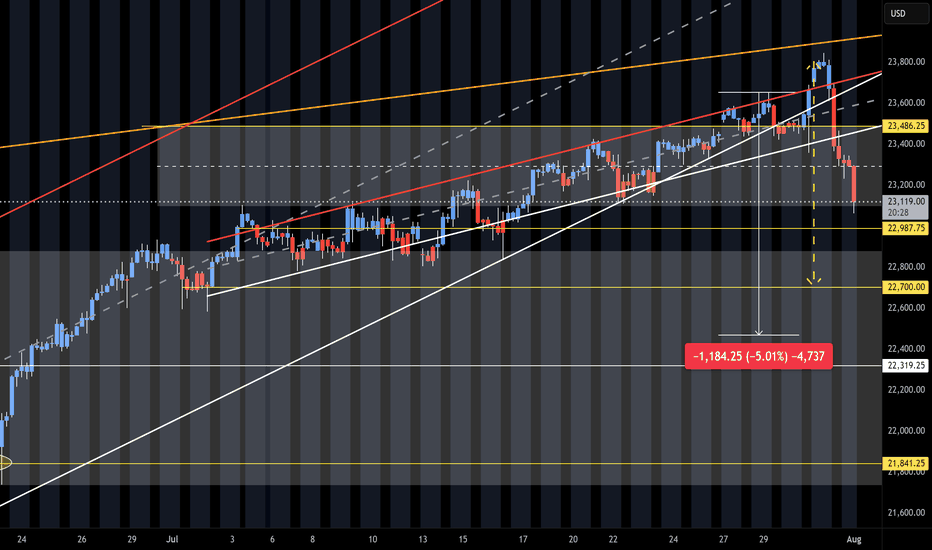

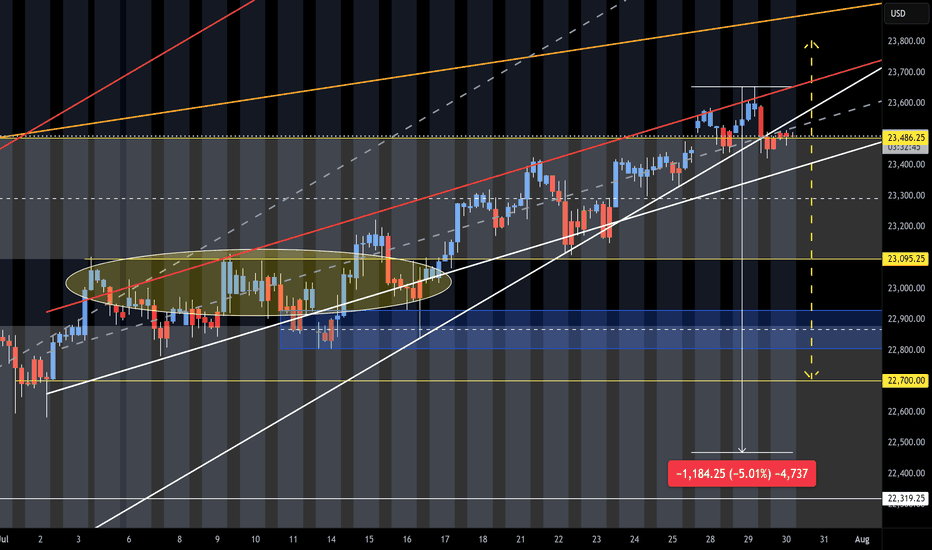

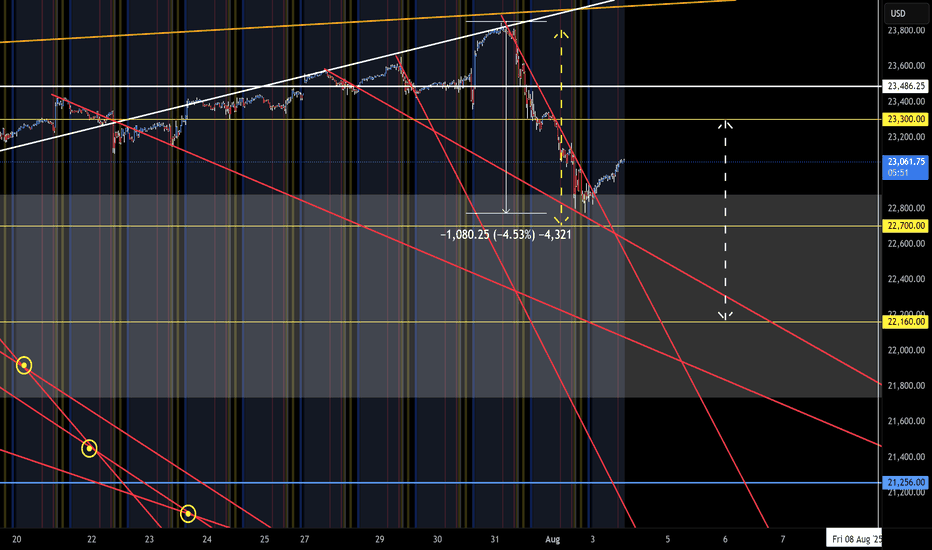

NQ Short (08-01-25)The 5% pull back is playing out. We had the heavy selling after the O/N Pump/Dump into the selling of the Reg Session and Outside Day Reversal. Up for weeks and down in hours. Next break down will have to be the failure of the long standing Friday into Monday Long Play. We did get the reg session se

Related futures

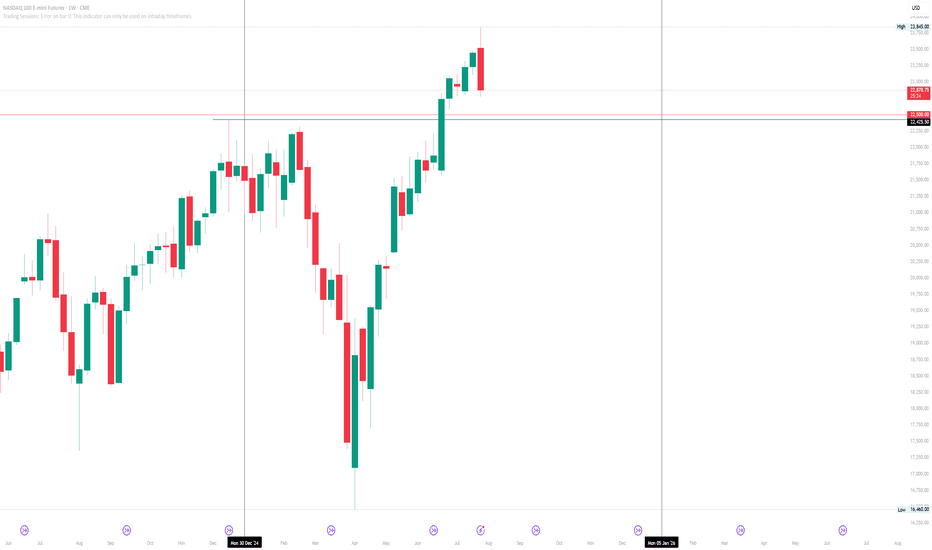

NQ Short (07-30-25)NAZ is at upper target and Turn Zone from May 12th post. Failure here should see a 5% drop test. The idea is that buyers will need some sellers in order to get higher. The sellers will help to test the level strength. Month end into a Friday-Monday Long play and a break in this long standing pattern

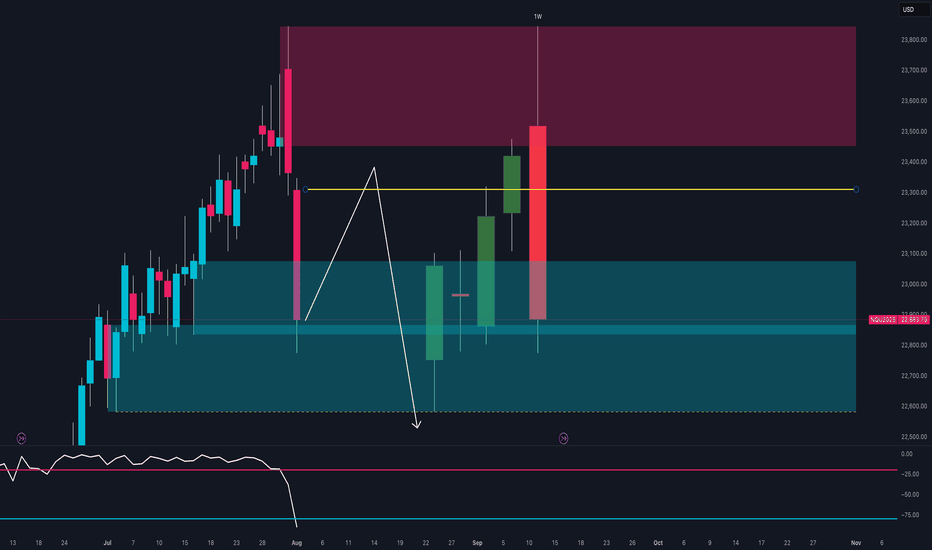

NASDAQ at Key Turning Point 🔍Technical Context

After testing the 23,600–23,800 supply zone, price printed a strong bearish rejection with a weekly engulfing candle.

The RSI broke decisively below the midline, signaling a clear loss of momentum.

Price is now trading back within the weekly demand zone between 22,800 and 22,950

How to Use Engulfing Candles in TradingViewEngulfing patterns are among the most powerful candlestick formations because they signal strong momentum shifts and can help you spot dramatic trend reversal opportunities.

What You'll Learn:

• How to identify valid engulfing formations where one candle completely covers another's bo

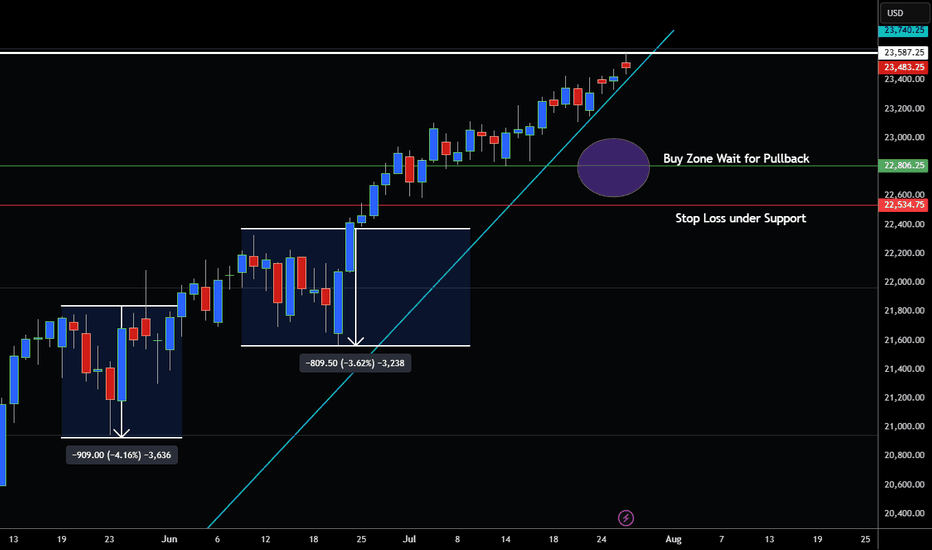

NQ Targets (08-04-25)Many calls did play out last week and looking for some targets to get tested this week. On 7/29 called the Yellow arrow (last week's called range), the white is this week's. NDX has some gaps to retest, YTD chart below and yellow arrows are the targets.

The 30M and 4HR charts are adjusted to matc

Nasdaq outlook on the weekly.... Where will price go next?Market cycle outlook on the year :

We have now reached a new month.

August 1st, which a new market cycle for the month to form, along beginning the backend of the year 2025 and the front end of a new week coming.

Closed bearish this week along with hitting all time highs once again for the Nasda

NASDAQ 100 LOOKING OVERBOUGHT RIPE FOR A CORRECTION?Hey Traders so today was looking at the Nasdaq 100 and it seems like it's approaching overbought territory at all time highs.

Of course no one knows what earnings season will bring and seasonally historically August is normally a good month for stocks.

So if we look at previous rallies market seem

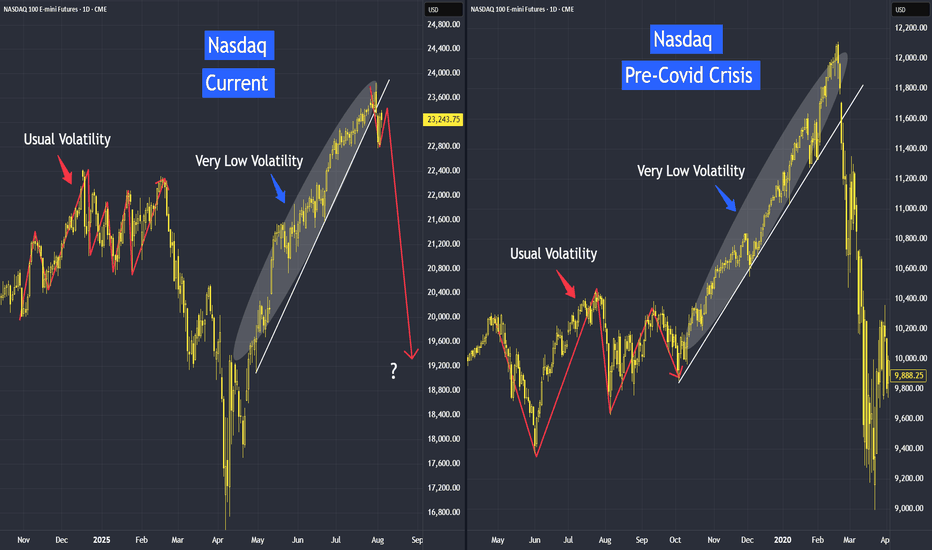

Calm Before a StormSince the post-COVID period, we have not seen such a gentle and continuous uptrend. This phenomenon reminds me of the market before the COVID meltdown.

How do I going to interpret this "Gentle & Continuous Uptrend" move?

My answer: Cautiously bullish

Back then, market was cautiously bullish beca

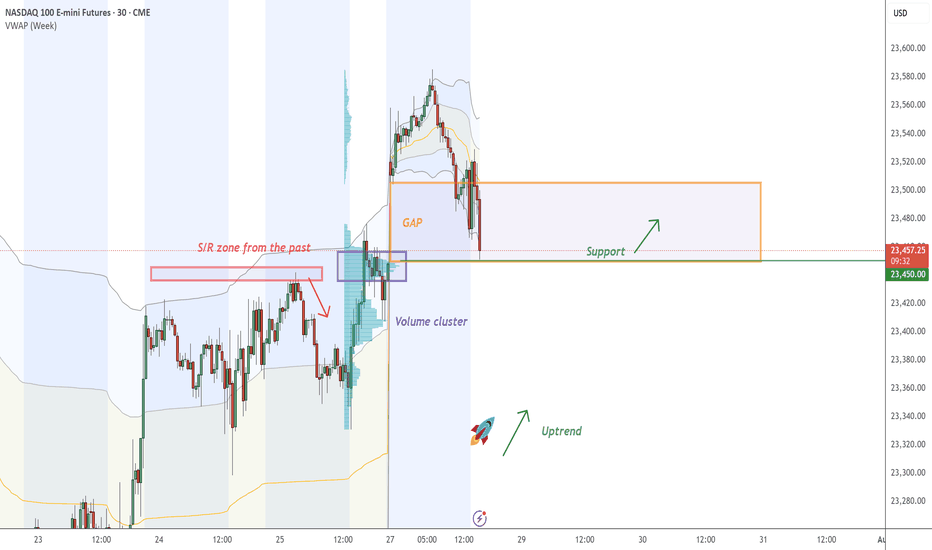

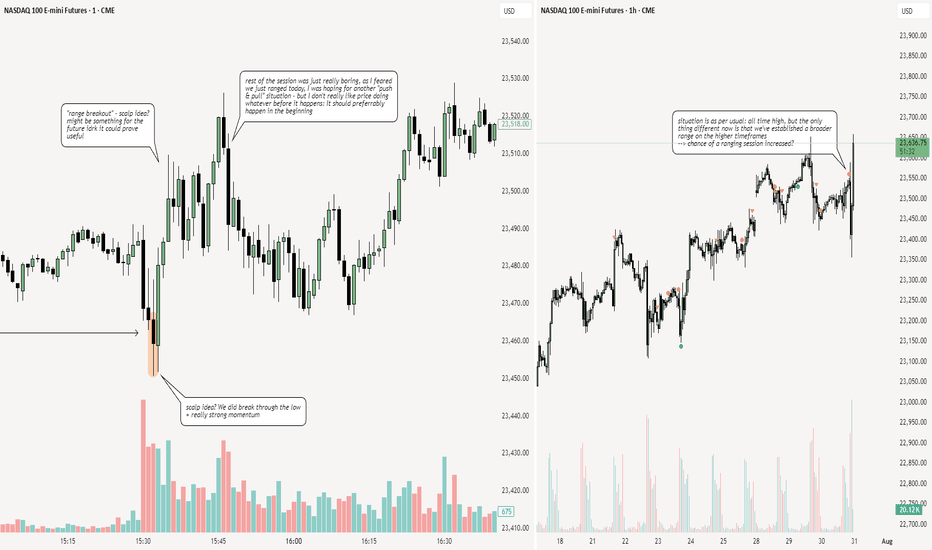

NASDAQ - Fair Value GAP On NASDAQ , it's nice to see a strong buying reaction at the price of 23450.00.

There's a significant accumulation of contracts in this area, indicating strong buyer interest. I believe that buyers who entered at this level will defend their long positions. If the price returns to this area, strong

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for E-mini Nasdaq-100 Futures (Sep 2018) is Sep 21, 2018.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Nasdaq-100 Futures (Sep 2018) before Sep 21, 2018.