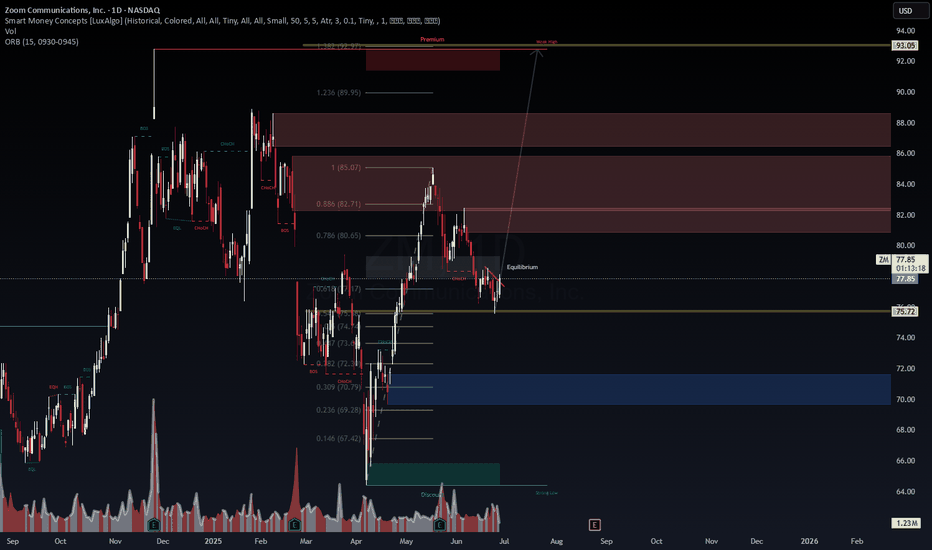

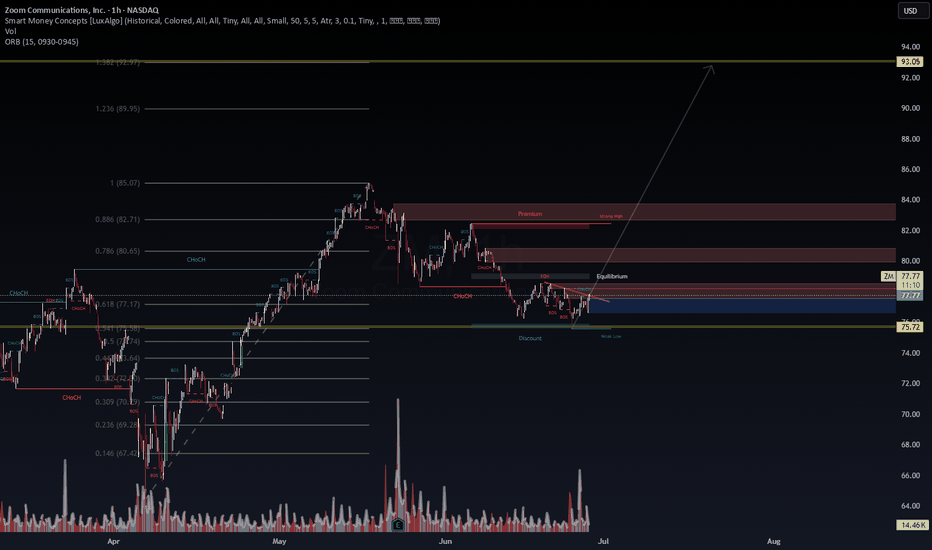

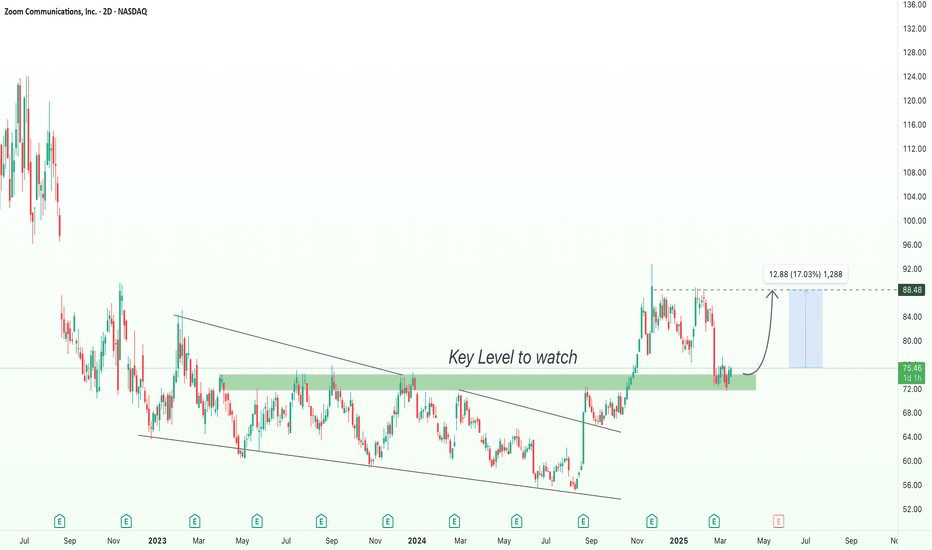

ZM: Uncanny Feeling this is going to explodeStrategy Type: Debit Call Spread (defined risk, favorable skew)

Thesis: Price moving from $77 toward the $85–$93 liquidity zone

🧾 Setup Details (as of $77.76 spot)

📅 Expiry:

August 16, 2025 (standard monthly expiration – gives time for move to unfold post-earnings and macro catalysts)

⚙️ Structure

Key facts today

In early 2025, Kaspersky noted a 13% rise in malware disguised as Zoom, with 1,652 unique files, highlighting its status as a major target for cybercriminals.

0.060 USD

898.00 M USD

4.15 B USD

About Zoom Communications, Inc.

Sector

Industry

CEO

Eric S. Yuan

Website

Headquarters

San Jose

Founded

2011

ISIN

ARBCOM4603B2

Zoom Communications, Inc. engages in the provision of a communications and collaboration platform. It operates through the following geographical segments: Americas, Asia Pacific, and Europe, Middle East, and Africa. The company was founded by Eric S. Yuan in 2011 and is headquartered in San Jose, CA.

Related stocks

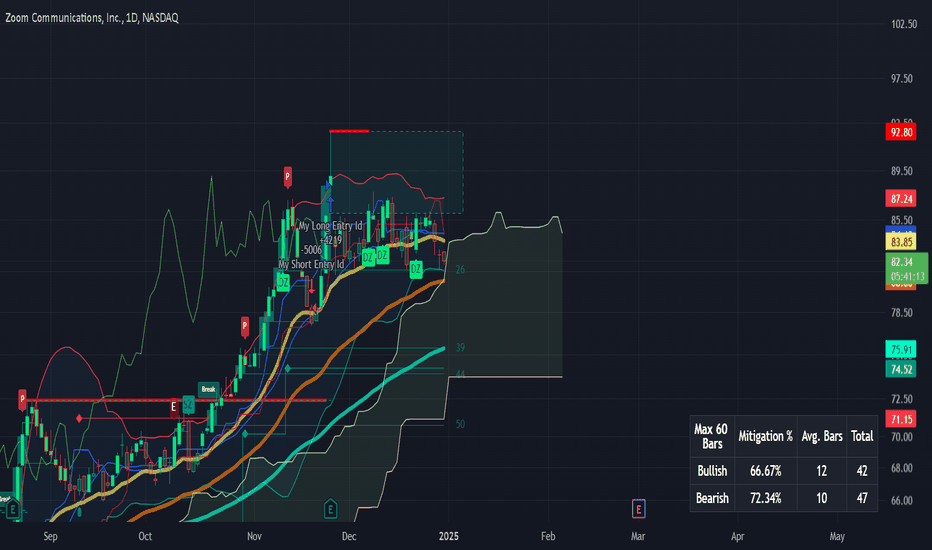

Zoom Communications ($ZM) – Discount Demand Zone Reversal in ProAfter an extended corrective move, NASDAQ:ZM has tapped into the 0.618–0.786 discount Fib zone around $75.72, aligned with BOS (Break of Structure) and CHoCH (Change of Character) signals. Price structure suggests a bullish reversal with upside targets of $87–$93 over the coming weeks.

🔍 Technica

Zoom (ZM) – Is There Upside Ahead?🔹 Analyst Expectations:

- Low Target: $75.00 (current price)

- Average Target: $91.64

- High Target: $115.00

🔹 Fundamental View:

- Zoom posted stronger-than-expected earnings, but the stock pulled back due to cautious revenue guidance.

- Financial health remains solid, and long-term demand for rem

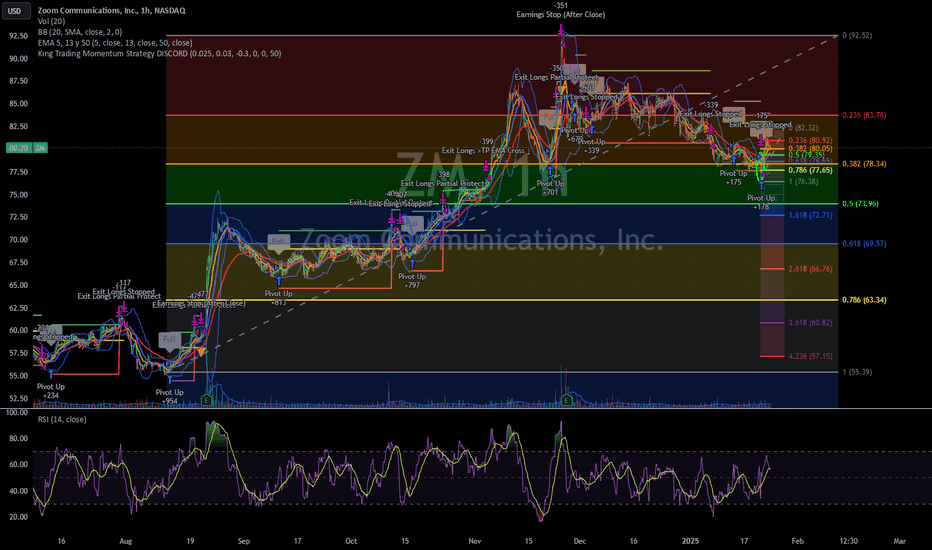

Time to "ZOOM" back to winnings ways?On Thursday afternoon, the King Trading Momentum Strategy triggered alongside eleven other alerts, followed by five more on Friday. This flurry of signals doesn’t exactly indicate a “bearish” sentiment, but as always, the market has its unpredictable ways! With markets approaching all-time highs, I’

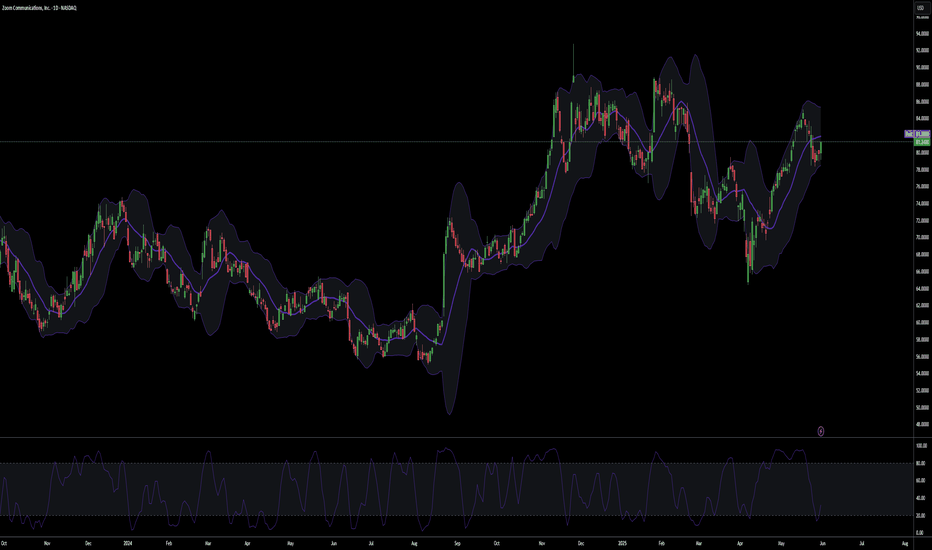

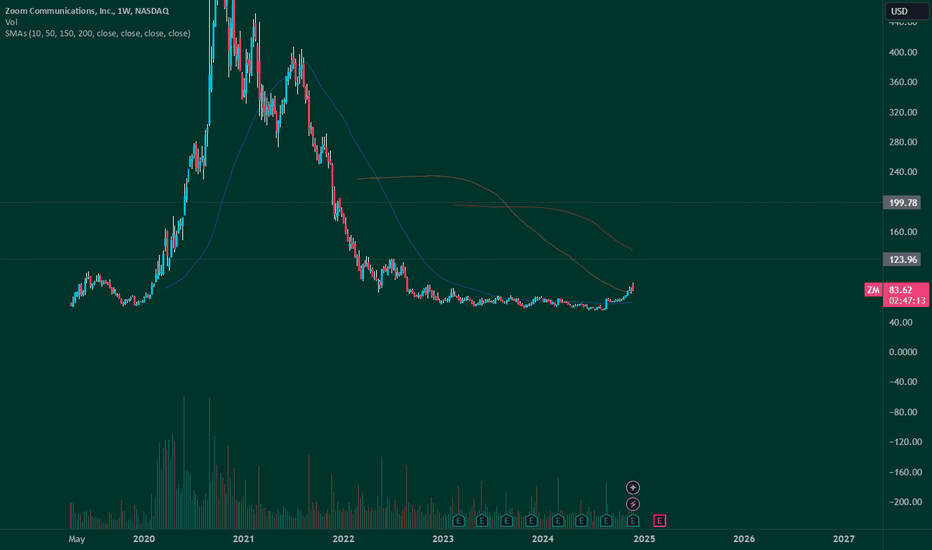

ZM - Looking for DirectionNASDAQ:ZM is currently trading below its 20-day MA and can enter the Ichimoku cloud. The volume is drying up. the next 10% upside is going to be a hard grind with supply zone in the range from 89-92. Its a tough trade and for the patient ones only. The fundamentals are strong. The technicals are no

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

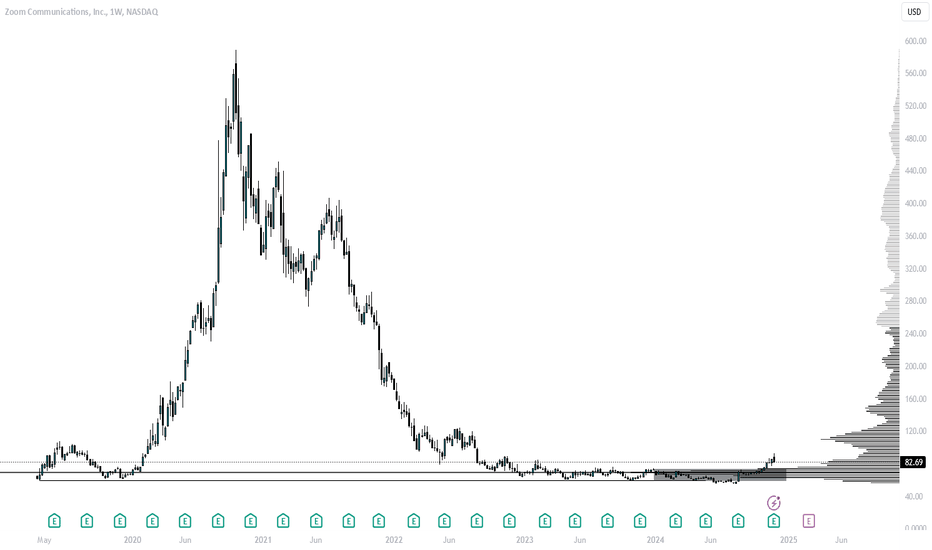

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ZMD is featured.