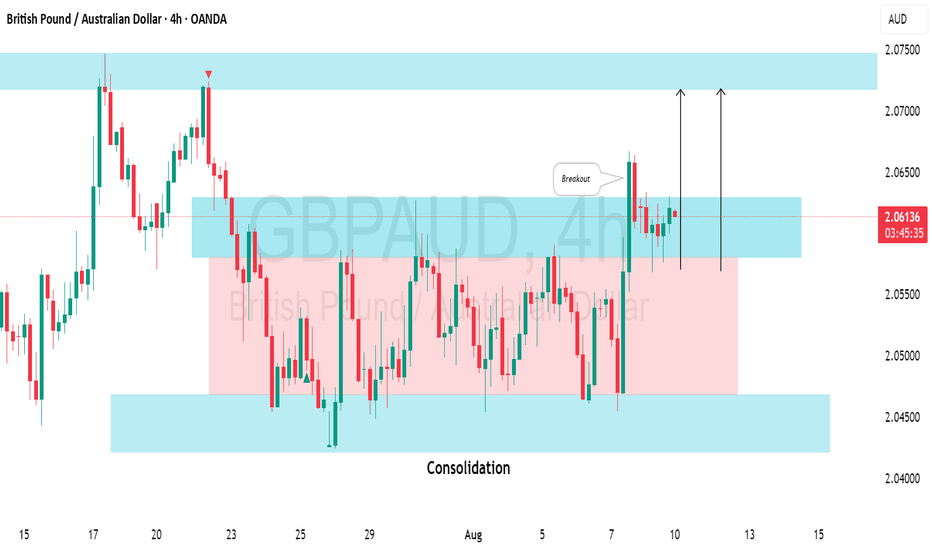

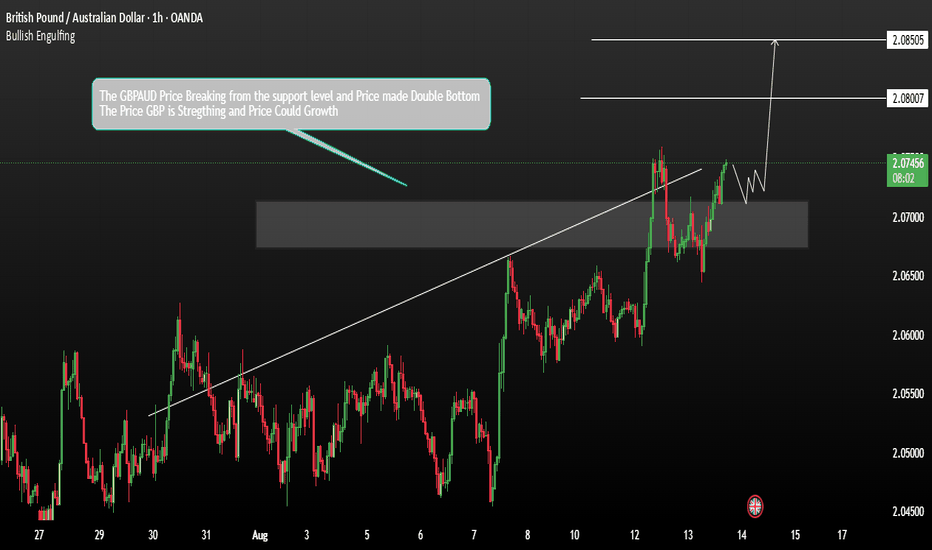

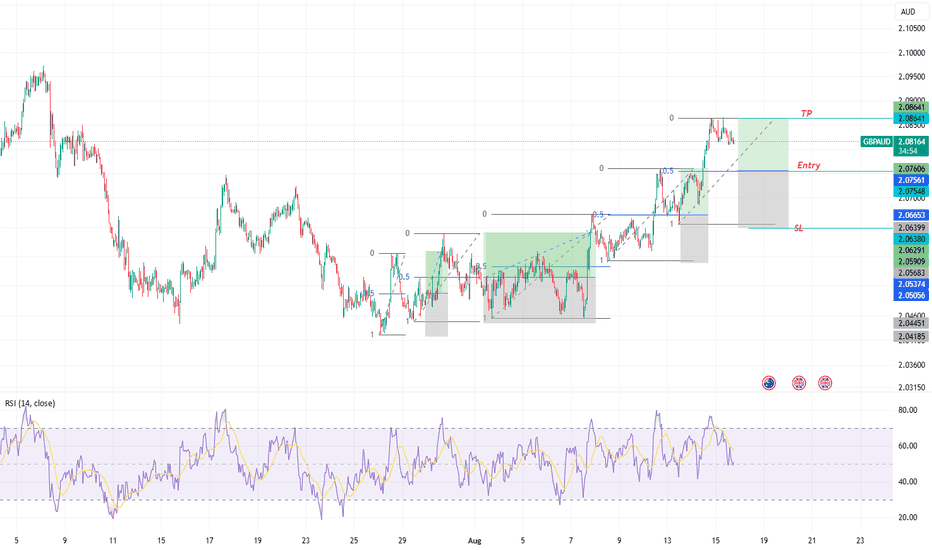

GBPAUD: Correction ContinuesAfter a period of consolidation within a broad horizontal range on an intraday chart, the 📈GBPAUD pair has violated its support level

This violation represents a significant indication of the buyers' dominance.

It could potentially initiate an upward correction, possibly reaching as high as 2.07

About British Pound / Australian Dollar

The British Pound vs. the Australian Dollar. Due to its relatively higher interest rates and its correlation to global equity markets, the Australian Dollar is often referred to as a risk currency. Mining, which is Australia’s largest economy sector, has been negatively affected by a slowdown in the global commodity super cycle and a decline in China’s growth.

Related currencies

GBPAUDHello Traders! 👋

What are your thoughts on GBPAUD?

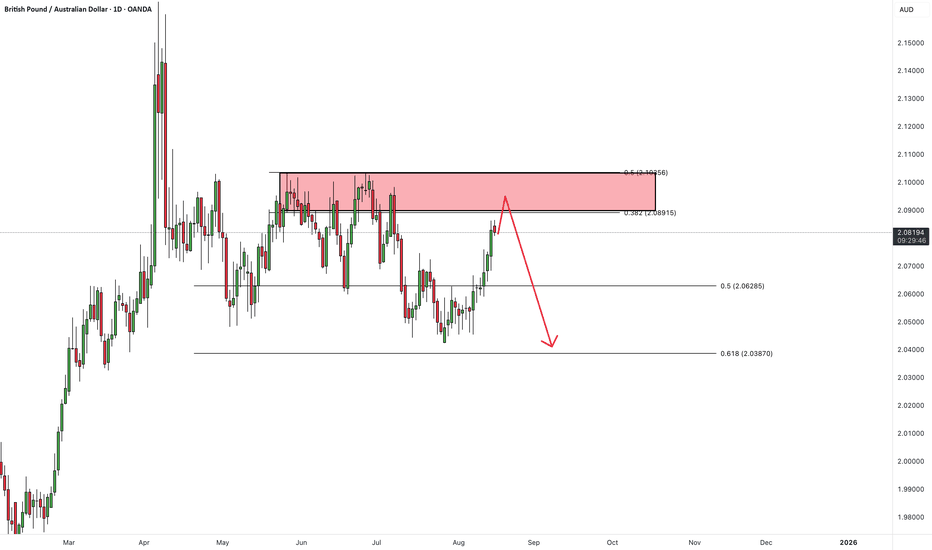

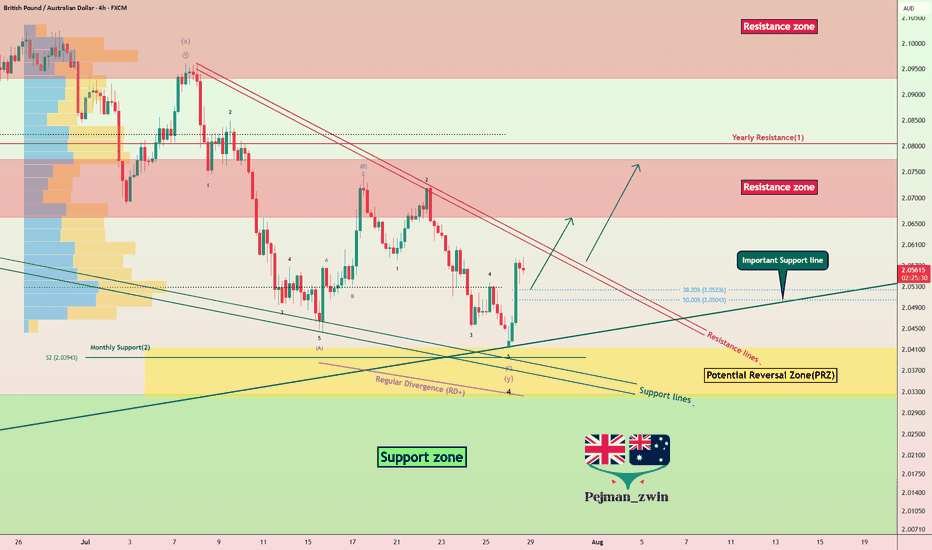

The GBP/AUD pair has reached a significant resistance zone.

We anticipate some consolidation or choppy movement in this area, followed by a potential bearish reversal toward lower support levels.

As long as price remains below the resistance, the b

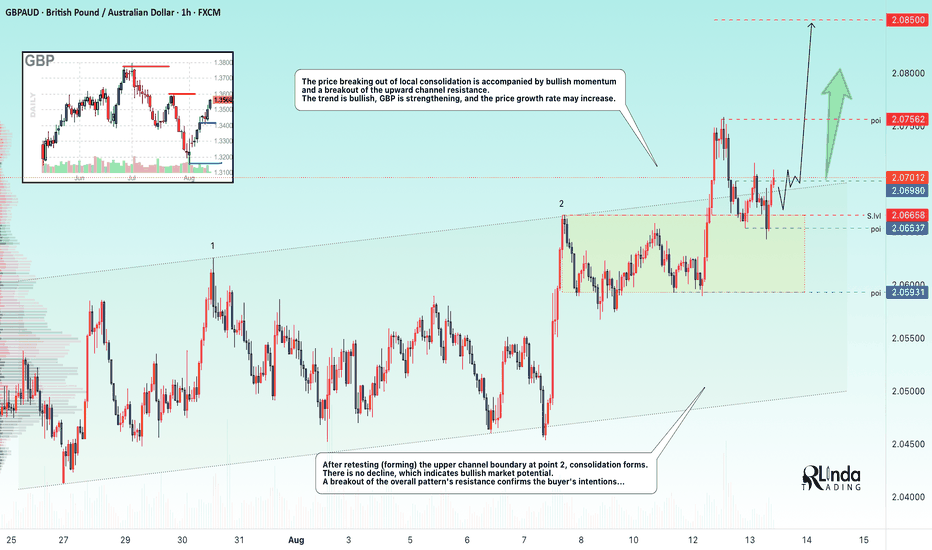

GBPAUD: Bullish Momentum Is IntactGBPAUD: Bullish Momentum Is Intact

GBPAUD confirmed another bullish pattern during the RBA meeting.

So far, the market is still moving against the AUD, despite the RBA Governor's optimistic comments.

GBPAUD is still rising and from this new pattern it could extend to the second target we had e

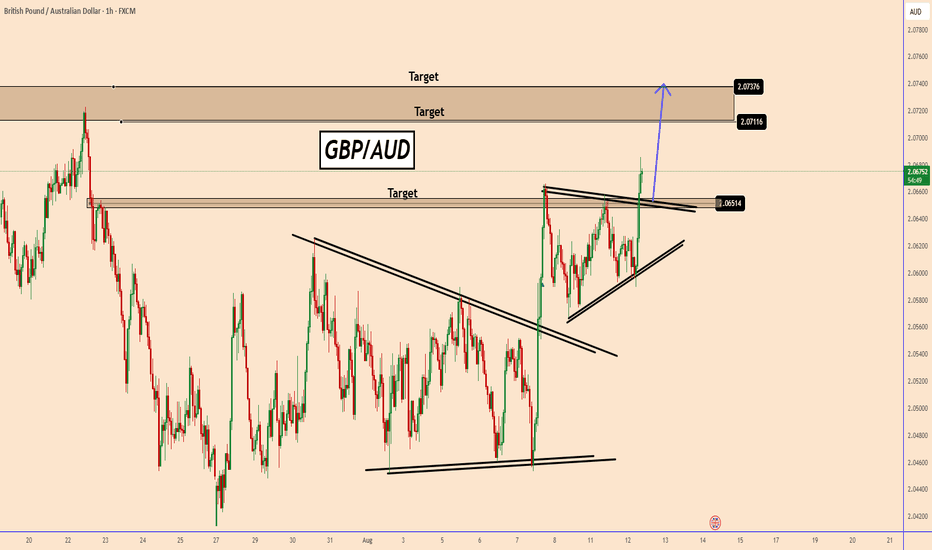

GBPAUD → Attempt to break through resistance. Rally?FX:GBPAUD is preparing to accelerate its growth within the global bullish trend. A breakout of the local channel resistance is forming...

Against the backdrop of the falling dollar, GBP is taking advantage of the opportunity and entering a phase of active growth. GBPAUD is emerging from local

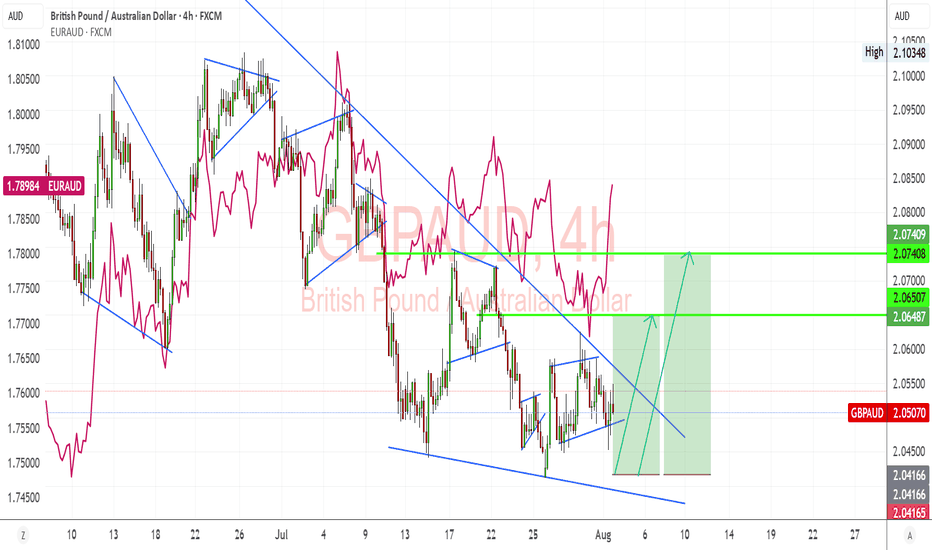

GBPAUD Potential Bullish Reversal Setup – Key Breakout Levels GBPAUD is showing signs of a potential bullish reversal after a prolonged downtrend, with price consolidating within a descending wedge pattern. The pair is testing a breakout point, and fundamentals favor a bullish recovery supported by GBP strength relative to AUD weakness.

Technical Analysis (4H

GBPAUD: Possible bounce at supportI am watching for a possible reversal GBPAUD, expecting a rejection with a upside target at around 2.073.

This area is where it can become a decision point, either price finds support and bounces, or it breaks below, and the move can start to extend lower.

Just sharing my thoughts for the charts, t

GBPAUD Formation Local Uptrend Level GBPAUD Against the backdrop of a weaker U.S. dollar, GBP is capitalizing on the momentum, entering an active growth phase. After retesting the trendline, the subsequent rebound signals strong bullish potential in the market.

Resistance Levels: 208.00 and 205.50 remain key confirmation zones for buy

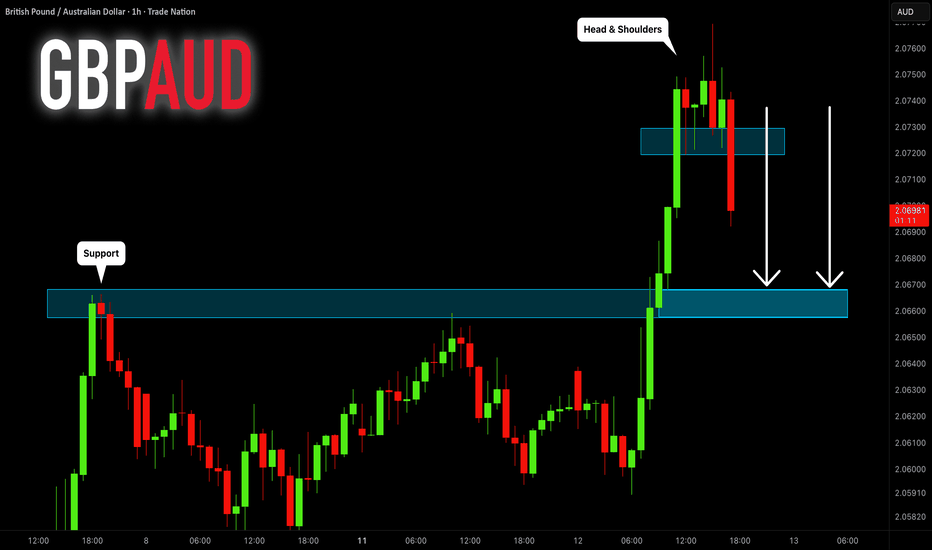

GBPAUD: Bearish After News 🇬🇧🇦🇺

GBPAUD looks bearish after the release of the US news today.

I see a strong intraday bearish pattern on an hourly time frame:

head and shoulders with a breakout of its neckline.

I will expect a bearish continuation to 2.0668 support.

❤️Please, support my work with like, thank you!❤️

I am pa

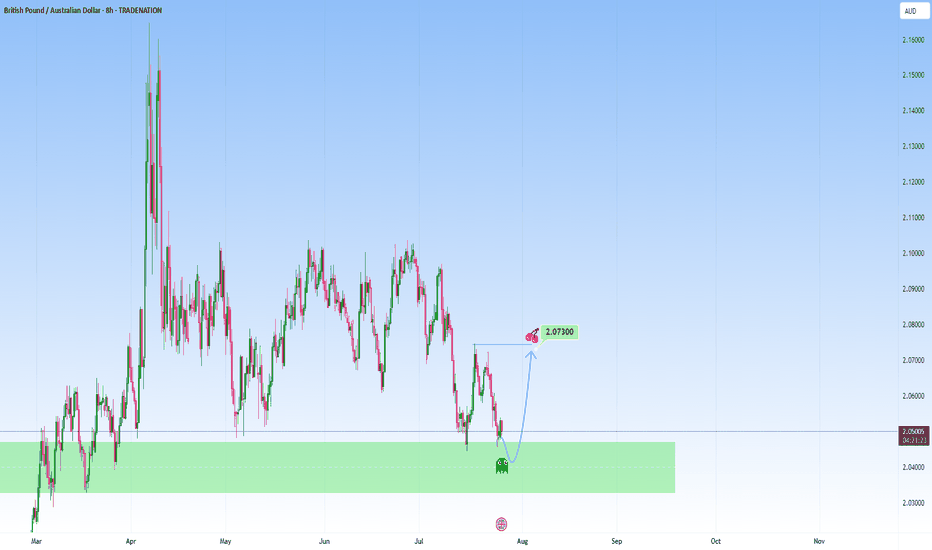

GBPAUD Reverses from Key Zone – Long Setup in Play!Today I want to share with you a Long position on GBPAUD ( OANDA:GBPAUD ).

GBPAUD started to rise well from the Important Support line , Support zone(2.032 AUD-1.987 AUD) , and Potential Reversal Zone(PRZ) and managed to close the 4-hour candle above 2.053 AUD (important) .

In terms of

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPAUD is 2.08085 AUD — it has decreased by −0.08% in the past 24 hours. See more of GBPAUD rate dynamics on the detailed chart.

The value of the GBPAUD pair is quoted as 1 GBP per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPAUD has the volatility rating of 0.35%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPAUD showed a 1.01% rise over the past week, the month change is a 1.32% rise, and over the last year it has increased by 7.11%. Track live rate changes on the GBPAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPAUD technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPAUD shows the strong buy signal, and 1 month rating is strong buy. See more of GBPAUD technicals for a more comprehensive analysis.