Related futures

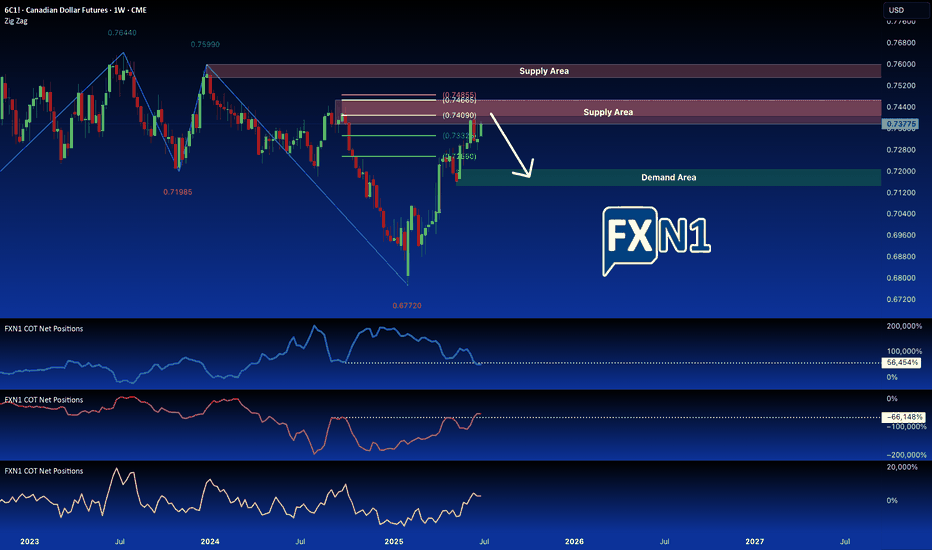

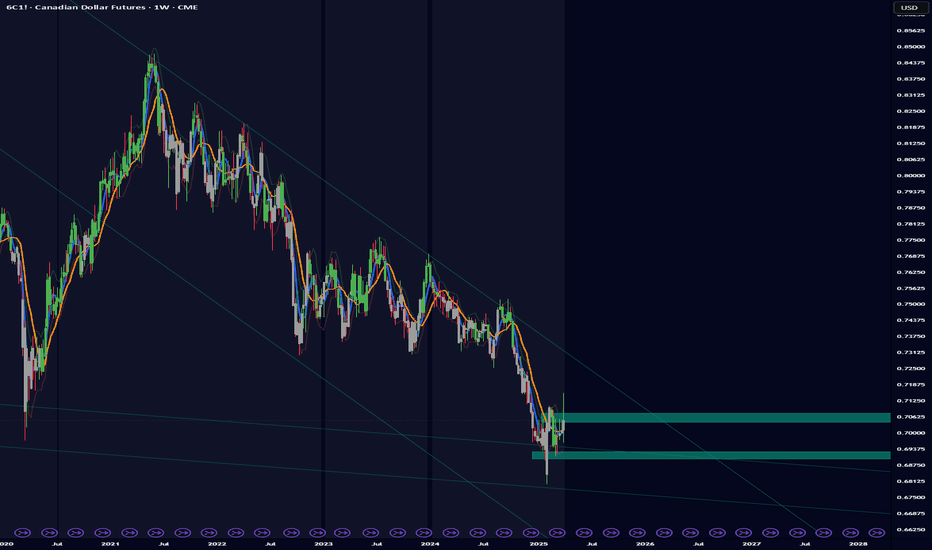

Canadian Dollar Futures (6C1!) Nears Key Monthly SupplyThe Canadian Dollar Futures (6C1!) remain in a downtrend, now testing a critical monthly supply zone after an initial rejection. With Commercials heavily short, Smart Money flat, and Retail traders still bullish, this setup favors another potential downside move. Traders should watch for a retest or

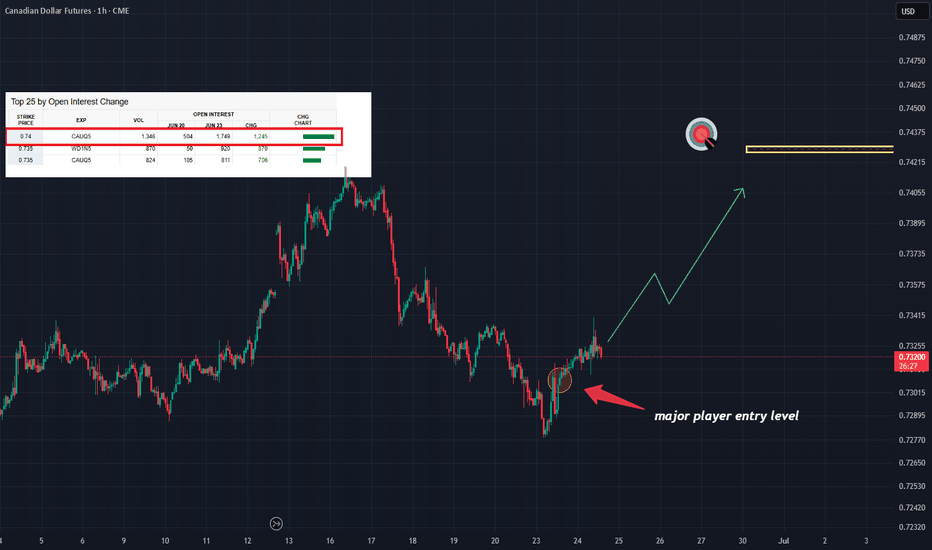

CAD Option Flow Positive Sentiment. It's worth taking a closer Based on the analysis of yesterday's trading on CME, we have captured an excellent portfolio in the lens.

The trader methodically formed this position in a 5-minute period of time, which is a good sign.

Сonfirmation - the market is already moving in his direction

But, reasonable entry level -

CAD Potential Short Fundamentals aligned with the technical to take a Level over level monthly to weekly supply zone short in the area that I marked for a potential 3R on the CAD futures. Fundamental analysis is based on Betting against retailers, short seasonality and overvaluation against bonds and the USD

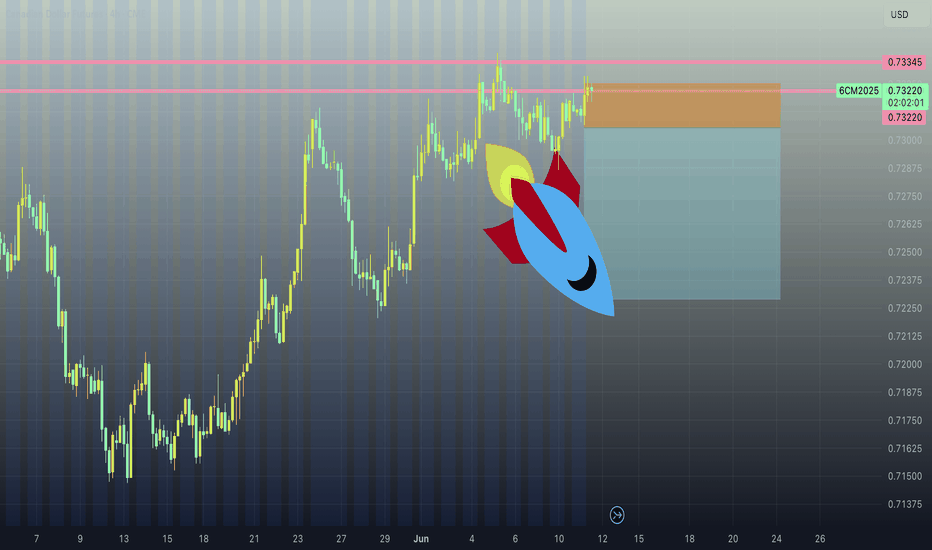

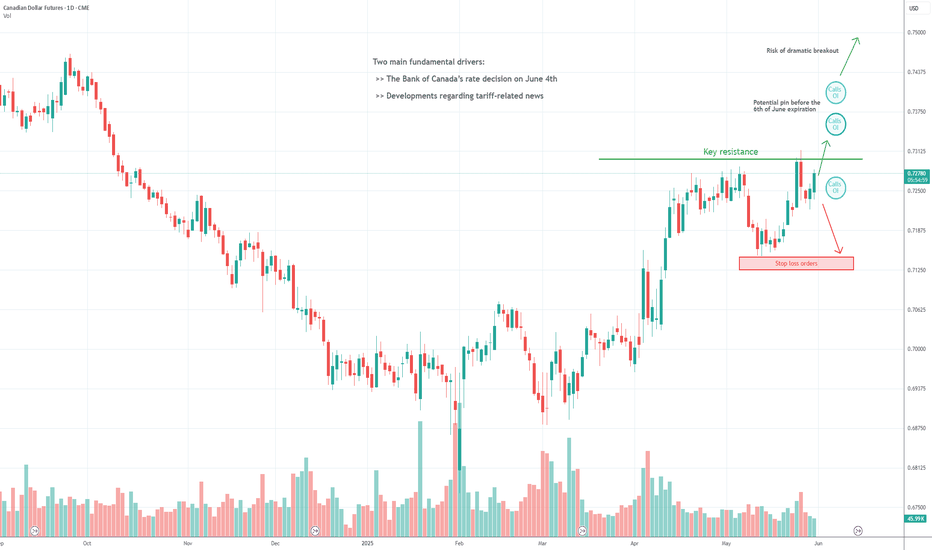

Action Plan for the Next Big MoveThe Canadian Dollar (CAD) is trading around 0.725, caught in a rare balance where clear conviction is elusive and volatility appears to be compressing, beneath the surface, the stage is set for a potentially explosive move. With the Bank of Canada set to announce its policy decision next week and tr

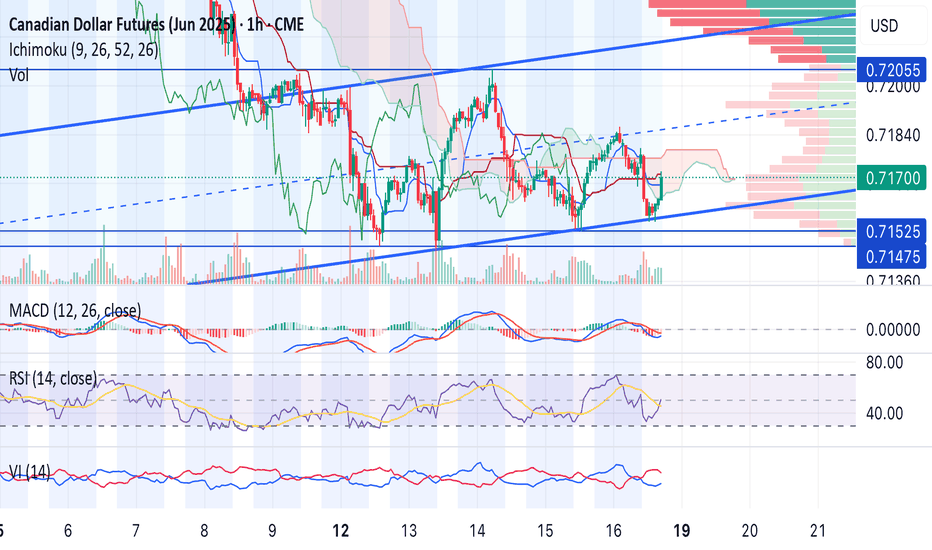

CAD/USD growing more bullishIn this chart we can see the CAD/USD conversion rate has formed a bullish divergence.

This pattern is formed when price action creates lower lows whereas simultaneously the RSI creates higher lows.

This divergence is indicative of a future sharp and sudden rise in price.

Entered (2) 6CM contracts

Multi-Year Bottoming Watch =**Week of:** April 7–11, 2025

**Bias:** Bullish Rotation Setup

**Trade Duration:** Multi-week to multi-month swing

**Status:** Compression Zone Reclaim | Macro Spring Forming

**Reflexivity Phase:** Phase 2 – Structural Reversal Attempt

---

## 🧠 Thesis

Canadian Dollar Futures (6C1!) ar

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

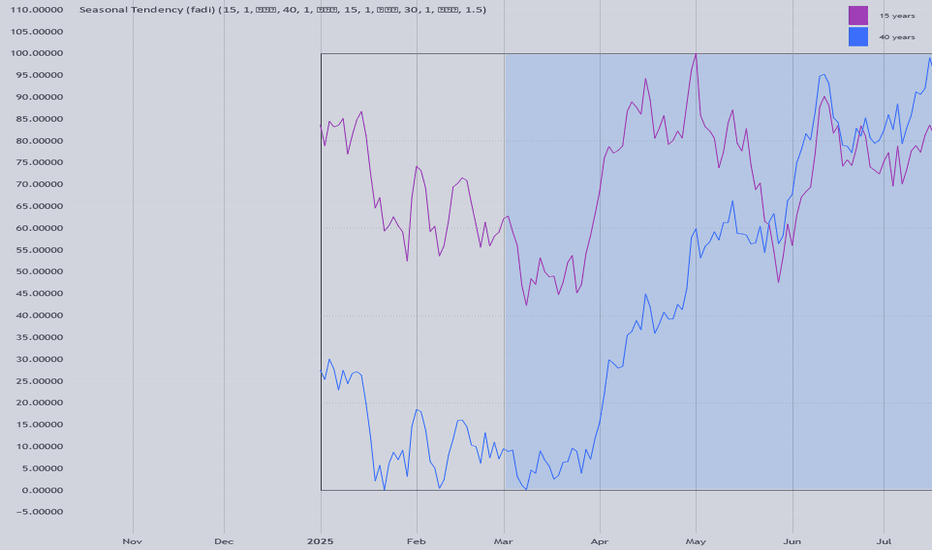

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Canadian Dollar Futures (Sep 2020) is Sep 15, 2020.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Canadian Dollar Futures (Sep 2020) before Sep 15, 2020.