AUDJPY Breakdown Signals Deeper Correction: Key Zones to WatchAUDJPY Breakdown Signals Deeper Correction: Key Zones to Watch

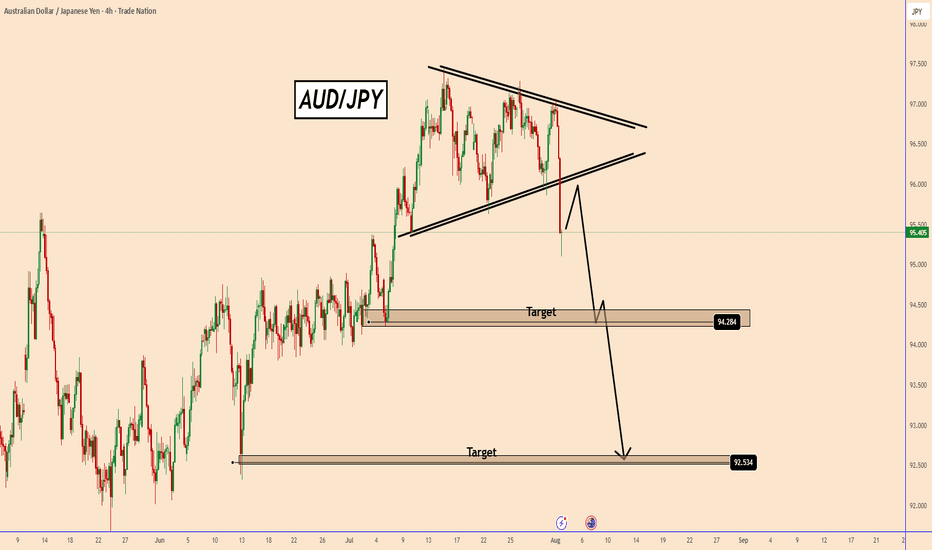

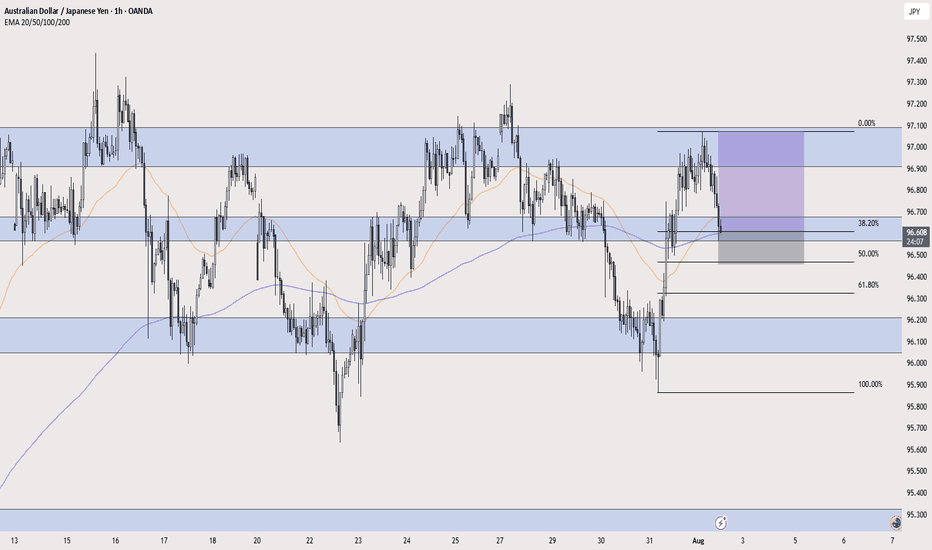

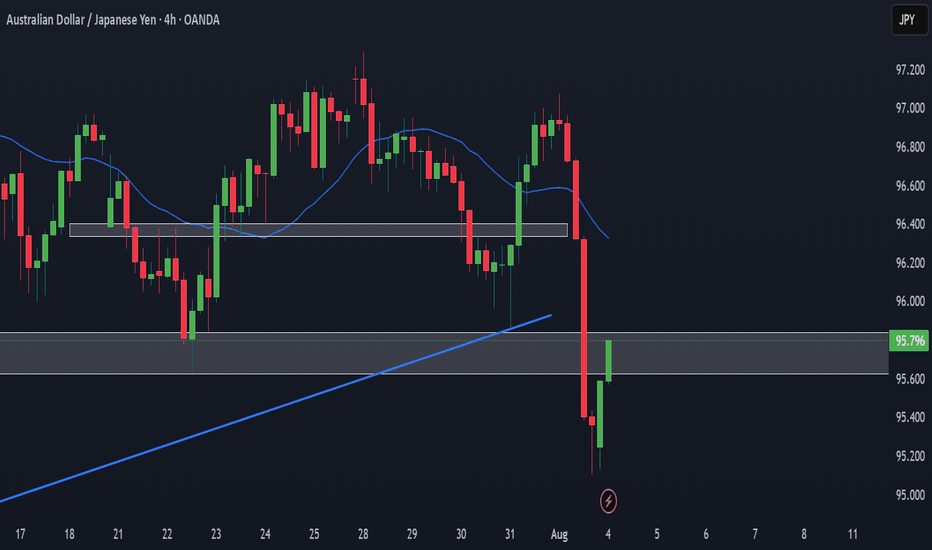

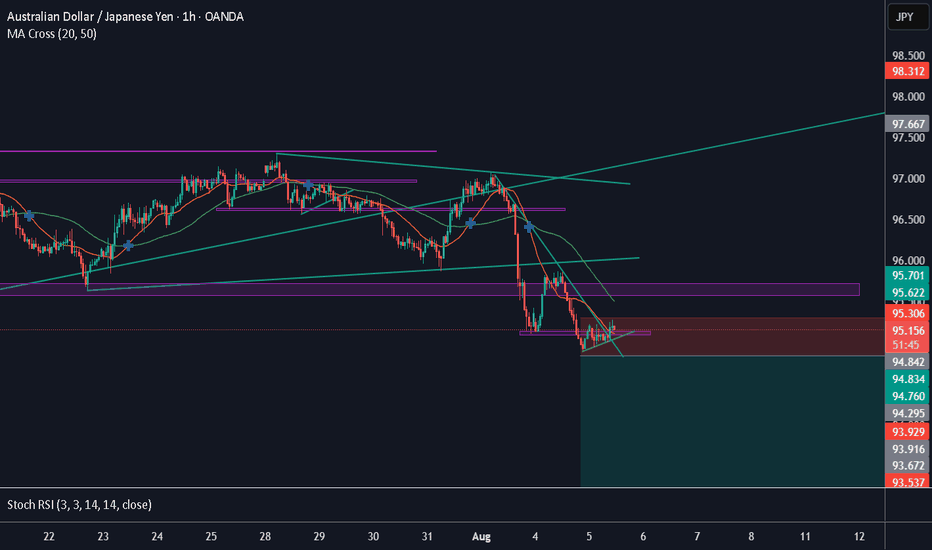

On the 4-hour chart, AUDJPY has broken out of a bearish formation, signaling strong downside momentum.

On Friday, the pair declined by nearly 180 pips—a move echoed across multiple XXXJPY pairs, triggered during the release of NFP da

About Australian Dollar / Japanese Yen

This pair is the Australian Dollar against the Japanese Yen. In regards to U.S. equities on a short to medium term basis, it is often one of the most highly correlated pairs to price action. The pair tends to decline is a risk off approach and rise in a low risk environment on carry flows.

Related currencies

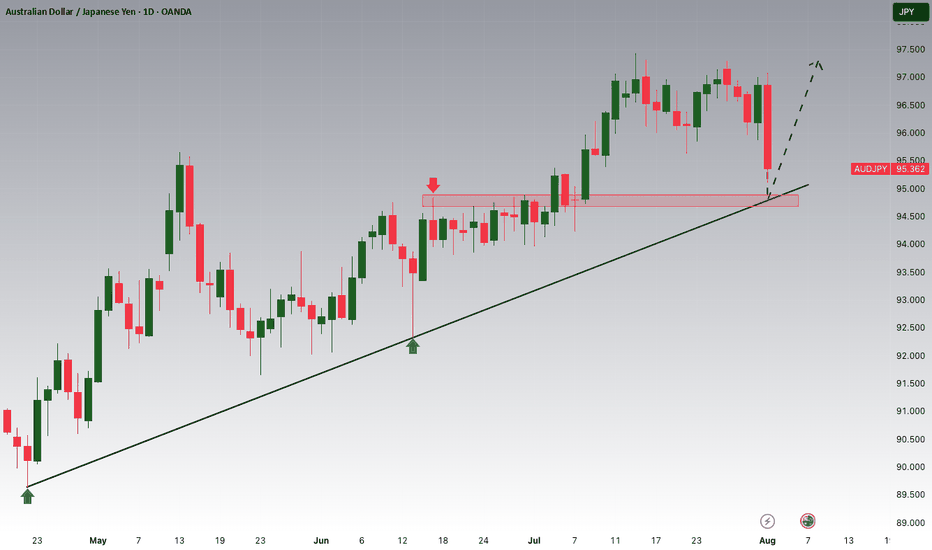

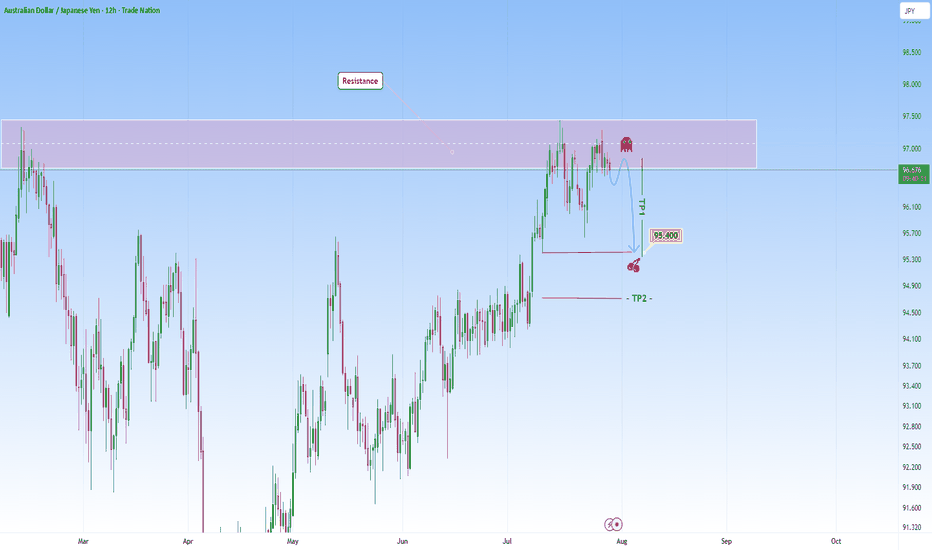

AUDJPY at Resistance: Could we see a reversal here?The market on this pair shows us a classic scenario where price presses into a resistance zone after a sustained bullish move. Price action approaching this zone appears hesitant, with smaller candles and wicks showing signs of exhaustion, meaning the possibility that buying momentum is weakening. T

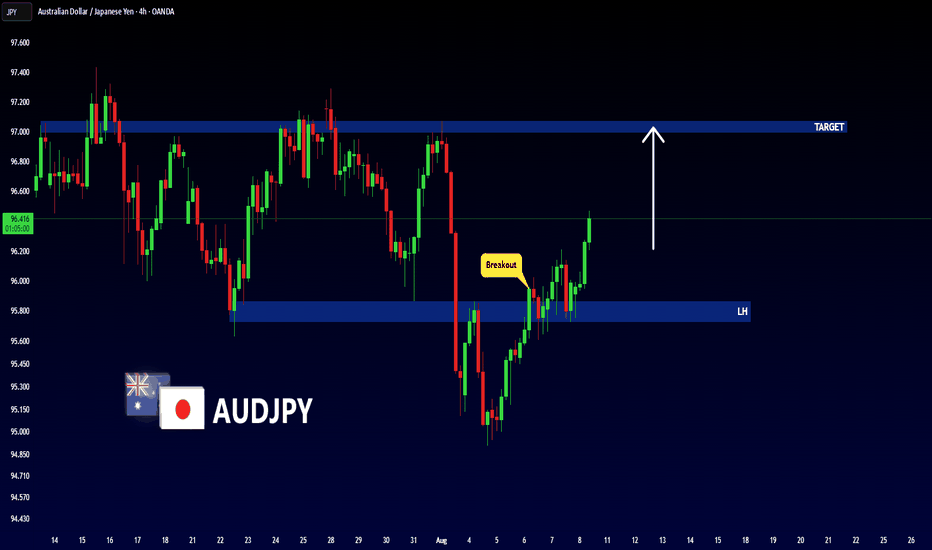

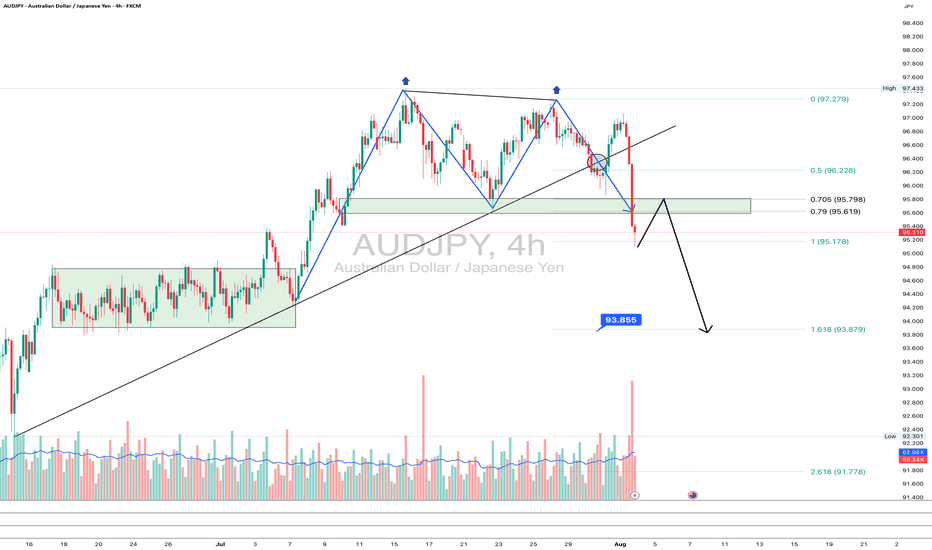

AUDJPY: goodbye uptrend?On the 4H chart, AUDJPY has printed a textbook double top pattern, breaking the rising trendline and diving below the 95.6–95.78 support zone - now acting as resistance. The pair is currently retesting this zone from below, which often provides a clean re-entry point for bears.

This area also align

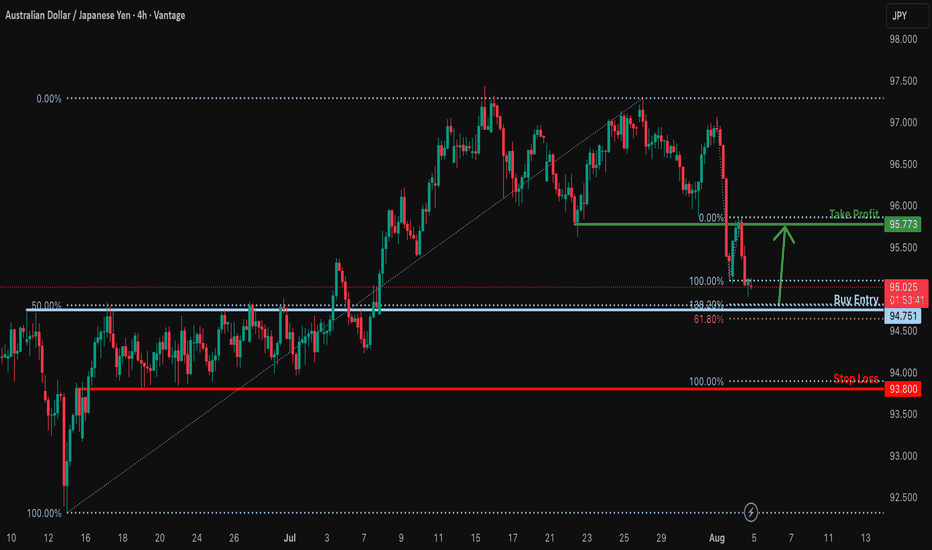

Bullish reversal off Fibonacci confluence?AUD/JPY is falling towards a support level, which is a pullback support aligning with the 138.2% Fibonacci extension, the 50% Fibonacci retracement, and the 61.8% Fibonacci projection. A bounce from this level could push the price toward our take-profit target.

Entry: 94.75

Why we like it:

There is

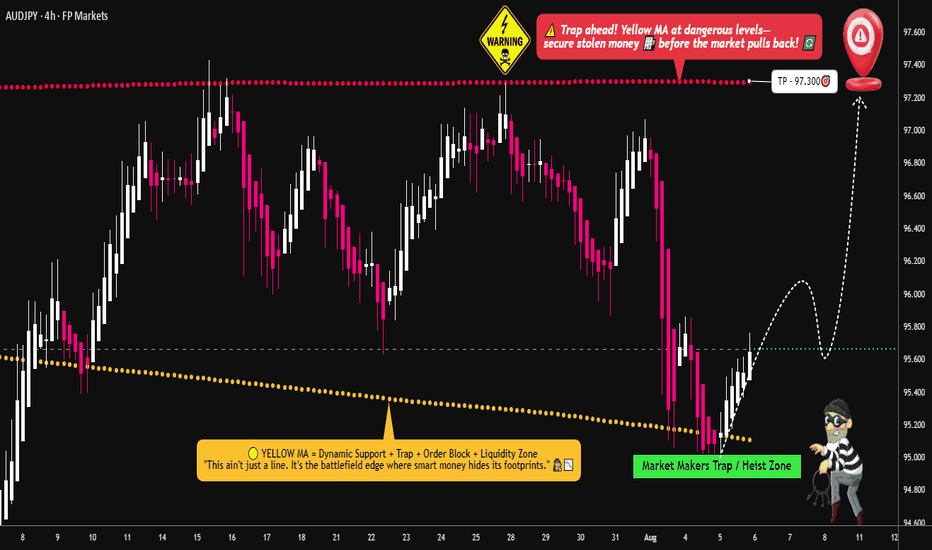

Cracking the Aussie-Yen Vault: Bullish Heist Setup in Progress🔓💸 AUD/JPY "Aussie vs Yen" Forex Bank Heist 💸🔓

🎯 Plan: Bullish Robbery | Targeting 97.300 | Stop Loss: 95.000

💰 Layered Entries | Precision Robbery | No Mercy

🚨🧠 Attention Robbers, Looters & Forex Mercenaries! 🧠🚨

The AUD/JPY vault is open, and Thief Trader is back with a multi-layer LIMIT ENTRY STR

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the AUDJPY pair is quoted as 1 AUD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 AUD.

AUDJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade AUDJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.