AUDJPY Breakdown Signals Deeper Correction: Key Zones to WatchAUDJPY Breakdown Signals Deeper Correction: Key Zones to Watch

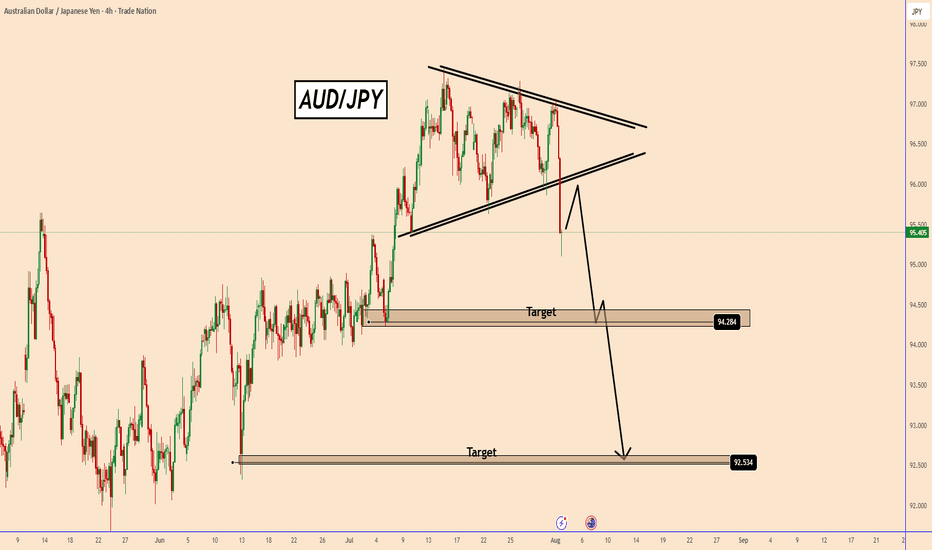

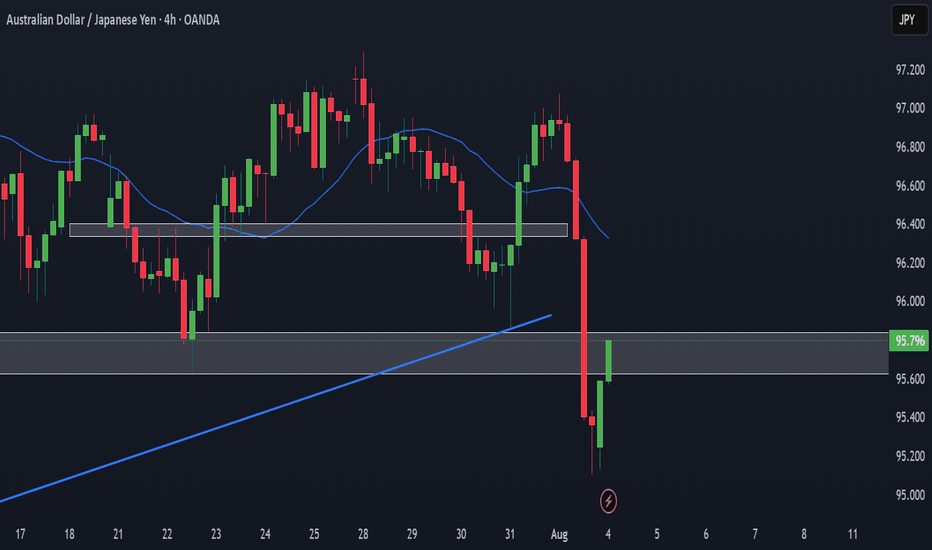

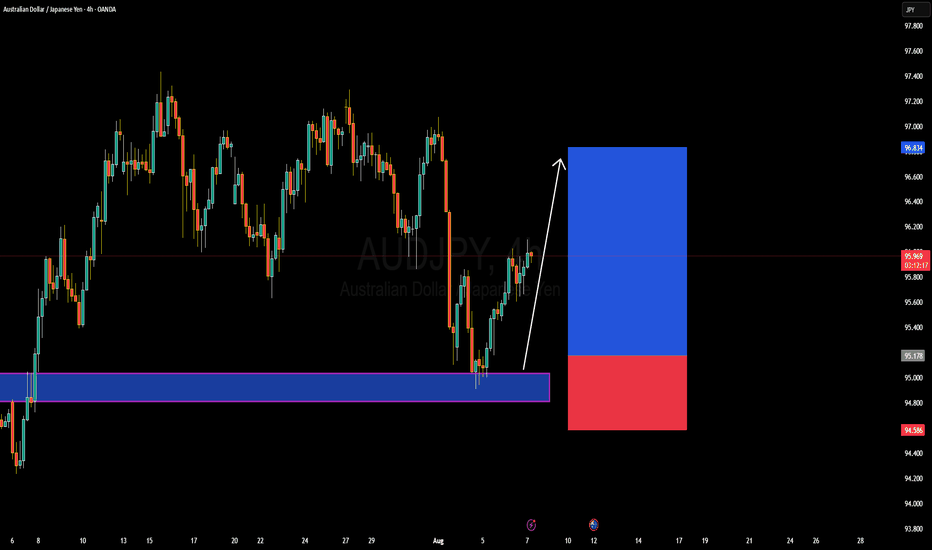

On the 4-hour chart, AUDJPY has broken out of a bearish formation, signaling strong downside momentum.

On Friday, the pair declined by nearly 180 pips—a move echoed across multiple XXXJPY pairs, triggered during the release of NFP da

About Australian Dollar / Japanese Yen

This pair is the Australian Dollar against the Japanese Yen. In regards to U.S. equities on a short to medium term basis, it is often one of the most highly correlated pairs to price action. The pair tends to decline is a risk off approach and rise in a low risk environment on carry flows.

Related currencies

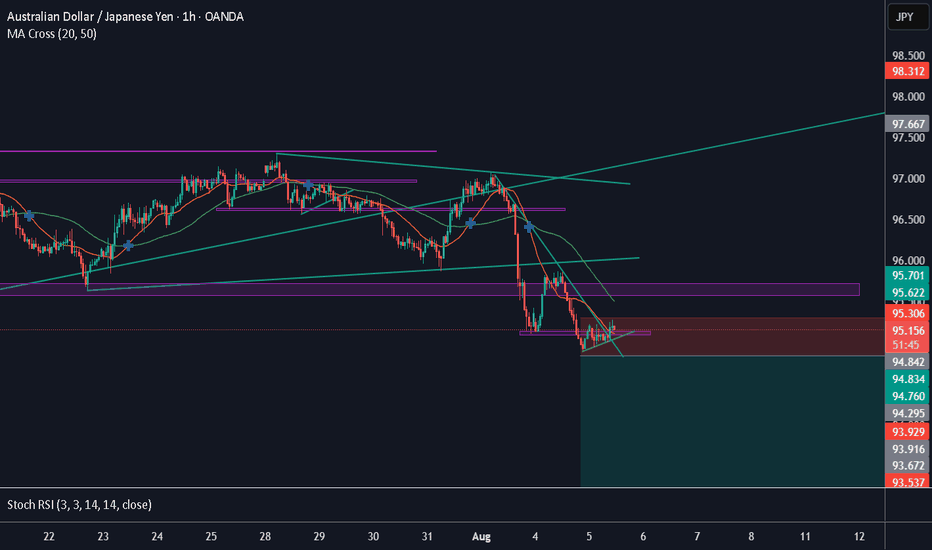

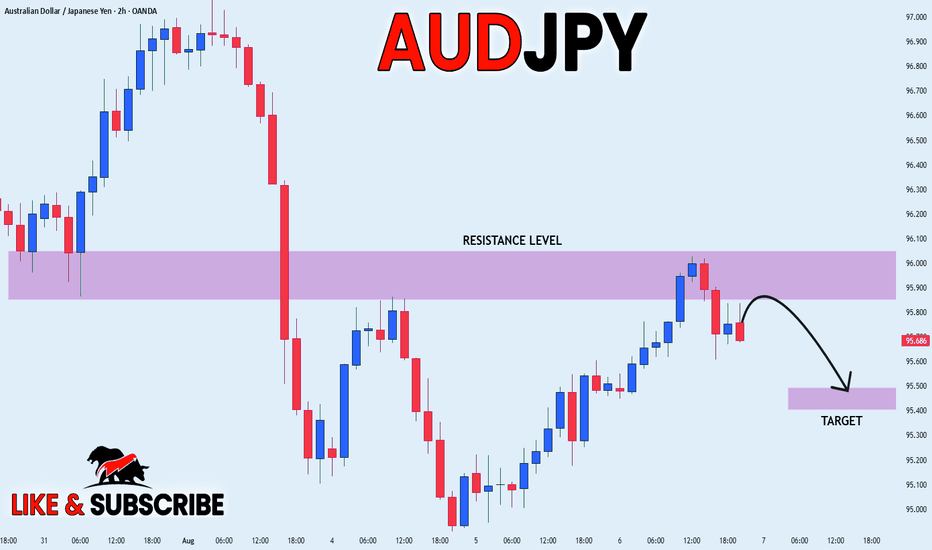

AUDJPY Strategy That Outsmarts the Noise: Entry & Target Ready!Hey friends 👋

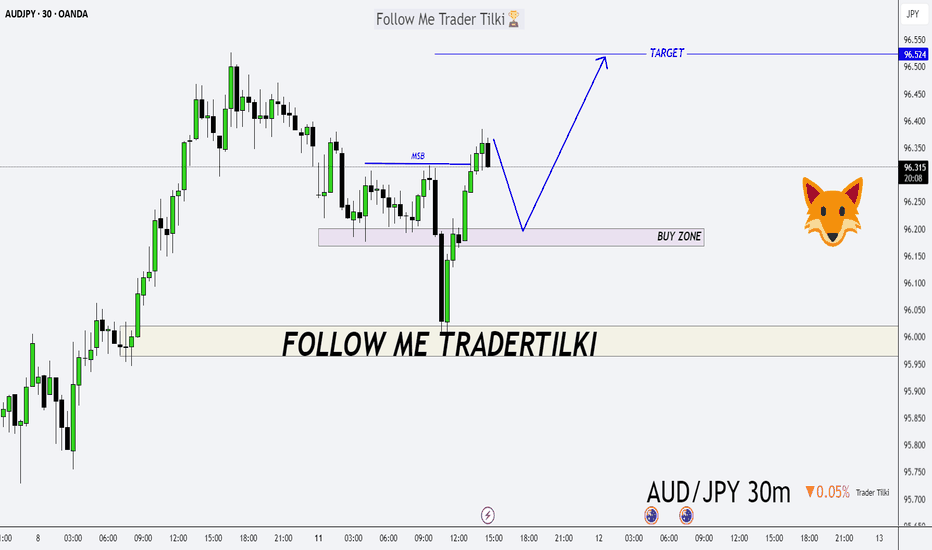

I’ve prepared an analysis for the AUDJPY pair. If the price reaches the 96.201 - 96.169 zone, I’ll be looking to open a buy position from that level.

My target will be set at 96.524.

Every single like you send is a huge source of motivation for me to keep sharing these analyses. Big

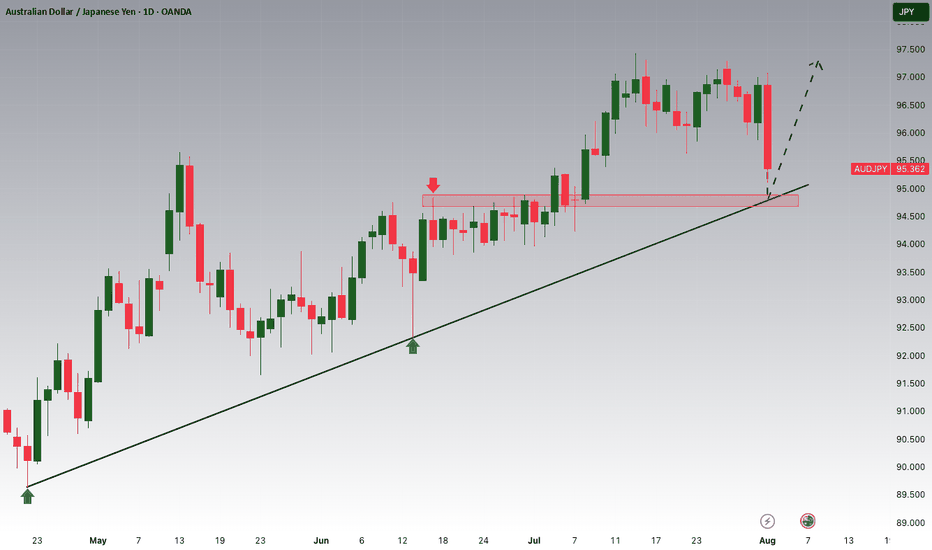

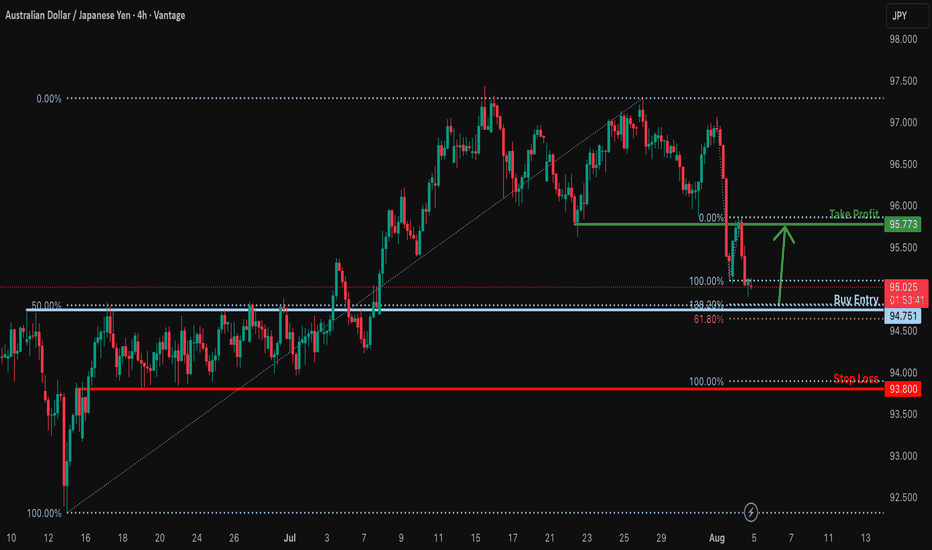

Bullish reversal off Fibonacci confluence?AUD/JPY is falling towards a support level, which is a pullback support aligning with the 138.2% Fibonacci extension, the 50% Fibonacci retracement, and the 61.8% Fibonacci projection. A bounce from this level could push the price toward our take-profit target.

Entry: 94.75

Why we like it:

There is

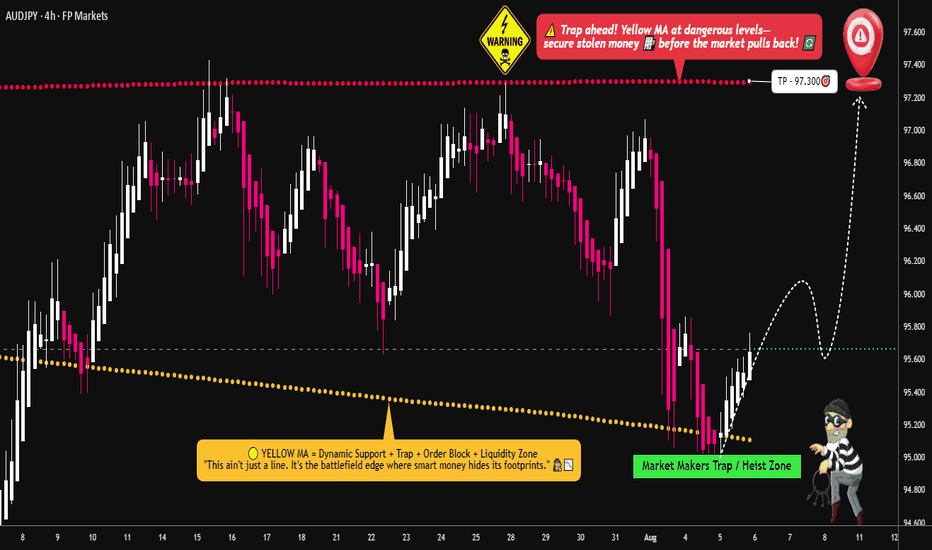

Cracking the Aussie-Yen Vault: Bullish Heist Setup in Progress🔓💸 AUD/JPY "Aussie vs Yen" Forex Bank Heist 💸🔓

🎯 Plan: Bullish Robbery | Targeting 97.300 | Stop Loss: 95.000

💰 Layered Entries | Precision Robbery | No Mercy

🚨🧠 Attention Robbers, Looters & Forex Mercenaries! 🧠🚨

The AUD/JPY vault is open, and Thief Trader is back with a multi-layer LIMIT ENTRY STR

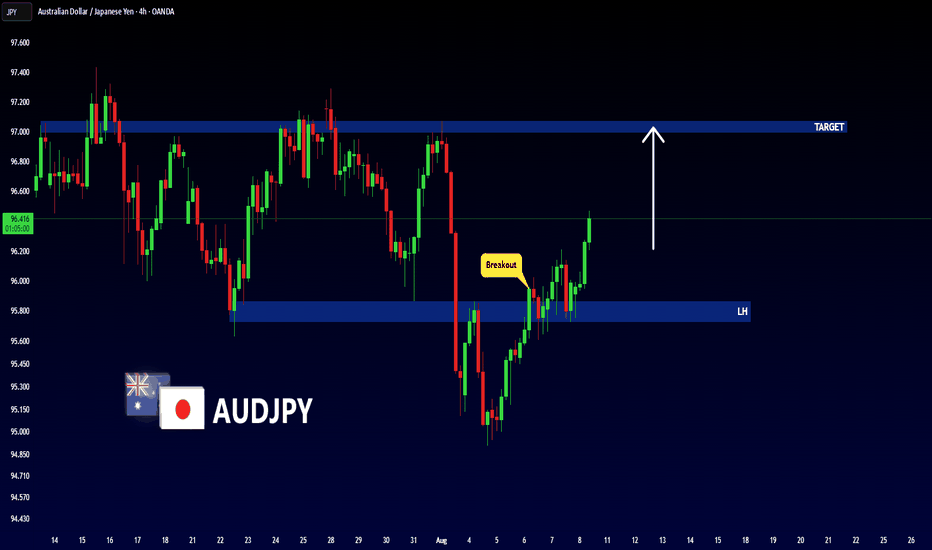

AUDJPY Forming Bullish MomentumAUDJPY has recently bounced from a strong demand zone near the 94.50–95.00 region, as seen on the 4H chart. This zone has acted as a key support area in previous price action, and the market is now printing higher lows after rejecting it multiple times. Price is showing bullish momentum, and with bu

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of AUDJPY is 96.201 JPY — it has increased by 0.35% in the past 24 hours. See more of AUDJPY rate dynamics on the detailed chart.

The value of the AUDJPY pair is quoted as 1 AUD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 AUD.

The term volatility describes the risk related to the changes in an asset's value. AUDJPY has the volatility rating of 0.55%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The AUDJPY showed a −0.54% fall over the past week, the month change is a 0.76% rise, and over the last year it has decreased by −0.92%. Track live rate changes on the AUDJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

AUDJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with AUDJPY technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the AUDJPY shows the buy signal, and 1 month rating is buy. See more of AUDJPY technicals for a more comprehensive analysis.