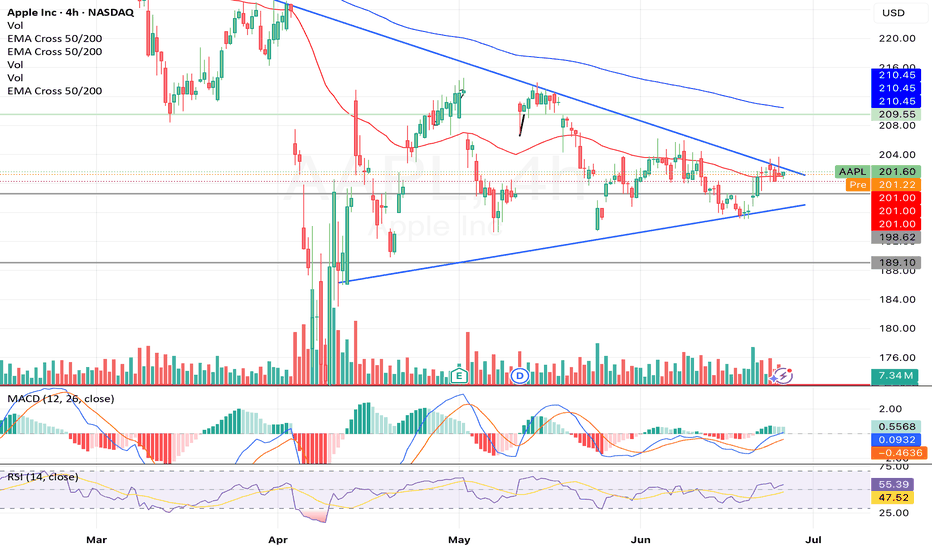

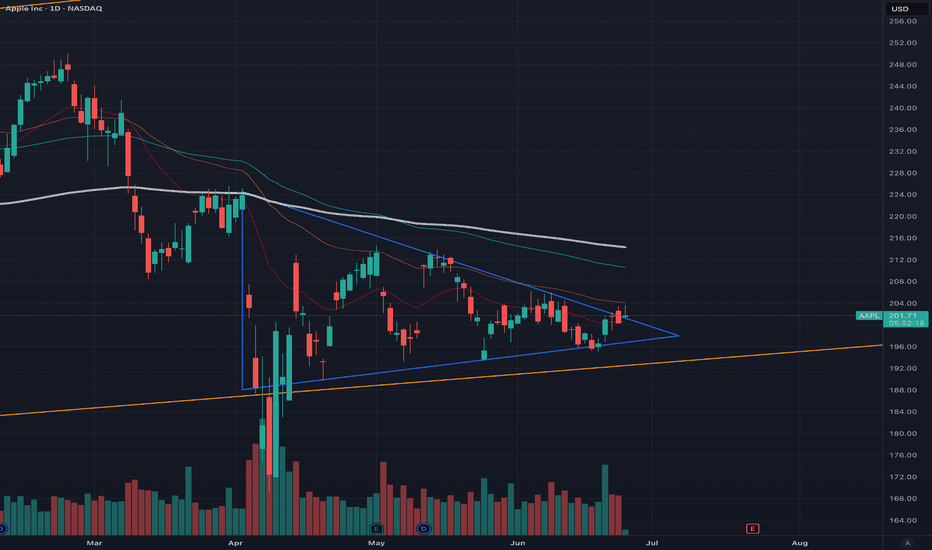

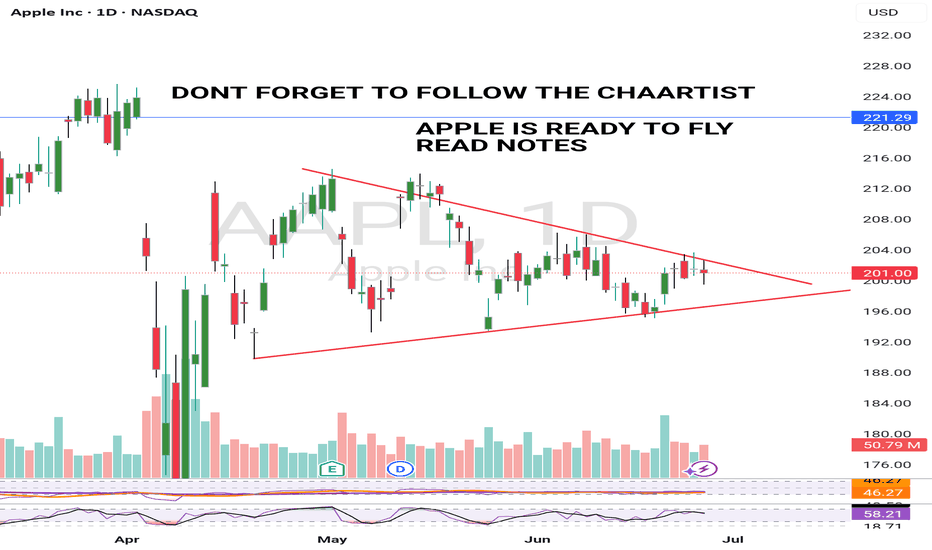

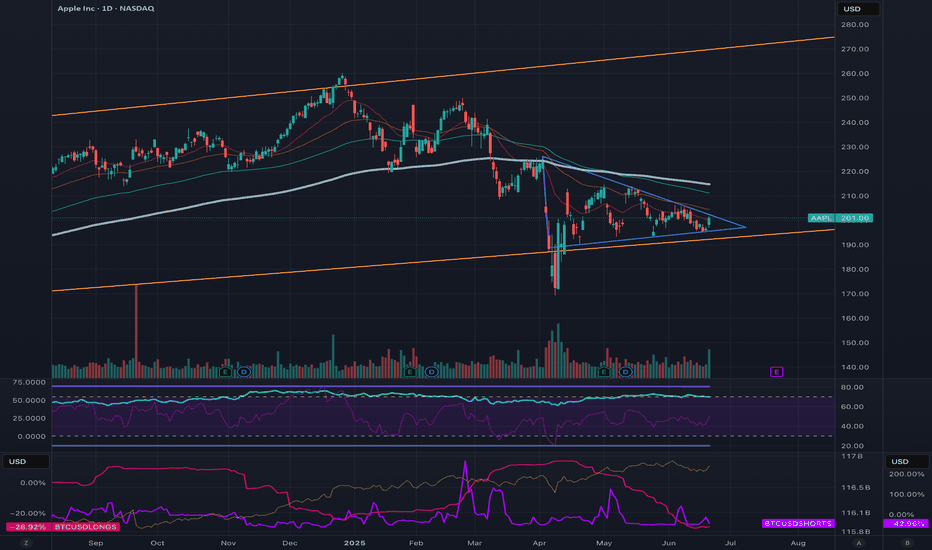

Light at the end of the Tunnel for AAPLI have been tracking this pattern that NASDAQ:AAPL started forming in April for some time now.

This is a classic symmetrical triangle formation with significant consolidation in the last trading sessions. This patterns typically lead to a breakout in either direction, and since price is near the

Key facts today

Brazil's antitrust regulator CADE recommended a ruling against Apple for anti-competitive practices in its iOS ecosystem, suggesting a fine and ending restrictions on digital goods and payments.

A U.S. Judge ruled that Apple must face a lawsuit from the Department of Justice, alleging it unlawfully dominates the smartphone market by restricting third-party developers.

Apple Inc. is facing a class action lawsuit over alleged misstatements regarding AI features in Siri affecting iPhone 16 sales. Investors from June 2024 to June 2025 are involved.

30,600.00

0.00 BRL

484.66 B BRL

2.02 T BRL

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

ISIN

BRAAPLBDR004

FIGI

BBG001721174

Apple, Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, AppleCare, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in April 1976 and is headquartered in Cupertino, CA.

Related stocks

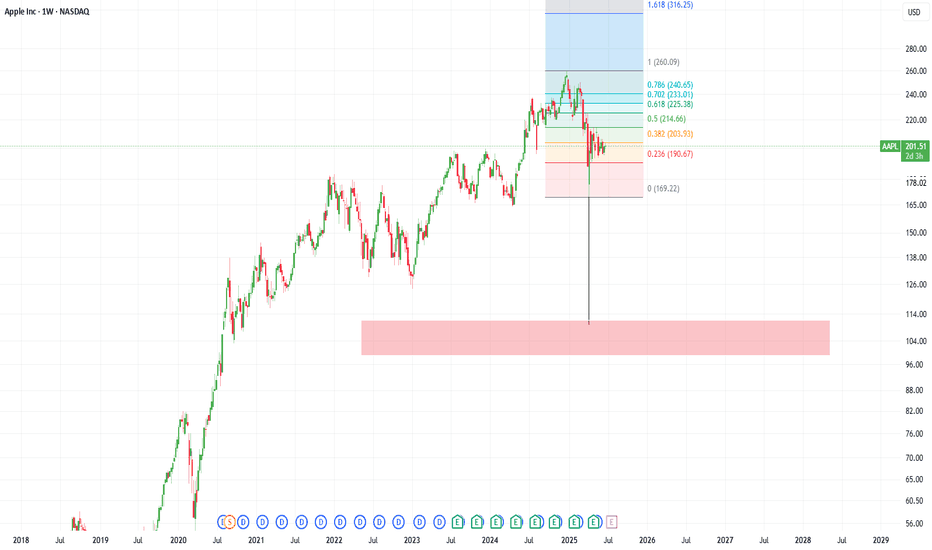

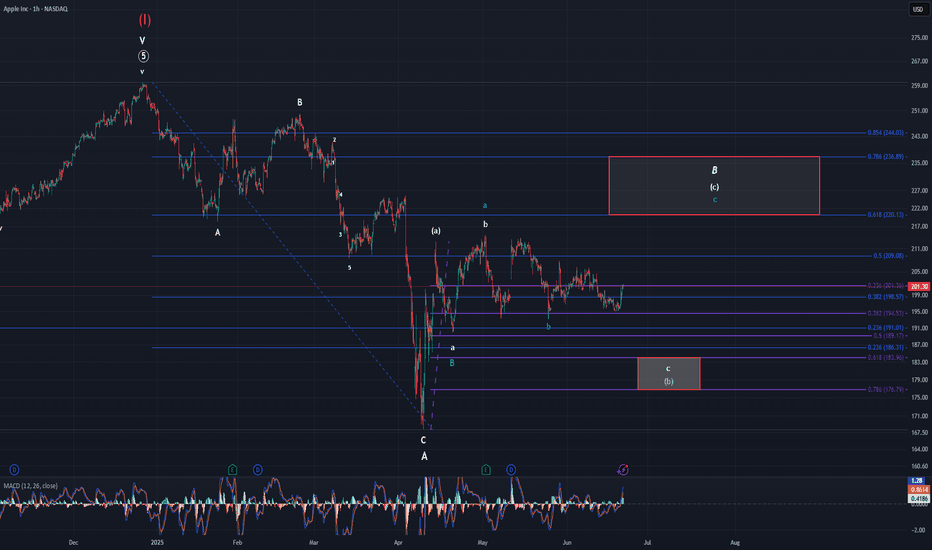

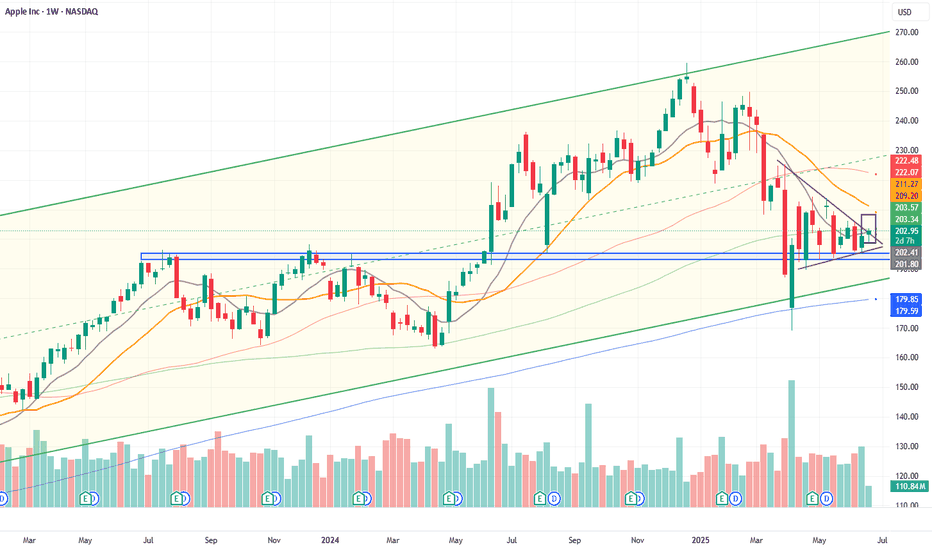

AppleNo change in regard to my Apple analysis. I am still waiting for price to either break down to the target box or head straight to the upper target box from here. I think given the current price action we have a higher probability of moving lower first, but the fact remains it is not required. This w

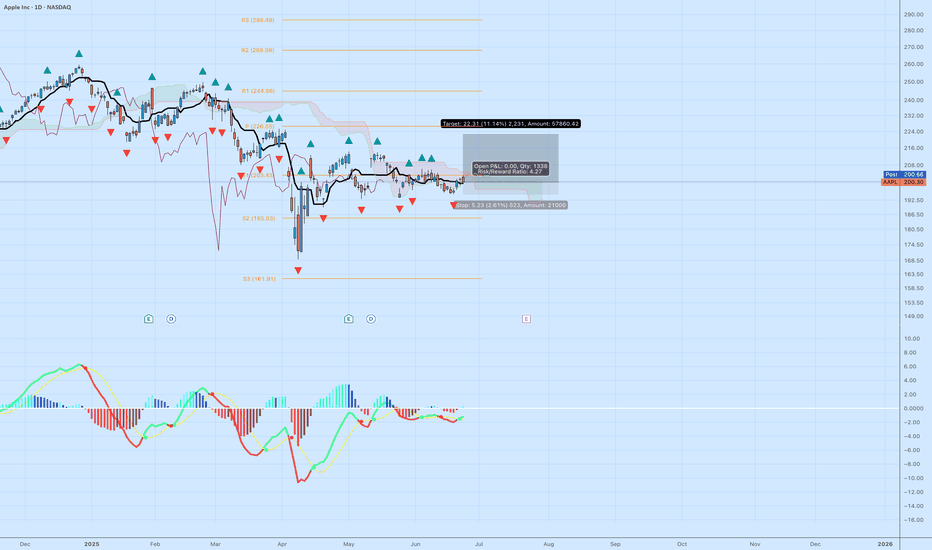

Time to buy? Too much negative press. Buy in Fear- Updated 25/6Apple has recently faced significant negative press, leading to fear and critical perceptions among investors. This situation highlights a common investment principle: buy in times of fear and sell in times of greed. As a result, I have taken a considerable long position on Apple, which I have since

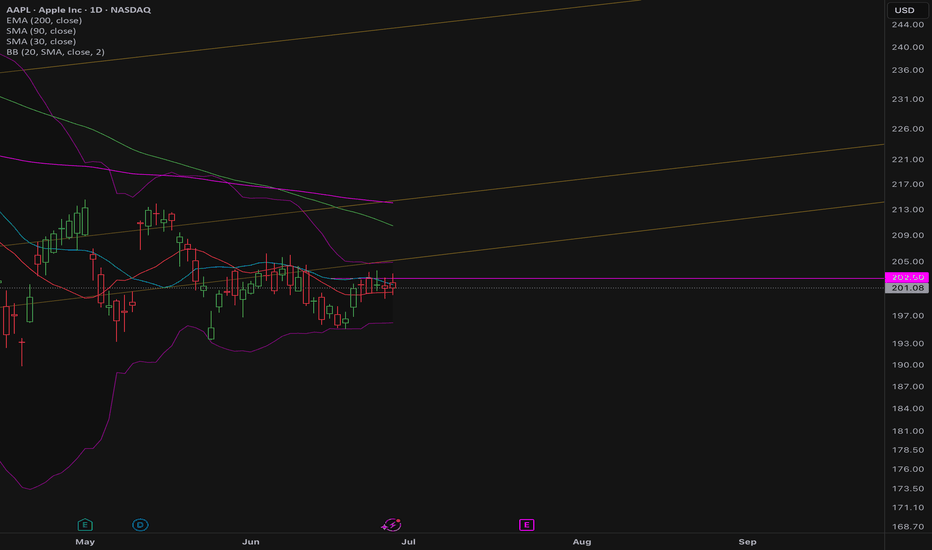

AAPL: Update - Key Levels to Watch for Price DevelopmentAAPL: Update - Key Levels to Watch for Price Development

Overall nothing changed and AAPL remains a valuable and strong structure

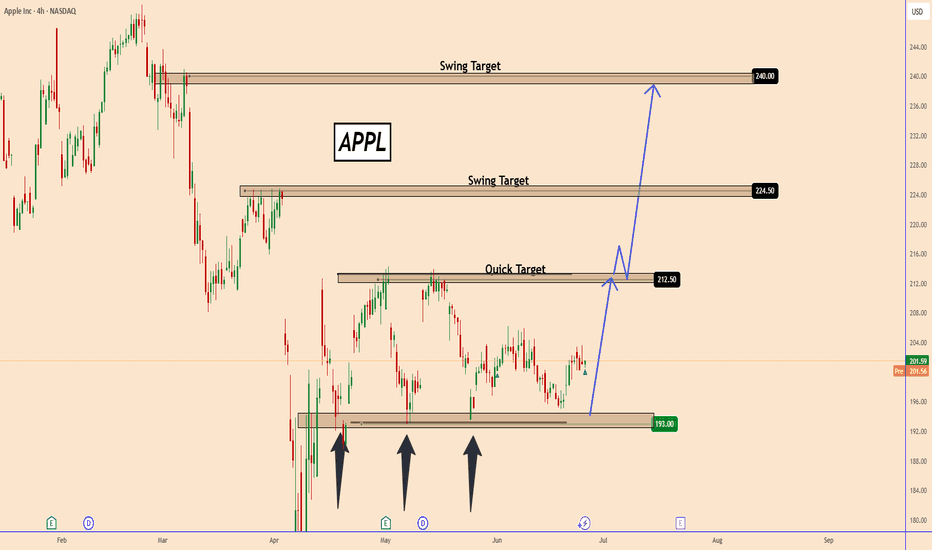

Apple's stock (AAPL) has been range-bound between $193 and $212.50 for the past two months, repeatedly testing support near $193 on three occasions.

Each time, the

$AAPL Long Setup – Range Breakout Potential with Tight RiskApple ( NASDAQ:AAPL ) is finally showing signs of strength after a prolonged sideways range. Price is attempting to break above the Ichimoku Cloud on the daily chart while MACD is starting to curve upward—indicating a potential shift in momentum. After holding the $190–$200 zone as support for month

Time to buy? Too much negative press. Buy in Fear- Updated 23/6Apple has been dealing with significant negative press recently, leading to fear and critical perceptions among investors. This situation suggests a common investment principle: in times of fear, you should buy, and in times of greed, you should sell. Consequently, I have taken a considerable long p

Breaking out!The price breaks through the purple resistance and is preparing to start an upward movement.

A compression triangle formation is taking shape, with the lows resting on the underlying purple trendline.

At $203.3, the weekly 100-period simple moving average (SMA100, green line) is located. A close a

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37833DZ0

APPLE 20/50Yield to maturity

6.79%

Maturity date

Aug 20, 2050

US37833DW7

APPLE 20/50Yield to maturity

6.58%

Maturity date

May 11, 2050

US37833EG1

APPLE 21/61Yield to maturity

6.58%

Maturity date

Feb 8, 2061

US37833EF3

APPLE 21/51Yield to maturity

6.58%

Maturity date

Feb 8, 2051

US37833EL0

APPLE 21/61Yield to maturity

6.55%

Maturity date

Aug 5, 2061

US37833EK2

APPLE 21/51Yield to maturity

6.54%

Maturity date

Aug 5, 2051

US37833EA4

APPLE 20/60Yield to maturity

6.46%

Maturity date

Aug 20, 2060

US37833DQ0

APPLE 19/49Yield to maturity

6.36%

Maturity date

Sep 11, 2049

US37833EE6

APPLE 21/41Yield to maturity

6.11%

Maturity date

Feb 8, 2041

APC3

APPLE 17/47Yield to maturity

5.91%

Maturity date

Nov 13, 2047

US37833DD9

APPLE 17/47Yield to maturity

5.89%

Maturity date

Sep 12, 2047

See all AAPL34 bonds

Curated watchlists where AAPL34 is featured.