Key facts today

Bank of America noted Shell's strong position amid low oil prices. Despite a weak Q2 update, Shell's LNG growth and acquisitions may aid recovery, with over $1 billion in net proceeds expected.

On July 8, 2025, Shell plc launched a share buy-back program for cancellation, managed by BNP PARIBAS SA until July 25, 2025, following UK Listing Rules and Market Abuse Regulations.

Shell has partnered with Libya's National Oil Corporation to evaluate hydrocarbon opportunities and conduct feasibility studies for the al-Atshan field and other NOC-owned fields.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

45.32 MXN

328.54 B MXN

5.59 T MXN

5.78 B

About SHELL PLC ORD EUR0.07

Sector

Industry

CEO

Wael Sawan

Website

Headquarters

London

Founded

2002

ISIN

GB00BP6MXD84

FIGI

BBG0150JZRH9

Shell Plc engages in the business of producing oil and natural gas. It operates through the following segments: Integrated Gas, Upstream, Marketing, Chemicals and Products, Renewables and Energy Solutions, and Corporate. The Integrated Gas segment includes liquefied natural gas, and conversion of natural gas into gas-to-liquids fuels. The Upstream segment focuses on exploration and extraction of crude oil, natural gas, and natural gas liquids. The Marketing segment is involved in mobility, lubricants, and sectors and decarbonization businesses. The Chemicals and Products segment consists of chemicals manufacturing plants with marketing network and refineries, which turn crude oil and other feedstocks into a range of oil products. The Renewables and Energy Solutions segment provides renewable power generation, marketing, trading, and optimizing power and pipeline gas, as well as carbon credits and digitally enabled customer solutions. The Corporate segment covers non-operating activities supporting Shell such as holdings, treasury organization, self-insurance activities, and headquarters and central functions. The company was founded in February 1907 and is headquartered in London, the United Kingdom.

Related stocks

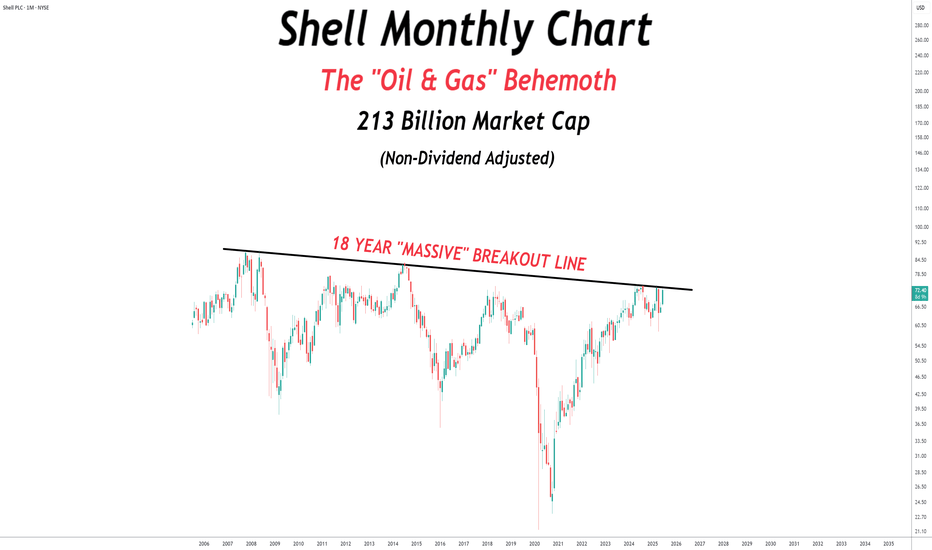

RDSA Shell Koninklijke Olie kan naar 7,5 terugvallen; Shell to 7De vraag naar olie droogt op zoals de vraag naar Haver terug liep toen paarden vervangen werden met brandstof autos. We vervangen nu de olie met electriciteit en dan is Koninklijke Olie klaar.

The demand for oil dries up like the demand for Horsefood fell back when horses were being replaced with f

SHEL opened a short position✅SHEL #SHEL is an energy and petrochemical company in Europe, Asia, Oceania, Africa, the USA and other countries of America.

📊 FUNDAMENTAL ANALYSIS

🔴Impeccable balance sheet and good value.

🔴Traded 8.5% below our fair value estimate

🔴Earnings growth is projected at 4.72% per year.

🔴Analysts agr

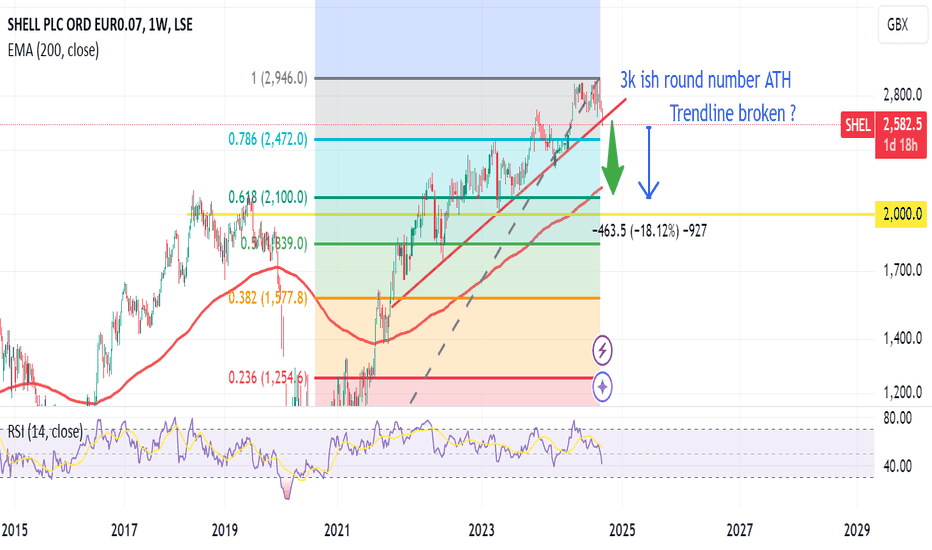

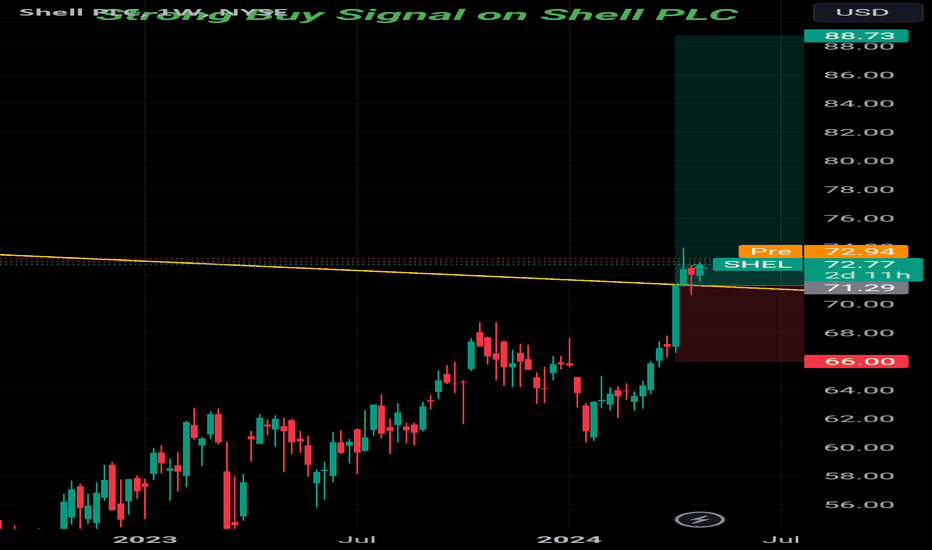

25% sell Shell and buy BPBP and Shell move together and BP has already lead the way lower

If Shell moves back to relative parity there is a 25% poss move

Shell moves back to EMA 200

Shell moves back to 0.618 fib retracement of prior move

This could be start of much larger move lower

Most MSM are claiming inflation t

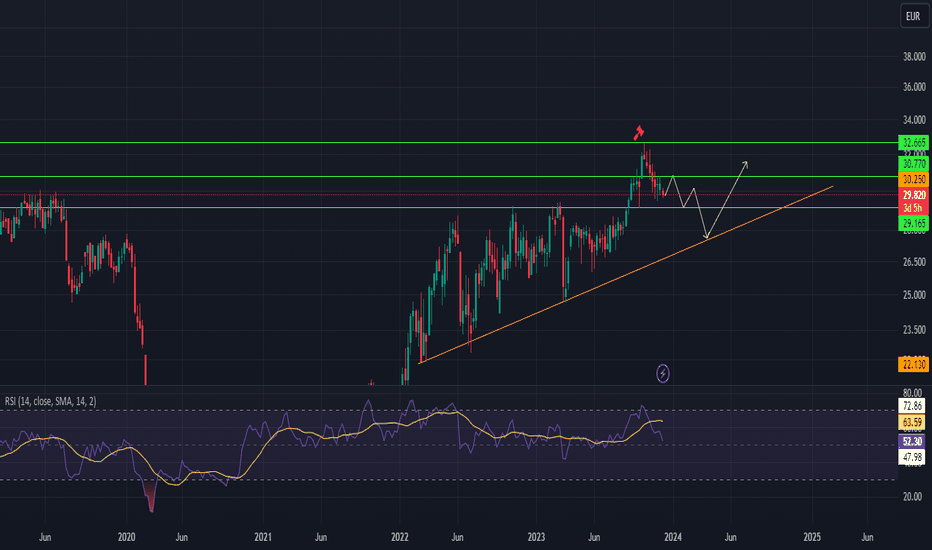

Shell quick 18% to sell off back to 200 EMA and to 61.8 FibAs Oil is weak bearish case for Shell to sell back to its 200 EMA and then just fake out below this level to reach the 61.8 Fib retracement of the recent move up

Shell looks like it just broke is support trendline

Other points Oil has broken out of a wedge and appears to be moving lower

BP and S

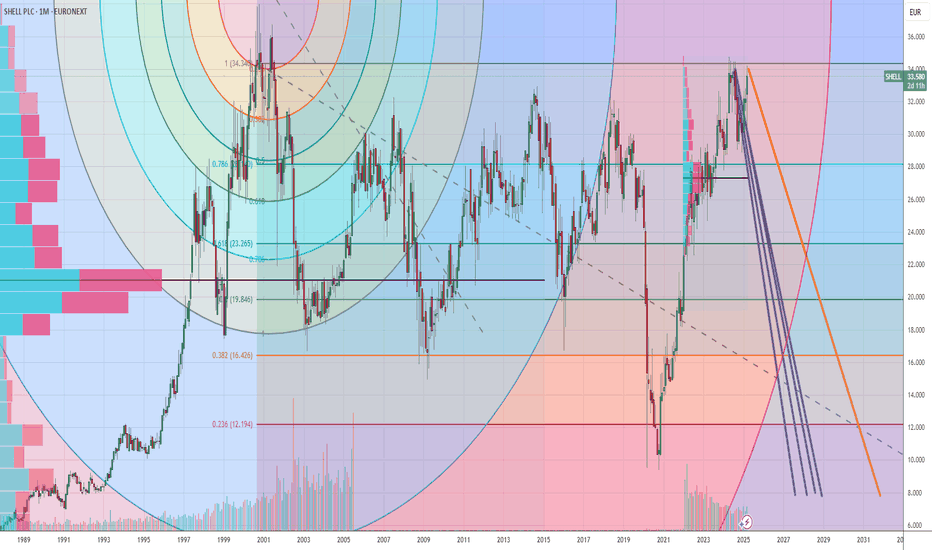

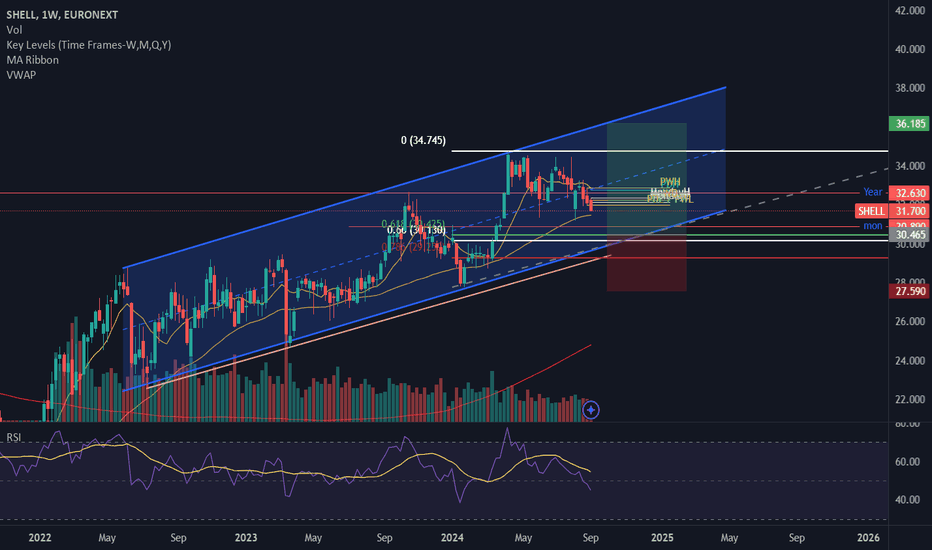

75: Key Levels Amidst Biofuel Plant Construction HaltShell (SHEL) is navigating significant financial and operational challenges. The company recently announced a delay in the construction of its biofuel plant in Rotterdam, which was initially expected to be operational this year but has now been postponed to 2030. This delay has resulted in a financi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS222838746

SHELL INTL F 20/52 MTNYield to maturity

8.80%

Maturity date

Sep 10, 2052

US822582CE0

SHELL INTL F 19/49Yield to maturity

7.03%

Maturity date

Nov 7, 2049

US822582CL4

SHELL INTL F 21/51Yield to maturity

7.02%

Maturity date

Nov 26, 2051

US822582CH3

SHELL INTL F 20/50Yield to maturity

6.97%

Maturity date

Apr 6, 2050

RDS5913231

Shell Finance US Inc. 3.25% 06-APR-2050Yield to maturity

6.72%

Maturity date

Apr 6, 2050

US822582BY7

SHELL INTL FIN. 16/46Yield to maturity

6.66%

Maturity date

Sep 12, 2046

US822582CK6

SHELL INTL F 21/41Yield to maturity

6.63%

Maturity date

Nov 26, 2041

RDS5913232

Shell Finance US Inc. 3.75% 12-SEP-2046Yield to maturity

6.48%

Maturity date

Sep 12, 2046

RDS5913229

Shell Finance US Inc. 4.0% 10-MAY-2046Yield to maturity

6.44%

Maturity date

May 10, 2046

US822582AT9

SHELL INTL FIN. 12/42Yield to maturity

6.42%

Maturity date

Aug 21, 2042

S0IC

SHELL INTL FIN. 13/43Yield to maturity

6.23%

Maturity date

Aug 12, 2043

See all SHEL/N bonds

Curated watchlists where SHEL/N is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

See all sparks

Frequently Asked Questions

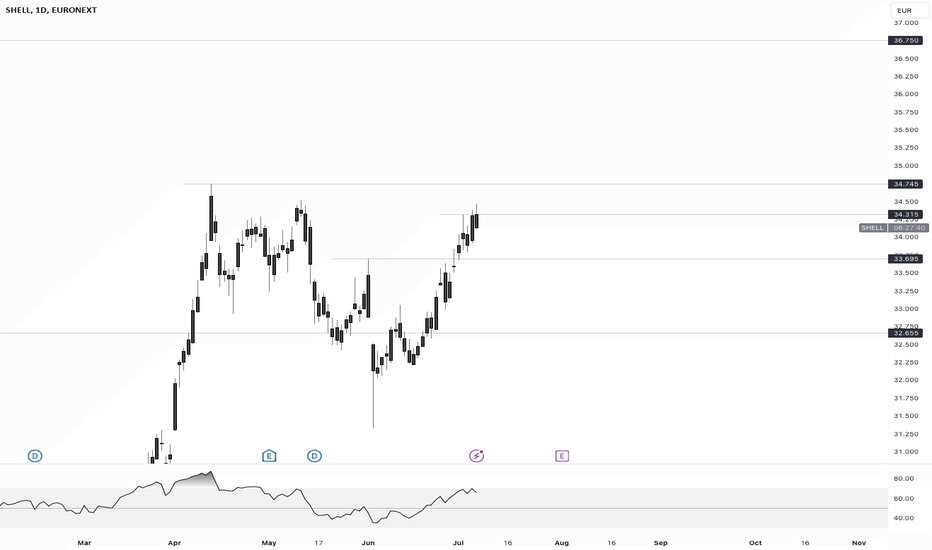

The current price of SHEL/N is 674.00 MXN — it hasn't changed in the past 24 hours. Watch SHELL PLC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange SHELL PLC stocks are traded under the ticker SHEL/N.

SHEL/N stock hasn't changed in a week, the month change is a 4.09% rise, over the last year SHELL PLC has showed a 14.39% increase.

We've gathered analysts' opinions on SHELL PLC future price: according to them, SHEL/N price has a max estimate of 1,019.23 MXN and a min estimate of 624.28 MXN. Watch SHEL/N chart and read a more detailed SHELL PLC stock forecast: see what analysts think of SHELL PLC and suggest that you do with its stocks.

SHEL/N reached its all-time high on Apr 1, 2025 with the price of 751.40 MXN, and its all-time low was 494.33 MXN and was reached on Jul 6, 2023. View more price dynamics on SHEL/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SHEL/N stock is 0.00% volatile and has beta coefficient of 1.13. Track SHELL PLC stock price on the chart and check out the list of the most volatile stocks — is SHELL PLC there?

Today SHELL PLC has the market capitalization of 3.82 T, it has increased by 1.20% over the last week.

Yes, you can track SHELL PLC financials in yearly and quarterly reports right on TradingView.

SHELL PLC is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

SHEL/N earnings for the last quarter are 18.85 MXN per share, whereas the estimation was 16.84 MXN resulting in a 11.91% surprise. The estimated earnings for the next quarter are 13.54 MXN per share. See more details about SHELL PLC earnings.

SHELL PLC revenue for the last quarter amounts to 1.42 T MXN, despite the estimated figure of 1.57 T MXN. In the next quarter, revenue is expected to reach 1.19 T MXN.

SHEL/N net income for the last quarter is 100.43 B MXN, while the quarter before that showed 18.89 B MXN of net income which accounts for 431.72% change. Track more SHELL PLC financial stats to get the full picture.

SHELL PLC dividend yield was 4.36% in 2024, and payout ratio reached 53.97%. The year before the numbers were 4.00% and 44.45% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 8, 2025, the company has 104 K employees. See our rating of the largest employees — is SHELL PLC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SHELL PLC EBITDA is 1.18 T MXN, and current EBITDA margin is 16.92%. See more stats in SHELL PLC financial statements.

Like other stocks, SHEL/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SHELL PLC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SHELL PLC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SHELL PLC stock shows the buy signal. See more of SHELL PLC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.