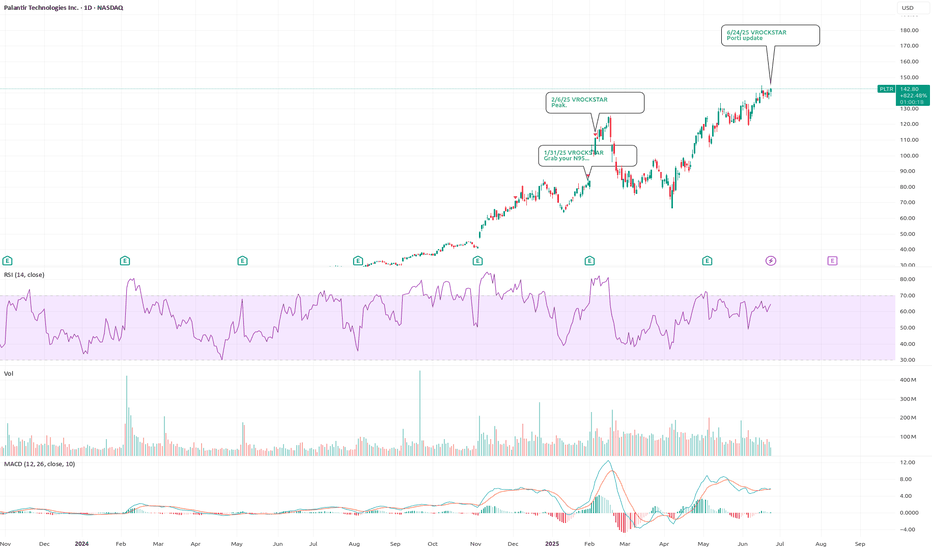

6/24/25 - $pltr - Porti update6/24/25 :: VROCKSTAR :: NASDAQ:PLTR

Porti update

- decided to do it on this "heads i win tails you lose" stonk

- good luck to the believers.

portfolio - i think mkt is cooked but could melt up. so i dug in my heels. 3 names i like. and shorts that r cheap and silly expensive. let's see who wins.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.25 USD

462.19 M USD

2.87 B USD

2.14 B

About Palantir Technologies Inc.

Sector

Industry

CEO

Alexander Caedmon Karp

Website

Headquarters

Denver

Founded

2003

FIGI

BBG01Q9GQZ82

Palantir Technologies, Inc. engages in the business of building and deploying software platforms that serve as the central operating systems for its customers. It operates through the Commercial and Government segments. The Commercial segment focuses on customers working in non-government industries. The Government segment is involved in providing services to customers that are the United States government and non-United States government agencies. The company was founded by Alexander Ceadmon Karp, Peter Andreas Thiel, Stephen Cohen, Joseph Lonsdale, and Nathan Dale Gettings in 2003 and is headquartered in Denver, CO.

Related stocks

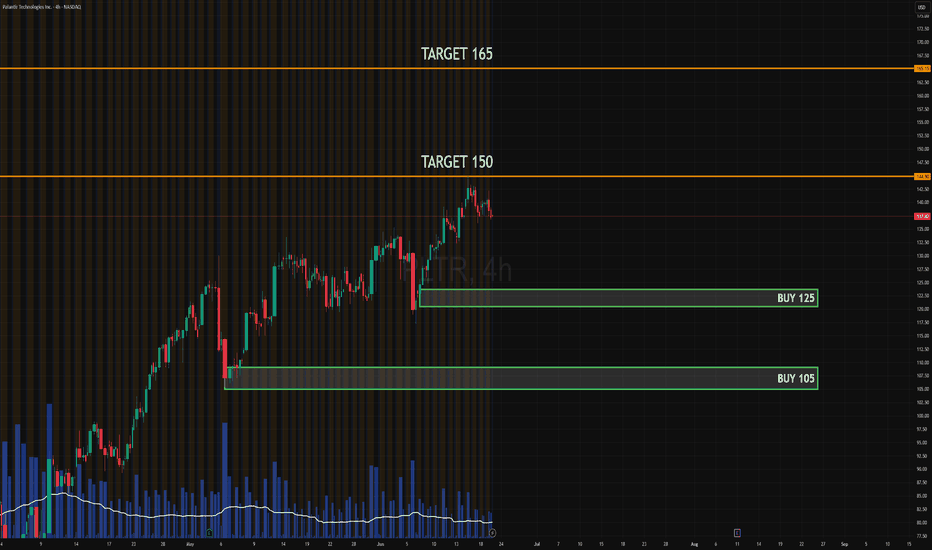

Bearish Divergences - Short TriggeredThis move up in the fifth wave is showing a bearish divergence on the RSI. I expected us to reach the $146-150 level. I have entered a short position with a tight stop loss. Nobody knows when the party's over, I'll take my chance here and if I am proven wrong, it will only be at a small loss.

Not

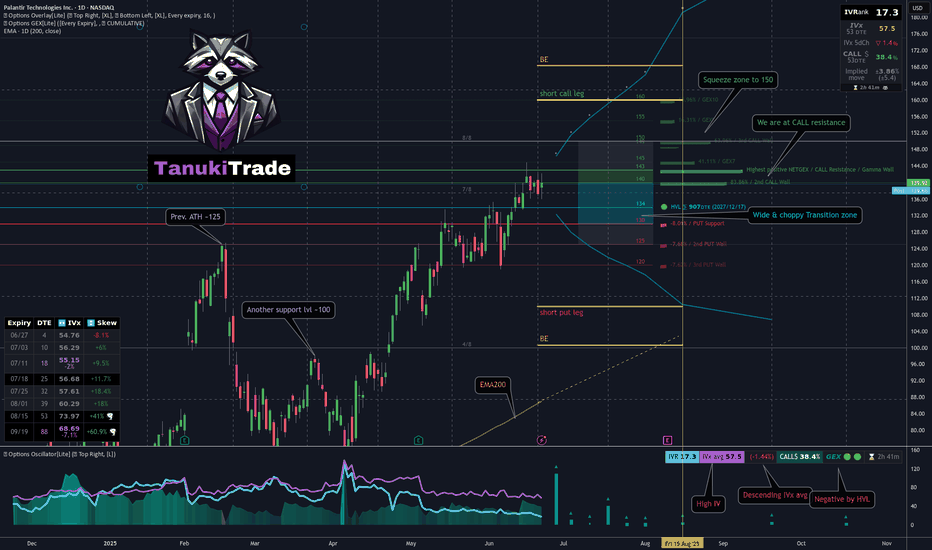

Jade Lizard on PLTR - My 53DTE Summer Theta PlayMany of you — and yes, I see you in my DMs 😄 — are trading PLTR, whether using LEAPS, wheeling, or covered calls.

I took a closer look. And guess what?

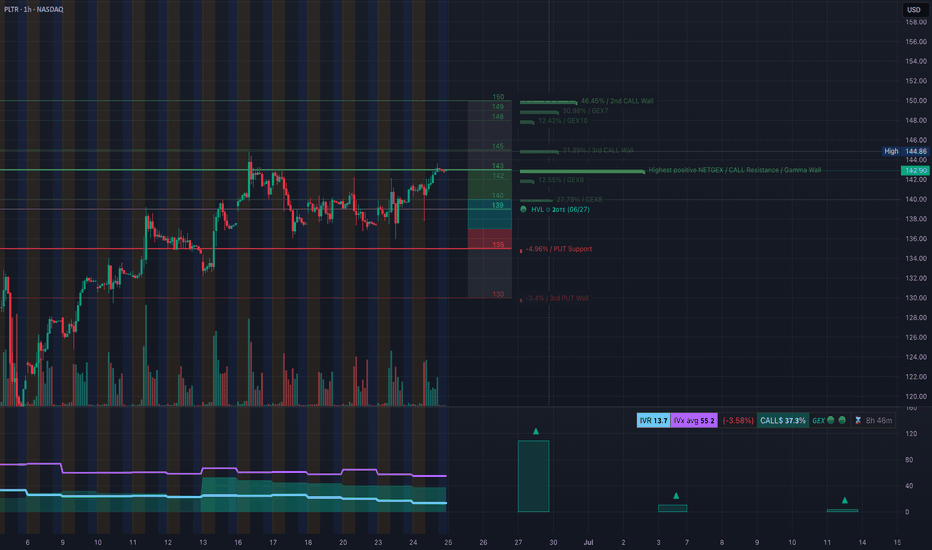

📈 After a strong move higher, PLTR was rejected right at the $143 call wall — pretty much all cumulative expiries cluster resistance there

Usin

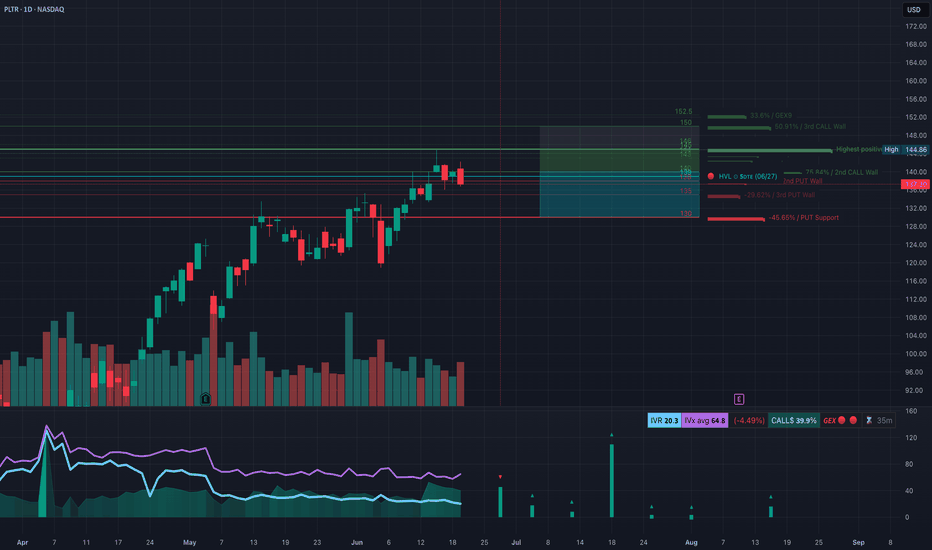

PLTR at a Decision Point – Will It Defend or Break Lower? Jun 23PLTR at a Decision Point – Will It Defend This Channel or Break Lower?

🔹 Options Sentiment (GEX) Overview:

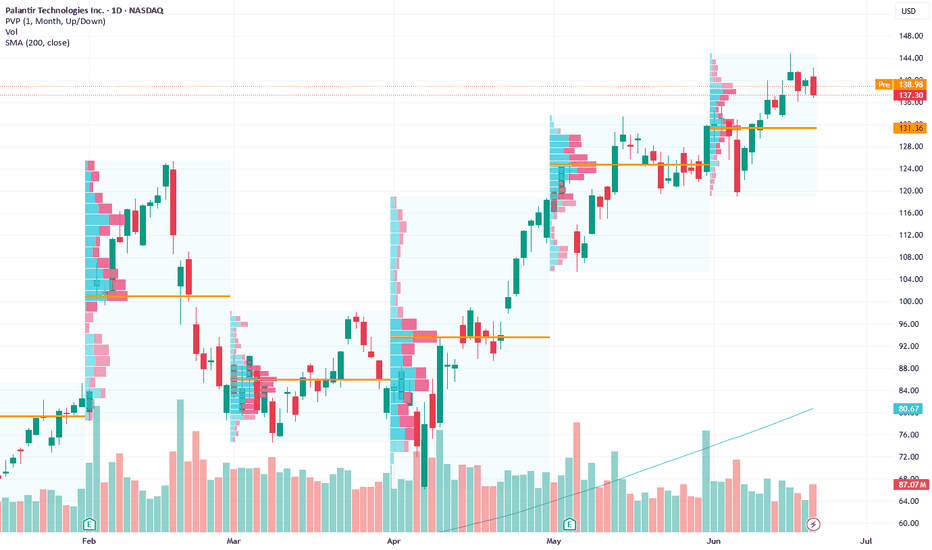

* Current Price: $137.30

* Gamma Flip Zone: $140.00 (HVL, short-term battleground)

* Call Walls:

* $143.00 (2nd Call Wall)

* $150.00–$152.5 (3rd Call Wall + GEX resistance zone)

* Put

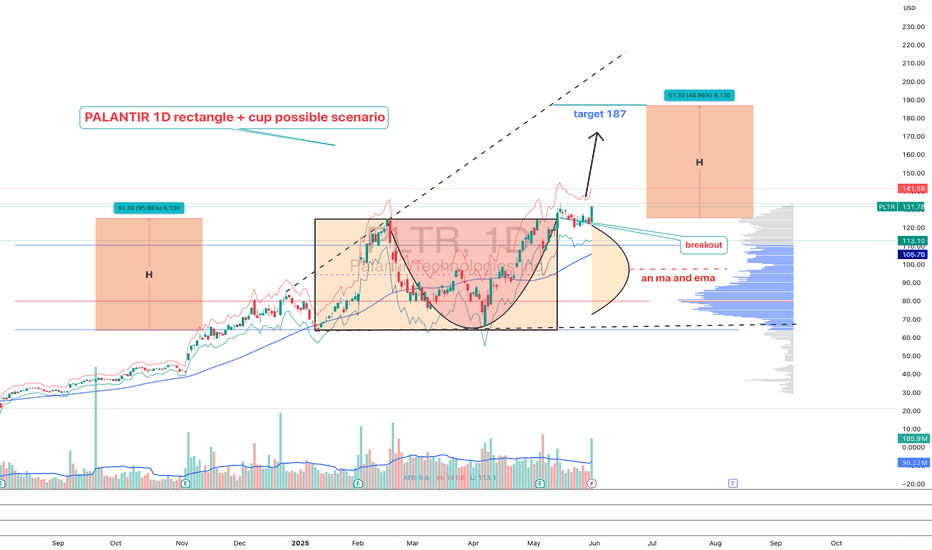

PLTR 1D — When the tea is brewed and the handle’s in placePalantir’s daily chart is shaping up a textbook cup with handle pattern — one of the most reliable continuation setups in technical analysis. The cup base was formed over several months and transitioned into a consolidation phase, building a rectangle structure where smart money likely accumulat

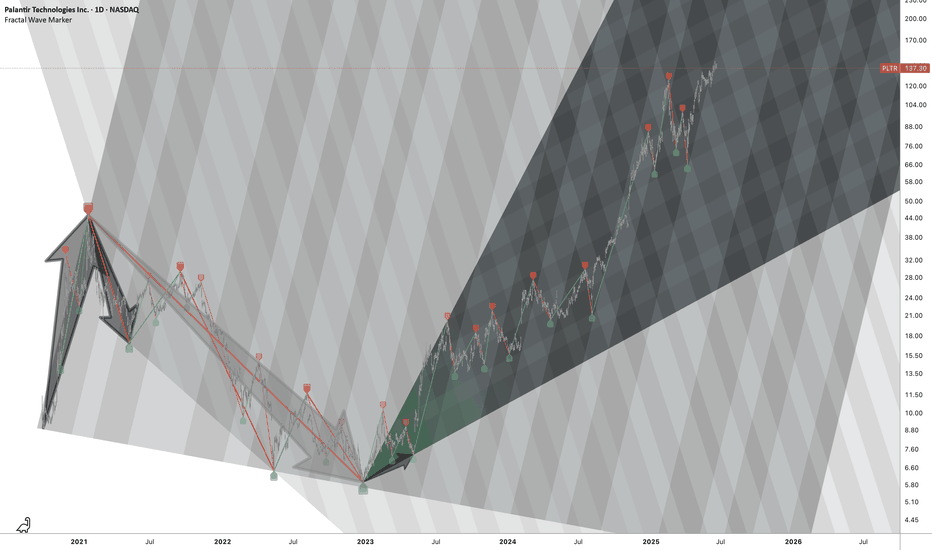

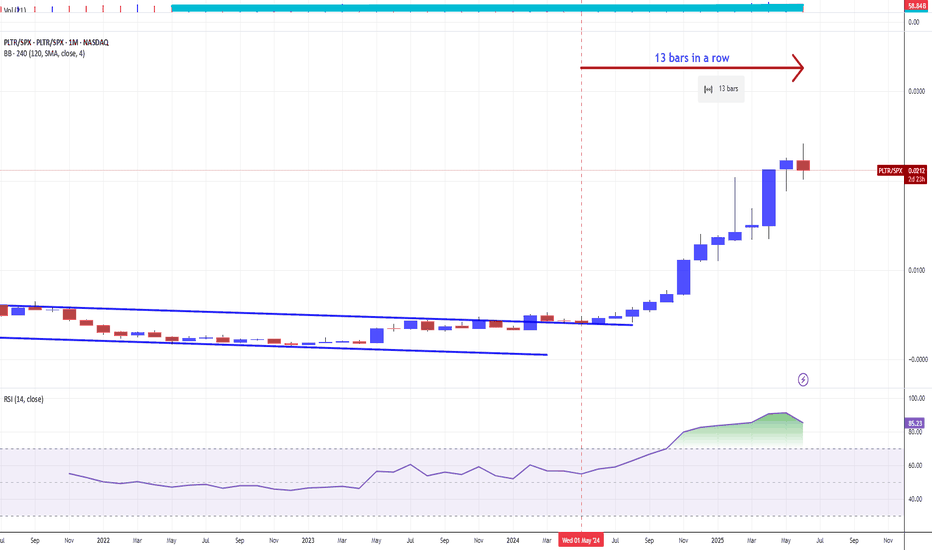

PALANTIR vs S&P500 INDEX. WILL AI UPBEAT TYCOON BUFFETT ITSELFFar far ago, somewhere in another Galaxy, in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas.

1️⃣ What was your best trade this year?

2️⃣ What is your trading goal for 2025?

Here's what we answered:

1️⃣ Wha

PLTR Breaking Resistance: Gamma Squeeze Potential to $144–$148?🧠 GEX Insights – Options Setup

* Current Price: $143.23

* Highest Positive GEX Level: $142.00

* Next Call Walls:

* $144.00 → +31.09% GEX (3rd Call Wall)

* $148.00 → +46.45% GEX (2nd Call Wall)

* IVR: 13.7 (low)

* IVX Avg: 55.2 → IV is underpriced, suitable for long calls

* Call Flow: 37.3% b

Long-Term Growth Opportunity Awaits Breakout

Targets:

- T1 = $140.00

- T2 = $145.00

Stop Levels:

- S1 = $133.00

- S2 = $130.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PLTR is 142.40 USD — it has decreased by −0.52% in the past 24 hours. Watch PALANTIR TECH INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BVL exchange PALANTIR TECH INC stocks are traded under the ticker PLTR.

PLTR stock has risen by 0.28% compared to the previous week, the month change is a 15.12% rise, over the last year PALANTIR TECH INC has showed a 183.10% increase.

We've gathered analysts' opinions on PALANTIR TECH INC future price: according to them, PLTR price has a max estimate of 160.00 USD and a min estimate of 40.00 USD. Watch PLTR chart and read a more detailed PALANTIR TECH INC stock forecast: see what analysts think of PALANTIR TECH INC and suggest that you do with its stocks.

PLTR reached its all-time high on Jun 24, 2025 with the price of 143.15 USD, and its all-time low was 50.30 USD and was reached on Nov 5, 2024. View more price dynamics on PLTR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PLTR stock is 0.53% volatile and has beta coefficient of 2.32. Track PALANTIR TECH INC stock price on the chart and check out the list of the most volatile stocks — is PALANTIR TECH INC there?

Today PALANTIR TECH INC has the market capitalization of 308.54 B, it has decreased by −2.91% over the last week.

Yes, you can track PALANTIR TECH INC financials in yearly and quarterly reports right on TradingView.

PALANTIR TECH INC is going to release the next earnings report on Aug 11, 2025. Keep track of upcoming events with our Earnings Calendar.

PLTR earnings for the last quarter are 0.13 USD per share, whereas the estimation was 0.13 USD resulting in a 1.05% surprise. The estimated earnings for the next quarter are 0.14 USD per share. See more details about PALANTIR TECH INC earnings.

PALANTIR TECH INC revenue for the last quarter amounts to 883.86 M USD, despite the estimated figure of 862.17 M USD. In the next quarter, revenue is expected to reach 937.45 M USD.

PLTR net income for the last quarter is 214.03 M USD, while the quarter before that showed 79.01 M USD of net income which accounts for 170.89% change. Track more PALANTIR TECH INC financial stats to get the full picture.

No, PLTR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 29, 2025, the company has 3.94 K employees. See our rating of the largest employees — is PALANTIR TECH INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PALANTIR TECH INC EBITDA is 435.34 M USD, and current EBITDA margin is 11.93%. See more stats in PALANTIR TECH INC financial statements.

Like other stocks, PLTR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PALANTIR TECH INC stock right from TradingView charts — choose your broker and connect to your account.