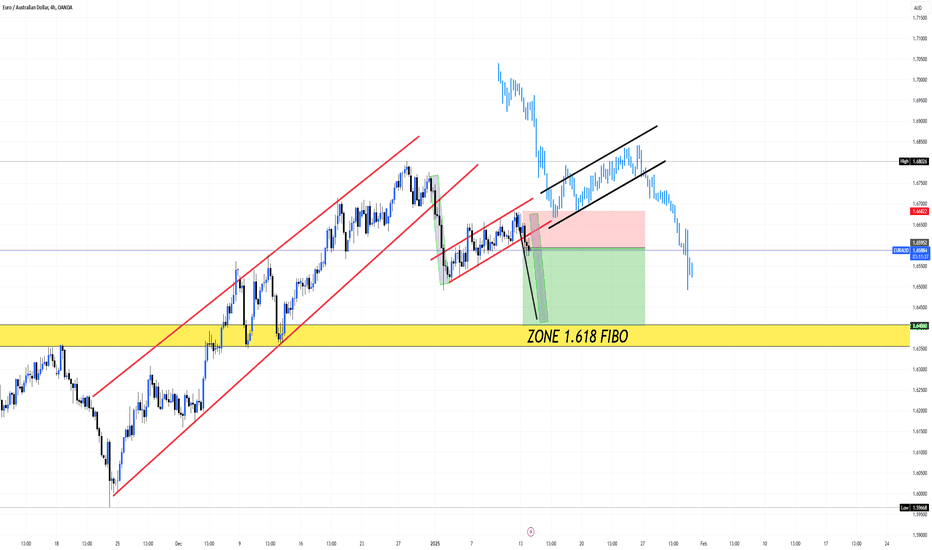

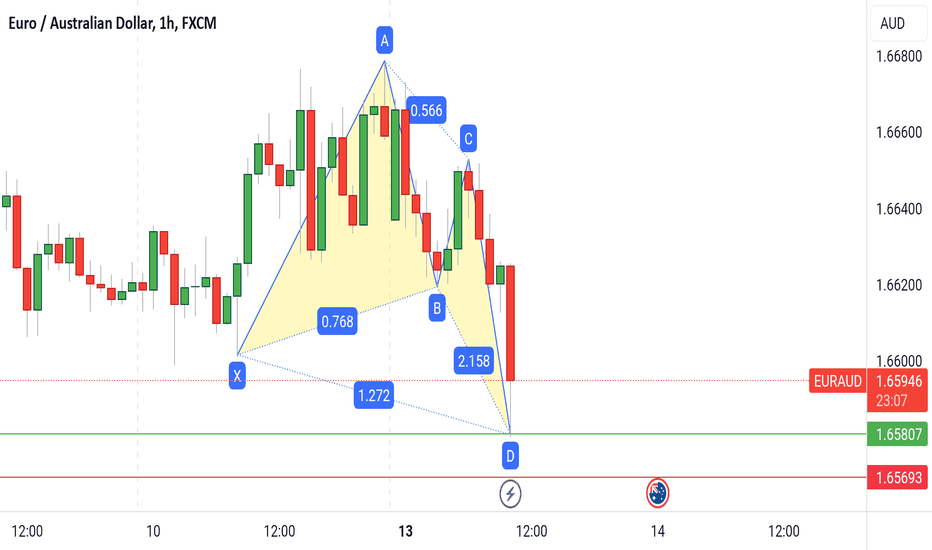

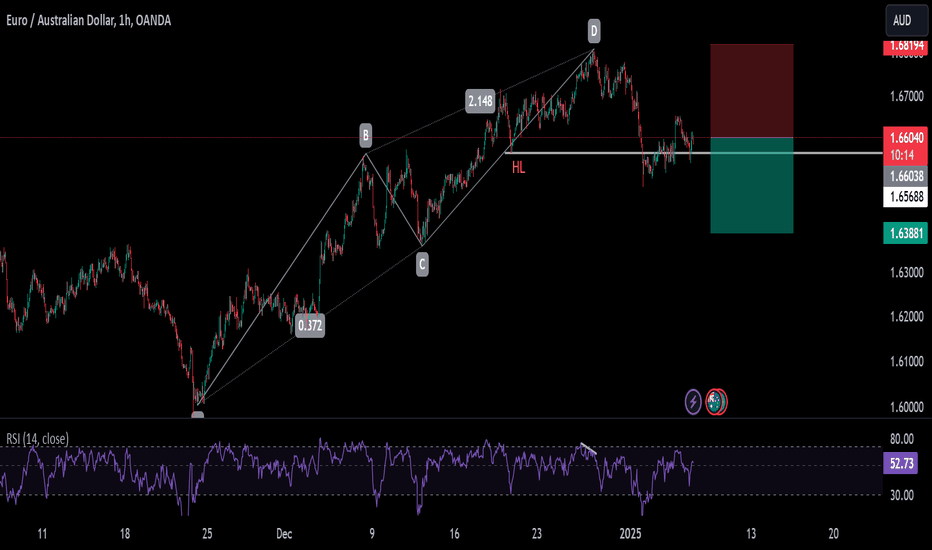

BUTTERFLY PATTERNHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

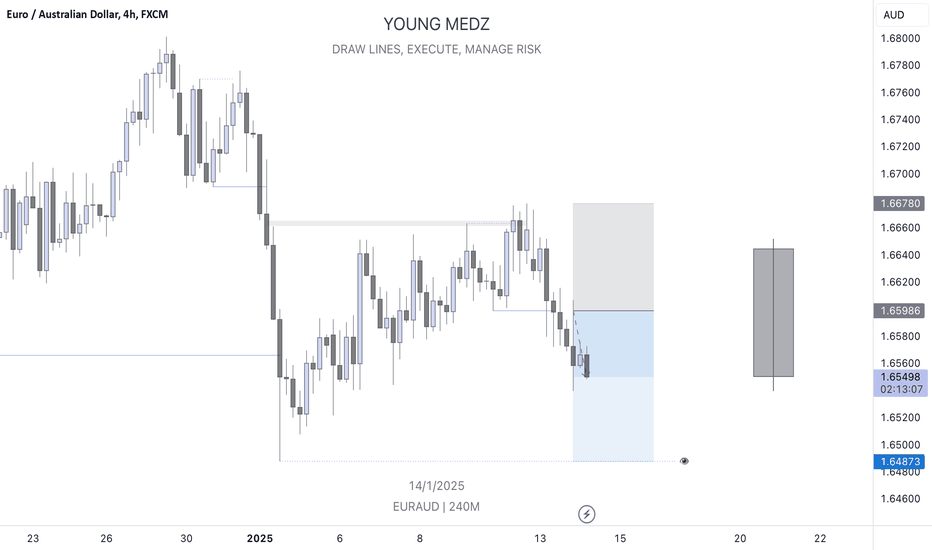

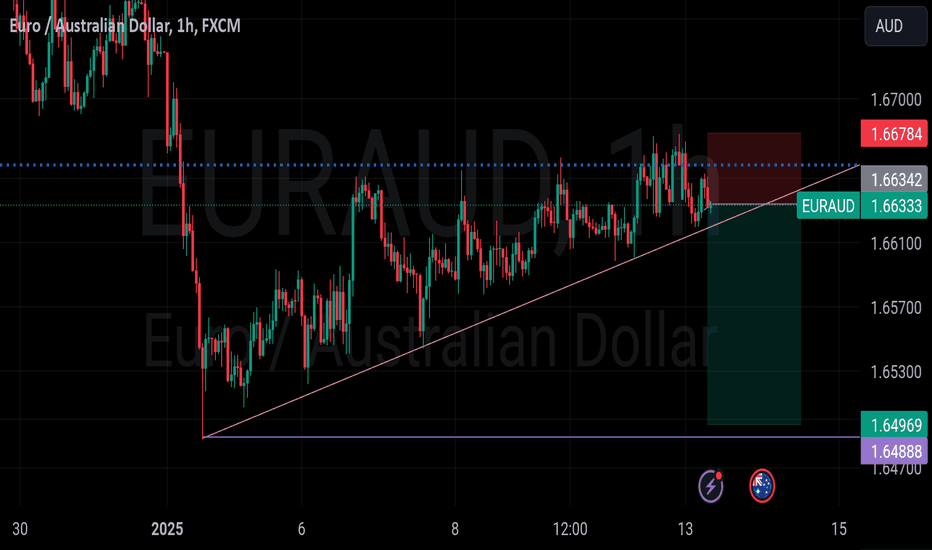

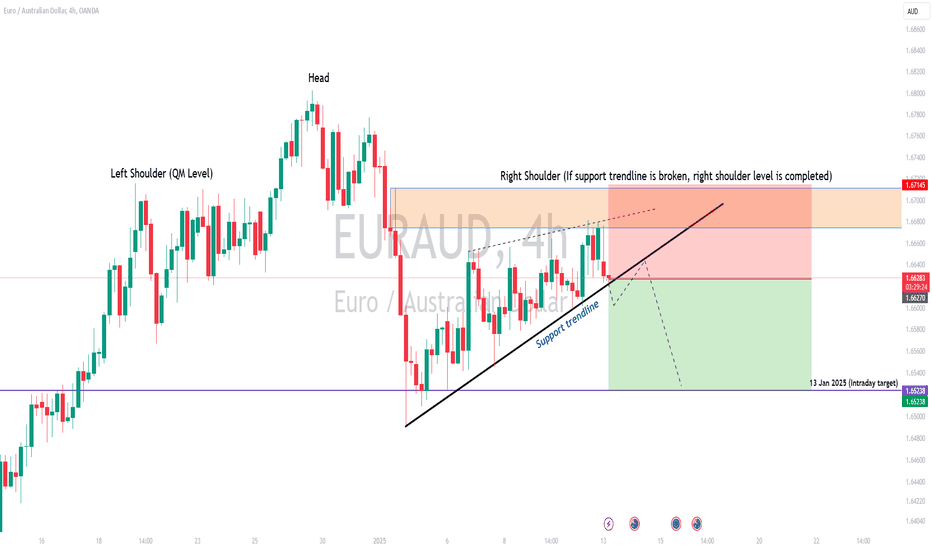

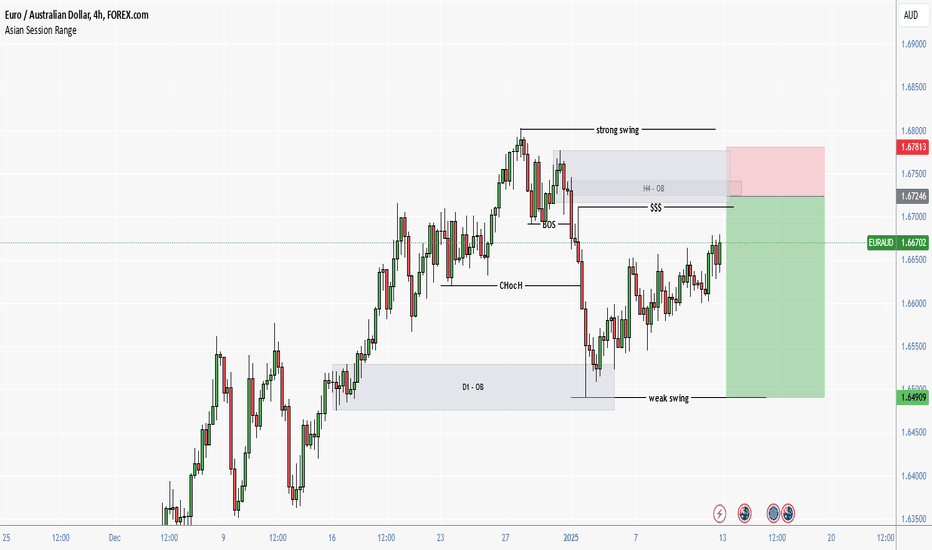

EURAUD H4 awaiting support trendline to be brokenThis pair is definitely attracting my attention with a potential bearish movement.

I'm still waiting H4 close to break support trendline as per drawn in the chart.

Once broken, the movement to downward is more promising in my opinion.

Good luck and happy trading.

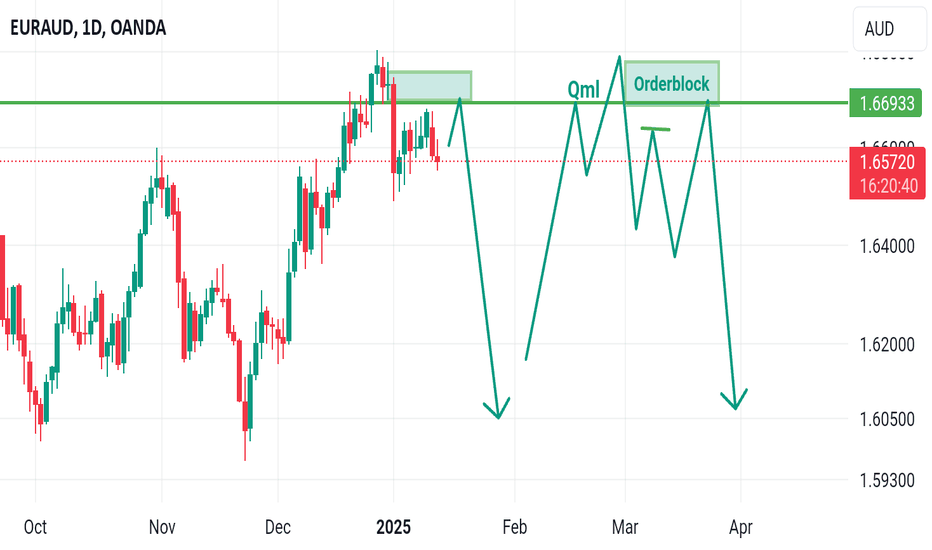

A CLEAR BEARISH STUCTURE ON EURAUD.

There was confusion between bulls and bears on EURAUD the previous week ,making the pair to be choppy throughout the week. Hence, the confusion seems to be caused by the brake and retest of structure (resistance level) on weekly time frame ,meanwhile price rejected on a major /supply/liquidity zone but the previous monthly candle closed bullish leaving us to wonder what could happen next. all I can see is sells, there is a great shooting star on the monthly resistance level that is still pushing-price down and I can see a break of trend and retest on a 4hr time frame .I can also see a bearish flag that completed with shooting star on the current resistance level giving a sell signs. Trade with care

EURAUD possible ideaAfter price broke previous high, It initiated a liquidity grab before it preceded to rally and break a previously protected strong higher low. This then gave us a shift in market structure from a bullish to bearish market. Price has currently formed liquidity just below a supply zone that it could use to fuel it's move to the downside, running an established trendline liquidity as well as the latest formed weak low.

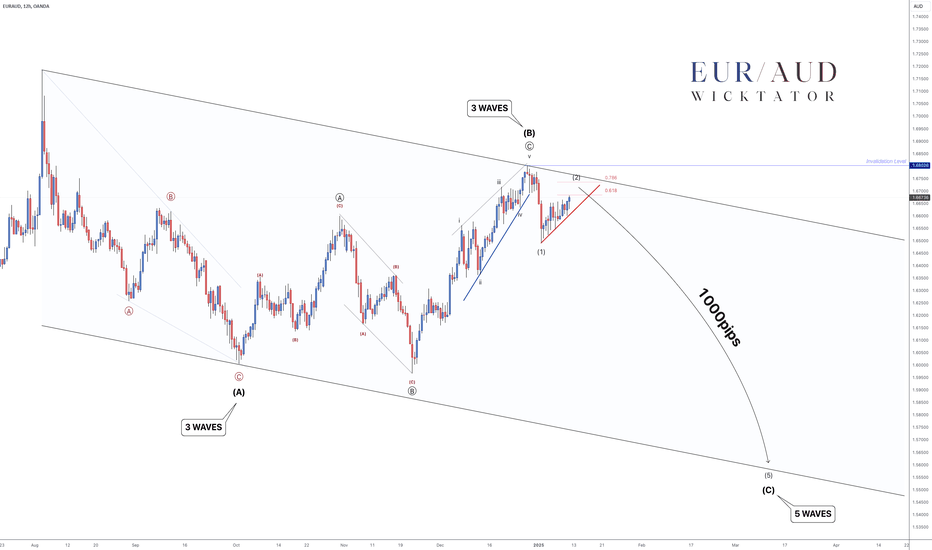

EURAUD - Start 2025 with a BIG Win!EURAUD has given us a fantastic opportunity to get in at the very start of a BIG move.

We are currently in an ABC correction. We'e completed waves A and B and now currently in wave C. We're expecting 5 waves from wave C and looks as if we've completed wave 1 and currently in wave 2. We're looking to catch the rest of the move on the break of the trendline.

Trade Idea:

- Safe entry on break of trendline

- Riskier entry within the fibs or anywhere below invalidation

- stops above invalidation

- Targets: 1.6 (700pips), 1.156 (1100pips)

- Taper as we move lower

What do you guys think?

Goodluck and as always, trade safe!

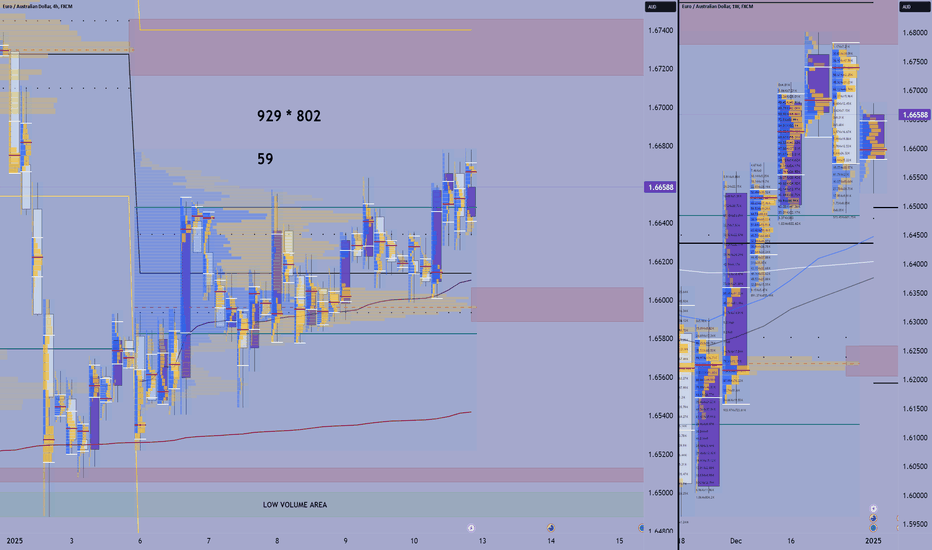

EURAUD OutlookEURAUD -

yearly

bullish, price has already tagged 12M VA and POC both and price got absorbed as it tagged POC.

monthly - bullish, price tagged and got absorbed from Dec's POC and VA and is now struggling to clear the secondary POC. structure on the monthly chart suggests an incoming aggressive move to the upside.

weekly

bullish. coast seems clear for the price to move up to the POC above.

plan to trade EA

my hypothesis is that EUR will get stronger suddenly as Trump comes into office on 20th and this will drive EA up.

drop down to origin and I see price aggressively moving up to tag the POC above and then pulling back to last week's POC.

alternatively, price can pull back to POC during the start of next week and then buyers might step in as we move closer to 20th.

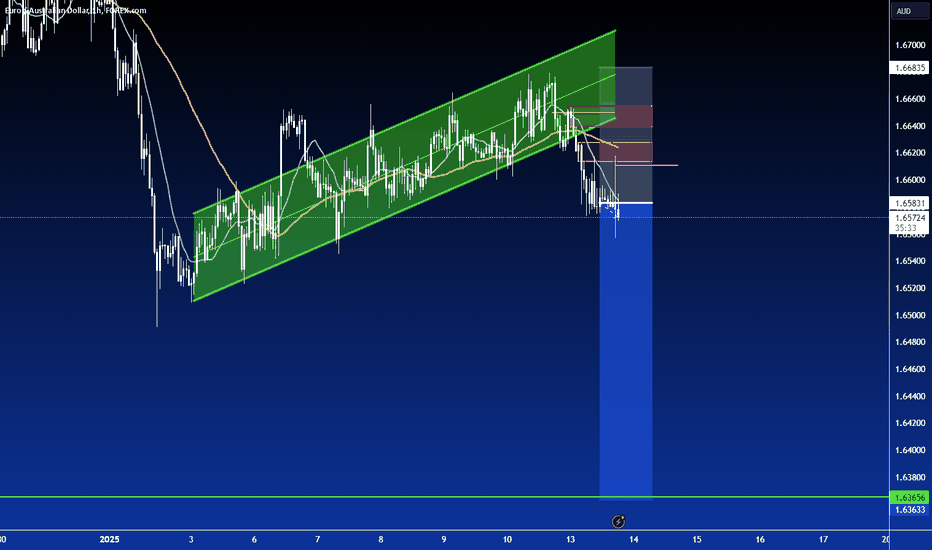

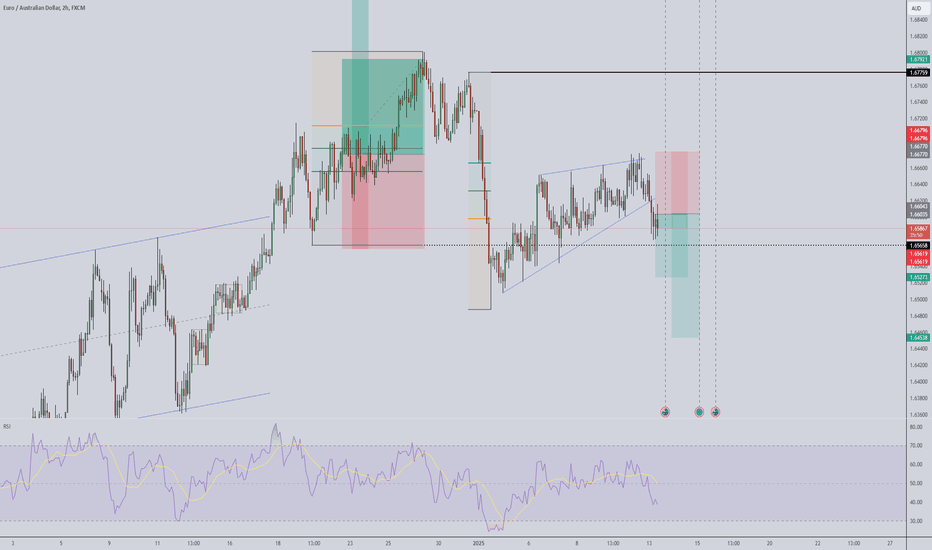

EURAUD (4H)📊 EURAUD 4H Analysis

The market structure has shifted from a bullish trend (higher highs and higher lows) to a bearish one with the break of structure and a new lower low (LL).

We observed:

🔹 Impulsive Move breaking the bullish trendline.

🔹 Corrective Move retesting the supply zone.

🔹 A potential continuation to the downside is expected as the market may respect the supply zone and form new lower lows.

📉 Bias: Bearish.

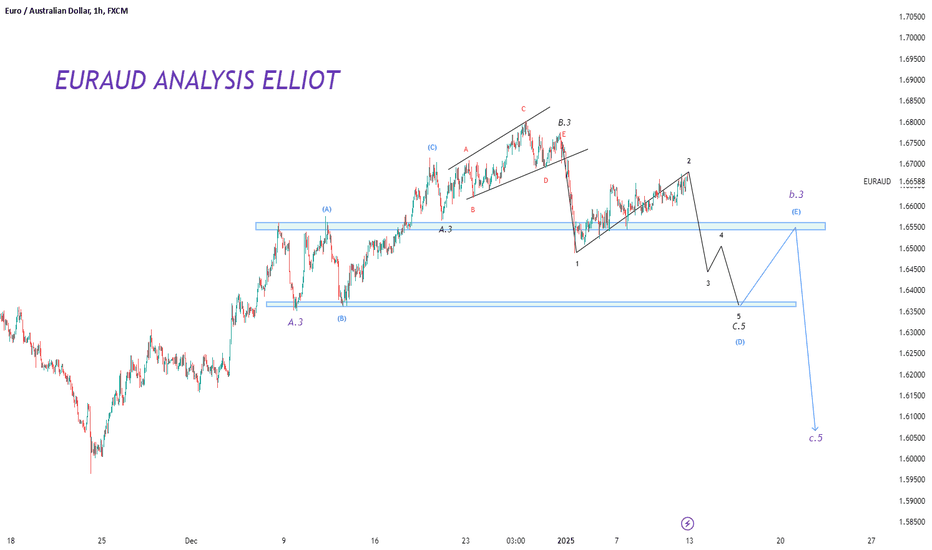

euraud analysis elliot sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

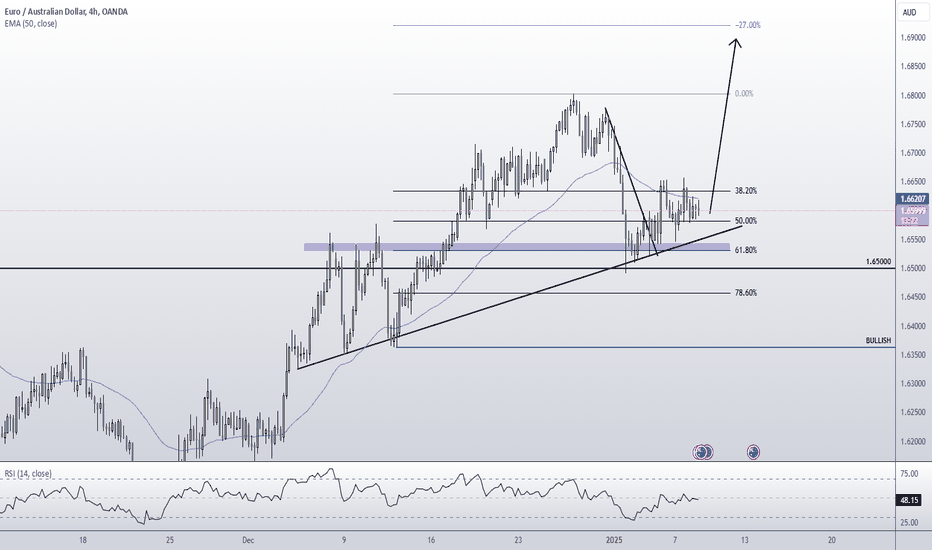

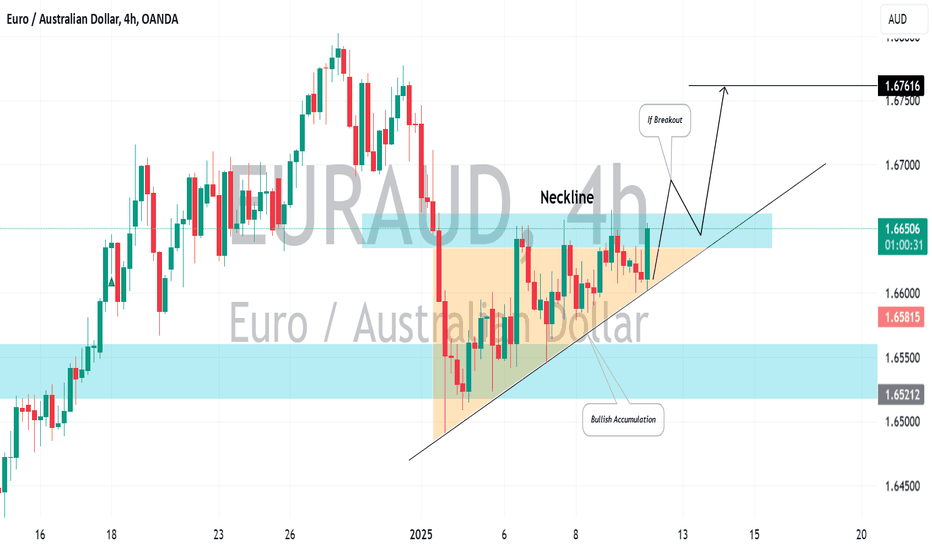

EURAUD: Your Trading Plan For Next Week ExplainedEURAUD is currently in a long-term uptrend on the daily chart.

At the beginning of the year, the price created a large ascending triangle pattern, which is a common bullish formation.

A significant bullish signal would be a breakout above the resistance line, which acts as the neckline of the pattern.

Confirmation of buyer strength and a continuation of the bullish trend would come with a 4-hour candle closing above this level. The next target for the price would be 1.6761.

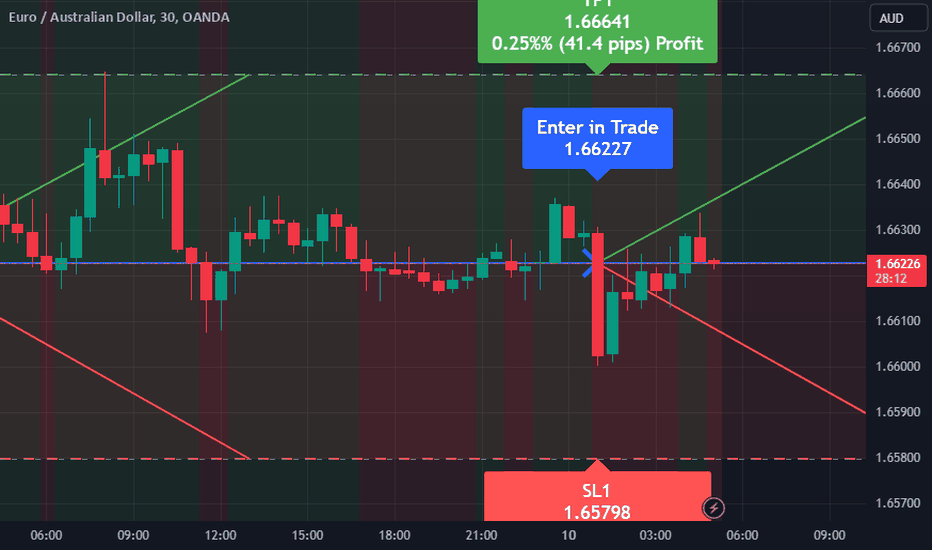

EURAUD Bullish Momentum: Time to Enter the Market!I'm eyeing the EURAUD pair right now, and the outlook looks promising. With a clear direction to buy, I'm setting an entry price at 1.66227. The take profit level is marked at 1.66641, while the stop loss is safely positioned at 1.65798.

The rationale for this bullish sentiment is multifaceted. Primarily, the EASY Trading AI strategy reveals a strong upward momentum in the EURAUD pair, driven by favorable economic indicators from the Eurozone and a relatively stable Australian economy. Recent data shows that the Eurozone is experiencing higher consumer confidence, which typically leads to increased demand for the Euro. Additionally, the Australian dollar has been under some pressure due to fluctuating commodity prices, which presents a favorable environment for EUR strength.

With our entry point at 1.66227, this allows us to capitalize on a potential price increase, aiming for that sweet take profit target. The stop loss at 1.65798 is designed to protect against unforeseen market reversals while providing enough room for the position to breathe. Keep an eye on the market sentiment, as minor shifts can impact our strategy.

If you are new to trading, consider utilizing tools that implement the EASY Trading AI strategy, or subscribe to our signals via Telegram for timely updates and insights to enhance your trading decisions.

Remember, while trading comes with its risks, thorough understanding and strategic planning can make a significant difference. Happy trading!

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade