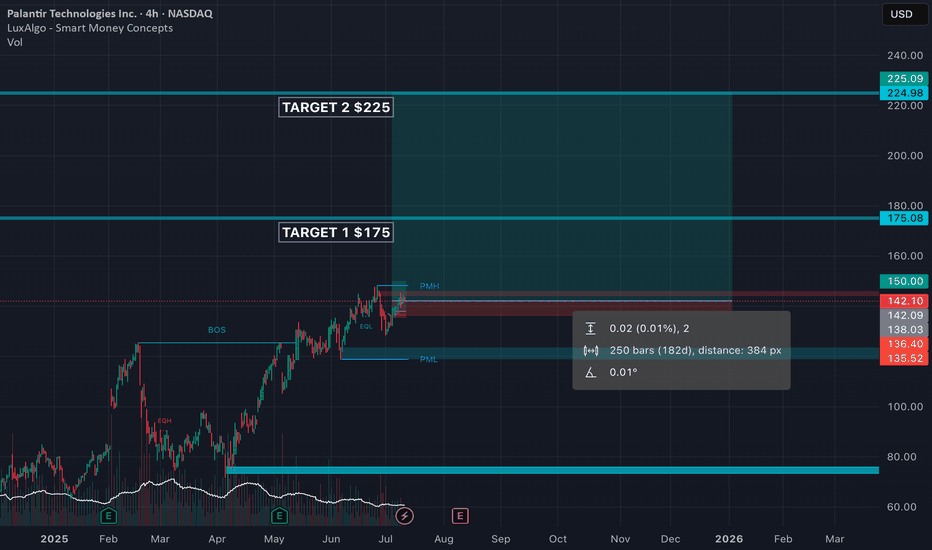

PLTR Trade Update – July 11, 2025📅

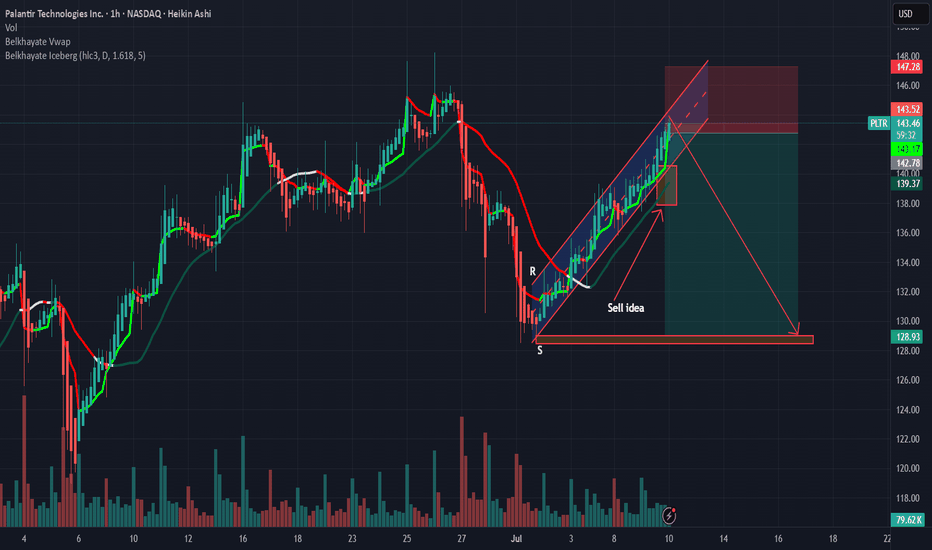

PLTR held the breakout like a champ. ✅ After a clean move through the triangle resistance yesterday, today’s price action continues to build strength above $142.50.

🔼 Bulls are in control, riding the momentum with higher lows and tight consolidation near breakout levels.

🎯 Targets remain firm at

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.11 MXN

9.64 B MXN

59.74 B MXN

2.14 B

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

FIGI

BBG012S29HP5

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

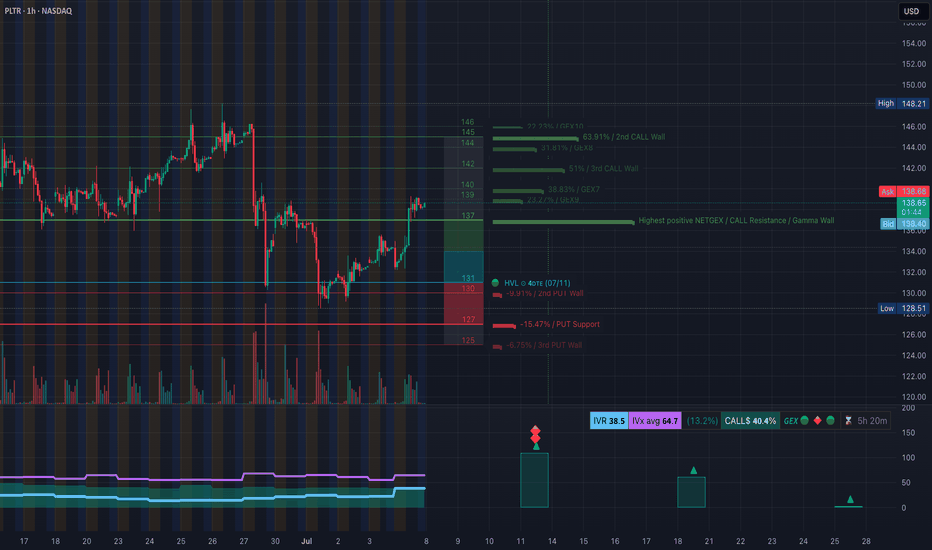

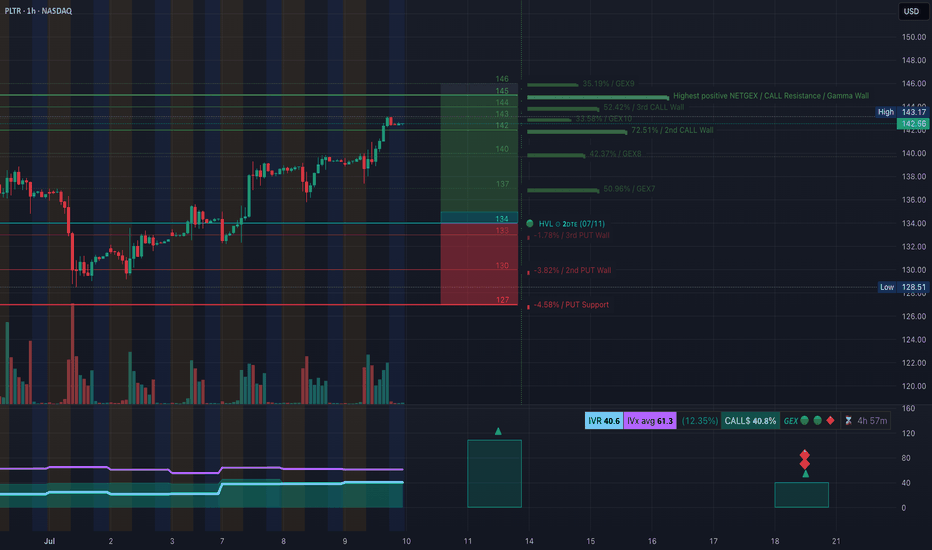

GEX-Based Options Sentiment GEX-Based Options Sentiment (as of July 7)

* Current Price: $138.69

* Highest Gamma Resistance (Call Wall): $139 → heavy OI + positive NetGEX → magnet + possible rejection

* Next Call Walls:

* $142 (GEX7, 51%)

* $144–146 stacked (GEX8–10) — breakout potential zone if $139 clears

* Put Wall +

PLTR Approaching Key Gamma Resistance–Will 140 Break or Reject?🔍 Options Sentiment (GEX Analysis):

PLTR is pushing into a high gamma zone with notable resistance from options positioning:

* Call Walls are stacked at 140, 142, and 145, with the 145 line aligning with a GEX10 and 2nd Call Wall (86.54%). This suggests significant overhead resistance and a possible

Earnings HFT gapsThe gaps that form during earnings season on or the next day after the CEO reports the revenues and income for that past quarter are always HFT driven. The concern over the past 2 previous quarters was the fact that the High Frequency Trading Firms were incorporating Artificial Intelligence into the

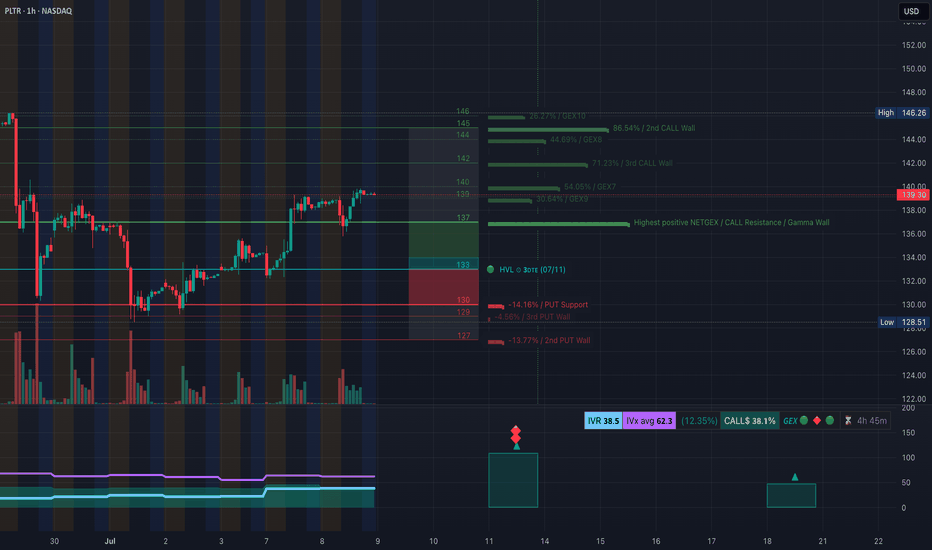

PLTR Poised for Gamma Squeeze? Here's the Key Setup-July 10📈 GEX Options Sentiment & Trade Strategy

Palantir (PLTR) is pressing into a high-compression zone on the Gamma Exposure (GEX) chart, where multiple call walls cluster between 143 → 146, with the strongest net positive GEX wall at 146, acting as the gamma squeeze ceiling. The 3rd call wall sits at ~1

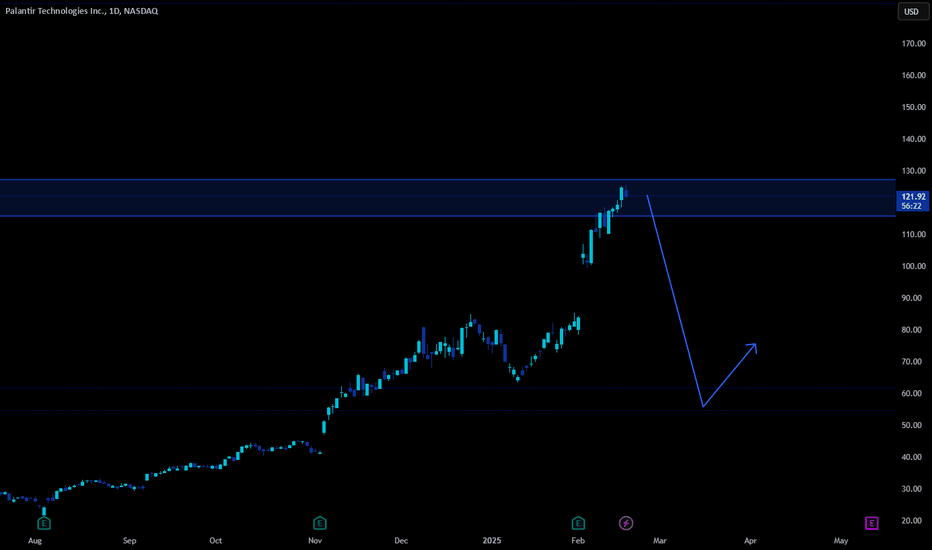

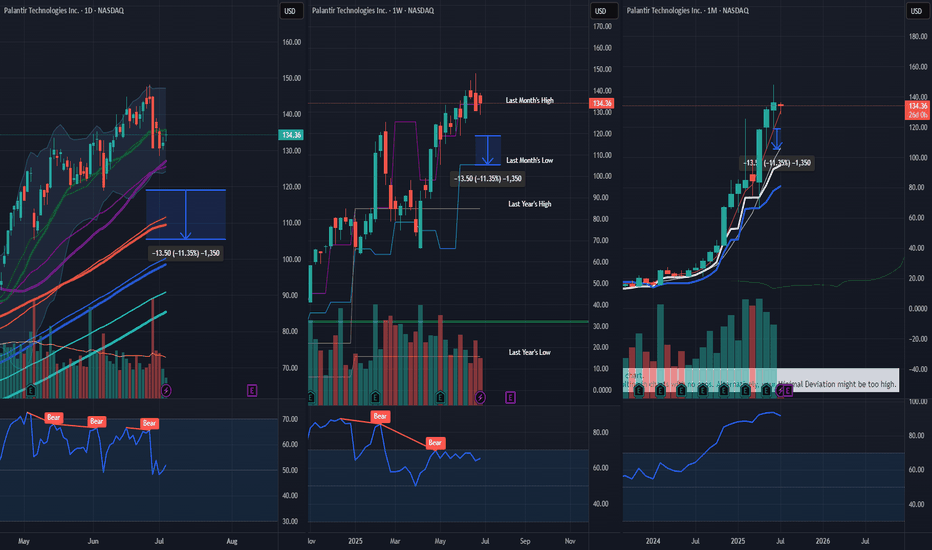

PLTR temporary top?Bearish case

Monthly RSI at 91

Weekly candles encountering resistance

Daily candles under the 20 day SMA

Bullish case

Monthly candle not a clear bearish candle, no monthly volume spike or no monthly RSI double top like SMCI and no bearish divergence detected yet.

Weekly no continuation down after

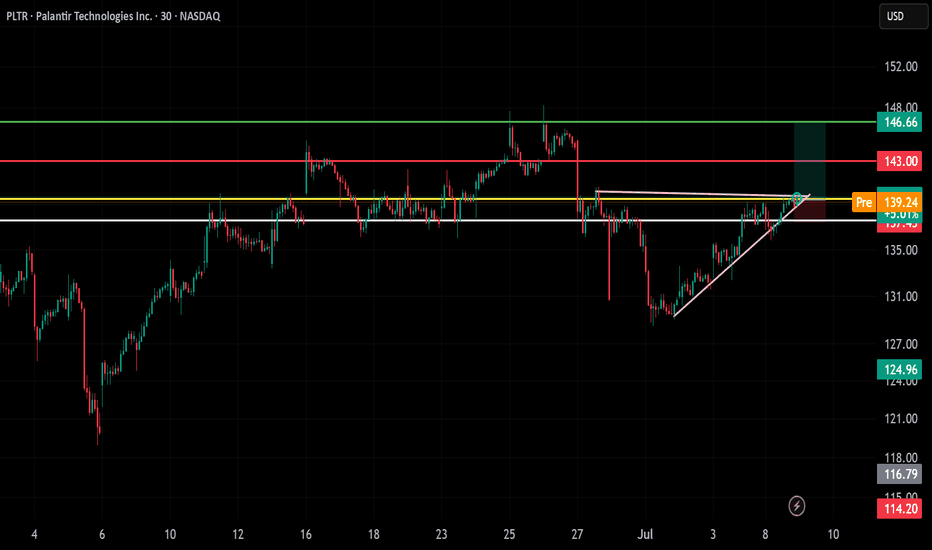

Trade Reflection – PLTR Long Setup🧠

Lately, I’ve been focusing on breakouts from key resistance levels supported by ascending trendlines. Today’s trade on NASDAQ:PLTR was a textbook example.

📈 Ticker: PLTR

🔁 Trade Type: Long

🕒 Timeframe: 30-min

📍 Entry Zone: $139.24 (Pre-market breakout)

🎯 Target: $146.66

🛑 Stop Loss: Below $137.

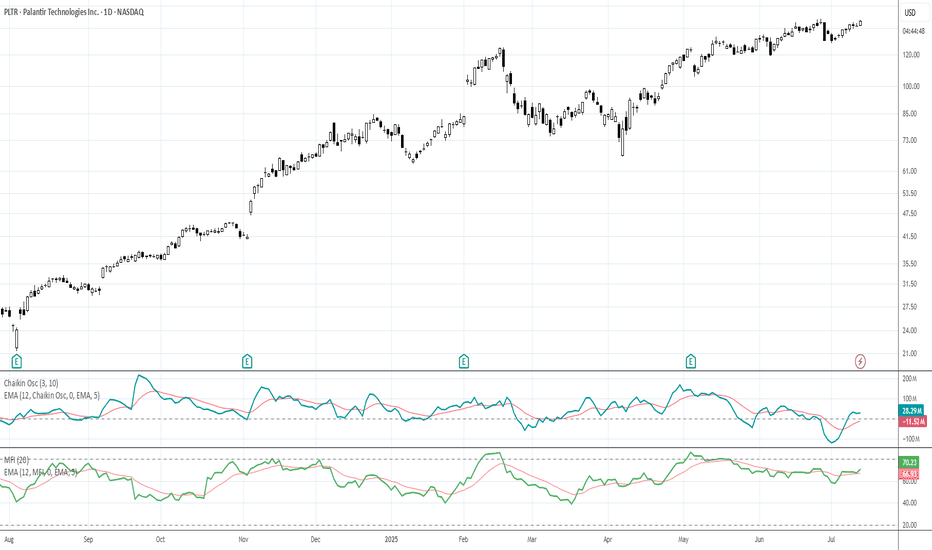

PLTR - Palantir Technologies: Why PLTR is the Perfect PlayExceptional Performance Leadership

Palantir Technologies has established itself as the undisputed champion of the U.S. stock market in 2025. The stock has delivered extraordinary returns of 402.92% over the past 12 months and 87.89% year-to-date, making it the best-performing stock in both the S&P

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PLTR is 2,816.77 MXN — it has increased by 5.51% in the past 24 hours. Watch PALANTIR TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange PALANTIR TECHNOLOGIES INC stocks are traded under the ticker PLTR.

PLTR stock has risen by 11.57% compared to the previous week, the month change is a 9.28% rise, over the last year PALANTIR TECHNOLOGIES INC has showed a 468.54% increase.

We've gathered analysts' opinions on PALANTIR TECHNOLOGIES INC future price: according to them, PLTR price has a max estimate of 2,980.63 MXN and a min estimate of 745.16 MXN. Watch PLTR chart and read a more detailed PALANTIR TECHNOLOGIES INC stock forecast: see what analysts think of PALANTIR TECHNOLOGIES INC and suggest that you do with its stocks.

PLTR stock is 1.91% volatile and has beta coefficient of 2.30. Track PALANTIR TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is PALANTIR TECHNOLOGIES INC there?

Today PALANTIR TECHNOLOGIES INC has the market capitalization of 6.60 T, it has increased by 4.77% over the last week.

Yes, you can track PALANTIR TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

PALANTIR TECHNOLOGIES INC is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

PLTR earnings for the last quarter are 2.66 MXN per share, whereas the estimation was 2.64 MXN resulting in a 1.05% surprise. The estimated earnings for the next quarter are 2.59 MXN per share. See more details about PALANTIR TECHNOLOGIES INC earnings.

PALANTIR TECHNOLOGIES INC revenue for the last quarter amounts to 18.11 B MXN, despite the estimated figure of 17.66 B MXN. In the next quarter, revenue is expected to reach 17.58 B MXN.

PLTR net income for the last quarter is 4.38 B MXN, while the quarter before that showed 1.65 B MXN of net income which accounts for 166.19% change. Track more PALANTIR TECHNOLOGIES INC financial stats to get the full picture.

No, PLTR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 15, 2025, the company has 3.94 K employees. See our rating of the largest employees — is PALANTIR TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PALANTIR TECHNOLOGIES INC EBITDA is 8.92 B MXN, and current EBITDA margin is 11.93%. See more stats in PALANTIR TECHNOLOGIES INC financial statements.

Like other stocks, PLTR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PALANTIR TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PALANTIR TECHNOLOGIES INC technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PALANTIR TECHNOLOGIES INC stock shows the buy signal. See more of PALANTIR TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.