Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.255 CHF

−173.10 M CHF

947.80 M CHF

51.92 M

About Emergent BioSolutions Inc.

Sector

Industry

CEO

Joseph C. Papa

Website

Headquarters

Gaithersburg

Founded

1998

FIGI

BBG00LVD90Z2

Emergent BioSolutions Inc. engages in the development, manufacture, and commercialization of medical countermeasures. It offers products for civilian and military populations that address accidental, intentional, and naturally occurring public health threats. The firm's products include ACAM2000, BioThrax, Raxibacuma, Vaxchora, and VIGIV. Its business units include Vaccines and Anti-Infectives, Antibody Therapeutics, Devices, and Contract Development and Manufacturing. The company was founded by Fuad El-Hibri on September 5, 1998 and is headquartered in Gaithersburg, MD.

Related stocks

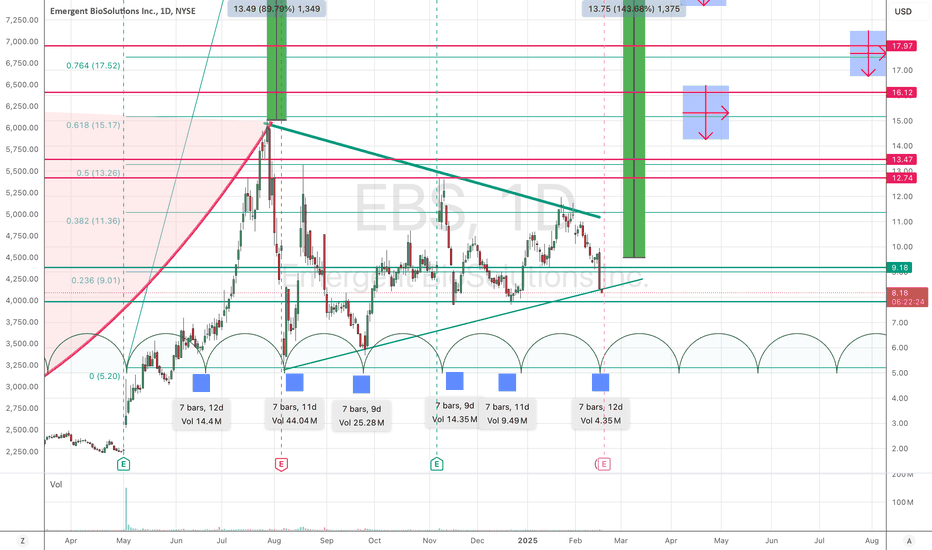

Emergent BioSolutions Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

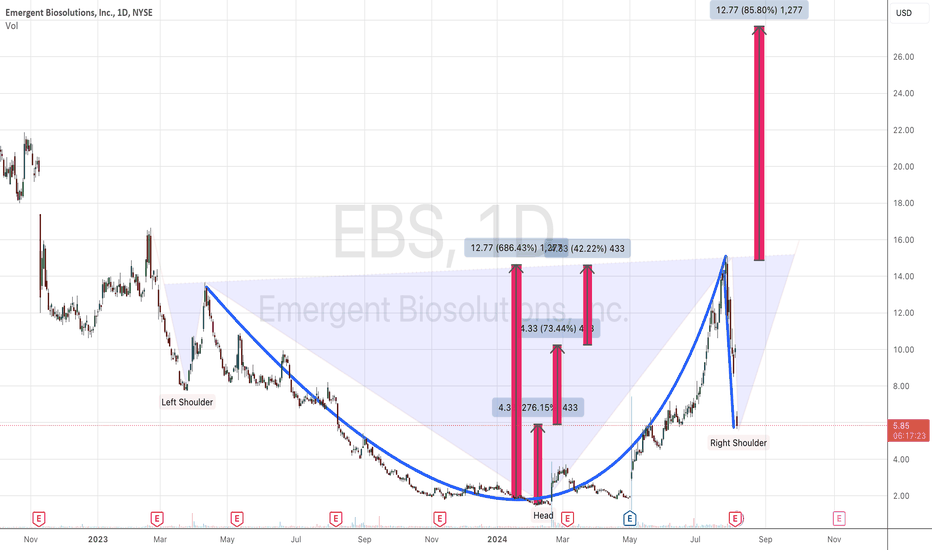

# Emergent BioSolutions Stock Quote

- Double Formation

* (Consolidation Argument)) At 4.50 USD

* 15.00 USD | Area Of Value | Subdivision 1

- Triple Formation

* (Open Trade)) At 13.00 U

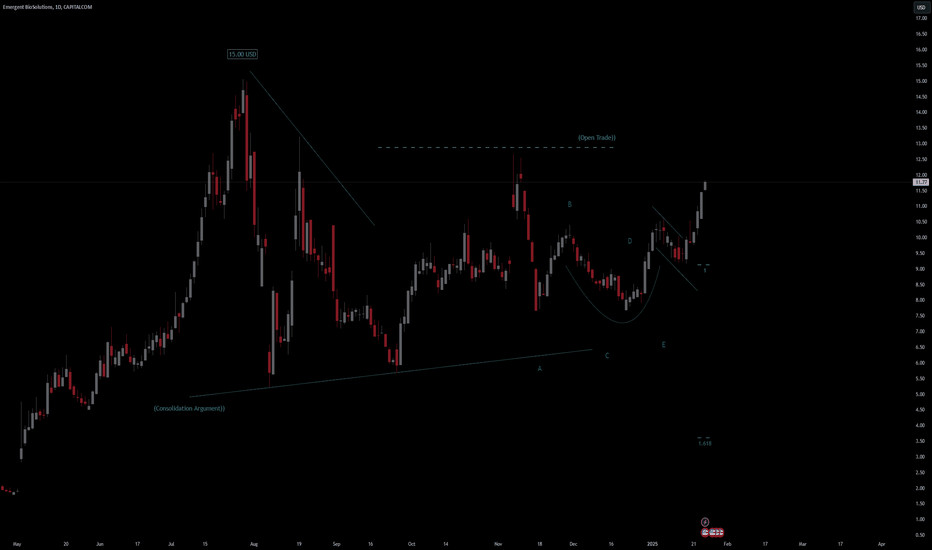

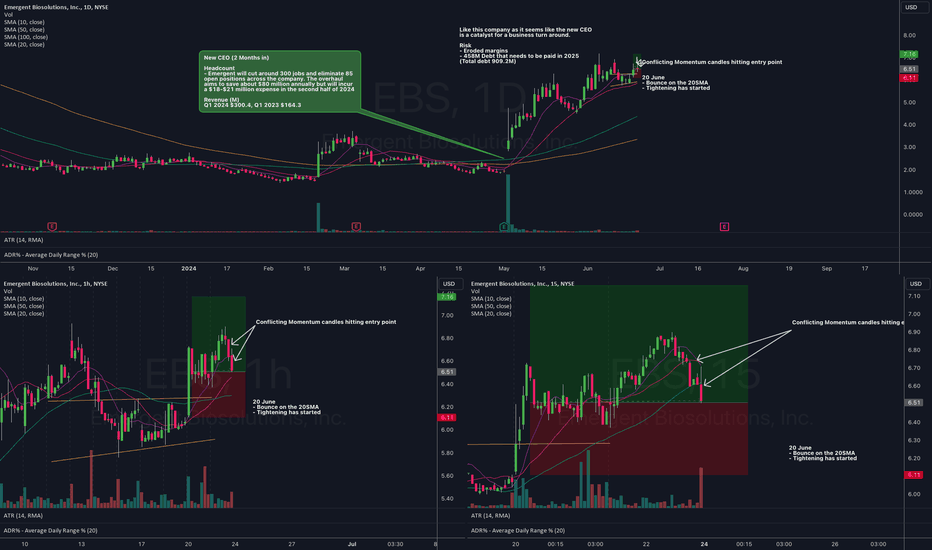

Emergent BioSolutions | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

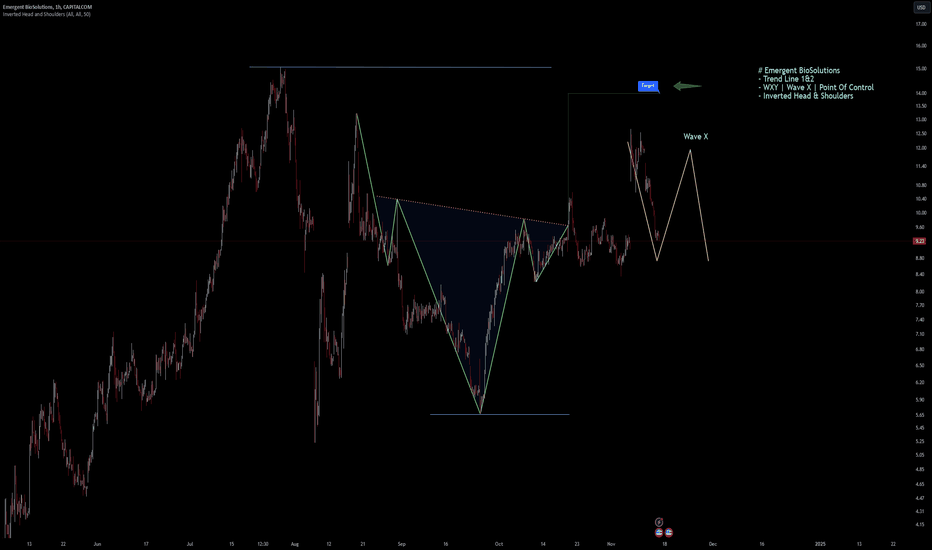

Notes On Session - 60 Minutes Time Frame

# Emergent BioSolutions - Based in Gaithersburg, Maryland | USA

- Trend Line 1&2 | Exchange Of Context

- WXY | Wave X | Point Of Control

- Inverted Head & Shoul

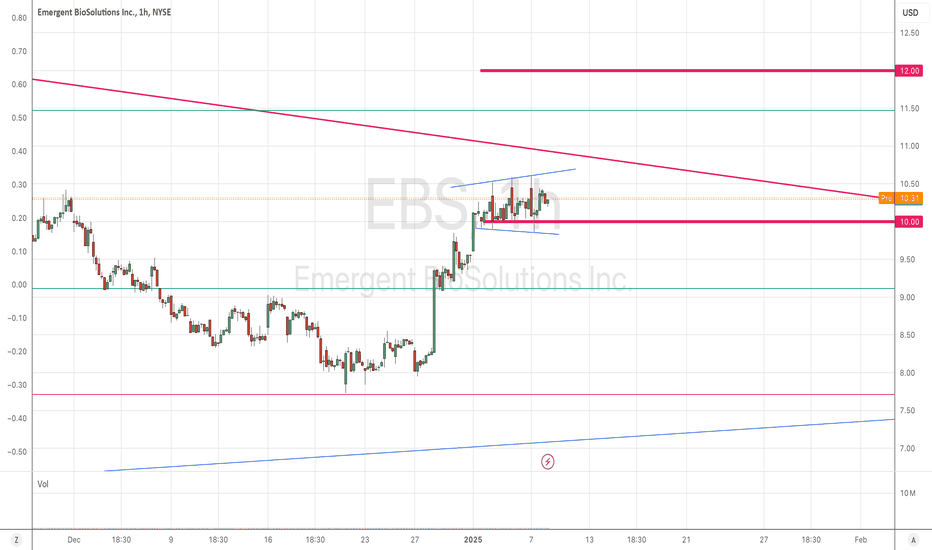

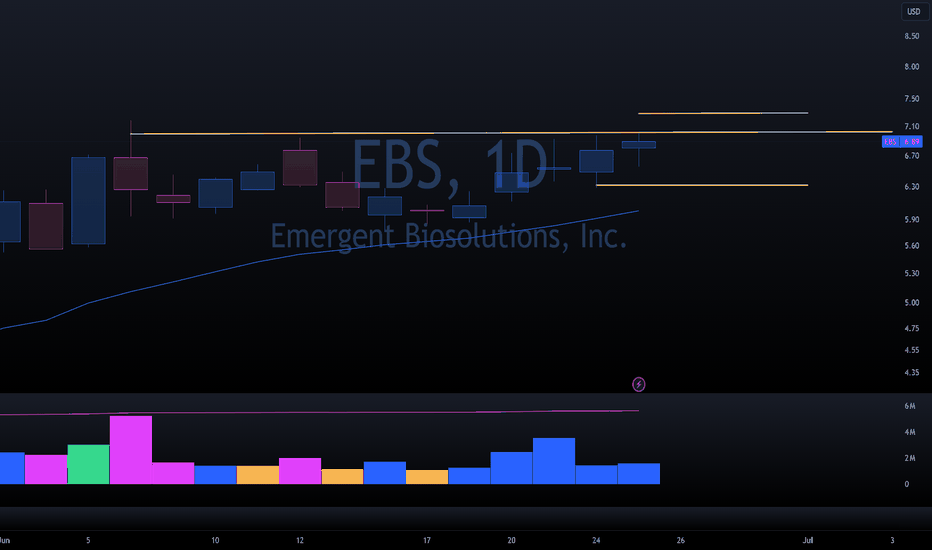

EBS Base Breakout SetupHey everybody got my camera working for this trade idea. Here we have the ebs stock setting up for a breakout in an uptrend and we're hoping for a bullish continuation here. I describe my entry points my stop loss and my profit target one and the logic behind them and how to position your share coun

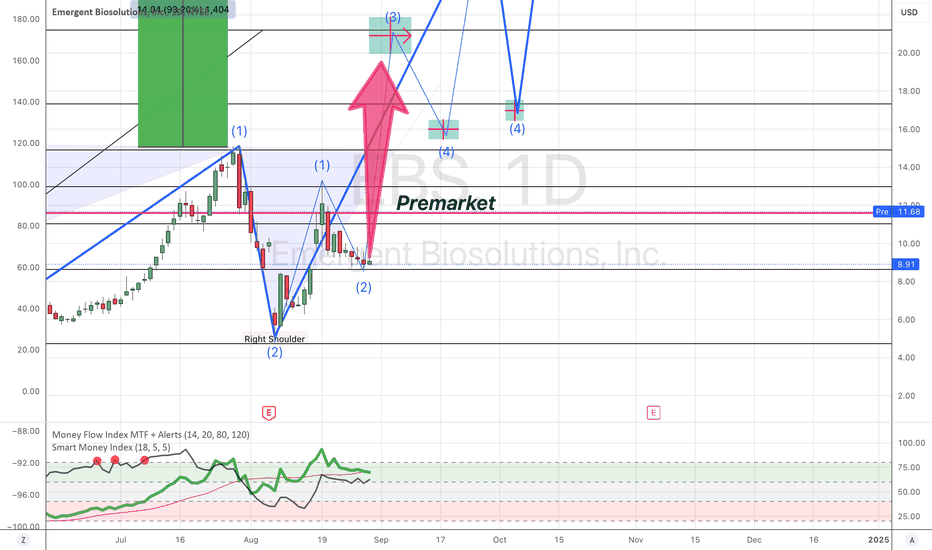

EBS - June 24 Qullamaggie Breakout and Episodic PivotThis is part of a Qullamaggie Breakout and Episodic Pivot study I am currently conducting

Qulla Breakout & EP (Discretionary & Systematic) 🚀

Swing Trend Strategy focused on Breakouts based on repeated momentum and Episodic Pivots based on unexpected news/fundamentals that is not properly priced in.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

EBS5025997

Emergent BioSolutions Inc. 3.875% 15-AUG-2028Yield to maturity

13.16%

Maturity date

Aug 15, 2028

EBS5025998

Emergent BioSolutions Inc. 3.875% 15-AUG-2028Yield to maturity

—

Maturity date

Aug 15, 2028

See all ER4 bonds

Frequently Asked Questions

The current price of ER4 is 5.716 CHF — it has decreased by −12.60% in the past 24 hours. Watch EMERGENT BIOSOLUTI stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange EMERGENT BIOSOLUTI stocks are traded under the ticker ER4.

ER4 stock has fallen by −12.60% compared to the previous week, the month change is a −12.60% fall, over the last year EMERGENT BIOSOLUTI has showed a −41.32% decrease.

We've gathered analysts' opinions on EMERGENT BIOSOLUTI future price: according to them, ER4 price has a max estimate of 12.23 CHF and a min estimate of 9.78 CHF. Watch ER4 chart and read a more detailed EMERGENT BIOSOLUTI stock forecast: see what analysts think of EMERGENT BIOSOLUTI and suggest that you do with its stocks.

ER4 stock is 14.42% volatile and has beta coefficient of 2.56. Track EMERGENT BIOSOLUTI stock price on the chart and check out the list of the most volatile stocks — is EMERGENT BIOSOLUTI there?

Today EMERGENT BIOSOLUTI has the market capitalization of 301.59 M, it has decreased by 0.00% over the last week.

Yes, you can track EMERGENT BIOSOLUTI financials in yearly and quarterly reports right on TradingView.

EMERGENT BIOSOLUTI is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

ER4 earnings for the last quarter are 0.63 CHF per share, whereas the estimation was 0.39 CHF resulting in a 61.36% surprise. The estimated earnings for the next quarter are −0.08 CHF per share. See more details about EMERGENT BIOSOLUTI earnings.

EMERGENT BIOSOLUTI revenue for the last quarter amounts to 196.70 M CHF, despite the estimated figure of 193.87 M CHF. In the next quarter, revenue is expected to reach 139.14 M CHF.

ER4 net income for the last quarter is 60.20 M CHF, while the quarter before that showed −28.43 M CHF of net income which accounts for 311.76% change. Track more EMERGENT BIOSOLUTI financial stats to get the full picture.

No, ER4 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 21, 2025, the company has 900 employees. See our rating of the largest employees — is EMERGENT BIOSOLUTI on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EMERGENT BIOSOLUTI EBITDA is 52.14 M CHF, and current EBITDA margin is 5.14%. See more stats in EMERGENT BIOSOLUTI financial statements.

Like other stocks, ER4 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EMERGENT BIOSOLUTI stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EMERGENT BIOSOLUTI technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EMERGENT BIOSOLUTI stock shows the sell signal. See more of EMERGENT BIOSOLUTI technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.