E-mini S&P 500 Futures (Sep 2016) forum

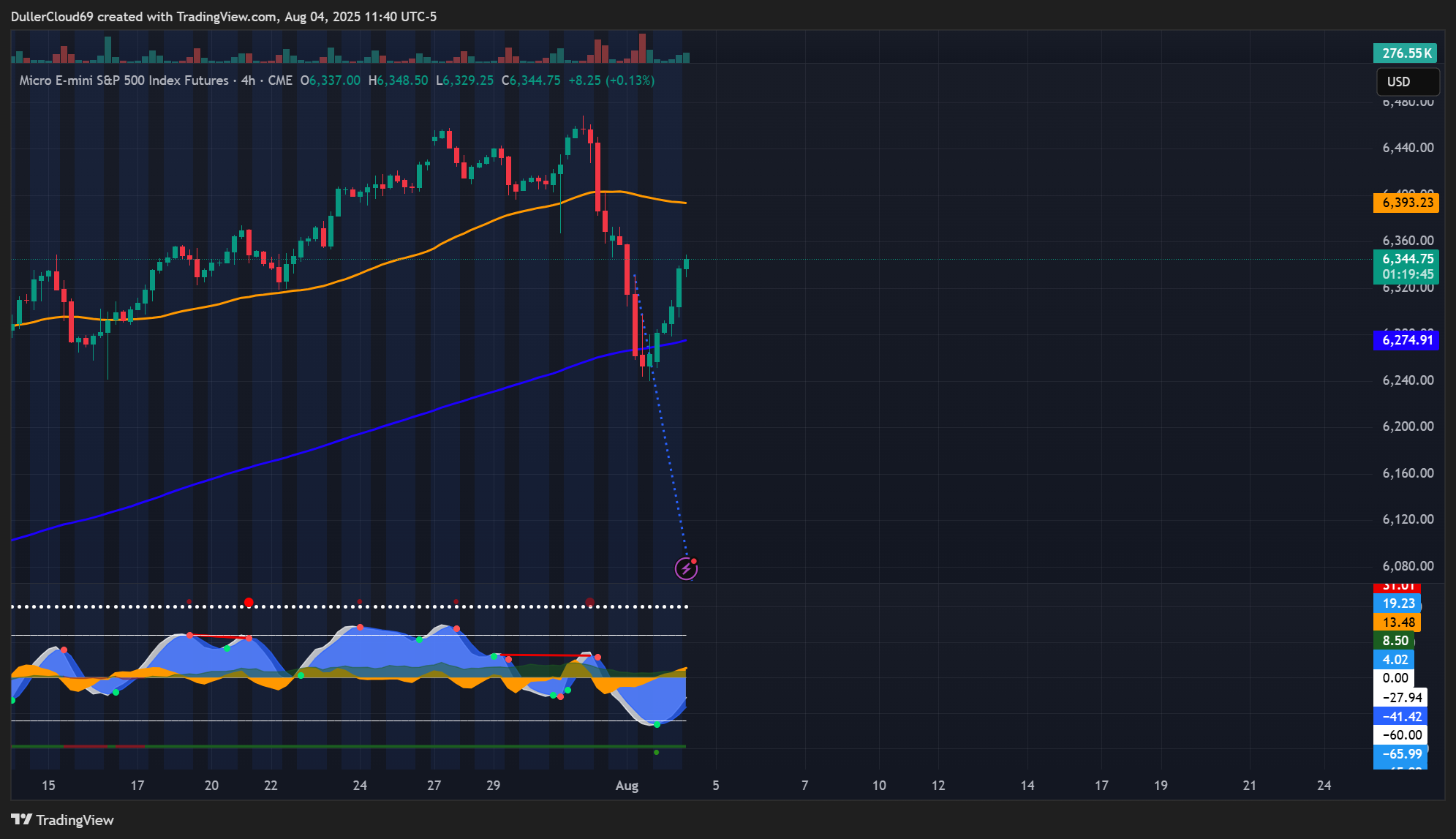

Liquidity Walls:

• 6347–6348 remains thick with passive sellers (360–370 stacked).

• New absorption cluster near 6345–6346: holding firm for now.

• 702 contracts hit into resistance at 6345.25—no breakout follow-through.

Despite a bullish intraday trend, the Bookmap showed:

• Heavy absorption at 6340 (736 + 610 stacked size)

• Reactive failure to push through that level

• Lower high formed immediately after the absorption

• Sellers stepped in aggressively, triggering short momentum

This qualifies as a liquidity-based scalp short, not a reversal of trend.