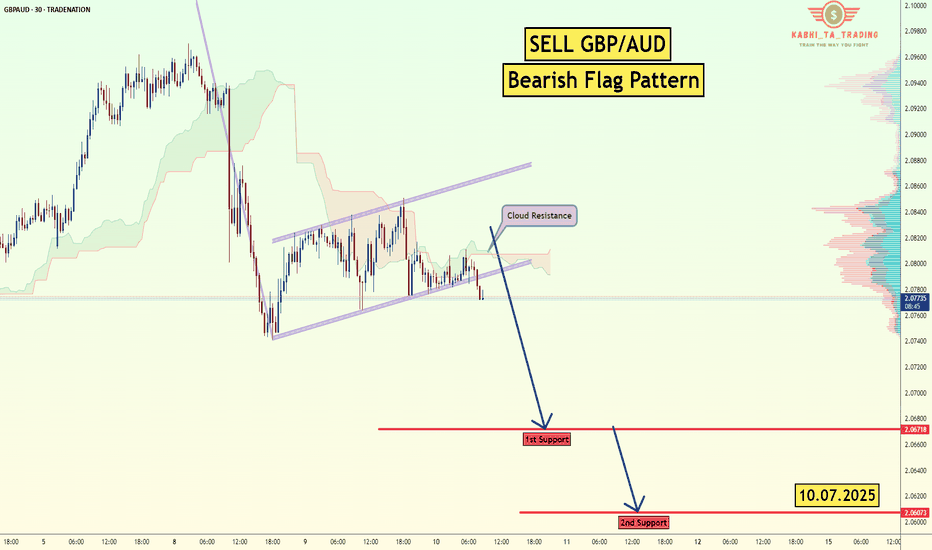

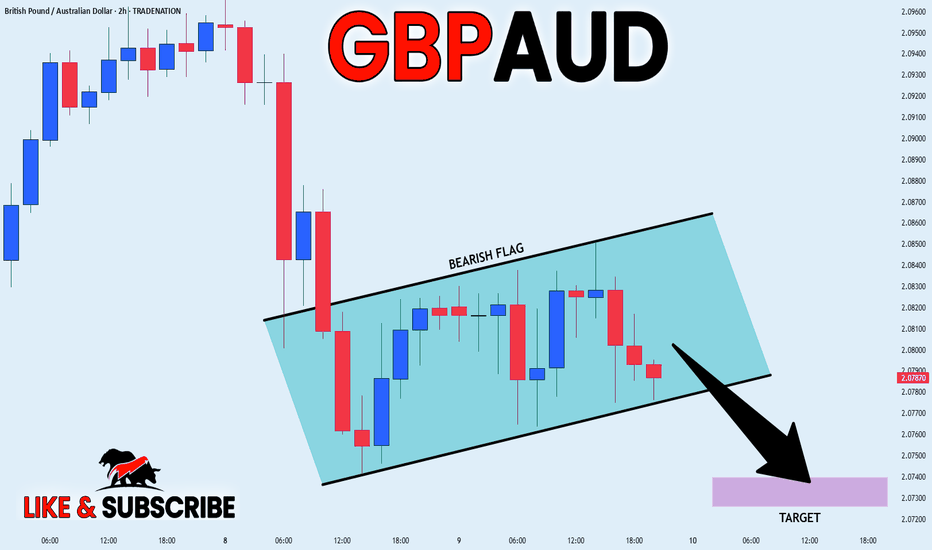

GBP/AUD - Bearish Flag (10.07.2025)The GBP/AUD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of Th

About British Pound / Australian Dollar

The British Pound vs. the Australian Dollar. Due to its relatively higher interest rates and its correlation to global equity markets, the Australian Dollar is often referred to as a risk currency. Mining, which is Australia’s largest economy sector, has been negatively affected by a slowdown in the global commodity super cycle and a decline in China’s growth.

Related currencies

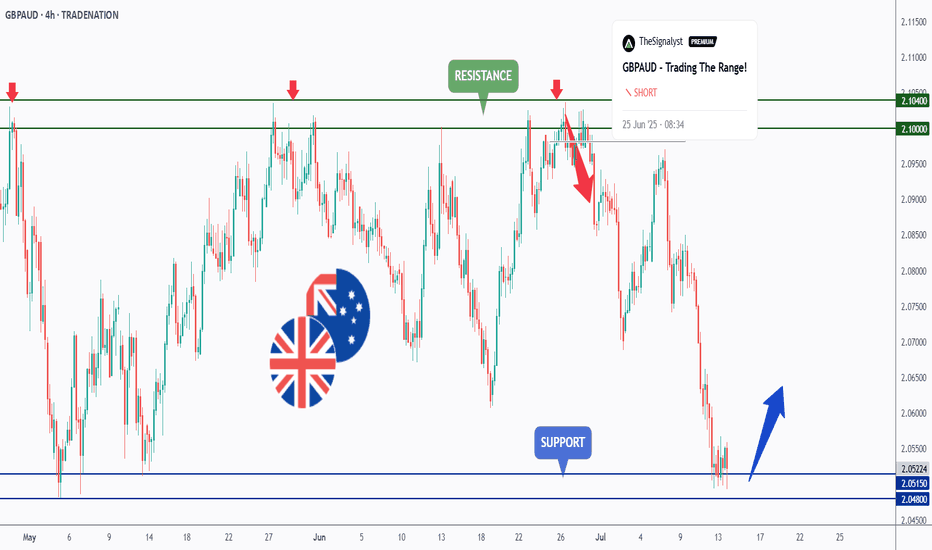

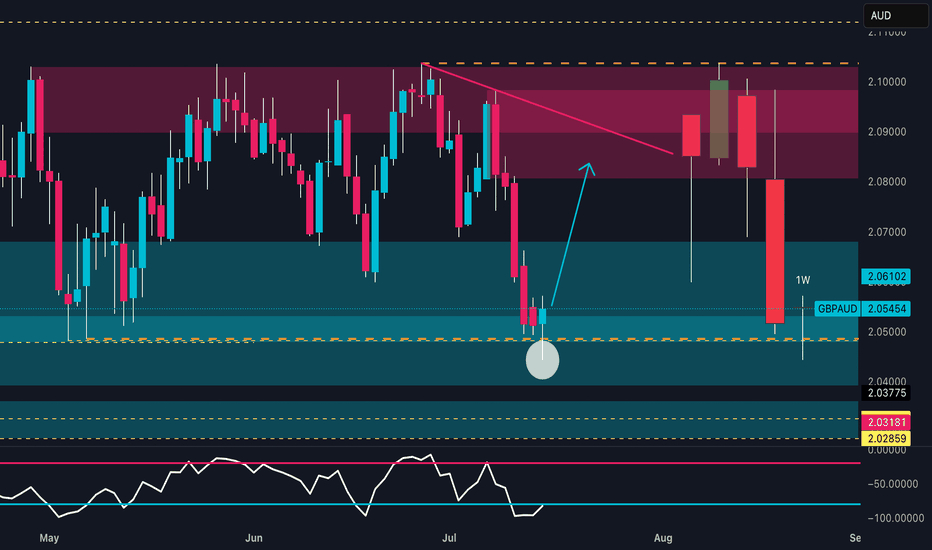

GBPAUD - Trading The Range - AGAIN!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been hovering within a big range.

Last week, as per our previous analysis, GBPAUD rejected the upper bound of the range and traded lower.

This week, GA is retesting the lower bound of the range a

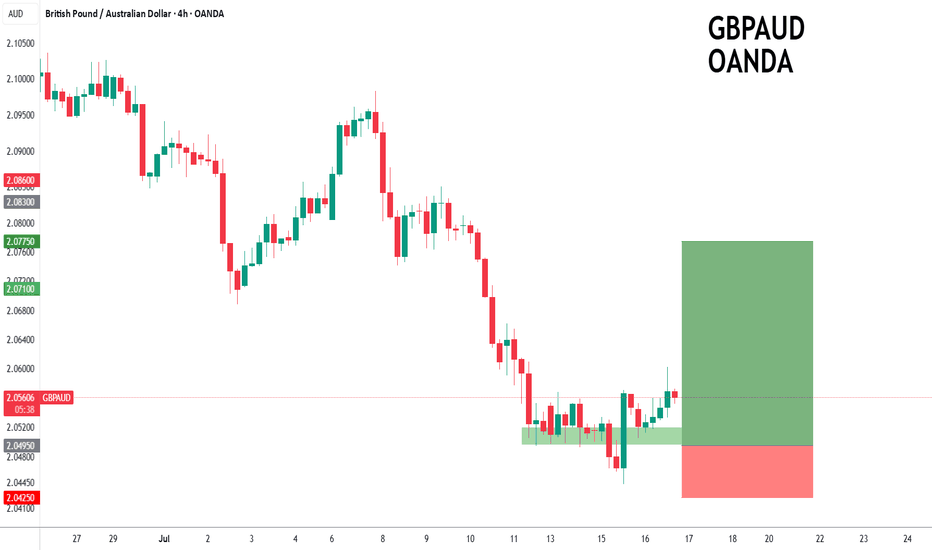

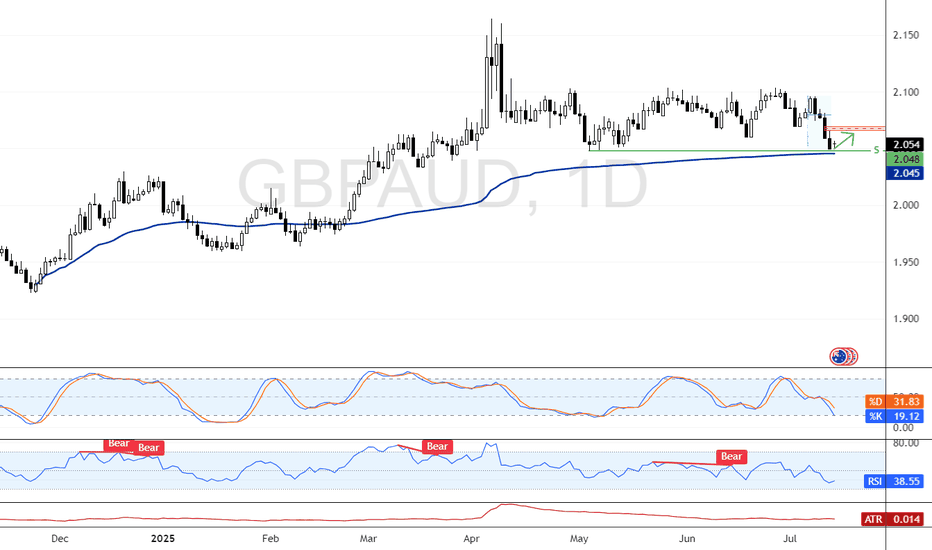

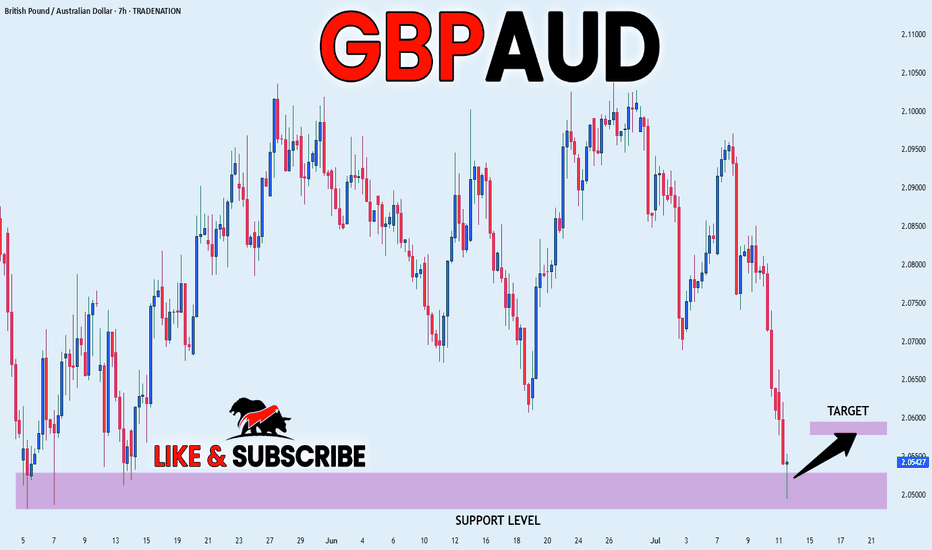

GBPAUD to turnaround?GBPAUD - 24h expiry

The primary trend remains bullish.

Price action looks to be forming a bottom.

We look for a temporary move lower.

Preferred trade is to buy on dips.

Bespoke support is located at 2.0495.

We look to Buy at 2.0495 (stop at 2.0425)

Our profit targets will be 2.0775 and 2.082

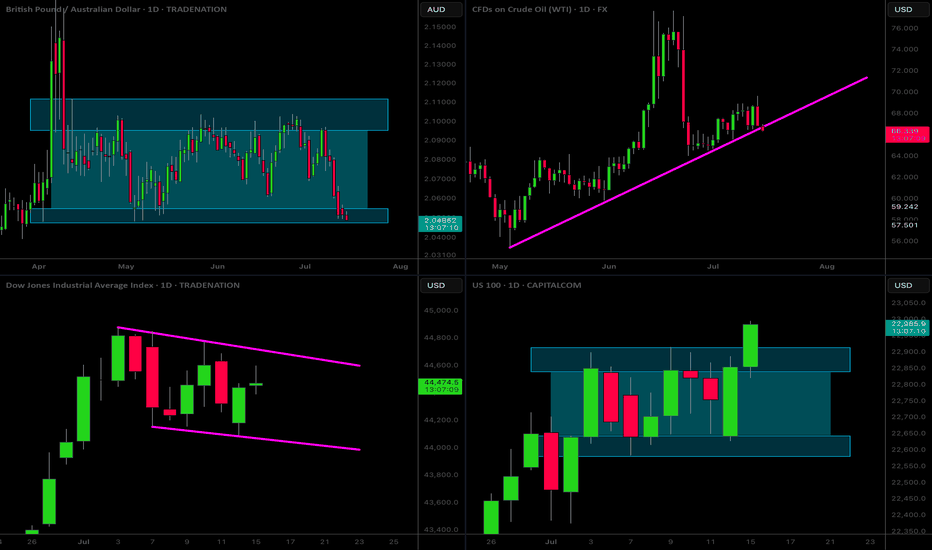

MarketBreakdown | GBPAUD, WTI CRUDE OIL, US30, US100

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #GBPAUD daily time frame 🇬🇧🇦🇺

The market is trading within a wide horizontal parallel channel.

The price is stuck on its support.

Probabilities will be high that the market will start growing from that.

Alternative

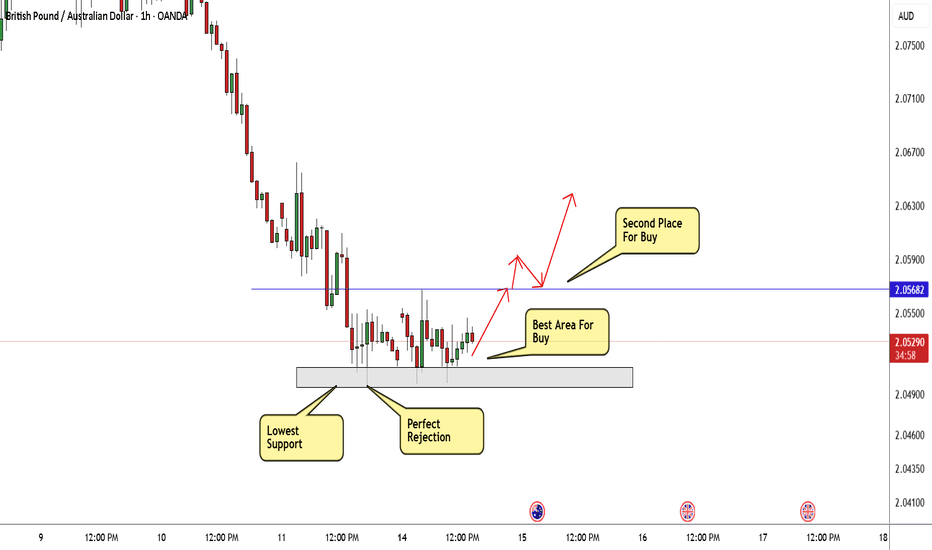

GBP/AUD Ready To Go Up After Melted , 2 Entries Valid !Here is my GBP/AUD 1H Chart and this is my opinion , the price moved very hard to downside without any correction and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the pri

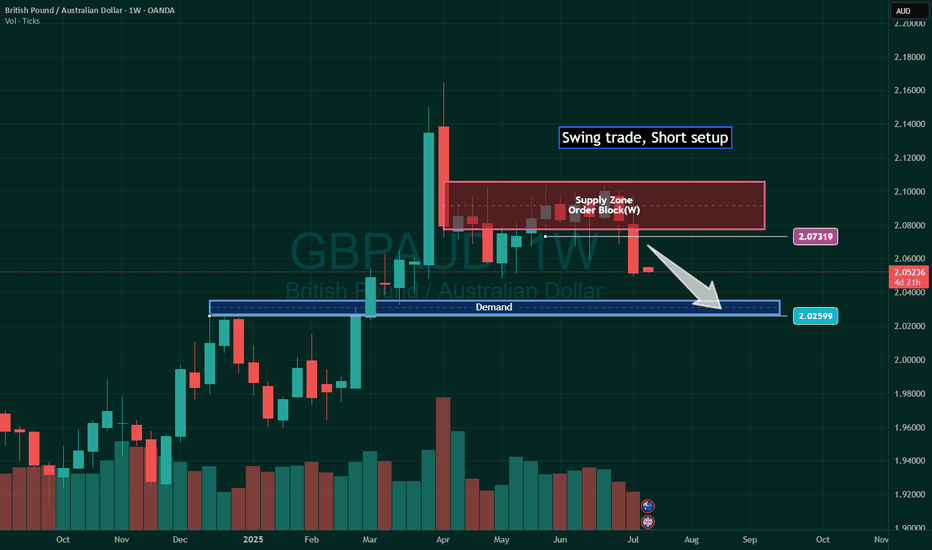

GBPAUD: Weekly Reversal | COT & Seasonality Support Bullish📊 Technical Outlook

Price strongly reacted from a key weekly demand zone between 2.0400 and 2.0500, showing clear absorption of bearish pressure. The RSI is rebounding from the 30 area, signaling early reversal potential.

The next technical target lies between 2.08900 and 2.10000, within a well-defi

GBP/AUD Tests 2.048 for Potential ReboundFenzoFx—GBP/AUD is testing the critical support level at 2.048, coinciding with the VWAP. From a technical perspective, a bullish move toward an upper resistance level is likely.

In this scenario, GBP/AUD has the potential to test the bearish FVG at approximately 2.070. Please note that the bullish

GBP_AUD LONG FROM SUPPORT|

✅GBP_AUD fell down sharply

But a strong support level was hit at 2.0500

Thus I am expecting a rebound

And a move up towards the target of 2.0580

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for

GBP_AUD BEARISH FLAG|SHORT|

✅GBP_AUD is going down now

And the pair has formed

A bearish flag pattern

Which makes me bearish biased

And after the breakout

I believe we will see bearish continuation

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and r

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of GBPAUD is 2.07389 AUD — it has increased by 0.05% in the past 24 hours. See more of GBPAUD rate dynamics on the detailed chart.

The value of the GBPAUD pair is quoted as 1 GBP per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 GBP.

The term volatility describes the risk related to the changes in an asset's value. GBPAUD has the volatility rating of 1.05%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The GBPAUD showed a −1.15% fall over the past week, the month change is a −1.66% fall, and over the last year it has increased by 7.72%. Track live rate changes on the GBPAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

GBPAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with GBPAUD technical analysis. The technical rating for the pair is neutral today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the GBPAUD shows the buy signal, and 1 month rating is buy. See more of GBPAUD technicals for a more comprehensive analysis.