Key facts today

Thermo Fisher Scientific will release its financial results for the second quarter of 2025 before the market opens on July 23, 2025, with a conference call scheduled for the same day at 8:30 a.m. ET.

RBC has increased its price target for Thermo Fisher Scientific to $572 from $569, while continuing to hold an 'Outperform' rating.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

16,298.093 CLP

6.32 T CLP

42.79 T CLP

376.78 M

About Thermo Fisher Scientific Inc

Sector

Industry

CEO

Marc N. Casper

Website

Headquarters

Waltham

Founded

1956

FIGI

BBG01NBNSGF3

Thermo Fisher Scientific Inc. serves the scientific community through a broad offering of innovative products and services. Thermo Fisher Scientific serves customers working in pharmaceutical and biotech companies, hospitals and clinical diagnostic labs, universities, research institutions and government agencies, as well as environmental, industrial, research and development, quality and process control settings. The company’s global team delivers an unrivaled combination of innovative technologies, purchasing convenience and pharmaceutical services through its brands, including Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, Patheon and PPD. The company continuously increases its depth of capabilities across its broad portfolio of innovative products and services and leverages its extensive global channels to address customers’ needs. The company does this through organic investments in research and development, capacity and capabilities and through acquisitions. The company’s goal is to enable its customers to be more productive in an increasingly competitive business environment, enable them to accelerate innovation, solve their challenges and advance their important work. The company’s history roots back to the year 1956 when the business was first established. Thermo Fisher Scientific was formed in 2006 from the merger of Thermo Electron and Fisher Scientific and is headquartered in Waltham, MA.

Related stocks

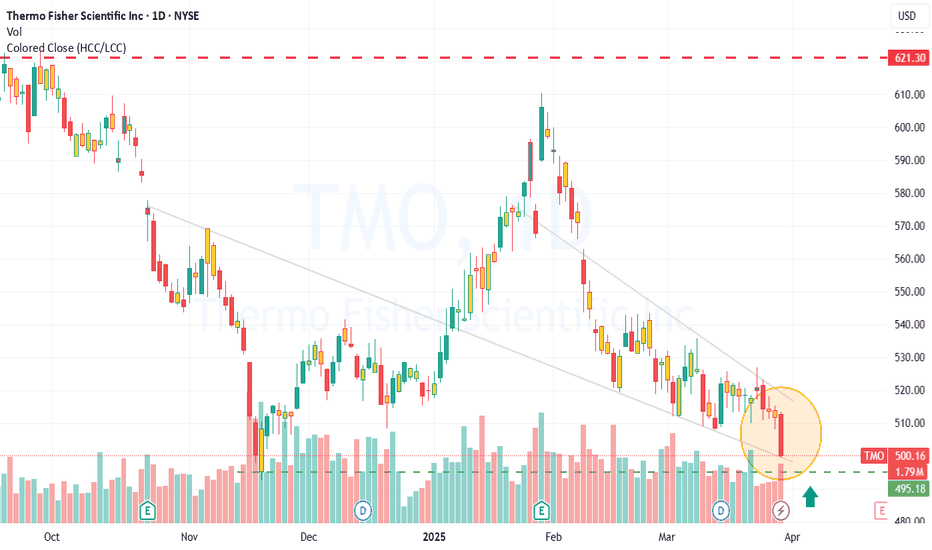

3 Oversold Stocks Poised for a Rally – MAS, IQV & TMOBelow is today’s SmartApingAI snapshot of three highly oversold names showing early signs of a rebound. Scroll down for a quick refresher on each company’s fundamentals, key technicals, and what makes them attractive at current levels.

1. Masco Corp ( NYSE:MAS )

What They Do:

Masco designs, m

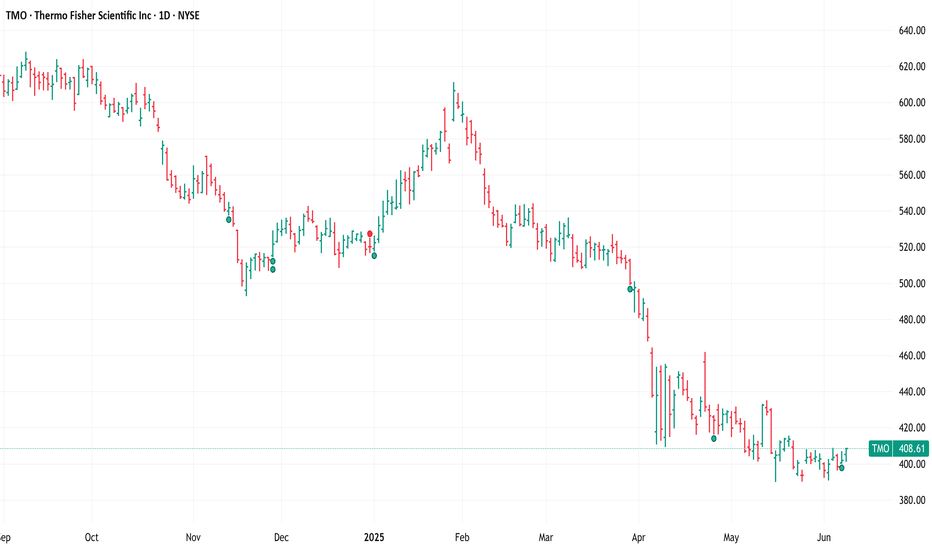

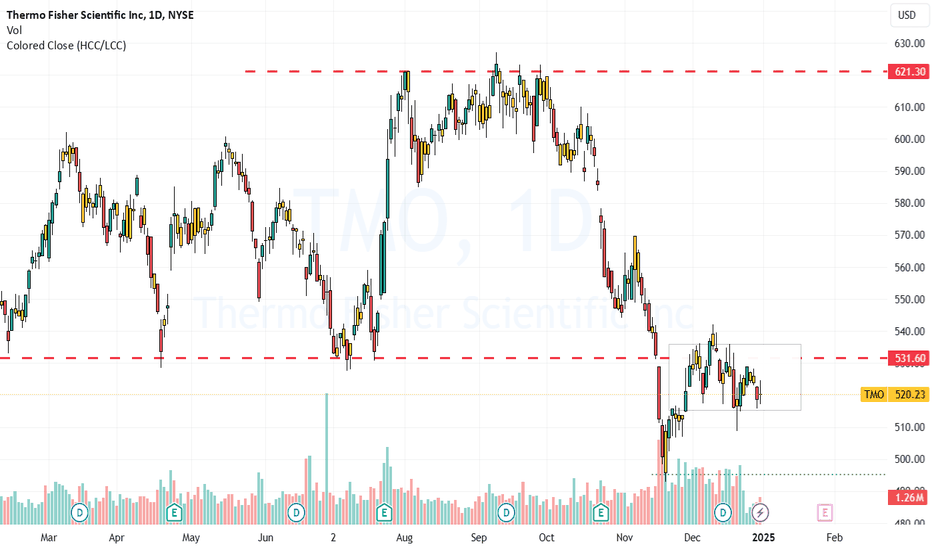

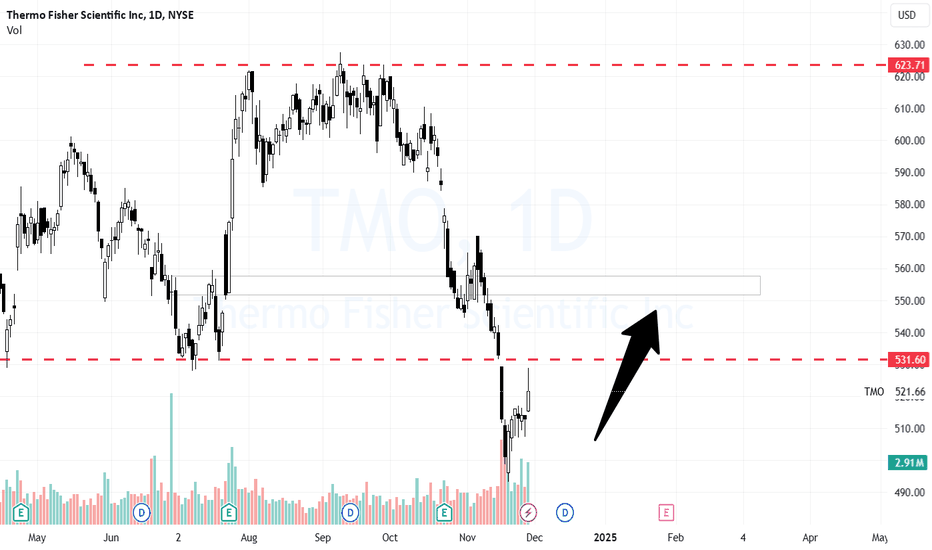

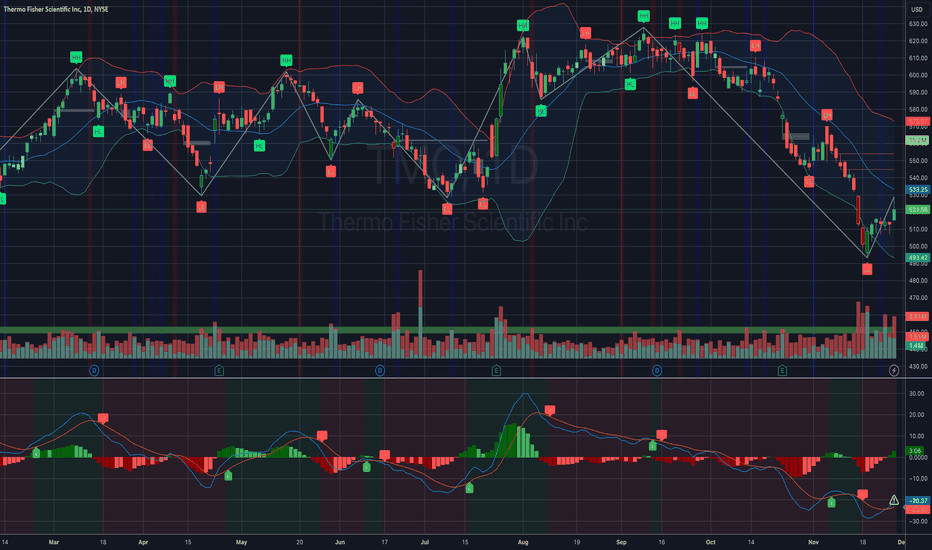

Still uncertain of continuing decline on 2 oscillatorsThe support matches that of the past, a fall from a 100 may not be enough to stop it, but inside the channel, as long as the break from it lands on that support line shy of 500, then we have a counter bounce which could prove a significant possibility gaining 20 points. Target 520 with a trailing st

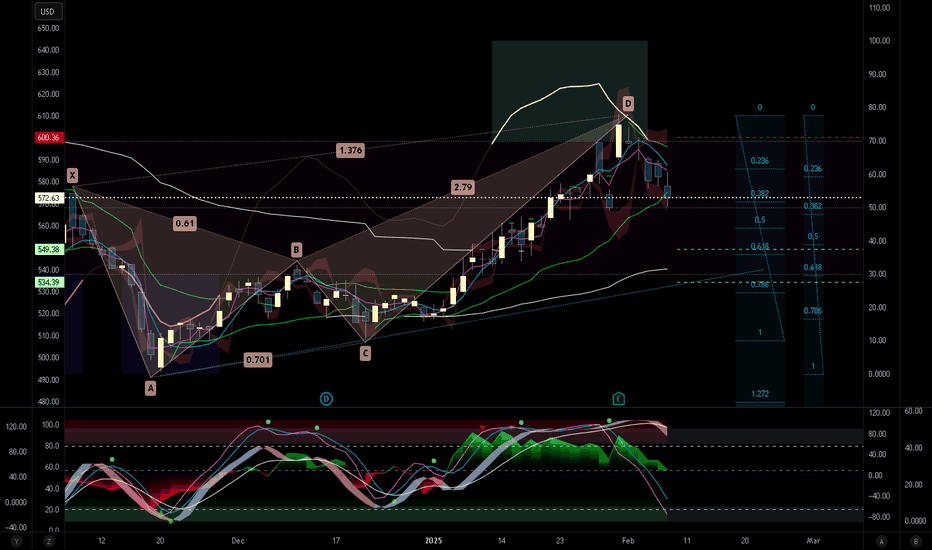

Plus on Thermo Fischer. TMOThe last take on TMO brought 7.5% profit in 13 days. It was manly based on Harmonic/RSX OBOS combo signature. The change in the candle stick tendency now might be an earliest of the earliest signs of a pivot. This is a very risky take, given limited evidence: Stoch/RSI cross, vWAP cross, US support

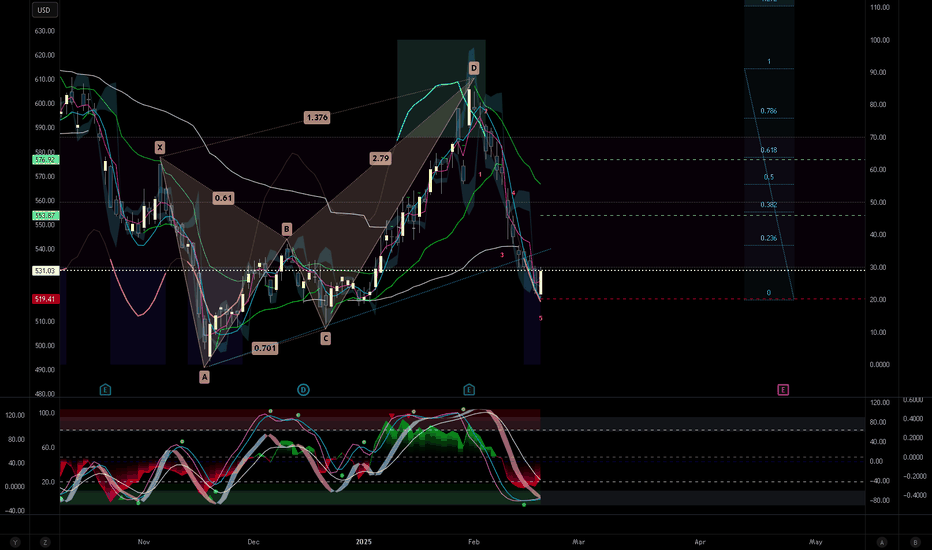

Betting on Cool Down at Thermo Fischer. TMOIt's not a perfect butterfly, but I am willing to take a shot given the wealth of evidence in the background from our algorithmic indicators. MIDAS cross line plus resistant vWAP and US, which also crossed 4-5 candles ago, plus cross on VZO and heralding cross on Stoch/RSI. BB %PCT is about to flip

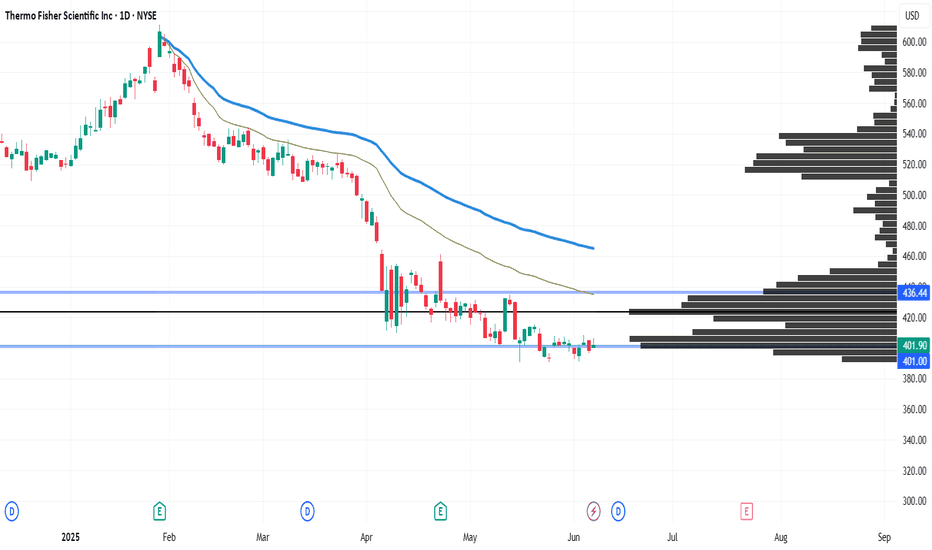

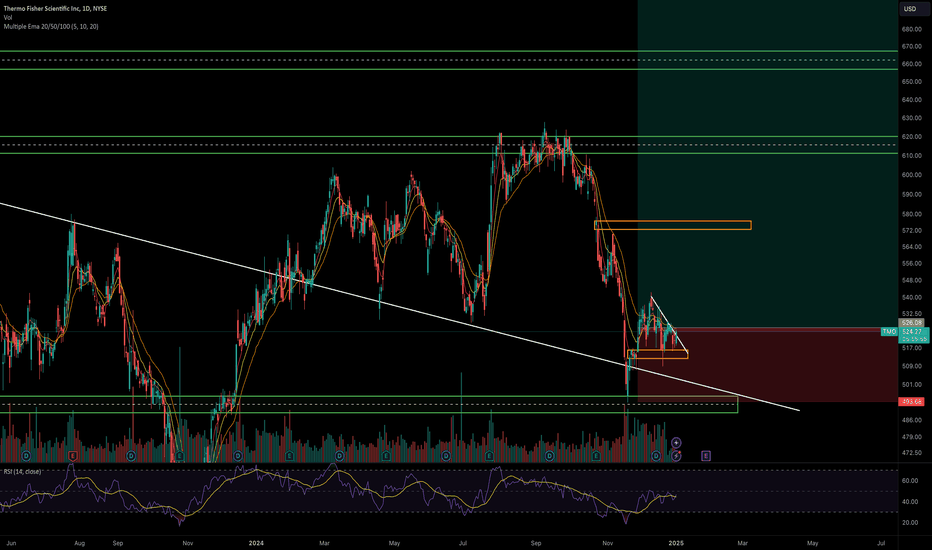

TMO Long Idea- Price has retested and held the weekly descending trendline

- on the daily timeframe, price has formed 5 waves and is holding the 0.618 retracement

- enter now with a stop loss at the previous swing low around 494

- upside levels to watch: 540, 570, 620

- beyond 620, new ATHs can be expected

looking at sub 500 levels just can't seem to find the bottomReading many timeframes and patterns, it's a simple concept along with good or bad fundamentals, and of course, the catalyst is to sell the news or buy the speculation. In this case, reading the chart, we see oscillators that are turning to the downside, we don't see confirmation of the bottom, we s

TMO Thermo Fisher Scientific Inc. (TMO) is currently experiencing a mixed financial and market performance. Here is a technical analysis of the stock as of November 2024:

1. **Recent Performance**: TMO's Q3 2024 earnings per share (EPS) came in at $5.28, slightly exceeding analyst estimates of $5.25, w

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

TMO4530434

Thermo Fisher Scientific Inc. 4.1% 15-AUG-2047Yield to maturity

5.88%

Maturity date

Aug 15, 2047

TMO4078058

Thermo Fisher Scientific Inc. 5.3% 01-FEB-2044Yield to maturity

5.54%

Maturity date

Feb 1, 2044

TMO5630948

Thermo Fisher Scientific Inc. 5.404% 10-AUG-2043Yield to maturity

5.53%

Maturity date

Aug 10, 2043

TMO5710956

Thermo Fisher Scientific Inc. 5.2% 31-JAN-2034Yield to maturity

4.71%

Maturity date

Jan 31, 2034

TMO5630927

Thermo Fisher Scientific Inc. 5.086% 10-AUG-2033Yield to maturity

4.67%

Maturity date

Aug 10, 2033

See all TMOCL bonds

Frequently Asked Questions

The current price of TMOCL is 384,100.000 CLP — it has decreased by −2.29% in the past 24 hours. Watch THERMO FISHER SCIENTIFIC INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange THERMO FISHER SCIENTIFIC INC stocks are traded under the ticker TMOCL.

TMOCL stock has fallen by −2.29% compared to the previous week, the month change is a 0.85% rise, over the last year THERMO FISHER SCIENTIFIC INC has showed a 0.85% increase.

We've gathered analysts' opinions on THERMO FISHER SCIENTIFIC INC future price: according to them, TMOCL price has a max estimate of 579,981.29 CLP and a min estimate of 420,954.16 CLP. Watch TMOCL chart and read a more detailed THERMO FISHER SCIENTIFIC INC stock forecast: see what analysts think of THERMO FISHER SCIENTIFIC INC and suggest that you do with its stocks.

TMOCL reached its all-time high on Jun 11, 2025 with the price of 393,100.000 CLP, and its all-time low was 380,860.000 CLP and was reached on May 30, 2025. View more price dynamics on TMOCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TMOCL stock is 2.34% volatile and has beta coefficient of 0.53. Track THERMO FISHER SCIENTIFIC INC stock price on the chart and check out the list of the most volatile stocks — is THERMO FISHER SCIENTIFIC INC there?

Today THERMO FISHER SCIENTIFIC INC has the market capitalization of 143.18 T, it has decreased by −2.16% over the last week.

Yes, you can track THERMO FISHER SCIENTIFIC INC financials in yearly and quarterly reports right on TradingView.

THERMO FISHER SCIENTIFIC INC is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

TMOCL earnings for the last quarter are 4.91 K CLP per share, whereas the estimation was 4.86 K CLP resulting in a 0.95% surprise. The estimated earnings for the next quarter are 4.89 K CLP per share. See more details about THERMO FISHER SCIENTIFIC INC earnings.

THERMO FISHER SCIENTIFIC INC revenue for the last quarter amounts to 9.88 T CLP, despite the estimated figure of 9.75 T CLP. In the next quarter, revenue is expected to reach 9.99 T CLP.

TMOCL net income for the last quarter is 1.44 T CLP, while the quarter before that showed 1.83 T CLP of net income which accounts for −21.34% change. Track more THERMO FISHER SCIENTIFIC INC financial stats to get the full picture.

Yes, TMOCL dividends are paid quarterly. The last dividend per share was 404.52 CLP. As of today, Dividend Yield (TTM)% is 0.40%. Tracking THERMO FISHER SCIENTIFIC INC dividends might help you take more informed decisions.

THERMO FISHER SCIENTIFIC INC dividend yield was 0.30% in 2024, and payout ratio reached 9.43%. The year before the numbers were 0.26% and 9.06% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 2, 2025, the company has 125 K employees. See our rating of the largest employees — is THERMO FISHER SCIENTIFIC INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. THERMO FISHER SCIENTIFIC INC EBITDA is 10.26 T CLP, and current EBITDA margin is 25.12%. See more stats in THERMO FISHER SCIENTIFIC INC financial statements.

Like other stocks, TMOCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade THERMO FISHER SCIENTIFIC INC stock right from TradingView charts — choose your broker and connect to your account.