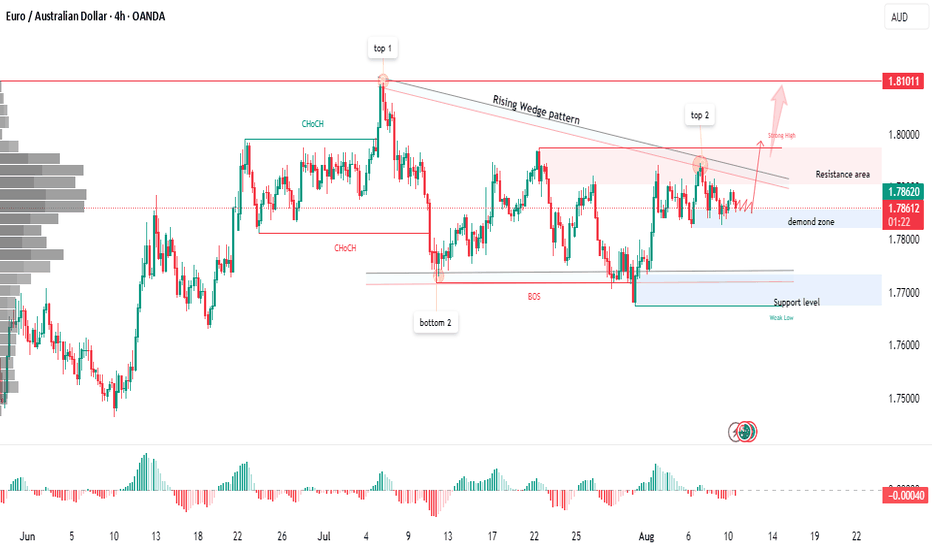

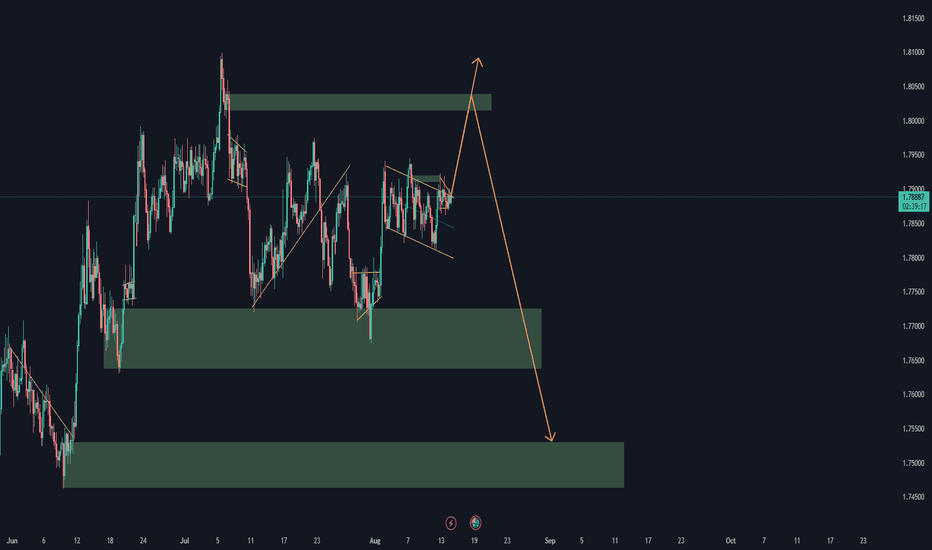

: EUR/AUD | Rising Wedge Pattern Near Key ResistanceEUR/AUD has been consolidating after forming a clear Rising Wedge structure between the first peak (Top 1) and the second peak (Top 2). Price action has recently tested the resistance area around 1.7860–1.7900, while holding above a demand zone near 1.7820.

From a market structure perspective:

CHo

About Euro / Australian Dollar

The Euro vs. the Australian Dollar. This pair is considered to be a great barometer for global risk. In 2012, during the European sovereign debt crisis the EURAUD reached its low. Since then, due to the European Central Bank’s policy of Outright Monetary Transactions (OTM or the “whatever it takes” measure ) the pair has recovered substantially.

Related currencies

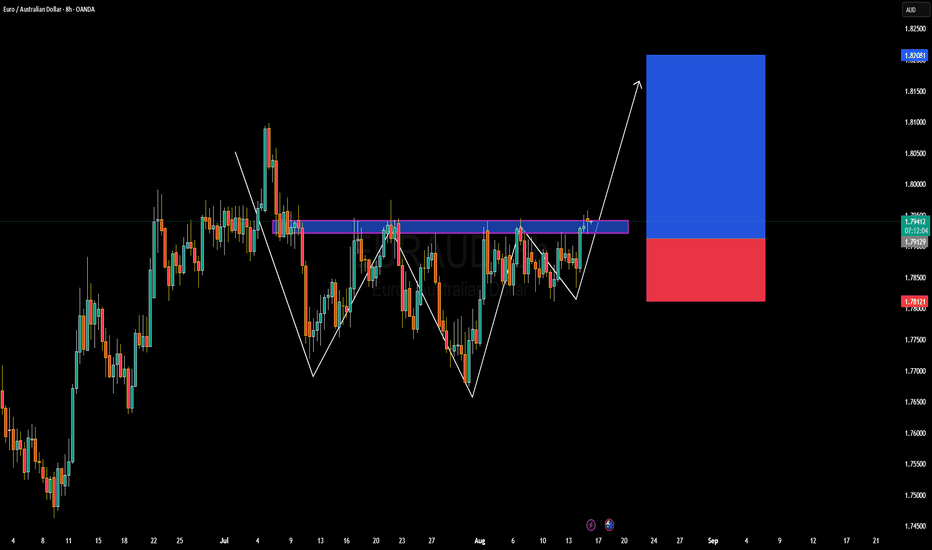

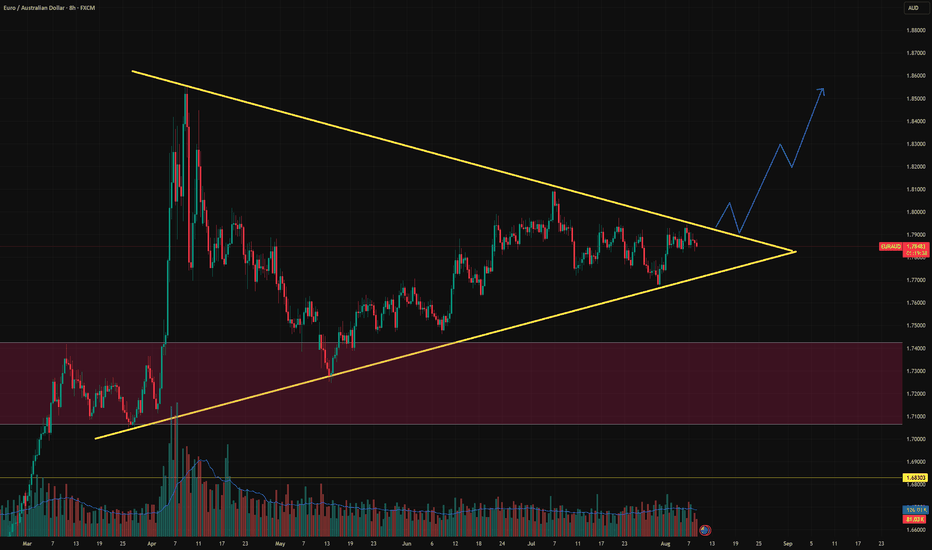

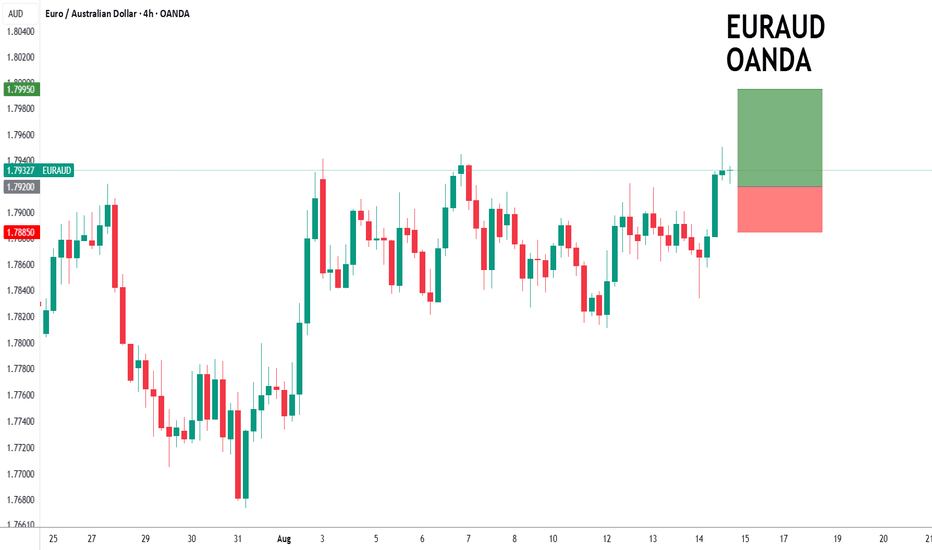

EURAUD Forming Bullish ContinuationEUR/AUD is edging above a persistent resistance zone around 1.7950–1.7970 on the 8-hour chart. The pair has formed a classic two-leg corrective structure, and the recent higher low suggests bullish continuation. A clean break and hold above this resistance could pave the way for a retest of the 1.82

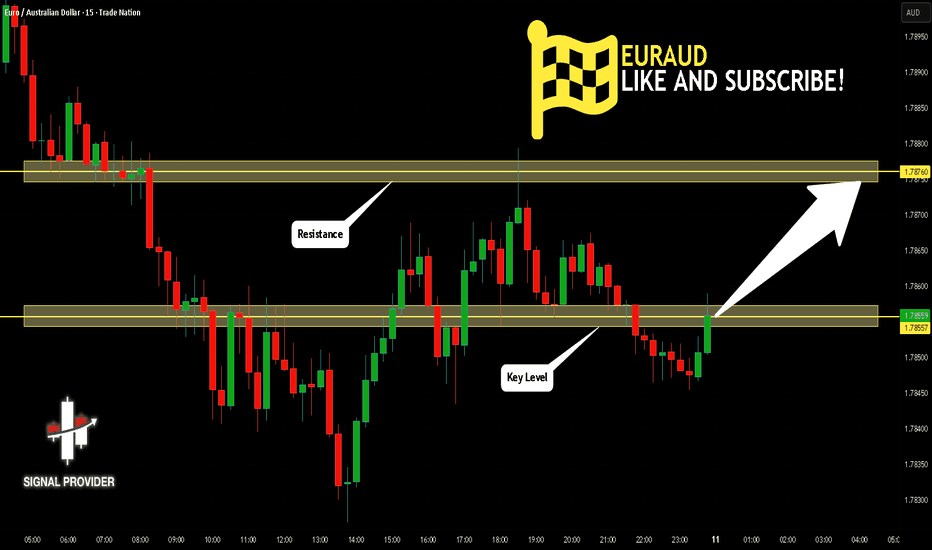

EURAUD Is Bullish! Buy!

Please, check our technical outlook for EURAUD.

Time Frame: 15m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.785.

The above observations make me that the market will inevitably achieve 1.787 leve

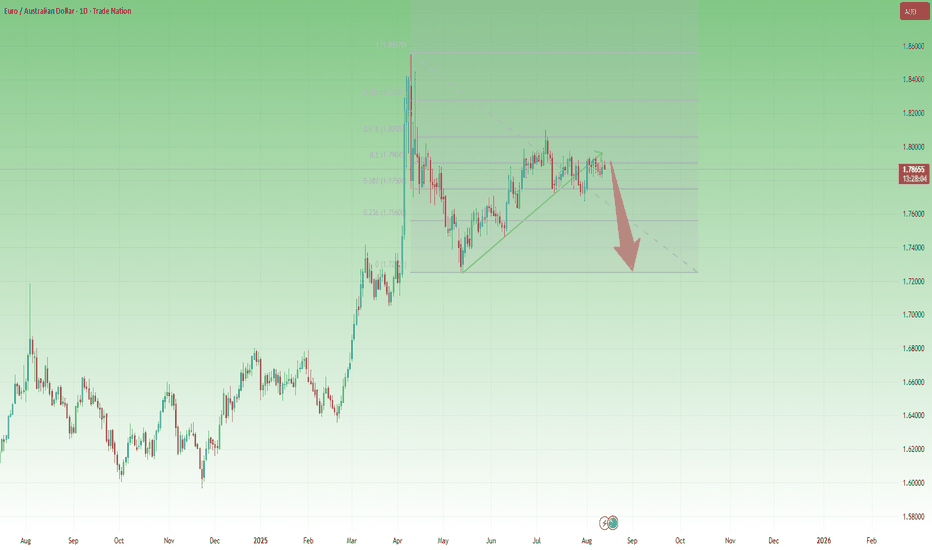

EUR/AUD – Second Chance for Bears?About a month ago, I drew attention to a potential long-term short setup on EUR/AUD, highlighting that the pair had formed a measured move pattern after the sharp drop from 1.85.

Since then, price broke below the rising trendline, but at that moment the drop lacked follow-through, and EUR/AUD bounc

EURAUD, We are still in.In the higher timeframes, the pair is bullish, very, and that's where the problem is, that there aren't recent structures to break to signify a trend shift.

In the weekly timeframe, the pair is still bullish, facing the same monthly situation of lacking recent structures.

In the daily timeframe thou

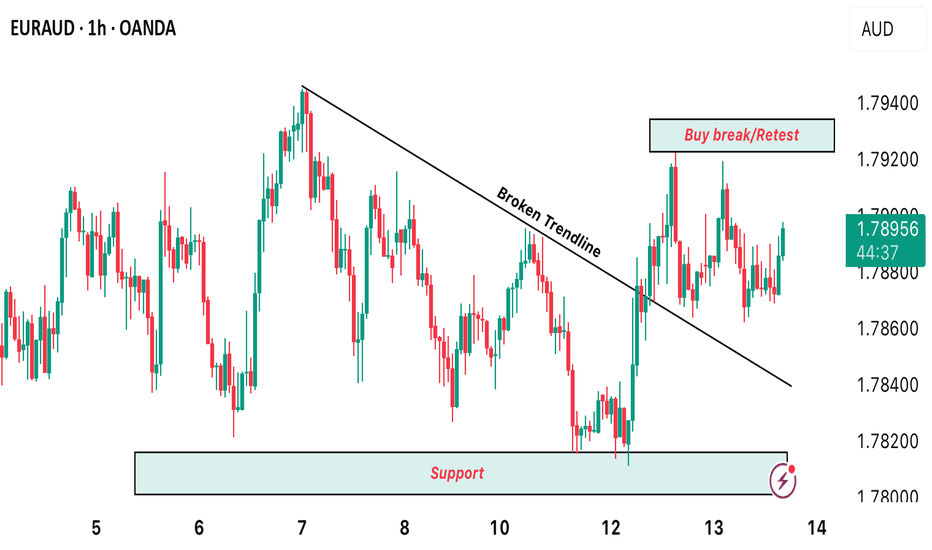

EURUAD LOOKING PROMISING FOR A BUY!!!! WATCHOUT Here’s H1 timeframe on EURUAD and we’re looking forward to buying upon the break/retest of 1.79228 Technical analysis suggest the possible buy opportunity as we see a break of the previous local trendline and a retest to it which signals bullish strength . Therefore, we plan to go long on this pair.

EUR/AUD Analysis – Symmetrical Triangle FormationKey Observations:

Pattern Type: Symmetrical triangle with converging trendlines.

Higher lows show demand stepping in.

Lower highs signal sellers defending resistance.

Volume Profile: Volume is tapering off, aligning with triangle logic → explosive move likely upon breakout.

Liquidity Pool Below

EURAUD to find buyers at market price?EURAUD - 24h expiry

Indecisive price action has resulted in sideways congestion on the intraday chart.

RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending.

Risk/Reward would be poor to call a buy from current levels.

A mo

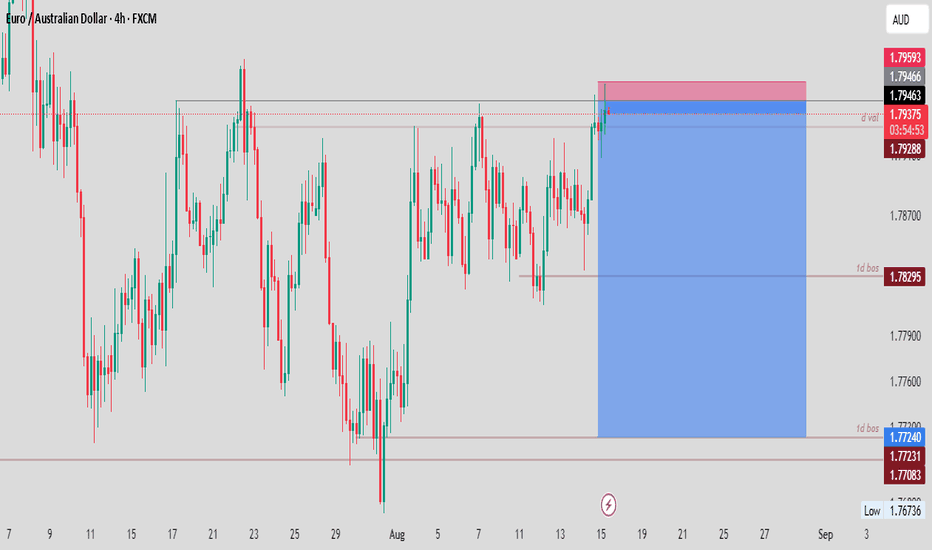

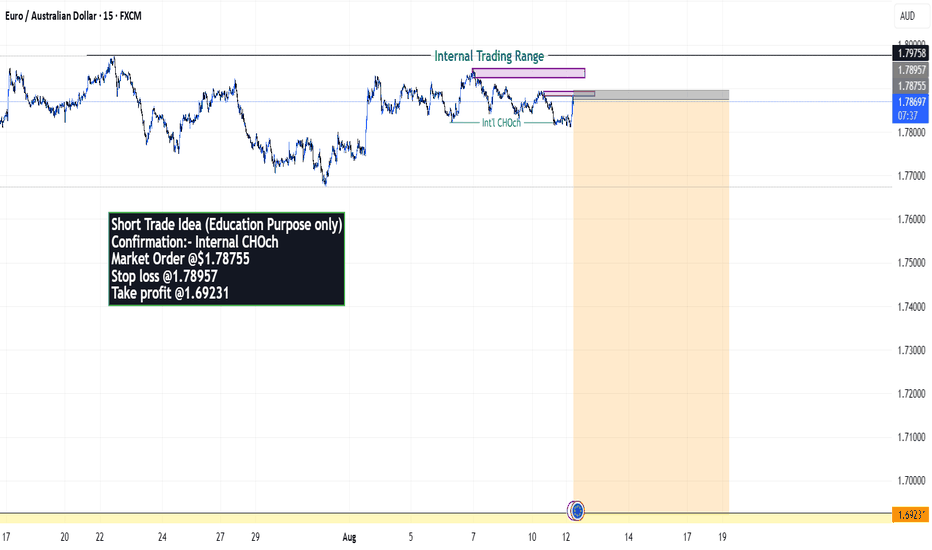

EURAUD ON THE WAY TO FILL FVG ? - {12/08/2025}Educational Analysis says that EURAUD (FX Pair) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) B

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURAUD is 1.79760 AUD — it has increased by 0.27% in the past 24 hours. See more of EURAUD rate dynamics on the detailed chart.

The value of the EURAUD pair is quoted as 1 EUR per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURAUD has the volatility rating of 0.36%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURAUD showed a 0.56% rise over the past week, the month change is a 1.01% rise, and over the last year it has increased by 7.87%. Track live rate changes on the EURAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURAUD technical analysis. The technical rating for the pair is strong buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURAUD shows the buy signal, and 1 month rating is buy. See more of EURAUD technicals for a more comprehensive analysis.