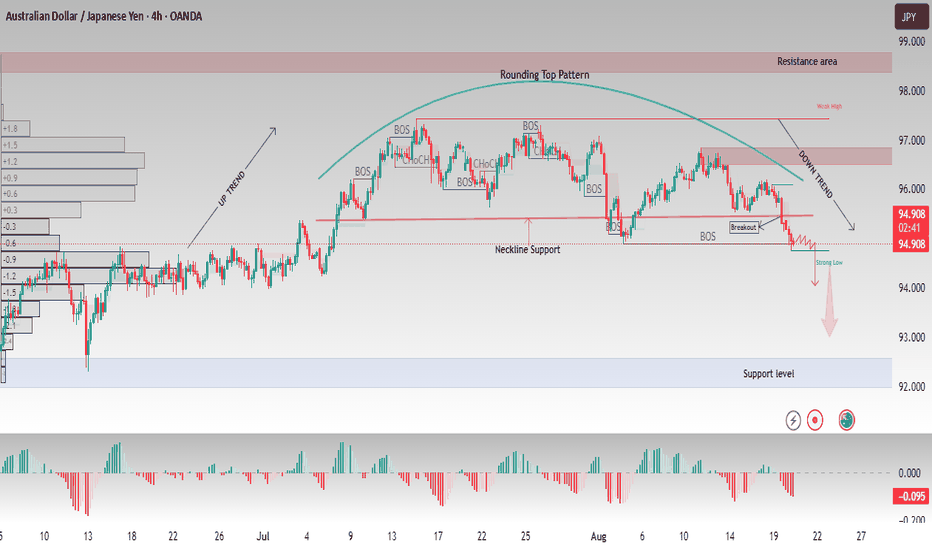

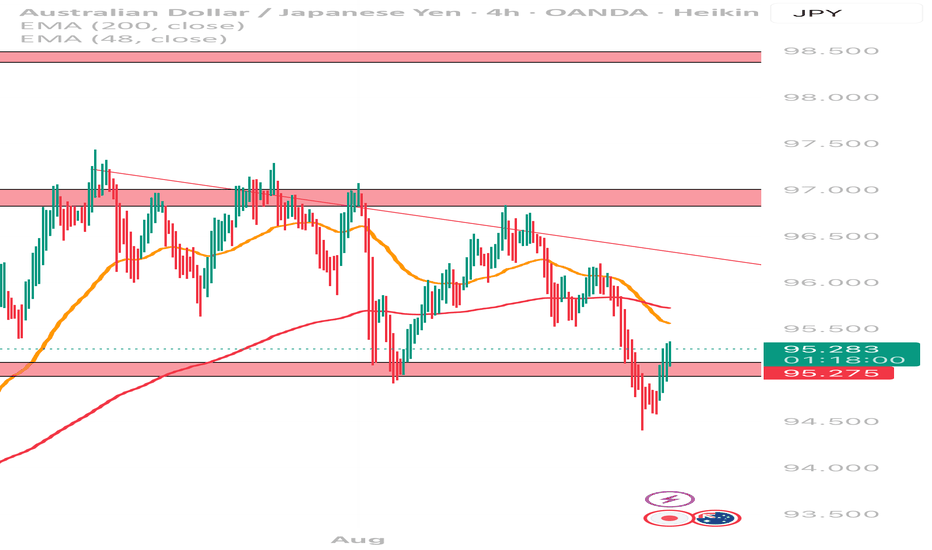

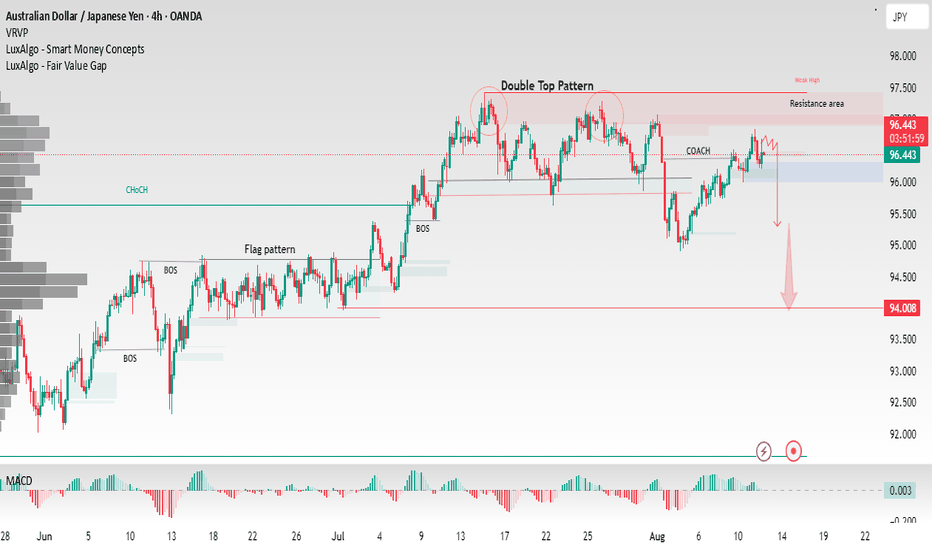

AUDJPY – Rounding Top Breakdown Signals Bearish ContinuationAUDJPY has completed a Rounding Top Pattern on the 4H timeframe, with a clean breakout below the neckline support around the 95.00 area.

The pair failed to sustain above the resistance zone near 97.50–98.00.

Structure shift confirms a downtrend, with price forming lower highs and breaking strong s

About Australian Dollar / Japanese Yen

This pair is the Australian Dollar against the Japanese Yen. In regards to U.S. equities on a short to medium term basis, it is often one of the most highly correlated pairs to price action. The pair tends to decline is a risk off approach and rise in a low risk environment on carry flows.

Related currencies

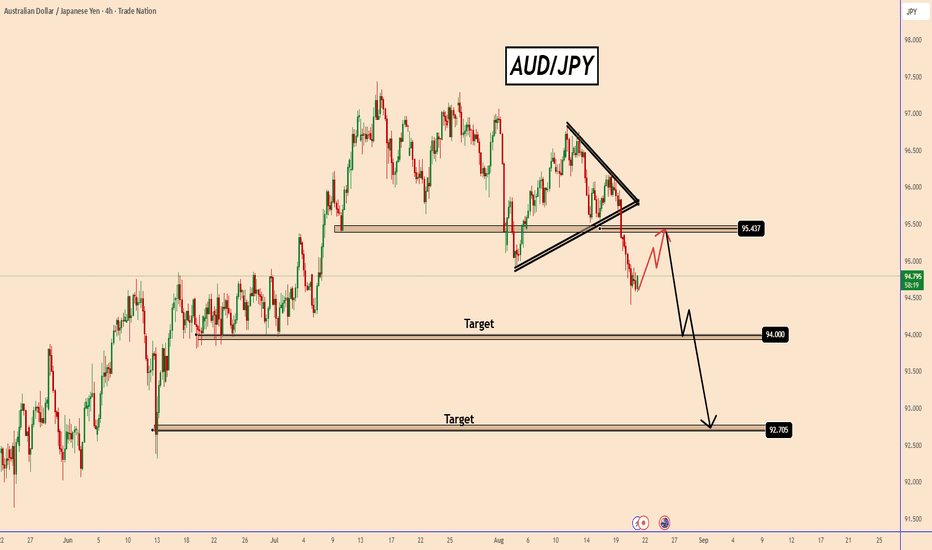

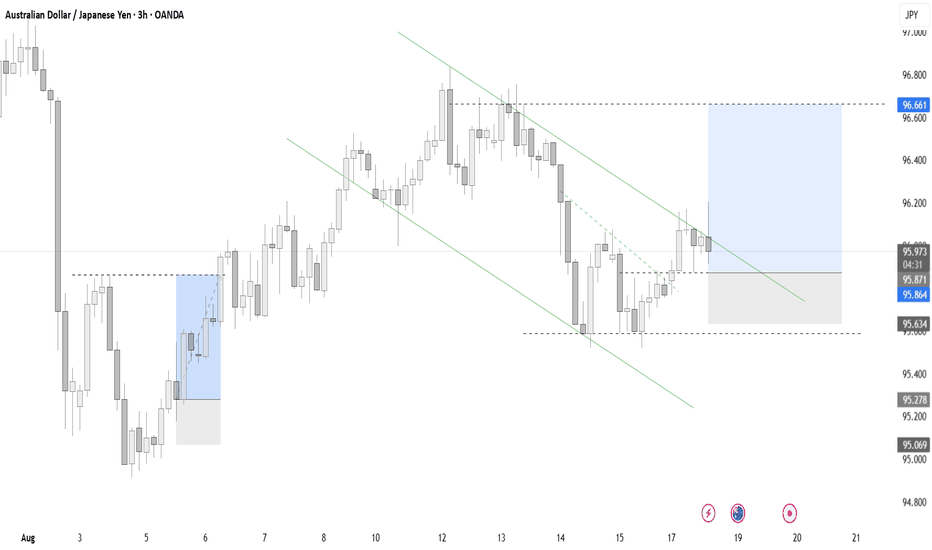

AUDJPY Triangle Breakdown: Retracement Before Deeper DropAUDJPY Triangle Breakdown: Retracement Before Deeper Drop

Two days ago, AUDJPY broke down from a well-defined triangle pattern, triggering a bearish move.

However, the JPY remains fundamentally weak, driven more by speculative headlines than a normal strength.

This imbalance suggests that AUDJ

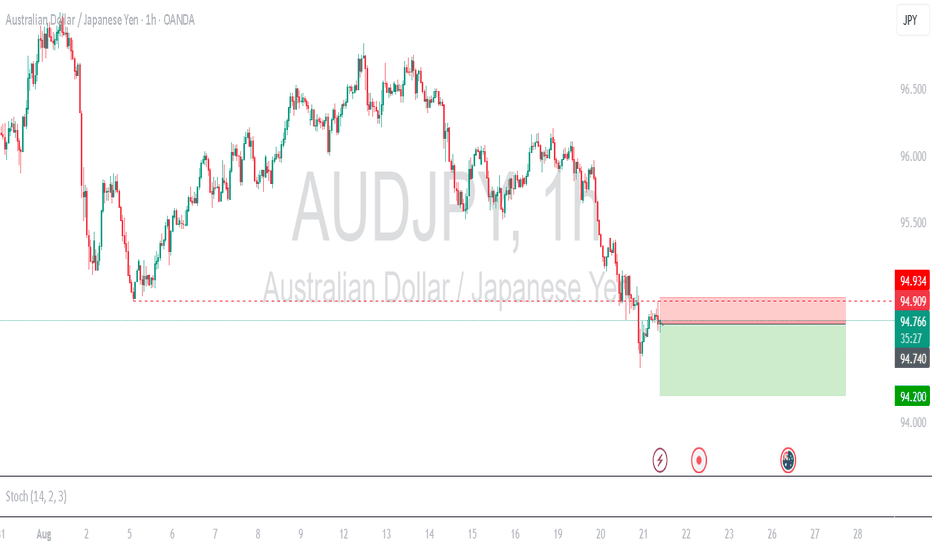

AUDJPY support at 94.37The AUDJPY remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 94.37 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 94.37 would confirm ongoing

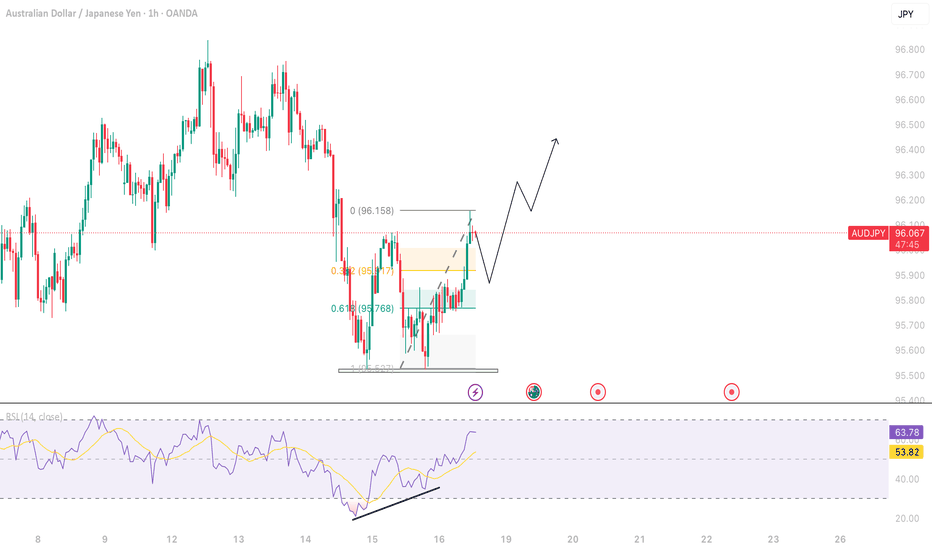

AUDJPY-Bullish🔗 Macro Confluence (as of Aug 18, 2025):

AUD Fundamentals:

Aussie supported by risk-on tone and commodity stability (iron ore prices firm)

RBA likely to hold or slow hikes – neutral to mild bullish

JPY Fundamentals:

BoJ remains dovish with intervention fears fading

Japanese economy showing soft inf

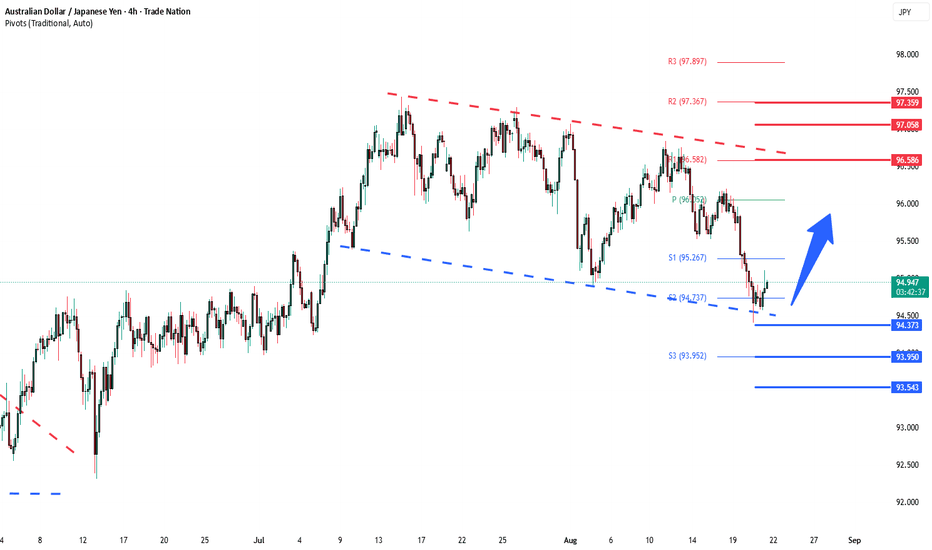

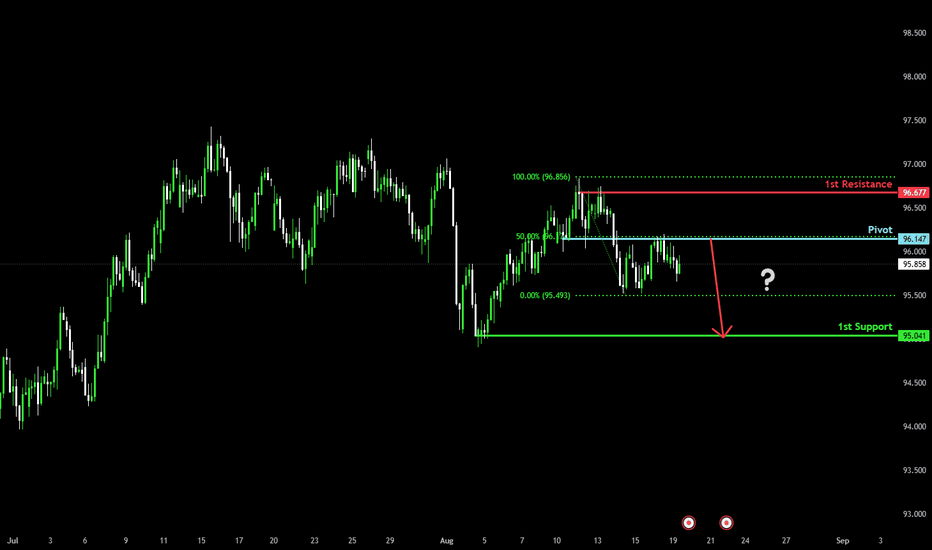

Bearish drop off 50% Fibonacci resistance?AUD/JPY has rejected off the pivot and could drop to the 1st support.

Pivot: 96.14

1st Support: 95.04

1st Resistance: 96.67

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may no

AUD/JPY – Double Top Signals Potential Bearish MoveAUD/JPY (4H) is showing a strong double top pattern at the resistance zone (96.9 – 97.1), followed by a break of structure (BOS) and rejection from the supply area.

Price has also filled the fair value gap and is showing signs of weakness with a potential downside target near 94.80.

If the bearish m

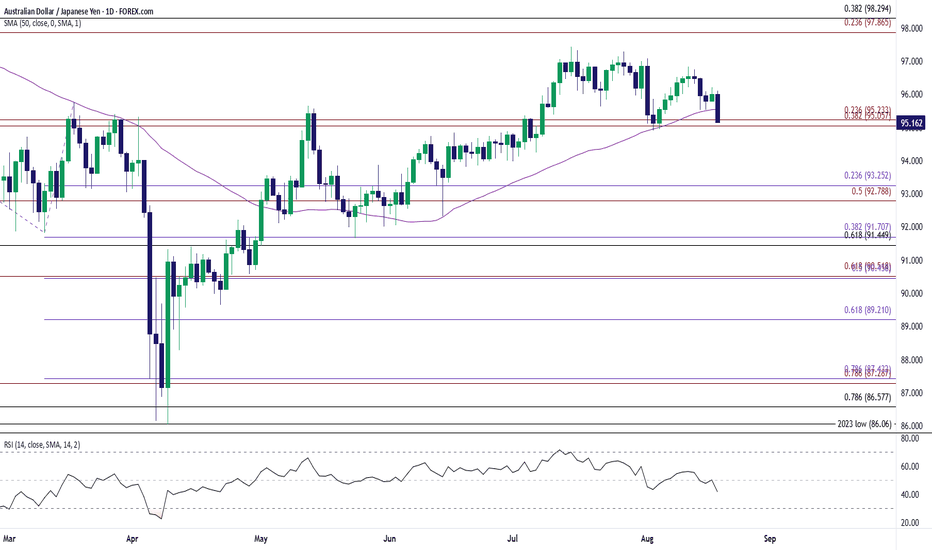

AUD/JPY Approaches Monthly LowAUD/USD gives back the advance from the start of the week to approach the monthly low (94.91), and a move/close below the 95.10 (38.2% Fibonacci extension) to 95.20 (23.6% Fibonacci extension) region may lead to a test of the July low (93.97).

Next area of interest comes in around 92.80 (50% Fibona

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of AUDJPY is 95.332 JPY — it has decreased by −0.16% in the past 24 hours. See more of AUDJPY rate dynamics on the detailed chart.

The value of the AUDJPY pair is quoted as 1 AUD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 AUD.

The term volatility describes the risk related to the changes in an asset's value. AUDJPY has the volatility rating of 0.48%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The AUDJPY showed a −0.42% fall over the past week, the month change is a −1.12% fall, and over the last year it has decreased by −2.65%. Track live rate changes on the AUDJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

AUDJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with AUDJPY technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the AUDJPY shows the neutral signal, and 1 month rating is neutral. See more of AUDJPY technicals for a more comprehensive analysis.