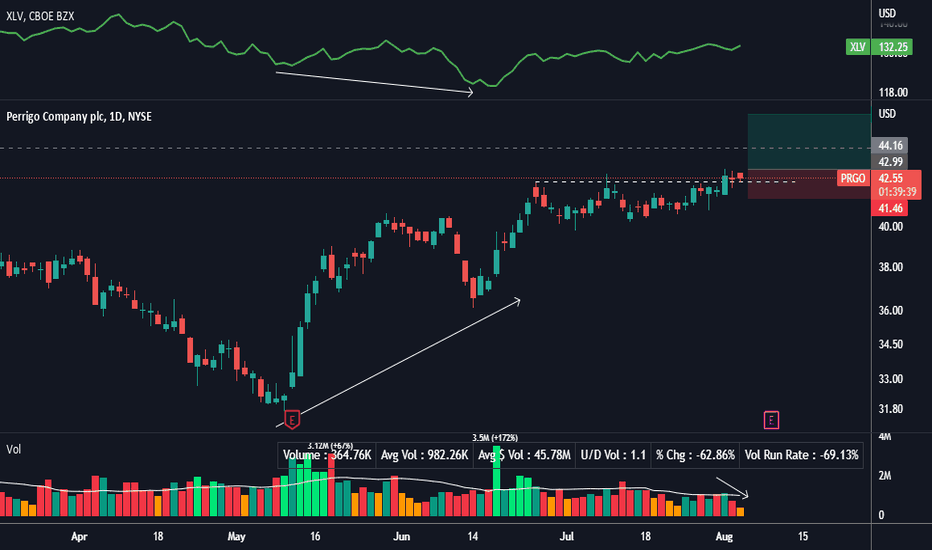

PRGO from $24.61 to $28MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

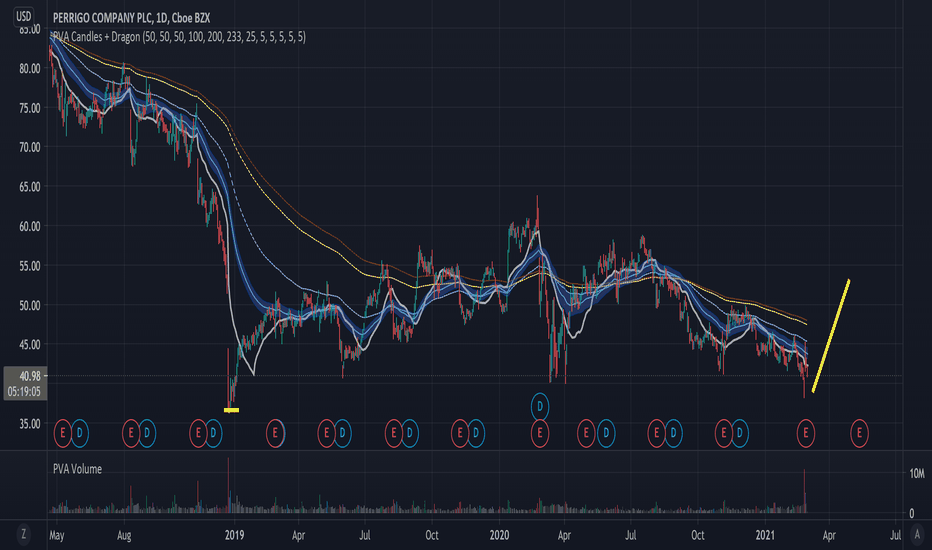

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Sq

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.123 CHF

−156.03 M CHF

3.97 B CHF

136.79 M

About Perrigo Company plc

Sector

Industry

CEO

Patrick Lockwood-Taylor

Website

Headquarters

Dublin

Founded

2013

ISIN

IE00BGH1M568

FIGI

BBG006TMQ7B0

Perrigo Co. Plc is a pure-play self-care company provider of consumer self-care products and over-the-counter (OTC) health and wellness solutions that enhance individual well-being by empowering consumers to proactively prevent or treat conditions that can be self-managed. The company was founded by Luther Perrigo in 1887 and is headquartered in Dublin, Ireland.

Related stocks

Healthcare leader $PRGO making a shark pattern Perrigo is in the Medical-Generic Drugs Group, they develop, manufactures, markets, and distributes private label self-care products, including cough, cold, and allergy products, analgesics, gastrointestinal products, smoking cessation products, infant formula and food products.

IBD gives it a #1

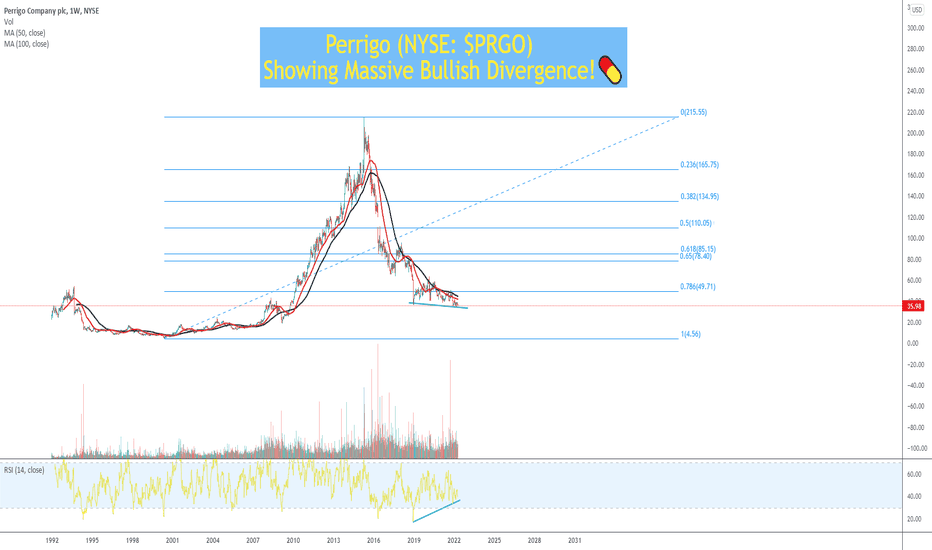

Perrigo (NYSE: $PRGO) Showing Massive Bullish Divergence! 💊Perrigo Company plc provides over-the-counter (OTC) health and wellness solutions that enhance individual well-being by empowering consumers to prevent or treat conditions that can be self-managed. The company operates through Consumer Self-Care Americas, Consumer Self-Care International, and Prescr

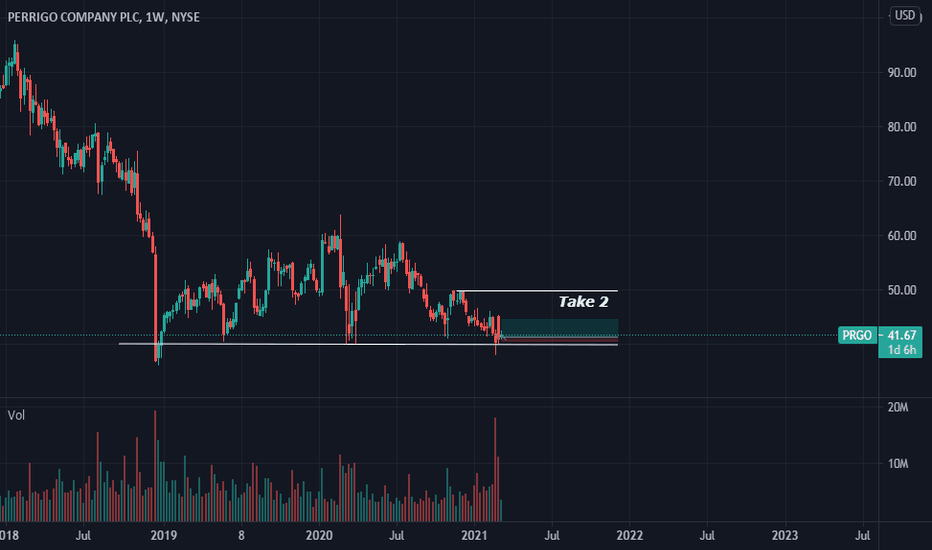

PRGO, LONG, SWINGHere is a range play with a strong weekly history of a bounce around this area of value . I like the risk vs reward . I also labeled a potential second level of profit on the chart, but personally I will take my profit at the first level.

This is a technical play only , I am not a fan of the compa

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

P

PRGO4188395

Perrigo Finance Unlimited Company 4.9% 15-DEC-2044Yield to maturity

7.59%

Maturity date

Dec 15, 2044

P

PRGO5891387

Perrigo Finance Unlimited Company 6.125% 30-SEP-2032Yield to maturity

6.09%

Maturity date

Sep 30, 2032

P

PRGO5002604

Perrigo Finance Unlimited Company 4.9% 15-JUN-2030Yield to maturity

5.54%

Maturity date

Jun 15, 2030

See all PIG bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange PERRIGO CO PLC stocks are traded under the ticker PIG.

We've gathered analysts' opinions on PERRIGO CO PLC future price: according to them, PIG price has a max estimate of 33.68 CHF and a min estimate of 24.05 CHF. Watch PIG chart and read a more detailed PERRIGO CO PLC stock forecast: see what analysts think of PERRIGO CO PLC and suggest that you do with its stocks.

PIG stock is 0.06% volatile and has beta coefficient of 0.24. Track PERRIGO CO PLC stock price on the chart and check out the list of the most volatile stocks — is PERRIGO CO PLC there?

Today PERRIGO CO PLC has the market capitalization of 2.97 B, it has decreased by −1.70% over the last week.

Yes, you can track PERRIGO CO PLC financials in yearly and quarterly reports right on TradingView.

PERRIGO CO PLC is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

PIG earnings for the last quarter are 0.53 CHF per share, whereas the estimation was 0.50 CHF resulting in a 6.05% surprise. The estimated earnings for the next quarter are 0.47 CHF per share. See more details about PERRIGO CO PLC earnings.

PERRIGO CO PLC revenue for the last quarter amounts to 924.11 M CHF, despite the estimated figure of 961.87 M CHF. In the next quarter, revenue is expected to reach 858.20 M CHF.

PIG net income for the last quarter is −5.67 M CHF, while the quarter before that showed −40.41 M CHF of net income which accounts for 85.98% change. Track more PERRIGO CO PLC financial stats to get the full picture.

Yes, PIG dividends are paid quarterly. The last dividend per share was 0.24 CHF. As of today, Dividend Yield (TTM)% is 4.20%. Tracking PERRIGO CO PLC dividends might help you take more informed decisions.

As of Jul 21, 2025, the company has 8.38 K employees. See our rating of the largest employees — is PERRIGO CO PLC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PERRIGO CO PLC EBITDA is 622.68 M CHF, and current EBITDA margin is 14.72%. See more stats in PERRIGO CO PLC financial statements.

Like other stocks, PIG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PERRIGO CO PLC stock right from TradingView charts — choose your broker and connect to your account.