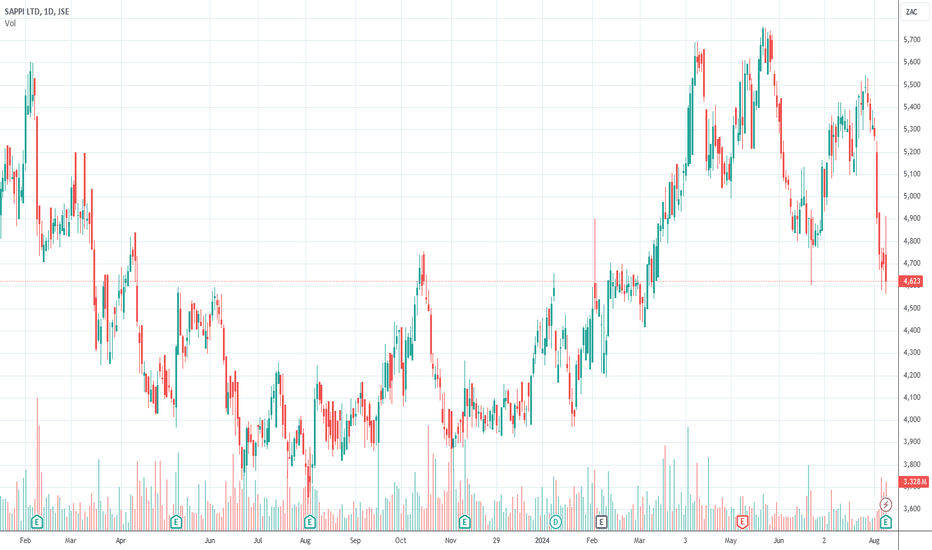

Our opinion on the current state of SAPPI(SAP)Sappi (SAP) manufactures paper, dissolving wood pulp (DWP), and paper pulp internationally and supplies products in 150 countries. DWP is used to manufacture clothing, packaging products, and many other applications. DWP, specialty, and packaging products were seen as the profit generator in the fut

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.28 EUR

29.64 M EUR

4.90 B EUR

601.55 M

About SAPPI LTD

Sector

Industry

CEO

Stephen Robert Binnie

Website

Headquarters

Johannesburg

Founded

1936

FIGI

BBG000C2CTN9

Sappi Ltd. is a holding company, which engages in the provision of paper-based solutions. Its products include dissolving pulp, graphic papers, packaging and speciality papers, casting and release papers, and biomaterials. It operates through the following geographical segments: North America, Europe, and South Africa. The company was founded on December 17, 1936 and is headquartered in Johannesburg, South Africa.

Related stocks

Our opinion on the current state of SAPPI(SAP)Sappi (SAP) is an international manufacturer specializing in paper, dissolving wood pulp (DWP), and paper pulp. The company supplies products to over 150 countries. DWP, a primary component used for clothing and packaging products, is crucial to Sappi's future profitability, although its price fluct

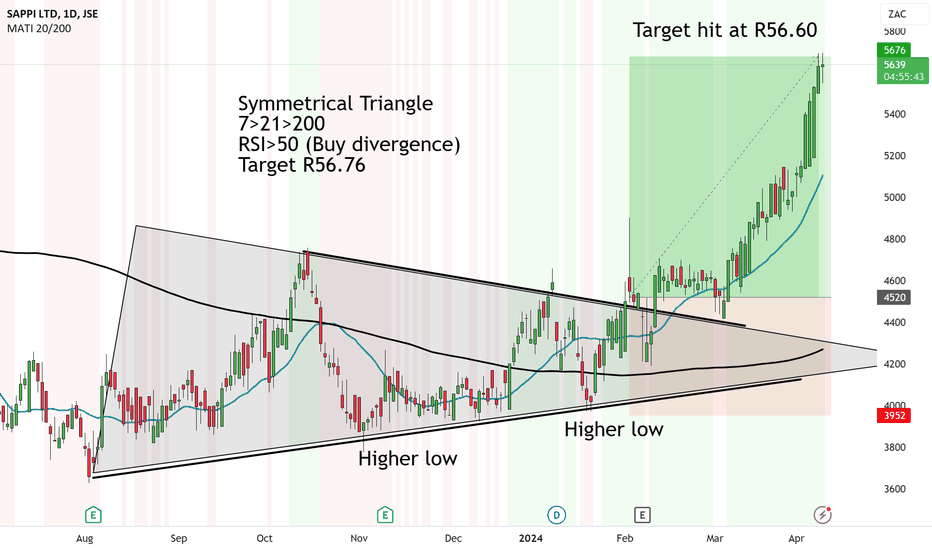

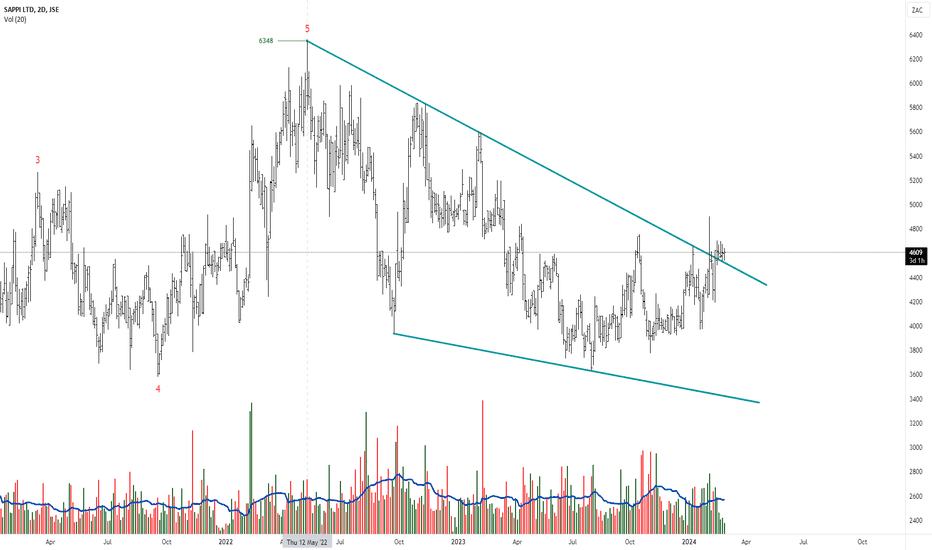

UPDATE SAPPI Target reached at R56.60 - Omwards and UpwardsSAPPI has performed great since it broke above the Symmetrical Triangle,.

The analysis was done in February, it broke above the Apex and since then has rushed to its first target at R56.60.

No ways, is this worth a punt to the short side. We can now expect some sideways chop, possible pattern fo

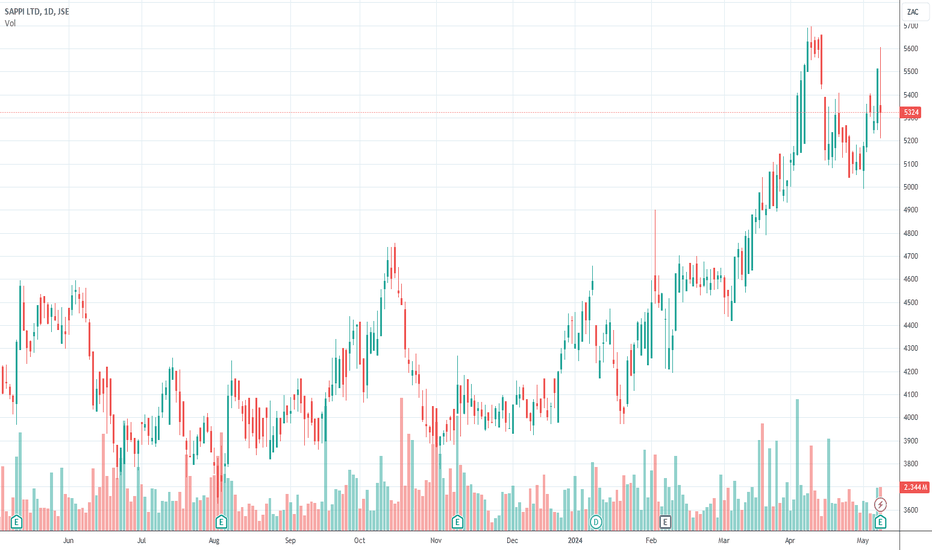

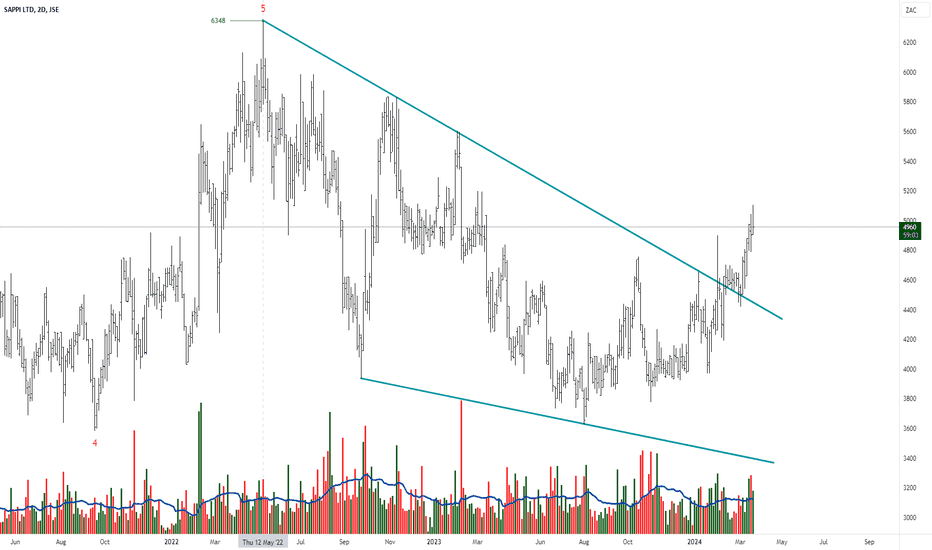

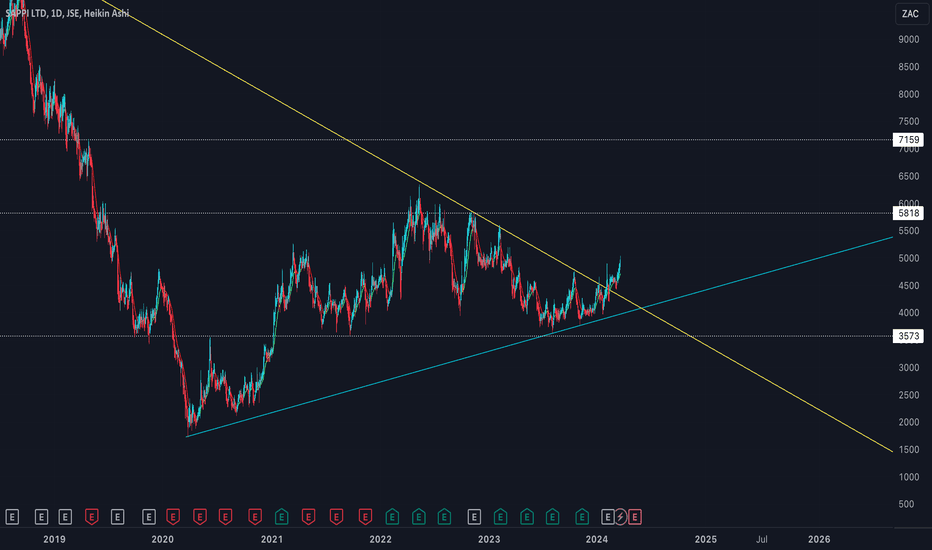

SAPPI - Broken its downtrendSappi has traded strongly recently and has now managed to break the yellow downward trend line. . As such, we could possibly see a retest of the yellow band before moving higher or, price could continue moving upwards in this relatively strong move. Initial target on this move would be around 58.18

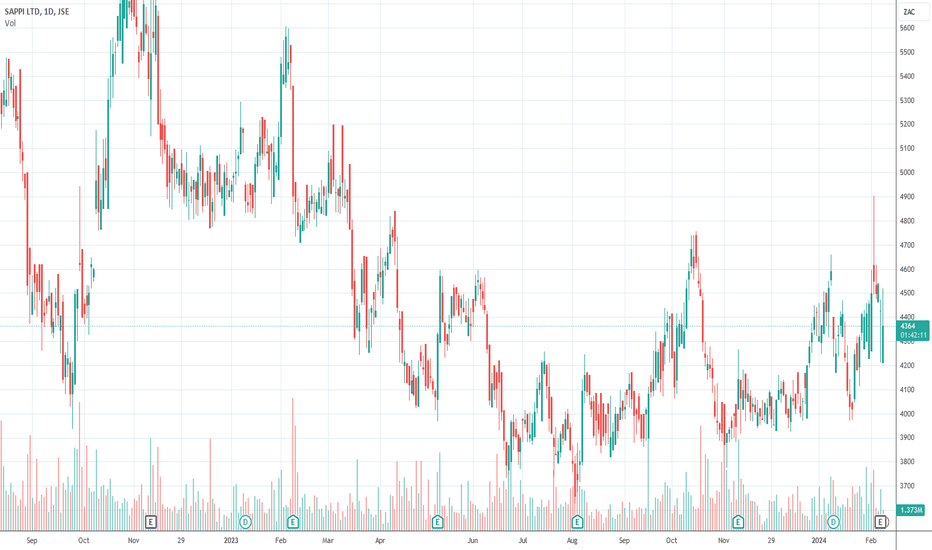

$JSESAP - Sappi: Not Yet Convinced It's A BreakoutSee link below for previous analysis

The stock has made a minor breakout from the upper resistance trendline and is currently using it as support.

I am not convinced by this breakout due to:

1-Low volume breakout

2-Weak price momentum after breakout

It's still early days but I will sit on my han

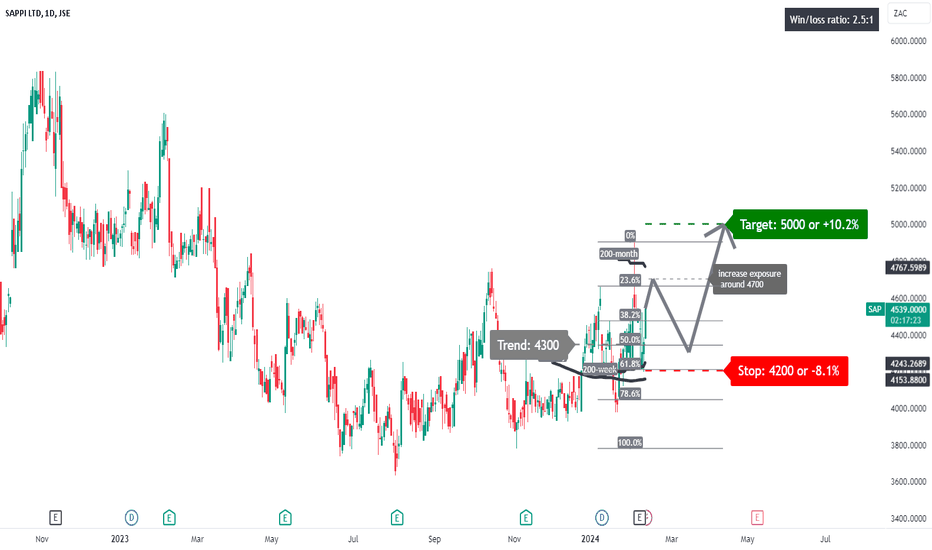

SAP: further gains after a correction?A price action above 4300 supports a bullish trend direction.

Further bullish confirmation for a break above 4700.

The target price is set at 5000.

The stop-loss price is set at 4200.

Remains above the confluence of 200-day and 200-week simple moving averages, supporting a bullish long-term trend.

Our opinion on the current state of SAPSappi (SAP) is a global leader in the manufacturing of paper, dissolving wood pulp (DWP), and paper pulp, supplying products to over 150 countries. DWP, crucial for manufacturing clothing, packaging products, and various other applications, was identified as a future profit generator for Sappi. Howe

SAPPI looking shap! Target potential to R56.76Symmetrical Triangle seems to have formed on Sappi.

Now on the contrary of a Symmetrical Triangle being a Continuation pattern, it is possible for a reversal to take place in this instance.

We have the converging of the trendlines where the price has reached an apex. Strong buy divergences and p

Our opinion on the current state of SAPSappi (SAP) manufactures paper, dissolving wood pulp (DWP) and paper pulp internationally and supplies products in 150 countries. DWP is used to manufacture clothing, packaging products and many other applications. DWP, specialty and packaging products were seen as the profit generator in the future

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS0149581935

SappiPapierHldg 7,5% 15/06/2032Yield to maturity

8.27%

Maturity date

Jun 15, 2032

XS3017018964

SappPap 4.5% 32Yield to maturity

4.98%

Maturity date

Mar 15, 2032

XS301701799

SAPPI PAPIER 25/32 REGSYield to maturity

4.80%

Maturity date

Mar 15, 2032

XS231095110

SAPPI PAPIER 21/28 REGSYield to maturity

3.89%

Maturity date

Mar 15, 2028

XS2310951368

SappPap 3.625% 28Yield to maturity

3.69%

Maturity date

Mar 15, 2028

See all SPIA bonds