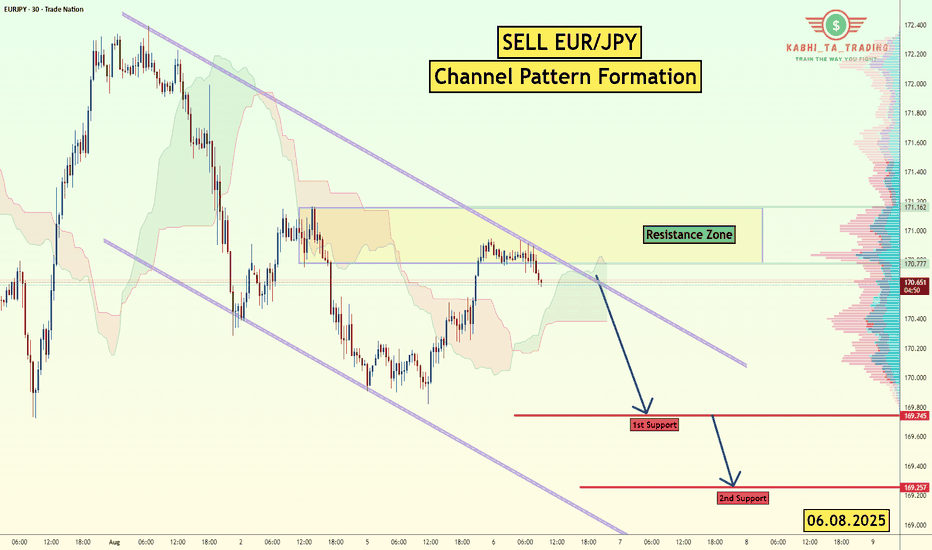

EUR/JPY Channel Formation (6.08.2025) The EUR/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Patt

About Euro / Japanese Yen

The Euro vs. the Japanese Yen. The Yen is a historically low-yielding currency, influencing traders to borrow cheaply in JPY to purchase higher-yielding currencies, including EUR. Because of this the pair is sensitive to broad-based market sentiment trend swings. Volatility may be found in news related to the Eurozone debt crisis and from the Bank of Japan’s anti-deflation policy efforts introduced in 2013.

Related currencies

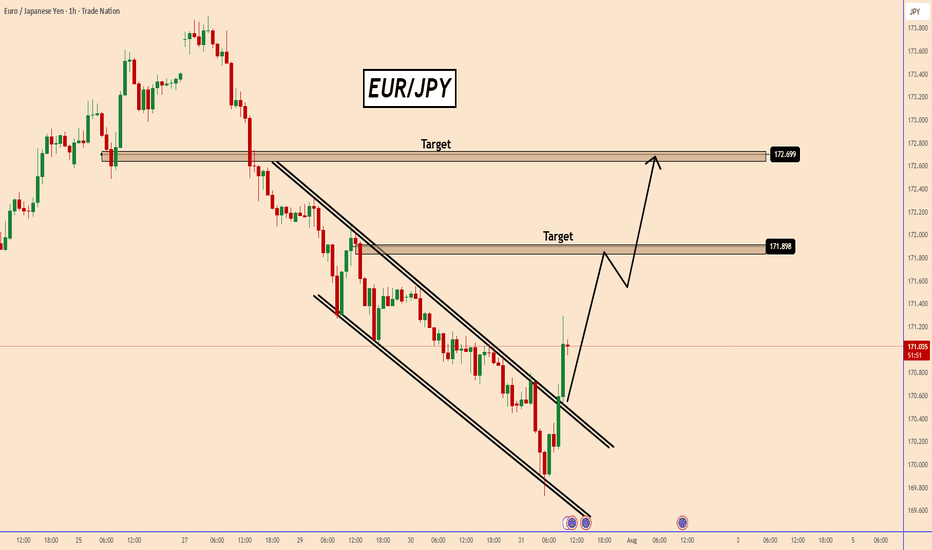

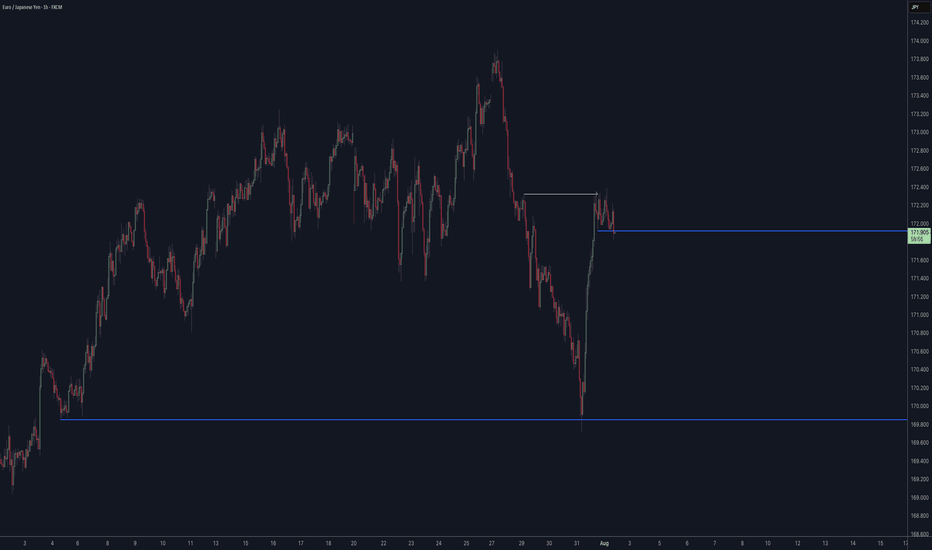

EURJPY Poised to test the top after the BOJ Rate DecisionEURJPY Poised to test the top after the BOJ Rate Decision

EURJPY broke out of a descending type of channel pattern or something similar.

The last two candles confirmed the bullish movement in a clear way and the odds are that EURJPY may rise further during the coming hours.

However this movement

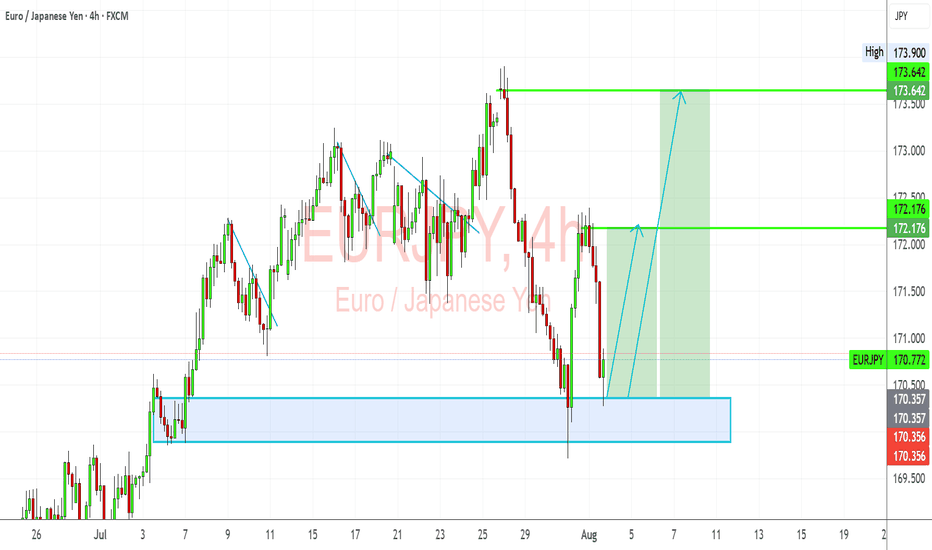

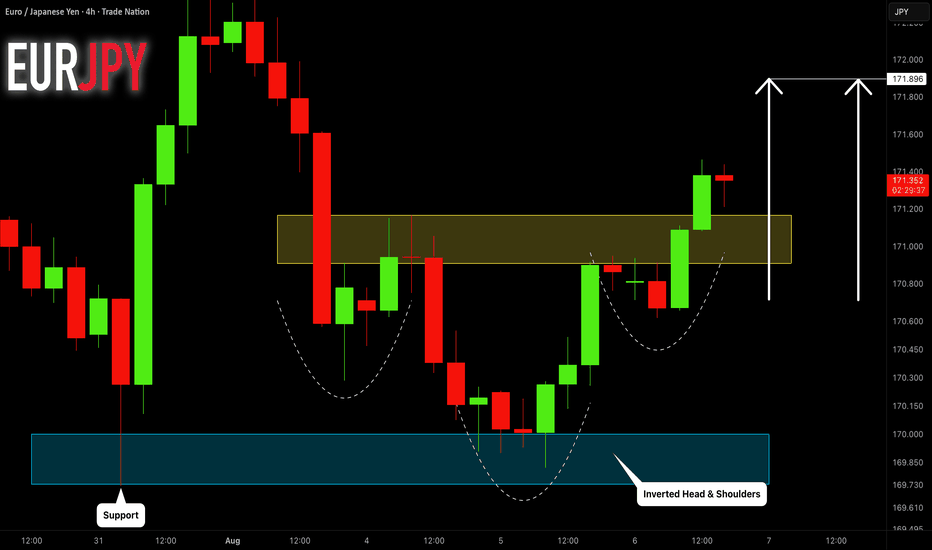

EURJPY: Bullish Rebound from Key Demand ZoneEURJPY has bounced off a critical demand zone and is showing signs of a bullish recovery. Despite the recent pullback, the pair’s structure remains fundamentally and technically bullish, driven by JPY weakness and EUR resilience.

Technical Analysis (4H Chart)

Pattern: Price tested a strong demand z

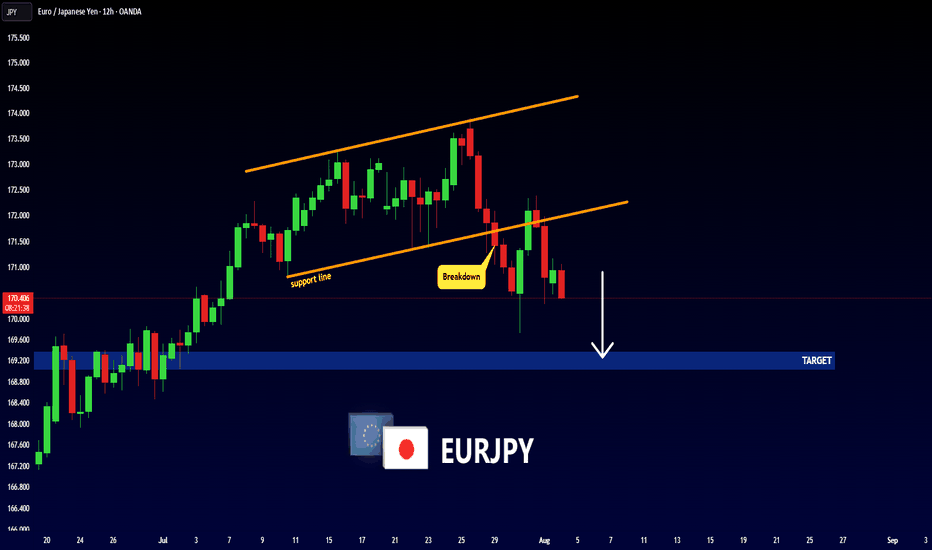

EURJPY: Classic Bullish Pattern 🇪🇺🇯🇵

There is a high chance that EURJPY will continue growing.

A bullish breakout of a neckline of an inverted head & shoulders

pattern leaves clear bullish clues.

Next resistance - 171.9

b]❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receiv

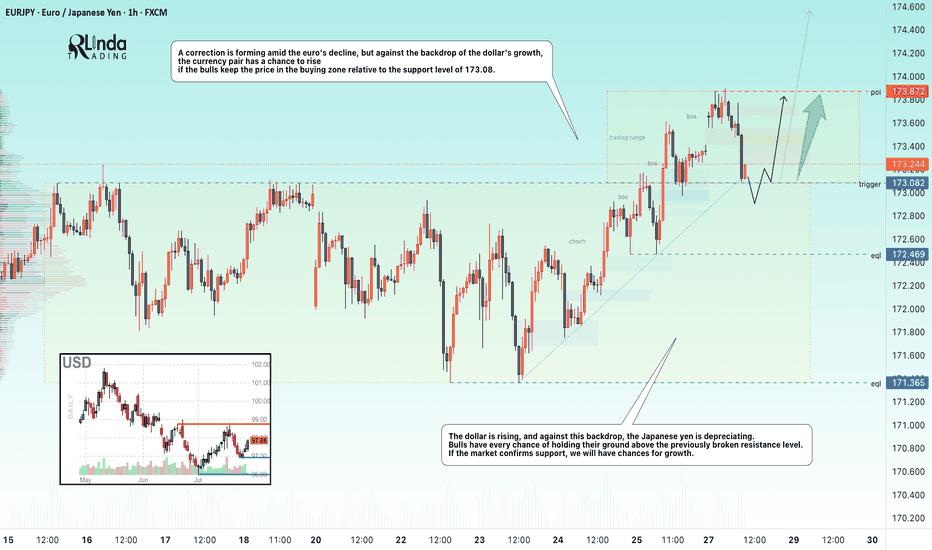

EURJPY → Retest support before growthFX:EURJPY has been correcting since the opening of the European session. The movement was triggered by yesterday's news related to the trade deal between the US and Europe...

EURJPY is reacting to news related to the deal between the US and Europe. A correction is forming amid the fall of the

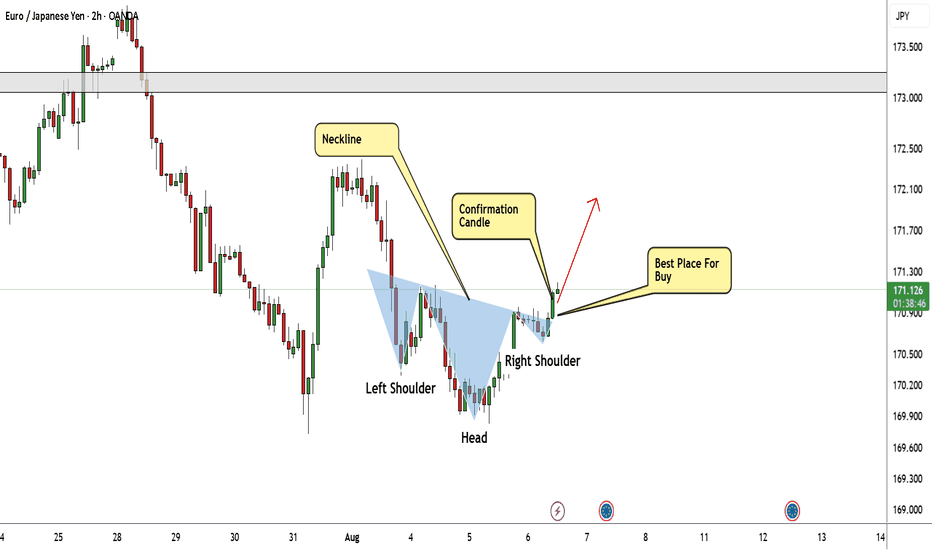

EUR/JPY Made Inverted H&S Pattern , Time To Buy And Get 150 PipsHere is my 2H Chart On EUR/JPY , The price created a very clear reversal pattern ( inverted head and shoulders pattern ) and the price closed above neckline so the pattern confirmed and we can buy it and targeting from 100: 200 pips , if we have a daily closure above 171.000 it will be a great conf

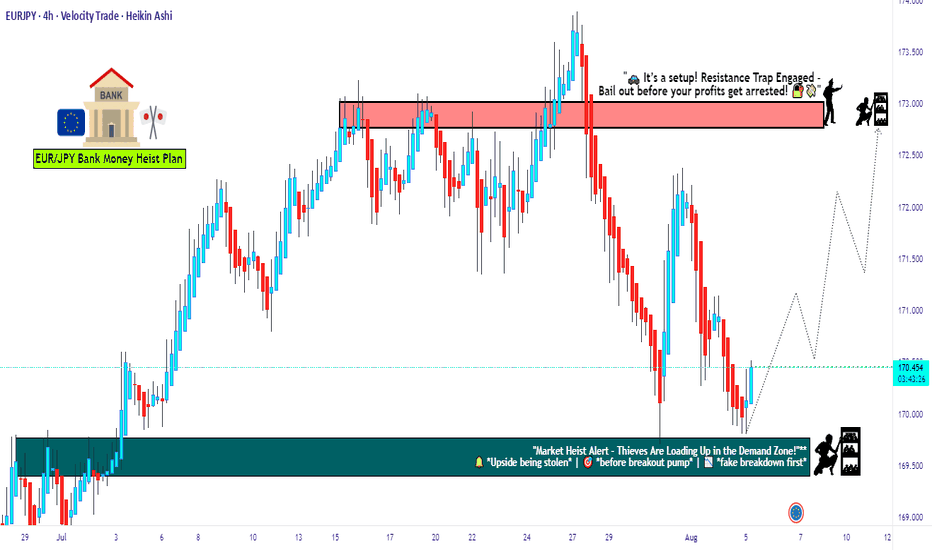

EUR/JPY Setup: Thief Trader's Stealth Bull Run to 173.000🔥💶 EUR/JPY Bullish Heist Plan 💶🔥

🧠 New Plan Unlocked – The EUR/JPY Bullish Mission is LIVE!

Thief Trader style means: No noise, no fluff — just pure sniper precision with layered limit orders. 🧤🔫

This isn’t trading… it’s a planned market robbery 💼💣

🧩 Asset: EUR/JPY

📊 Strategy: Bullish Bias with St

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURJPY is 171.453 JPY — it has decreased by −0.16% in the past 24 hours. See more of EURJPY rate dynamics on the detailed chart.

The value of the EURJPY pair is quoted as 1 EUR per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURJPY has the volatility rating of 0.45%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURJPY showed a 0.64% rise over the past week, the month change is a 0.33% rise, and over the last year it has increased by 8.76%. Track live rate changes on the EURJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURJPY technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURJPY shows the buy signal, and 1 month rating is buy. See more of EURJPY technicals for a more comprehensive analysis.