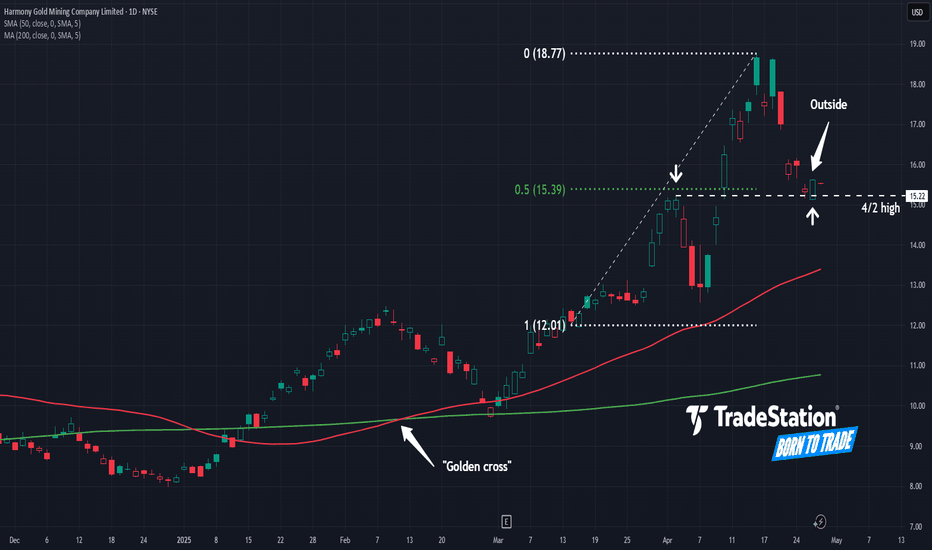

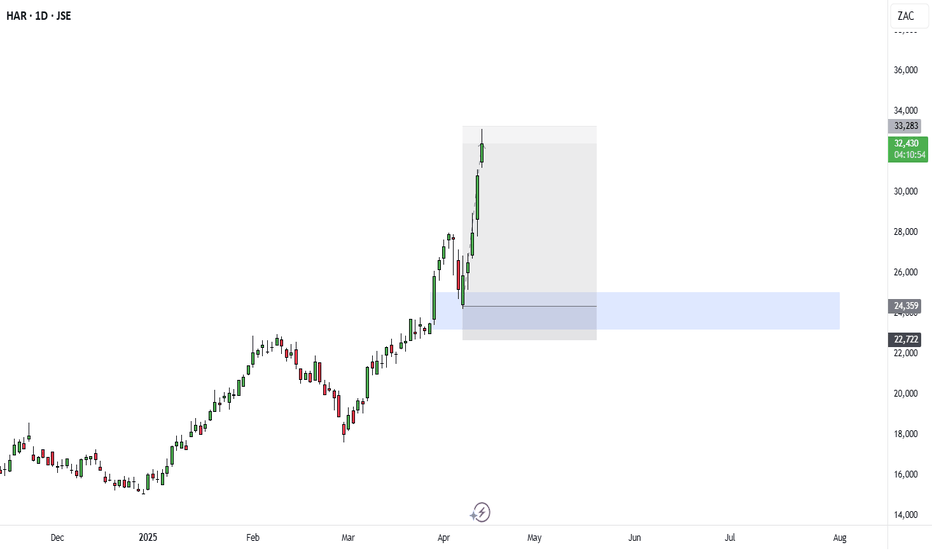

Harmony Gold Pulls BackHarmony Gold has been rallying this year along with precious metals, and now some traders may see an opportunity in its latest pullback.

The first pattern on today’s chart is the price area around $15.50. It’s near the April 2 high and a 50 percent retracement of the rally following the March break

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

19.49 MXN

8.42 B MXN

61.40 B MXN

621.73 M

About HARMONY GM CO LTD

Sector

Industry

CEO

Beyers Nel

Website

Headquarters

Randfontein

Founded

1950

FIGI

BBG00ZQZTR23

Harmony Gold Mining Co. Ltd. is a world-class gold-mining and exploration company with a copper footprint. It involves nine deep-level mines, an open-pit mining operation and several surface retreatment facilities. It operates through the following segments: Tshepong North, Tshepong South, Moab Khotsong, Bambanani, Joel, Doornkop, Target 1, Kusasalethu, Masimong, Mponeng, Mine Waste Solutions and Hidden Valley. The company was founded on August 25, 1950 and is headquartered in Randfontein, South Africa.

Related stocks

Harmony Gold Mining (HMY) – Strong Growth & Rising ProfitabilityCompany Overview:

Harmony Gold Mining NYSE:HMY continues to outperform expectations, delivering higher grades, cost efficiency, and production expansion.

Key Catalysts:

High-Quality Gold Extraction ⛏️

Underground recovered grades surged to 6.4 g/t, exceeding full-year guidance.

Reinforces HMY’

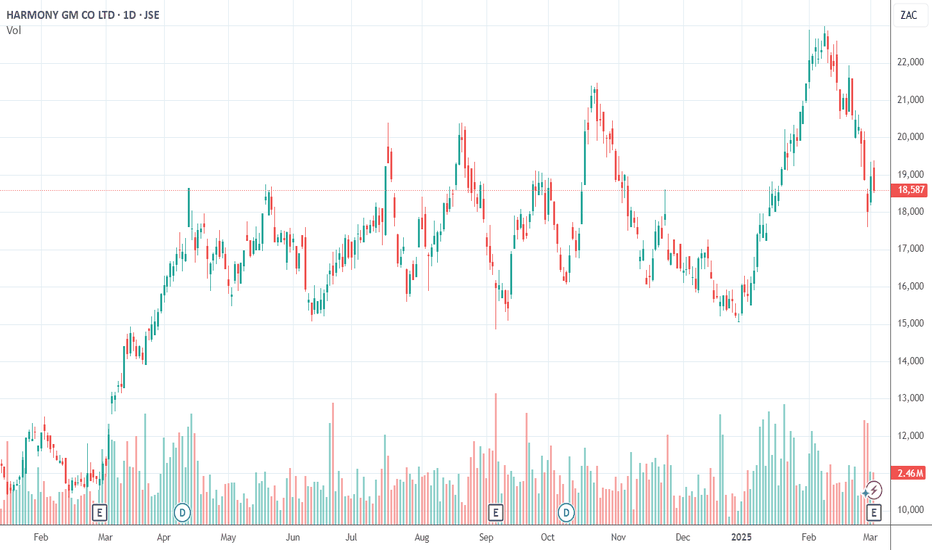

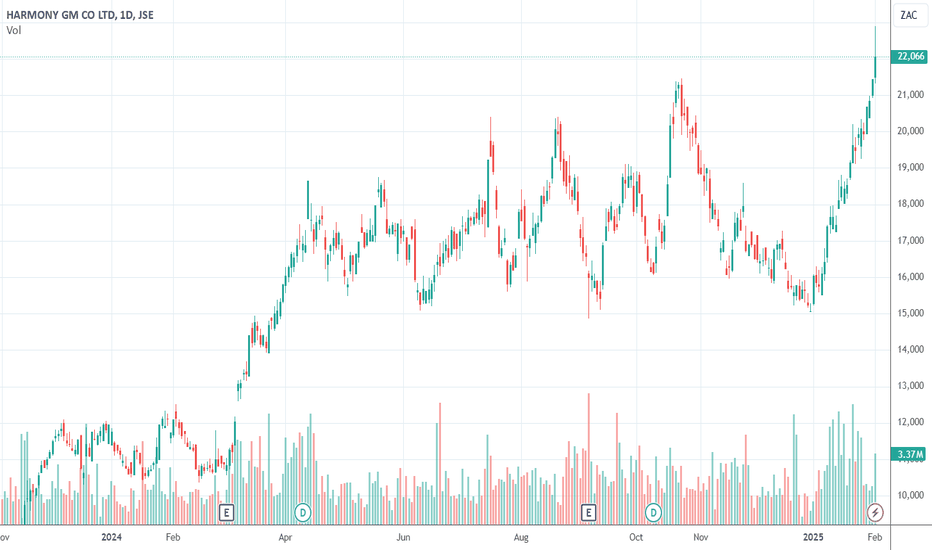

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was probably South Africa's most marginal gold mine until it got Mponeng gold mine working effectively. The development of this mine and its processing plant are expected to cost around US$2,8bn - and Harmony does not at this stage have its share of that cash (about R20bn). During 2021

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was probably South Africa's most marginal gold mine until it got Mponeng gold mine working effectively. The development of this mine and its processing plant are expected to cost around US$2,8bn – and Harmony does not at this stage have its share of that cash (about R20bn). During 2021

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was historically considered South Africa’s most marginal gold mining operation until it successfully integrated Mponeng gold mine into its portfolio. The development of Mponeng and its processing plant is expected to cost around US$2.8 billion, and Harmony has yet to secure its share o

HMY - Falling Wedge ABCD Pattern HMY is formed a falling wedge from recent highs and currently making falling wedge with ABCD pattern. This means there is one more leg downwards to go. In ABCD pattern, the size of the second move downwards is very much the same as first move (either in $ or % terms). The projected price of completi

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was historically South Africa's most marginal gold miner, but its acquisition of the Mponeng gold mine has significantly strengthened its position. Mponeng is the deepest mine in the world, bringing with it the challenges of ultra-deep-level mining. The development of this mine and its

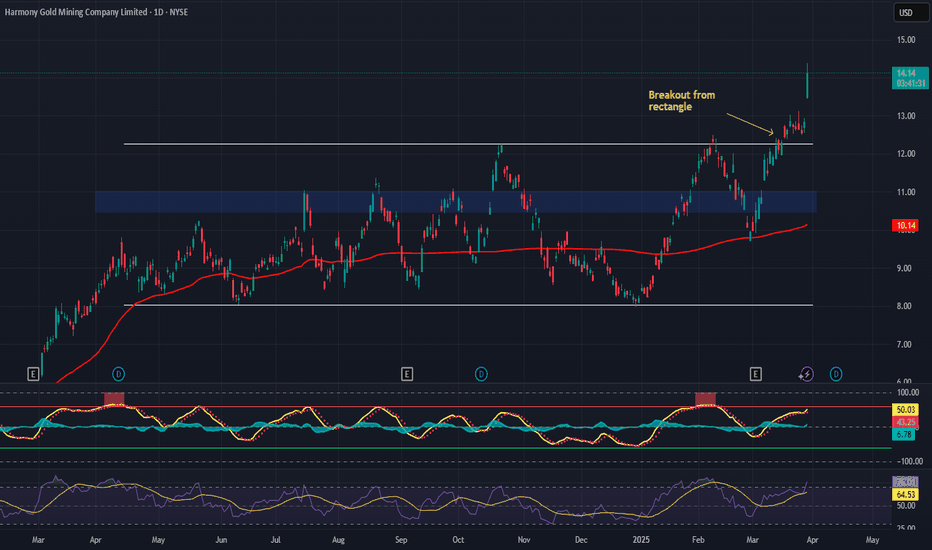

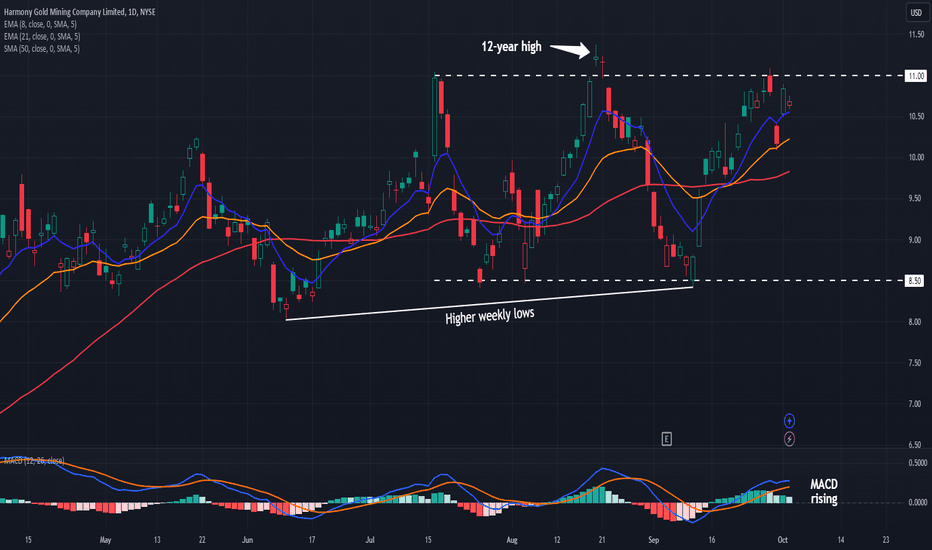

Harmony Gold Could Be Near a BreakoutHarmony Gold Mining rallied sharply in March and April. Now, after a period of consolidation, some traders may see potential for a breakout.

The first pattern on today’s chart is the range between $8.50 and $11. Prices are nearing the upper level. A close above may confirm resistance is fading.

Se

Our opinion on the current state of HARMONY(HAR)Harmony Gold (HAR) has historically been considered one of South Africa's more marginal gold mining operations until it managed to bring the Mponeng gold mine into effective operation. The development of this mine and its associated processing plant is expected to require a significant investment of

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where HMY/N is featured.

Frequently Asked Questions

The current price of HMY/N is 263.00 MXN — it has decreased by −2.59% in the past 24 hours. Watch HARMONY GOLD MINING COMPANY LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange HARMONY GOLD MINING COMPANY LIMITED stocks are traded under the ticker HMY/N.

HMY/N stock has risen by 0.08% compared to the previous week, the month change is a 68.77% rise, over the last year HARMONY GOLD MINING COMPANY LIMITED has showed a 68.77% increase.

We've gathered analysts' opinions on HARMONY GOLD MINING COMPANY LIMITED future price: according to them, HMY/N price has a max estimate of 300.21 MXN and a min estimate of 189.56 MXN. Watch HMY/N chart and read a more detailed HARMONY GOLD MINING COMPANY LIMITED stock forecast: see what analysts think of HARMONY GOLD MINING COMPANY LIMITED and suggest that you do with its stocks.

HMY/N stock is 5.09% volatile and has beta coefficient of 0.67. Track HARMONY GOLD MINING COMPANY LIMITED stock price on the chart and check out the list of the most volatile stocks — is HARMONY GOLD MINING COMPANY LIMITED there?

Today HARMONY GOLD MINING COMPANY LIMITED has the market capitalization of 169.42 B, it has increased by 0.22% over the last week.

Yes, you can track HARMONY GOLD MINING COMPANY LIMITED financials in yearly and quarterly reports right on TradingView.

HARMONY GOLD MINING COMPANY LIMITED is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

HMY/N net income for the last half-year is 9.13 B MXN, while the previous report showed 2.61 B MXN of net income which accounts for 249.62% change. Track more HARMONY GOLD MINING COMPANY LIMITED financial stats to get the full picture.

Yes, HMY/N dividends are paid semi-annually. The last dividend per share was 1.95 MXN. As of today, Dividend Yield (TTM)% is 0.95%. Tracking HARMONY GOLD MINING COMPANY LIMITED dividends might help you take more informed decisions.

HARMONY GOLD MINING COMPANY LIMITED dividend yield was 1.14% in 2024, and payout ratio reached 14.15%. The year before the numbers were 0.76% and 7.26% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 13, 2025, the company has 34.72 K employees. See our rating of the largest employees — is HARMONY GOLD MINING COMPANY LIMITED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HARMONY GOLD MINING COMPANY LIMITED EBITDA is 27.74 B MXN, and current EBITDA margin is 32.72%. See more stats in HARMONY GOLD MINING COMPANY LIMITED financial statements.

Like other stocks, HMY/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HARMONY GOLD MINING COMPANY LIMITED stock right from TradingView charts — choose your broker and connect to your account.