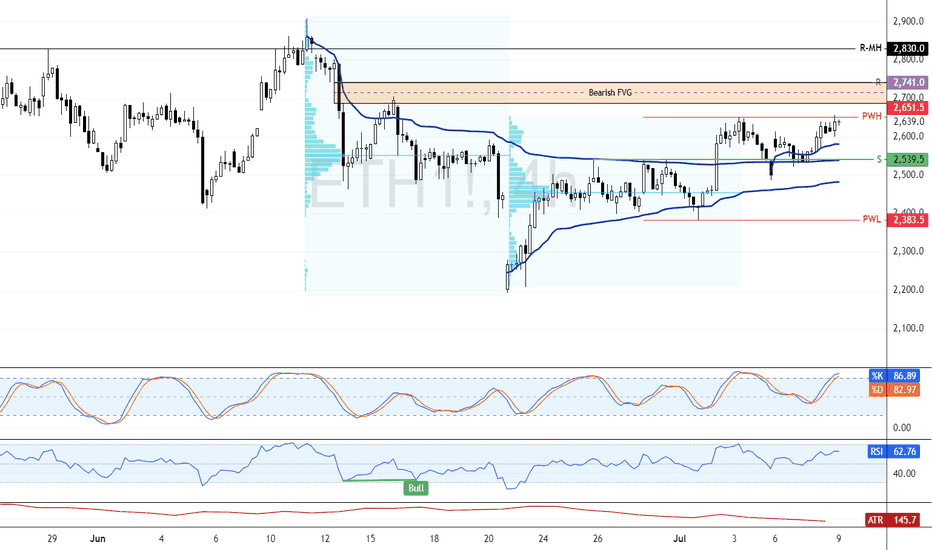

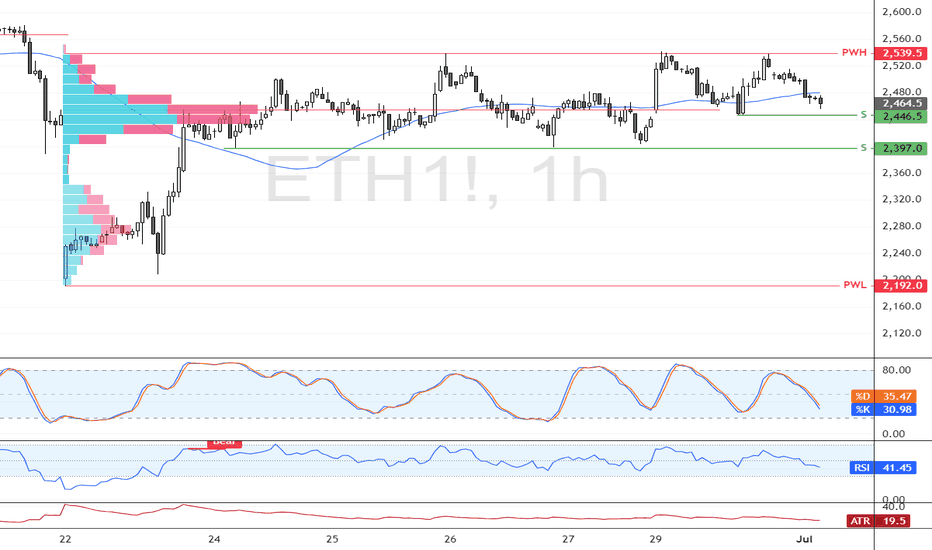

Ethereum Bullish Bias Pauses After Reaching Weekly HighF enzo F x—Ethereum rose from $2,539.5, backed by VWAP and volume profile, but momentum eased after hitting the $2,651.0 weekly high. Stochastic signals overbought conditions at 87.0, hinting at possible consolidation or downside pressure.

Bullish scenario : The bullish trend remains intact above

Related futures

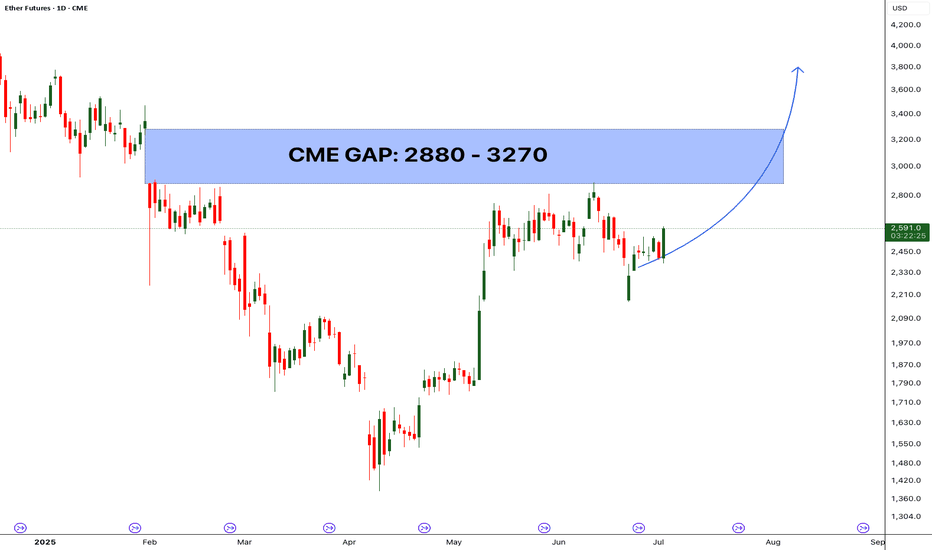

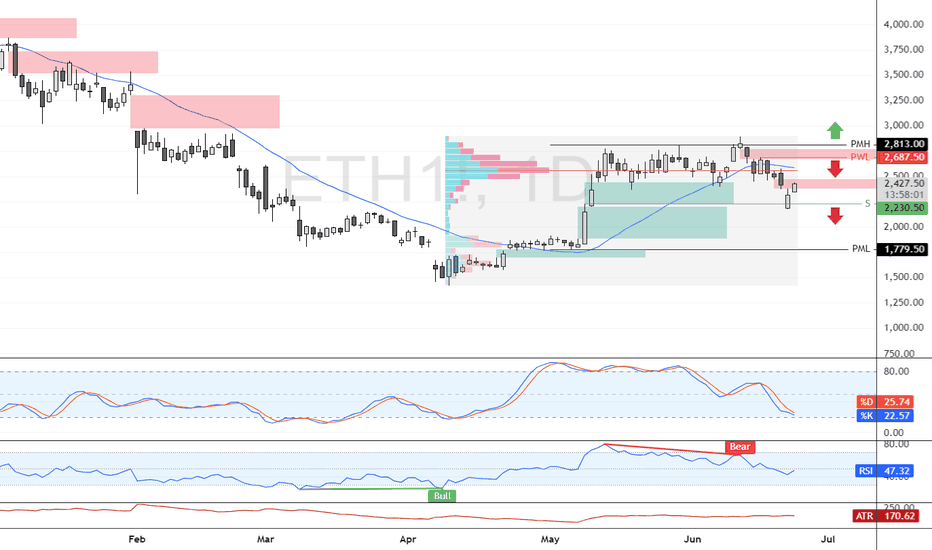

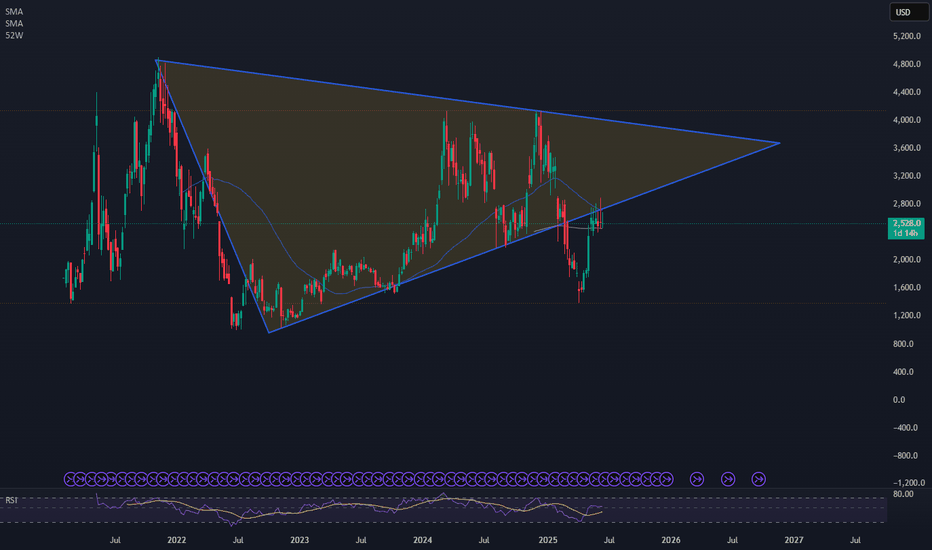

Ethereum - ETH - Heading towards the CME Gap - 3200 Target+ After a significant crash, Ethereum has shown a strong recovery.

+ A large CME gap exists between $2,880 and $3,270.

+ Historically, 90% of CME gaps tend to get filled sooner or later.

+ Current price action suggests Ethereum is heading directly toward this gap.

+ High probability that the CME gap

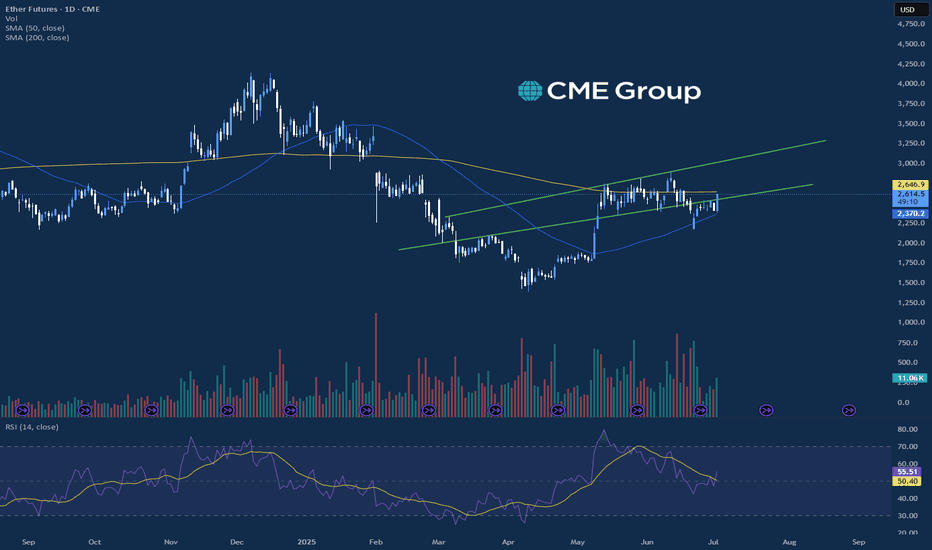

Crypto Leading Markets HigherMarkets are having an interesting day after what could be considered a “bad” day in terms of economic data. Equities, Precious Metals, Energy, and Crypto markets all broadly traded higher today with crypto leading the way higher. Traders saw Bitcoin, Ether, Solana, and XRP all trade up over 4% on th

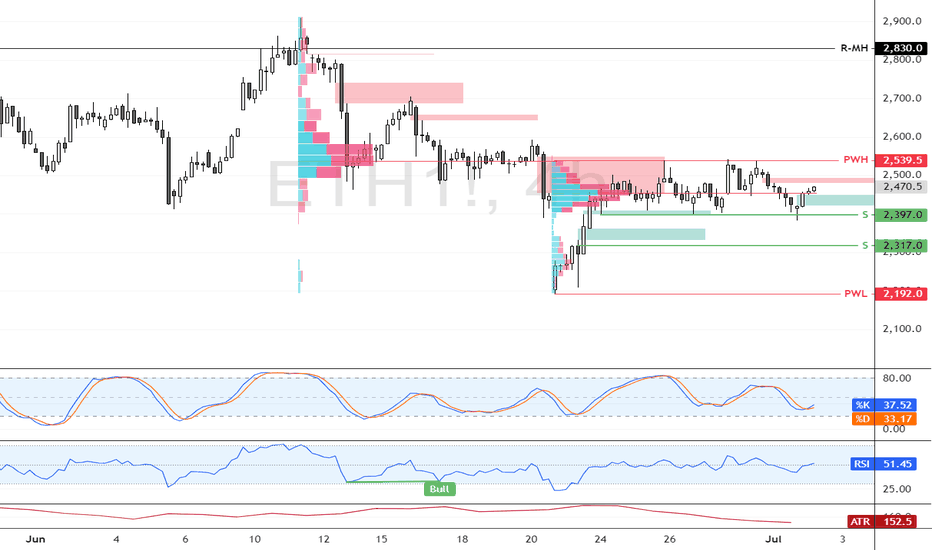

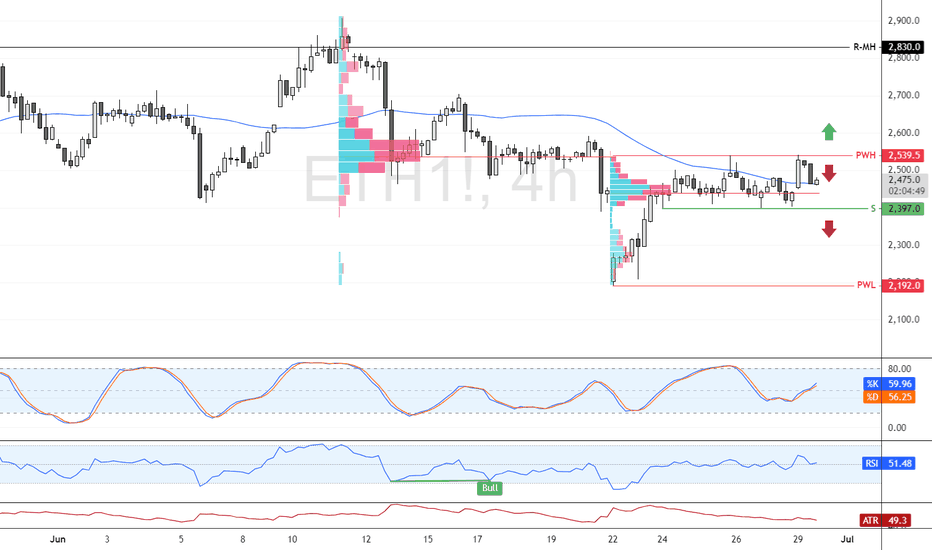

ETH Momentum Builds Above Key SupportFenzoFx—Ethereum bounced from the $2,397.0 support and swept liquidity below the level, backed by a bullish FVG on the 4-hour chart. ETH is currently testing resistance at $2,500.0, and a breakout could lead to a retest of $2,539.0.

The bullish setup remains valid above $2,397.0; below that, $2,31

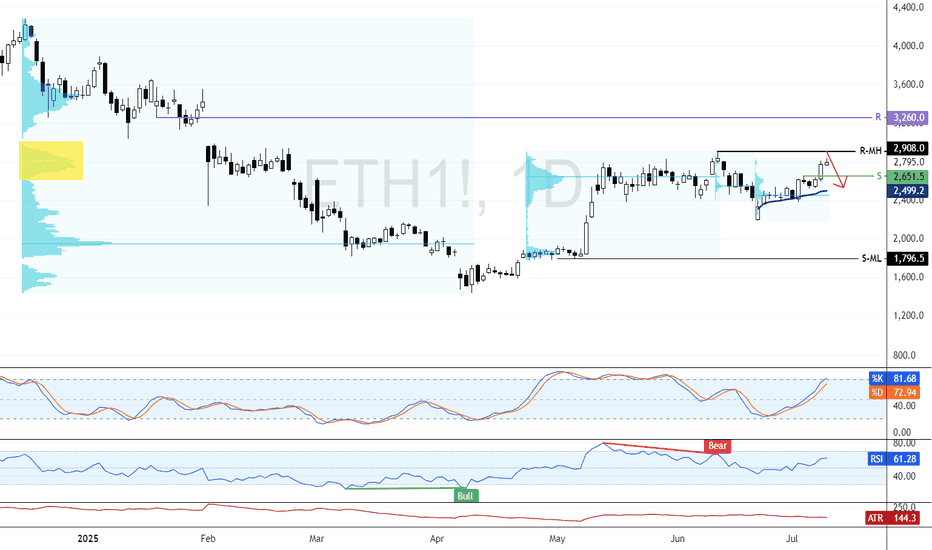

Ethereum Approaches $2,908 as Bullish Momentum FadesEthereum remains bullish, trading near $2,796 and approaching monthly resistance at $2,908. Stochastic shows an overbought reading of 81.0, suggesting short-term buying exhaustion.

Bearish Scenario : A pullback toward $2,651 is likely if $2,908 holds. Extended selling pressure could lead to a test

Ethereum Faces Resistance at $2,539.0Ethereum was rejected at the $2,539.0 resistance, a high-volume supply zone. If this level holds, ETH could drop toward $2,397.0, and a break below it may trigger further downside toward $2,192.0.

The bearish outlook is invalidated if ETH/USD closes above $2,539.0.

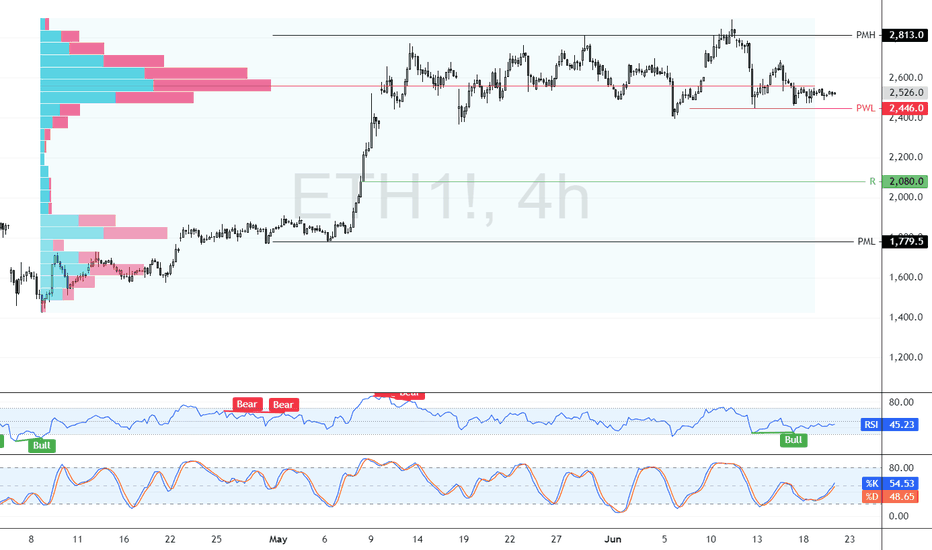

Bearish Wave Builds Below Key ETH Supply ZoneFenzoFx—Ethereum failed to break above $2,813.0 and is now trading around $2,430 after trimming nearly 5.0% of recent losses.

The $2,687.0 area, backed by the 50-period SMA, acts as a premium supply zone. A bearish wave could follow, targeting $1,779.0, supported by prior monthly lows and RSI div

Ethereum Rejected By Strong Resistance, A Bearish OutlookFenzoFx—Ethereum is consolidating around $2,525 after being rejected by the $2,813.0 resistance, a strong supply zone. Immediate support lies at $2,446.0. If ETH closes below this level, a move toward $2,080 is likely.

The bearish outlook is invalidated if ETH stabilizes above $2,813.0.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Micro Ether Futures (Nov 2025) is 2,906.5 USD — it has risen 1.89% in the past 24 hours. Watch Micro Ether Futures (Nov 2025) price in more detail on the chart.

Track more important stats on the Micro Ether Futures (Nov 2025) chart.

The nearest expiration date for Micro Ether Futures (Nov 2025) is Nov 28, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Micro Ether Futures (Nov 2025) before Nov 28, 2025.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Micro Ether Futures (Nov 2025). Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Micro Ether Futures (Nov 2025) technicals for a more comprehensive analysis.