British Pound / Swiss Franc forum

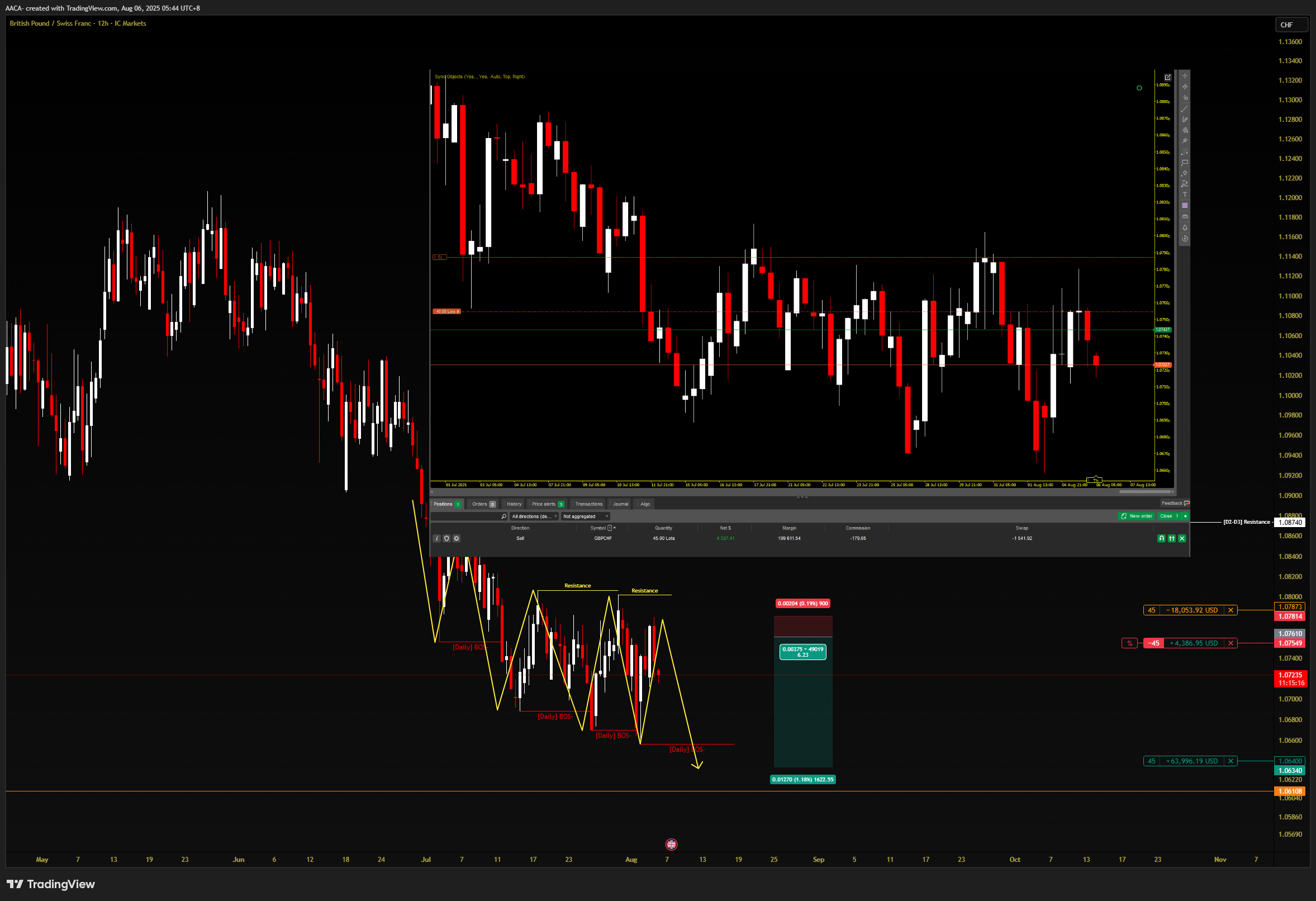

Idea: GBPCHF RETAINS BEARISH MOMENTU…

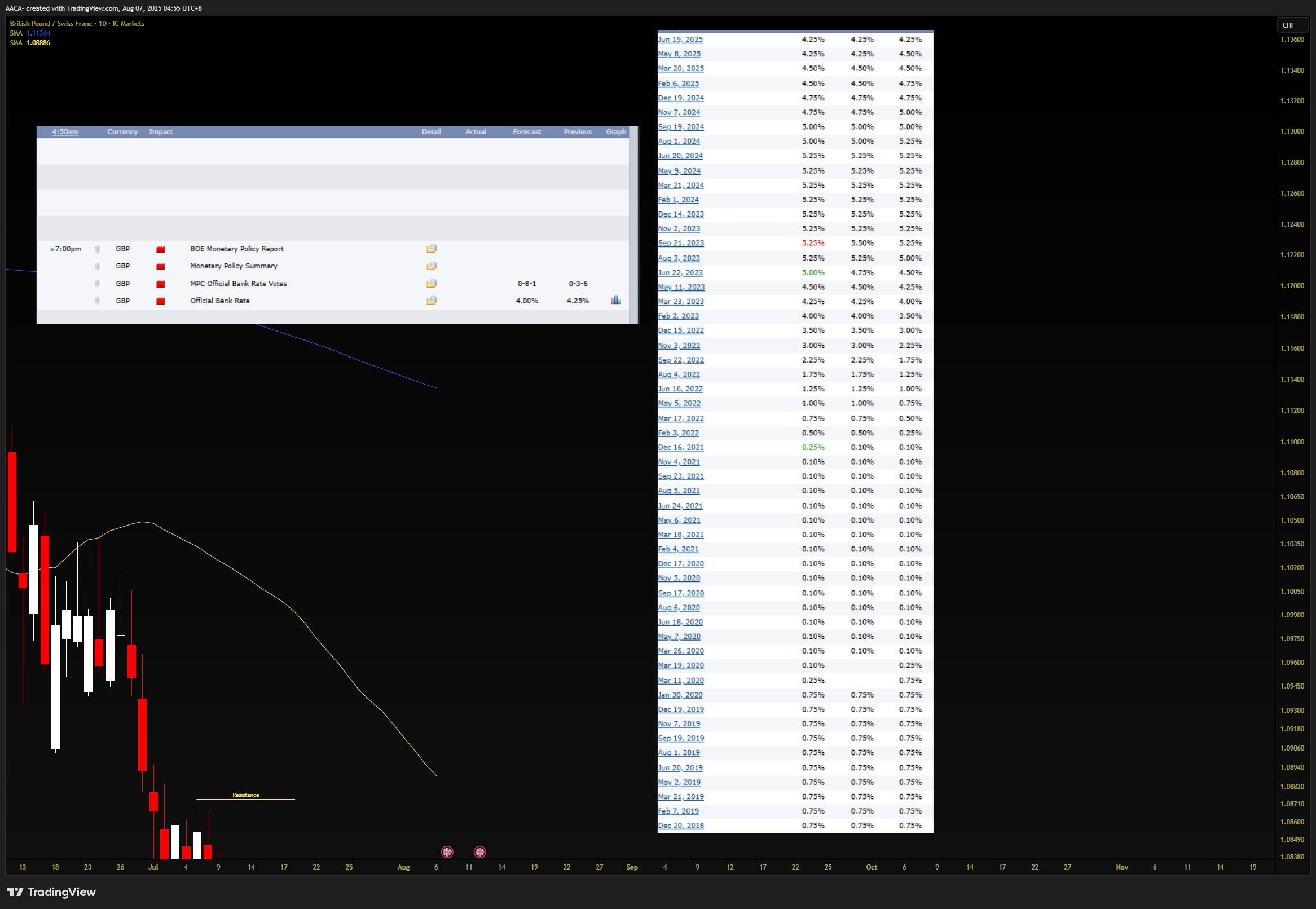

Out of 50+ GBP interest rate forecasts, only 3 have deviated from expectations — that’s a track record exceeding 98% accuracy. This level of consistency makes GBP one of the more predictable currencies when it comes to rate pricing and market response.

With a -0.25% rate cut forecasted for tomorrow and the market’s forecasting accuracy historically strong, I’m confident in maintaining my short position going into the event.

#insiderinformation

Dont tell anyone I shared this :) Retail buyers will get liquidated tomorrow.

#insiderinformation

#insidertrading

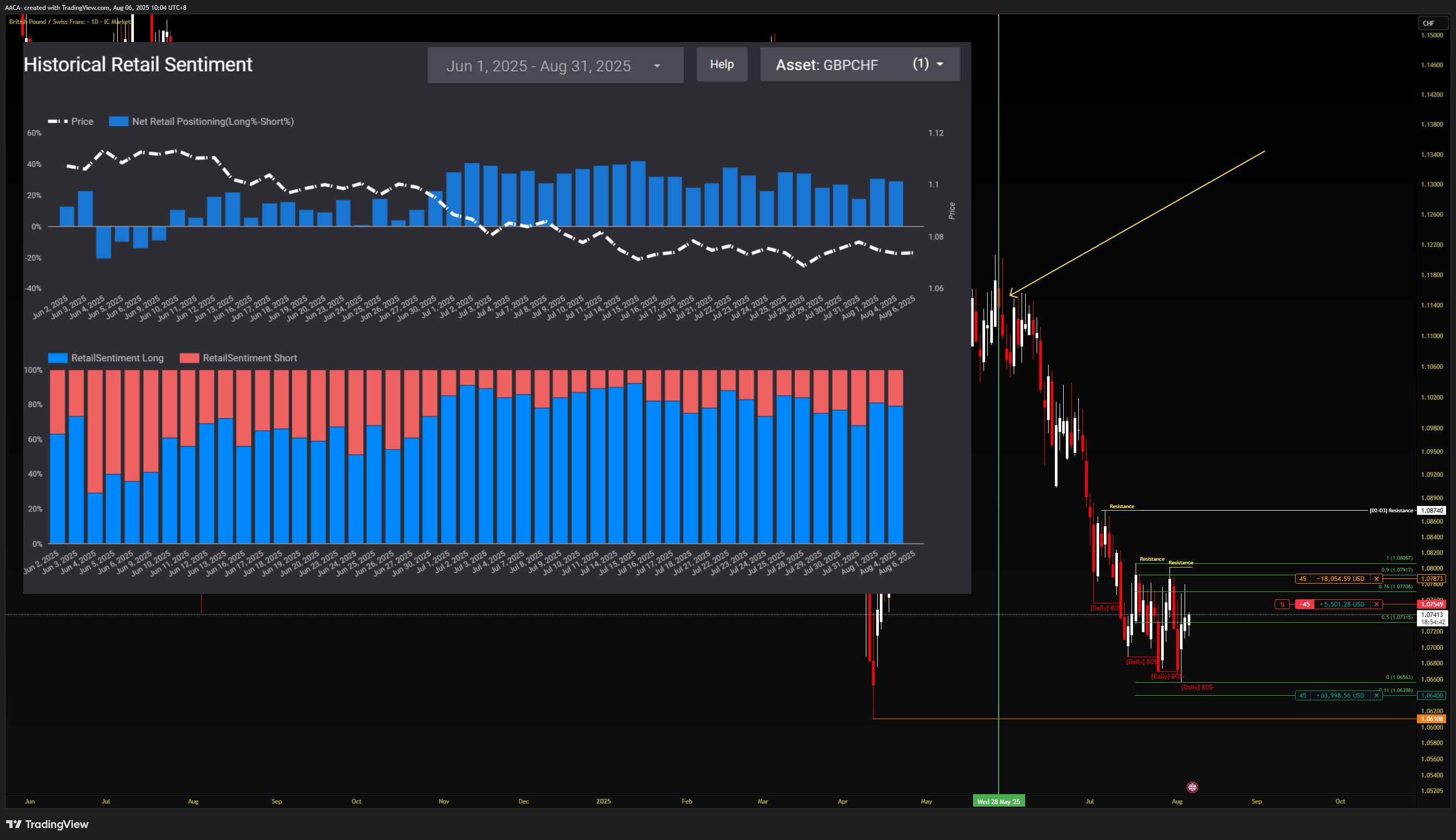

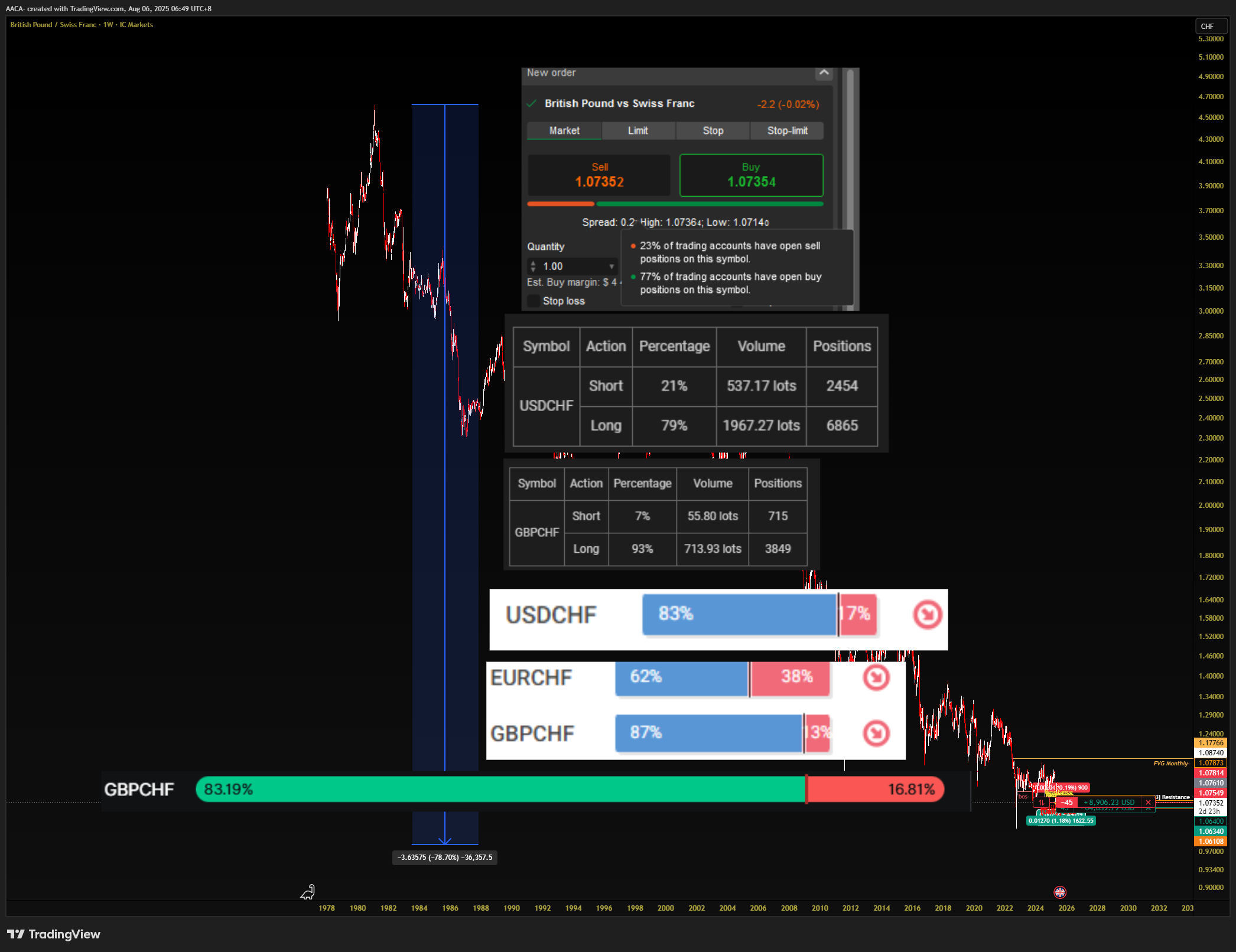

80-90% of retail is bullish on GBPCHF for 3 months. 95% of retail blow up their accounts in 90 days.

If you're convinced that tariffs alone are a sufficient catalyst for a reversal—without alignment from broader fundamentals or technical structure—then logically, you should be positioned Long. Otherwise, it raises the question: is this conviction or just a narrative without execution?

Looking through your posts, it’s clear I overestimated your grasp of the markets. Engaging was a misstep—one I won’t repeat. Time is capital, and I just realized I spent mine poorly.