Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.09 EUR

5.15 B EUR

133.64 B EUR

2.88 B

About HONDA MOTOR CO

Sector

Industry

CEO

Toshihiro Mibe

Website

Headquarters

Tokyo

Founded

1948

ISIN

JP3854600008

FIGI

BBG000DGZBT5

Honda Motor Co., Ltd. engages in the manufacture and sale of automobiles, motorcycles, and power products. It operates through the following segments: Automobile, Motorcycle, Financial Services, and Power Product and Other Businesses. The Automobile segment manufactures and sells automobiles and related accessories. The Motorcycle segment handles all-terrain vehicles, motorcycle business, and related parts. The Financial Services segment provides financial and insurance services. The Power Product and Other Businesses segment offers power products and relevant parts. The company was founded by Soichiro Honda on September 24, 1948 and is headquartered in Tokyo, Japan.

Related stocks

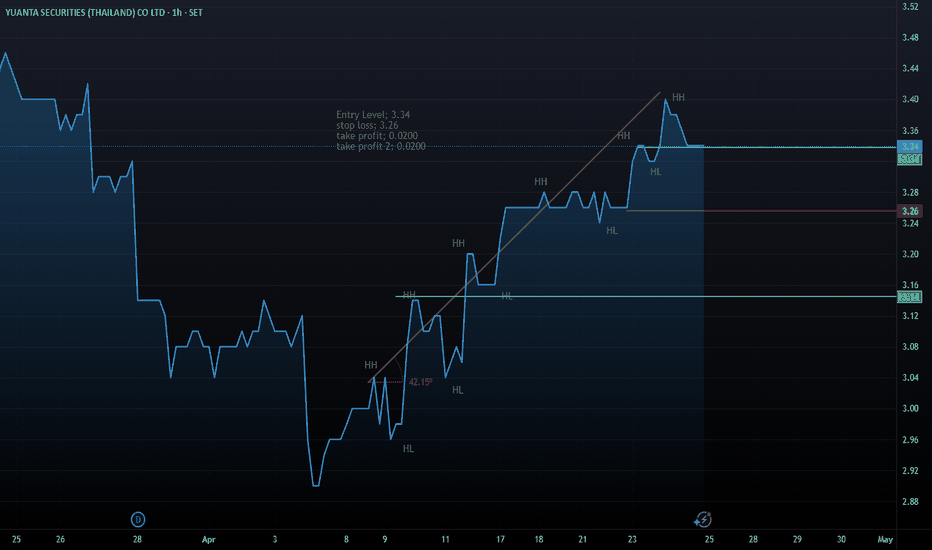

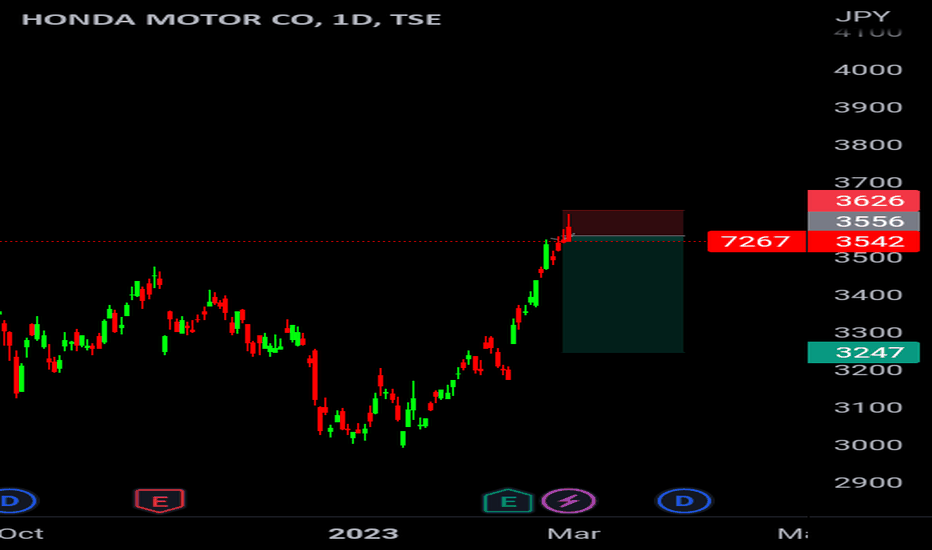

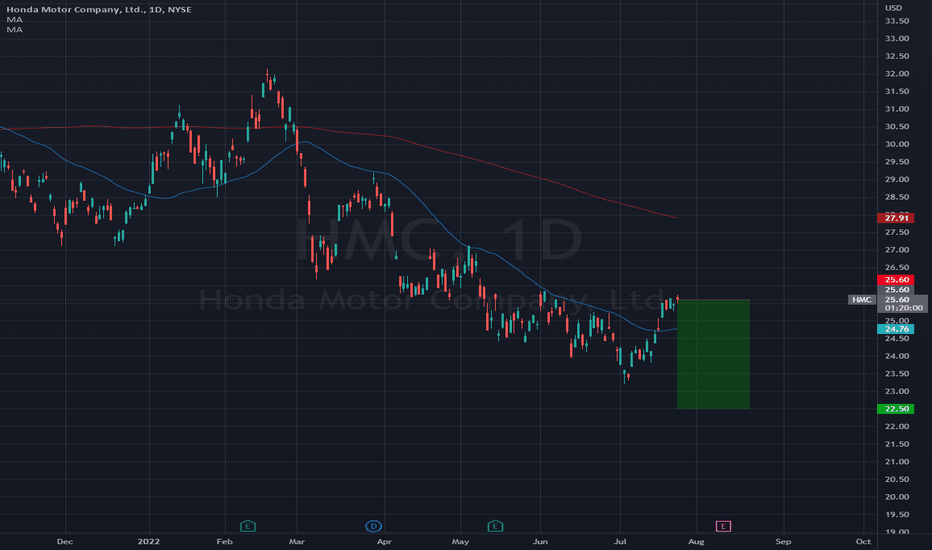

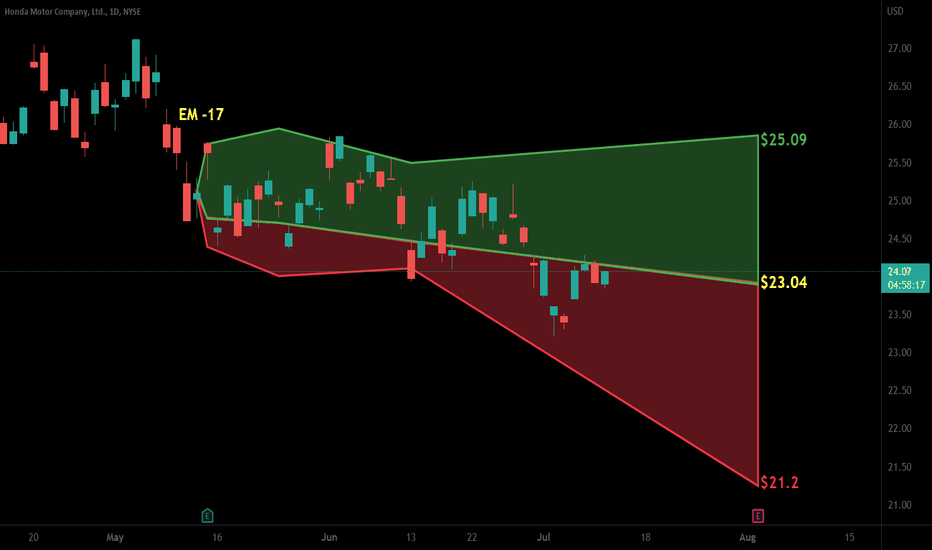

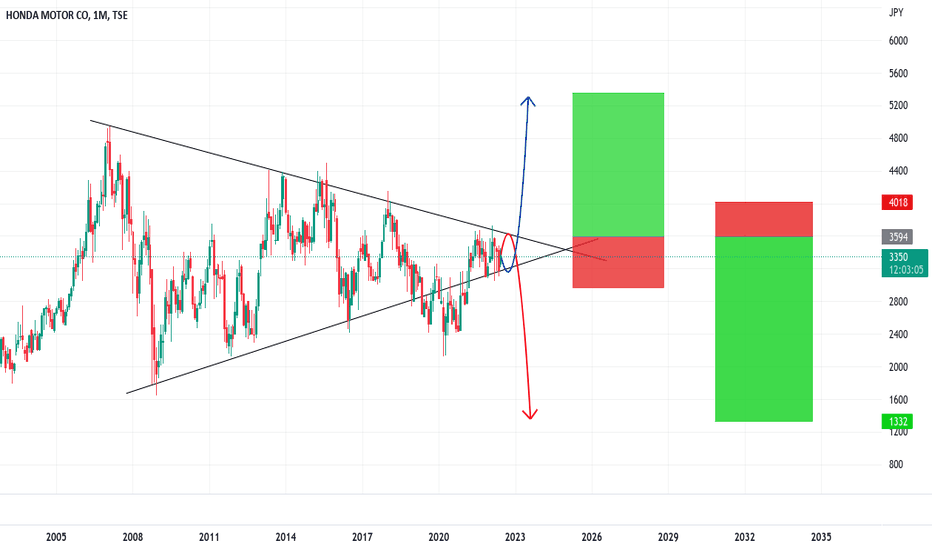

Honda motor company is setting up for a fall.Hello,

Introduction:

In recent market developments, Honda Motor Company, a renowned player in the automotive industry, finds itself navigating through a challenging phase. The company's stock is currently on a downward trend, signaling potential obstacles ahead. Investors and industry analysts a

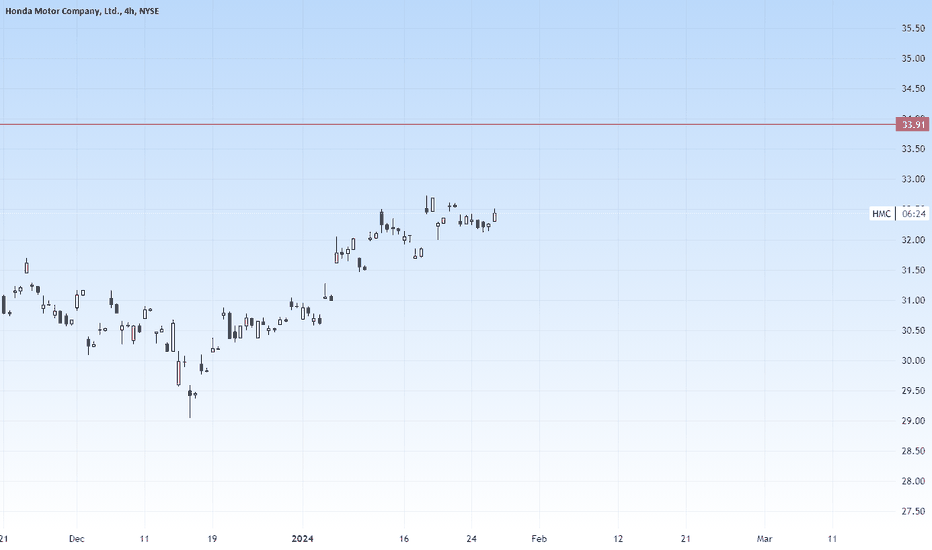

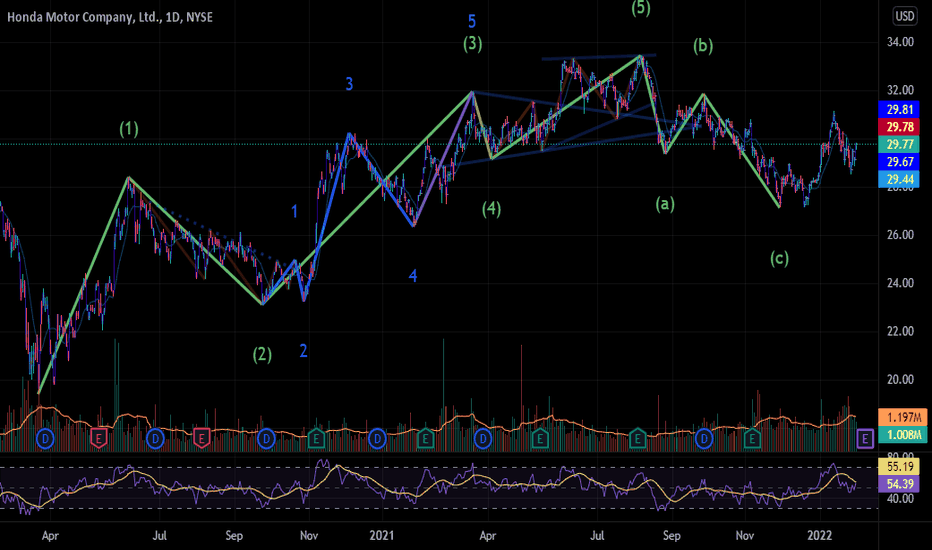

Honda Bull After earnings or before ? Strong Performance: Honda Motor shares have shown solid relative strength over the last month, tacking on nearly 6% and outperforming the S&P 5001.

Positive Earnings Estimate Revisions: The shares are looking to break out of a multi-year consolidation period, with positive earnings estimate revisio

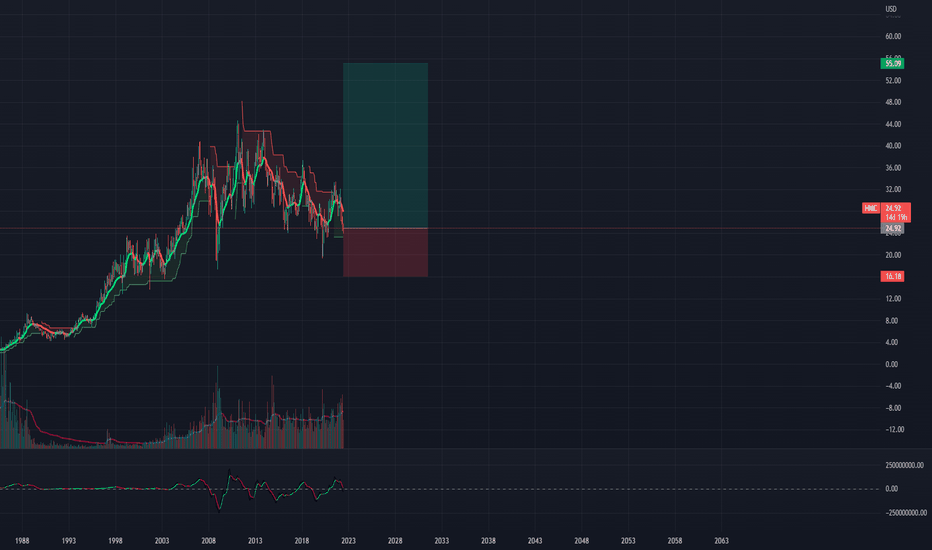

HMC Inflation adjustmentMusashi Seimitsu Industry Company, a supplier of transmission gears and suspension parts to Honda Motor Company, is negotiating with automakers to reflect the impact of higher shipping and material costs. Another Honda supplier, Yachiyo Industry Company, which manufactures fuel tanks and sunroofs, h

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

A

HMC6020580

American Honda Finance Corp. 5.2% 05-MAR-2035Yield to maturity

5.37%

Maturity date

Mar 5, 2035

A

HMC5731051

American Honda Finance Corp. 4.9% 10-JAN-2034Yield to maturity

5.22%

Maturity date

Jan 10, 2034

A

HMC6020687

American Honda Finance Corp. FRN 03-MAR-2028Yield to maturity

5.19%

Maturity date

Mar 3, 2028

A

HMC5109819

American Honda Finance Corp. 1.8% 13-JAN-2031Yield to maturity

5.16%

Maturity date

Jan 13, 2031

A

HMC5846700

American Honda Finance Corp. FRN 09-JUL-2027Yield to maturity

5.14%

Maturity date

Jul 9, 2027

A

HMC6119245

American Honda Finance Corp. FRN 09-JUL-2027Yield to maturity

5.10%

Maturity date

Jul 9, 2027

A

HMC5770797

American Honda Finance Corp. FRN 12-MAR-2027Yield to maturity

5.04%

Maturity date

Mar 12, 2027

A

HMC6119454

American Honda Finance Corp. 5.15% 09-JUL-2032Yield to maturity

5.04%

Maturity date

Jul 9, 2032

A

HMC5922333

American Honda Finance Corp. FRN 22-OCT-2027Yield to maturity

5.01%

Maturity date

Oct 22, 2027

See all HDM bonds

Curated watchlists where HDM is featured.

Frequently Asked Questions

The current price of HDM is 8.76 EUR — it has increased by 0.61% in the past 24 hours. Watch HONDA MOTOR CO LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange HONDA MOTOR CO LTD stocks are traded under the ticker HDM.

HDM stock has fallen by −1.66% compared to the previous week, the month change is a 1.69% rise, over the last year HONDA MOTOR CO LTD has showed a −10.58% decrease.

We've gathered analysts' opinions on HONDA MOTOR CO LTD future price: according to them, HDM price has a max estimate of 10.98 EUR and a min estimate of 6.94 EUR. Watch HDM chart and read a more detailed HONDA MOTOR CO LTD stock forecast: see what analysts think of HONDA MOTOR CO LTD and suggest that you do with its stocks.

HDM stock is 3.08% volatile and has beta coefficient of 1.16. Track HONDA MOTOR CO LTD stock price on the chart and check out the list of the most volatile stocks — is HONDA MOTOR CO LTD there?

Today HONDA MOTOR CO LTD has the market capitalization of 37.36 B, it has decreased by −1.00% over the last week.

Yes, you can track HONDA MOTOR CO LTD financials in yearly and quarterly reports right on TradingView.

HONDA MOTOR CO LTD is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

HDM earnings for the last quarter are 0.06 EUR per share, whereas the estimation was 0.16 EUR resulting in a −64.79% surprise. The estimated earnings for the next quarter are 0.36 EUR per share. See more details about HONDA MOTOR CO LTD earnings.

HONDA MOTOR CO LTD revenue for the last quarter amounts to 33.03 B EUR, despite the estimated figure of 32.49 B EUR. In the next quarter, revenue is expected to reach 31.17 B EUR.

HDM net income for the last quarter is 188.39 M EUR, while the quarter before that showed 1.91 B EUR of net income which accounts for −90.13% change. Track more HONDA MOTOR CO LTD financial stats to get the full picture.

HONDA MOTOR CO LTD dividend yield was 5.07% in 2024, and payout ratio reached 38.00%. The year before the numbers were 3.60% and 30.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 21, 2025, the company has 194.17 K employees. See our rating of the largest employees — is HONDA MOTOR CO LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HONDA MOTOR CO LTD EBITDA is 17.41 B EUR, and current EBITDA margin is 13.03%. See more stats in HONDA MOTOR CO LTD financial statements.

Like other stocks, HDM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HONDA MOTOR CO LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HONDA MOTOR CO LTD technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HONDA MOTOR CO LTD stock shows the sell signal. See more of HONDA MOTOR CO LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.