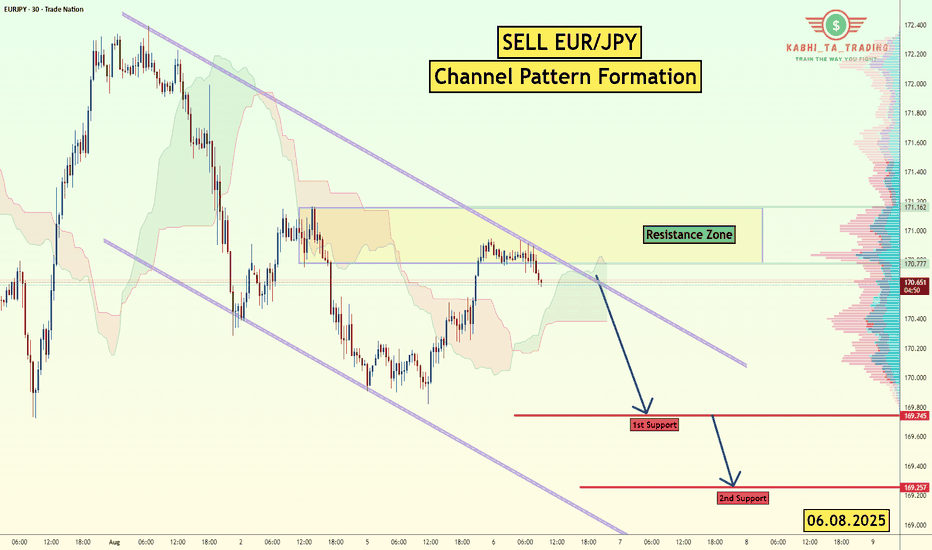

EUR/JPY Channel Formation (6.08.2025) The EUR/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Patt

About Euro / Japanese Yen

The Euro vs. the Japanese Yen. The Yen is a historically low-yielding currency, influencing traders to borrow cheaply in JPY to purchase higher-yielding currencies, including EUR. Because of this the pair is sensitive to broad-based market sentiment trend swings. Volatility may be found in news related to the Eurozone debt crisis and from the Bank of Japan’s anti-deflation policy efforts introduced in 2013.

Related currencies

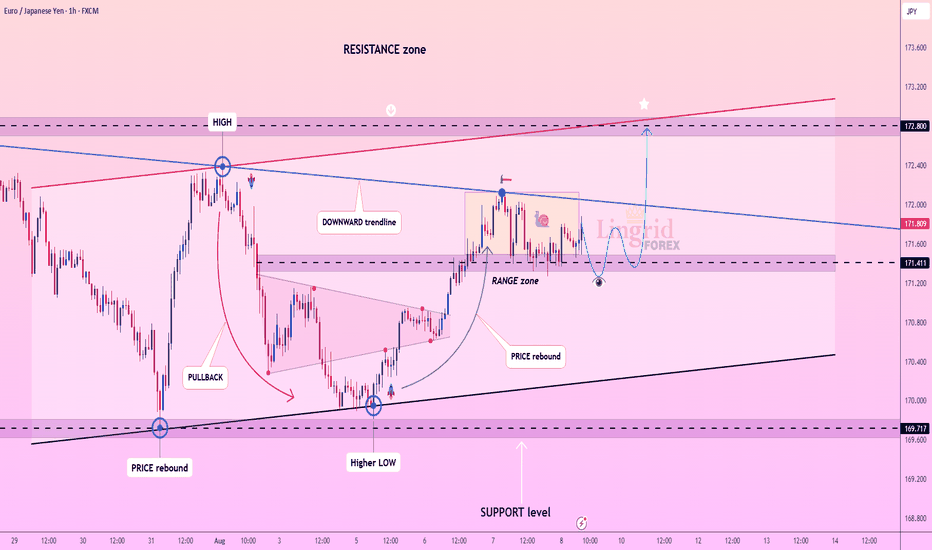

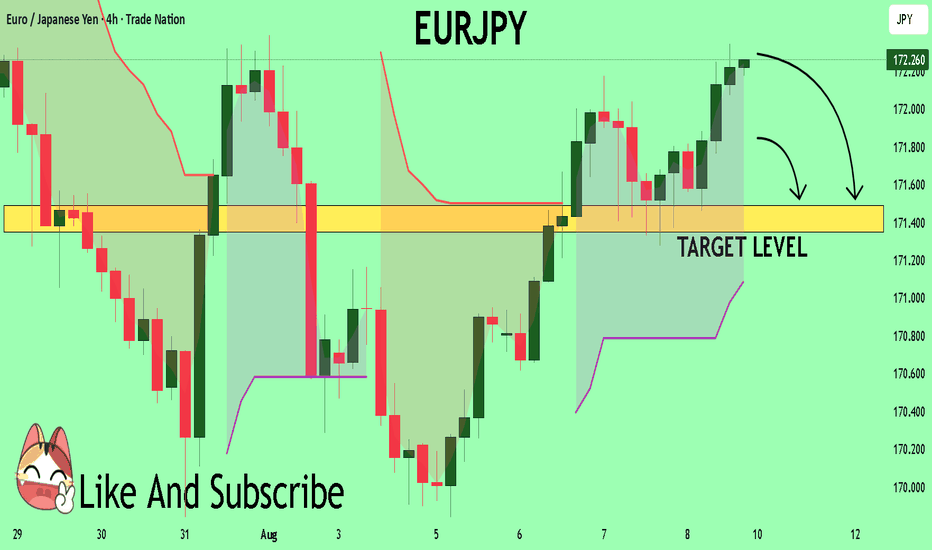

Lingrid | EURJPY Trendline Breakout. Long From SupportThe price perfectly fulfilled my previous idea . FX:EURJPY is consolidating inside a tight range between 171.411 support and the downward trendline after rebounding from a higher low. Price is testing the upper boundary of this range, and a breakout could signal continuation toward the 172.800 re

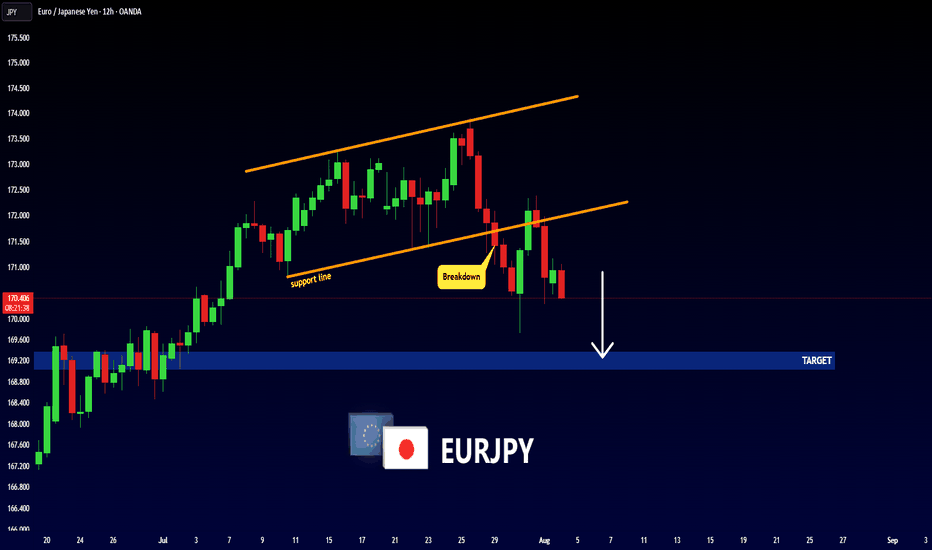

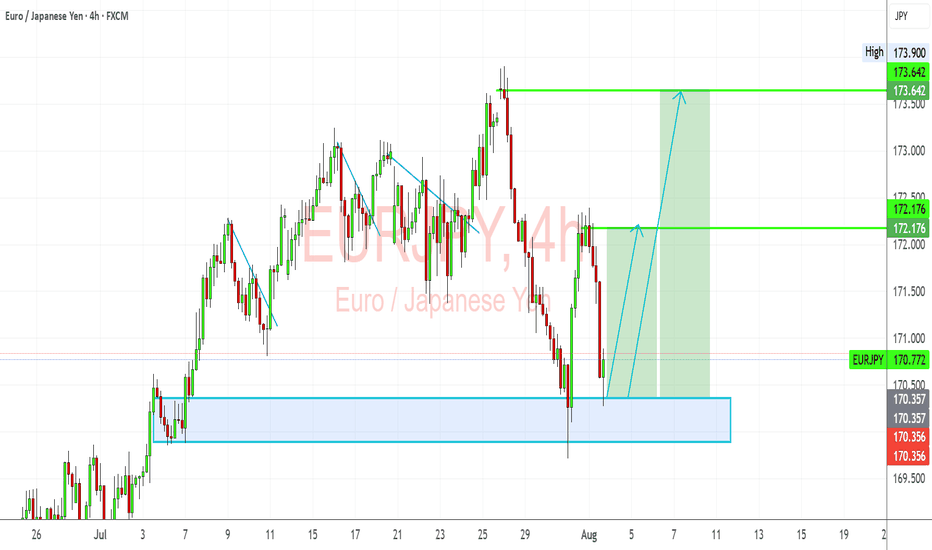

EURJPY: Bullish Rebound from Key Demand ZoneEURJPY has bounced off a critical demand zone and is showing signs of a bullish recovery. Despite the recent pullback, the pair’s structure remains fundamentally and technically bullish, driven by JPY weakness and EUR resilience.

Technical Analysis (4H Chart)

Pattern: Price tested a strong demand z

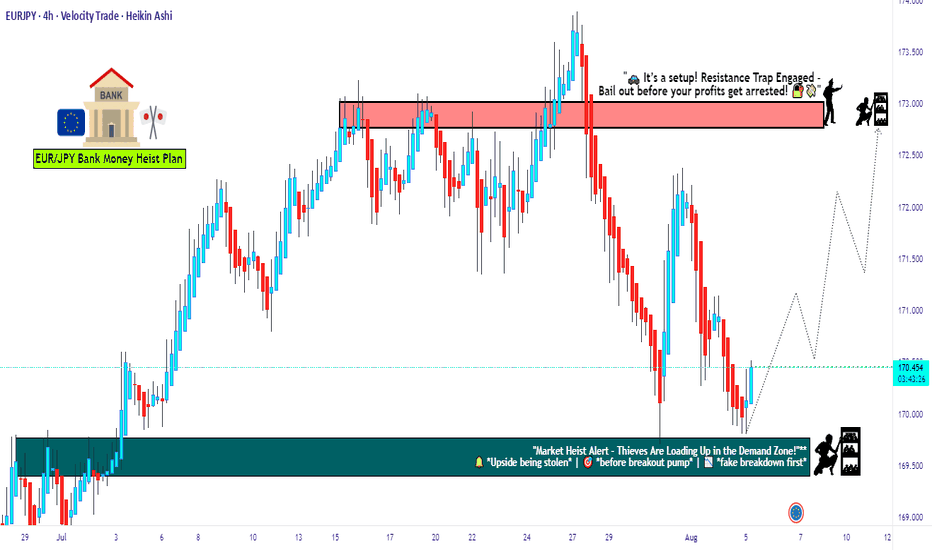

EUR/JPY Setup: Thief Trader's Stealth Bull Run to 173.000🔥💶 EUR/JPY Bullish Heist Plan 💶🔥

🧠 New Plan Unlocked – The EUR/JPY Bullish Mission is LIVE!

Thief Trader style means: No noise, no fluff — just pure sniper precision with layered limit orders. 🧤🔫

This isn’t trading… it’s a planned market robbery 💼💣

🧩 Asset: EUR/JPY

📊 Strategy: Bullish Bias with St

EURJPY Buyers In Panic! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 172.25 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 171.49

About Used Indicators:

The

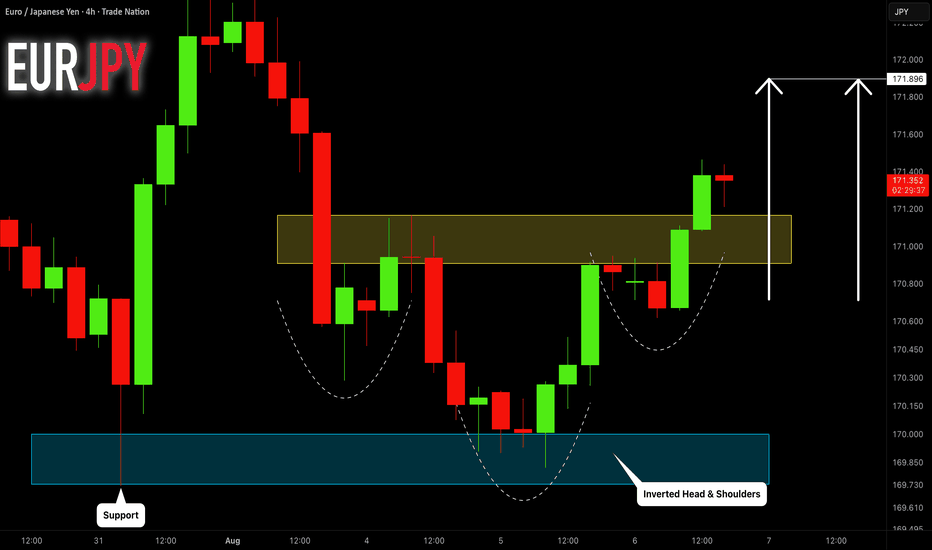

EURJPY: Classic Bullish Pattern 🇪🇺🇯🇵

There is a high chance that EURJPY will continue growing.

A bullish breakout of a neckline of an inverted head & shoulders

pattern leaves clear bullish clues.

Next resistance - 171.9

b]❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receiv

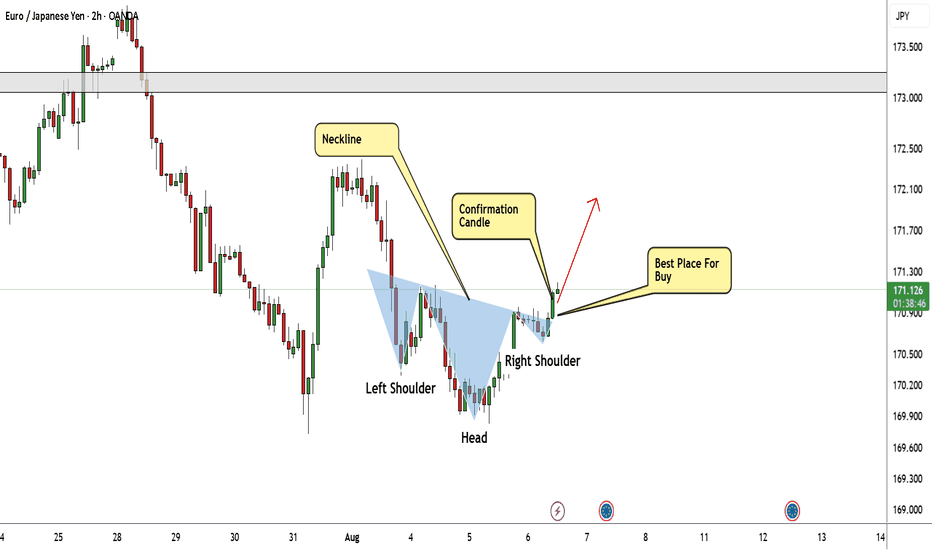

EUR/JPY Made Inverted H&S Pattern , Time To Buy And Get 150 PipsHere is my 2H Chart On EUR/JPY , The price created a very clear reversal pattern ( inverted head and shoulders pattern ) and the price closed above neckline so the pattern confirmed and we can buy it and targeting from 100: 200 pips , if we have a daily closure above 171.000 it will be a great conf

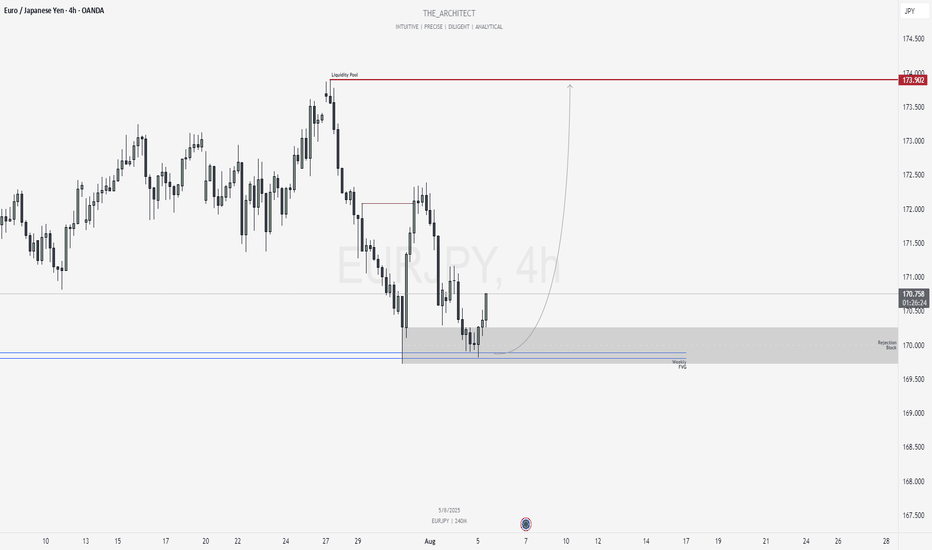

EURJPY: Rejection Block Support Fuels Bullish momentum!Greetings Traders,

In today’s analysis of EURJPY, recent price action confirms the presence of bullish institutional order flow. As a result, we aim to align ourselves with this directional bias by seeking high-probability buying opportunities that target the long-term highs, where a significant li

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the EURJPY pair is quoted as 1 EUR per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 EUR.

EURJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.