What do you do about Spark?This analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

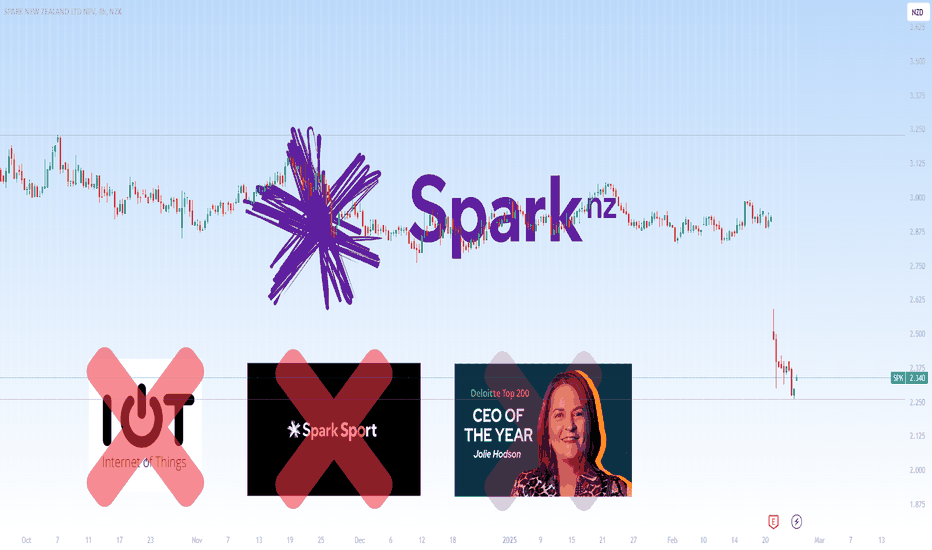

Ah, Spark. Shocker of a result on Friday — losing in all segments (save their IoT business, which is negligible anyway). Since Jolie Hodson beca

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.06 EUR

179.67 M EUR

2.14 B EUR

1.86 B

About SPARK NEW ZEALAND LTD NPV

Sector

Industry

CEO

Jolie Hodson

Website

Headquarters

Auckland

Founded

1987

ISIN

NZTELE0001S4

FIGI

BBG000HV17Y8

Spark New Zealand Ltd. engages in the provision of telecommunications and digital services. It operates through the following segments: Mobile, Broadband, Procurement and Partners, Cloud, Security, and Service Management; Managed Data, Networks, and Services; Voice, and Other Products. The company was founded on February 24, 1987 and is headquartered in Auckland, New Zealand.

Related stocks

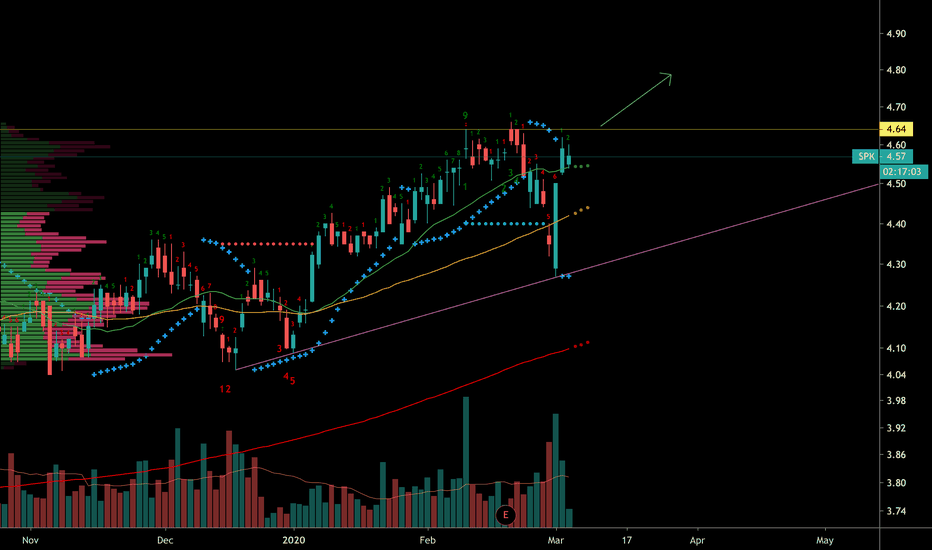

SPARK LONG FROM THIS SUPPORT

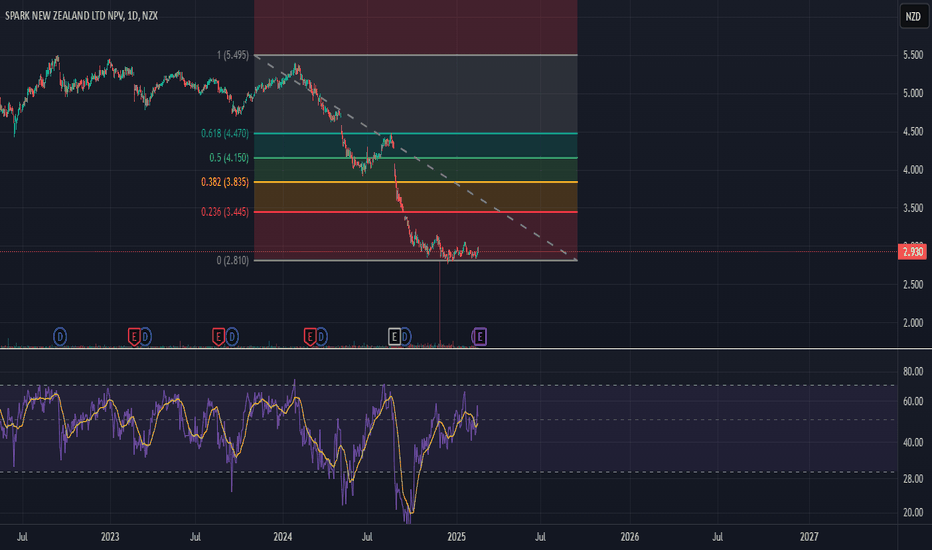

Hey everyone! The price of Spark New Zealand (SPK.NZ) has recently dipped, and I believe it's a great buying opportunity right now.

💡 Targets:

Target 1: NZD 3.445

Target 2: NZD 3.835

Target 3: NZD 4.100

These targets seem very achievable given the stock's performance and current market conditions

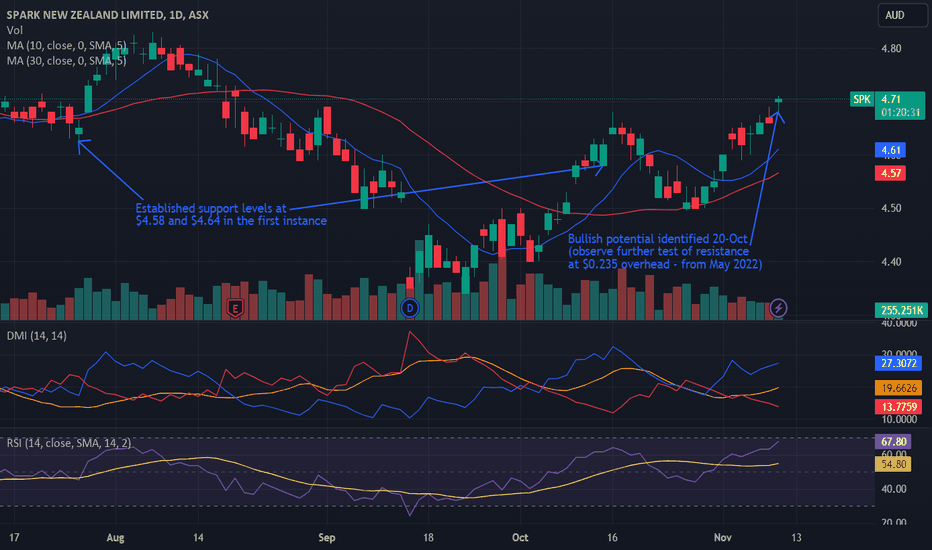

Bullish potential and potential breakout detected for SPKLooking at afternoon trade, SPK represents a potential bullish opportunity should momentum continue and higher highs and higher lows be made past the current position, considering breach of recent resistance levels aligning with technical indicators of RSI and DMI. Relative strength in the Midcap 50

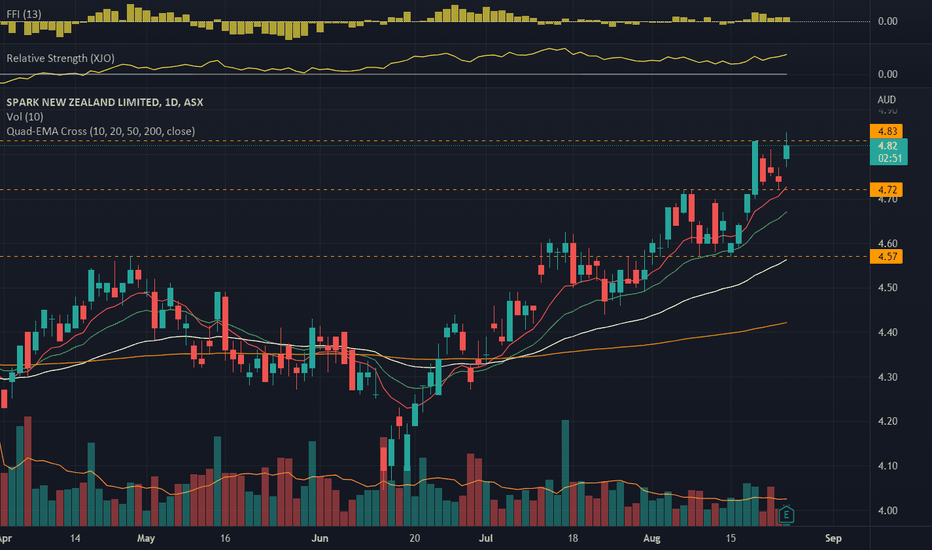

SPK.ASX_Bullish Retracement Trade_LongENTRY: 4.824 (average)

SL: 4.69

TP: 4.96

- ADX>25

- Daily RS +ve

- Daily FFI +ve

- Weekly RS +ve

- Weekly FFI +ve

- Moving averages are aligned.

- Breakout on 18 Aug 2022 and retraced to resistance-turned-support (3.04) before rebounding off today.

- Entry today based on breakout and >3% rebound of

Here is a buy setup in Spark New Zealand $SPKSpark New Zealand is holding up very well after last week market downturn.

We can see Spark New Zealand still above all three rising moving averages at the current time of this post.

Technical indicators are showing a strong possibility sell volume are near the end and buyers are coming back in to

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of NZT is 1.26 EUR — it hasn't changed in the past 24 hours. Watch SPARK NEW ZEALAND LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange SPARK NEW ZEALAND LTD stocks are traded under the ticker NZT.

NZT stock has risen by 9.57% compared to the previous week, the month change is a 10.53% rise, over the last year SPARK NEW ZEALAND LTD has showed a −46.61% decrease.

We've gathered analysts' opinions on SPARK NEW ZEALAND LTD future price: according to them, NZT price has a max estimate of 1.93 EUR and a min estimate of 1.06 EUR. Watch NZT chart and read a more detailed SPARK NEW ZEALAND LTD stock forecast: see what analysts think of SPARK NEW ZEALAND LTD and suggest that you do with its stocks.

NZT stock is 5.00% volatile and has beta coefficient of 1.39. Track SPARK NEW ZEALAND LTD stock price on the chart and check out the list of the most volatile stocks — is SPARK NEW ZEALAND LTD there?

Today SPARK NEW ZEALAND LTD has the market capitalization of 2.36 B, it has decreased by −1.49% over the last week.

Yes, you can track SPARK NEW ZEALAND LTD financials in yearly and quarterly reports right on TradingView.

SPARK NEW ZEALAND LTD is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

NZT earnings for the last half-year are 0.02 EUR per share, whereas the estimation was 0.04 EUR, resulting in a −58.11% surprise. The estimated earnings for the next half-year are 0.05 EUR per share. See more details about SPARK NEW ZEALAND LTD earnings.

SPARK NEW ZEALAND LTD revenue for the last half-year amounts to 1.05 B EUR, despite the estimated figure of 1.04 B EUR. In the next half-year revenue is expected to reach 957.34 M EUR.

NZT net income for the last half-year is 18.91 M EUR, while the previous report showed 90.40 M EUR of net income which accounts for −79.08% change. Track more SPARK NEW ZEALAND LTD financial stats to get the full picture.

SPARK NEW ZEALAND LTD dividend yield was 7.78% in 2024, and payout ratio reached 186.80%. The year before the numbers were 6.24% and 52.33% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 30, 2025, the company has 5.29 K employees. See our rating of the largest employees — is SPARK NEW ZEALAND LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SPARK NEW ZEALAND LTD EBITDA is 511.14 M EUR, and current EBITDA margin is 28.23%. See more stats in SPARK NEW ZEALAND LTD financial statements.

Like other stocks, NZT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SPARK NEW ZEALAND LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SPARK NEW ZEALAND LTD technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SPARK NEW ZEALAND LTD stock shows the sell signal. See more of SPARK NEW ZEALAND LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.