July 7 - 11th: Sell The RIPs, Buy The DIPs! (PART 2)Welcome back to the Weekly Forex Forecast!

This is Part 2 of the FOREX futures outlook for the week of July 7 - 11th.

In this video, we will analyze the following FX markets:

CHF and JPY

Last Friday was a bank holiday, so the price action is discounted. This Monday has no red folders on the cale

Contract highlights

Related futures

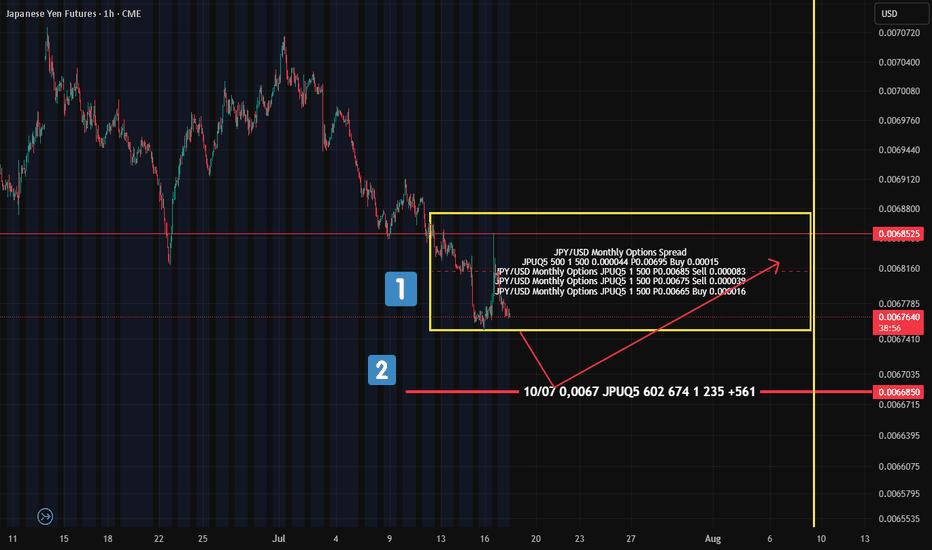

Yen Futures Options: What the "Put Condor" Tells Us About FutureA quick look at the options sentiment on Japanese Yen futures (not spot) — and there’s something interesting on the flow radar.

On July 10 , a "Put Condor" was placed — boundaries marked by the yellow rectangle on the chart (№1).

The goal of this setup? Price should expire within these boundaries —

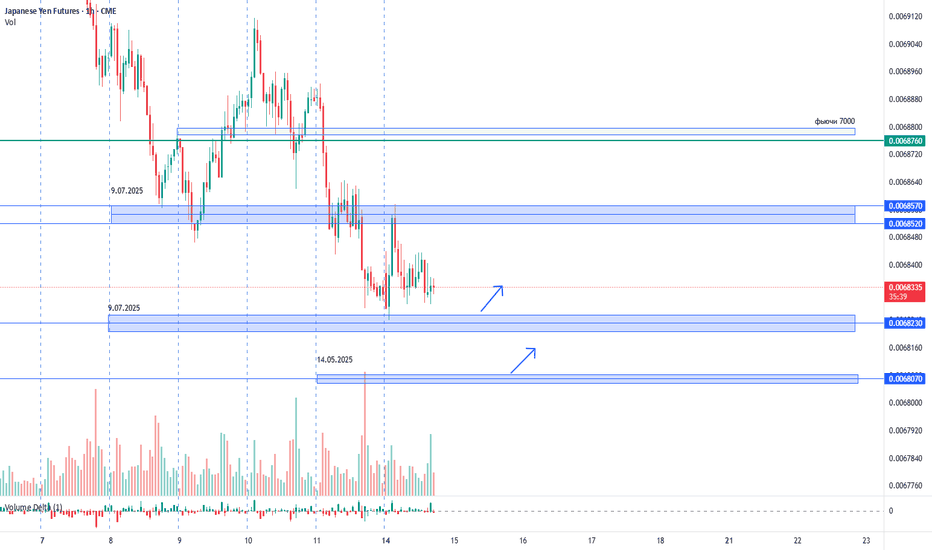

USDJPY. 14.07.2025. The plan for the next few days.The nearest interesting resistance zones have already been worked out at night and have given a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I believe we will see a correction that can be monetized. We are waiting for

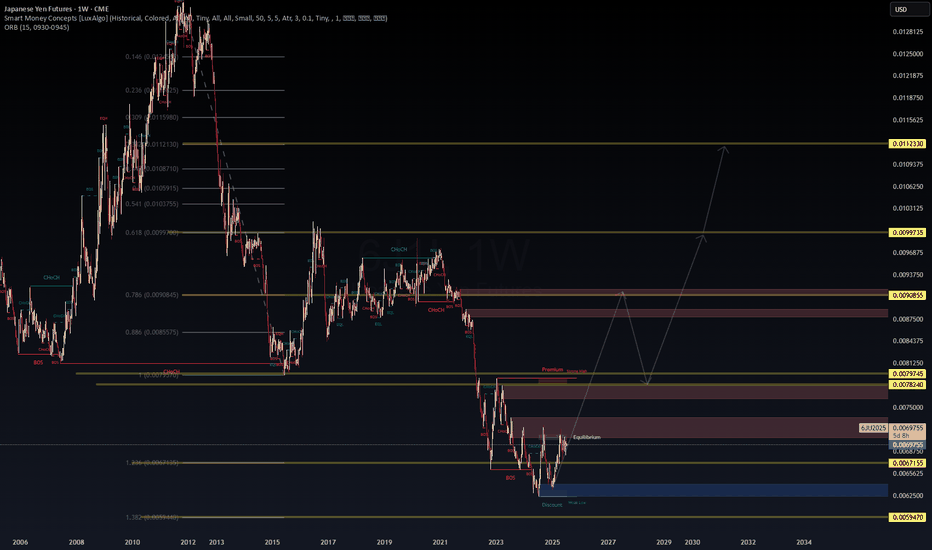

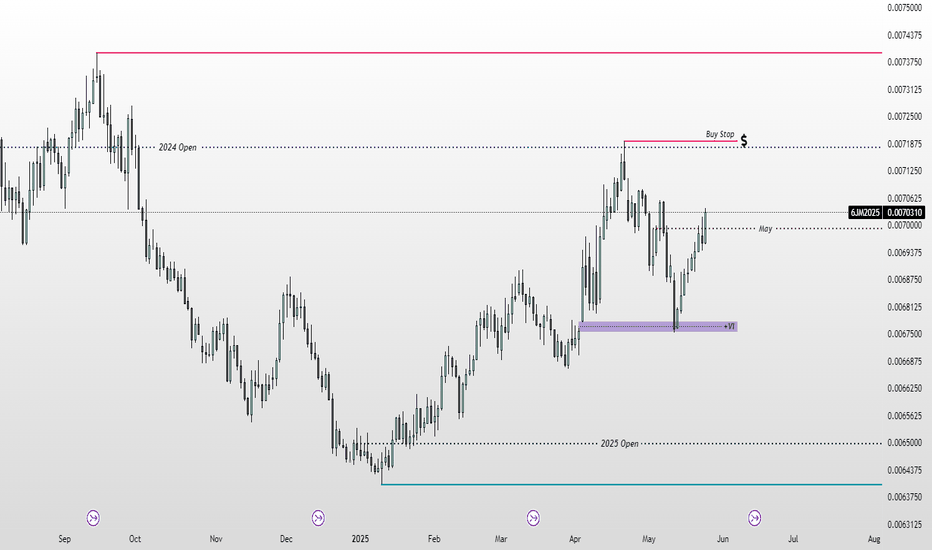

JPY/USD 6J Futs : Alignment Across All Frameworks🧭

✅ 1. Macro Outlook (Bearish JPY → Bullish USDJPY → Bearish JPYUSD short-term)

BOJ is behind the curve (still dovish)

Fed remains restrictive

Japan faces weak exports, aging demographics, and trade shocks

Result: Short-term pressure on JPY → price consolidates in Discount zone

🟢 This explains

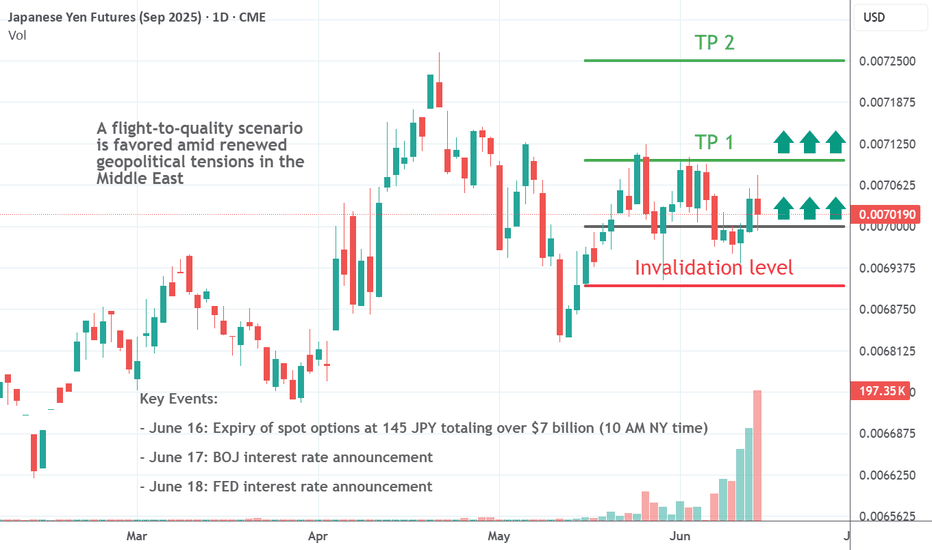

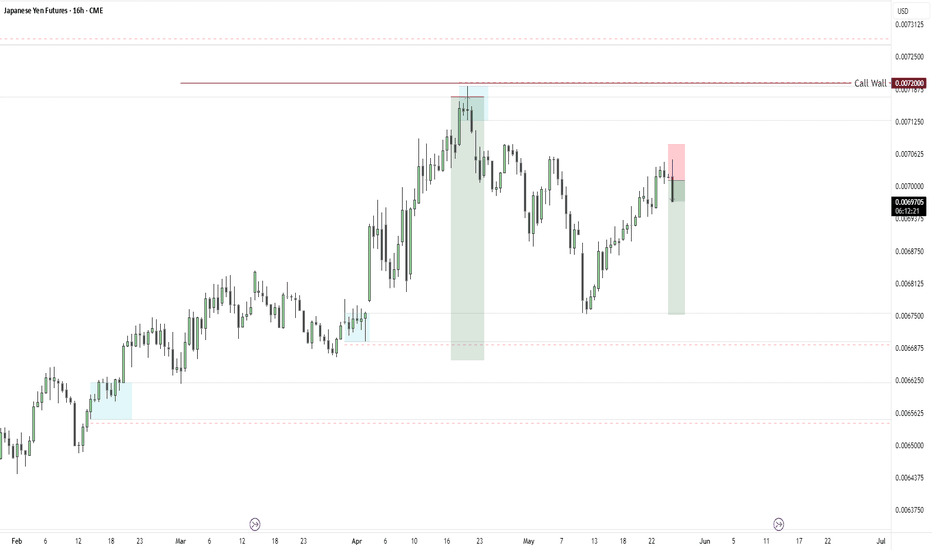

Buy the Dip into 0.0070 Pre-Expiry Pin & Policy RiskThe Japanese yen has experienced significant swings in recent weeks, both higher and lower, reflecting a fragile balance between diverging monetary policies and ongoing geopolitical uncertainty. That said, its status as a safe-haven currency continues to offer it defensive appeal among global invest

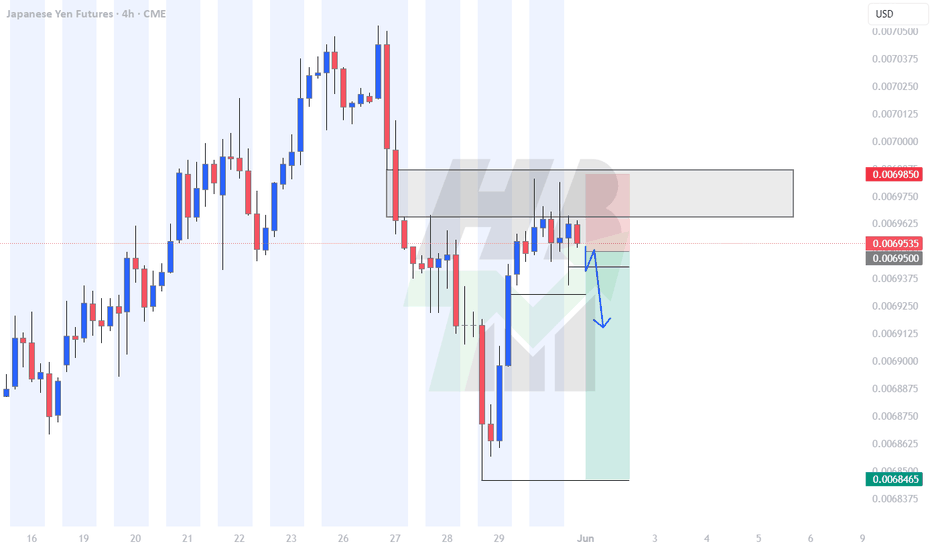

Weekly FOREX Forecast Jun 2 - 6th: CHF & JPY FuturesThis is the FOREX futures outlook for the week of Jun 2 - 6th.

In this video, we will analyze the following FX markets:

CHF JPY

It's been a consolidative week, but the USD is still weak. Look for valid breakdowns of consolidations before buying against the USD.

NFP week ahead! Mon-Wed will be t

Yen tells a different storyDespite the poor data that came out of Japan, the price action has been telling a different narrative. I'm going to pay attention on this asset until it has reached towards the Weekly objective. I'd like to see the price purge the obvious swing high as noted and fails to push higher to confirm my bi

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Japanese Yen Futures (Nov 2025) is 0.0068525 USD — it has risen 0.60% in the past 24 hours. Watch Japanese Yen Futures (Nov 2025) price in more detail on the chart.

Track more important stats on the Japanese Yen Futures (Nov 2025) chart.

The nearest expiration date for Japanese Yen Futures (Nov 2025) is Nov 17, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Japanese Yen Futures (Nov 2025) before Nov 17, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Japanese Yen Futures (Nov 2025) this number is 1.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Japanese Yen Futures (Nov 2025) shows that traders are closing their positions, which means a weakening trend.