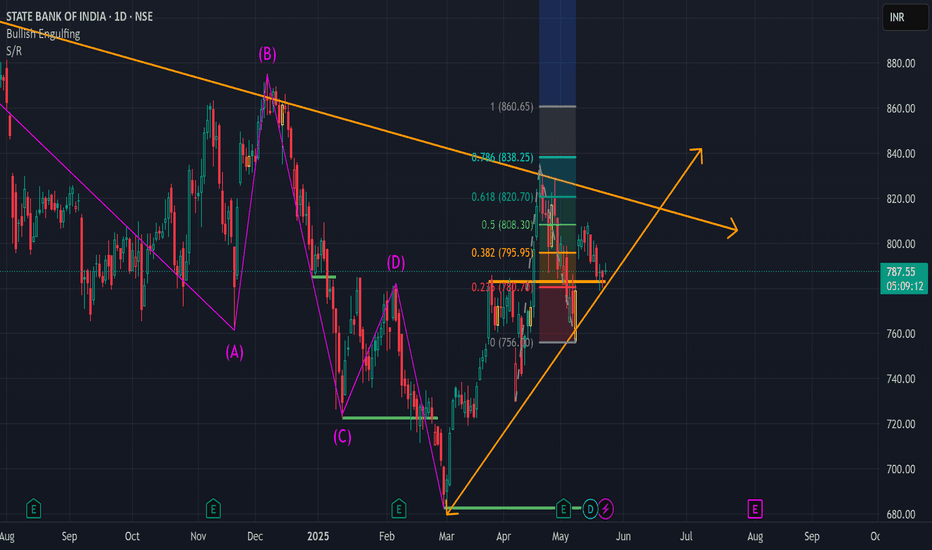

SBIN📝 Trade Plan

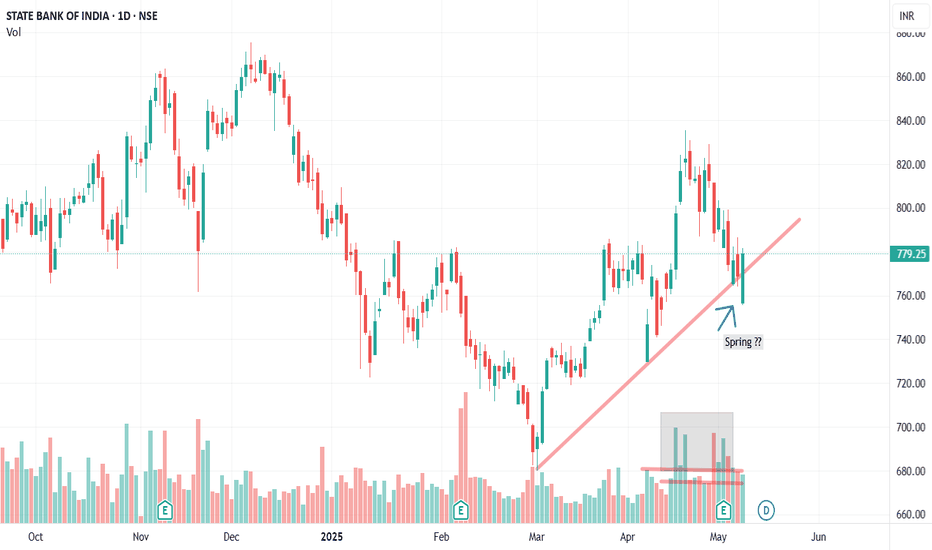

Position: Long (Buy)

Entry: 800

Stop Loss: 757

Risk: 43 points

Target: 1256

Reward: 456 points

Risk-Reward (RR): 10.6 – Excellent

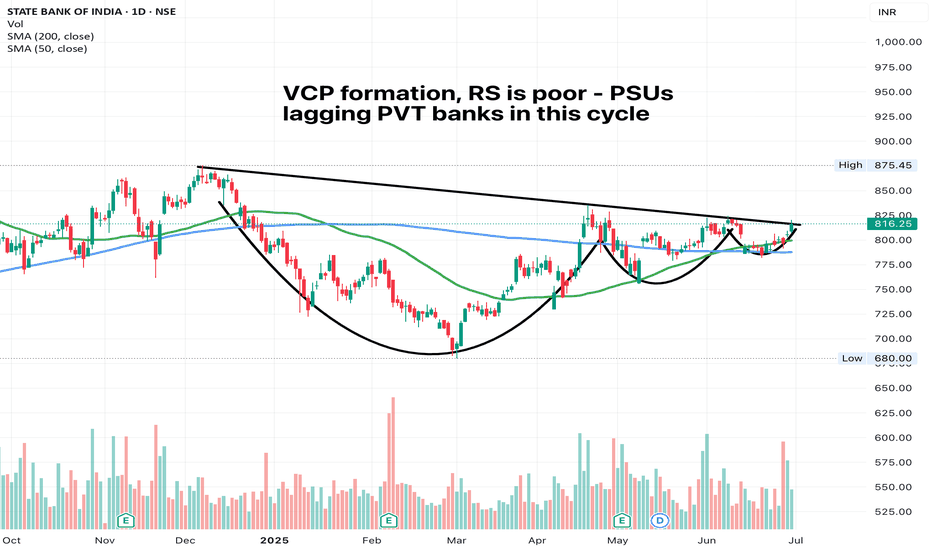

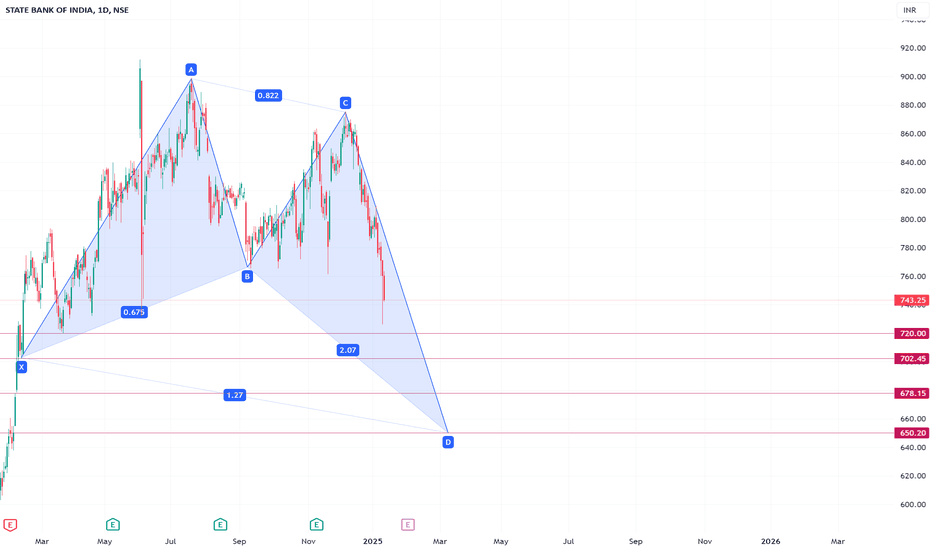

✅ Multi-Timeframe Trend & Demand Zone Alignment

Zone Trend Demand Logic Avg Demand Zone

HTF UP RBR, BUFL 650

MTF UP RBR, DMIP, SOE, BUFL 762

ITF UP DMIP, B

Key facts today

JPMorgan maintains an 'overweight' rating on State Bank of India (SBIN) and increased the price target to 965 rupees, indicating a potential upside of about 20% from the last close.

State Bank of India was among the top gainers in the Indian equity market on Monday, even as financial stocks generally declined due to profit-taking by investors.

SBI's subsidiaries, SBI General Insurance and SBI Payment Services, may launch IPOs as part of the government's monetisation plan, aiming for ongoing profitability through 2025-26.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.50 EUR

8.48 B EUR

71.96 B EUR

About STATE BANK OF INDIA

Sector

Industry

CEO

Rana Ashutosh Kumar Singh

Website

Headquarters

Mumbai

Founded

1921

FIGI

BBG000HKVN38

State Bank of India engages in the provision of public sector banking, and financial services statutory body. It operates through the following segments: Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business. The Treasury segment includes the investment portfolio and trading in foreign exchange contracts and derivative contracts. The Corporate/Wholesale Banking segment consists of lending activities of Corporate Accounts Group, Commercial Clients Group, and Stressed Assets Resolution Group that provides loans and transaction services to corporate and institutional clients and further include non-treasury operations of foreign offices. The Retail Banking segment refers to the retail branches, which primarily includes personal banking activities including lending activities to corporate customers. The Other Banking business segment focuses on the operations of all the non-banking subsidiaries and joint ventures of the group. The company was founded on January 27, 1921 and is headquartered in Mumbai, India.

Related stocks

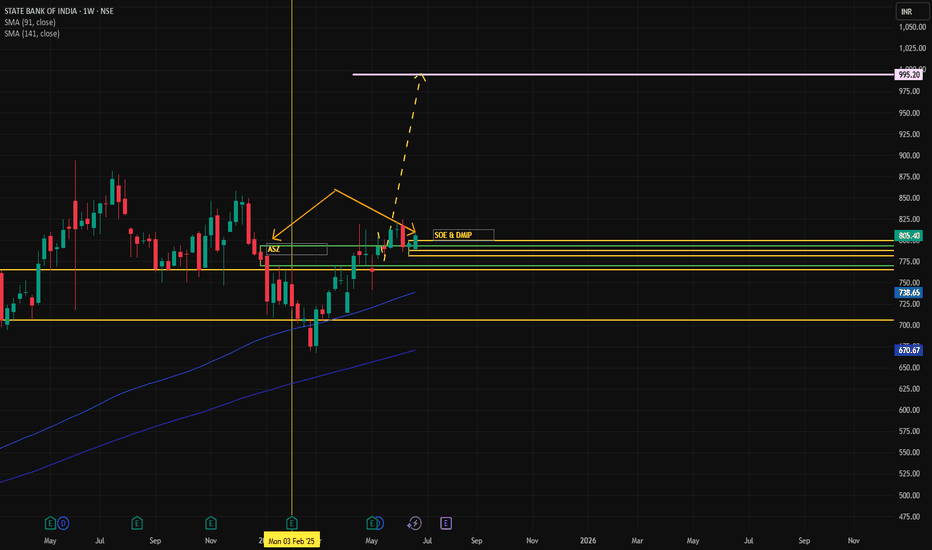

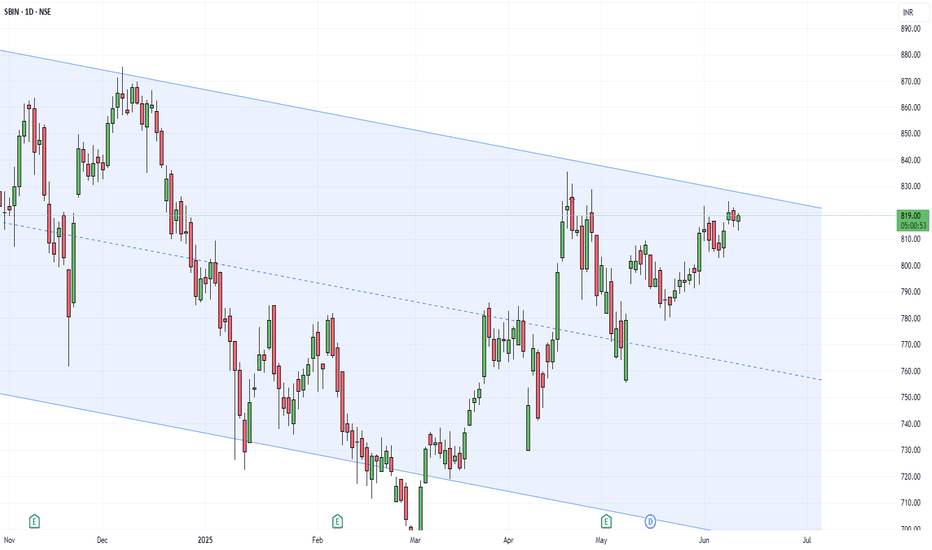

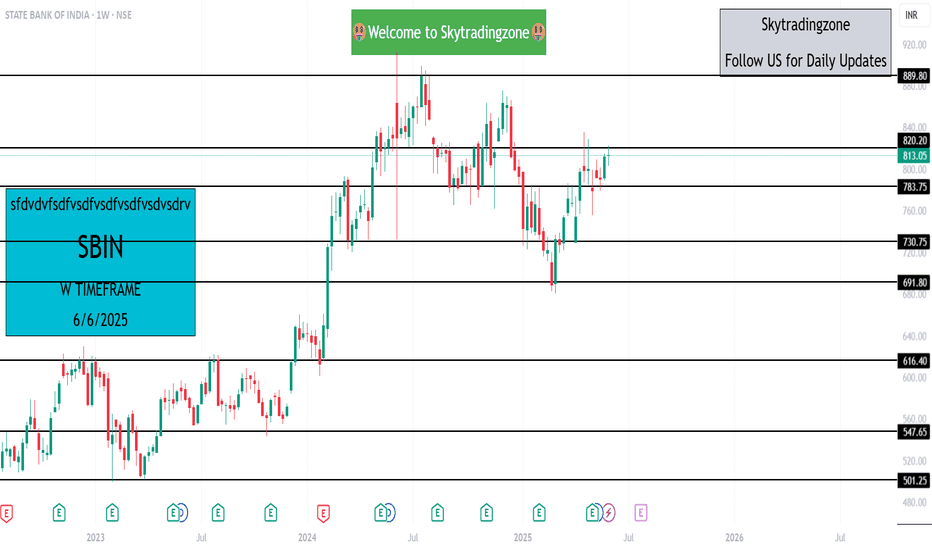

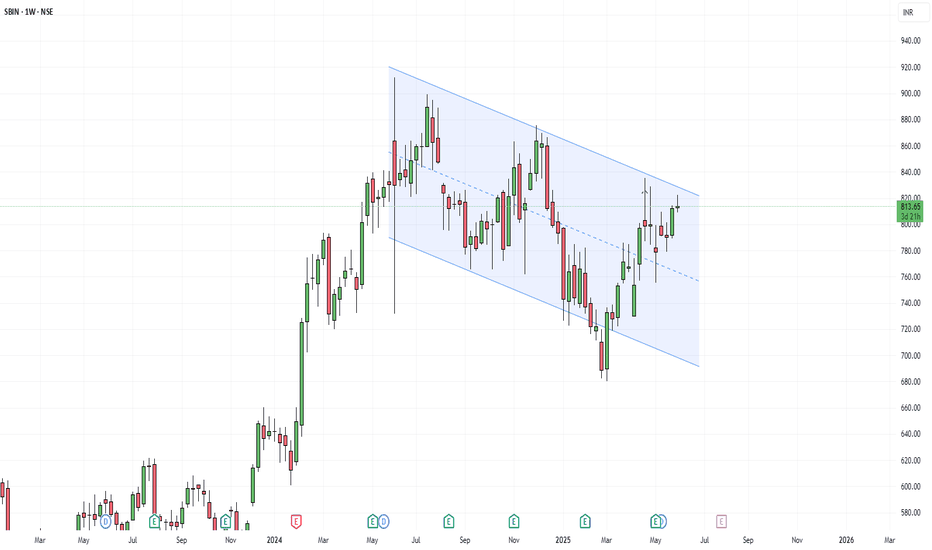

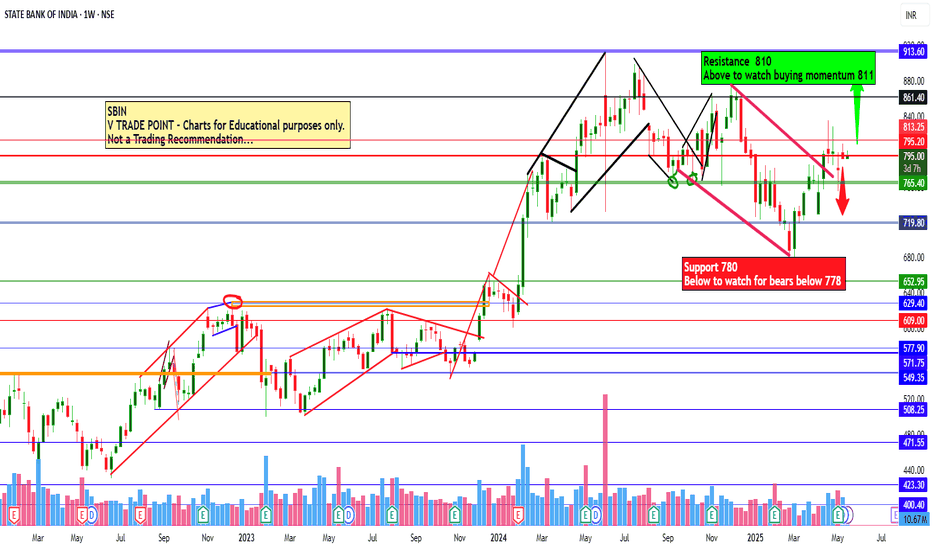

SBIN Weekly Levels and reportLook at the Weekly Chart:

This will show you how SBIN’s price has moved each week.

Identify Support and Resistance:

Support is where the price usually doesn’t fall below (like a floor).

Resistance is where the price often doesn’t go higher than (like a ceiling).

Example: If SBIN’s price bounced

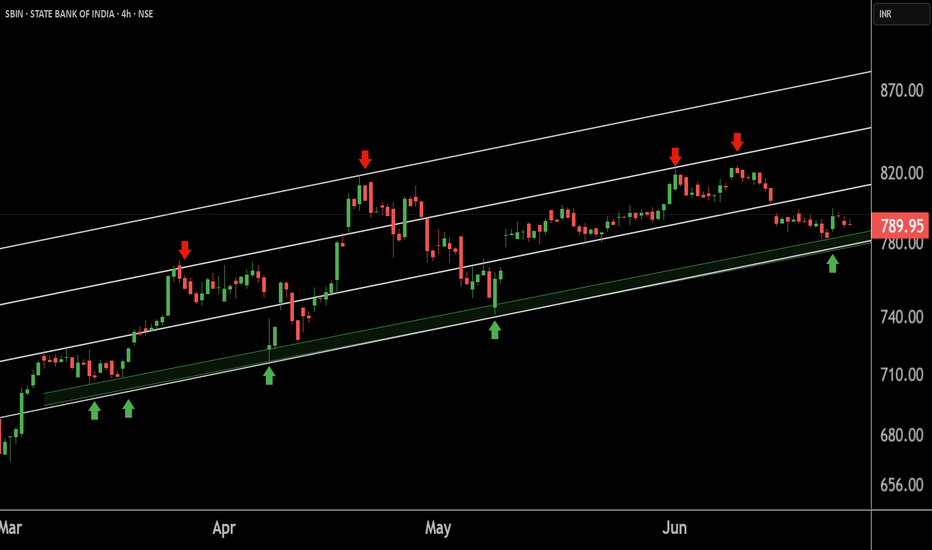

State Bank of India view for Intraday 20th May #SBIN State Bank of India view for Intraday 20th May #SBIN

Resistance 810 Watching above 811 for upside momentum.

Support area 780 Below 800 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 800 ignoring downside move for intraday

Charts for Educational purposes o

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

S

SBIN5412137

State Bank of India (London Branch) 2.49% 26-JAN-2027Yield to maturity

4.93%

Maturity date

Jan 26, 2027

S

SBIN5114735

State Bank of India (London Branch) 1.8% 13-JUL-2026Yield to maturity

4.90%

Maturity date

Jul 13, 2026

S

SBIN5693776

State Bank of India (London Branch) 4.875% 05-MAY-2028Yield to maturity

4.56%

Maturity date

May 5, 2028

See all SID bonds

Curated watchlists where SID is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks