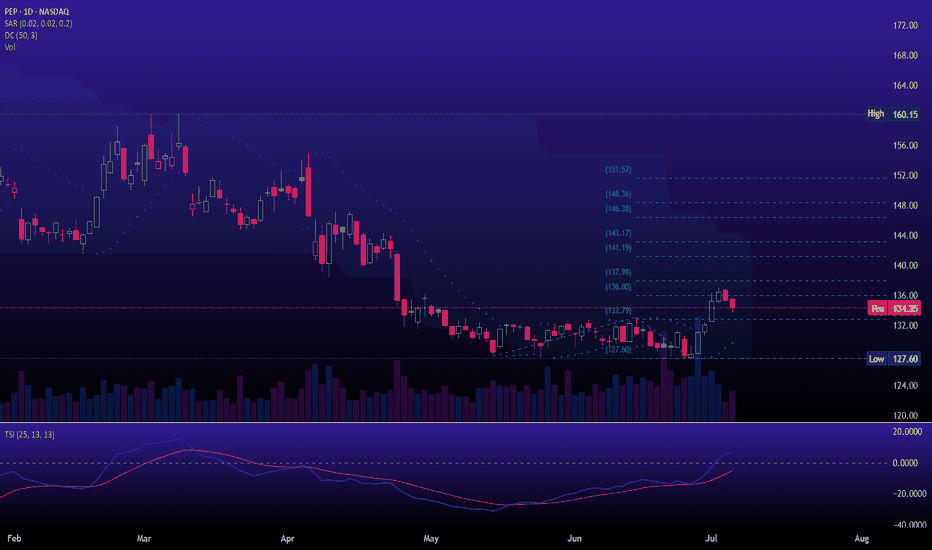

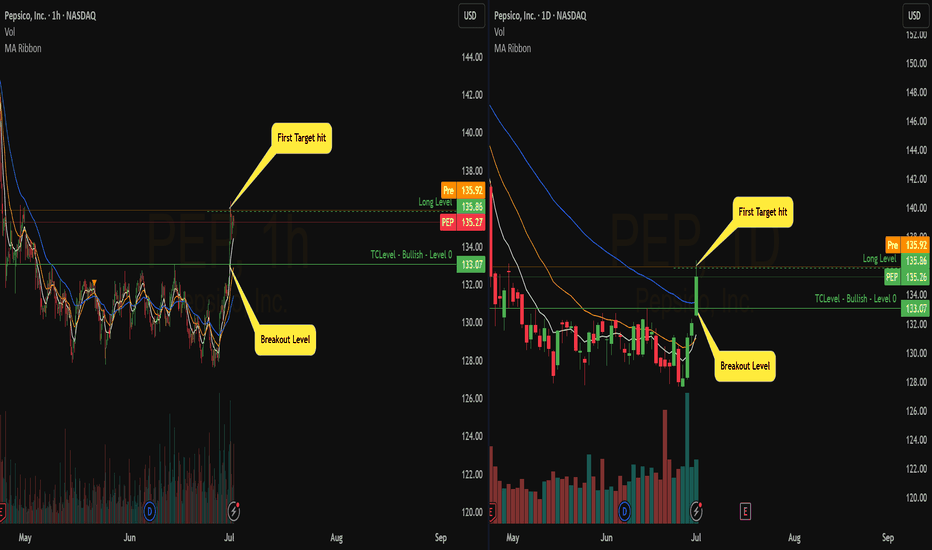

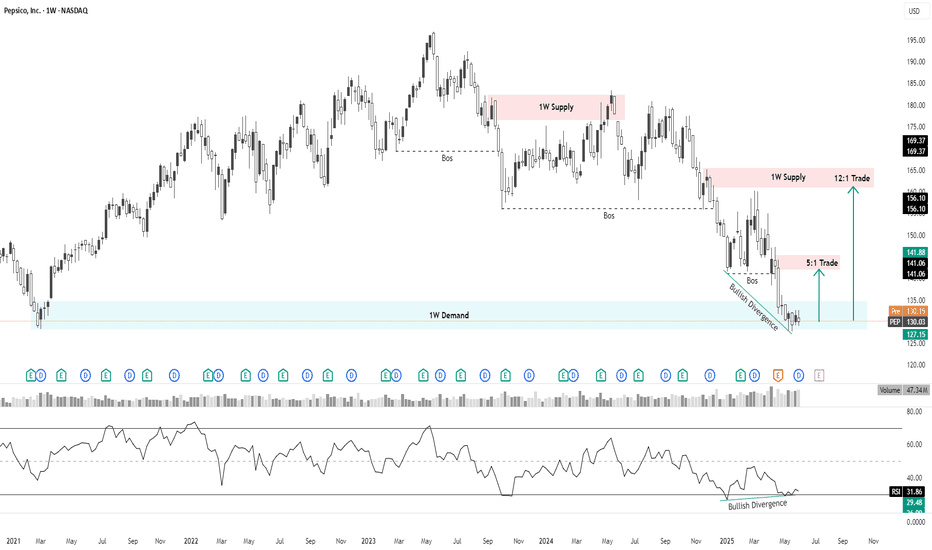

PEP is in the Wyckoff Accumulation phaseThis Week (July 8 - 12):

Support: The recent consolidation shelf around $130.00 is the first line of defense. The absolute low and our line in the sand is the Selling Climax low at $127.60.

Resistance: The 20-week moving average at $138.30 is the immediate ceiling it needs to break through.

Next

Key facts today

On July 17, 2025, PepsiCo Inc. reported its financial results for the 12 and 24 weeks ended June 14, 2025, and announced a realignment of its reportable segments.

PepsiCo reported $1.86 billion in pretax impairment charges for Q2, including a $1.78 billion write-down on Rockstar and an $80 million charge for Be & Cheery.

PepsiCo has identified mitigation strategies to partially offset the higher supply chain costs it has been experiencing.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.30 EUR

9.25 B EUR

88.73 B EUR

1.37 B

About PepsiCo, Inc.

Sector

Industry

CEO

Ramon Luis Laguarta

Website

Headquarters

Purchase

Founded

1965

FIGI

BBG000C1X2Q4

PepsiCo, Inc. is a global food and beverage company. The Company's portfolio of brands includes Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. The Company operates through six segments: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), North America Beverages (NAB), Latin America, Europe Sub-Saharan Africa (ESSA), and Asia, Middle East and North Africa (AMENA). The FLNA segment includes its branded food and snack businesses in the United States and Canada. The QFNA segment includes its cereal, rice, pasta and other branded food businesses in the United States and Canada. The NAB segment includes its beverage businesses in the United States and Canada. The Latin America segment includes its beverage, food and snack businesses in Latin America. The ESSA segment includes its beverage, food and snack businesses in Europe and Sub-Saharan Africa. The AMENA segment includes its beverage, food and snack businesses in Asia, Middle East and North Africa.

Related stocks

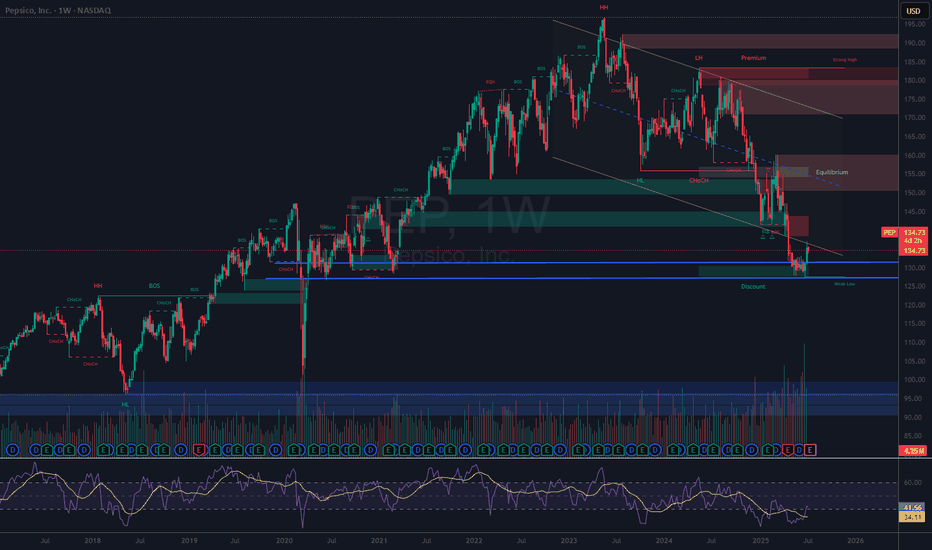

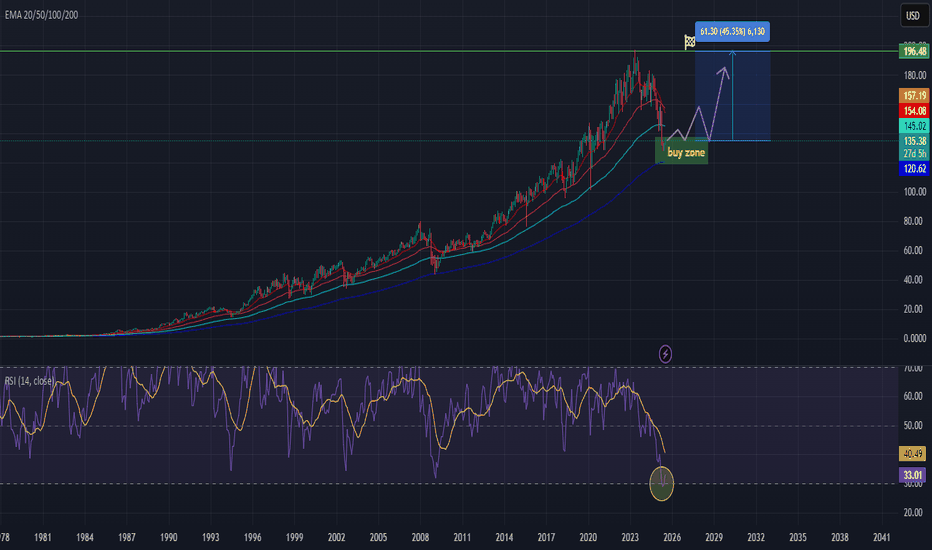

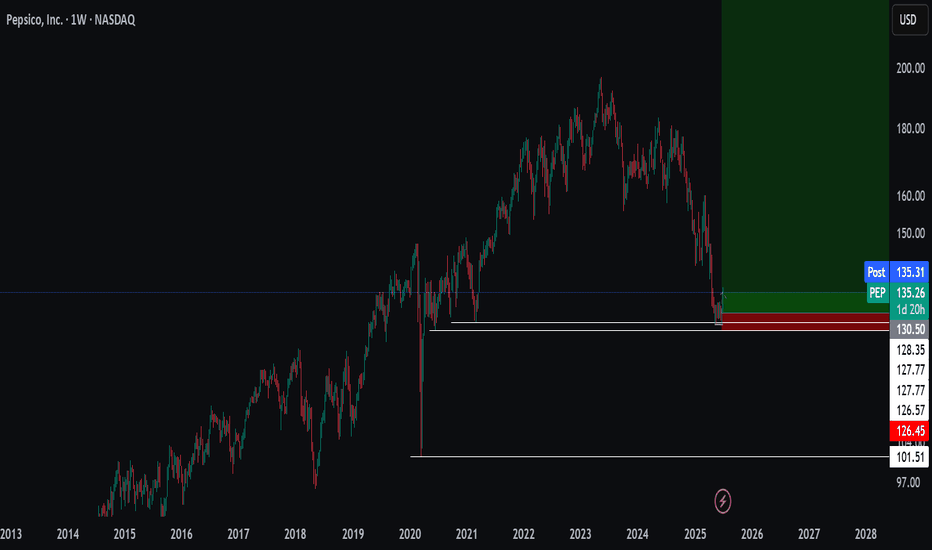

PEP Long-Term Buy Opportunityhi Traders,

The chart presents a compelling long-term buying opportunity for PepsiCo (PEP). The price is currently sitting in the identified "buy zone", a historically reliable area for accumulation. If we experience further dips, it’s still considered a buying opportunity all the way down to the 2

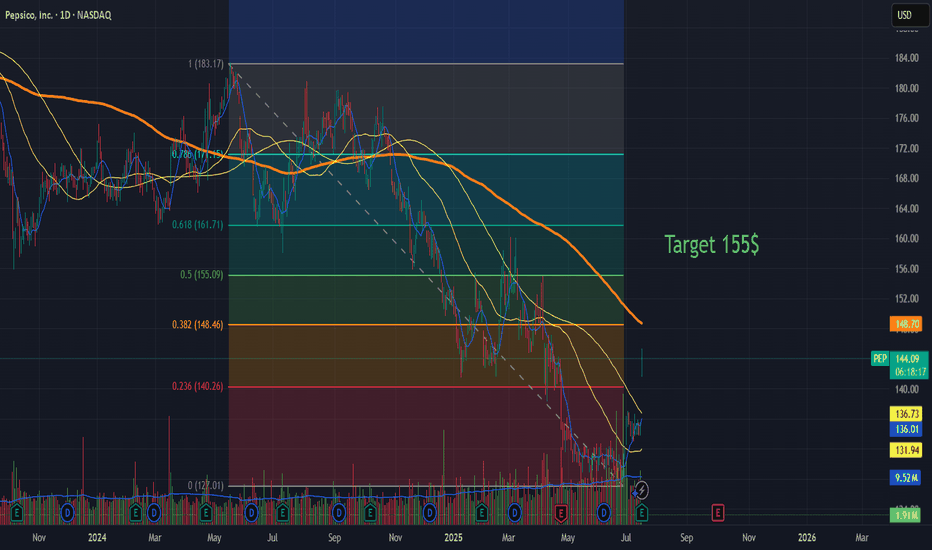

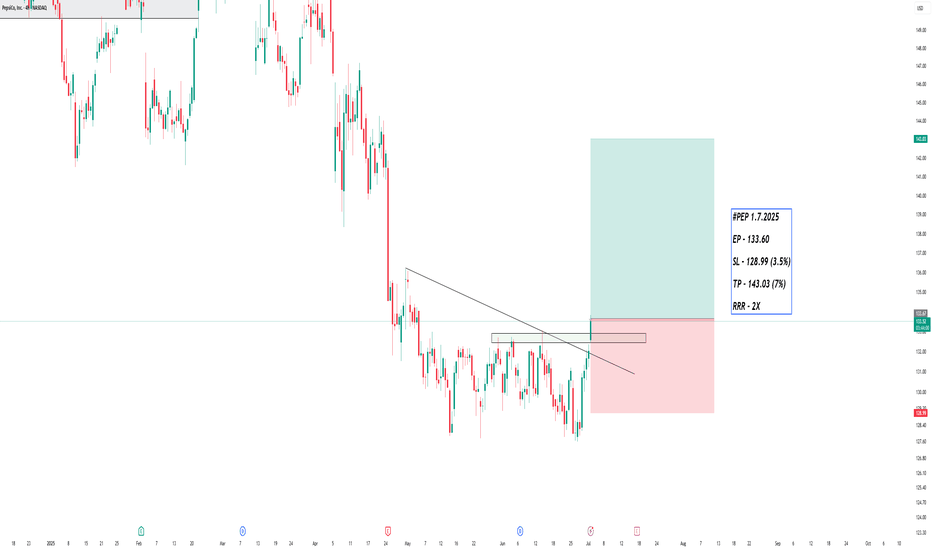

$PEP Bullish Swing Setup – Oversold & Ready to Rebound ?PepsiCo ( NASDAQ:PEP ) is sitting at a major long-term support after a deep pullback — this could be a strong opportunity for a risk-defined bounce. Here's what the chart is signaling:

🔹 Entry Zone: Price is currently near $128 — a historically significant level that acted as resistance in the past

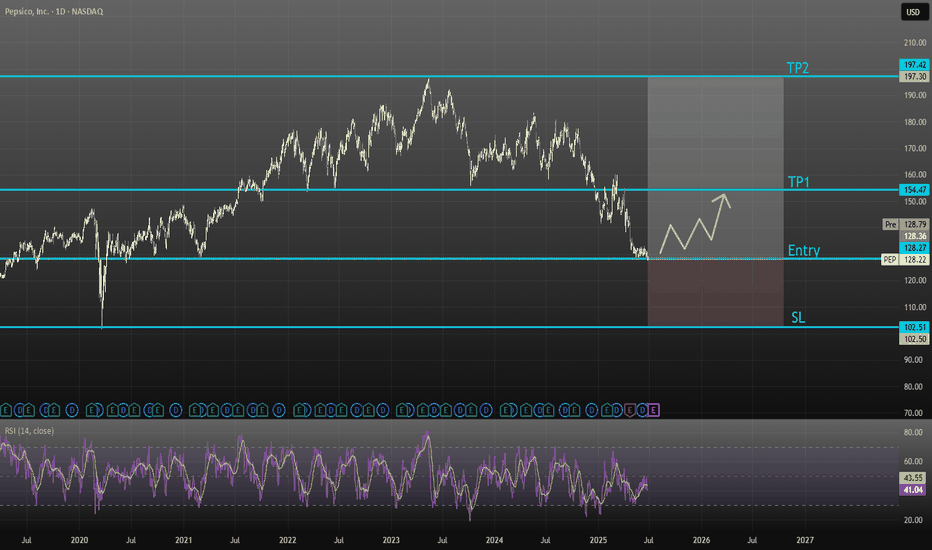

PEP – Bullish Divergence at Weekly DemandPepsiCo (PEP) has retraced into a key weekly demand zone, where price previously launched long bullish legs. At the same time, a bullish divergence is forming between price and RSI, suggesting selling momentum may be weakening.

Structure has clearly shifted bearish over the past two years, with mul

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US713448FG8

PEPSICO 21/51Yield to maturity

7.08%

Maturity date

Oct 21, 2051

PEP4895343

PepsiCo, Inc. 2.875% 15-OCT-2049Yield to maturity

6.85%

Maturity date

Oct 15, 2049

US713448FF0

PEPSICO 21/41Yield to maturity

6.61%

Maturity date

Oct 21, 2041

PEP4864210

PepsiCo, Inc. 3.375% 29-JUL-2049Yield to maturity

6.59%

Maturity date

Jul 29, 2049

US713448DP0

PEPSICO INC. 16/46Yield to maturity

6.57%

Maturity date

Oct 6, 2046

PEP4968014

PepsiCo, Inc. 3.625% 19-MAR-2050Yield to maturity

6.44%

Maturity date

Mar 19, 2050

PEP4968015

PepsiCo, Inc. 3.875% 19-MAR-2060Yield to maturity

6.33%

Maturity date

Mar 19, 2060

PEPS

PEPSICO INC. 17/47Yield to maturity

6.26%

Maturity date

May 2, 2047

PEP5447005

PepsiCo, Inc. 4.2% 18-JUL-2052Yield to maturity

6.20%

Maturity date

Jul 18, 2052

PEPB

PEPSICO INC. 12/42Yield to maturity

6.11%

Maturity date

Mar 5, 2042

PEP3887895

PepsiCo, Inc. 3.6% 13-AUG-2042Yield to maturity

6.04%

Maturity date

Aug 13, 2042

See all PEP bonds

Curated watchlists where PEP is featured.

Frequently Asked Questions

The current price of PEP is 125.54 EUR — it has increased by 8.02% in the past 24 hours. Watch PEPSICO INC. DL-,0166 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange PEPSICO INC. DL-,0166 stocks are traded under the ticker PEP.

PEP stock has risen by 9.51% compared to the previous week, the month change is a 10.82% rise, over the last year PEPSICO INC. DL-,0166 has showed a −16.61% decrease.

We've gathered analysts' opinions on PEPSICO INC. DL-,0166 future price: according to them, PEP price has a max estimate of 144.90 EUR and a min estimate of 94.31 EUR. Watch PEP chart and read a more detailed PEPSICO INC. DL-,0166 stock forecast: see what analysts think of PEPSICO INC. DL-,0166 and suggest that you do with its stocks.

PEP stock is 8.26% volatile and has beta coefficient of 0.06. Track PEPSICO INC. DL-,0166 stock price on the chart and check out the list of the most volatile stocks — is PEPSICO INC. DL-,0166 there?

Today PEPSICO INC. DL-,0166 has the market capitalization of 159.50 B, it has increased by 0.05% over the last week.

Yes, you can track PEPSICO INC. DL-,0166 financials in yearly and quarterly reports right on TradingView.

PEPSICO INC. DL-,0166 is going to release the next earnings report on Oct 2, 2025. Keep track of upcoming events with our Earnings Calendar.

PEP earnings for the last quarter are 1.80 EUR per share, whereas the estimation was 1.72 EUR resulting in a 4.50% surprise. The estimated earnings for the next quarter are 2.02 EUR per share. See more details about PEPSICO INC. DL-,0166 earnings.

PEPSICO INC. DL-,0166 revenue for the last quarter amounts to 19.29 B EUR, despite the estimated figure of 18.91 B EUR. In the next quarter, revenue is expected to reach 20.33 B EUR.

PEP net income for the last quarter is 1.70 B EUR, while the quarter before that showed 1.47 B EUR of net income which accounts for 15.23% change. Track more PEPSICO INC. DL-,0166 financial stats to get the full picture.

Yes, PEP dividends are paid quarterly. The last dividend per share was 1.25 EUR. As of today, Dividend Yield (TTM)% is 4.05%. Tracking PEPSICO INC. DL-,0166 dividends might help you take more informed decisions.

PEPSICO INC. DL-,0166 dividend yield was 3.51% in 2024, and payout ratio reached 76.68%. The year before the numbers were 2.91% and 75.37% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 319 K employees. See our rating of the largest employees — is PEPSICO INC. DL-,0166 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PEPSICO INC. DL-,0166 EBITDA is 16.65 B EUR, and current EBITDA margin is 19.72%. See more stats in PEPSICO INC. DL-,0166 financial statements.

Like other stocks, PEP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PEPSICO INC. DL-,0166 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PEPSICO INC. DL-,0166 technincal analysis shows the strong buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PEPSICO INC. DL-,0166 stock shows the sell signal. See more of PEPSICO INC. DL-,0166 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.