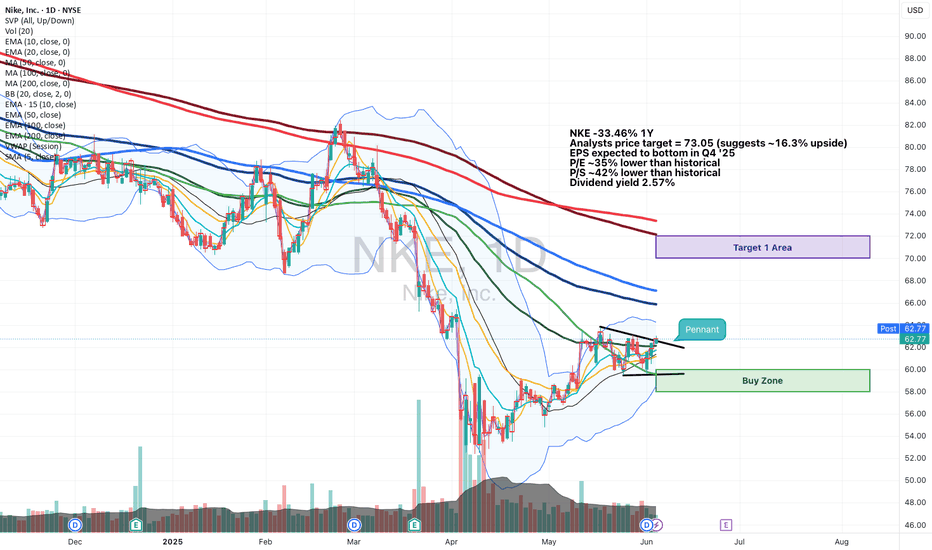

Will Nike’s Upcoming Earnings ‘Just Do It’ for Investors?This hasn’t been the greatest year for Nike NYSE:NKE , which will report earnings next Thursday at a time when the stock is down more than 20% year to date. What does technical and fundamental analysis say might happen to the stock from here?

Let’s take a look:

Nike’s Fundamental Analysis

NKE

1.49 USD

2.74 B USD

39.47 B USD

About Nike

Sector

Industry

CEO

Elliott J. Hill

Website

Headquarters

Beaverton

Founded

1964

ISIN

ARDEUT111341

FIGI

BBG000HG0S03

NIKE, Inc. engages in the design, development, marketing, and sale of athletic footwear, apparel, accessories, equipment, and services. It operates through the following segments: North America, Europe, Middle East, and Africa (EMEA), Greater China, Asia Pacific and Latin America (APLA), Global Brand Divisions, Converse, and Corporate. The North America, EMEA, Greater China, and APLA segments refer to the design, development, marketing, and selling of athletic footwear, apparel, and equipment. The Global Brand Divisions segment represents its NIKE Brand licensing businesses. The Converse segment designs, markets, licenses, and sells casual sneakers, apparel, and accessories. The Corporate segment is composed of unallocated general and administrative expenses. The company was founded by William Jay Bowerman and Philip Hampson Knight on January 25, 1964 and is headquartered in Beaverton, OR.

Related stocks

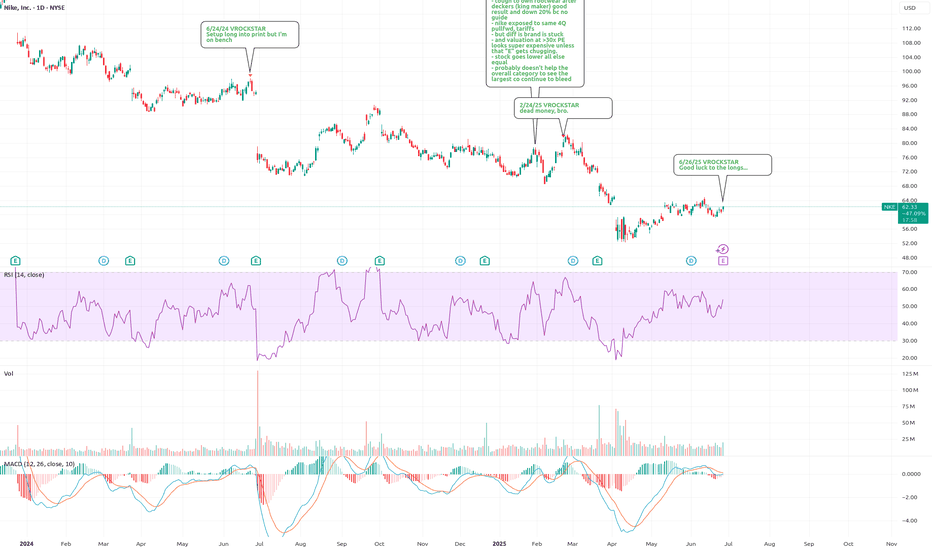

6/26/25 - $nke - Good luck to the longs...6/26/25 :: VROCKSTAR :: NYSE:NKE

Good luck to the longs...

- keeping it small

- but let's be real

- nke still trades dayum near 30x earnings and earnings aren't growing.

- discretionary is impossible to buy

- tariff tylk back, whaddidu think?

- they miss miss miss...

- comps not reporting good r

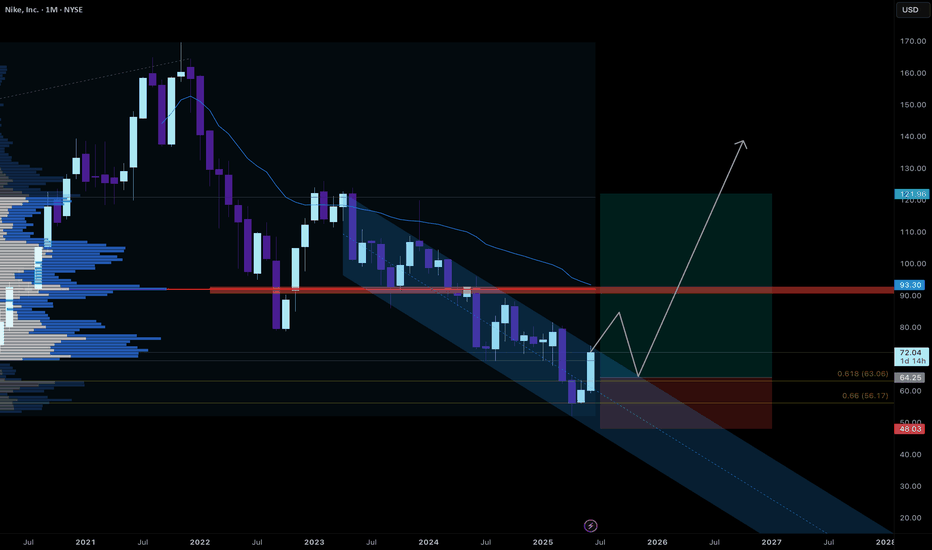

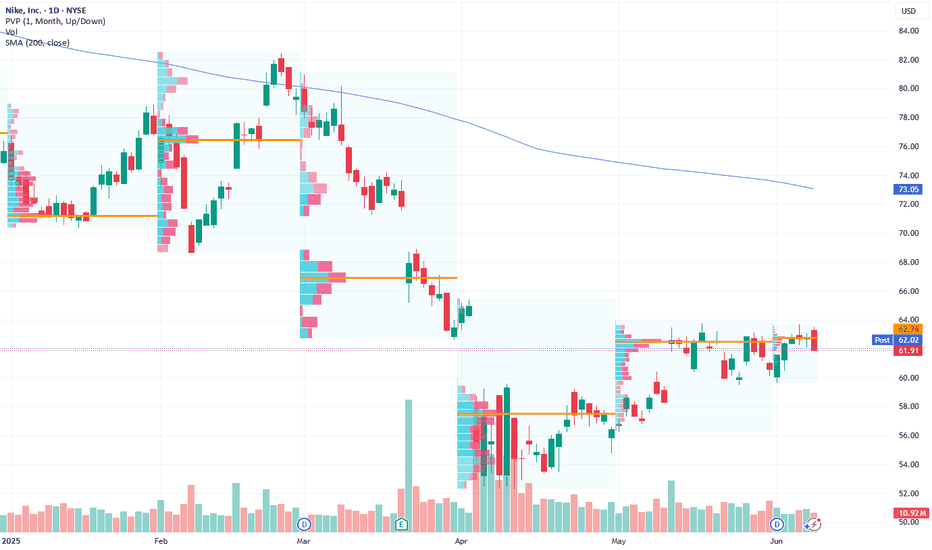

Nike’s Accumulation Zone Signals Bullish Reversal Potential

Current Price: $60.53

Direction: LONG

Targets:

- T1 = $63.25

- T2 = $66.00

Stop Levels:

- S1 = $55.80

- S2 = $52.40

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intellige

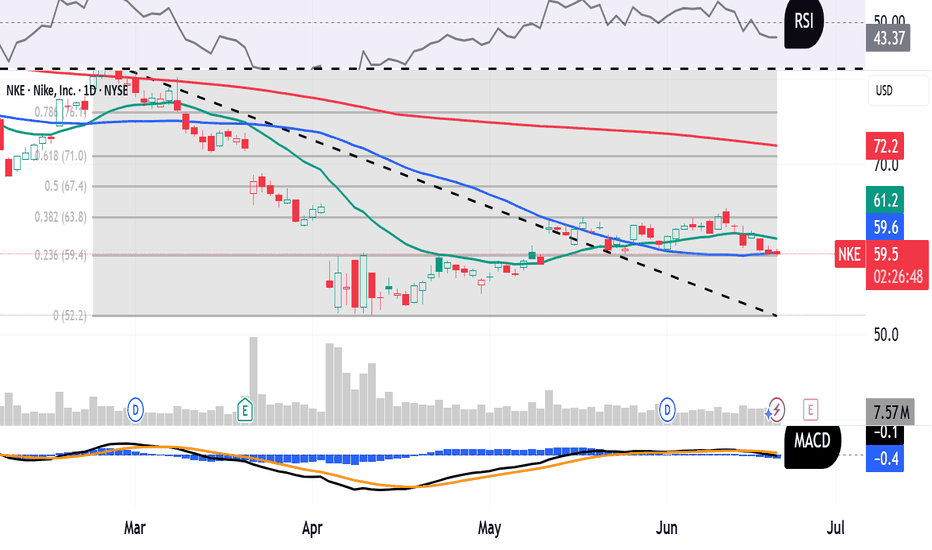

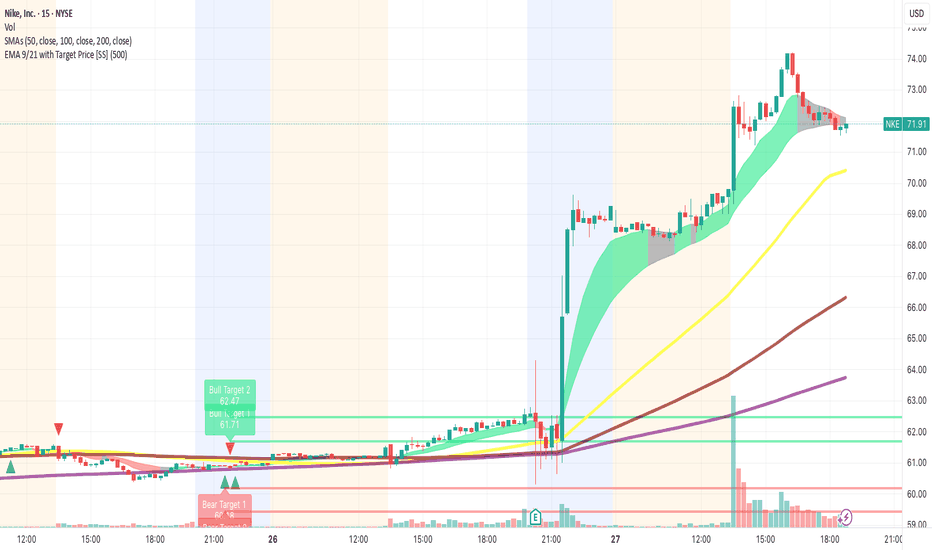

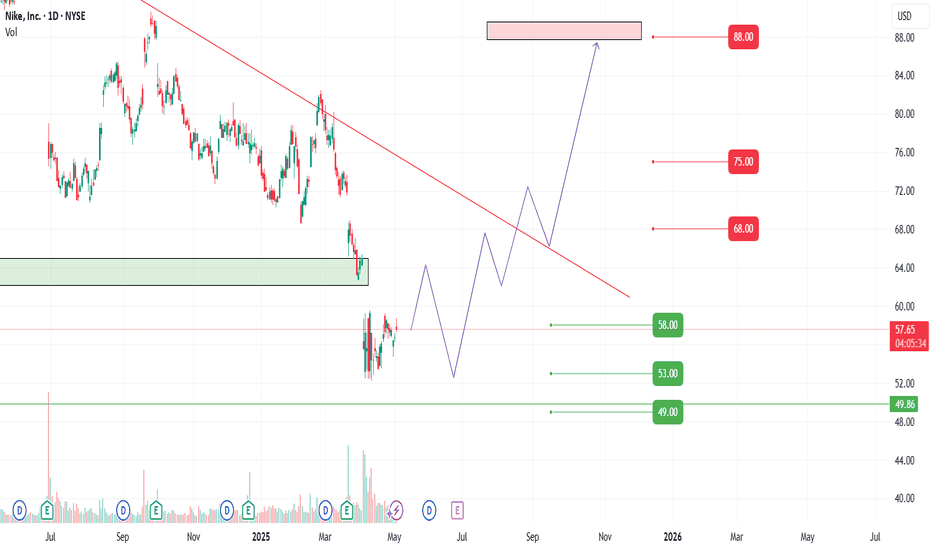

Break of downward sloping channel LongNike has swept liquidity and is now showing a strong bounce to the upside.

Although I didn’t manage to enter the initial long, I am monitoring for a break above the current downward-sloping channel. A clean breakout followed by a retest would provide a more reliable entry point. I’m not aiming to c

Nike hit us hard… and that needs to be said too.Nike hit us hard… and that needs to be said too.

I’m not going to sugarcoat it: we entered a PUT before earnings, and we lost. We had over 20 criteria from our “Eagle Trap” system lined up — high RSI, a sharp rally with no solid fundamentals, declining sales in China and the U.S., weak forward guid

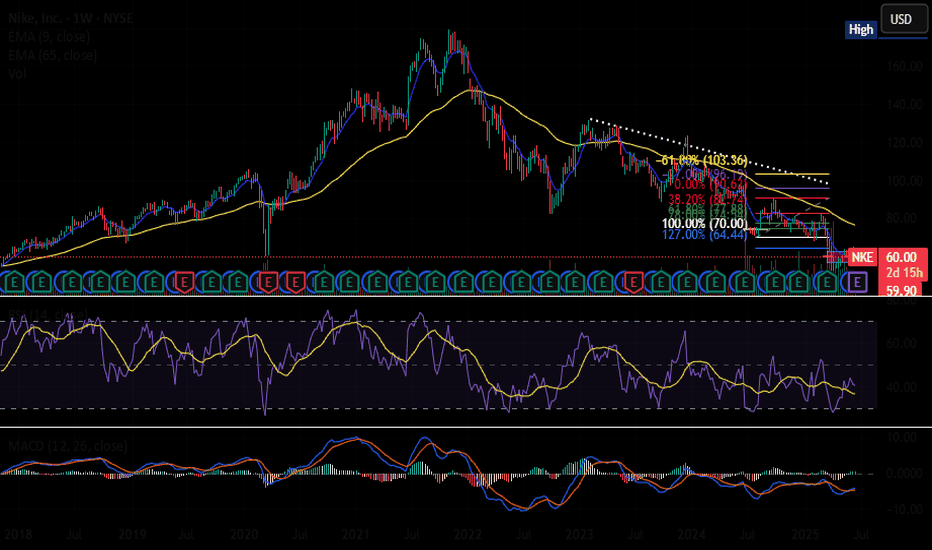

NKE at 52-Week Lows Oversold Giant or Value Trap?Nike is a blue-chip name going through a rough patch. But this recent dip, fueled by disappointing earnings and macro uncertainty, could present a classic oversold opportunity. The stock is now in a high-probability reversal zone where risk/reward becomes extremely attractive.

🎯 Updated Entry Plan:

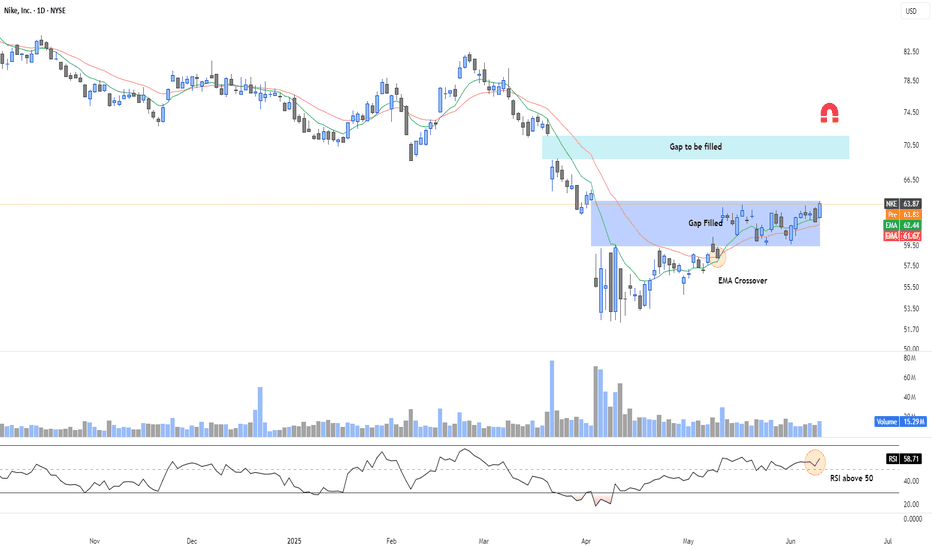

NKE – EMA Crossover and Bullish Continuation PotentialNIKE (NKE) has completed a clean technical gap fill and is now showing early signs of a trend reversal.

🔍 Key Technical Factors:

✅ Gap Filled: The March-April gap was filled cleanly and held.

✅ EMA Crossover: EMA 9 crossed above EMA 21 → bullish short-term signal.

✅ RSI > 50: Momentum shifting bull

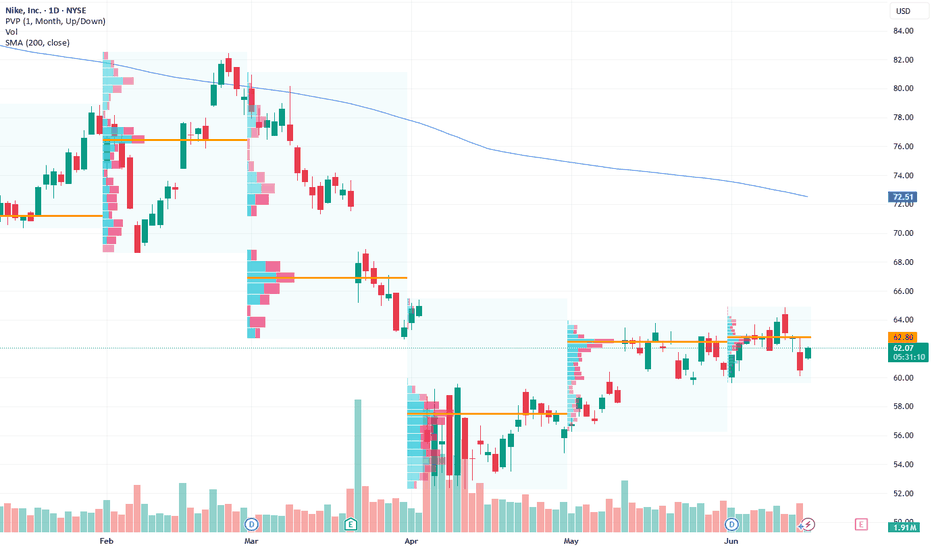

Nike's Pullback Provides a Valuable Long Opportunity

Current Price: $62.80

Direction: LONG

Targets:

- T1 = $64.50

- T2 = $68.00

Stop Levels:

- S1 = $61.00

- S2 = $59.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intellige

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US654106AG8

NIKE 16/46Yield to maturity

6.63%

Maturity date

Nov 1, 2046

NKE4971170

NIKE, Inc. 3.375% 27-MAR-2050Yield to maturity

6.54%

Maturity date

Mar 27, 2050

NKEB

NIKE 15/45Yield to maturity

6.29%

Maturity date

Nov 1, 2045

NKEA

NIKE 13/43Yield to maturity

6.23%

Maturity date

May 1, 2043

NKE4971169

NIKE, Inc. 3.25% 27-MAR-2040Yield to maturity

5.91%

Maturity date

Mar 27, 2040

NKE4971168

NIKE, Inc. 2.85% 27-MAR-2030Yield to maturity

4.36%

Maturity date

Mar 27, 2030

US654106AF0

NIKE 16/26Yield to maturity

4.31%

Maturity date

Nov 1, 2026

NKE4971167

NIKE, Inc. 2.75% 27-MAR-2027Yield to maturity

4.03%

Maturity date

Mar 27, 2027

See all NKED bonds

Curated watchlists where NKED is featured.