Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.73 USD

4.15 B USD

31.79 B USD

952.41 M

About PayPal Holdings, Inc.

Sector

CEO

James Alexander Chriss

Website

Headquarters

San Jose

Founded

1998

FIGI

BBG0077VNXV6

PayPal Holdings, Inc. engages in the development of technology platforms that enable digital payments and simplifies commerce experiences on behalf of merchants and consumers worldwide. Its solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom, and Paydiant products. The firm also enables consumers to exchange funds with merchants using funding sources, which include bank account, PayPal account balance, PayPal Credit account, credit, and debit card or other stored value products. It operates through United States and Other Countries geographical segments. The company was founded in December 1998 and is headquartered in San Jose, CA.

Related stocks

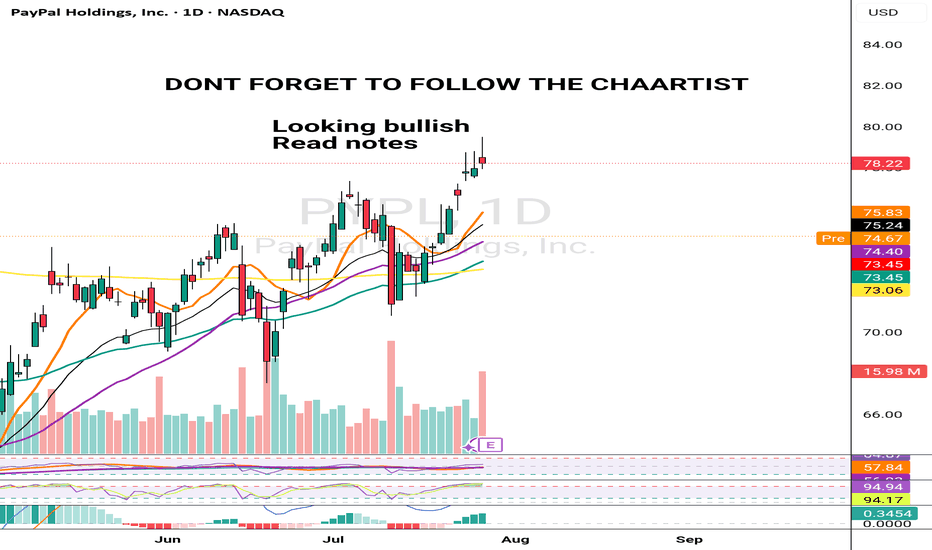

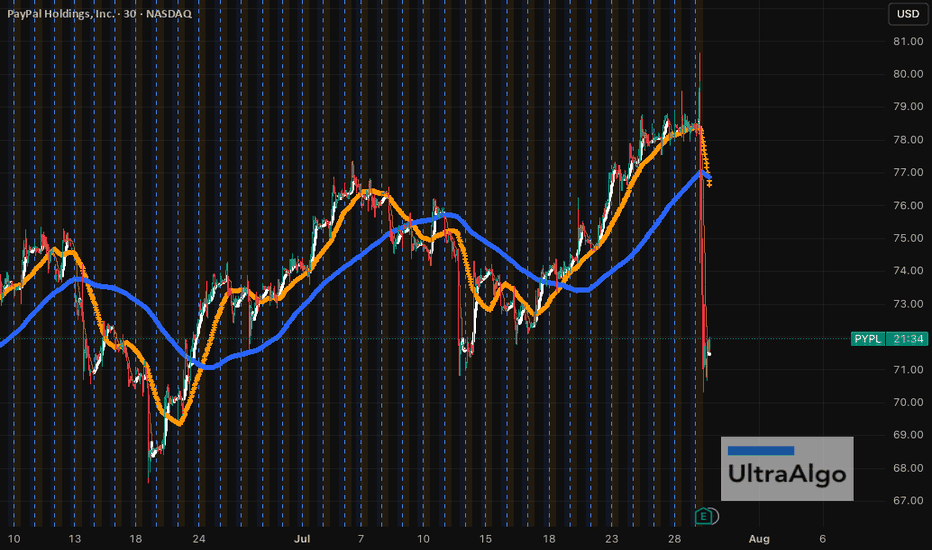

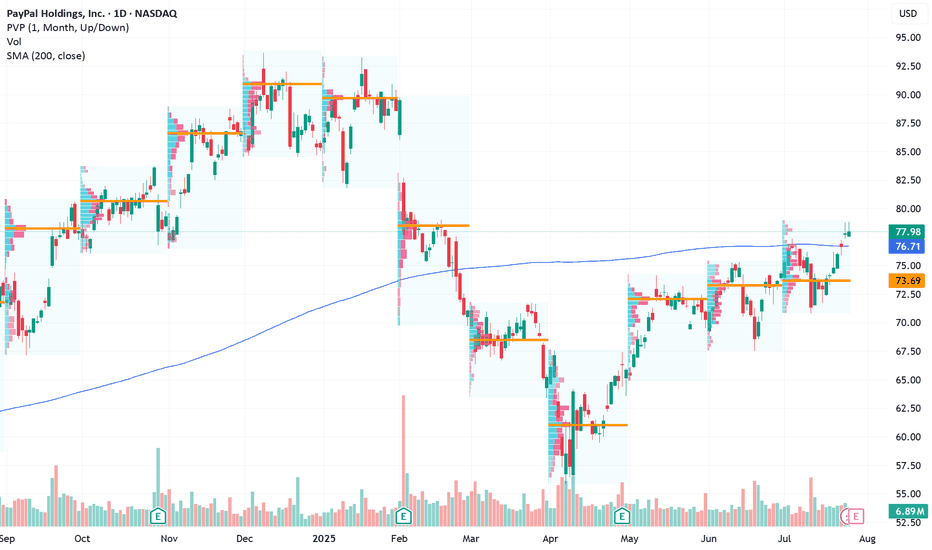

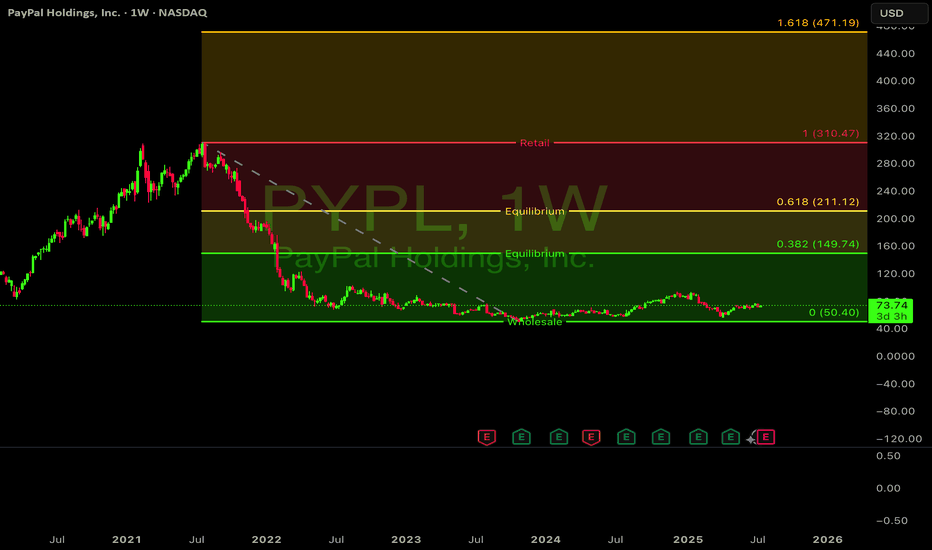

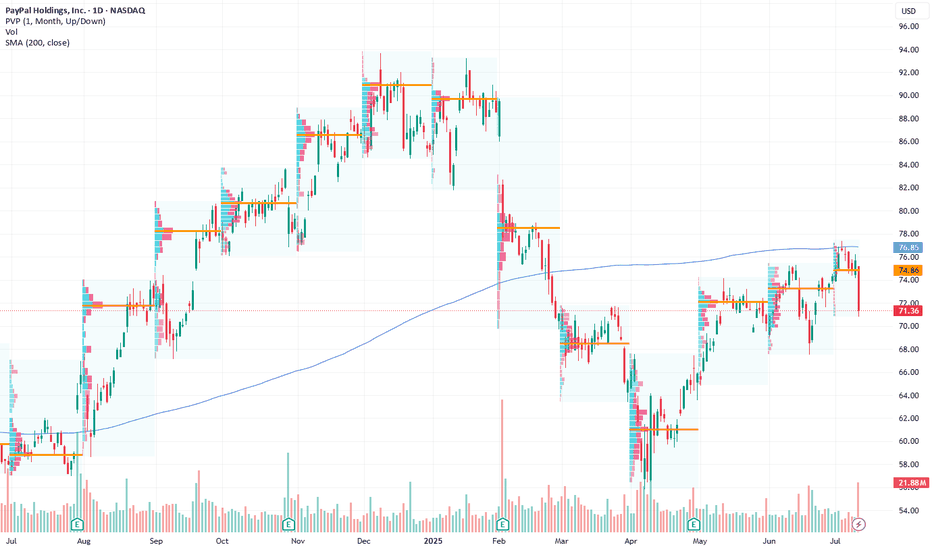

$PYPL - nice value gap just formed. Any takers?NASDAQ:PYPL smashed through the $75 resistance a week ago, signaling strong bullish momentum. Holding above the 50 SMA, the stock is poised for further gains. Then earlier 10% dip from mixed signals. UltraAlgo flagged it early, giving traders a heads-up of a potential Buy signal in the making. Char

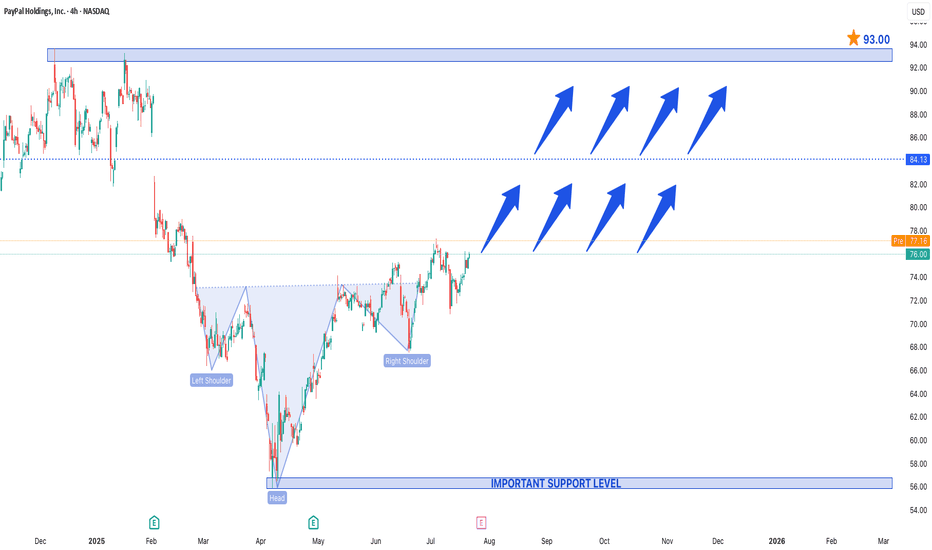

Head & Shoulders Pattern Spotted in PayPal Holdings IncHead & Shoulders Pattern Spotted in PayPal Holdings Inc.

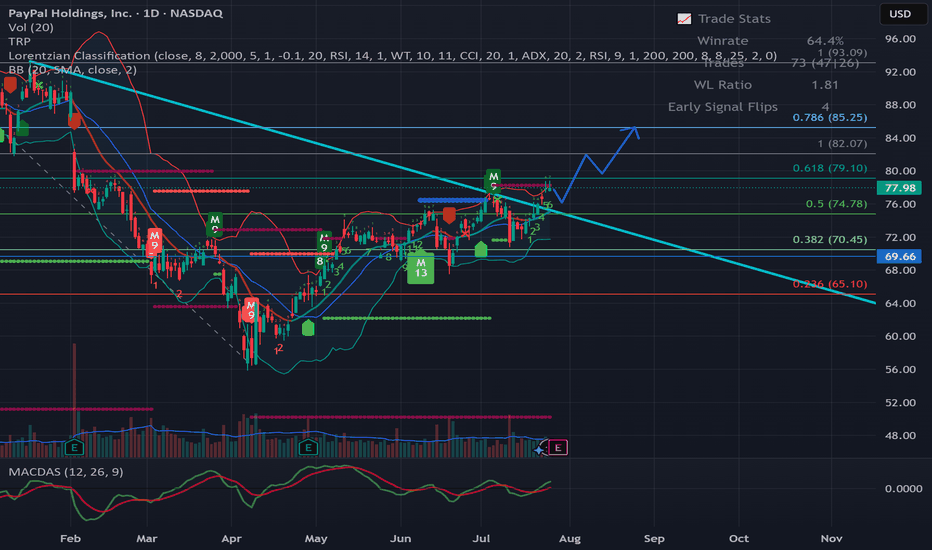

A Head & Shoulders (H&S) pattern has been identified in PayPal Holdings Inc. (PYPL), but unlike the traditional bearish reversal setup, this could be an inverse Head & Shoulders, signaling a potential bullish turnaround.

Key Observations:

PayPal’s Stablecoin Ambitions Falter Ahead of Earnings ReportWhen PayPal launched its own stablecoin PYUSD in August 2023, the move was seen by many as a bold step toward dominating the digital payments space. However, nearly two years later, PYUSD has yet to meet expectations. Its market share remains minimal, trading volume is weak, and trust from the DeFi

Go Long on PayPal Amid Strategic Stability and Earnings Catalyst Current Price: $77.98

Direction: LONG

Targets:

- T1 = $80.50

- T2 = $83.00

Stop Levels:

- S1 = $76.00

- S2 = $74.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

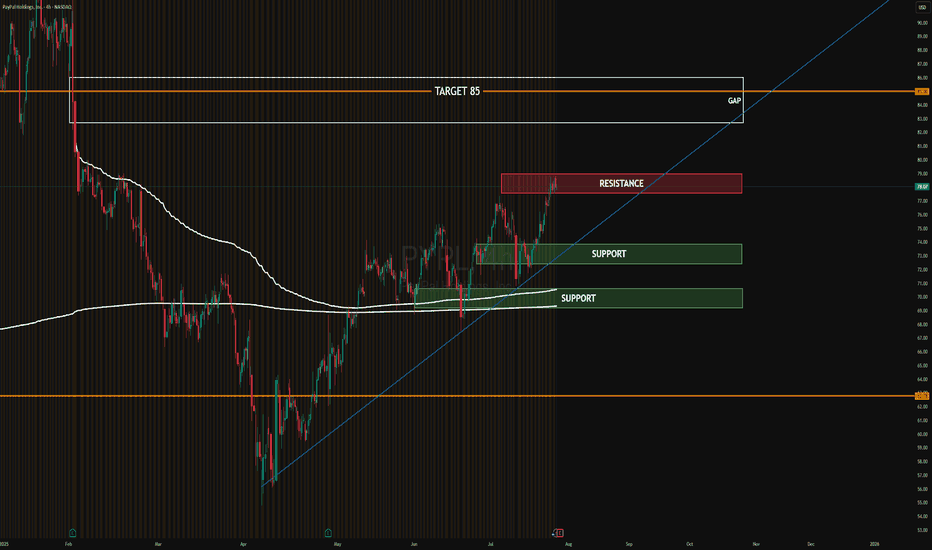

PYPL - Potential to 85.00Hello Everyone,

This week i will be busy on Sunday and not have time to work on Charts. Therefore today i spent some time and make some analysis.

PYPL is the first one.

Look like there is a break out to up trend and I am expecting it to reach 85 soon which is more than %10 .

It could re-test to

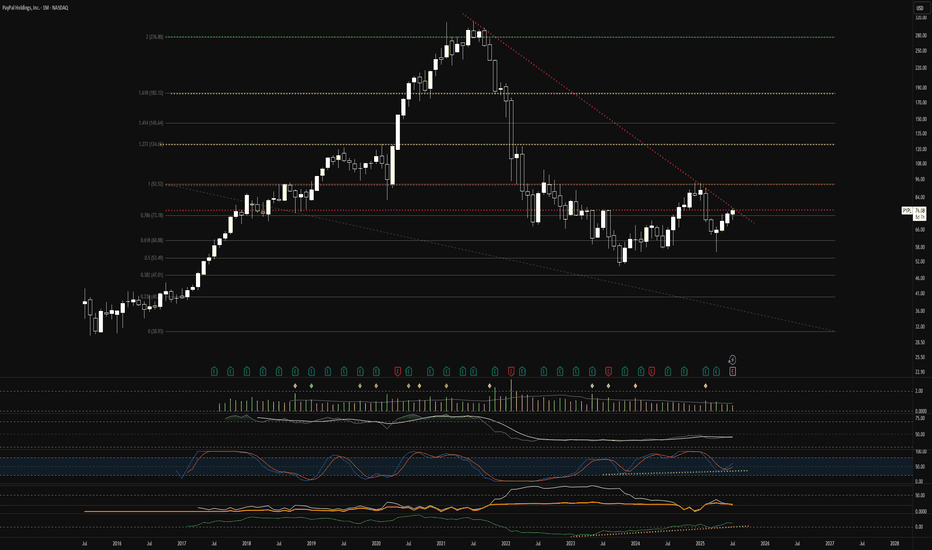

$PYPL should be in your kids kids accountNASDAQ:PYPL breaking out! PayPal forming solid base above $70 after 3-month consolidation. Recent upgrade from Seaport Global signals shifting sentiment. Chart shows golden cross with volume confirmation.

Key resistance at $75 once broken, path to $85+ looks clear.

Long-term target: $141 .

Ult

PayPal: Short Position Recommended as Bearish Divergence SignalsCurrent Price: $71.36

Direction: SHORT

Targets:

- T1 = $69.00

- T2 = $66.50

Stop Levels:

- S1 = $73.00

- S2 = $74.50

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ident

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PYPL4986744

PayPal Holdings, Inc. 3.25% 01-JUN-2050Yield to maturity

6.63%

Maturity date

Jun 1, 2050

PYPL5415329

PayPal Holdings, Inc. 5.25% 01-JUN-2062Yield to maturity

5.91%

Maturity date

Jun 1, 2062

US70450YAM5

PAYPAL HLDGS 22/52Yield to maturity

5.87%

Maturity date

Jun 1, 2052

PYPL5815519

PayPal Holdings, Inc. 5.5% 01-JUN-2054Yield to maturity

5.70%

Maturity date

Jun 1, 2054

PYPL6020599

PayPal Holdings, Inc. 5.1% 01-APR-2035Yield to maturity

4.91%

Maturity date

Apr 1, 2035

PYPL5815518

PayPal Holdings, Inc. 5.15% 01-JUN-2034Yield to maturity

4.82%

Maturity date

Jun 1, 2034

PYPL6020598

PayPal Holdings, Inc. FRN 06-MAR-2028Yield to maturity

4.77%

Maturity date

Mar 6, 2028

US70450YAH6

PAYPAL HLDGS 20/30Yield to maturity

4.72%

Maturity date

Jun 1, 2030

US70450YAL7

PAYPAL HLDGS 22/32Yield to maturity

4.62%

Maturity date

Jun 1, 2032

US70450YAE3

PAYPAL HLDGS 19/29Yield to maturity

4.45%

Maturity date

Oct 1, 2029

2PPA

PAYPAL HLDGS 19/26Yield to maturity

4.31%

Maturity date

Oct 1, 2026

See all PYPL bonds

Curated watchlists where PYPL is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BOATS exchange PayPal Holdings, Inc. stocks are traded under the ticker PYPL.

We've gathered analysts' opinions on PayPal Holdings, Inc. future price: according to them, PYPL price has a max estimate of 120.00 USD and a min estimate of 62.00 USD. Watch PYPL chart and read a more detailed PayPal Holdings, Inc. stock forecast: see what analysts think of PayPal Holdings, Inc. and suggest that you do with its stocks.

Yes, you can track PayPal Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

PayPal Holdings, Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

PYPL earnings for the last quarter are 1.40 USD per share, whereas the estimation was 1.30 USD resulting in a 7.97% surprise. The estimated earnings for the next quarter are 1.21 USD per share. See more details about PayPal Holdings, Inc. earnings.

PayPal Holdings, Inc. revenue for the last quarter amounts to 8.29 B USD, despite the estimated figure of 8.08 B USD. In the next quarter, revenue is expected to reach 8.21 B USD.

PYPL net income for the last quarter is 1.26 B USD, while the quarter before that showed 1.29 B USD of net income which accounts for −2.02% change. Track more PayPal Holdings, Inc. financial stats to get the full picture.

No, PYPL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 24.4 K employees. See our rating of the largest employees — is PayPal Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PayPal Holdings, Inc. EBITDA is 7.16 B USD, and current EBITDA margin is 21.35%. See more stats in PayPal Holdings, Inc. financial statements.

Like other stocks, PYPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PayPal Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.