FLR Call Setup: Breakout Aiming for $53+!"" 🚀

📝 Caption/Description:

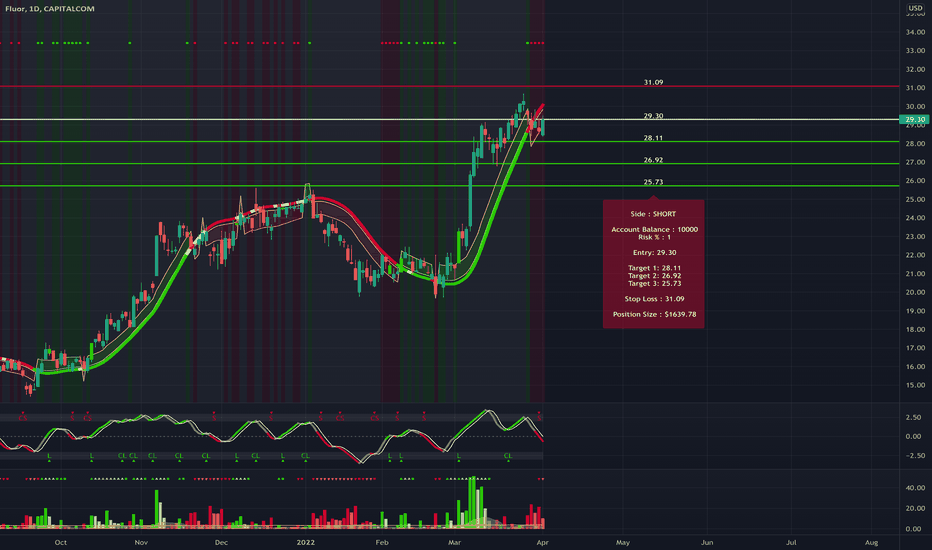

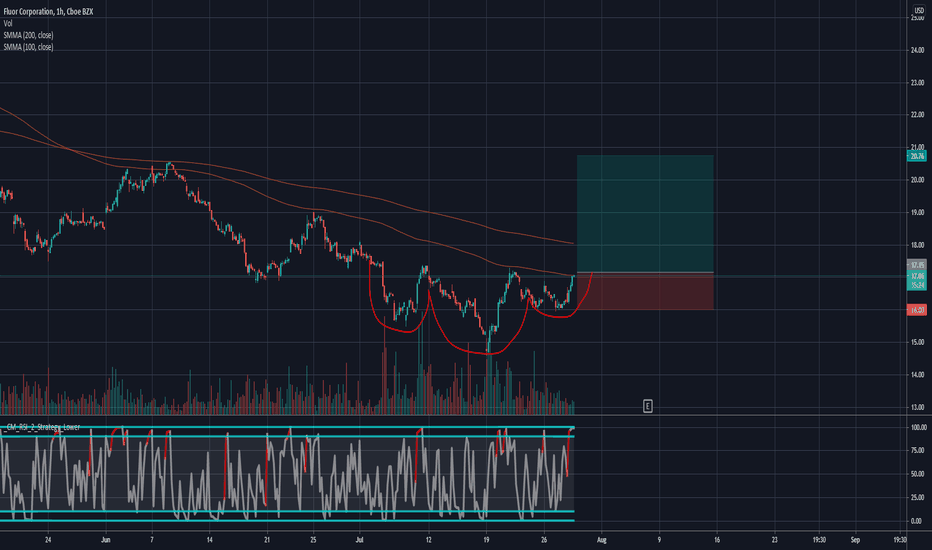

📈 Call Trade on FLR (30-min Chart)

🔹 Entry: $49.81

🔹 Stop Loss: $48.47

🔹 Target: $53.56

🔹 R:R Ratio: ~1:2.5

🔸 Strong breakout from ascending wedge

🔸 Holding above key resistance-turned-support levels

💡 Watch $51.42 zone for partial profits

🦅 Chart by ProfittoPath

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

21.06 EUR

2.07 B EUR

15.76 B EUR

159.27 M

About Fluor Corporation

Sector

Industry

CEO

James R. Breuer

Website

Headquarters

Irving

Founded

1912

FIGI

BBG01JJ4RFP8

Fluor Corp. is a holding company, which engages in the provision of engineering, procurement and construction (EPC), fabrication and modularization, and project management services. It operates through the following segments: Energy Solutions, Urban Solutions, Mission Solutions, and Other. The Energy Solutions segment focuses on energy transition markets, asset decarbonization, carbon capture, renewable fuels, waste-to-energy, green chemicals, hydrogen, nuclear power, and other low-carbon energy sources. The Urban Solutions segment involves the provision of EPC, project management, and professional staffing services. The Mission Solutions segment includes the technical products to federal agencies and services to commercial nuclear clients. The Other segment consists of operations on AMECO, Stork and NuScale. The company was founded by John Simon Flour, Sr. in 1912 and is headquartered in Irving, TX.

Related stocks

It's Time to BuildUS and the West need to build and build quick to stay ahead of China. Why shouldn't the US spend and build the coolest infrastructure in the world if the world needs your business and will lend you money all day? Fluor is the cheapest infrastructure stock out there they have decades of experience ma

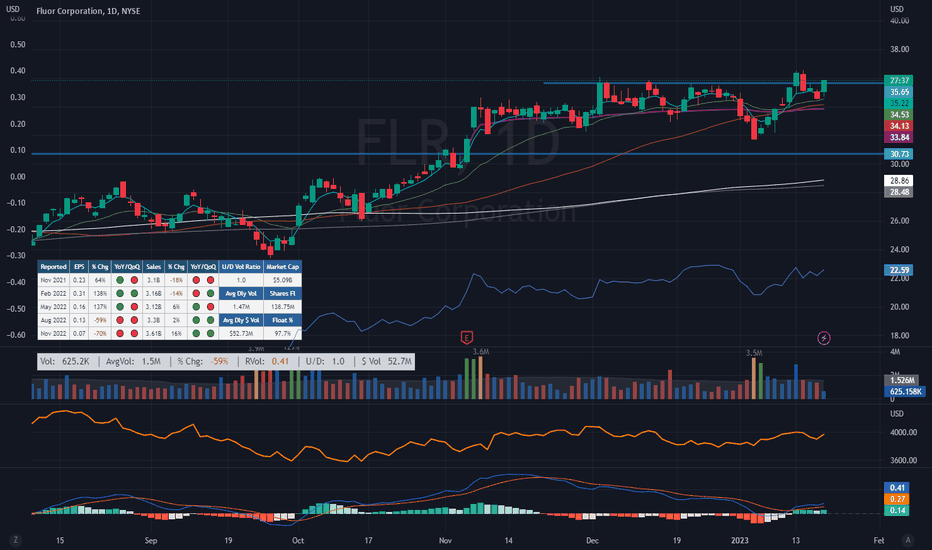

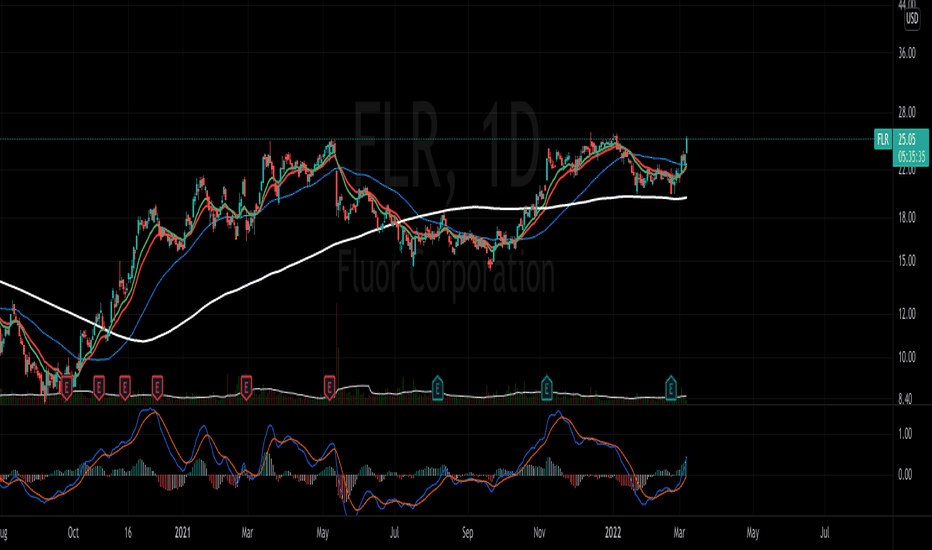

$FLR Flat Base – Ready to Breakout?FLR has been basing now for 11 weeks and has been trying to get over that top area of resistance. One negative thing and probably the thing holding it back is the EPS have declined in the last 2 quarters. But sales have risen. I don’t expect this to be a barn burner, but a 10% move is a fair probabi

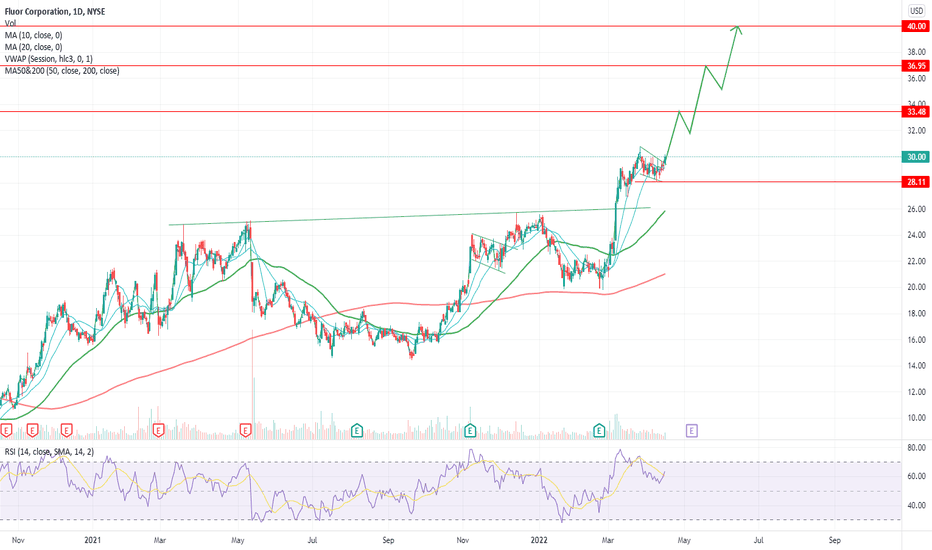

Fluor corporation broke out of the flag patternNYSE:FLR is showing major relative strength to the overall market and just broke out of the flag pattern. Anticipated price action and targets are shown on the chart, stop loss daily close below 28$.

Hit the like button please if you find this useful :)

This is only my own view and not financial ad

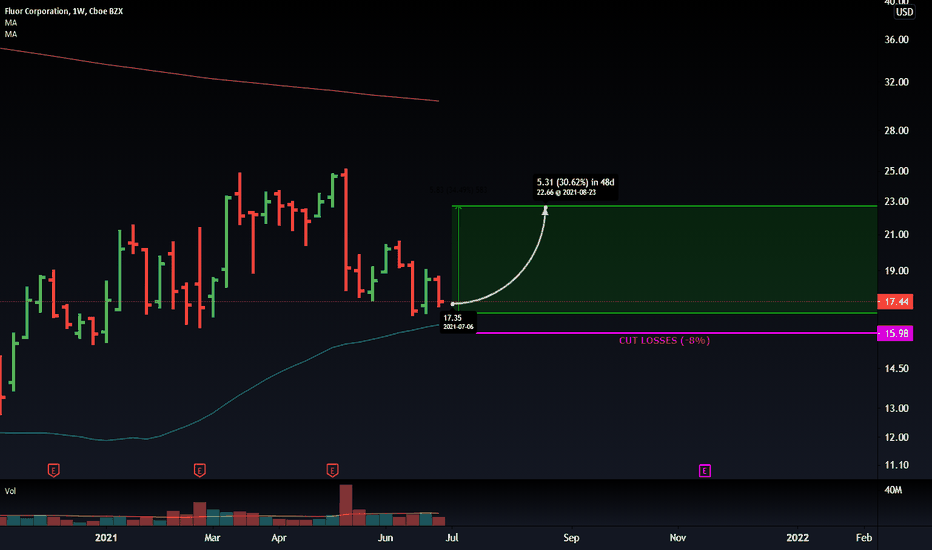

BUY $FLR - NRPicks Jul 05Fluor Corp. operates as a holding company. The firm engages in the provision of engineering, procurement, construction, fabrication and modularization, operations, maintenance and asset integrity, as well as project management services, on a global basis. It operates through the following segments:

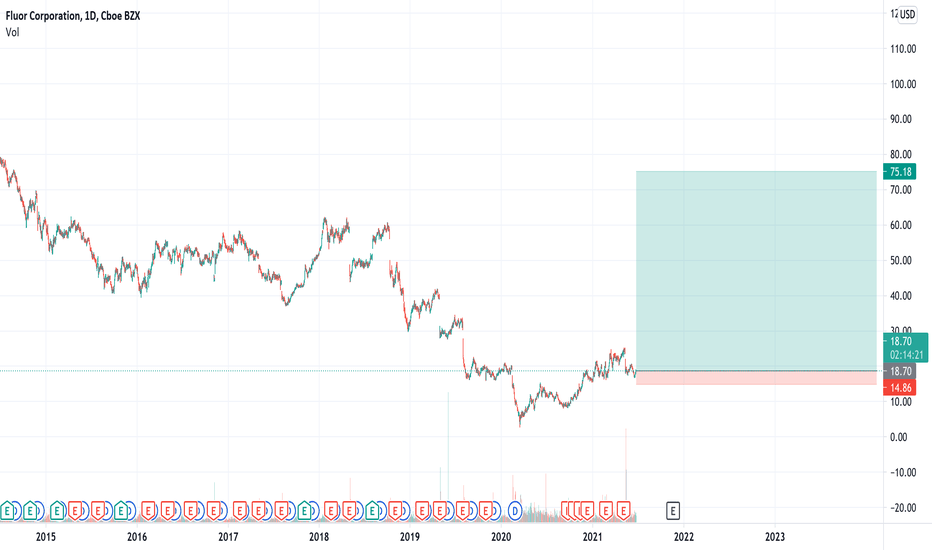

FLR FLUOR TRADE IDEA LONG TERMFrom a long term perspective:

Scenario 1

the first impulse movement may be completed with the top around 25 which matches well with fibo levels

the second wave shall be in progress and may correct up to 38,2% - 23,6%, means around 11-12 USD

therefore a good entry point would be around 13USD

Scenar

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US343412AF9

FLUOR (NEW) 18/28Yield to maturity

5.15%

Maturity date

Sep 15, 2028

FLR5875519

Fluor Corporation 1.125% 15-AUG-2029Yield to maturity

−2.67%

Maturity date

Aug 15, 2029

See all FLU bonds

Curated watchlists where FLU is featured.

Frequently Asked Questions

The current price of FLU is 35.44 EUR — it has decreased by −1.49% in the past 24 hours. Watch FLUOR CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange FLUOR CORP stocks are traded under the ticker FLU.

FLU stock has fallen by −5.07% compared to the previous week, the month change is a −21.84% fall, over the last year FLUOR CORP has showed a −19.69% decrease.

We've gathered analysts' opinions on FLUOR CORP future price: according to them, FLU price has a max estimate of 49.25 EUR and a min estimate of 34.56 EUR. Watch FLU chart and read a more detailed FLUOR CORP stock forecast: see what analysts think of FLUOR CORP and suggest that you do with its stocks.

FLU stock is 1.07% volatile and has beta coefficient of 1.39. Track FLUOR CORP stock price on the chart and check out the list of the most volatile stocks — is FLUOR CORP there?

Today FLUOR CORP has the market capitalization of 5.77 B, it has increased by 5.80% over the last week.

Yes, you can track FLUOR CORP financials in yearly and quarterly reports right on TradingView.

FLUOR CORP is going to release the next earnings report on Oct 31, 2025. Keep track of upcoming events with our Earnings Calendar.

FLU earnings for the last quarter are 0.37 EUR per share, whereas the estimation was 0.47 EUR resulting in a −21.75% surprise. The estimated earnings for the next quarter are 0.41 EUR per share. See more details about FLUOR CORP earnings.

FLUOR CORP revenue for the last quarter amounts to 3.38 B EUR, despite the estimated figure of 3.83 B EUR. In the next quarter, revenue is expected to reach 3.60 B EUR.

FLU net income for the last quarter is 2.09 B EUR, while the quarter before that showed −222.77 M EUR of net income which accounts for 1.04 K% change. Track more FLUOR CORP financial stats to get the full picture.

FLUOR CORP dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 15, 2025, the company has 26.87 K employees. See our rating of the largest employees — is FLUOR CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FLUOR CORP EBITDA is 342.11 M EUR, and current EBITDA margin is 2.72%. See more stats in FLUOR CORP financial statements.

Like other stocks, FLU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FLUOR CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FLUOR CORP technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FLUOR CORP stock shows the strong sell signal. See more of FLUOR CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.