Can $ALB Triple Without Lithium Prices Hitting All-Time Highs?🧠 TL;DR

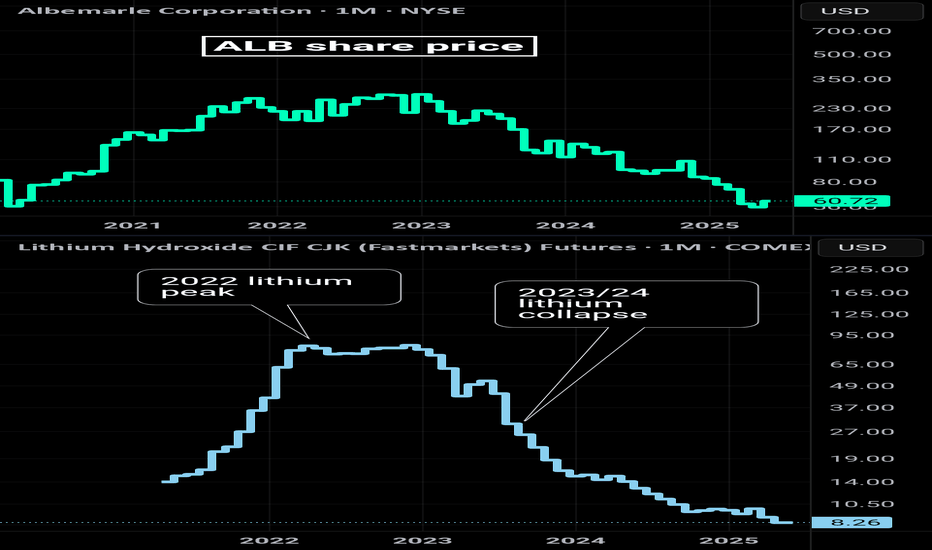

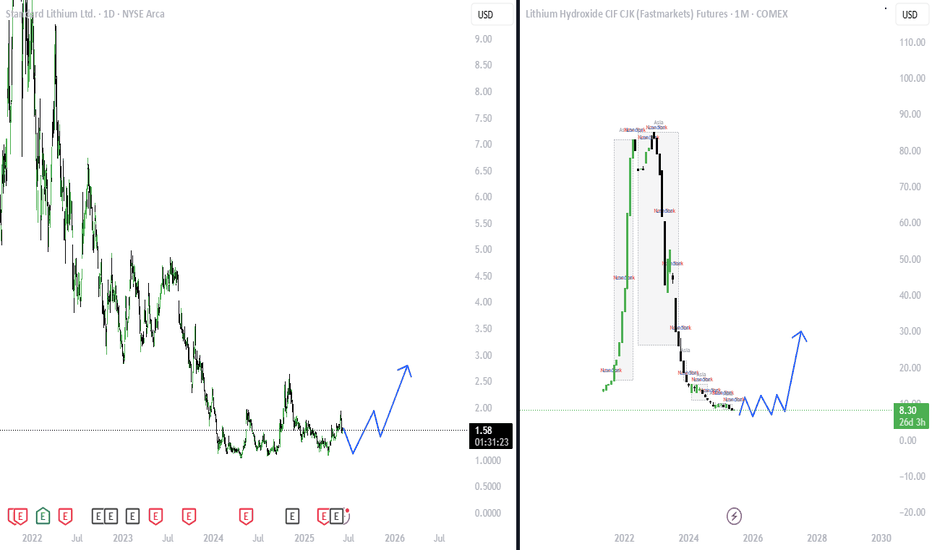

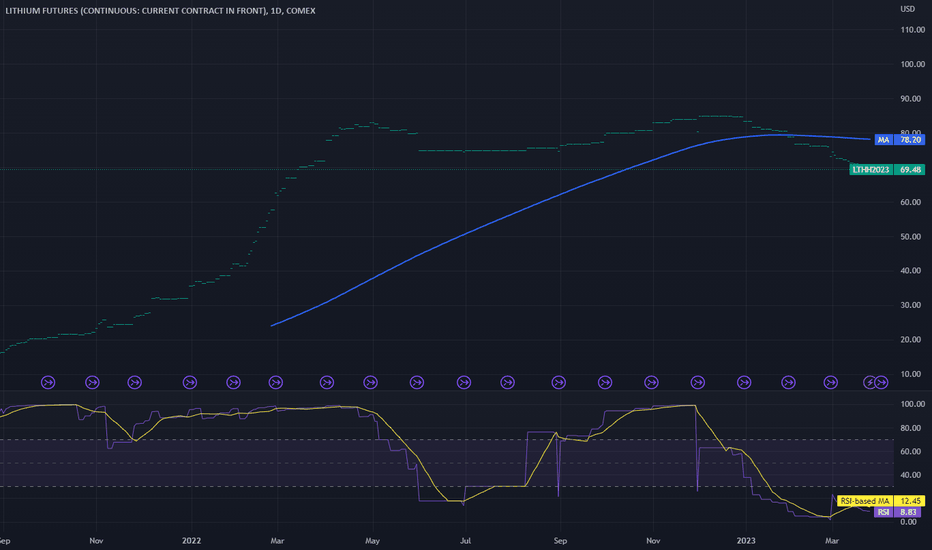

Albemarle ( NYSE:ALB ), a global lithium heavyweight, has seen its stock price collapse over 70% from its 2022 highs, closely tracking the decline in lithium spot prices. With lithium carbonate plunging from ~$80,000/ton to under $15,000/ton, many investors assume a rebound in the commodi

Related commodities

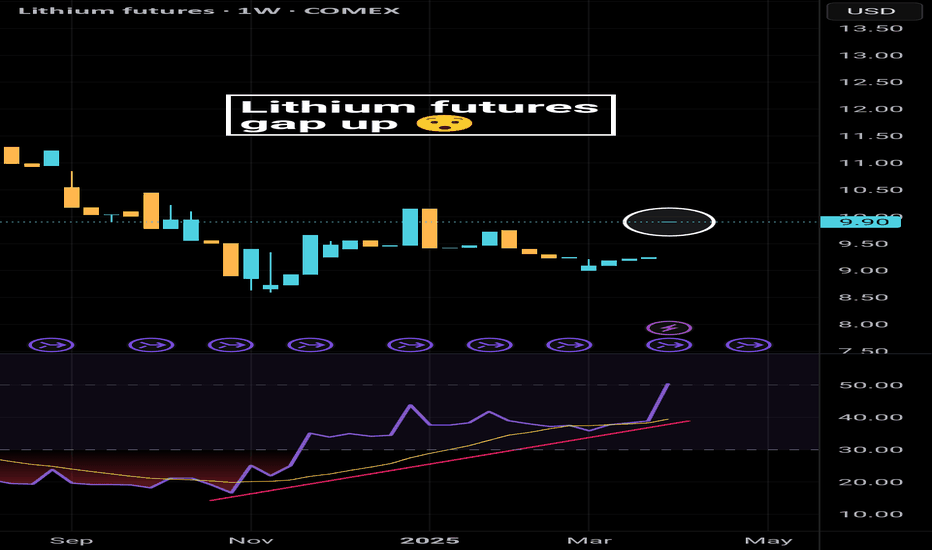

Will Lithium go up?Why Are Lithium Prices at Multi-Year Lows?

1. Oversupply: Between 2022 and 2024, global lithium production surged by over 35%, outpacing demand growth of approximately 30%. This imbalance led to a surplus of around 154,000 tonnes in 2024.

2. Slower EV Adoption: The anticipated rapid growth in

US-Ukraine minerals deal: key commodities at stake Ukraine is set to sign an “improved” minerals deal with the US after the US dropped its claim to $500 billion in potential revenue, according to the FT. The news has boosted the euro and market sentiment, but what about the commodities involved?

Ukraine holds about 5% of the world's critical raw m

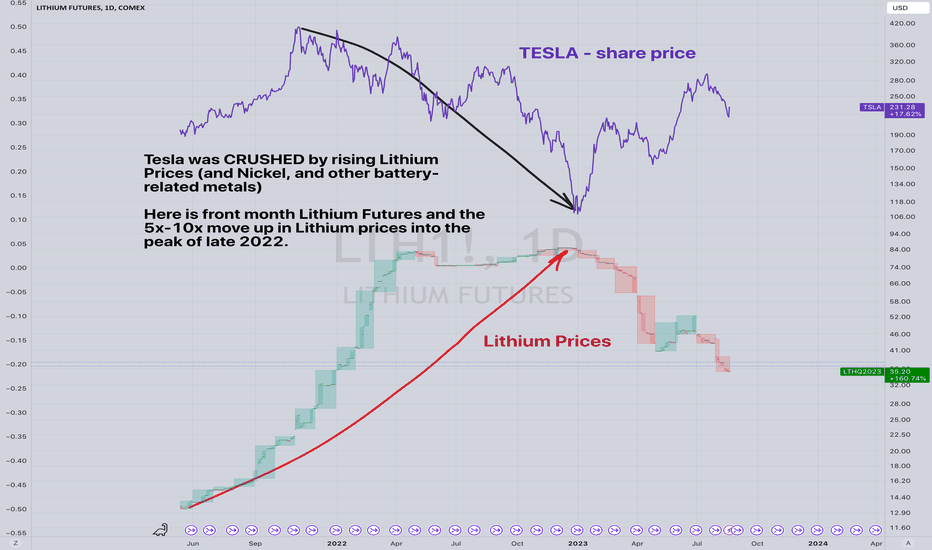

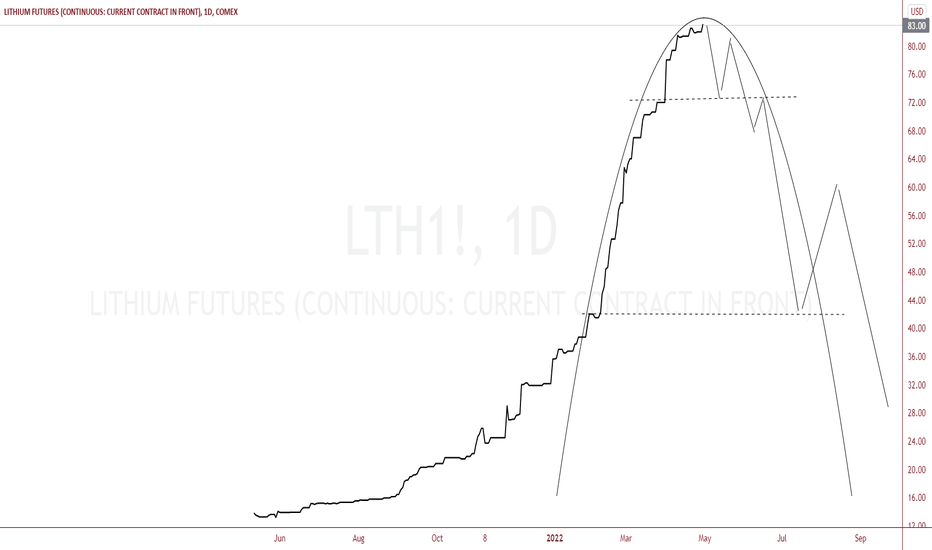

Tesla $TSLA vs Lithium PricesTesla NASDAQ:TSLA vs Lithium Prices

Tesla was faced with crushing increases in the price of lithium which created a feedback-loop spiral to the downside for investor and speculator expectations.

There were many other factors going on at the same time for Tesla's big slide from $400+ down to $100

Lithium Commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutua

Lithium Commodity USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutua

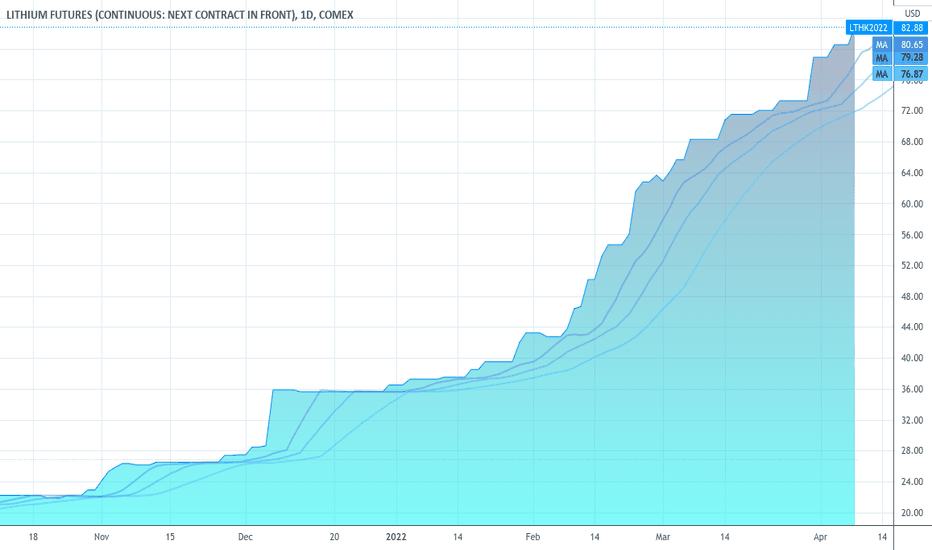

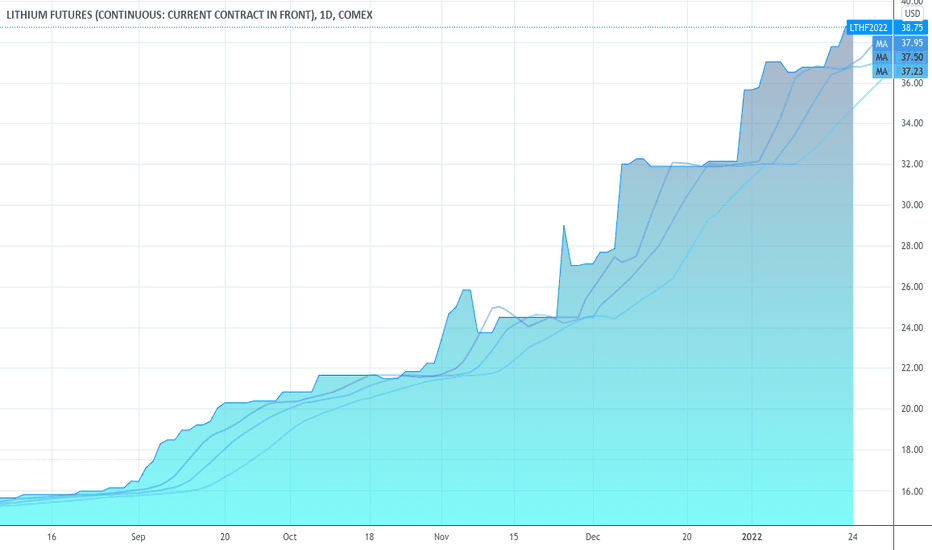

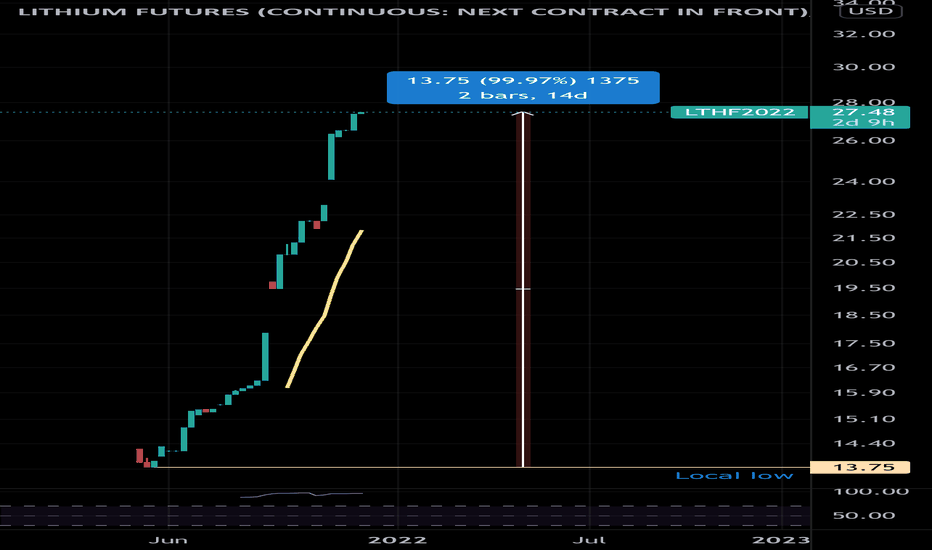

Lithium Long: Price is at the inception phase of demandSummary: long, there is insufficient lithium in the world to meet rechargeable battery demand.

Bullish on the weekly and monthly TF.

Core component for: electric cars, electric bike, solar systems for homes, laptops, etc..

It is probably that Lithium 2-4x going into 2022.

Simply insufficient Li

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.