Related futures

4 Powerful, Daily Affirmations for Faith-Based TradersAffirmations make a huge difference.

But why?

It's because they shape our beliefs.

Whatever we think, affects what we say.

Whatever we say, affects what we do.

Whatever we do, is who we become and what our life actual looks like.

Repeat these affirmations daily and watch your life change bef

Automated Execution: TradingView Alerts → Tradovate using AWS LaI’ve built a fully automated pipeline that takes live TradingView alerts and turns them into real orders in Tradovate. Here’s how it works, step by step (I will provide a video on it):

PineScript Alerts

My indicator/strategy in TradingView fires alert() with a JSON payload (symbol, side, qty, pr

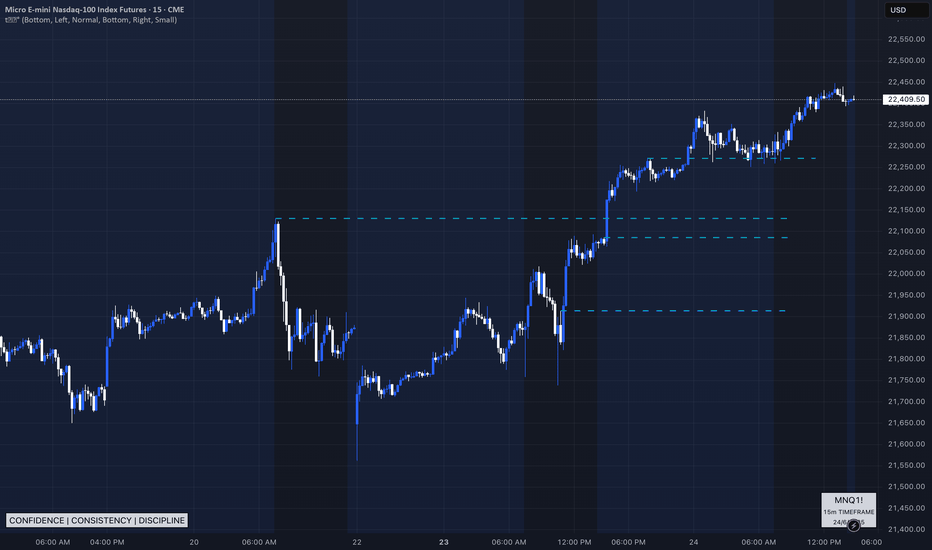

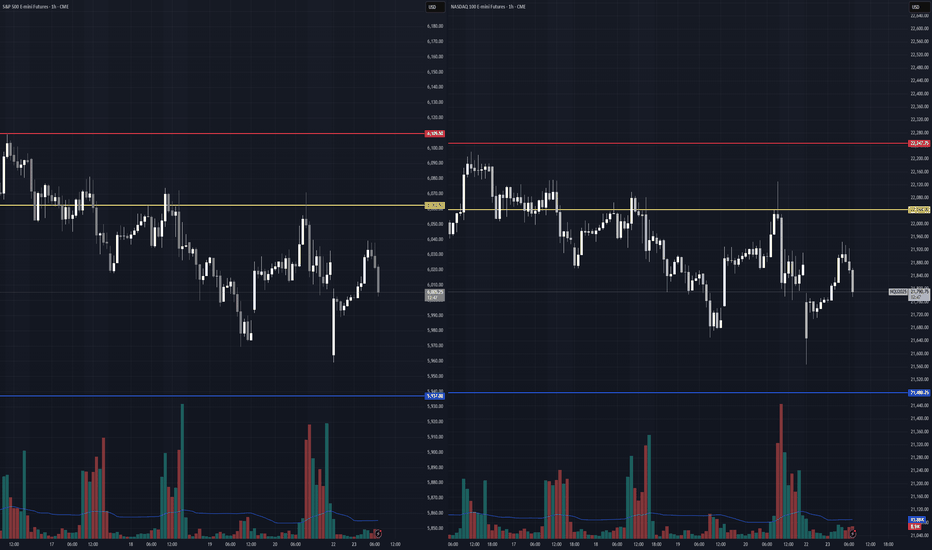

PO3 analysis previewThis chart displays my current working model for PO3 structure, focusing on a multi-timeframe analysis (9m, 27m, 81m, 3H) using volume imbalances and key time-based phases. I’ve marked potential accumulation, manipulation, and distribution zones, alongside session-specific traps (like NYO sweeps) an

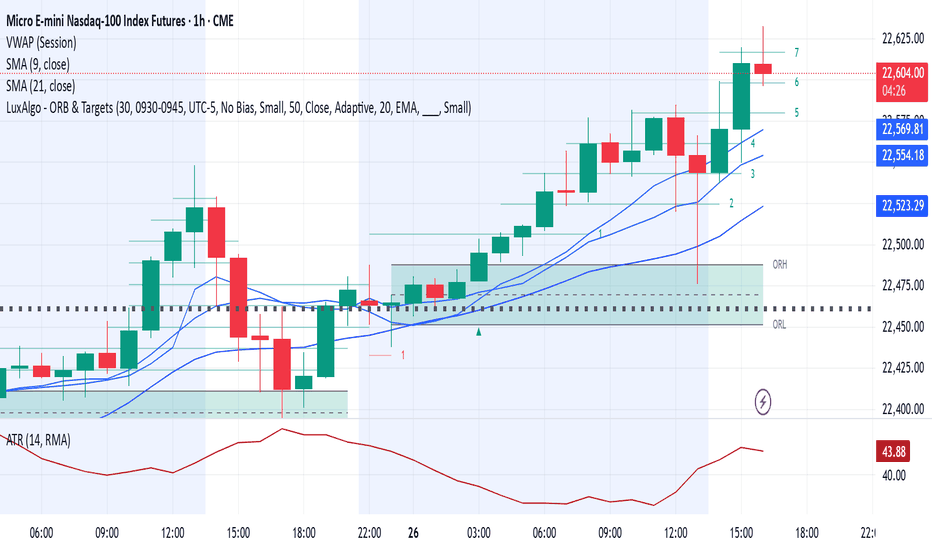

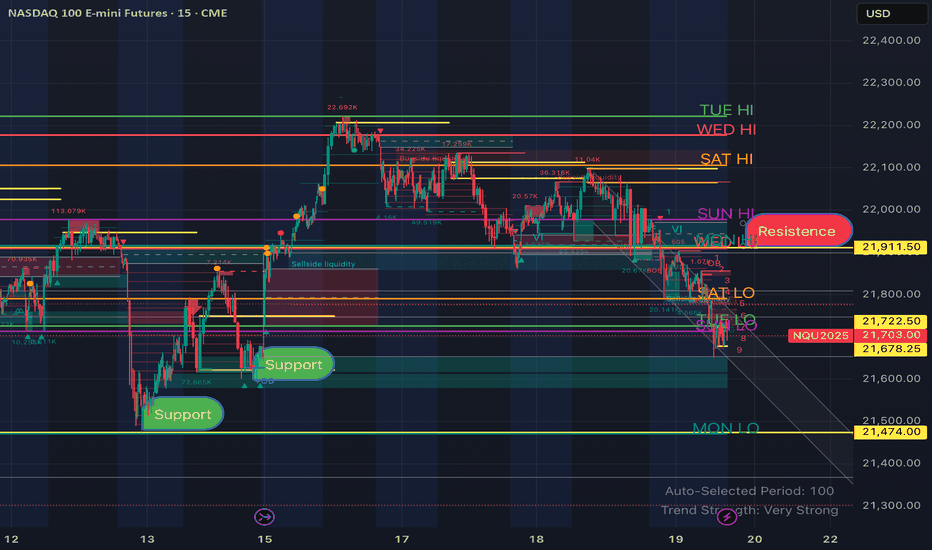

NQ2025 – Clean Liquidity Sweep & OB Rejection Leads to Trend ConDescription (for the Idea post):

NASDAQ Futures (NQ2025) - June 19th Setup Breakdown

Market showed textbook Smart Money behavior today.

🔹 Key Highlights:

Price swept the Saturday Low and Wednesday Low, triggering sell-side liquidity.

Reaction from an old Order Block + Fair Value Gap (FVG) zone near

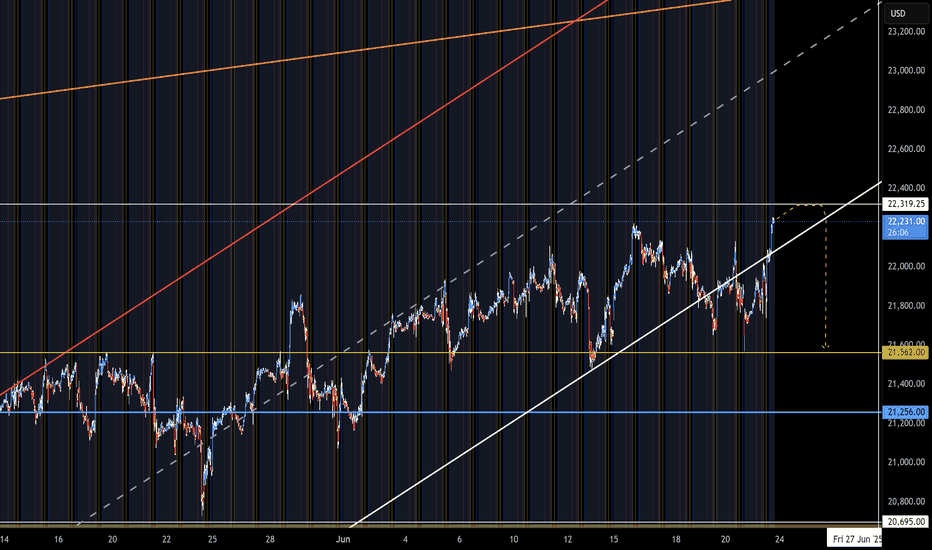

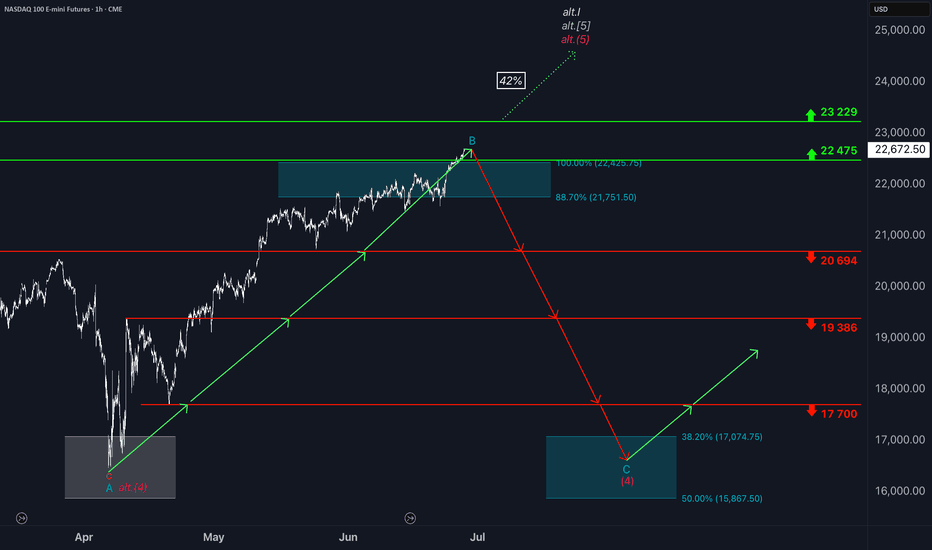

Nasdaq: At the Upper EdgeYesterday, the Nasdaq climbed above resistance at 22,475 points. Currently, the index is positioned outside our turquoise Target Zone (coordinates: 21,751 – 22,425 points), which remains active. Stops for short positions 1% above the zone have not yet been triggered. Our primary scenario remains int

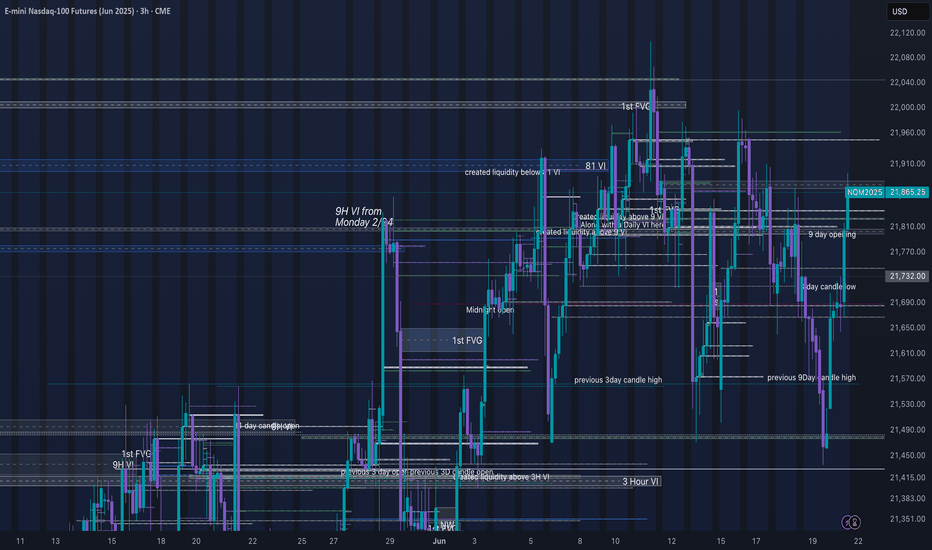

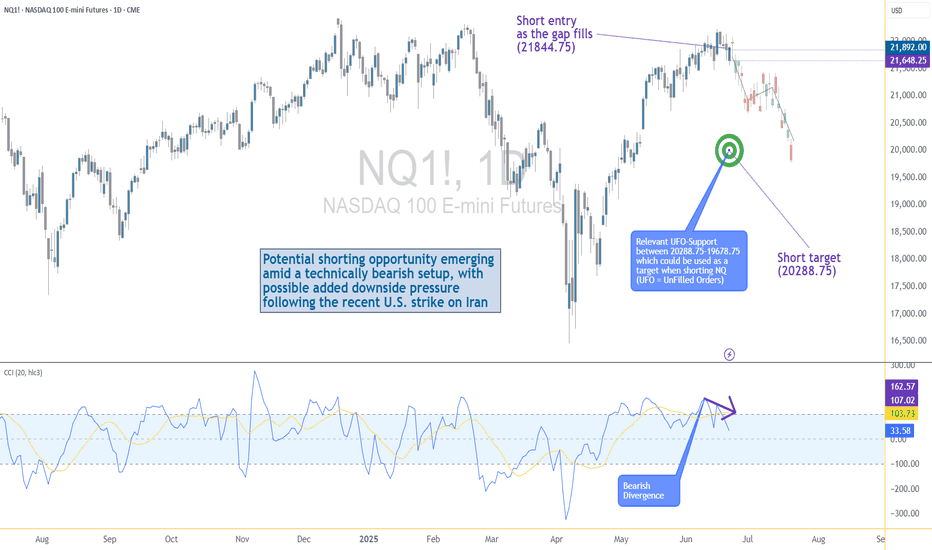

US–Iran Conflict Triggers a Potential Nasdaq Bearish Setup🟣 Geopolitical Flashpoint Meets Technical Confluence

The U.S. weekend airstrike on Iranian nuclear facilities has reignited geopolitical instability across the Middle East. While broader markets often absorb news cycles quickly, high-beta assets like Nasdaq futures (NQ) tend to react more dramatic

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for E-mini Nasdaq-100 Futures (Mar 2015) is Mar 20, 2015.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Nasdaq-100 Futures (Mar 2015) before Mar 20, 2015.