Contract highlights

Related commodities

Coffee just gave a two-bar reversal to go long6 23 25 oil just went higher presumably from what happened with Tehran... and I heard several people say that oils going a lot higher. I really don't believe that but more importantly we can use some of the tools on the chart to decide when to take trades as a buyer and a seller. there's a cl

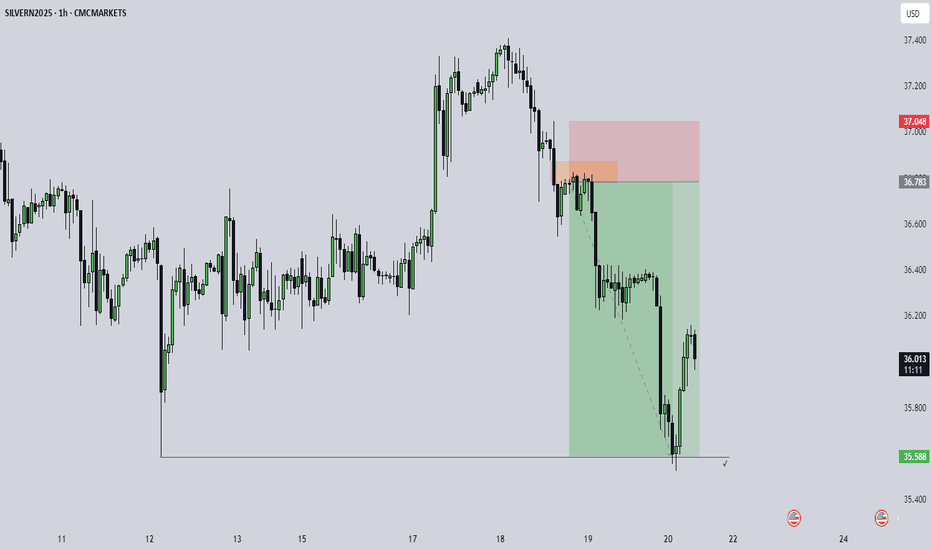

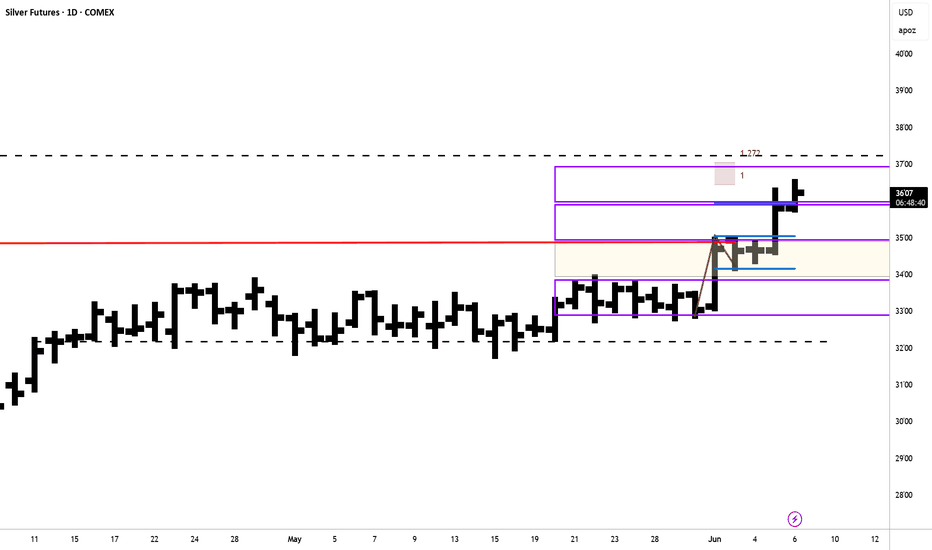

Short on SILVERHTF look BULLISH whit news of IRAN but just munpelation news

I see Silver engage on weely FVG but still shorting so my real bias is bearish > Overlapping parte whit +OB in HTF

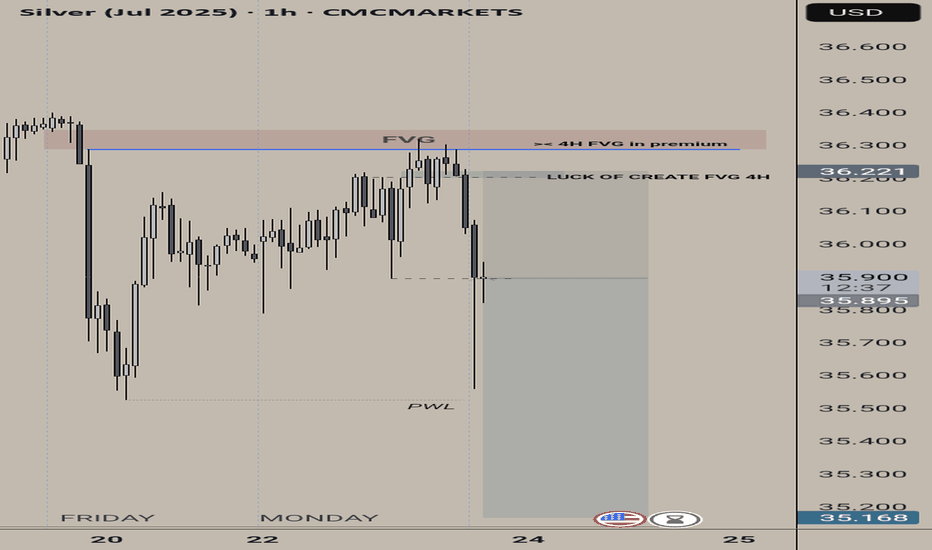

So after that engagement on 4H FVG i waited for failure of creating FVG higher

Then after opening price directly go down

Futures Watchlist for week ending 6/27/2025Come join as i go through the future tickers that im watching this week and where i see them going. With war talks filling up on social media this will add to our volatility and we will look at key levels to capitalize off of it! Let me know your thoughts on these tickers. Also let me know if there

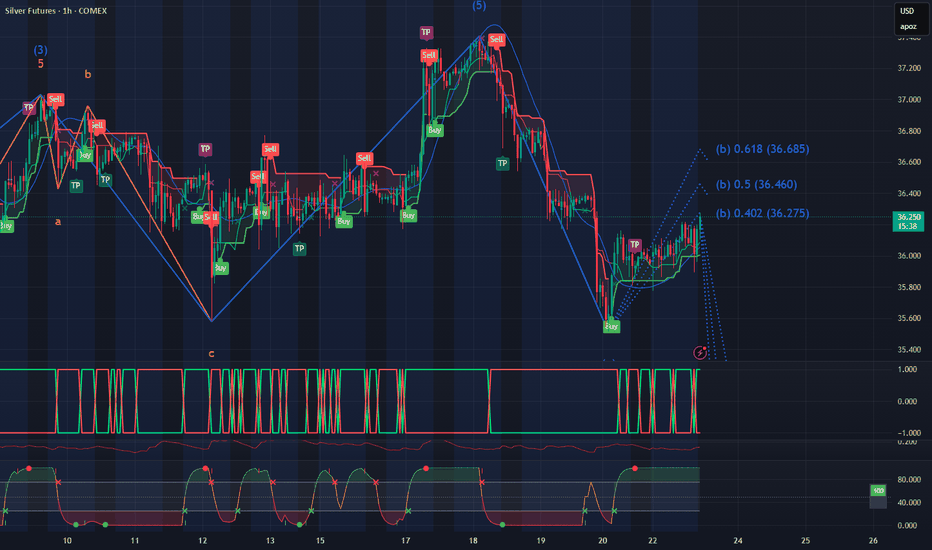

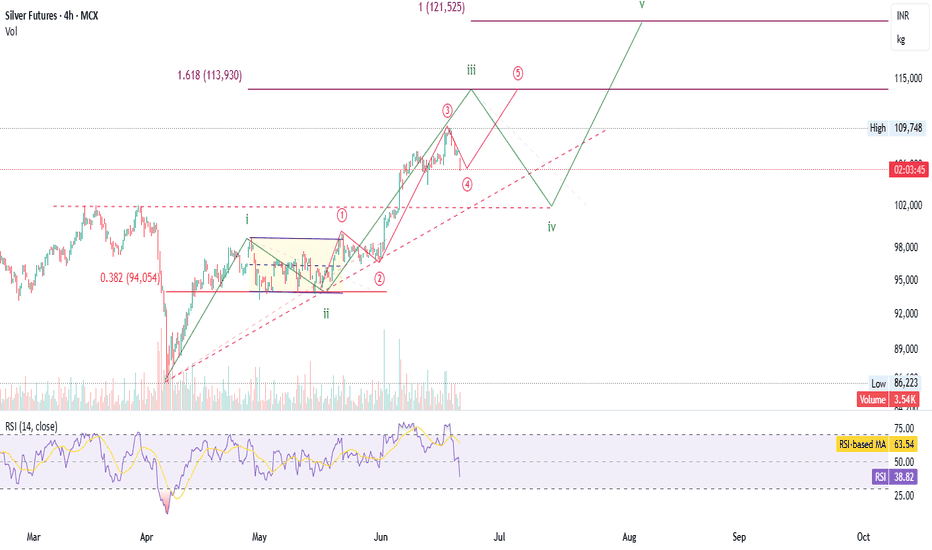

Silver- The New Love of GOLD bugs ?!The chart displays a bullish impulse wave structure, with clear labeling of waves ① to ⑤ (sub-waves) and i to v (main impulse structure). Here's the breakdown:

🔹 Wave Structure

Wave ① and ②:

Wave ② retraced to around the 0.382 Fibonacci level (94,054), which is a healthy correction.

Wave ③:

A po

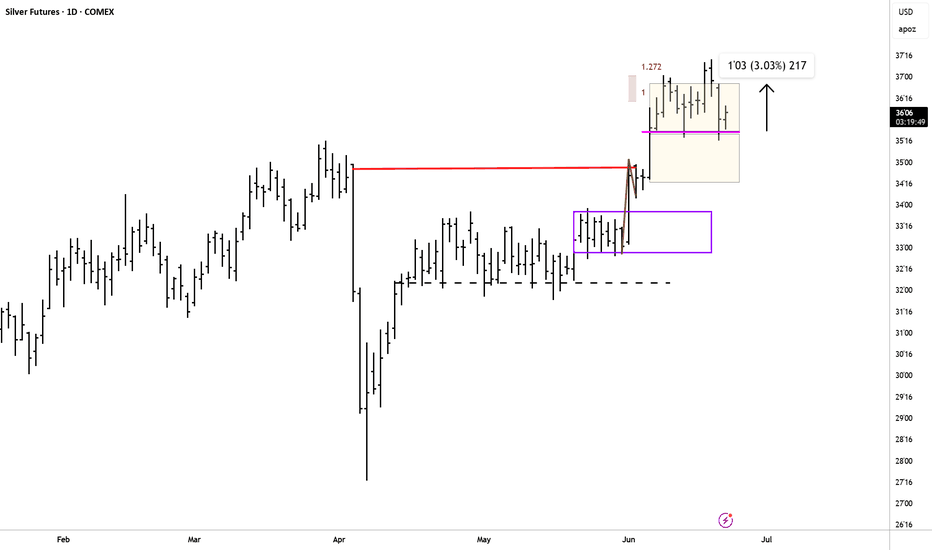

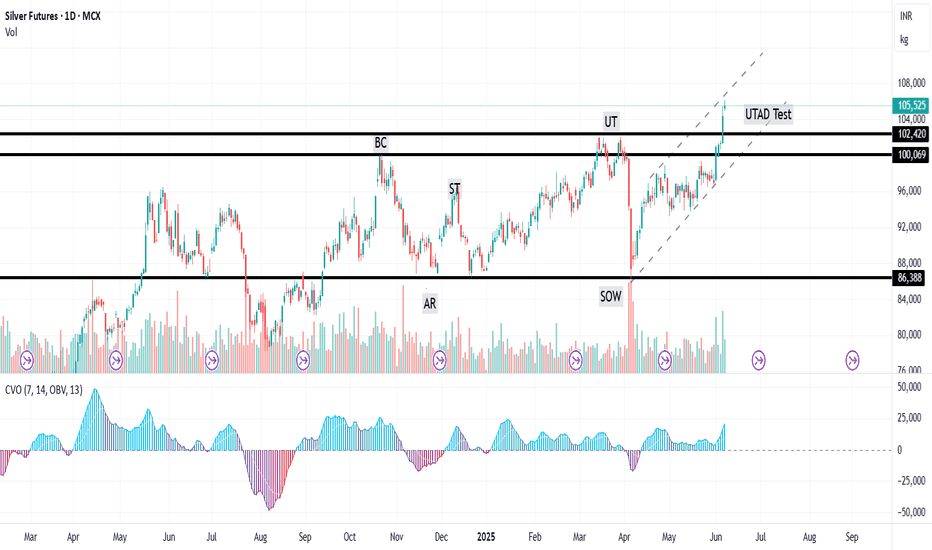

SI1! - 7 months RECTANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

This is Friday and this is an intense look at Silver Friday I am showing you excruciating insights on Trading 2 bar setups and how they guide you to trading decisions that will send you off into the right direction and keep you out of decisions that will turn you in the wrong direction. you can only trade A two-bar reversal when it happens and

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Silver Futures (Dec 2028) is 40.790 USD / APZ — it has risen 0.49% in the past 24 hours. Watch Silver Futures (Dec 2028) price in more detail on the chart.

Track more important stats on the Silver Futures (Dec 2028) chart.

The nearest expiration date for Silver Futures (Dec 2028) is Dec 27, 2028.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Dec 2028) before Dec 27, 2028.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Silver Futures (Dec 2028). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Silver Futures (Dec 2028) technicals for a more comprehensive analysis.