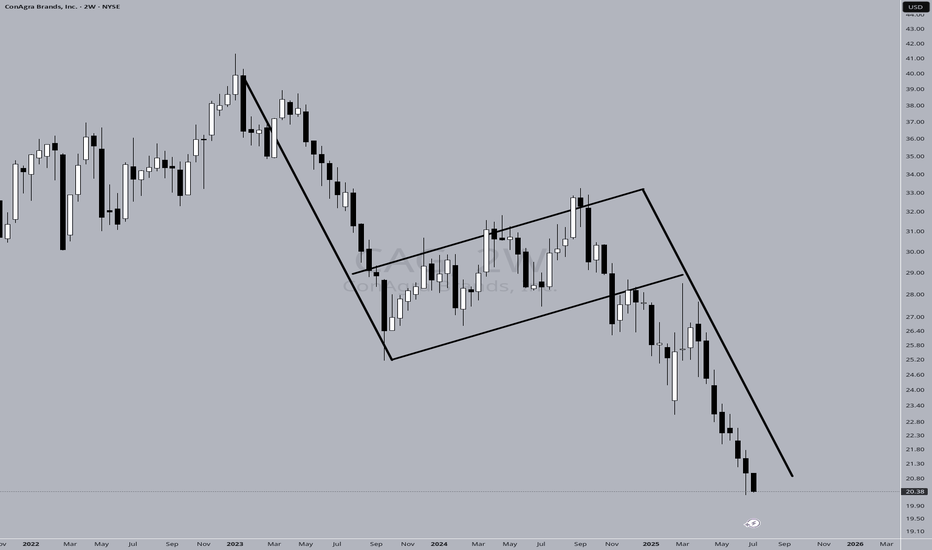

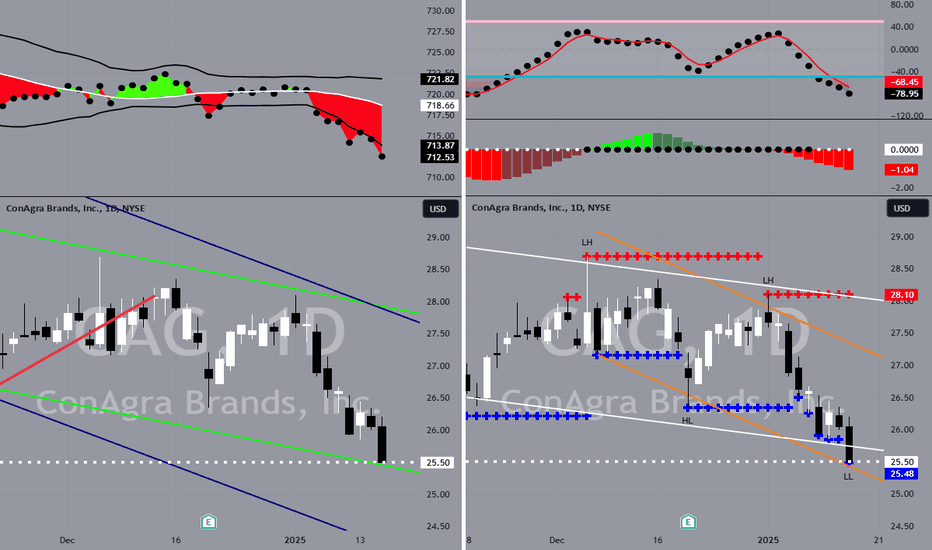

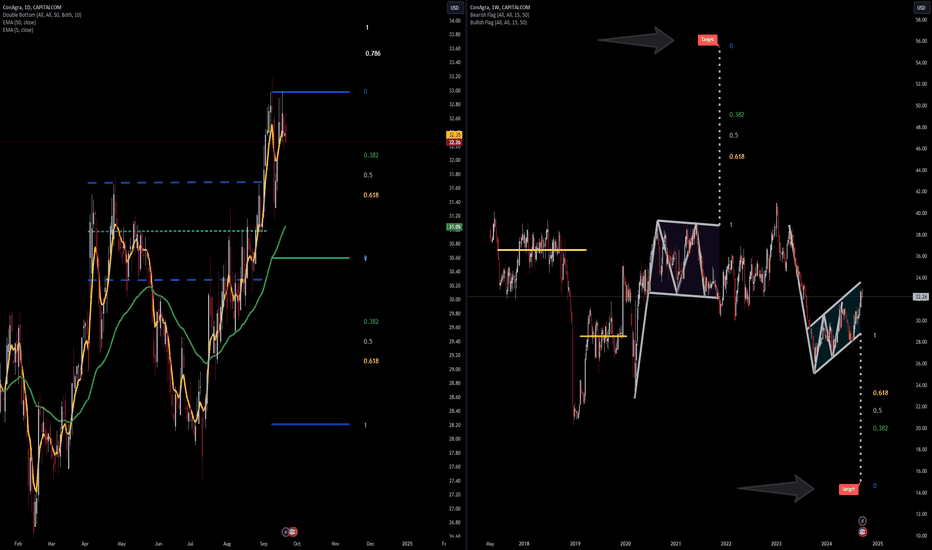

Bear Flag Completed?This pattern in stock trading is called a bear flag, right?

Here's why:

Prior Downtrend (Flagpole): You can see a significant downward move leading into the pattern, which forms the "flagpole."

Consolidation/Correction (Flag): After the sharp drop, the price enters a period of consolidati

Key facts today

Several firms cut their price targets for Conagra Brands (CAG), with Goldman Sachs at $18 and Bernstein at $21, amid ongoing cost pressures and weak sales.

8,014.71

0.01 BRL

6.58 B BRL

66.33 B BRL

About ConAgra Brands, Inc.

Sector

Industry

CEO

Sean M. Connolly

Website

Headquarters

Chicago

Founded

1919

ISIN

BRC1AGBDR008

FIGI

BBG00R2592J2

Conagra Brands, Inc. engages in the manufacture and sale of processed and packaged foods. It operates through the following segments: Grocery and Snacks, Refrigerated and Frozen, International, and Foodservice. The Grocery and Snacks segment includes branded, and shelf stable food products sold in various retail channels in the United States. The Refrigerated and Frozen segment is composed of branded, and temperature-controlled food products sold in various retail channels in the United States. The International segment offers branded food products in various temperature states, sold in various retail and foodservice channels outside of the United States. The Foodservice segment focuses on branded and customized food products, including meals, entrees, sauces, and a variety of custom-manufactured culinary products packaged for sale to restaurants and other foodservice establishments in the United States. The company was founded by Alva Kinney and Frank Little in 1919 and is headquartered in Chicago, IL.

Related stocks

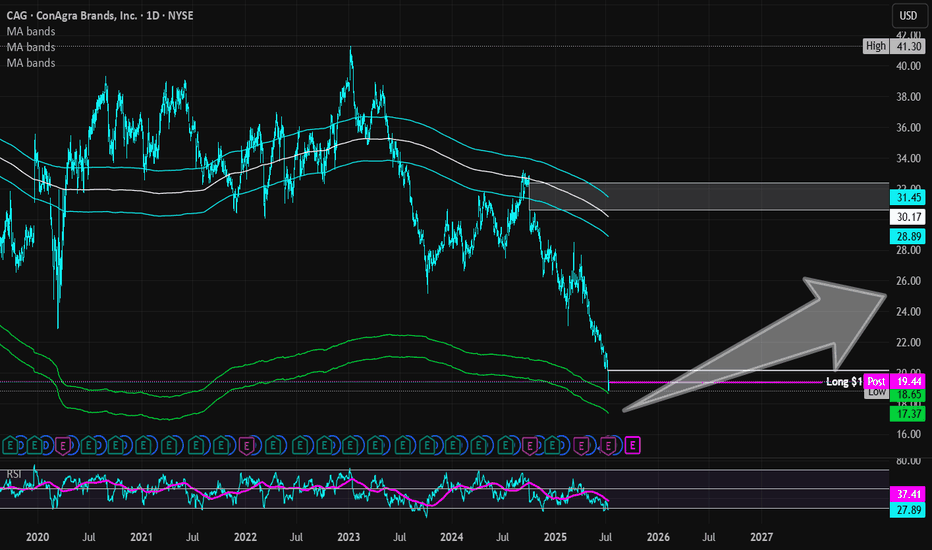

ConAgra Brands | CAG | Long at $19.38ConAgra Brands NYSE:CAG , maker of Marie Callender's, Healthy Choice, Birds Eye, Orville Redenbacher's, Slim Jim, and many more, has seen a continuous drop in share price since the rise of interest rates, inflation, and tariffs. The stock is currently trading near its book value of $18.71 and has

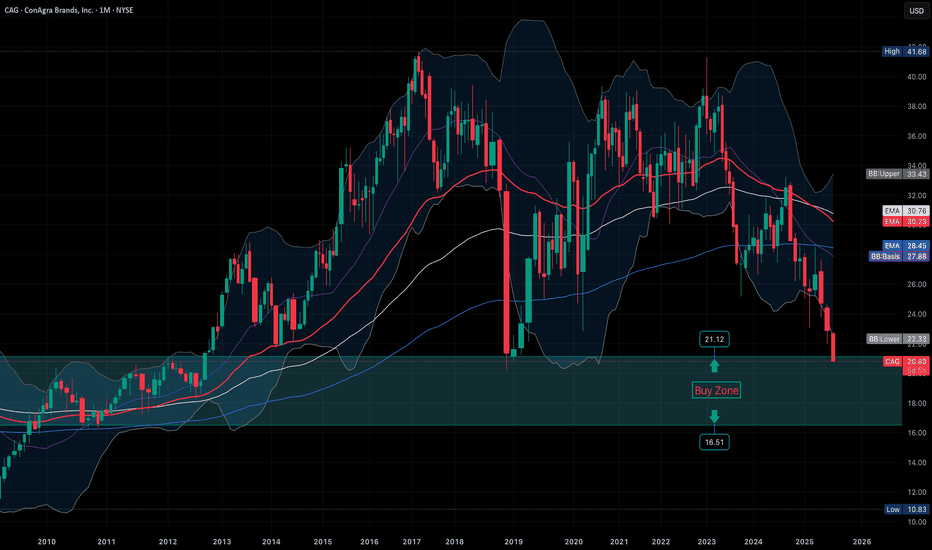

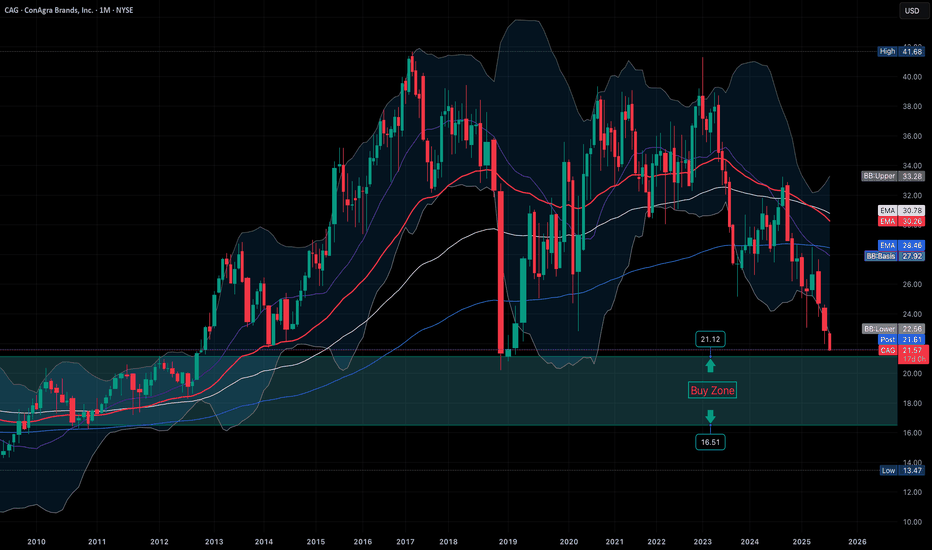

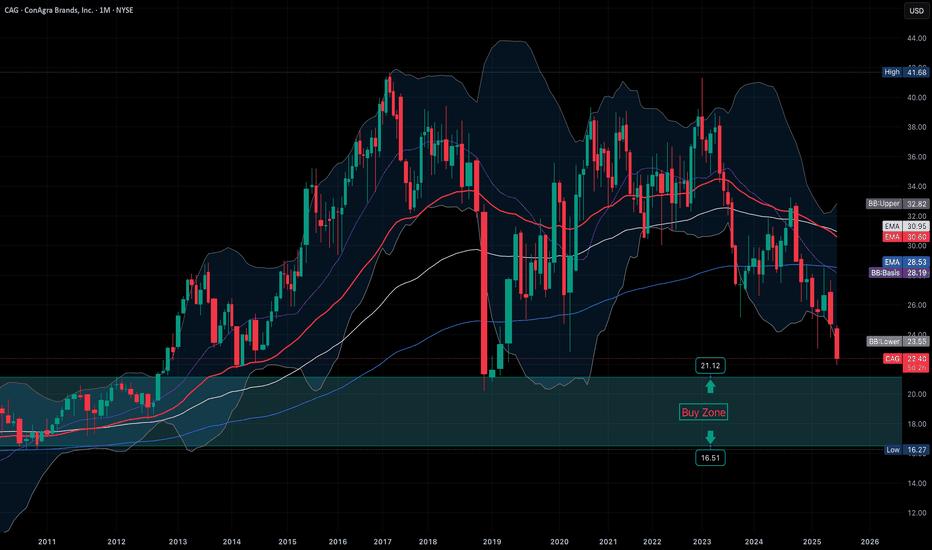

CAG Price has now entered the "Buy Zone"CAG has officially entered the Buy Zone I outlined in May ($21.12–$16.51), with today’s move pushing shares to the high $20 range.

This marks the first time in over five years the stock has traded at these levels -- historically an area where buyers have stepped in. With the zone now in play, I’ve

CAG: Approaching the Buy Zone. Plan Remains UnchangedCAG Approaching the upper edge of the Buy Zone I mapped out on May 25 ($21.12–$16.51), with today's move down to $21.57 putting it right on deck.

The chart remains structurally weak -- monthly candle still hugging the lower Bollinger Band, and the long-term trend hasn’t shifted.

Plan hasn’t change

CAG: Bearish Trend Intact. Eyes on Strategic Entry "Buy Zone"Still in a confirmed downtrend, IMO, with price action reflecting a mix of structural and macro headwinds. No interest in forcing a trade here -- but I’ve mapped out a "Buy Zone" between $21.12 and $16.51, where I’d look to scale into a long-term position.

The chart remains decisively bearish, rein

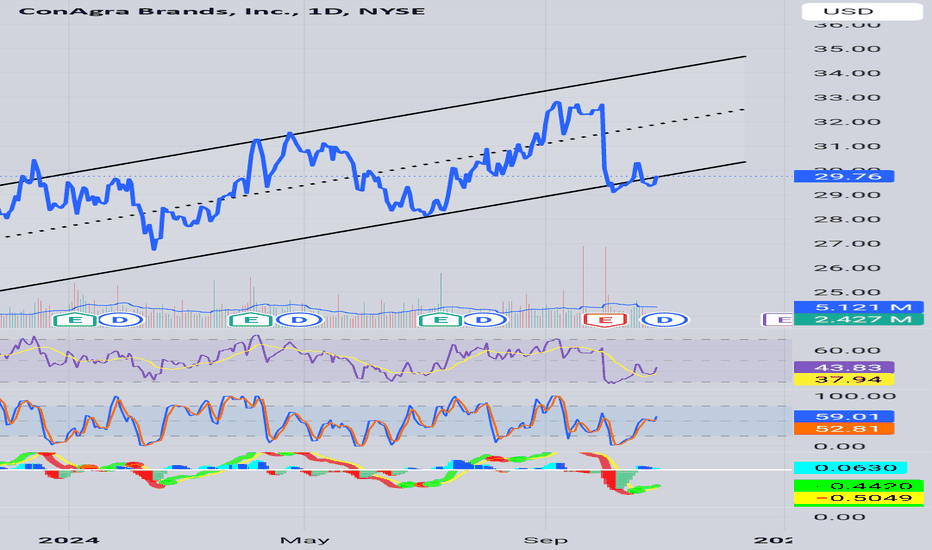

CAG to $27My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price at bottom of channels (period 52 39 & 26)

Stochastic Momentum Index (SMI) at overso

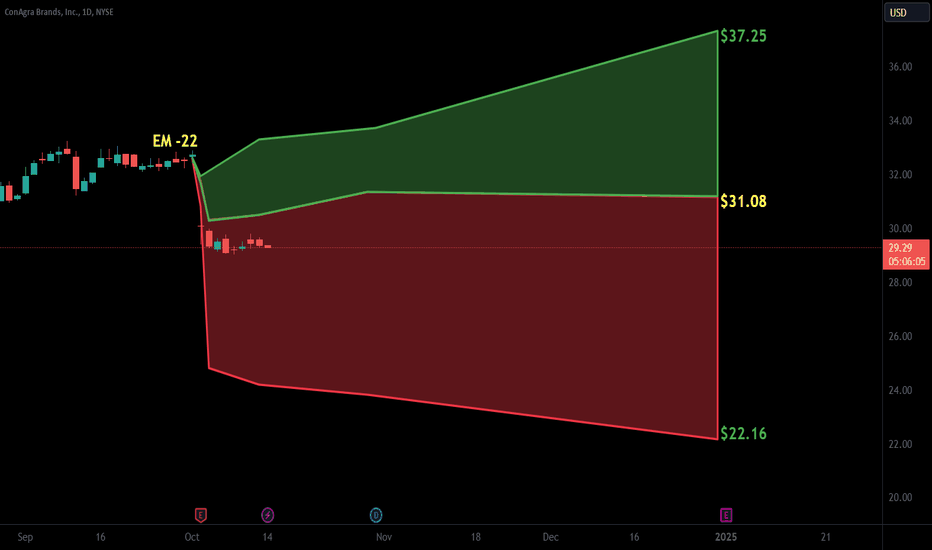

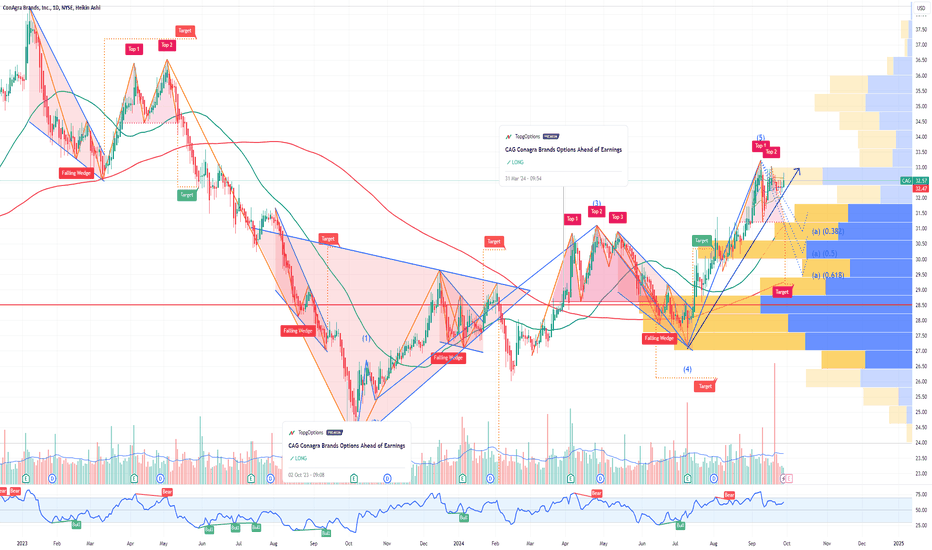

CAG Conagra Brands Options Ahead of EarningsIf you haven`t bought the dip on CAG:

Now analyzing the options chain and the chart patterns of CAG Conagra Brands prior to the earnings report this week,

I would consider purchasing the 32usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $1.05.

If these

Conagra Brands, Inc. | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

# Trend | Time Frame Conductive | Weekly Time Frame

- General

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CAG3956088

Conagra Brands, Inc. 4.65% 25-JAN-2043Yield to maturity

7.46%

Maturity date

Jan 25, 2043

US205887CE0

CONAGRA BRANDS 18/48Yield to maturity

6.78%

Maturity date

Nov 1, 2048

CAG4057799

Conagra Brands, Inc. 6.625% 15-AUG-2039Yield to maturity

6.23%

Maturity date

Aug 15, 2039

US205887CD2

CONAGRA BRANDS 18/38Yield to maturity

6.14%

Maturity date

Nov 1, 2038

US205887CF7

CONAGRA BRA. 20/27Yield to maturity

4.80%

Maturity date

Nov 1, 2027

CAG.GH

Conagra Brands, Inc. 7.0% 01-OCT-2028Yield to maturity

4.73%

Maturity date

Oct 1, 2028

US205887CC4

CONAGRA BRANDS 18/28Yield to maturity

4.71%

Maturity date

Nov 1, 2028

CAG4739466

Conagra Brands, Inc. 4.6% 01-NOV-2025Yield to maturity

4.68%

Maturity date

Nov 1, 2025

CAG5618920

Conagra Brands, Inc. 5.3% 01-OCT-2026Yield to maturity

4.66%

Maturity date

Oct 1, 2026

CAG.GG

Conagra Brands, Inc. 6.7% 01-AUG-2027Yield to maturity

4.64%

Maturity date

Aug 1, 2027

CAG.GL

Conagra Brands, Inc. 8.25% 15-SEP-2030Yield to maturity

4.54%

Maturity date

Sep 15, 2030

See all C1AG34 bonds

Curated watchlists where C1AG34 is featured.