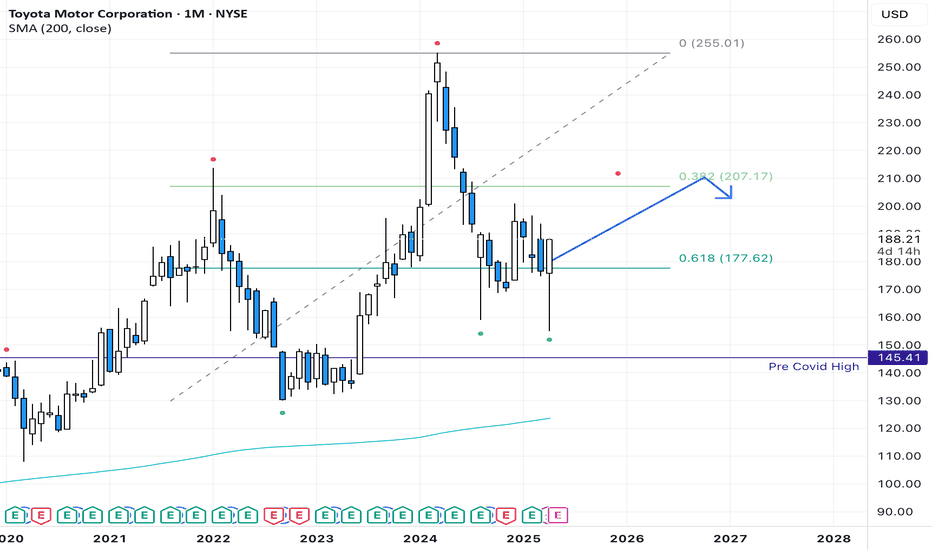

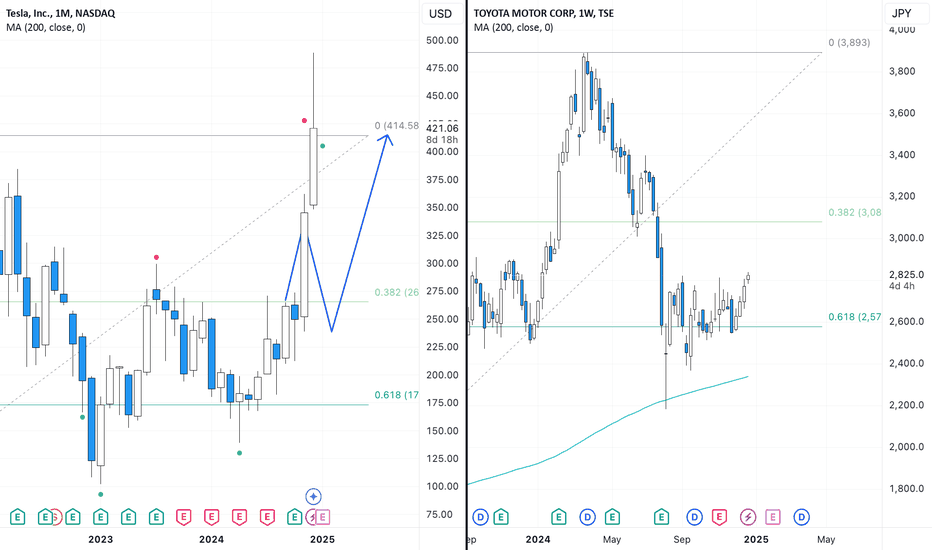

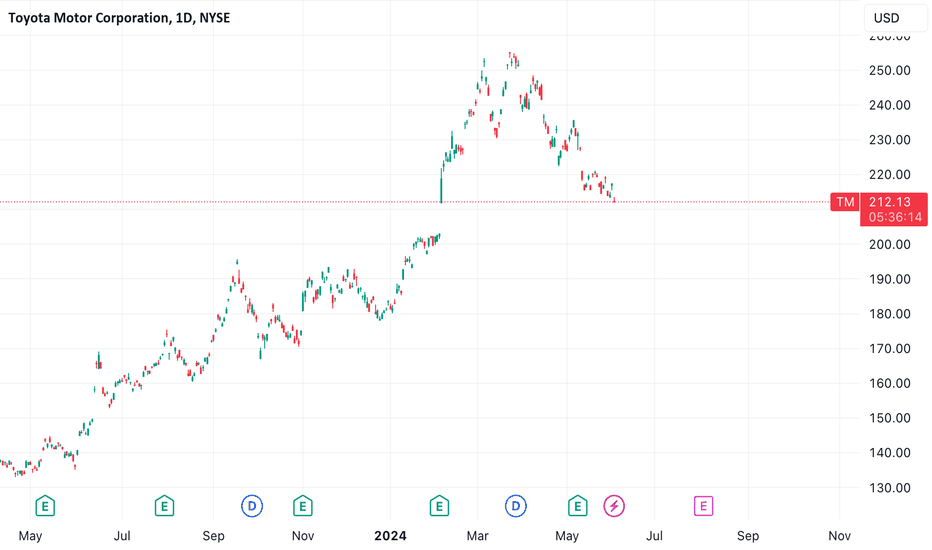

Toyota on Fire — Just Getting Started?The global EV theme has faced renewed pressure as China's BYD aggressively captures market share, putting giants like Tesla and Toyota under strain. Toyota's stock recently plunged near its 2023 lows as sales expectations were trimmed.

However, technicals paint a different picture now.

The stock s

Key facts today

Toyota Motor aims to privatize its subsidiary, Toyota Industries, in a $33 billion deal, addressing shareholder concerns over governance linked to parent-child listings.

Toyota Motor will increase prices for some vehicles sold in the US by an average of $270 starting next month, as part of its regular pricing review, with shares down 1% in pre-bell trading.

S&P Global Ratings assigned an A+ rating to Toyota Motor's US dollar bonds, highlighting its strong market position, steady profits, and solid finances amid challenges from auto electrification.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

482.96 MXN

640.36 B MXN

6.46 T MXN

1.30 B

About TOYOTA MOTOR CORP

Sector

Industry

CEO

Koji Sato

Website

Headquarters

Toyota

Founded

1937

FIGI

BBG000C3WQ97

Toyota Motor Corp. engages in the manufacture and sale of motor vehicles and parts. It operates through the following segments: Automotive, Financial Services, and All Other. The Automotive segment designs, manufactures, assembles and sells passenger cars, minivans, trucks, and related vehicle parts and accessories. It is also involved in the development of intelligent transport systems. The Financial Services segment offers purchase or lease financing to Toyota vehicle dealers and customers. It also provides retail leasing through lease contracts purchased by dealers. The All Others segment deals with the design, manufacture, and sale of housing, telecommunications and other businesses. The company was founded by Kiichiro Toyoda on August 28, 1937 and is headquartered in Toyota, Japan.

Related stocks

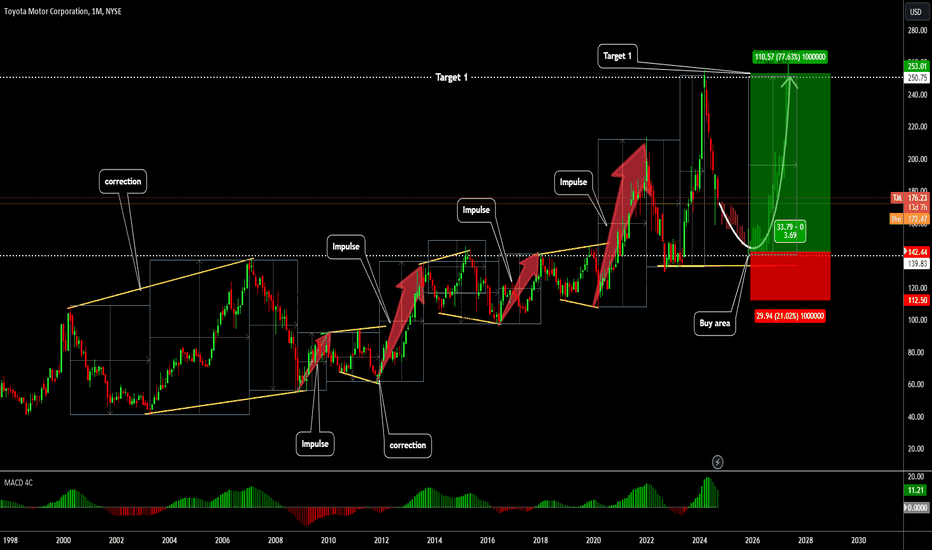

Bullish on Toyota, Buy when confirmation hitsToyota is a huge company with it's earnings reports as of late picking up massive steam, since this whole Tariff debacle It is only clearly apparent that the stock is ready to rebound after a long period of bearish behavior, once we reach the confirmation line we can say for certain that Toyota is o

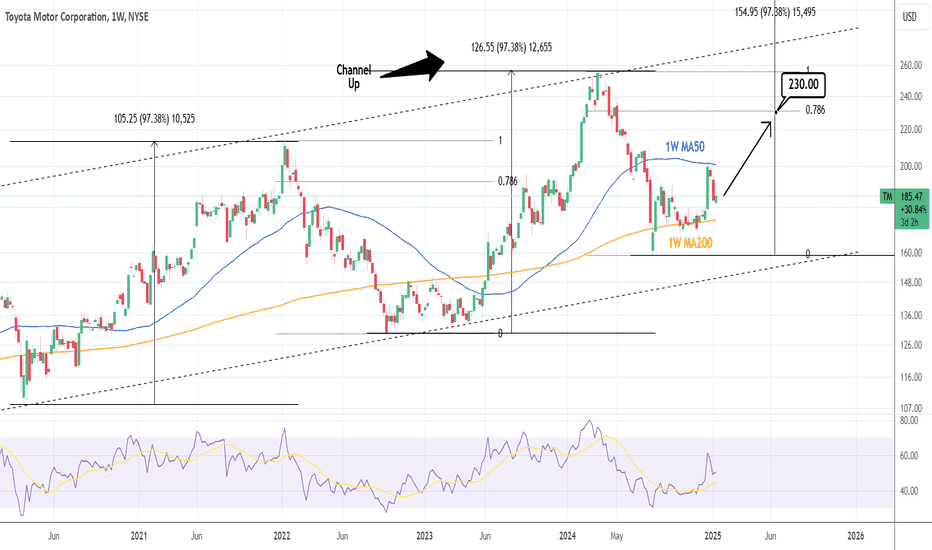

TOYOTA: Excellent conditions for a long term buy.Toyota is neutral both on its 1D (RSI = 51.295, MACD = 2.650, ADX = 28.284) and 1W technical outlook. On the last week of December it got rejected on the 1W MA50 and if it finds support on the 1W MA200, we expect it to recreate the bottom pattern of March 2023. For almost the past 5 years the patter

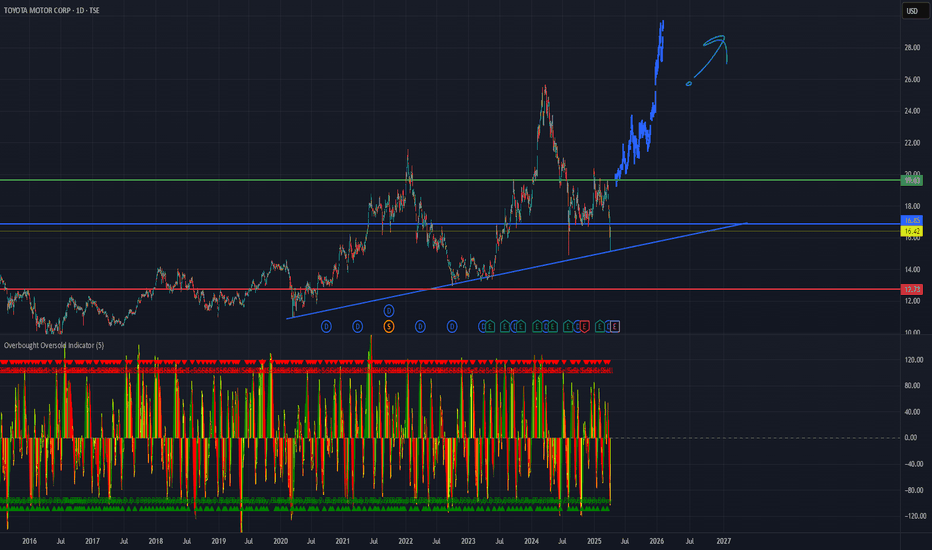

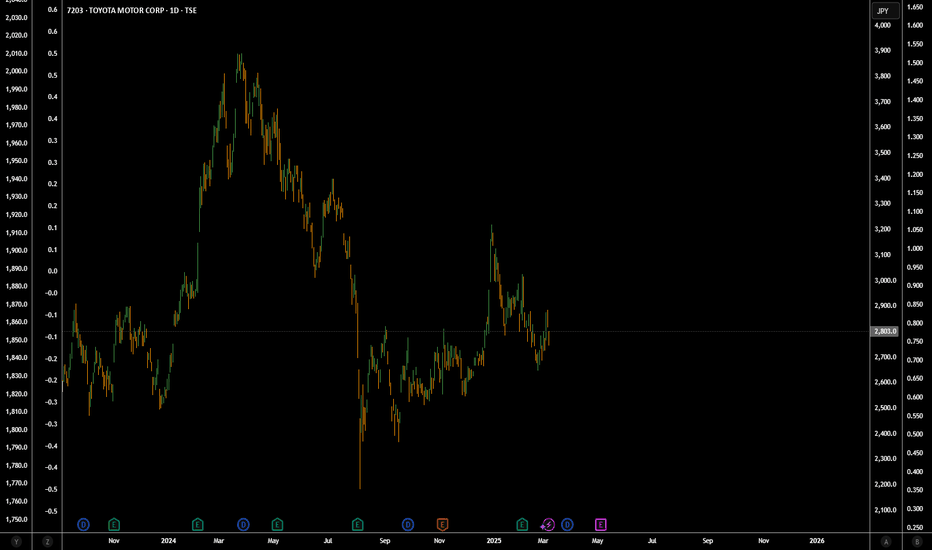

Electric Vehicles: The Top Trends to Watch in 2025Trump's friendly relationship with Elon Musk, combined with the potential continued market focus on electric vehicles and the automotive sector next year, is worth keeping an eye on. Currently, Toyota's stock in Japan is showing signs of a technical rebound, and the Toyota ADRs listed in the U.S. se

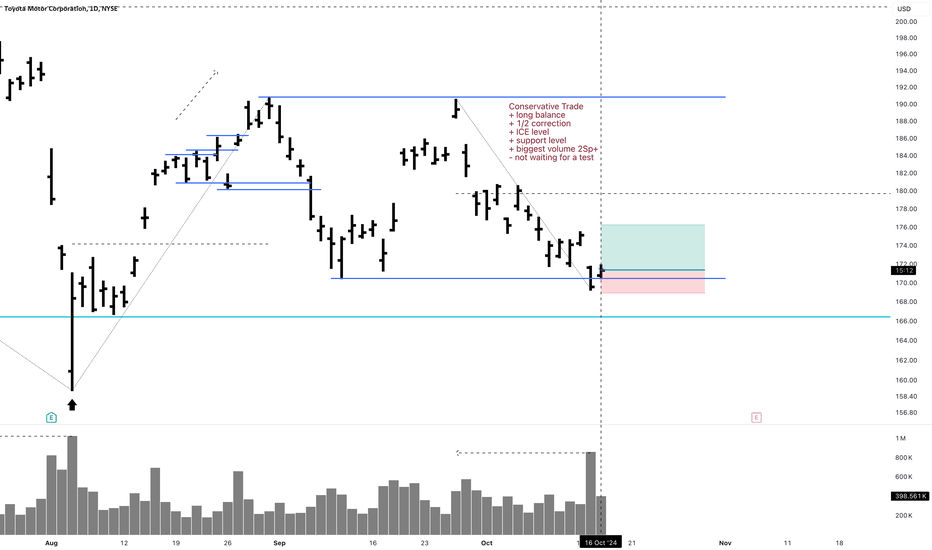

TM 1D Investment Long Conservative TradeConservative Trade

+ long balance

+ 1/2 correction

+ ICE level

+ support level

+ biggest volume 2Sp+

- not waiting for a test

Monthly Trend

"+ long impulse

+ T2 level

+ 1/2 correction

+ support level

+ biggest volume Sp

+ weak test?"

Calculated affordable stop limit at $168.93

Take profits

20% at

Toyota setting up for buy opportunities in monthly chartHello,

In the fast-paced world of stock trading, timing is everything. And right now, Toyota Motor Corporation is setting up for what could be one of the most profitable opportunities this year. But why are savvy investors rushing to position themselves at this very moment?

The answer lies in a ra

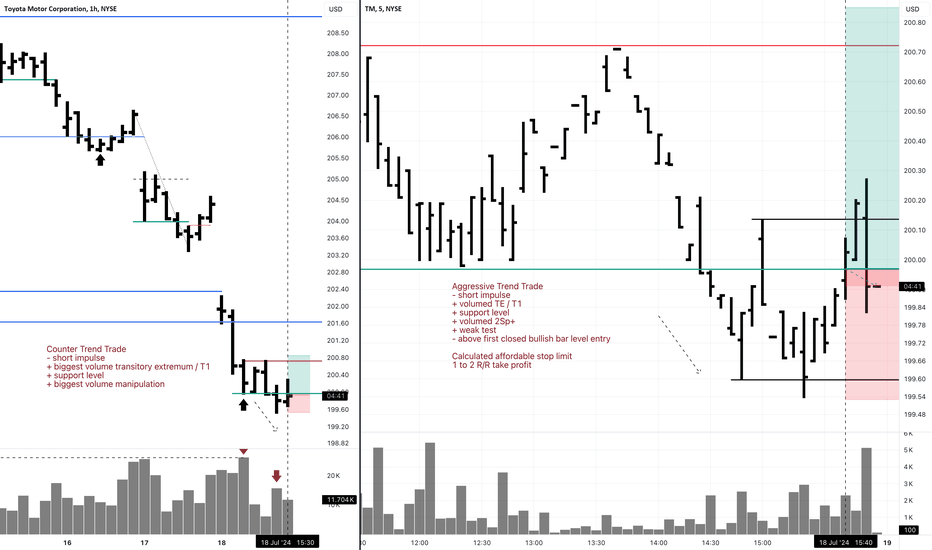

TM 5M Long Daytrade Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ volumed TE / T1

+ support level

+ volumed 2Sp+

+ weak test

- above first closed bullish bar level entry

Calculated affordable stop limit

1 to 2 R/R take profit

Hourly context counter trend

"- short impulse

+ biggest volume transitory extremum / T1

+ support

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TYCZX

Toyota Cia Financiera de Argentina SA FRN 06-JUN-2026Yield to maturity

24.39%

Maturity date

Jun 6, 2026

TM5437697

Toyota Motor Credit Corporation 3.95% 30-JUN-2025Yield to maturity

7.08%

Maturity date

Jun 30, 2025

TM4623671

Toyota Motor Credit Corporation 4.0% 27-APR-2048Yield to maturity

5.93%

Maturity date

Apr 27, 2048

TM5714111

Toyota Motor Credit Corporation 5.5% 13-DEC-2035Yield to maturity

5.50%

Maturity date

Dec 13, 2035

TM5899558

Toyota Motor Credit Corporation 5.0% 28-SEP-2039Yield to maturity

5.38%

Maturity date

Sep 28, 2039

XS1885506813

TOYOTA MOTOR CREDIT STEP-UP 24OT25Yield to maturity

5.30%

Maturity date

Oct 24, 2025

TM5762431

Toyota Motor Credit Corporation 5.3% 28-FEB-2029Yield to maturity

5.20%

Maturity date

Feb 28, 2029

TM5761808

Toyota Motor Credit Corporation 5.25% 05-MAR-2029Yield to maturity

5.10%

Maturity date

Mar 5, 2029

US89236TJQ9

TOYOTA M.CRD 21/31 MTNYield to maturity

5.09%

Maturity date

Sep 12, 2031

TM5974783

Toyota Motor Credit Corporation 5.35% 09-JAN-2035Yield to maturity

5.06%

Maturity date

Jan 9, 2035

TM5732713

Toyota Motor Credit Corporation 5.0% 22-JAN-2029Yield to maturity

5.04%

Maturity date

Jan 22, 2029

See all TM/N bonds