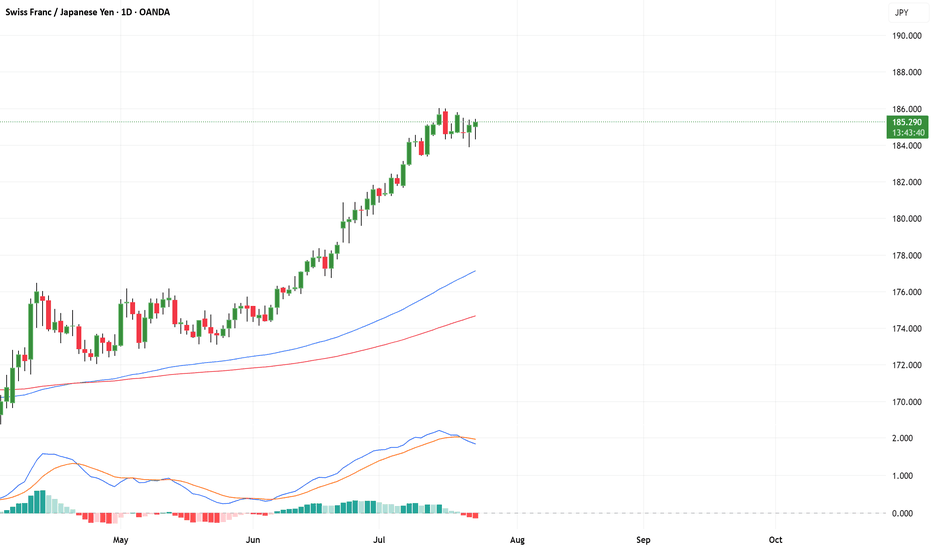

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves

About Swiss Franc / Japanese Yen

The Swiss Franc vs. the Japanese Yen. After reaching its low in 2008 this pair has steadily traded higher mainly due to aggressive Japanese monetary easing. Also, due to low interest rates and different financial properties these currencies are considered to be safe haven and funding currencies.

Related currencies

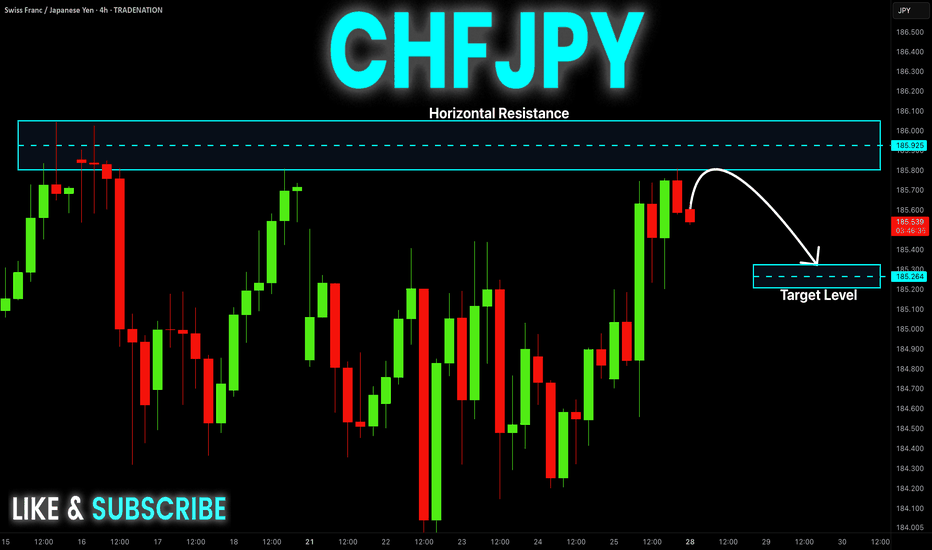

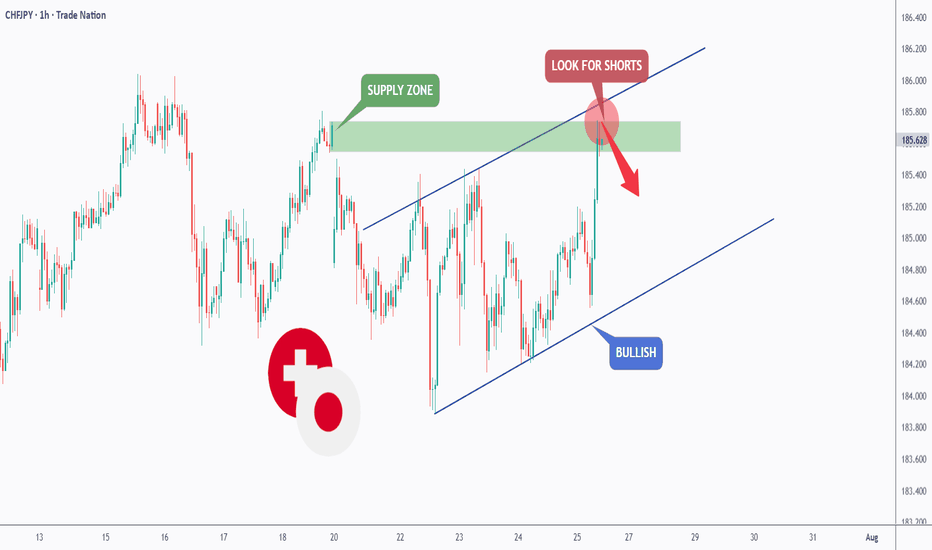

CHF-JPY Short From Resistance! Sell!

Hello,Traders!

CHF-JPY keeps trading in

An uptrend and the pair

Is locally overbought so after

The pair hits the horizontal

Resistance level of 186.000

We will be expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclo

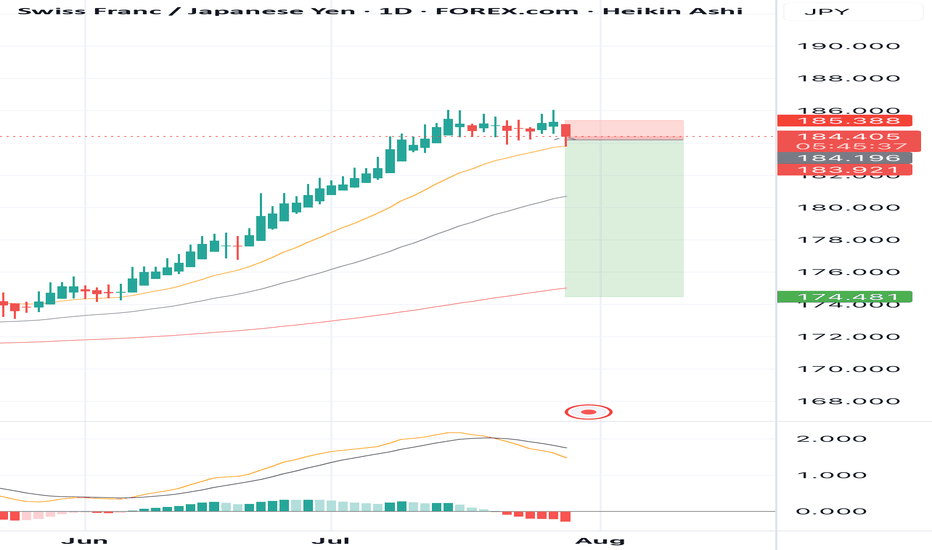

SELL CHFJPY for bullish trend reversal SELL CHFJPY for bullish trend reversal

STOP LOSS : 185.38

Trade trade is based on false breakout and divergence.....

First what is false breakout, A false breakout in Forex occurs when the price breaks through a key level (like support or resistance) but quickly reverses and returns to its o

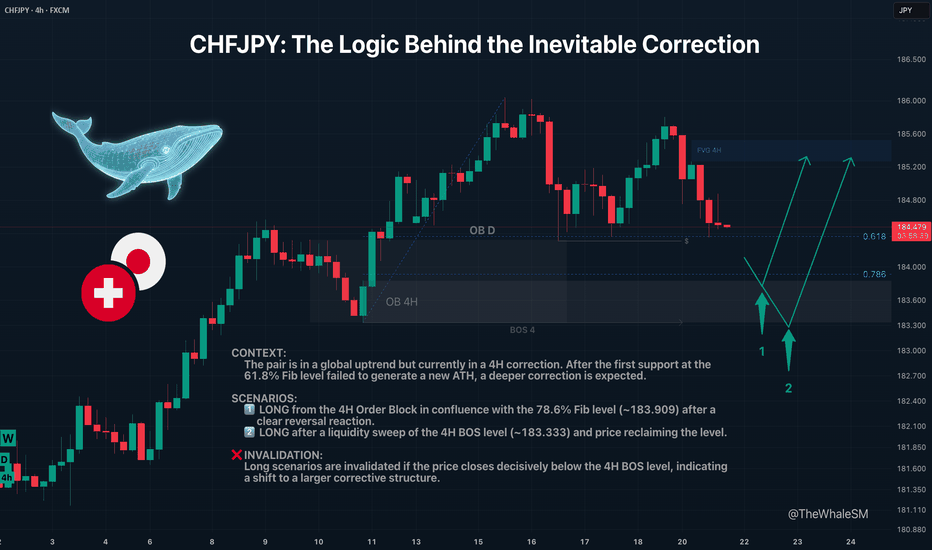

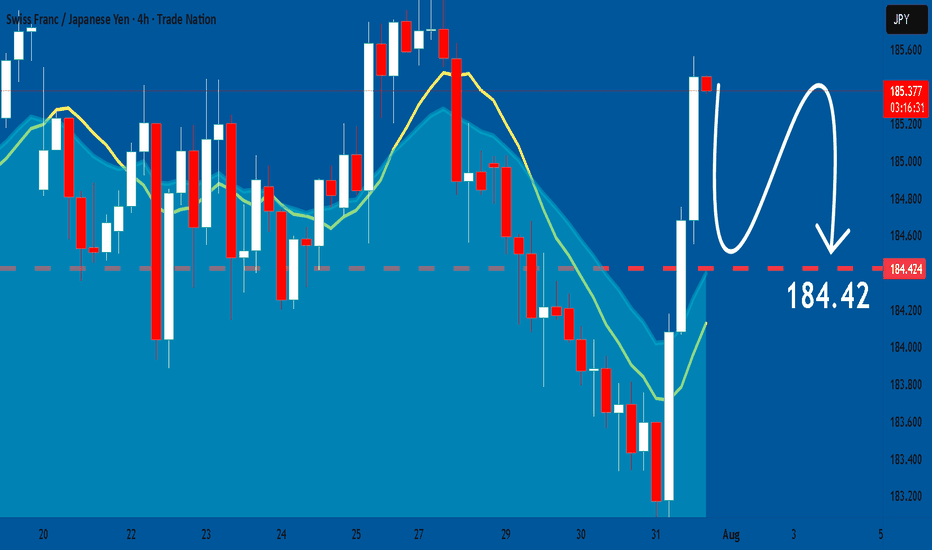

CHFJPY: The Logic Behind the Inevitable CorrectionCHFJPY recently bounced from what seemed like a perfect support level. Many likely saw this as a buy signal. But when the price failed to make a new high, it sent a clear warning: the correction isn't over yet.

This analysis dives into why that first bounce was a trap and where the next institu

CHFJPY: Bearish Continuation is Expected! Here is Why

The price of CHFJPY will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤

CHFJPY - The Bulls Are Exhausted!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CHFJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong supply.

🏹 Thus, the highlighted red c

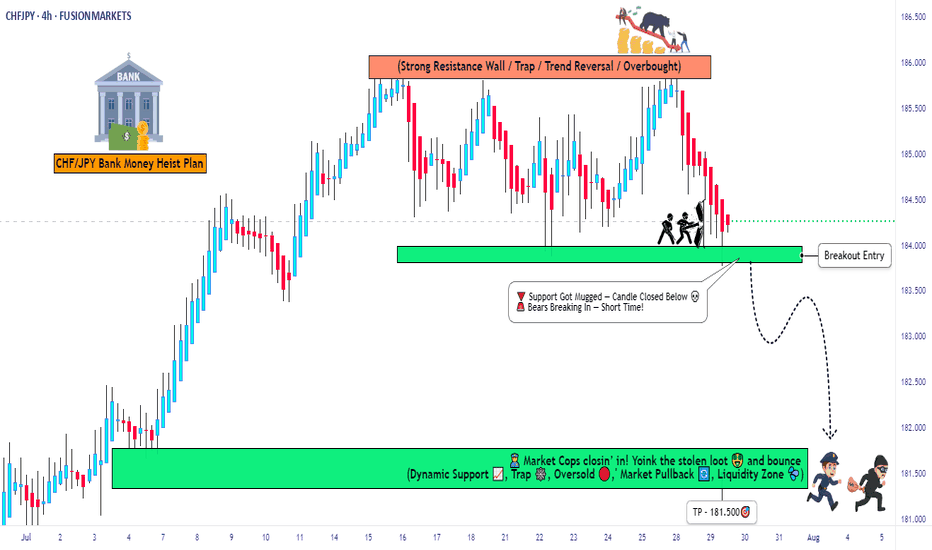

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/

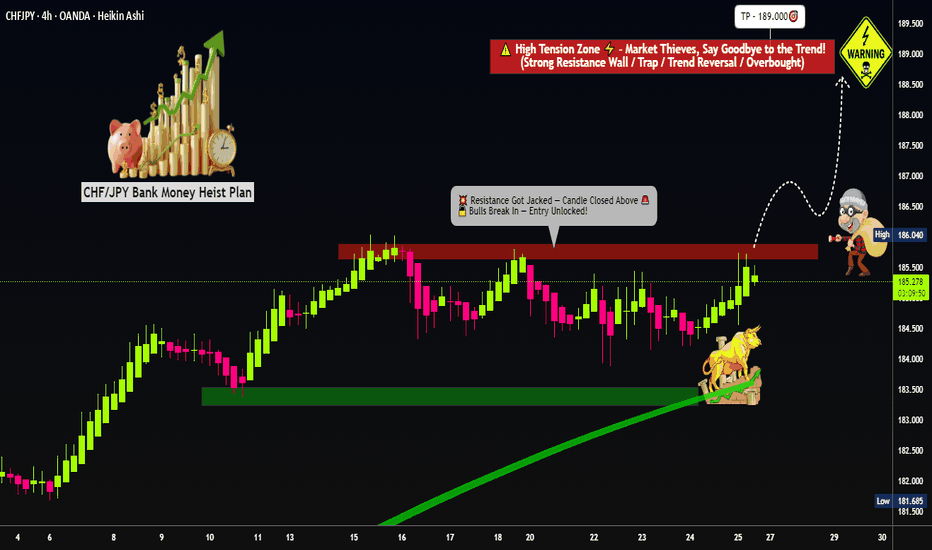

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to a

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

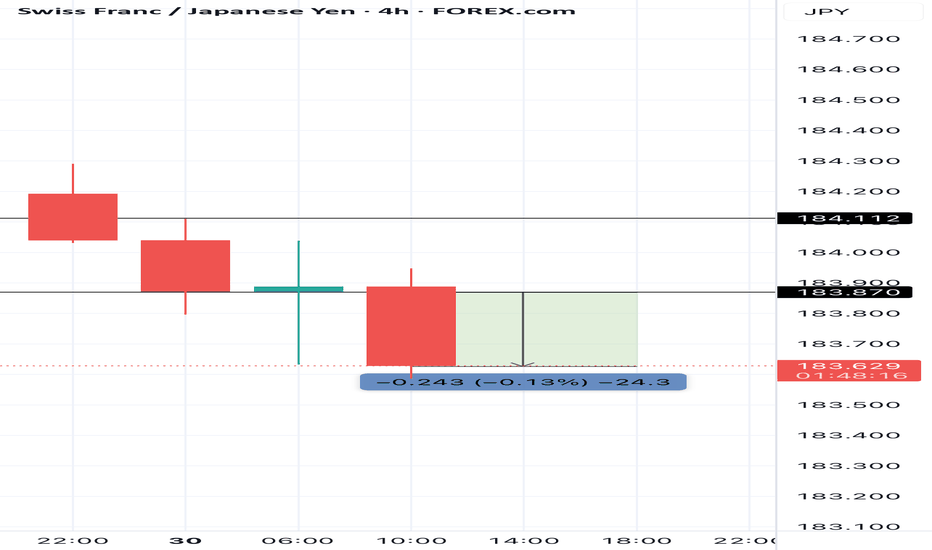

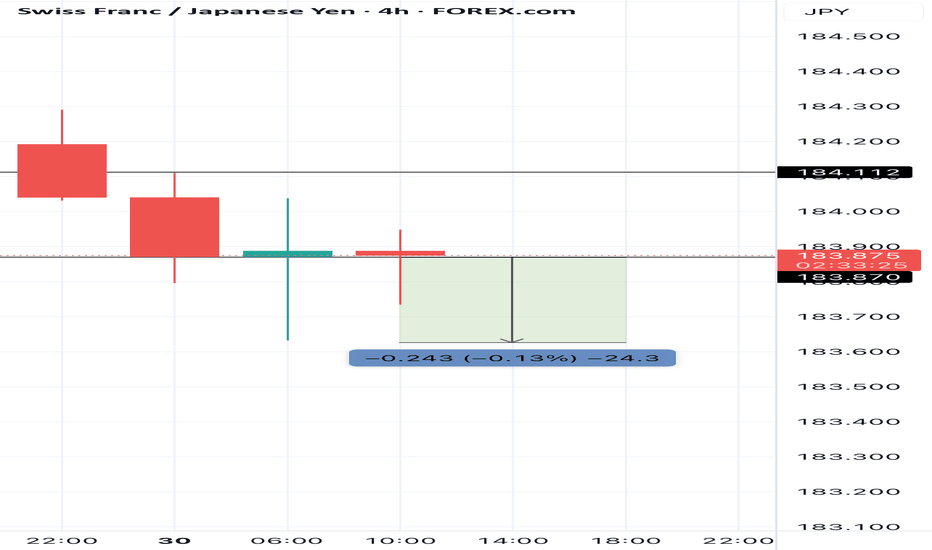

The current rate of CHFJPY is 183.301 JPY — it has decreased by −1.17% in the past 24 hours. See more of CHFJPY rate dynamics on the detailed chart.

The value of the CHFJPY pair is quoted as 1 CHF per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 CHF.

The term volatility describes the risk related to the changes in an asset's value. CHFJPY has the volatility rating of 1.48%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CHFJPY showed a −0.85% fall over the past week, the month change is a 1.07% rise, and over the last year it has increased by 7.18%. Track live rate changes on the CHFJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CHFJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CHFJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CHFJPY technical analysis. The technical rating for the pair is neutral today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CHFJPY shows the buy signal, and 1 month rating is buy. See more of CHFJPY technicals for a more comprehensive analysis.