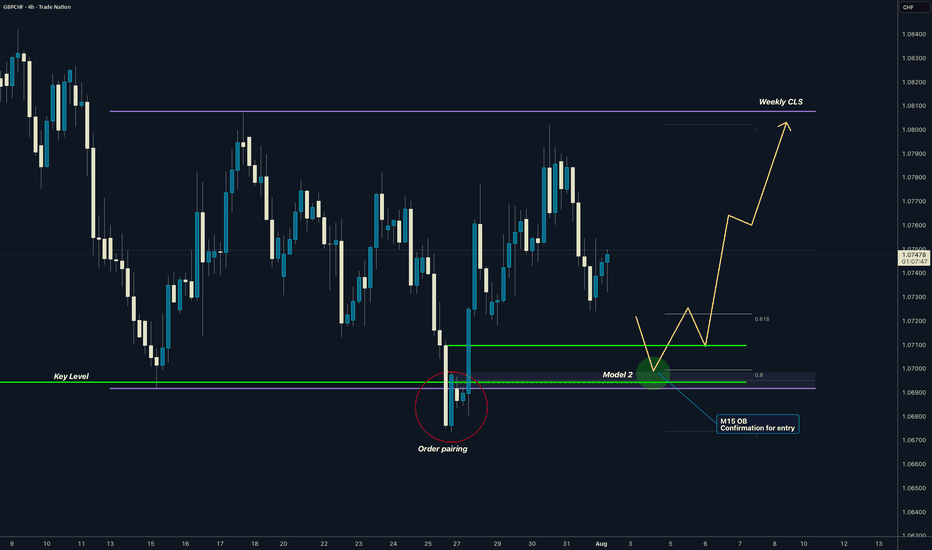

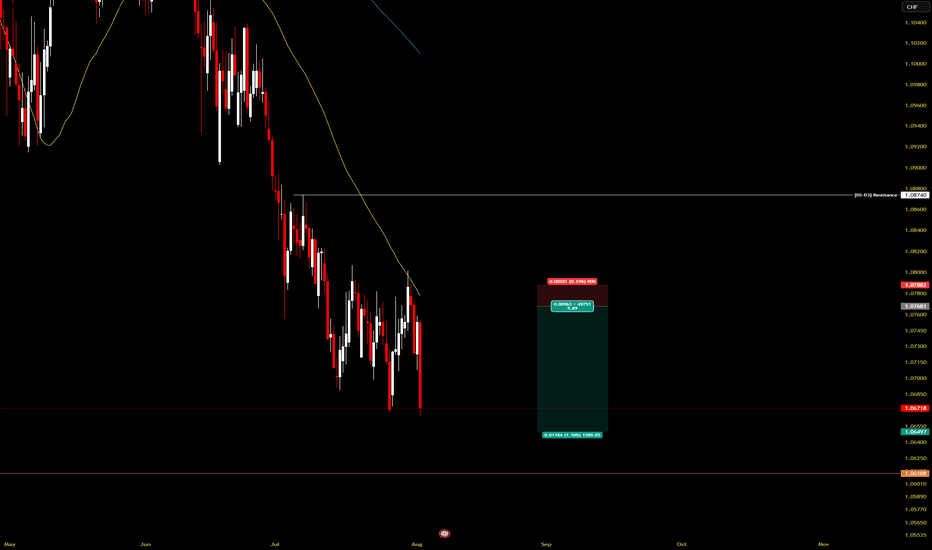

GBPCHF I Weekly CLS I Model 2 I Target full CLS rangeYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/d

About British Pound / Swiss Franc

The British Pound vs. Swiss Franc cross is a lower volatility pair that is tempered by the currencies' economic and geographic proximity. The British Pound is one of the premier reserve currencies and represents the world's largest financial center. In turn, the Swiss Franc is used as a reserve currency around the world and is currently ranked rarely 5th or 6th in value held as reserves after the United States dollar, the euro, the Japanese yen, the pound sterling and the Canadian dollar.

Related currencies

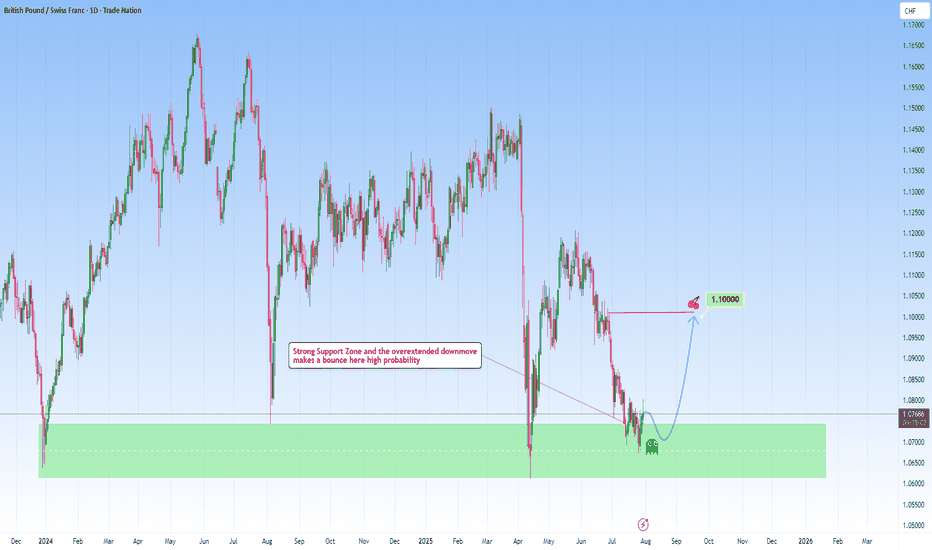

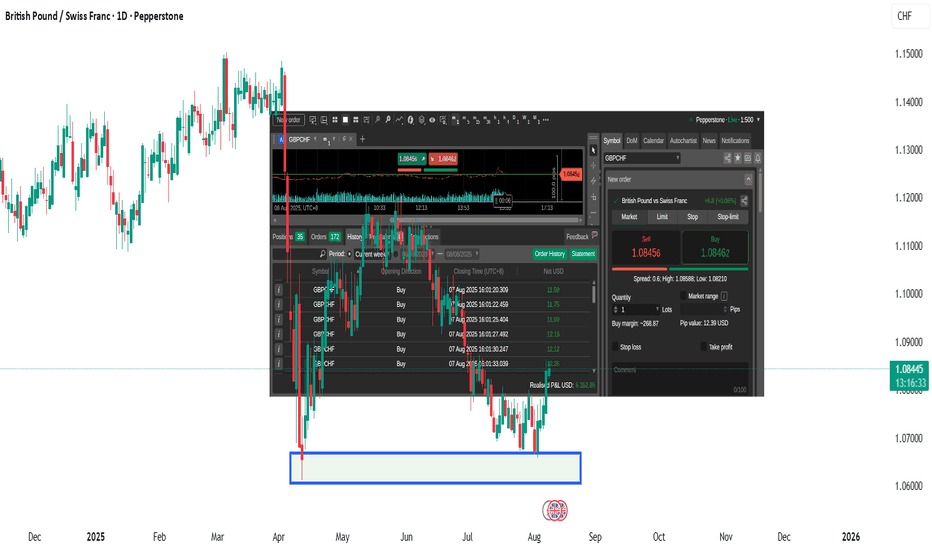

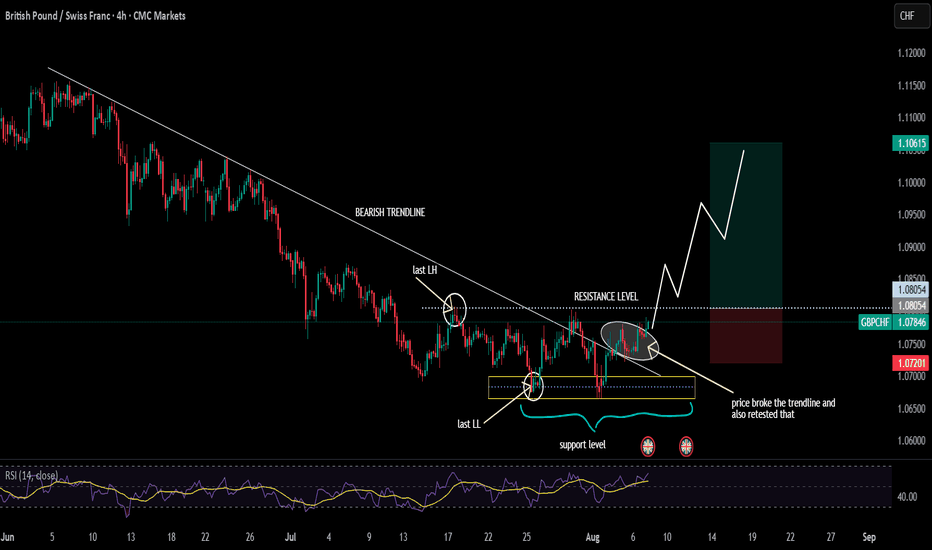

GBPCHF meets strong support: A reversal here is high probabilityLooking at GBPCHF and how it fits within my approach to structure-based trading, this one is really speaking my language.

Price has come down into a key higher-timeframe support zone: a zone that’s proven itself multiple times in the past. Now, price has shown some initial rejection there, making m

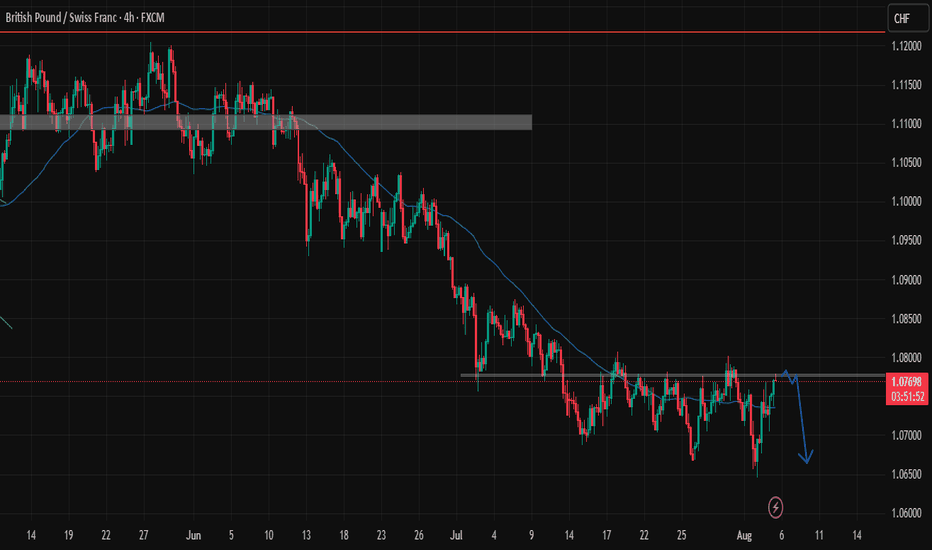

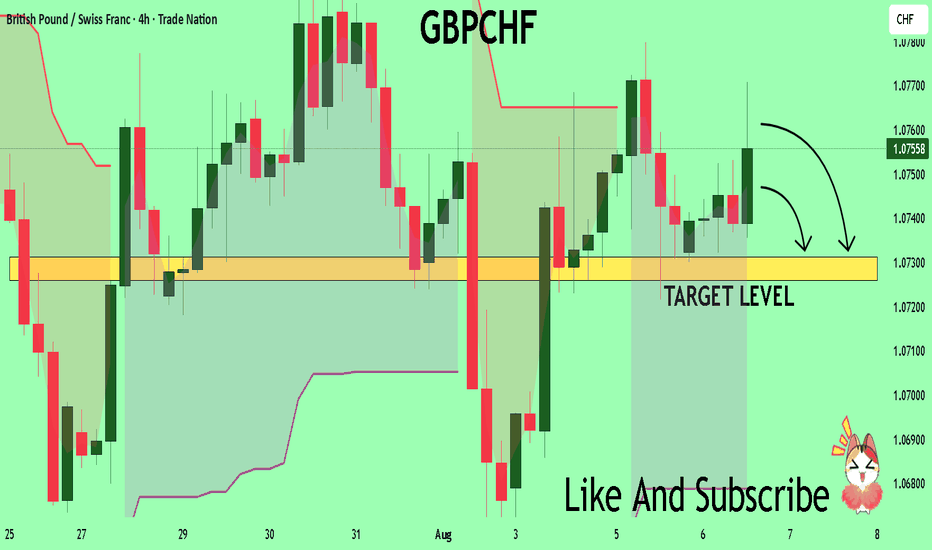

GBPCHF Will Collapse! SELL!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

The market is trading on 1.0756 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0731

About Used Indicators:

A super-trend

GBPCHF RETAINS BEARISH MOMENTUMInstitutional (COT) data shows a net reduction in GBP exposure, suggesting big money is pulling out of the pound. Retail sentiment also leans heavily against the trend, with traders buying the dip — another contrarian bearish signal. Seasonality does not favor the pair in August either, with histori

CHF Double Bottom Support ZoneI made over 5,000 USD on a live trading account trading CHF-related pairs. They often form some kind of a bottom/support then bounce off of it. You need to have your stoploss ready for there are times that they will break these support levels hard. You can then wait for another zone for which they w

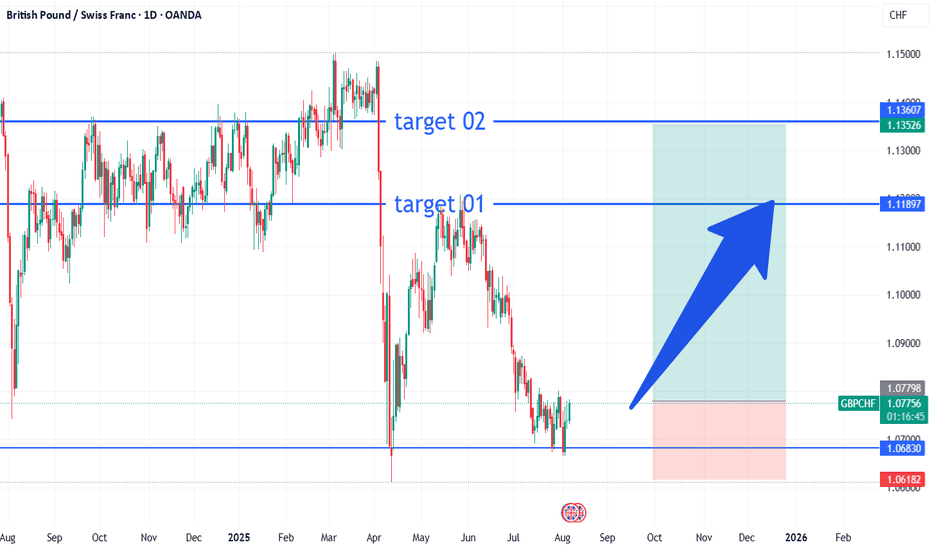

GBP/CHF Bullish Reversal Setup – Eyes on 1.11897 & 1.13607 Targe📈 GBP/CHF Bullish Reversal Setup – Eyes on 1.11897 & 1.13607 Targets 🎯

Pair: GBP/CHF

Timeframe: 1D

Status: Bullish Reversal Anticipation

Date: August 6, 2025

📝 Analysis:

GBP/CHF has been consolidating near the key support zone around 1.06830, showing signs of potential bottoming. Price action ind

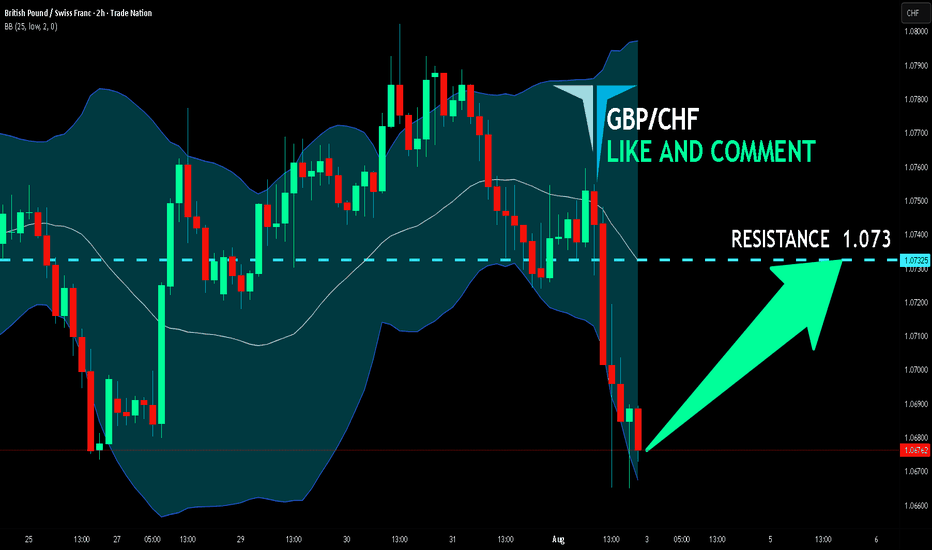

GBP/CHF BEST PLACE TO BUY FROM|LONG

Hello, Friends!

GBP/CHF pair is in the uptrend because previous week’s candle is green, while the price is clearly falling on the 2H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.073 because the pair is oversold due to its

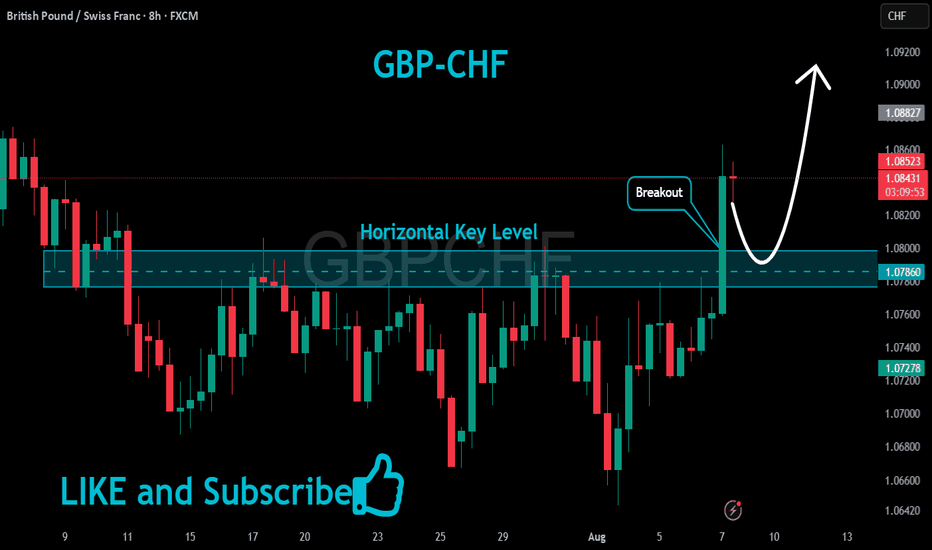

GBPCHF Strong Bullish Breakout!

HI,Traders !

#GBPCHF is trading in a strong

Uptrend and the price

Made a bullish breakout

Of the key horizontal level

Of 1.07860 and the breakout

Is confirmed so we are

Bullish biased and we will

Be expecting a further move

Up after the potential pullback !

Comment and subscribe to help us grow

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The value of the GBPCHF pair is quoted as 1 GBP per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 GBP.

GBPCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade GBPCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.