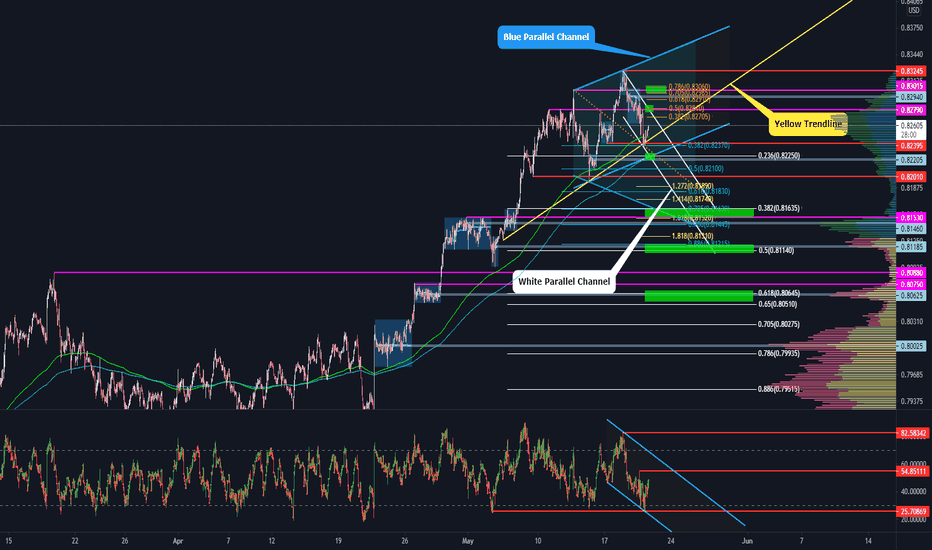

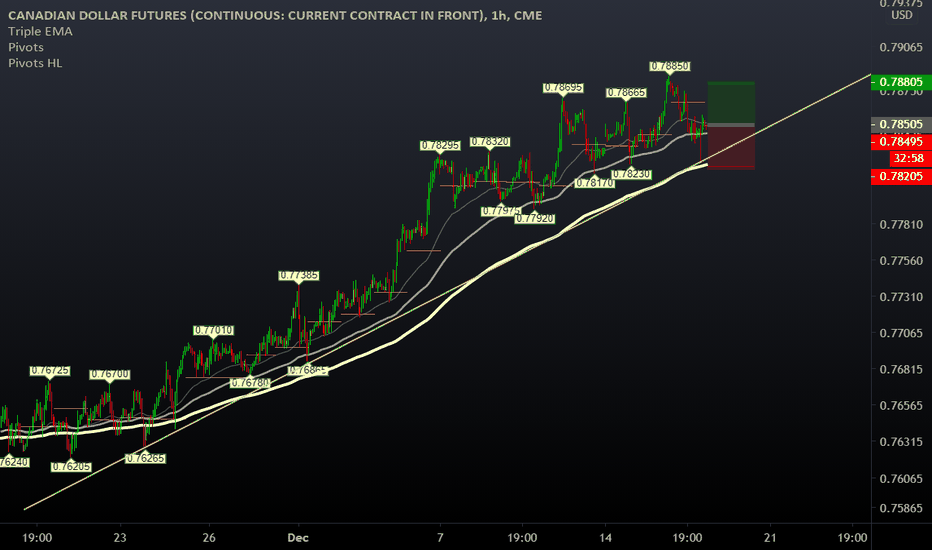

CADUSD | When and where to enter long and short#CADUSD #Futures #6CM2021 #1HR

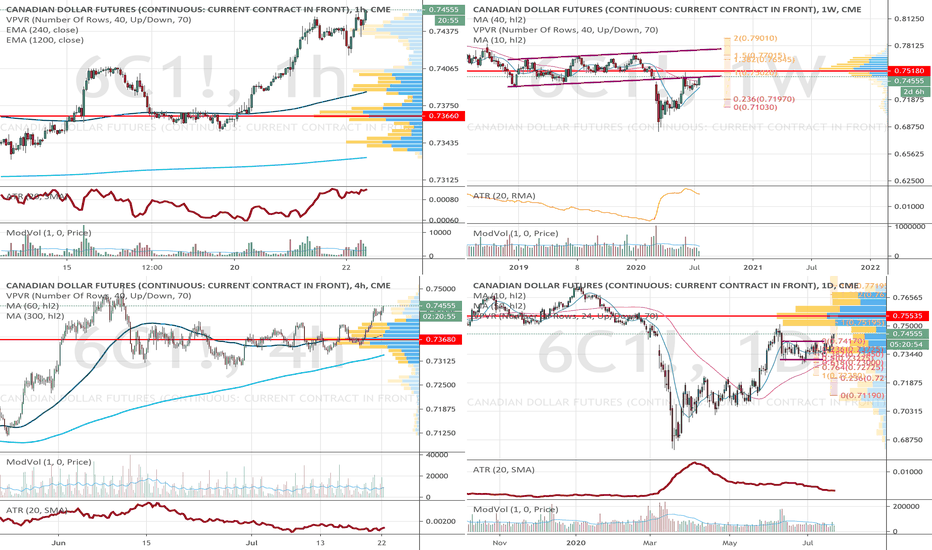

- Here is CADUSD futures 1hr chart. Currently, yellow upward trendline is supporting and a short-term bottom has been formed at 0.82370. I am more bearish when this bottom fails supporting.

- When that happens before 5/20 19:00, I am looking at 0.82200~0.82280 as a short-term support. If you wish to enter long here, make sure to take profit under the previous bottom at 0.82370 since it will then act as a resistance due to SR Flip.

- On the other hand, if CADUSD rallies upward to test the top of the white channel before 5/20 18:00, 0.82760~0.82840 seems to be a decent resistance. If white channel gets broken above, 0.82990~0.83070 is next resistance I am considering.

- If the market gets bearish and goes through some more correction, here are some of the supports for long entry: 0.81530~0.81630, 0.81110~0.81210, and 0.80540~0.80670.

- All of the periodic references are in Korean standard time (UTC+09:00).

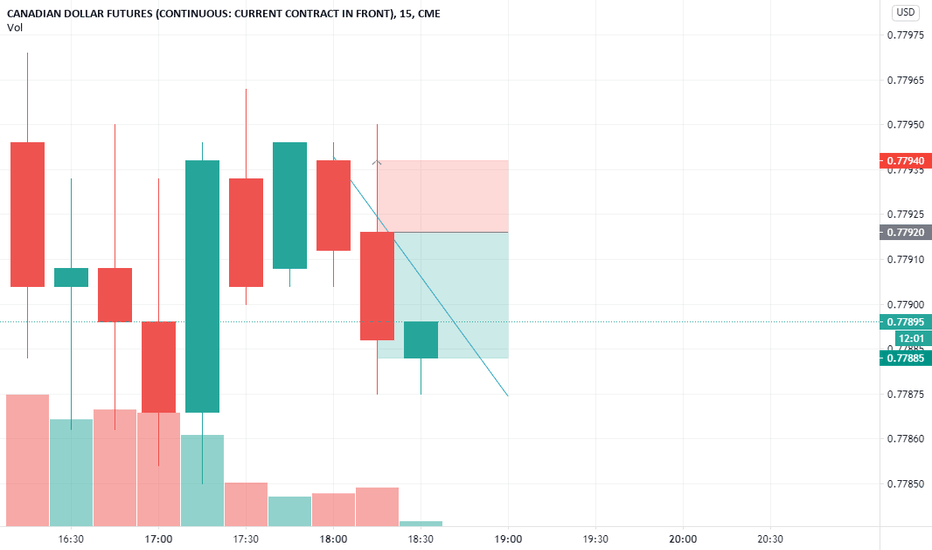

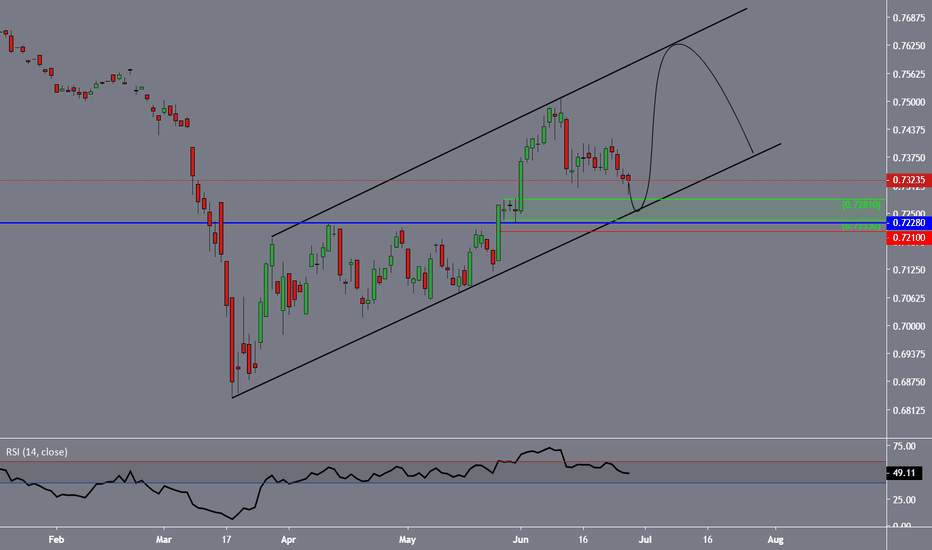

MCD1! trade ideas

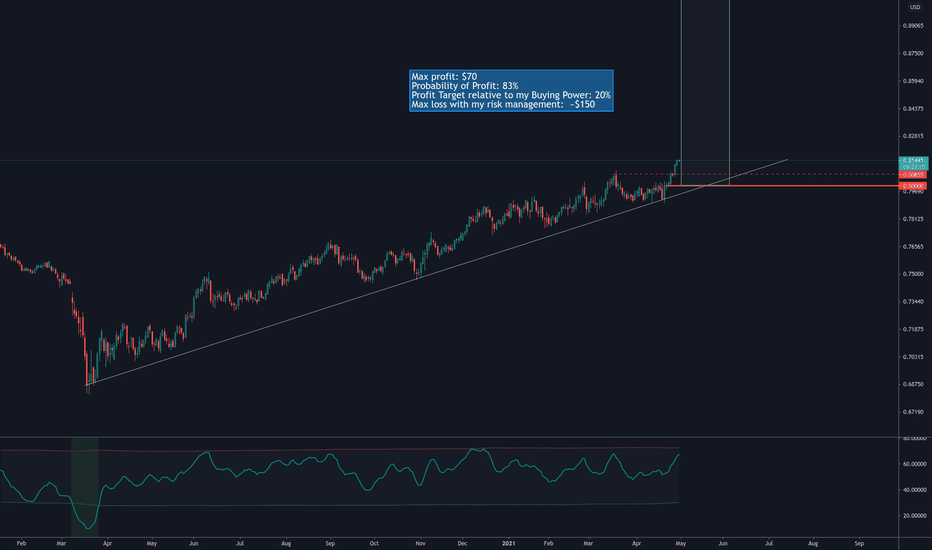

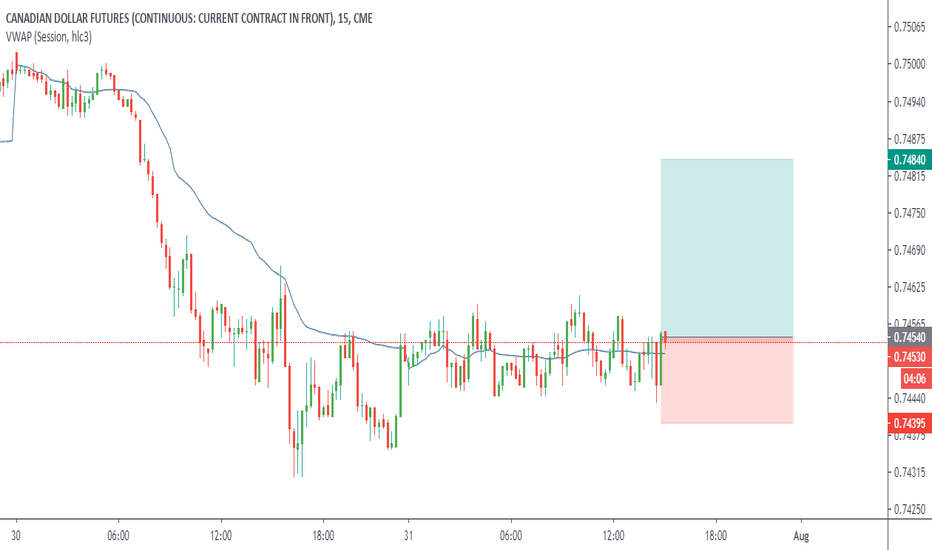

Canadian Dollar short put verticalMax profit: $70

Probability of Profit: 83%

Profit Target relative to my Buying Power: 20%

Max loss with my risk management: ~$150

Req. Buy Power: $430 (max loss without management at expiry, no way to let this happen!)

Tasty IVR: 28 (average at futures)

Expiry: 36 days

Sell 1 !6CM1 Jun4' 0.8 Put

Buy 1 !6CM1 Jun4' 0.785 Put

Credit Call spread for 0.70cr each

Stop/my risk management : Closing immediately if daily candle is closing BELOW the box, max loss in my calculations in this case could be 150$. Probability of loss in this way: ~10% .

Take profit strategy: 50% of max.profit in this case with auto sell order at 0.35db. Probability of profit this way: ~90%.

Of course I'll not wait until expiry in any case!

If you liked this article, check my other ideas.

Anyway: HIT THE LIKE BUTTON BELOW , and for fresh option ideas FOLLOW ME( @mrAnonymCrypto ) on tradingview !

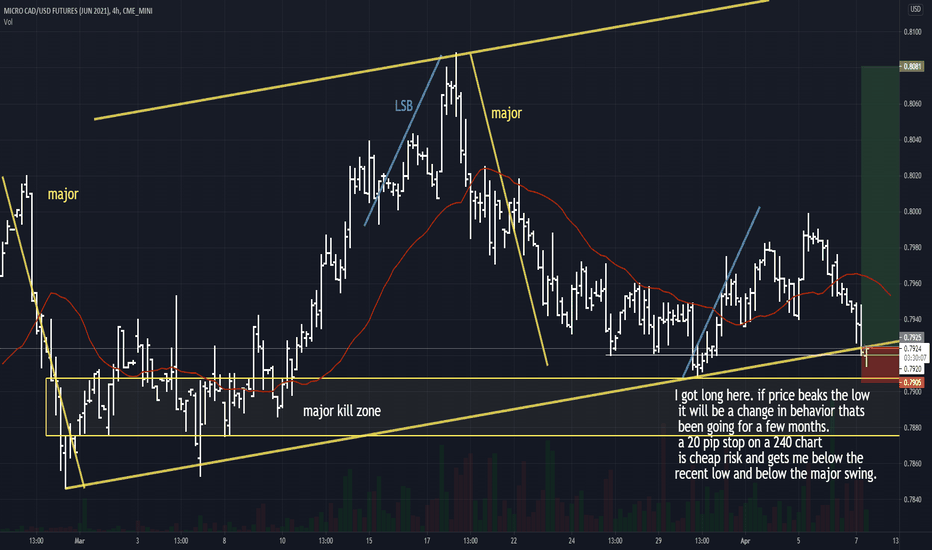

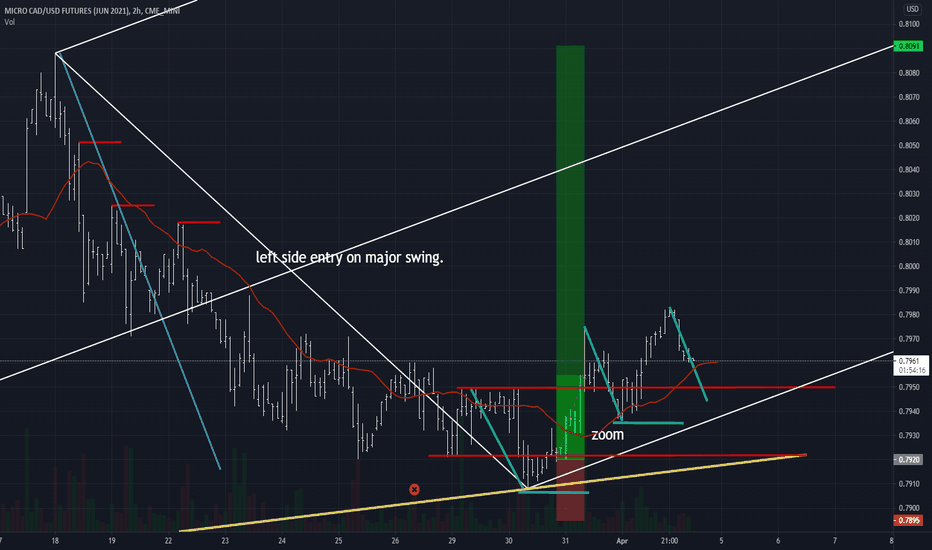

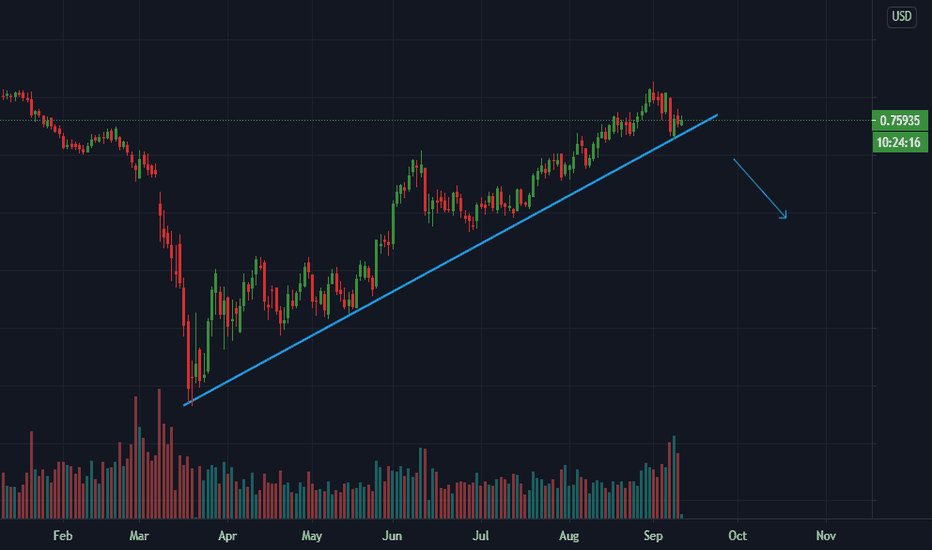

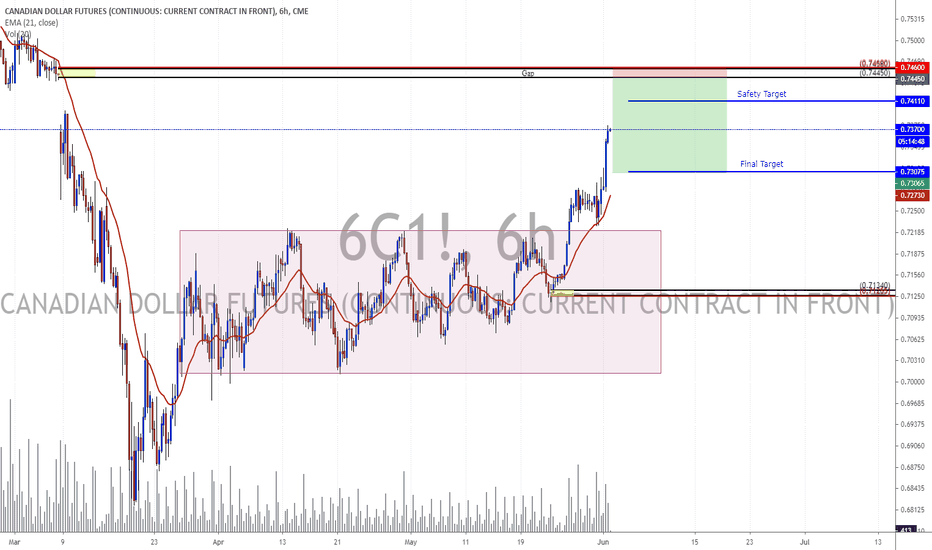

cadusd long major swing rr+ 7.8 to 1 I got long here. if price beaks the low it will be a change in behavior thats been going for a few months. a 20 pip stop on a 240 chart is cheap risk and gets me below the recent low and below the major down CME_MINI:MCDM2021 swing. if price fails and cracks the major swing , we could double that move to the downside. if it hold here, I see a try for new highs.

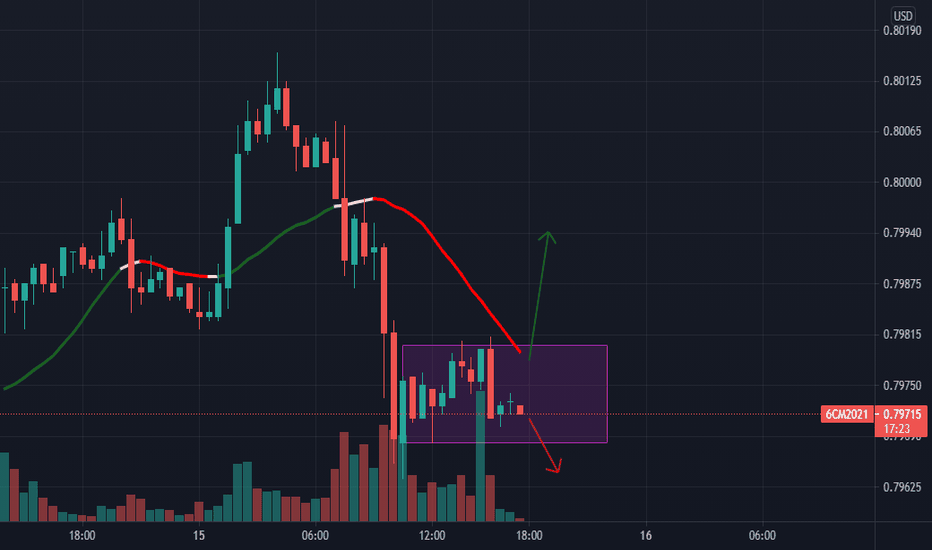

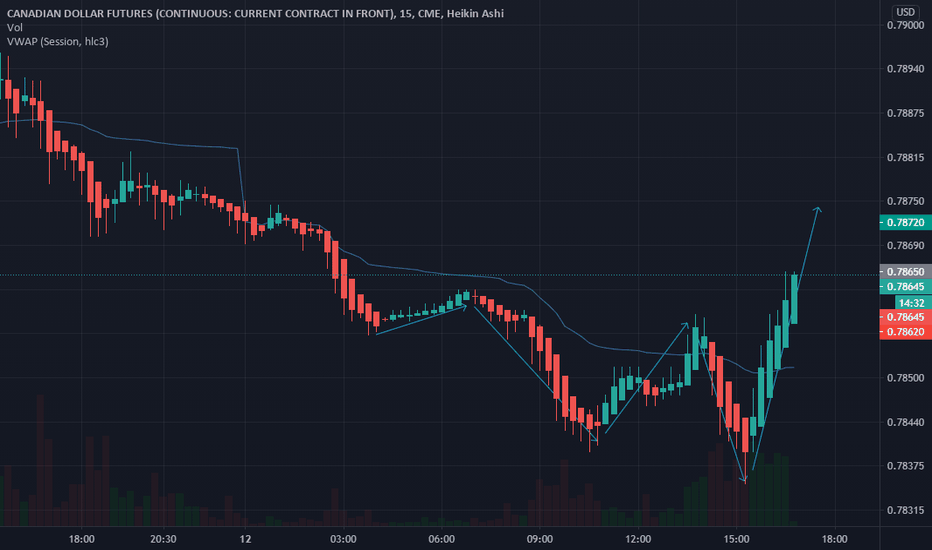

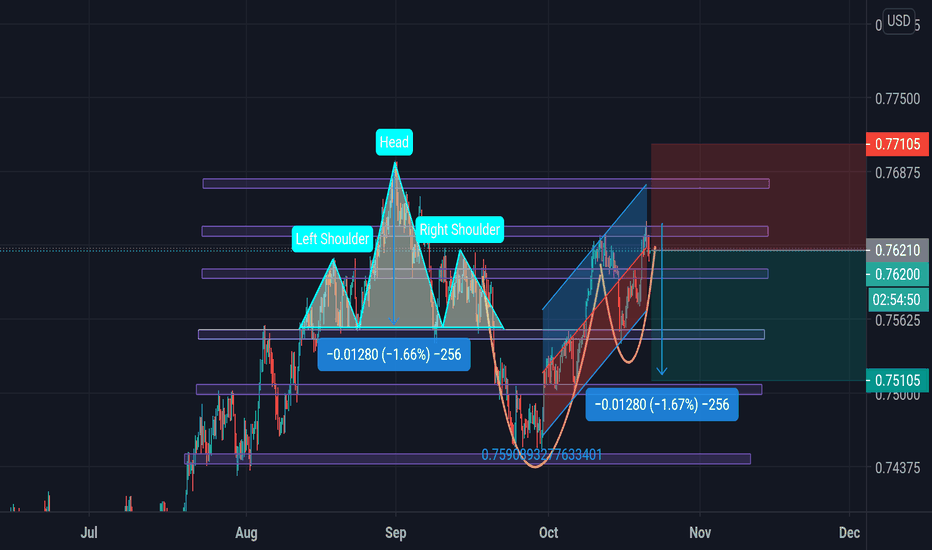

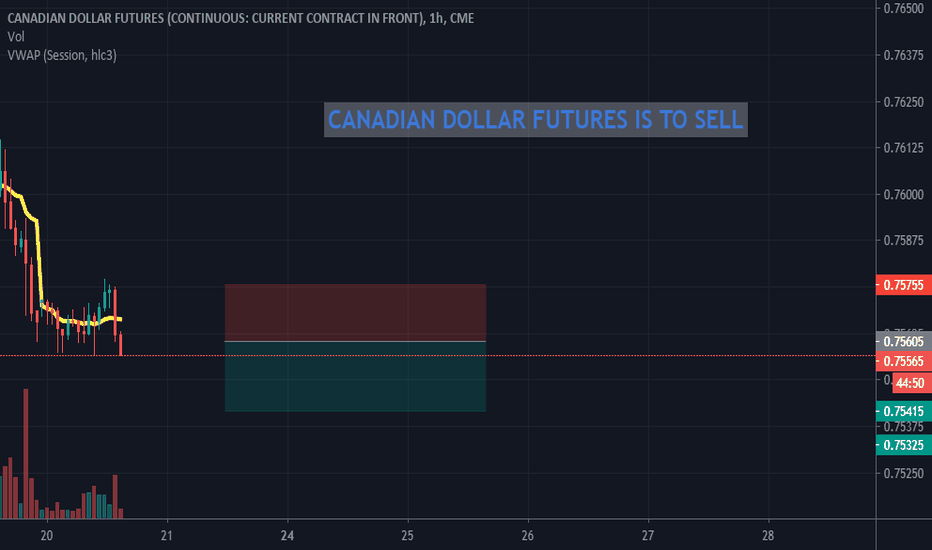

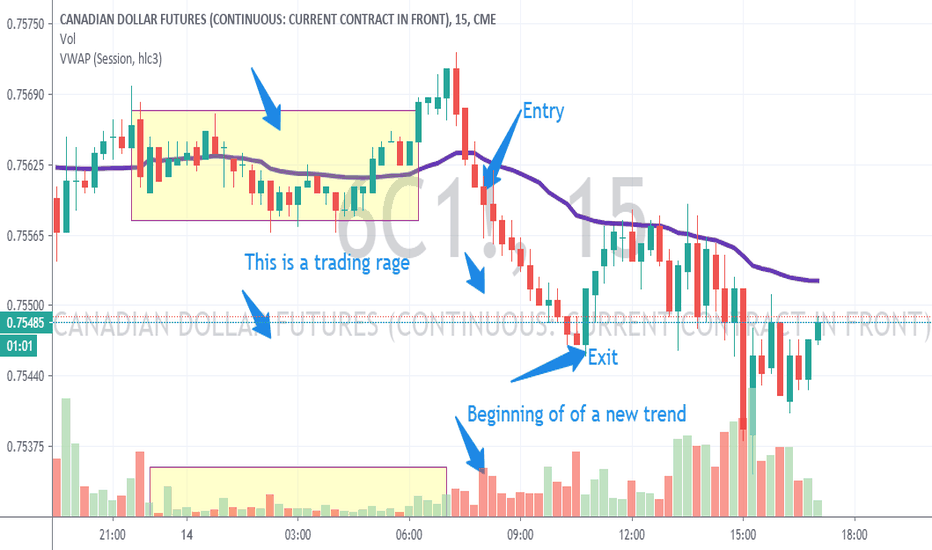

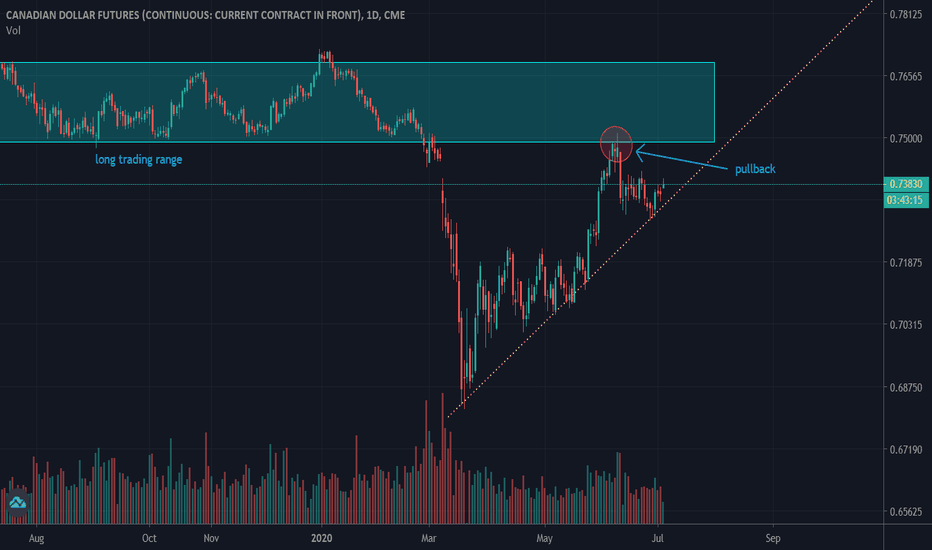

the canadian dollar to buy or sell?after a long trading range, the market dropped. Then a pullback trying to reach the previous support was entamed.

if the market has a strong green volume, it is obvious that we will reach the previous tops of the market. If else, the support (yellow) will be broken and the market would begin a descend.

So let's look at the volumes and see what algotraders will decide...

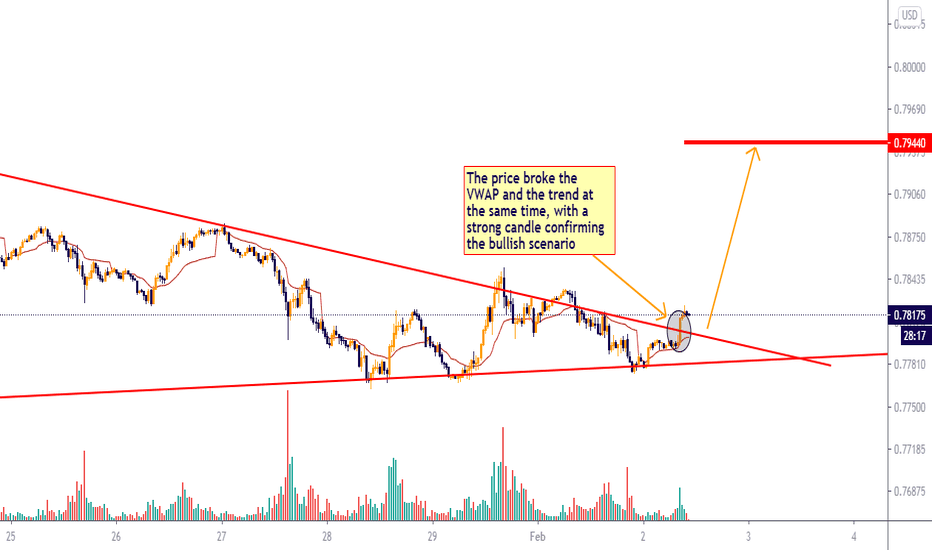

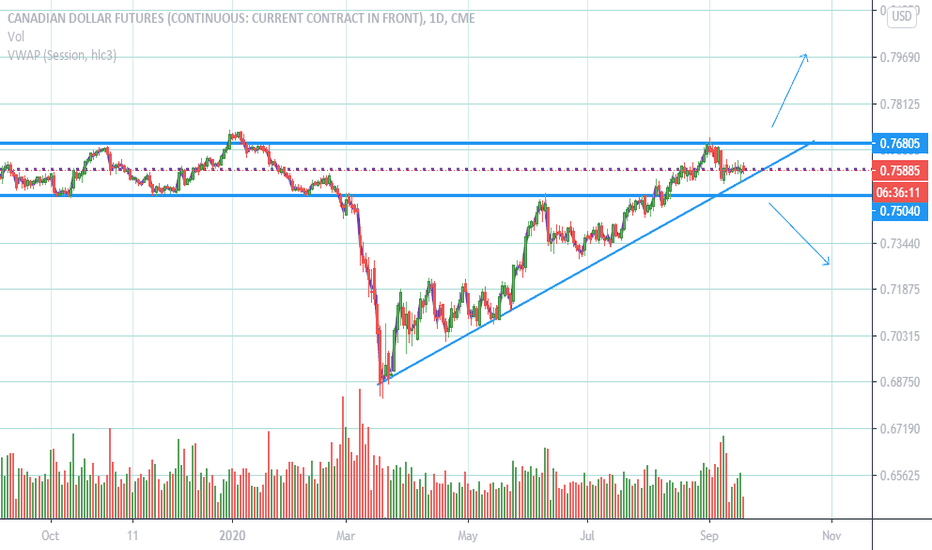

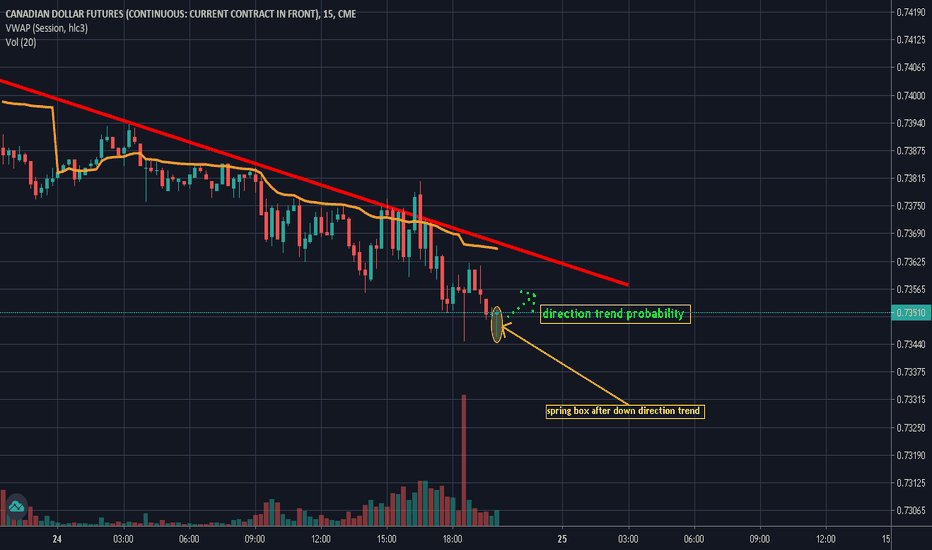

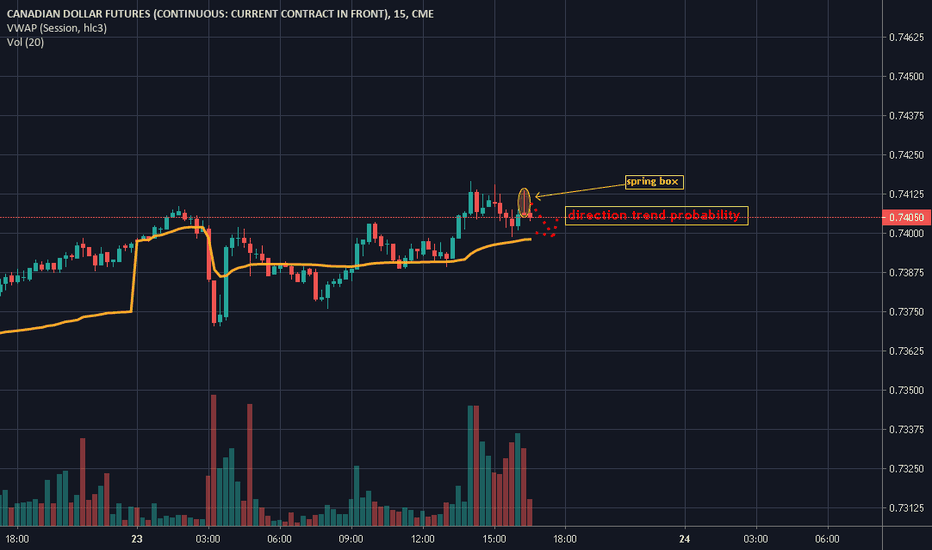

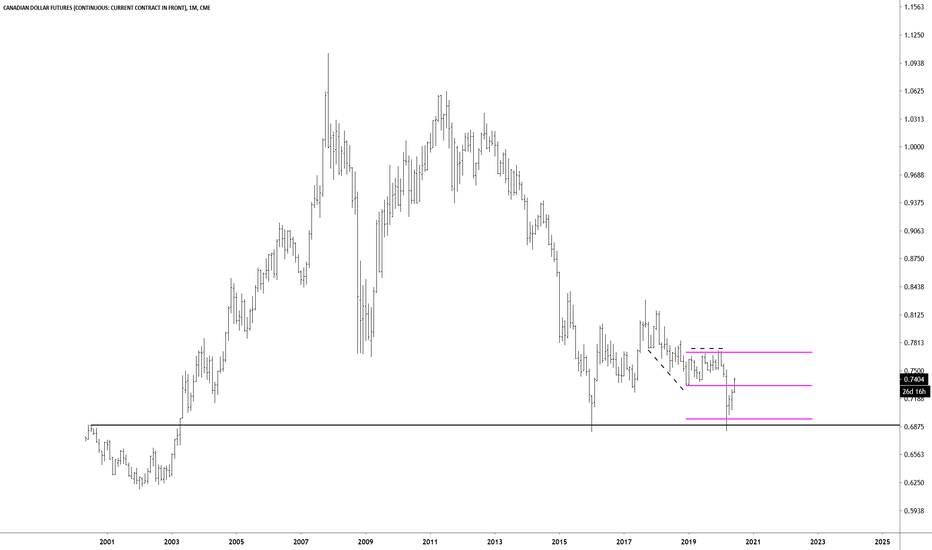

Discretionary Trading6.4.20 I just got a personal message from a follower who I respect and like. I copied the message but left the follower's name out. Respectfully, this trader plans to be profitable with minimal or no discretion, except for entering a trade, and establishing a risk and reward... and then following through with the trade in robot fashion. This will not work, and it is not realistic in my opinion. Trading is not easy, and most professional mutual funds... actually 90% of mutual funds... cannot match the performance of an index fund that is comparable to their selection of stocks. I thought I would talk about this and then go through some futures contracts on the currencies to discuss simple patterns and lines that I look for.