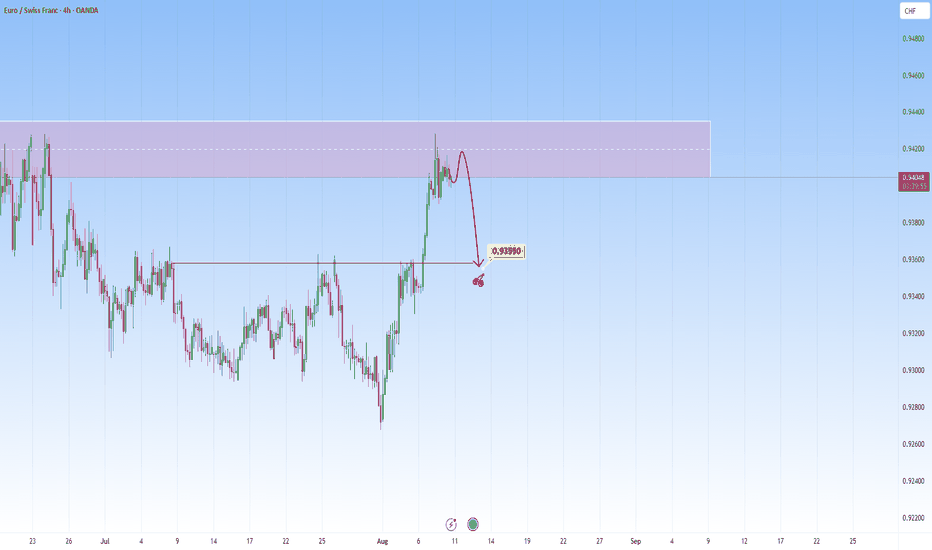

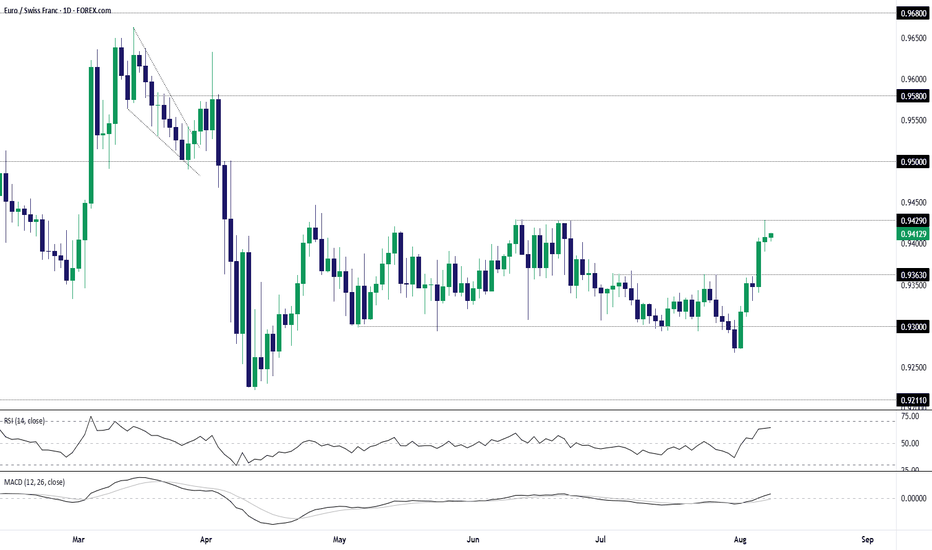

EURCHF: Likely pullback at resistanceI am watching for a reversal EURCHF, expecting a rejection with a target at around 0.93550.

This area is where it can become a decision point: either price bounces, or it breaks above and the move can start to go higher.

I'll be watching for confirmation: not just in candlestick structure, but al

About Euro / Swiss Franc

The Euro vs. the Swiss Franc. This pair is known as a pair trend because there are often long upward or downward trends. It is also often adapted to Swing Trading but because of its lack of volatility it is less popular with scalpers. The EUR/CHF and the USD/SHF exchange rates are highly positively correlated.

Related currencies

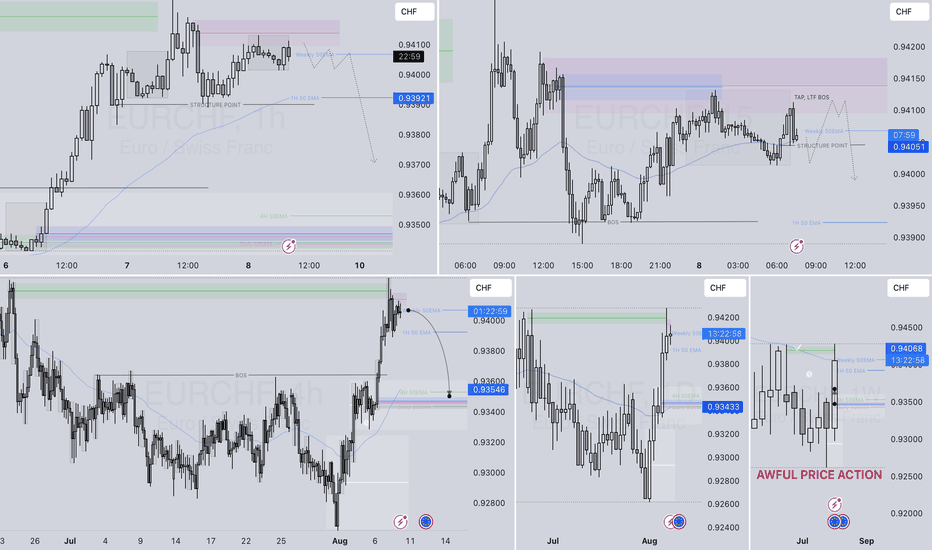

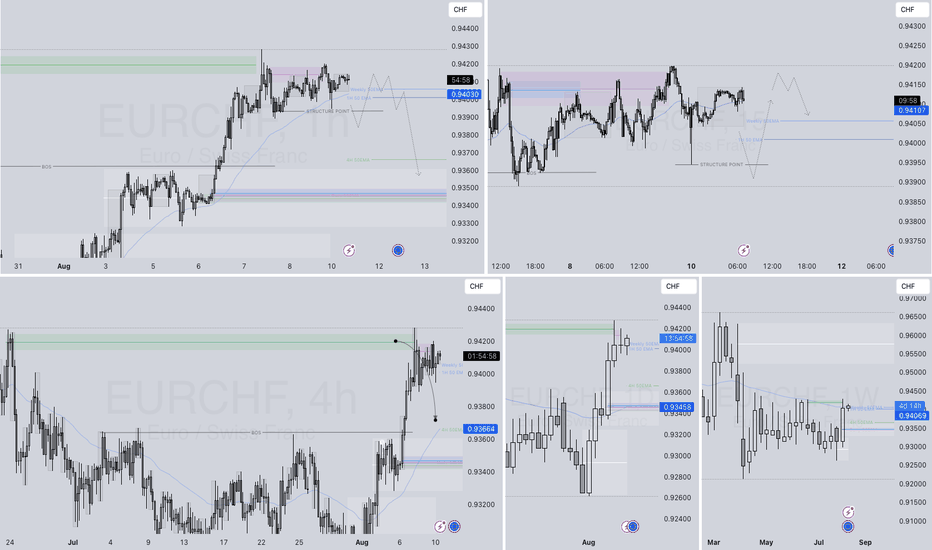

EURCHF too?In the higher timeframes (monthly) prices have traced a confirmed uptrend.

This is also confirmed in the daily timeframe.

But prices being in a strong structural and psychological level, we are expecting a significant counter trend, which happens to have been confirmed in the lower time frames.

We a

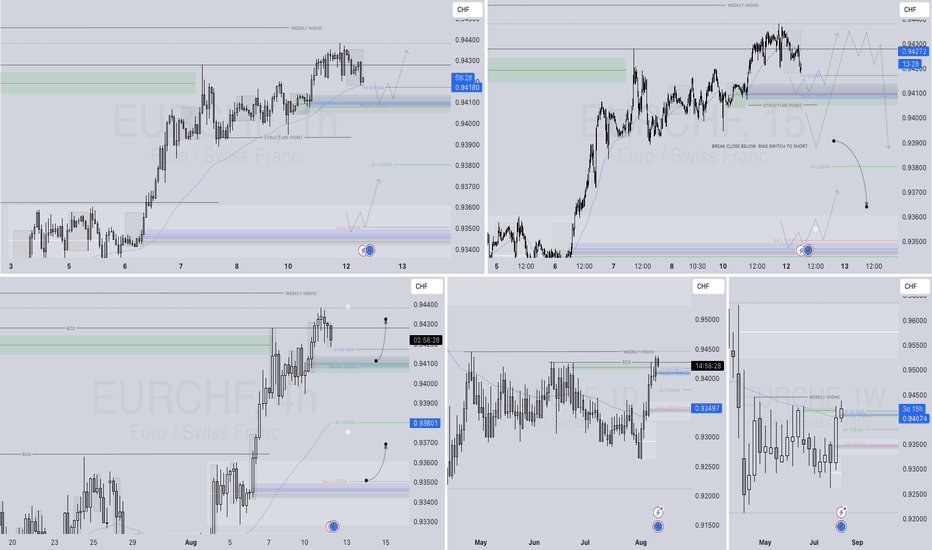

EURCHF – DAILY FORECAST Q3 | W32 | D8 | Y25📊 EURCHF – DAILY FORECAST

Q3 | W32 | D8 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a d

EURCHF - Low risk High Probability IdeaIn higher time frames EURCHF is in a downtrend, but for some time including the daily and intra day timeframes we have been in an uptrend (higher time frame counter trend).

Currently prices being at a strong monthly level, we are expecting a shift of the current intraday uptrend situation.

We are ca

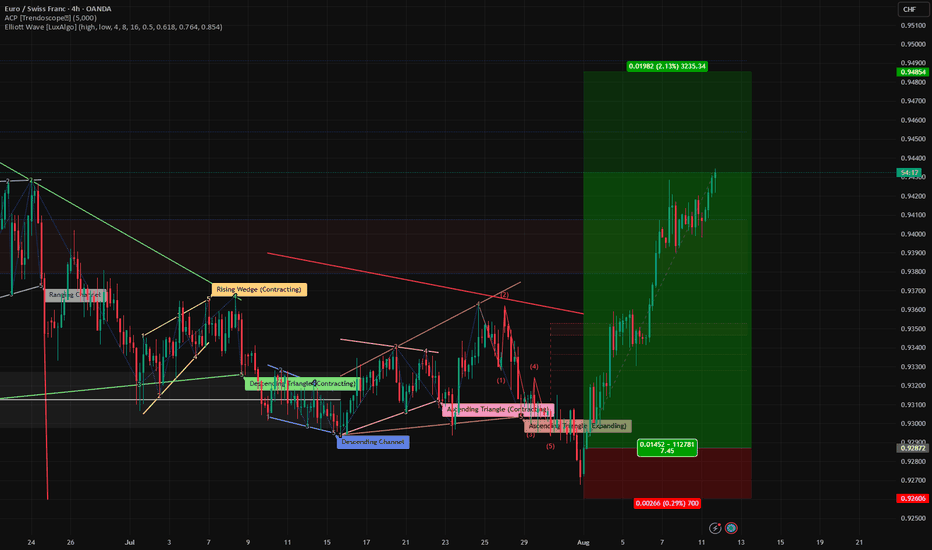

EURCHF – Buy Trade UpdateEURCHF – Buy Trade Update 📈

Our EURCHF long is in profit ✅ and I’m now trailing my stop-loss to lock it in. Price is still moving higher with steady momentum.

The bullish push started picking up after Trump’s 39% tariffs came into effect on August 7, which weighed on CHF by dampening Swiss trade se

EURCHF – DAILY FORECAST Q3 | W33 | D11 | Y25📊 EURCHF – DAILY FORECAST

Q3 | W33 | D11 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a

EURCHF – DAILY FORECAST Q3 | W33 | D12 | Y25 📊 EURCHF – DAILY FORECAST

Q3 | W33 | D12 | Y25

Daily Forecast 🔍📅

📌 NOTE – Market Context Update

We’ve seen the daily candle close above the weekly 50 EMA, which suggests bullish intent... BUT 🧠⚠️

Let’s stay mindful — price is currently testing a major higher time frame level, and with 4 trading

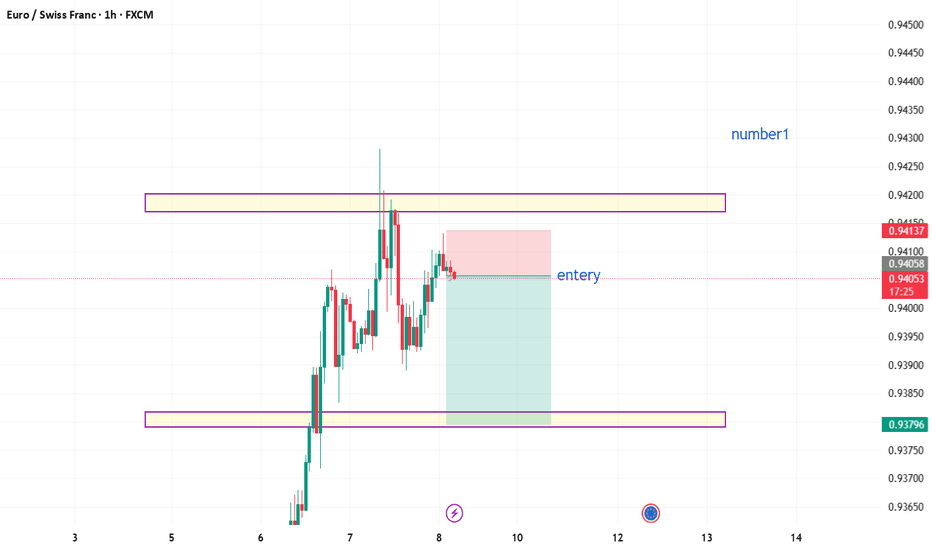

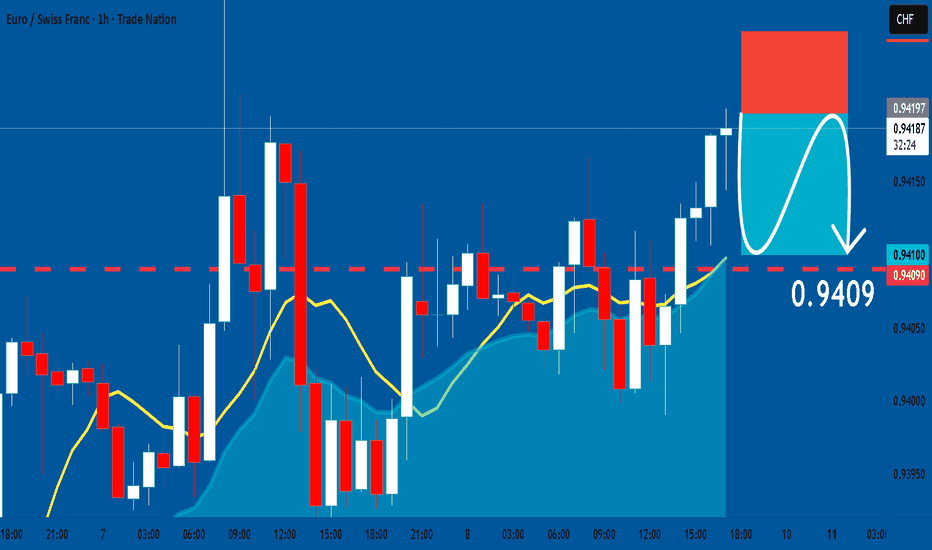

EURCHF: Bearish Continuation & Short Signal

EURCHF

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell EURCHF

Entry - 0.9419

Stop - 0.9425

Take - 0.9409

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a

EUR/CHF Bulls Test Range Highs Following Sharp ReboundEUR/CHF sits just beneath the top of the range it’s been trading in over the past three months, providing a variety of potential setups depending on how the near-term price action evolves.

The bullish engulfing candle on the daily chart last Friday set the tone for the price action seen this week,

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURCHF is 0.94097 CHF — it has decreased by −0.02% in the past 24 hours. See more of EURCHF rate dynamics on the detailed chart.

The value of the EURCHF pair is quoted as 1 EUR per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURCHF has the volatility rating of 0.11%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURCHF showed a 0.25% rise over the past week, the month change is a 1.25% rise, and over the last year it has decreased by −1.23%. Track live rate changes on the EURCHF chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURCHF technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURCHF shows the neutral signal, and 1 month rating is sell. See more of EURCHF technicals for a more comprehensive analysis.